So I listened to the second day presentation. This was more of an investor day with financial details. Much of the presentation was done by Michael Kramer, the COO of JCP. He too comes from Apple retail where he was CFO of the retail business, he became CFO of Abercrombie and Fitch and then later CEO of Kellwood, a supplier to department stores. So Kramer has a lot of retail experience. This is good.

Like yesterday, Kramer started off talking about how department stores have dropped the ball and how that doesn’t make any sense.

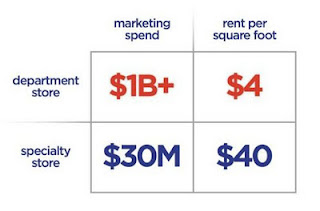

He offered the advantages that department stores have compared to specialty stores. Below is a table that shows the advantages in two of the major expenses of a store. Department stores spend a lot more on marketing, and have rent expense that is way lower than specialty stores.

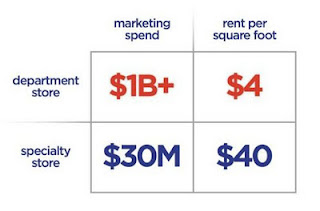

How can this be? How can department stores lose so much market share with such advantages? Over the years, see how department stores have lost share:

Johnson showed this chart yesterday, but a little more detail shows that of the 69% that is not department store sales, 37% of the total is actually specialty stores (the rest are discount retailers etc…).

So what happened? Johnson yesterday spoke of the deterioration of the 6 P’s. Kramer says that department stores have basically lost sight of their customers.

As an example, he spoke of his experience as a supplier to department stores. One unnamed department store had unproductive brands sitting on their shelves and Kramer asked for that space for his better products. The department store said no. Why? Because those unproductive products made as much money as the other products due to vendor kickbacks.

Kramer said this is one of the problems that department stores have. They think financially that the unselling product is OK to have in the stores as they get paid back by the vendor. But what happens to the customer? If you have stuff they don’t want on the shelf and you are OK with that because someone else is paying you, that’s not a good long term strategy. Eventually, the customer will stop coming. (They did say that JCP does not have this problem).

As Johnson said yesterday, Kramer said they will simplify pricing and stop confusing customers.

How will all this ‘change’ be paid for? They already talked about how they can redirect all that money they spent doing the 590 promotions that nobody responded to to better, more effective and less frequent promotions. The press reported that $80 million will be spent on promotions but failed to mention that this is cost that is coming out of the 590 promotions they did before, so I don’t think there is a net increase in spending there.

Costs

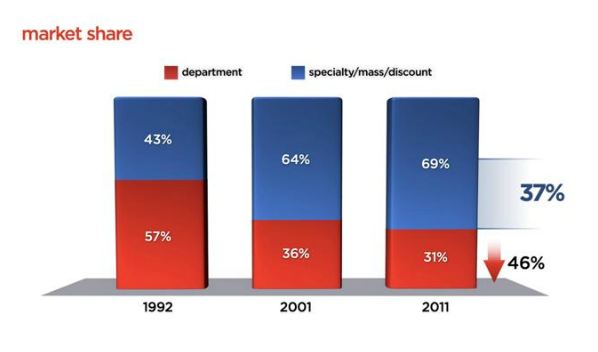

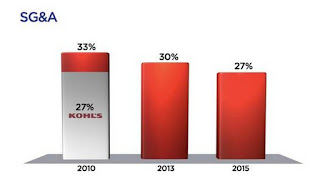

Kramer pointed out that corporate overhead at JCP is a bit higher than Kohl’s (KSS), a competitor, and they feel they can bring JCP’s cost down to KSS’s level.

By bringing SGA level down to KSS’s would be worth $1 billion in savings. That’s pretty big for a company with $18 billion in sales (that would lift operating margins by more than 5%).

They can’t do this overnight, so they will cut costs over time towards 2015.

Where will the savings come from? They have identified areas of savings in the following areas:

(I know I am getting a little trigger happy with the Windows 7 “Snip” function. I have to admit, it’s pretty convenient!).

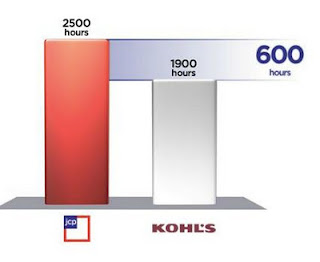

They can also save labor costs by increasing labor productivity. The amount of labor hours to operate a store at JCP is much higher than at KSS, and they think they can get it down to KSS’s level. If they do, that can amount to a lot of costs saved:

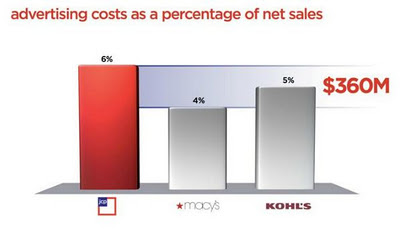

Advertising cost is also a bit higher than the competition and they think they can get that down too. They believe that events, brand/store announcements and things like that will offer a lot of free publicity over the next few years as they develop their stores.

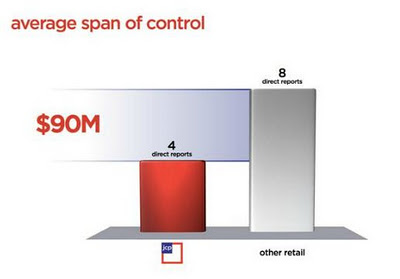

Also, corporate headquarters is inefficient with too many layers of management that they plan to cut down:

Span of control is basically how many people directly report per manager. Increasing this, (or cutting layers) can save $90 million.

Another example of cost saving Kramer mentioned was the number of cashier stations in the store. There are currently a lot of them where they are not utilized at all except during peak times (he said they are “rarely used”) and yet the stations are still staffed even during off peak hours. By shutting these stations, they can save $100 million.

Some argue that Johnson was able to create the great Apple store because Apple had great products, but the fact is that throughout the existence of Apple stores, they were never the cheapest seller. Customers were always able to buy the very same Apple products for less at Best Buy or on Amazon. And yet the Apple stores have done so well. The Apple stores also never got preferential treatment despite begging by Johnson.

- 40%+ gross margins

-

27% SGA to sales

-

13% contribution margin (operating margin)

JCP believes that with better, simpler pricing, partnerships with key brands and instore shops and their Market Square concept will drive traffic and help boost sales.

- debt remains unchanged so interest expense remains the same at around $231 million/year

- total shares outstanding is 213 million, which is the average shares outstanding for the quarter ended October 29, 2011 (since the transformation is planned to be completely self-funded, this is not unreasonable)

-

Sales of $17.8 billion, which is the sales for the most recent full year

-

40% tax rate (which is a little higher than the 37-39% range it’s been recently)

Nordstrom 15.7x 13.6x

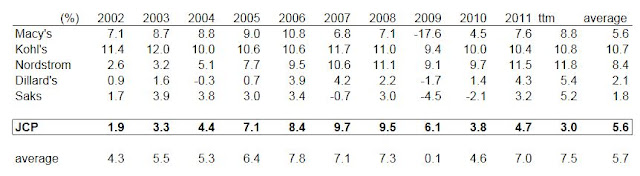

I don’t see anyone achieving 13% operating margins in the department store sector even in the good times of 2006-2007. Peak margins even at Kohl’s seem to be around 11.7%. So JCP is aiming for something even better than what Kohl’s did during the best of times. But then even Macy’s achieved a 10.8% margin in 2006, so maybe it is doable.

Conclusion

The 13% margin does look aggressive given the table above, but these guys are really overhauling JCP in a major way so it may happen. If it does, there seems to be plenty of upside in the stock price, even after the close to 20% rally on the presentation.

I don’t own any JCP at the moment; these things are very hard to evaluate. Who knows if they will succeed or not?

But it seems like they do have an active shareholder that has a strong interest in seeing JCP succeed (including Vornado’s Roth who would love to see JCP do well as it would enhance the value of Vornado’s Manhattan Mall). It seems like they do have a solid, experienced retail team that is energetic and motivated to succeed.

An interesting point is that since this makeover doesn’t include anything drastic on the balance sheet, like huge debt increase or massive financial engineering, like repurchasing shares (or leveraged recap) at the expense of capex and store maintenance, there might be little risk involved.

If the makeover fails, what happens? JCP goes back to being what it was; a mediocre department store? This may not be such a disaster on the downside.

JCP stock has traded in the range of $20-40 post crisis (excluding the 2009 panic low) before Johnson came on board. So let’s say that if this doesn’t work out, JCP goes back to $30/share.

That’s a 25% drop; not a complete disaster. And on the upside, you have a potential double or more. So that’s $11 downside risk ($41 down to $30) and $48/share upside potential ($41 up to $89/share); not at all a bad risk/return profile if you think there is at least a 50/50 chance of the makeover succeeding (in fact, it can be interesting even if there is a less than 50/50 chance of a successful makeover).

Not bad at all.

As usual, this is not a stock recommendation. I don’t have any more insight than anyone else on whether this ‘transformation’ will succeed or not, which will be the primary driver of the stock price going forward. I may buy and sell this stock in the future according to how things develop.

at the current price, jcp would be closer to it's real estate value.

Johnson is reverting back to the coupons and discounts because it's the only way customers are conditioned to come back.