I just finished reading The Big Secret for the Small Investor, and thought it was really good. I know, I know. This is old news. It’s been blogged and discussed to death, I think. But I haven’t kept up with my reading and I just happened to come across this at the local library so I checked it out.

I don’t know how much professional investors would get out of it as there is not much new in here other than the idea of using a value-weighted index to outperform other index types (even though I really enjoyed reading it).

Here is the blurb from the book on ways individuals can manage their money:

- They can do it themselves. Trillions of dollars are invested this way. (Of course, the only problem here is that most people have no idea how to analyze and choose individual stocks. Well, not really the only problem. Most investors have no idea how to construct a stock portfolio, most have no idea when to buy and sell, and most have no idea how much to invest in the first place.)

- They can give it to professionals to invest. Trillions of dollars are invested this way.(Unfortunately most professionals actually underperform the market averages over time. In fact,it may be even harder to pick good professional managers than it is to pick good individual stocks.)

- They can invest in traditional index funds. Trillions of dollars are also invested this way.(The problem is that investing this way is seriously flawed–and almost a guarantee of subpar investment returns over time.)

- They can read The Big Secret for the Small Investor and do something else. Not much is invested this way. Yet…

Valuing a Business

Greenblatt is a great writer and he really describes well how a business should be looked at, how it should be valued etc. He also explains really well why most people and money managers can’t outperform the market (chasing performance etc). This section alone is worth a lot for novice investors and people starting out, and it’s even great for pros to refresh themselves on what they’re trying to do.

Importance of Owning Stocks

He also does a great job explaining why most people should put a substantial amount of their net worth in stocks. But he also says that that doesn’t mean people should be 100% in equities all the time; like he said in his essay, people should own as much stock as they can tolerate the occasional (and inevitable) 50% decline in the market (which nobody will be able to market-time in and out of consistently). He provides a tip for avoiding the emotional traps of investing (just keep a constant ratio in stocks at all times, bull or bear market. And don’t try to time it as that is one of the biggest factors in causing people to underperform!).

Indexing

In the book, he explains that most money managers can’t outperform the S&P 500 index, so he starts there and then improves on the S&P 500 index step-by-step finally arriving at the value-weighted index.

Value-weighted Indexing

The problem with traditional indexing is that you end up owning more of the most expensive stocks (and large cap) and less of the smaller, cheaper stocks. Greenblatt explains that this is why equal-weighted indices tend to outperform over time compared to market-cap weighted indices (such as the S&P 500 index). Equal-weighted indices put the same amount of money in each stock regardless of market-cap so this bias goes away.

He also explains that fundamental-weighted indexing tends to outperform the market-cap weighted indices for the same reason; it doesn’t own more of the bigger cap and more overvalued stocks, but weights the index according to some fundamental factor like dividends, earnings, sales or some such thing. So it eliminates the bias of owning more of something overvalued. (It would still have a large cap bias as you would still end up owning more of a big company than a small company based on fundamental factors).

Greenblatt’s solution is an improvement on all of the above. Since Greenblatt is a value investor, he is most interested in value. So therefore, instead of using something arbitrary like market capitalization to weight an index, or something a bit more meaningful like fundamental factors, why not just weight the index based on valuation? Own more of something undervalued and less of something overvalued.

That makes total sense, and he has shown in his other book (“The Little Book That Beats the Market“) that valuation matters and works.

Data

Greenblatt set up a website for this book and here is some of the data posted there. The website is:

http://valueweightedindex.com/

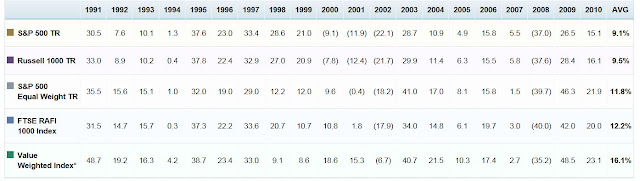

Check out the results of using a value-weighted index:

Pretty impressive. If the figures are too small, you can just go to the website and see all of these figures.

I know many people will be skeptical of this and say that the index was probably optimized somehow. But Greenblatt is a real money manager and he is not out there doing stuff to make money off of selling books. He understands that the problem with these ‘models’ is backfitting / over-optimizing (that’s why the Magic Formula is so simple; just two factors. He knows he can improve on them by testing various factors and weights, but then the model wouldn’t be as robust. What is so impressive about the magic formula is how simple it is and how consistent the results tend to be over time).

But the Problem is…

So we can read this book and go, what a great idea! And then what? Where do we buy value-weighted index funds? Alas, there aren’t any. In the book (and at the website), he directs us to equal-weighted index funds and fundamental-weighted index funds and some value-based ETFs (which is not the same idea Greenblatt describes), but there are no value-weighted funds.

I guess Greenblatt is hoping to push the ETF industry into creating them so he wouldn’t have to do it himself. He is obviously more interested in teaching than trying to make money off of his ideas.

But What About the Magic Formula (MF)?

There has been a lot of talk about the MF on blogs, websites and whatnot, how it works or it doesn’t work etc. But for the most part, I tend to think the time period has been too short to make any real evaluation, not to mention the fact that we had a huge financial crisis since then.

As Greenblatt has said himself, the MF can underperform for long periods of time. This is precisely why it will continue to keep working over time. If something works too well and too consistently in every time period, then it would probably very soon stop working (think of those “I can guarantee you 1%/month consistently with less volatility than the S&P 500 index!”. How long did that last?).

In the case of the MF, Greenblatt did set up a company to invest using their method and they do have mutual funds available.

Here’s the website:

http://www.formulainvesting.com/

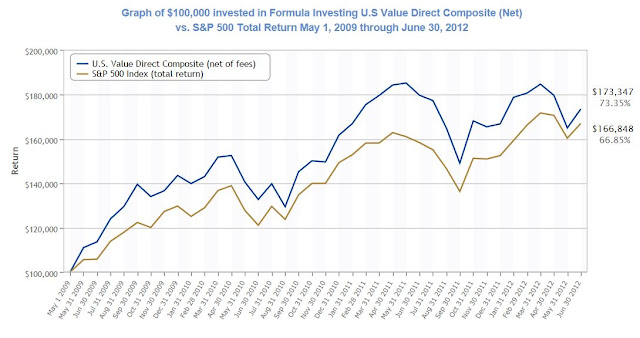

And here’s a composite index of returns based on the strategy from the website:

This is way too short a time period to evaluate returns so this may not be too meaningful.

But as a way to invest money, I am a big believer in this approach. I would bet that over long periods of time, this approach would outperform the index and most money managers.

So Which Mutual Fund is Better?

Formula Investing runs four mutual funds (with small minimums):

- U.S. Value 1000

- U.S. Value Select

- International Value 400

- International Value Select

So what’s the difference? The “Select” funds invest in 75-120 names whereas the Value 1000 (and 400 for the International) invests in 1,000 names.

I think if you want to see the MF work, it’s going to be more pronounced with fewer names. With a 1,000 stock portfolio, I can’t imagine it diverging too far from the index. Of course, Greenblatt suggests in his book that 20-30 names (the MF results in the The Little Book That Beats the Market is based on a 30 stock portfolio. I initially wrote 8-10 names here, but that was wrong) is enough diversification, but that’s not going to work for an open-end mutual fund.

So I would go with the “Select” funds.

U.S. or International? Right now since the International funds seem to be performing so horribly, and since the problems on the planet seems more focused around the world ex-U.S., I would tend to lean towards the International. Isn’t this where the values would be?

I know we are all pretty confident that China and Europe is going to implode. It’s a no-brainer right now to be out of those countries. But that’s sort of the whole purpose of value investing, especially the mechanical kind where we override emotions, right? To go in when nobody want to. Greenblatt did say in a presentation not too long ago that any time you look at the list of values that the MF website spits out, most people would hate those names. There would be good, sound, rational reasons why you wouldn’t want to own those names. But that’s precisely the reason why those names are on that list, and that’s why the MF tends to outperform.

So on that basis, I would go with the ugly-looking International Select fund, out of the above Formula Investing funds. But if you decide to do that, don’t look at what the fund owns. I guarantee you that you will change your mind. You will say, “yuck!” and not get into the fund. Also, I can guarantee you that the week after you buy into it, something will happen and the NAV of the fund will plunge. Then you will kick yourself for reading something on a blog. But don’t worry. If you decide to buy, don’t worry about what it does over the next month or even year (If you are going to worry about short term performance, then just don’t buy it!).

Or how about some sort of balanced approach? Keep a constant percentage in each of U.S. and International, and then rebalance every now and then so that you would sell the one that did well and buy the one that did less well (so you sell dear and buy cheap). But there may be costs associated with that so I don’t know. It’s just a thought. I don’t do anything with mutual funds myself, and when I did own them, I tended never to rebalance anything.

Anyway, I have no problem at all recommending these funds to friends and family members etc. for their equity exposure. I am that comfortable with the approach of these funds and the people involved (Greenblatt).

So having said that, if you are friend or family and are reading this, look through your equity mutual fund holdings and if you own anything that is blah, some fund you own that you bought for a reason you don’t remember and it’s so-so or worse, then get rid of those and roll it into one of these funds. If you own mutual funds that you like, though, and is doing well, there is no reason to dump those.

I know most people tend to accumulate too many different mutual funds and stocks (as they are sold to them by various people. Most of these things sounded like good ideas at one time or another. But for some reason, people tend to buy stuff and never sell so they have this sort of financial attic of stocks and funds collecting dust. When you look carefully, sometimes you say, “What the…?”).

If that’s you, then clear some of that stuff out and just invest in one of these funds. You will do better.

Magic Formula or Value Weighted Index?

As far as mutual funds go, only Formula Investing exists, and according to the Value Weighted Indexing website, there really isn’t a fund to invest with the “Big Secret” approach. So this isn’t really a choice.

But if we had to make a choice, I would tend to favor a more concentrated Magic Formula approach since it would have fewer names and therefore potentially higher alpha. A value-weighted index fund would have many names in the portfolio so maybe a more limited alpha (even though the outperformance of the value-weighted index in the above table is pretty substantial).

These Won’t Ever Be Popular

By the way, these approaches, whether it’s the MF or value-weighted index won’t really get popular. Why? Because it’s not good for the ‘industry’. With all these mutual funds companies with armies of analysts and portfolio managers including ‘stars’, why would they push hard to point out that they can’t outperform the S&P 500 over time, and then advertise something that even beats the S&P 500 index?

Why would brokers push these on clients? If they did, they would never be able to convince clients to sell them to buy into whatever the next big thing is (and earn commissions).

(This reminds me of a conversation I had with a broker trying to get my business many years ago. I told her that I had all my money in Berkshire Hathaway (I didn’t own any at the time so I lied…) and that Buffett works for me for $100,000/year and he has a great track record over decades. No front-end loads, back-end loads, 12b-1 fees or any other such nonsense. Does she have any funds like that? Does following analyst recommendations and buying their IPOs lead to Buffett-like performance? Why do I need a broker when Warren does all the work for me, and I bet his broker is better than any broker I can hope to find. Of course, she never called again: mission accomplished.)

Or How About Something Else?

And here’s an interesting twist to this whole thing. It is often much more profitable to invest in a money manager than in the funds they themselves manage (even if the funds perform very well). This is due to the operating leverage that the fund management company enjoys and the added kicker of revenue growth above and beyond investment performance due to asset accumulation.

So even if the stock market only returns 5%/year going forward, if they have net inflows that amounts to 5% of AUM, that would lead to a 10%/year growth in revenues. With constant margins, earnings would grow faster than the market and if the valuation is unchanged, the value of the fund management company grows faster than the stock market.

That’s one layer of the leverage. But then you have the operating leverage too. If AUM grows in existing funds or the marginal cost of launching new funds is low, then operating margins can go up as AUM increases. So that adds another potential kicker to the valuation of a fund management company.

This doesn’t always work. I think in many of the recently IPO’ed private equity and hedge funds, the AUM growth seems to come primarily from launching new strategies (that usually entails acquisitions of whole portfolio management teams that run the new strategy), so the operating leverage doesn’t really kick in as much.

WisdomTree Investments (WETF)

So this naturally leads to WisdomTree Investments. The hedge fund legend Michael Steinhardt owns a big chunk of this thing so he is obviously a big believer in the fundamental-weighted index concept. Who knows, maybe WETF will eventually launch value-weighted index funds.

Anyway, I was going to take a quick look at WETF in this post, but since this is already getting long I will make this another separate post. As a preview, I will say that it is an interesting company but doesn’t look particularly cheap to me at this point unless AUM continues to grow at a high pace.

I view WETF as a solid short which should serve as a hedge to overall market w/ idiosyncratic profit potential – no take-out likely and it's tough to make money in the ETF game unless you're significantly larger. Steinhardt has been in there forever, so I wouldn't view him as providing a 'seal of approval'

I agree that's it's certainly not cheap on current metrics (I'll make a post on this later), but I'm not sure it's a great short either. It might be a good short for the short term, though, because of valuation. But they have been growing assets at a pretty hefty pace despite current market conditions. They've had net cash inflows every month or quarter except one even throughout the crisis. On top of that, if these indices do better than a market-cap weighted index (which I suspect they might), there is a chance that they can do well.

As for Steinhardt, yeah, he's been in there a while, but WETF is still in the early stages. I think they only started in 2006 or so (before that, WETF was the Individual Investor Inc. or some such Steinberg entity that published the magazine). I don't have a view about Steinberg either way, but if Steinhardt has a significant amount of money in there, he is not one to sit around and be passive about it.

I think he would be happy with the asset growth at WETF so far. Anyway, I'll look at this more in my next post…

Hi kk, given that Mr. Greenblatt serves as a member of Pzena (PZN) Board of Directors, could you share your thoughts about the stock? I know, this is probably out from the discussion of this post, but, given that you often talk about asset managers and your analysis are really appreciated, I try …

As you'll probably know, Mr. Pzena is a so called 'deep value guy', buying and holding a high conviction group of fundamentally analyzed stocks from the cheapest quintile of the universe in terms of p/b –> to generalize, Greenblatt buy cheap stocks in terms of Ev/Ebit and Pzena buy cheap stocks in terms of P/B.

PZN’s aum were impaired by the last crisis: being a pure equity manager and having invested a lot of money in the glorious financials like Fannie_Freddie, Aig, Citigroup, the company’s AUM took a hit so that currently PZN manages $16.4 bln. (8/31/12), coming from the $28.5 bln. (3/31/07) near the ipo date of end of October 07. Recently there was a positive news that Vanguard has added PZN’s strategy to the Windsor fund but from the highs near the IPO (near 22$) the stock is at 5$ (with the A share currently at 10.54 mln from 6.1 mln).

So, how do you value this stock?

I’m a bit confused by the ‘economic interest’ concept: from the last 10-k “(…) As of December 31, 2011, the holders of Class A common stock (through the Company) and the holders of Class B units of the operating company held approximately 16.3% and 83.7%, respectively, of the economic interests in the operations of the business”.

This is the flow chart: http://www.sec.gov/Archives/edgar/data/1399249/000114420412014940/v304912_chrt-flow.jpg

… I see this formula is shared by other asset managers (see Calamos (CLMS) for example: http://www.sec.gov/Archives/edgar/data/1299033/000129903312000028/organizationstructure.jpg

Thank you, Giuseppe

P.s: now Pzena is long HPQ, DELL … the ‘value trap’ that Mr. Chanos is currently short … We’ll see!

Hi, yes, I have been following PZN since the IPO so maybe I'll make a post about it. When you look at the company as a whole, just add up the total number of shares including class A an B and it's not so hard (just assume all B is converted to A for analytical purposes).

Yes, Pzena really screwed up during the crisis; I read his analysis of FRE and his valuation differential between commodity related stocks and financials etc.

I don't think PZN is necessarily cheap or attractive currently (but I'll look at it in a post), but I do like that it is a pure, simple value manager that might have some significant operating leverage if AUM starts to pick up again. And yes, the Windsor news is really good, I think.

I take that back about PZN; maybe it is cheap now. Let me take a closer look. Watch out for my next post (which will be PZN).

Ok, thank you for you answer