I was going to pick this apart to see what it is worth and all that, but a few things about this is bugging me so I will hold off on looking at this in too much detail for now.

Anyway, just some quick thoughts. I do like the idea of private equity. I am not one of those that think of private equity guys as asset strippers or anything like that. I think they serve an important function in the economy/capital markets. I know some of the older school financial people don’t like what private equity does but I am not one of those.

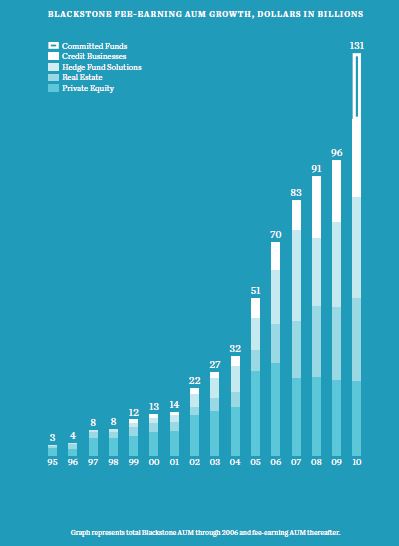

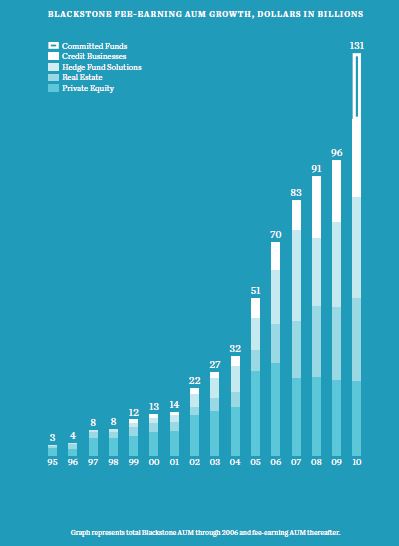

One of the main issues I have with BX as an investment is simply it’s huge success over the past few years.

Again, when AUM goes up so much in private equity, they have to increasingly chase the mega-deals, and do that with other giant private equity firms which tends to make prices much higher.

At this point, the private equity portfolio is a small portion of total AUM. On a fee basis, as the above chart shows (also from the 2010 annual report), only 15% of the fees come from the private equty business.

Hedge funds and Real estate now account for more than half of the fee related income at Blackstone.

That may be good, actually. But for me, I was attracted to Blackstone for their reputation in private equity, and I do have a lot of respect for Stephen Schwarzman. I think he is very smart and competent.

But to own BX now is not the same as owning a private equity firm that generates 30-40%/year returns for their clients. Most of the portfolio as it exists today will not generate those kinds of returns.

So first of all, this is not a pure private equity play investment that some may believe it to be. It is a very different bet than that.

I don’t have anything against real estate and hedge funds.

There is good disclosure on the real estate fund returns in the financials of BX, but there really isn’t much for the hedge fund business. An aggregate, composite return is mentioned here and there, but there is no breakdown in terms of strategy like Och-Ziff (OZM) and Fortress Investment Group (FIG) discloses. Nor do I have much knowledge or comfort with the people who are running BX’s hedge fund business (not to mention that I am not a big fan of funds of funds).

My concerns with size apply to these two segments too. Many high return hedge funds turn flat once their asset base gets too big. There is just no getting around that. But without a look ‘inside’ it’s even more worrisome.

This is not to say that BX can’t do well going forward. Schwarzman is no fool and he will probably continue to do well. It’s just more a comfort issue for me.

AUM level too high, private equity now a minority business there, not much disclosure about the big hedge fund business segment are issues that I can’t get comfort with.

Also, I tend to like asset managers as they have operating leverage: they have a high fixed cost base but when asset levels rise due to investment performance and net inflows of investment funds, the asset managers earnings go up a lot.

But I notice that a lot of asset increase at BX recently has come from adding different strategies. This is good from a diversification standpoint, I suppose, but it does increase the cost base. If they increase AUM by increasing the number of different stategies, fund types and fund managers, then the operating leverage won’t work to the same effect. This, of course, is not necessarily a bad thing. Schwarzman is actually trying to build a sustainable business that will outgrow his own presence.

What I worry about is in fact Schwarzman’s goal. He wants BX to be a company that can survive without him into perpetuity. So again, this is not automatically a bad thing. It’s just a personal preference issue for me as an investor on why I would or wouldn’t be interested in investing in BX.

The other issue is that the S&P 500 index has been flat since 2000 and interest rates are very low. This means that pension funds and other financial institutions have very little chance of making their projected investment returns.

This is kind of a dangerous thing. The right thing to do when pension asset return assumptions are too high is to reduce them and take an earnings hit. But CEO’s don’t generally want to do that. They would rather take the ‘easy’ way out and simply not own bonds and stocks (or they will reduce allocation to those assets dramatically). They will shift their asset mix to ‘alternative’ investments that promise them higher returns.

As far as I’m concerned, and maybe I am overly conservative, that might be a recipe for disaster.

A lot of the assets rushing into BX and other alternative asset managers are flowing in for this reason, and that is kind of scary.

Looking into these things, it’s no wonder that a lot of large, blue chip stocks are trading so cheaply; nobody wants to own stocks since they’ve been flat forever. They want to own ‘alternative’ assets that will make them enough so that they don’t have to take down their pension asset return assumption (and worsen the underfunded status of the funds, or take an earnings hit).