There is talk out there that Softbank and Alibaba is going to bid $17 billion for Yahoo’s Asian holdings in some sort of tax free deal. I don’t know what the real term sheet looks like, it was just on CNBC. But let’s take a quick look to jot down some of th facts.

Here’s the basic information:

(grabbed from the CNBC screen)

- 40% of Alibaba ($12 billion)

- 35% of Yahoo Japan ($5 billion)

- Yahoo keeps 15% stake in Alibaba

- Tax-free, cash-rich split

- Yahoo “core” valued at $6/share?

I don’t know what the last item valuing Yahoo’s core business at $6.00 means. The stub value after deducting the $17 billion on the deal is $2/Yahoo share.

Actually, dividing $17 billion by the 1.24 billion shares I think is outstanding gives $13.70/share, and Yahoo is trading around $16/share so that gives the Yahoo operation a value of $2.30/share.

But actually, the 3Q figures show that Yahoo has cash, cash equivalents and bonds worth $2.87 billion on the balance sheet. That’s $2.31/share, so the market is actually giving the Yahoo “core” business a value of zero.

So here’s my math:

Yahoo’s Asian holdings: $13.70/share

Cash, cash eq and bonds on balance sheet at September-end 2011: $2.31/share

Total: $16.01

Stock price: $16.00

Implied value of core business: $0.00

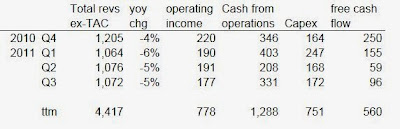

What is this business actually worth? Here’s some info for the last four quarters of Yahoo’s core business:

For the last four quarters through September 2011, Yahoo had total revenues (excluding traffic acquisition costs) of $4.4 billion and operating income of $778 million. Using a 35% tax rate, that is a net income of $506 million or so and with 1.24 billion shares outstanding that’s around $0.41/share in EPS. This is also very close to free cash flow per share.

At a 10x p/e ratio, that would value Yahoo’s core business at $4.10/share giving a total value of $20.00/share or so for the whole of Yahoo (including the Asian holdings). I think I heard an analyst mention the value of Yahoo at $20/share, so this calculation is not far off.

If you assume a 10% free cash flow yield for Yahoo’s core business, we can get a similiar figure. With free cash flow in the past four quarters of $560 million, that’s $4.51/share, so not too far off from using a 10x p/e multiple (which gives a $4.10/share value).

As of the end of the third quarter, Yahoo’s guidance for the 4Q 2011 was:

Revnues: $1,125 – $1,235 million

Operating income: $200 – 260 million

Using the midpoint of this guidance, you get 4Q 2011 revenues of $1,180 million and an operating earnings figure of $230 million.

So doing the above exercise using a 2011 fully year projection would result in a figure that is pretty close to the last four quarters.

The problem with the above analysis is that revenues at Yahoo has been declining 4-6% year-over-year in the past four quarters. If this trend continues, it’s possible that Yahoo may not be worth the above. It may well be worth much less.

you have a very interesting blog

are you a professional investor?

are you contactable by email?

This comment has been removed by a blog administrator.

This comment has been removed by a blog administrator.