I know, this is a broken record blog. We all know financials are cheap and we all know there are plenty of reasons why they are cheap and why they might be right to be priced cheap.

However, I tend to still like the well-managed financials.

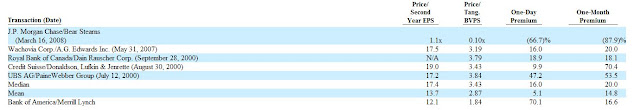

This is laughable and I don’t mean to suggest financials should trade at over 3x tangible book value, but here’s a valuation of historic deals in the investment banking sector I pulled out from the Merrill Lynch merger proxy (merger proxies are great sources of information; investment banks do a lot of valuation work to validate deal values and you get all that stuff for free in the filings):

OK, that came out pretty small but historic investment bank acquisitions have happened at an average of around 3x tangible book value with a median valuation of 3.4x.

Of course, this is pre-crisis so the world is quite a bit different now.

But I do think investment banks are certainly worth more than tangible book, if not a multiple of it. Right now, people are worried about a complete European implosion and financial blowup that may be worse than what we saw in 2008/2009 in the U.S.

Anyway, here’s a list of price-to-tangible book values that was in the “Heard on the Street” page of the Wall Street Journal this morning:

PTBV ratio

J.P. Morgan 95%

Goldman Sachs 76%

Jefferies Group 76%

Citigroup 52%

Morgan Stanley 51%

Bank of America 44%

As I mentioned before, I really do like J.P. Morgan (JPM) and Goldman Sachs (GS). I do think they are both very well managed. JPM is a huge bank so will be subject to macro forces, but management has proven they can handle once in a hundred year events.

GS, too, has managed the crisis pretty well but they may be more flexible and agile than JPM since they are not a major bank. Investment banks tend to be pretty nimble. GS doesn’t have a large physical presence (bank branches) or a large retail sales force (retail brokers) so don’t have a large fixed cost base burden. If things don’t recover, you can be sure they will cut costs quickly and will move capital to where they can earn an adequate return.

At this point, according to the recent earnings conference call, GS is waiting for things to clear up a bit since things are in a sort of ‘crisis’ situation. They do think that when things stabilize they will be able to deploy capital profitably. If they thought this downturn is permanent, they would then use their excess capital to repurchase shares (and will probably cut more costs).

An interesting play here too is Jefferies Group (JEF). I don’t own JEF, but tend to really like it especially so cheap. They are a small investment bank which has good sides and bad. Right now, they are seeing the bad side of it. JEF shares have tumbled alot after the MF Global blowup; people are now concerned about smaller firms that are too small to survive (versus too big to fail firms).

Some of my favorite value managers at Leucadia (LUK) bought into JEF stock on this decline as they are confident in the management of Richard Handler. I think JEF will be able to pull through this as they do have a great reputation and Handler is known to be a conservative CEO (unlike the more risk-taking, reckless Corzine).

But in finance, you never know. Good firms will go down in crisis situations, sometimes (although I don’t think that happened in the 2008/2009 crisis; I think the firms that went down in that crisis weren’t really good, well managed, conservative firms. They were reckless, aggressive, overleveraged, horribly managed firms (BSC, LEH etc…)).

The good side of a smaller investment bank like JEF is that they may have more opportunities if they have a good niche (many smaller investment banks like Cowen haven’t made money in years) and are well-managed. The good thing is that they don’t depend on mega-deals. Bigger investment banks have to do bigger and bigger deals to increase revenues, just like larger and growing private equity funds have to do bigger and bigger deals to deploy bigger and bigger amounts of capital.

Anyway, all of these are financial companies and as I keep saying, one should be very careful how much exposure they have in any single sector (otherwise, I would be buying JEF too, but I have enough financial exposure now).

If Europe does really implode, financials can certainly go down more. By their very nature, they are risky and another financial crisis of bigger than 2008 proportions is not a zero probability.

I do talk a lot about financials here now just because I do tend to think they are cheap, and because of my experience in the industry I tend to be more comfortable with some of them than most other investors and the general public (that seem to resent/hate financials!).

But that doesn’t mean investors should pile into these things too much!