So 3G/BRK made their move and Kraft it is. Buffett was on CNBC this morning and he said that BRK paid $4.25 billion for common stock in Heinz initially and will pay another $5.2 billion to get this deal done for a total common equity investment of around $9.5 billion. After this deal closes, BRK will own around 320 million shares of the new Kraft-Heinz of a total 1.22 billion or so shares outstanding. That puts BRK’s cost per share at just under $30/share. KRFT closed at $83.15/share yesterday. Taking out the $16.50/share special dividend that will be paid out to the old KRFT shareholders (and BRK won’t get), that puts the ex-dividend price of KRFT at $66.70/share, so that’s roughly a double for BRK. BRK also owns preferred shares and warrants.

$66.70/share and 320 million shares owned means that this stake is worth $21 billion, and this would be a listed stock holding.

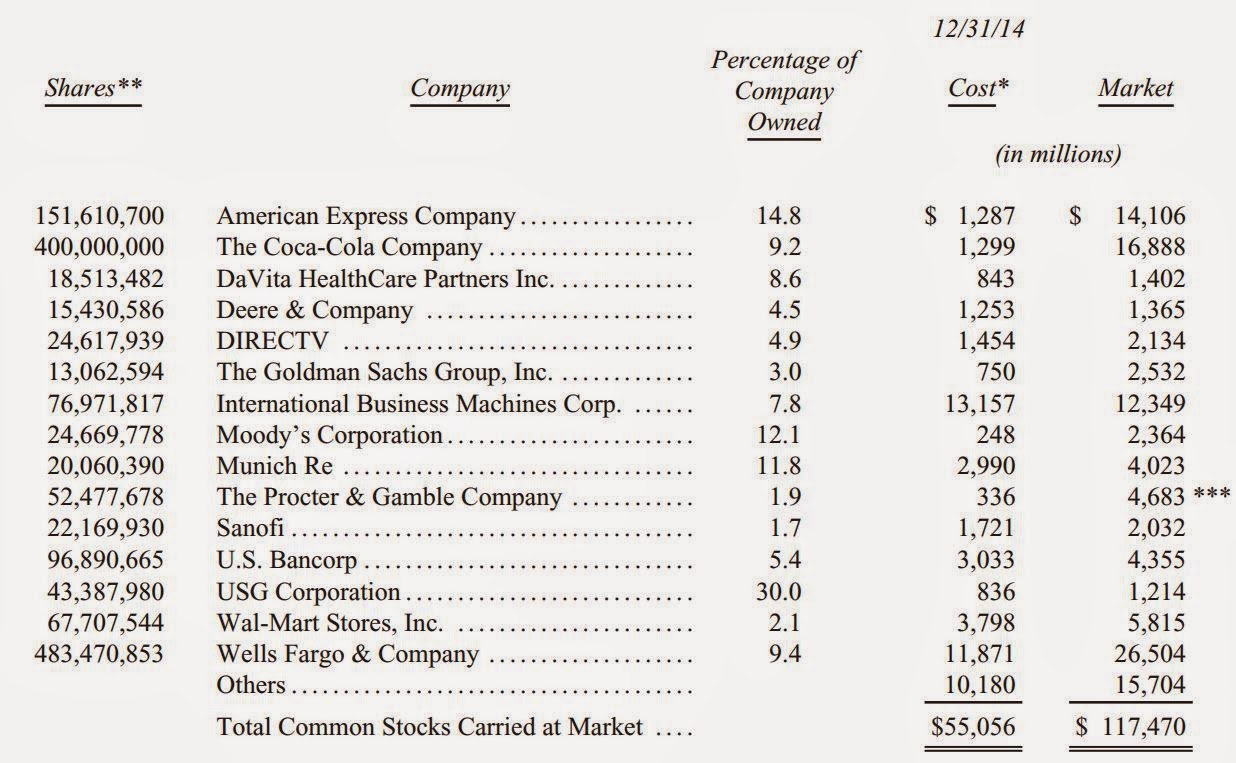

This is great news for people who think BRK’s equity portfolio is too financials-heavy.

As a refresher, check out BRK’s equity portfolio at the end of 2014:

So this would be a gigantic position, second only to Wells Fargo.

What are They Paying for KRFT?

This is an unusual deal. Usually, mergers/acquisitions are for cash, listed stock or some combination of them. This one is a combination of cash and an unlisted stock. So there is no fixed value (as in an all cash acquisition) or market value (price of acquirer’s stock) to measure this deal against.

I wonder what merger arbs do in this case. Usually, they buy the stock against a fixed price (in an all cash acquisition), or they buy the target and short the buyer against it (in a stock-for-stock merger). Here, what do you do?

I guess you can view the $16.50/share special dividend as sort of the premium on the deal. KRFT’s pre-announcement price was around $62/share so this premium is around 27%. KRFT shareholders receive $16.50/share in cash and one share of the new Kraft-Heinz for each KRFT share.

But let’s say yesterday’s closing price, $83.15/share is the acquisition price. What is the valuation at this level?

P/E ratio

KRFT’s EPS in 2014 and the estimates for 2015 and 2016 were:

EPS P/E

2014a $3.15 26.4x

2015e $3.24 25.7x

2016e $3.47 24.0x

So the current price implies an acquisition price of 26.4x P/E, pretty high.

EBITDA in 2014 was $3.6 billion (both the above EPS and EBITDA exclude a non-cash charge for post-retirement benefit expense), and EV is around $56 billion so that comes to 15.6x EV/EBITDA.

Price After Synergies

That seems high. But they said there is $1.5 billion in synergies to be expected. If we adjust the above figures, we can get $5.1 billion in EBITDA; that would bring the deal price down to 11x EV/EBITDA post-synergy. For EPS, we can add $1.5 billion after, say, 30% tax and using 588 million shares. That would add close to $1.80/share in after-tax earnings per share. Add that to the $3.15/share and we get $5.00/share post-synergy EPS. That brings the acquisition price down to around 17x P/E. 11x EV/EBITDA and 17x P/E is very reasonable.

What is the New KRFT Worth?

Well, this is the key issue. The above acquisition price is sort of circular. The more we think the post merger entity is worth, the higher the old KRFT price will go up, and the higher the acquisition price will look. Even if the current KRFT stock price went up a lot, the cost to HNZ to acquire KRFT will not increase at all as the cash portion is fixed, and the stock portion will not increase. Regardless of how high the old KRFT goes, shareholders will still only receive one new share of the new KRFT.

Anyway, let’s take a look at the post-merger valuation of KRFT. First of all, we have to adjust the current price for the $16.50/share special dividend that will be paid once to the old KRFT shareholders.

Ex-dividend, the new KRFT would be trading at around $67/share. There will be 1.22 billion shares outstanding, and net debt will be $28 billion. This includes repaying the preferreds to BRK and replacing it with debt. Therefore, post-merger, the EV would be around $110 billion.

Adjusted EBITDA at HNZ in 2014 was $2.8 billion, and the old KRFT had EBITDA of $3.6 billion (again, this excludes the post-retirement benefit adjustment so will differ from what you may see elsewhere). That gives us total EBITDA of $6.4 billion.

On this basis, the new KRFT is already trading at 17.2x EV/EBITDA.

That seems a bit on the high side. But wait. There will be $1.5 billion in synergies, so we might have to put that in. We can just add $1.5 billion to the $6.4 billion combined EBITDA and then we get a pro-forma combined EBITDA of $7.9 billion. That gets us to EV/EBITDA of 13.9x EV/EBITDA.

P/E

We’ll start with the combined $6.4 billion EBITDA. Take out D&A for both of $961 for an EBIT of $5.4 billion. Take out $1.2 billion of interest expense and we get $4.2 billion in pretax income. But this interest expense actually doesn’t include $8 billion of preferreds, which will be refinanced with investment grade debt. They say current HNZ debt and this preferred stock will be refinanced by investment grade debt, but let’s just use 5% for now. That’s another $400 million of interest expense (for the preferreds that get refinanced at 5%). So pretax income is actually $3.8 billion. (It’s a little complicated, but I think the preferreds don’t show up in the Heinz 10-K because they are at the parent company level. The 10-K only includes financials of the subsidiary and not the parent (that’s why you don’t see preferred stock on the balance sheet or preferred dividends in the income statement)).

Using a 30% tax rate (I used 24% for HNZ and 33% for the old KRFT for a 40/60 blended rate), that’s net income of around $2.7 billion. That’s $2.20/share in EPS for a 30x P/E for the new combined entity at $67/share. That’s kind of expensive.

But then again, let’s include the synergies. Then we get $6.4 billion + $1.5 billion = $7.9 billion in EBITDA, take out D&A of $961 million for EBIT of $6.9 billion. Take out $1.6 billion in interest expense (which includes preferreds converted into debt at 5%) for pretax income of $5.3 billion. After tax, that comes to $3.7 billion in net income or $3.00/share in EPS. That brings down the P/E to 22.3x.

This doesn’t take into account the refinancing of current HNZ high yield debt into investment grade debt.

Growth

By the way, even though they won’t give us long term guidance on growth, one of the major factors in this deal is growth. Most of KRFT’s sales are in the U.S. while HNZ has 60% of sales outside the U.S. The idea, like in the Burger King/Horton deal, is to use HNZ’s global distribution platform to increase sales of KRFT products around the world. This is probably too aggressive, but just imagine if KRFT’s sales breakdown evolved to something simliar to HNZ’s; a double in sales?

Margins

By the way, the old KRFT had these margins:

EBITDA margin: 17.6%

Operating margin: 20.0%

After ‘synergies’, their margins would be:

EBITDA margin: 28.0%

Operating margin: 25.8%

For the new entity, the margins would be:

EBITDA margin: 22.0%

Operating margin: 18.6%

After synergies, this would be:

EBITDA margin: 27.2%

Operating margin: 25.2%

For reference, here are some comps; their current valuations and margins:

| ttm | ttm | EBITDA | Operating | |

| P/E | EV/EBITDA | margin | margin | |

| PEP | 22.4 | 13.1 | 18.6% | 15.0% |

| KO | 25.3 | 15.3 | 27.9% | 23.6% |

| GIS | 23.2 | 13.1 | 17.9% | 14.8% |

| K* | 16.6 | 11.3 | 17.8% | 14.7% |

| MDLZ | 28.0 | 14.5 | 14.7% | 11.6% |

| CPB | 18.8 | 11.0 | 17.9% | 14.2% |

| DPS | 21.7 | 12.4 | 22.9% | 19.3% |

| SJM | 21.0 | 11.6 | 21.9% | 16.8% |

| average | 22.1 | 12.8 | 20.0% | 16.3% |

*For K, I used “comparable” figures, which exclude charges.

With the best margins out there (and similar to KO), there shouldn’t be a problem with the new KRFT trading at 22x P/E and 14x EV/EBITDA. Yes, we are assuming the $1.5 billion in synergies get realized, but when you look at what 3G has done in the past, I don’t have any doubt it will be realized.

For reference, here are some figures from the HNZ merger proxy back in 2013:

This is what the comps were trading at back in 2013. Maybe this is not so useful but it’s good to look at everything so…

| Enterprise Value/EBITDA | P/E | |||||||

| Company | LTM | CY 2013E | LTM | CY 2013E | ||||

|

Campbell Soup Company

|

9.7x | 9.8x | 14.9x | 14.7x | ||||

|

ConAgra Foods, Inc.

|

9.9x | 9.8x | 13.8x | 13.9x | ||||

|

General Mills, Inc.

|

10.1x | 10.0x | 15.6x | 15.3x | ||||

|

The Hershey Company

|

13.4x | 12.5x | 24.9x | 22.2x | ||||

|

The Kellogg Company

|

11.6x | 10.9x | 17.3x | 15.4x | ||||

|

Kraft Foods Group, Inc.

|

10.8x | 10.4x | not meaningful | 16.2x | ||||

|

Groupe Danone S.A

|

10.3x | 9.7x | 16.9x | 16.1x | ||||

|

Mondelēz International, Inc.

|

13.9x | 12.5x | not meaningful | 17.6x | ||||

|

Nestlé S.A.

|

12.2x | 11.1x | 19.3x | 17.7x | ||||

|

PepsiCo, Inc.

|

10.6x | 10.2x | 17.3x | 16.4x | ||||

|

Unilever PLC

|

10.9x | 10.2x | 18.6x | 17.1x | ||||

| Enterprise Value/EBITDA | P/E | |||||||

| LTM | CY 2013E | LTM | CY 2013E | |||||

|

Mean

|

11.2x | 10.6x | 17.6x | 16.6x | ||||

|

Median

|

10.8x | 10.2x | 17.3x | 16.2x | ||||

|

Heinz

|

11.9x | 11.2x | 17.3x | 16.4x | ||||

And here is the precedent transactions of comps:

| Date of Transaction Announcement |

Target | Acquiror | Transaction Value ($billion) |

Enterprise Value / LTM Sales |

Enterprise Value / LTM EBITDA |

|||||||||||

|

November 2012

|

Ralcorp Holdings Inc. | ConAgra Foods, Inc.

|

$ | 6.8 | 1.5x | 11.9x | ||||||||||

|

November 2010

|

Del Monte Foods Co. | Funds affiliated with Kohlberg Kravis Roberts & Co. L.P.,

Vestar Capital Partners and Centerview Partners

|

$ | 5.3 | 1.4x | 8.8x | ||||||||||

|

January 2010

|

Kraft Foods’ North America frozen pizza business | Nestlé S.A. | $ | 3.7 | 1.8x | 12.5x | ||||||||||

|

July 2007

|

Group Danone S.A.’s biscuits division | Kraft Foods Group, Inc. | $ | 7.2 | 2.6x | 13.2x | ||||||||||

|

December 2000

|

Quaker Oats Co. | PepsiCo, Inc. | $ | 14.0 | 2.8x | 15.6x | ||||||||||

|

October 2000

|

The Keebler Company | The Kellogg Company | $ | 4.4 | 1.6x | 11.1x | ||||||||||

|

July 2000

|

Pillsbury | General Mills, Inc. | $ | 10.5 | 1.7x | 11.0x | ||||||||||

|

June 2000

|

Nabisco Holdings Corp. | Philip Morris Companies Inc. | $ | 18.9 | 2.1x | 13.2x | ||||||||||

|

June 2000

|

Bestfoods | Unilever PLC | $ | 24.3 | 2.6x | 13.9x | ||||||||||

|

Implied Enterprise Value

as a Multiple of:

|

||||||||

| LTM Sales | LTM EBITDA | |||||||

|

Mean

|

2.0x | 12.4x | ||||||

|

Median

|

1.8x | 12.5x | ||||||

| Company | EV | EV/EBITDA | ||||||||||

| ($ in millions) | 2013E | P/E 2013E | ||||||||||

|

Nestlé S.A.

|

$ | 233,969 | 11.3x | 17.6x | ||||||||

|

PepsiCo, Inc.

|

135,550 | 10.3x | 16.5x | |||||||||

|

Unilever plc

|

123,112 | 10.5x | 17.8x | |||||||||

|

Mondelēz International, Inc.

|

75,436 | 12.6x | 17.6x | |||||||||

|

Groupe Danone S.A.

|

50,478 | 10.0x | 16.0x | |||||||||

|

Kraft Foods Group, Inc.

|

37,387 | 11.1x | 17.4x | |||||||||

|

General Mills, Inc.

|

37,561 | 10.4x | 15.2x | |||||||||

|

Kellogg Company

|

29,064 | 10.8x | 15.4x | |||||||||

|

The Hershey Company

|

19,605 | 12.5x | 22.1x | |||||||||

|

ConAgra Foods, Inc.1

|

24,429 | 9.5x | 12.8x | |||||||||

|

Campbell Soup Company

|

16,281 | 9.9x | 14.6x | |||||||||

|

The J.M. Smucker Company

|

11,639 | 9.3x | 16.2x | |||||||||

|

McCormick & Company, Incorporated

|

9,614 | 13.0x | 19.6x | |||||||||

|

Hormel Foods Corporation

|

8,990 | 9.9x | 18.0x | |||||||||

|

1Financial data were pro forma for the Ralcorp acquisition.

|

|

|||||||||||

|

Selected Public Companies

|

Heinz –

Management |

Heinz – Street

|

||||||||||||

| Mean | Median | |||||||||||||

|

EV/EBITDA

|

||||||||||||||

| 2013E | 10.8x | 10.5x | 11.1x | 11.2x | ||||||||||

|

P/E

|

||||||||||||||

| 2013E | 16.9x | 16.9x | 16.4x | 16.4x | ||||||||||

| Date Announced |

Target | Acquiror | EV ($ in thousands) |

EV/LTM EBITDA |

||||||||

|

Dec. 2012

|

Morningstar Foods, LLC | Saputo Inc. | $ | 1,450 | 9.3x | |||||||

|

Nov. 2012

|

Ralcorp Holdings, Inc. | ConAgra Foods, Inc. | 6,775 | 12.1x | ||||||||

|

Feb. 2012

|

Pringles Business of Procter & Gamble Company | Kellogg Company | 2,695 | 11.1x | 1 | |||||||

|

June. 2010

|

American Italian Pasta Co. | Ralcorp Holdings, Inc. | 1,256 | 8.3x | ||||||||

|

Jan. 2010

|

North American Frozen Pizza Business of Kraft Food Global, Inc. | Nestlé S.A. | 3,700 | 12.5x | ||||||||

|

Nov. 2009

|

Birds Eye Foods, Inc. | Pinnacle Foods Group, Inc. | 1,371 | 9.5x | ||||||||

|

Sept. 2009

|

Cadbury plc | Kraft Foods Inc. | 21,395 | 13.3x | ||||||||

|

June 2008

|

The Folgers Coffee Company | The J.M. Smucker Company | 3,398 | 8.8x | ||||||||

|

Apr. 2008

|

Wm. Wrigley Jr. Company | Mars, Incorporated | 23,017 | 18.4x | ||||||||

|

Nov. 2007

|

Post Foods | Ralcorp Holdings, Inc. | 2,642 | 11.3x | 1 | |||||||

|

July 2007

|

Global Biscuit Business of Groupe Danone S.A. | Kraft Foods Global, Inc. | 7,174 | 13.6x | 1 | |||||||

|

Feb. 2007

|

Pinnacle Foods Group, Inc. | The Blackstone Group, L.P. | 2,142 | 8.9x | ||||||||

|

Aug. 2006

|

European Frozen Foods Division of Unilever plc | Permira Advisors Ltd. | 2,199 | 9.9x | 1 | |||||||

|

Aug. 2006

|

Chef America, Inc. | Nestlé S.A. | 2,600 | 14.5x | ||||||||

|

Dec. 2002

|

Adams Confectionary Business of Pfizer Inc. | Cadbury Schweppes plc | 3,750 | 12.8x | 1 | |||||||

|

Oct. 2001

|

The Pillsbury Company | General Mills, Inc. | 10,396 | 10.1x | 2 | |||||||

|

Dec. 2000

|

The Quaker Oats Company | PepsiCo, Inc. | 14,010 | 15.6x | ||||||||

|

Oct. 2000

|

Keebler Foods Company | Kellogg Company | 4,469 | 10.7x | ||||||||

|

June 2000

|

Nabisco Holdings Corp. | Philip Morris Companies Inc. | 19,017 | 13.7x | ||||||||

|

June 2000

|

International Home Foods | ConAgra Foods, Inc. | 2,909 | 8.5x | ||||||||

|

May 2000

|

Bestfoods | Unilever plc | 23,503 | 14.5x | ||||||||

|

Selected Transactions

|

The Merger

|

|||||||||

| Mean | Median | |||||||||

|

EV/LTM

EBITDA

|

(all

transactions)

|

|||||||||

| 11.8x | 11.3x | 13.7x | ||||||||

|

EV/LTM

EBITDA

|

(transactions

since 2009)

|

|||||||||

| 10.9x | 11.1x | 13.7x | ||||||||

Moelis determined that a fair value range for HNZ, based on previous food company deals, was 11.0x – 14.0x LTM EBITDA.

So according to this, KRFT is currently trading within range. Keep in mind that the new KRFT is going to have tremendous margins and some real growth opportunities.

Conclusion

So this deal looks really interesting. Some people are skeptical of these cost-cutting deals but I think the 3G guys are really good. Sales is not growing at HNZ currently because they were rationalizing their SKU line-up, cutting unprofitable lines etc.

The right way to look at this is that the special dividend itself is the acquisition premium. Something around 30% is typical in takeovers.

Other than the special dividend, old KRFT shareholders end up with one new Kraft-Heinz share. What does that mean? At the pre-deal price of $62/share, old KRFT shareholders owned a company trading at around 20x ttm P/E and 12.4x EV/EBITDA. This company had an operating margin of 18% and EBITDA margin of 20%.

Post deal, before an increase in the stock price (other than the amount of the special dividend), on a pro-forma basis at $62/share, the old KRFT shareholder would own the new Kraft-Heinz that trades, on a pro-forma basis at 21x P/E and 13x EV/EBITDA, a pretty similar valuation. But the pro-forma operating margin would be 27% and EBITDA margin would be 25%.

That sounds like a good deal to me. You get a nice premium, and you end up with a better stock than you owned previously. You were stuck with sort of a no-growth situation and suddenly there is hope.

The new Kraft-Heinz (synergies are already priced into the above metrics) would not only have better margins, but also a much more interesting and promising growth profile than the current KRFT.

The post-announcement rally in the stock price has pushed up the valuation of KRFT to $67/share on an ex-dividend basis, so the current pro-forma valuation is more like 22x P/E and 14x EV/EBITDA. This is at the high end of food companies, but they will also have margins at the high end and greater growth prospects.

This is a first pass look at this deal, sort of a back-of-the-napkin look so I am probably missing a few things here and there. There are a lot of moving parts here and others will make different adjustments than I made so may come up with different figures.

And there are things that we don’t know yet. The merger proxy should be very enlightening in that sense.

Anyway, this is kind of an exciting deal; it will be fun to follow.

Do you know the record date for the special dividend? Thanks

No. The deal is expected to close in the second half of this year. More details should follow, especially in the proxy.

I'll preface this comment by saying that I'm not an analyst or a number cruncher. When dealing with buying public companies given that WEB will rarely issue BRK stock it must be hard for existing management to willingly sell out for cash. They would be giving up all upside. This deal to me is pretty creative in that KRFT shareholders got a premium ($16.50) as well as upside to come if 3G can work its magic. On top of that, they get Buffett as a 26%+ owner and board member. To me, I don't think one can go wrong in owning KRFT for those reasons. So, without crunching any numbers I bought a bunch yesterday (3/25) at the open.

It looks interesting. It's certainly fully priced including the synergies so one can't call it cheap. So to buy here, you have to think they will do better (actual figures may be better than the above as I don't take into account some things like lower interest rates on HNZ's current debt, improvement in cash flows etc.).

Plus you have to think they can actually grow the business over time. A lot of people seem to be saying this deal is not so great because they are on the wrong side of eating trends (highly processed versus world moving to less processed/healthier).

But at a reasonable valuation, you can do worse than partnering with Buffett and 3G.

Is Kraft even allowend to sell outside US (Mondelez Spin-Off?)

Good point. Those license agreements roll off over the next few years. They didn't give details on the conference call but said there is some stuff in the Form 10 about them.

Could it be possible that you are mixing up some numbers when calculating your double for BRK?

I agree that he paid +/- 30 per share but he paid this for shares in the newCo (the one with 1220 s/o) and not the one currently listed on the market (at the price of 83 (or 66.7 ex div) and 588 s/o).

I guess a more correct way to look at his current gains is determine a value based on your estimates of EBITDA. Take the 8 bn EBITDA number, slap on a 11x multiple (or whatever pleases you), get a 88 bn EV – net debt of 28 bn (insert debt reduction if it pleases) to arrive at an equity value for newCo of 60 bn, divided by 1220 shares gives you around 49 per share.

Still not a bad deal (duh).

The 1.2 billion shares includes the old HNZ. So after the merger, BRK will own 320 mn shares in the new entity. For this common equity stake, he paid a total of $9.5 billion. So I think it's correct.

Yes but you are assuming those 1220 shares will trade at 66.7, right?

Yes.

Any guesses on the eventual regular dividend? The other 3G companies seem to pay. Bud ~50% payout ratio and Ambev fluctuates between 20-50%.

If they pay half, then that's 1.50 per share dividends

I haven't thought about that. But yes, I guess you can estimate something by plugging in various payout ratios.

They will keep the $2.20 annual dividend and will grow it over time. Net of $16.50 special dividend, that's a 3%+ yield. Not bad for an investment grade company when 10 yr tsy is >2%.

One other point, the refi of HNZ debt and preferreds is expected to reduce interest expense. Any color on that?

Hi, the refinancing of the preferreds should save them $450-500 mn/year in cash according to the conference call (merger call). As for refinancing their debt, it would probably save them 100 bps or a little more but that assumes the ratings of KRFT doesn't change post-deal. On $14 billion of gross debt, that would be another $140 million+ in savings (pretax).

thanks, hc.

Do you understand why they are leaving so much equity on the table? Couldn't 3G and BRK (especially) used all the cash they have to get more equity since the huge cash position is a problem, and this company it so large. It seems like a missed opportunity. I am clearly missing something. Maybe 3G does not want BRK to have too much equity?

Yeah, I think it has something to do with BRK/3G partnering. They want it to be 50/50, probably. It would be awkard if BRK owned the other half (what the public would own after the merger) for a total of 75% or whatever, and then have 3G run it. Maybe a fund has to know that there is an "out". If the only exit was BRK buying the rest of it, they may not get a good price. I don't know…

Thanks kk for this great analysis. 😉 Here is Matt Levine on it : http://www.bloombergview.com/articles/2015-03-26/so-buffett-will-only-get-to-triple-his-ketchup-money

Interesting analysis. However couldn't help but thinking of Buffett's own "what you get, and what you pay" approach when thinking about this deal.

Kraft shareholders are getting 1.37bn in EBITDA (49% of Heinz's 2.8bn) and paying (i.e. losing) 1.84bn (51% of Kraft's 3.6bn). In other words Kraft shareholders are losing c. 470m in EBITDA while Heinz shareholders gain that amount.

Furthermore, they are also getting 8.8bn in new debt (49% of Heinz's 18bn) and shedding 5.1bn (51% of Kraft's 10bn). Thus, Kraft shareholders have 3.7bn more debt to be repaid than they did prior to the deal.

However, the saving grace is the 10bn dividend Kraft shareholders receive (I take 10bn, although 588m shares x 16.50 = 9.7bn?). On an EV basis Kraft shareholders are getting 6.3bn (10bn dividend less additional debt of 3.7bn taken on) and giving up 470m in EBITDA. This would put the multiple at 13.4X EBITDA – a stiff but not ridiculous price for either party I guess.

That's one way to look at it. If Heinz was way bigger, then that sort of analysis makes more sense since you are giving up one stock with certain characteristics for another. But here, even though you are making an exchange exactly as you state, the more relevant question for me is what you started with and what you end up with. That's why I described my analysis the way I did. You start out owning a slow, stodgy stock with no real prospect before the deal, and after the deal you end up with a stock with similar proforma valuation with a much better outlook.

The $1.5 billion in synergies will lead to value creation that will happen thanks to the deal so you have to incorporate that somewhere in the analysis.

Plus, they will improve cash flows which is not included in my anaylsis.

Indeed. You need to consider things like ROCE, cash conversion and growth prospects to evaluate whether trading 1m EBITDA in Kraft for 1m EBITDA in Heinz is the same. Perhaps 1m at Kraft is worth 13.4X while 1m at Heinz is good for 15.4X (because of higher growth prospects, better cash generation, etc.). That seems to be the crux of your argument.

I was merely pointing out that if you do what Buffett always says (look at both what you're receiving AND paying) then Kraft shareholders are getting roughly 13.4X EBITDA (a pretty decent multiple by any stretch). By participating in future synergies, cutting CAPEX, etc. (to the tune of 49% Kraft and 51% Heinz) Kraft shareholders are implictly getting a better deal (obviously this applies to Heinz as well which helps soften the headline multiple).

If anything I'm agreeing with you – its not a bad deal for Kraft shareholders. Perhaps its a question of semantics. It just seems to me that rather concentrating on appraising the combined entity; it might be more useful (and simpler) to focus on the two building blocks;1) what is Kraft worth, and 2) what is Heinz worth, and then add your synergies etc,etc.

You are right. I just found it easier to go from the final entity and backwards and didn't feel the need to go much further. Anyway, thanks for the discussion.

Fantastic post and great insightful comments!

Great work! Thanks for sharing.

Just because someone says there is going to be 1.5 Billion in synergies doesn't mean there are so I don't think one should pay full value for that regardless of anyone's track record.

The math here shows 17.2 PE if you accept they achieve 1.5 Billion in savings. I don't see how that is a good buy. Sure if you get the shares at $30 like Buffett it's good deal. But I think anyone hold Kraft shares post the special dividend will be seeing a crappy long term return.

I know one thing for sure. Buffett and 3G wouldn't pay $67 a share for Kraft/Heinz after the dividend was paid.

Well, we are all going to have various opinions on this. That's why I like to put as much information there as possible. So someone who wouldn't mind pay 20x P/E for the old KRFT, or the current KO, for example, might not mind paying 17x p/e for something with a real catalyst.

It is certainly not your conventional value situation so I can understand many would not be interested in this at all. I don't own any, but am interested in the situation.

Anyway, thanks for dropping by!

this is true….I would like to add as a searched around for analysis of the deal – this is the best I've found.

Curious how the above poster got 17x,not saying it's wrong just curious how he got there. Again thanks for the post, very helpful.

Oh, I just took the KRFT adjusted earnings per share from last year and then added the $1.5 billion synergies to it (and adjusted for tax) to get a 17x p/e for what HNZ is paying for KRFT. So that is where that number came from.

skip the fancy math – Buffett wants 10% return – he is paying $30 a share for a firm that post synergies makes $3.00 per share. The other shareholders who aren't 3G – at 67 a share – they get 4.4%. If held Kraft share's I'd sure be unloading them because you're about to be diluted to a crappy return going forward.

This doesn't make sense. KRFT shareholders had a 5% earnings yield before the deal and you expect them to sell because now they have 4.4% earnings yield + better management + improved growth outlook? What??

Also – this is supposed to be earnings accretive by 2017… so double what??

I wouldn't have held Kraft shares before the merger either. It was a crappy buy before and it's still a crappy buy.

My point is that there is little to no dilution, but you state "You're about to be diluted to a crappy return going forward". This looks to be the opposite sort of deal. 4.4% estimate of current earnings yield vs. ~5% before the deal with growth prospects.

"synergies" is cutting jobs. this is a financial transaction. depending on HNZ to grow your business is a fools errand.

This comment has been removed by the author.

I think in the M&A world, people look at deals as "financial" transactions or "strategic". Financial buyer just means that the buyer is a private equity firm, merchant bank or something like that; a financial entity. A strategic buyer is usually an operating entity.

I see the point of Autonut's post now. Thanks.

Does the cash distributed by the merger, will get taxed as a dividend? or no tax on 16.5 per share? thanks.

I haven't seen anything definitive (it might be somewhere) but I guess it wouldn't be taxed as a normal dividend; maybe a return of capital since the cash being paid out is not out of retained earnings and looks like new capital raised etc… But not sure.

Thanks a lot. I guess we have to wait for the merger agreement document…any idea when that might be out? is there a regulatory requirement as to the deadline for submission post announcement day? thx.

I don't know.

The merger proxy was filed by Heinz. (look for S-4). And it looks like the cash dividend will be taxed normally, but depends on your cost basis of KRFT shares. Here is a cut and paste. There should be more somewhere later in the proxy, but I just cut and paste the Q&A section at the beginning of the filing here:

Q: What are the material U.S. federal income tax consequences of the merger, the subsequent merger and the special dividend to Kraft shareholders?

A: The obligations of Kraft, on the one hand, and Heinz, on the other hand, to complete the merger are conditioned, respectively, on Kraft’s receipt of a written opinion from Sullivan & Cromwell LLP, tax counsel to Kraft, and Heinz’s receipt of a written opinion from Cravath, Swaine & Moore LLP, tax counsel to Heinz, each to the effect that for U.S. federal income tax purposes, the merger and the subsequent merger will be treated as a single integrated transaction that will qualify as a “reorganization” within the meaning of Section 368(a) of the Code.

For U.S. federal income tax purposes, the special dividend, the merger and the subsequent merger should be treated as a single integrated transaction. As a result, both the Kraft Heinz common stock and the special dividend should be treated as received in exchange for shares of Kraft common stock pursuant to a transaction qualifying as a reorganization for U.S. federal income tax purposes. A Kraft shareholder who exchanges his or her shares of Kraft common stock for shares of Kraft Heinz common stock pursuant to the merger and receives cash in the special dividend will recognize gain, but will not recognize any loss, for U.S. federal income tax purposes. The amount of gain recognized will equal the smaller of (i) the amount of cash received in the special dividend and (ii) the excess, if any, of (x) the amount of cash received in the special dividend and the fair market value of the Kraft Heinz common stock received in the merger (determined at the effective time of the merger) over (y) the Kraft shareholder’s tax basis in the shares of Kraft common stock surrendered in the merger. Subject to the conditions and restrictions set forth in the section entitled “Material U.S. Federal Income Tax Consequences” beginning on page [—] of this proxy statement/prospectus, any recognized gain will generally be long-term capital gain if the shareholder’s holding period for the shares of Kraft common stock surrendered is more than one year at the effective time of the merger.

For more information on the U.S. federal income tax consequences of the merger, the subsequent merger and the special dividend, see the section entitled “Material U.S. Federal Income Tax Consequences” beginning on page [—] of this proxy statement/prospectus. Kraft shareholders should consult their tax advisors for a full understanding of all of the tax consequences of the merger, the subsequent merger and the special dividend to them.

Although intrinsic value appears to have increased for BRK in 2014 by 12+ %, BV increased only 8.3 %. If the $ 9.5 billion of BRK equity turns into $ 21 billion of Kraft-Heinz stock, then BRK BV will increase 4+ %.Odd that BRK price is down and people re pushing the Kraft price upwards.

Thank you for your column. I work full time in medicine, and my investing is simply to provide for retirement, which I hope is 8+ years away, even though I am 62. Your writings are wonderful to follow, and fortunately for me, many of the companies you choose to review are ones in which I already invested. You have greatly helped me to better understand them as businesses. In my world we all devote time for which we are not compensated except with goodwill. Thanks for doing the same.

LIMLaGrange

Thanks for the nice comment. And yeah, regarding BRK and KRFT, it's just Mr. Market being Mr. Market.

I'd like to further discuss the warrants to purchase an additional 46 mm shares of Heinz Holdco common shares. In the 2014 10-K, it states that the Heinz Holdco warrants have a exercisable price of $0.01 share and expire on June 7, 2018. The question I have is how these warrants will be affected by the new transaction to merge KRFT/HNZ. The first thing that comes to mind, as a quick back-of-the-envelope estimate, is to look at the dilution that will occur to the common. Basically, BRK bought 425 mm shares of HNZ for $4.25 bn, then injected an additional $5.25 bn to own an eventual 320 mm shares of the combined company. The dilution in shares is roughly 0.75. So, taking this logic to the warrants, it seems that maybe the 46 mm will turn into approximately 35 mm (46 x 0.75). If this is so, and the exercisable price remains $0.01/sh (key IF, by the way…), then BRK will end up owning around 355 mm shares of new KFRT/HNZ for pretty much the same $9.5 bn investment. If all this is so, then the actual cost basis would be in the $26-$27/sh range. Thoughts? Am I missing something? Thank you all in advance for your comments!

That sounds about right. The warrants if not exercised will remain outstanding and will represent warrants to purchase Kraft Heinz. From the S-4:

Ownership of the Combined Company

As of the date of the registration statement of which this proxy statement/prospectus forms a part, entities affiliated with 3G Capital owned 425,000,000 shares of Heinz common stock (equal to approximately 46% of the Heinz common stock on a fully diluted basis) and Berkshire Hathaway owned 425,000,000 shares of Heinz common stock and, by exercising the Berkshire warrant, was entitled to receive an additional 46,195,652 shares of Heinz common stock (equal to, in the aggregate, approximately 51% of the Heinz common stock on a fully diluted basis). The remaining 3% of the fully diluted Heinz common stock was held by Heinz directors and management, including in the form of Heinz stock options and Heinz restricted stock units. In addition, 80,000 shares of Series A Preferred Stock were issued and outstanding and held by Berkshire Hathaway.

As a result of the equity investments, the pre-closing Heinz share conversion and the merger, we expect that:

• on a fully diluted basis, approximately 51% of the outstanding Kraft Heinz common stock will be held by shareholders that were shareholders (or were affiliates of shareholders) of Heinz immediately prior to the effectiveness of the merger (including 3G Global Food Holdings and Berkshire Hathaway) and approximately 49% of the outstanding Kraft Heinz common stock will be held by shareholders that were Kraft shareholders immediately prior to the effectiveness of the merger;

• to the extent not exercised prior to the consummation of the merger, the Berkshire warrant will remain outstanding and will be exercisable for shares of Kraft Heinz common stock; and

• the 80,000 shares of Series A Preferred Stock will remain issued and outstanding with substantially identical terms.

Buying here at $69 with 3%+ yield?

Sorry for the late response. It is interesting, but everything is getting cheap! But no, I haven't bought any here…

From your article:

"…If we adjust the above figures, we can get $5.1 billion in EBITDA; that would bring the deal price down to 11x EV/EBITDA post-synergy. That would add close to $1.80/share in after-tax earnings per share. Add that to the $3.15/share and we get $5.00/share post-synergy EPS."

From the Q1 2016 – For the Three Months Ended

Adjusted EBITDA(2) 1,951 in millions

Adjusted EPS(2) $ 0.73 $

EBITDA seems even more than expected, EPS also not far off

You should be worried about your dividends. This company's latest launch of "racey" Devour brand foods is not giving them a very good public image right now. Trying to insinuate food is like sex is a very bad move because it's the old thinking that sex will sell anything. WRONG. People in that caliber are the minority and those of us with brains realize very well what they are doing. I'm intellectually insulted and I will no longer buy their products. I don't need their poop that bad.

Hi KK,

It would be nice to see a follow up post on this with the recent news with Kraft Heinz.

Hi,

Yes, interesting development. I don't own this and haven't been following so closely recently. It is kind of surprising, but it may be interesting here. I will take a look at it over the next few weeks and may post if I find anything interesting to say.

One thing I will say is that I'm not sure this problem is really due to their cost-cutting as most people seem to say. I sort of felt that way with Lampert too, although in that case, the criticism of under-investment is probably a little more convincing (as their stores were definitely in terrible condition; I was actually scared to get into the elevator at their store in Astor Place, NYC, as it used to shake and grunt etc… lol…

But these guys are facing problems of the changing times. Sears, for example, basically had no reason to exist and couldn't find one, really, over the years, investment or not. They couldn't complete with the likes of Best Buy, Home Depot, Lowes, Walmart, Target, and of course, Amazon.

As for KHC, it's kind of similar as 'brands' just don't have the power that they once had, especially as millenials tend to see the establishment brands as evil, or unhealthy at best. So that's what they are fighting against, so it's not really the doing of 3G, I don't think, so much as the changing times which is hitting everyone.

Of course, maybe they could have done better, but it's really tough in this new era, I think, so the issue is a lot more than just about cost-cutting or not.

Anyway, this is very interesting and I don't really have any answers at the moment so stay tuned…