I can already hear it: “Value investing doesn’t work! Look at Bill Miller! Told ya so!”.

Yes, Bill Miller does look sort of like a bull market genius. He was a mutual fund hero for outperforming the S&P 500 index for 15 years in a row from 1990 through 2005.

I was never a big fan of Miller, though. One quote that scared me years ago attributed to him is “The one with the lowest cost wins”, or some such thing. If he likes something, he just keeps buying it as it goes down, almost to a reckless extent. The problem with this approach is that you have to really be right. Of course, if you are right, then buying something for less is good.

Anyway, Bill Miller became the lead manager of the Legg Mason Value Trust back in 1990, and since then the average annual return has been +9.39%/year versus +9.14% for the S&P 500 index. So he did beat the index over the long haul, but just barely. And this was after a hefty 1.8% expense (according to this morning’s WSJ article).

The assets under management for this fund went from $20.8 billion down to $2.8 billion, which is an astounding drop. (By the way, this to me is more of an argument of what happens when a fund gets too big rather than the validity or invalidity of value investing).

This supports John Bogle’s view that people should just stick to low cost index funds (which I tend to agree with for the most part).

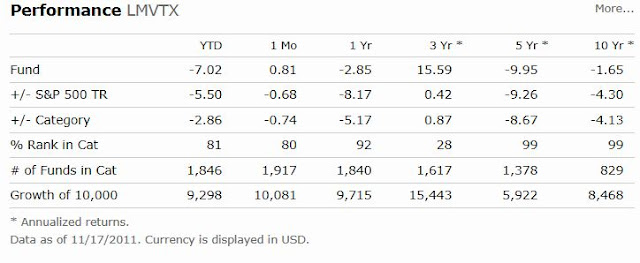

Here are some more figures for the fund from Morningstar:

Over the past five years, the fund underperformed the index by 9.3% per year and underperformed by 4.3% per year over the past ten years. That’s a pretty huge underperformance.

Compare this to the book value per share growth of Berkshire Hathaway (BRK), another old guy that people often call a ‘bull market genius’: Book value per share grew 10%/year in the five years through December 2010 and +9%/year over ten years. Yes, it’s a different endpoint, but it won’t make much difference. And yes, BRK is not a mutual fund but a corporation with cash flow etc… But BRK does own a heck of a lot of financials (Wells Fargo, American Express, U.S. Bank etc…) and has a bunch of operating businesses in the housing related sector, and is big into the insurance business which has been an awful business in the recent past.

Looking back at Miller’s error, this exactly makes my point about good management. I remember when Miller was asked about his poor performance during the crisis. His response was that the crisis got a bit worse than they expected.

At the time, my reaction was that this is not acceptable!

A while back on a conference call, Jamie Dimon talked about having a fortress balance sheet. Analysts were bothered by Dimon’s conservatism and his response was something to the effect that if they take too much risk and try to maximize profits and then the economy gets much worse than they expect, he doesn’t want to go back to investors and say, “Sorry guys, things got worse than we thought so your stock is worth zero”. Dimon said that that is totally unacceptable.

(This is why JPM got through the crisis without a loss in any quarter).

This is also why Warren Buffett got through the crisis with decent returns even if his stock picks were suboptimal (he was buying Wells Fargo right before the crisis too). Buffett doesn’t put himself in the position that things will hurt him too much if things get worse than he thinks (and he has admitted that the crisis was much worse than he thought; he did say that the Fed drew the line in the sand when they brokered the Bear Stearns/JPM deal. He said at the time that the worst of the financial crisis was over, at least in terms of the financial markets).

Buffett was totally wrong about that but didn’t put himself in a position that it would hurt BRK too much if he was wrong. THIS is the key difference between Buffett and Dimon versus many others like Bill Miller.

Here’s another thought. With this Bill Miller comedown, many will conclude that value investing doesn’t work, or that active investing doesn’t work and nobody can outperform the markets.

This reminds me, again, of trying to learn the right lesson from something and not the wrong one.

When so many people lost money on subprime loans, people concluded simple-mindedly that subprime loans are just no good. Is this correct?

As usual, I think bad subprime loans area bad, and good subprime loans are good. Leucadia made good money by being able to distinguish that when they bought Americredit (and then sold it not too soon after to GM for a nice gain).

But most people will not distinguish that. They will simply conclude that subprime loans are bad, period. (Just like many people seem to conclude that all derivatives are bad, all corporations are evil, all banks are bad etc…).

Here’s an example of why subprime loans on it’s own is not bad at all.

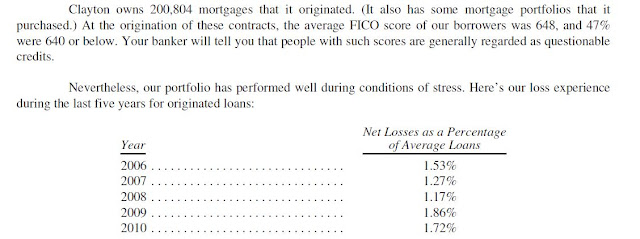

Mobile home, low credit loans are probably the worst category in terms of image. But here’s Berkshire Hathaway’s loan loss history of their mobile home loans:

This is a cut-and-paste from BRK’s 2010 annual report. So a good half of the portfolio are loans to people with credit scores below 640, pretty subprime.

And yet, look at the loan losses. Very low. Why? Because they made “good” loans, not “bad” ones (high loan-to-value etc…).

This serves to illustrate yet again that it’s not the category that is important so much, but how something is done.

Good banking is a good business. Banking done badly is a horrible business. Investment banking done well is a good business. Investment banking done badly is a horrible business.

Value investing, too, falls into that category. I suppose history will record Miller as a bad example of value investing (reckless) but some others will go down as good value investors.