JPM posted their 2011 annual report last night and as usual it’s a great read. It’s probably the best annual report written out there (other than Warren Buffett’s).

I know a lot of people are skeptical of what corporate executives say. They say, “you actually believe what these CEOs tell you?!”.

Good point. But what I tend to do is to not categorize people by their titles and automatically accept or reject what they say because they are CEOs or bankers. I know that much of the American public simply do not trust CEOs; we’ve had Enron, Worldcom not to mention the recent Lehman, AIG, Bear Stearns and many other corporate scandals. How can we trust corporations and their CEOs?

For me, since I spend so much time reading and following businesses, I tend to think that I know who I can listen to and trust and who to not trust at all.

Warren Buffett and Jamie Dimon are two people that you *can* trust and believe.

When Buffett said U.S. stocks were expensive and people expecting double digit returns from the stock market are dreaming back in the late nineties, people said he was over the hill and didn’t know what he was talking about; he just doesn’t get it. Of course he was right (note what he has been saying recently about gold, and what people have been saying about Buffett).

Back in 2008 when everybody thought that capitalism was over and investors were in a state of total panic, he told people to buy American stocks because he is. Again, people laughed at him. People actually told me that Buffett is just talking his book; he is losing so much money in the stock market that he is just trying to talk the market up to save himself.

Well, people who said that just don’t know Buffett. I’ve read his reports going back to the 1950s and he never says anything to try to move markets. He says what he believes and more often than not, he is right.

When the economy really started to fall apart, Buffett was on live television telling the public that we are in fact in a recession. He said never mind the economic data and what people say; he sees numbers from his many businesses and we are definitely in a recession. He did not sugarcoat then either. He called it like it is. He saw awful numbers and said so. When people talked about green shoots, he said then too that he saw no green shoots.

This is the same with Jamie Dimon. He is no slick salesman. All throughout the mid 2000s, he kept saying how credit spreads were too thin, people weren’t getting paid for the risk they were taking and there is a lot of bad stuff out there that can hurt a lot of people.

When things imploded, he said on public television that things are “horrible”. He didn’t sugarcoat anything. He tells it like it is, and I can imagine that it is a nightmare for his public relations and legal people.

So these guys aren’t promoters who are just talking positive all the time to push their agendas.

Having said all that, let’s get back to Dimon’s letter to shareholders.

I don’t mean this to be a summary or anything like that. He covers a lot of important topics and I recommend anyone interested in business to read it.

I will just make some comments on things that grabbed me.

Normalized Earnings

JPM earned $19 billion in 2011 and had a return on tangible equity of 15%. He points out the many headwinds that the world economy faced in 2011 and yet JPM did reasonably well; we had the European crisis, U.S. government debt credit downgrade, Japan earthquake and tsunami etc…

And he reiiterated that JPM should have earned $23-24 billion in 2011, and that the difference with what they actually earned ($19 billion) were the high costs in mortgage and mortgage-related issues.

This means that this $23-24 billion earnings figure doesn’t take into account any growth in assets or normalization of interest rates or anything like that.

As I said before, that would come to $6.30/share in EPS, and it’s not a stretch at all to see JPM stock trading up over $60 (10x earnings).

Regulatory Confusion

He spends a lot of time talking about the complicated regulations being negotiated and going into effect. Bank critics say that banks are trying to push back and prevent regulation but Dimon points out that this is not true. Dimon wants more regulation in many areas, but he wants GOOD and meaningful regulation. Not bad knee-jerk regulations with unintended consequences.

I don’t expect the business press to understand what Dimon is trying to say, but I totally agree with it. What Dimon wants is not more or less, but just better regulation. He is not against it at all.

Future of Investment Banking

He does talk about the future of investment banking (it is not dead, but is in fact a growth business) and growth potential for JPM in many areas. He also explains the role of investment banks in fund raising and in market-making (this business is not understood well at all by the public so it’s good that he took the time to explain it).

“Housing is getting better – there, I said it”

OK, so this is where I’m sure a lot of naysayers will come out and say, no way! Impossible! Dimon says in the annual report that housing is actually getting better. Buffett too, on CNBC recently, said that if he could he would love to buy a bundle of hundreds or thousands of homes as they are very reasonably valued with prospects of good returns. It just doesn’t make sense for him to buy one house at a time.

And as I said at the beginning, Buffett and Dimon are not the kind of people to say things they don’t mean or believe. So here is the greatest investor of all time saying that single family homes are great investments now. He has also been calling for a turn in the housing market.

Keep in mind that neither of these people are calling for another housing bubble or for housing prices to go up 20%/year for many years or anything like that.

Here are some of the facts that Dimon threw out there which is not that different from what Buffett and some other ‘smart’ investors have been saying recently (Buffett admitted in the Berkshire Hathaway annual report that he called for a bottoming in the housing market before and was wrong about the timing, but he still thinks it will come (it’s also important to note that Buffett’s investment style doesn’t require him to be right on timing such things):

- The U.S. is adding 3 million people per year since the crisis began four years ago

- The U.S. will add 30 million people in the next ten years

- This growing population creates the need for 1.2 million new housing units per year, but household formations have been half of that in the past four years; household formations will eventually return to 1.2 million as the employment situation improves

- Job conditions are improving slowly

- 845,000 housing units were built annually in the past four years. Destruction from demolition, disaster and dilapidation averaged 250,000 per year

- Total housing inventory is 2.7 million, down from peak of 4.4 million in May 2007; it would take only six months to sell all of this at existing sales rate, down from 12 months two years ago

- Shadow inventory is declining after peaking in 2009; mortgages 90+ day delinquent and in foreclosure was 5.1 million but now down to 3.9 million and could be 3 million in twelve months

- Housing is at all time high level of affordability due to low house prices and low mortgage rates

- It is now cheaper to buy than to rent in half of the markets in America; this has not been true in more than 15 years

- Household debt service ratio is lowest since 1994

Dimon ends the section saying “More jobs, more households, more Americans, good value – it’s just a matter of time“.

Ignore Macro?

So I tell people to ignore macro concerns and yet I seem pretty interested in the U.S. housing market. Well, I am interested in the housing market as it is a key component in getting the U.S. economy back on track. So I pay attention to what people say, particularly people I trust and who have been right before and are *not* known as forecasters.

But having said that, I don’t base any of my investments on what people say. For example, when I hear Buffett say that housing will bottom eventually, I don’t go out and buy housing stocks or anything like that at all.

My investment decisions are based on price/valuation and what a company will eventually earn in a more “normal” environment. I don’t care when that “normal” environment comes; people go wrong when they try to predict when that would be.

I don’t ever want to be in a position where I pile into housing stocks, for example, because I expect a turn in the housing market over the next year and then I lose a lot of money because the turn doesn’t come.

What’s the difference between that and what I try to do?

JPM is a great example. JPM would do really great if the housing market *did* turn. They have really expanded their footprint with the Wamu purchase and are growing branches all over the place. They have many more mortgage bankers than before.

So if housing picked up, JPM (as well as WFC which has also increased it’s footprint across the country) would get some pretty hefty upside to revenues and profits.

But the key issue for me is that even if the housing market did *not* recover at all, it is making tons of money and the stock is pretty cheap. A housing market recovery would be a bonus. A stronger U.S. economy would be a bonus.

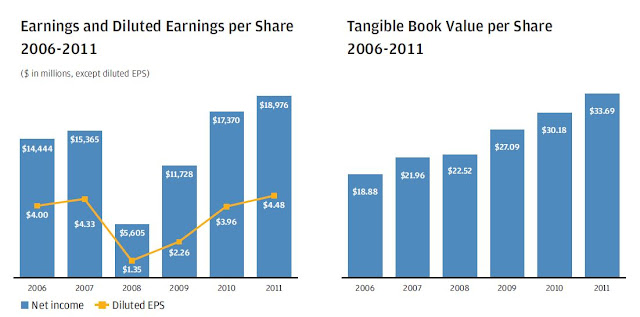

Keep in mind how JPM has done in an awful environment. Here’s a graph that I post all the time; it was also in the annual report so here it is again:

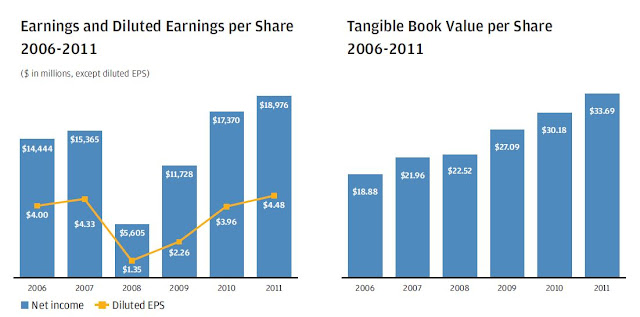

So in the worst economic environment since the great depression, JPM managed to make money throughout and has even increased tangible book value per share by more than 12%/year in this turbulent five year period.

Imagine what they could do in a more “normal” environment.

So JPM is a good investment that makes money even without a recovery in the housing market; even if it continues to muddle along the bottom, JPM can make money.

Contrast that with some favored ‘macro’ trades out there; there are housing, construction and material stocks (like USG) that are losing money and has been losing money forever. The scenario is that they can make tons of money *if* the housing market turns (if not, they can go bust no too far in the future).

Why would you do that if you can get something that is making money now and will make more in a recovery and you can get it for so cheap? And you don’t have to cross your fingers and hope for a quick recovery in housing. You can just be comfortable that things will turn eventually and things will be fine. If it doesn’t come you are still doing OK.

Why Would You Own the Stock?

OK, so I digressed quite a bit. The last part of the letter to shareholders is a section with this title. He goes on to say that banks stocks are depressed for many reasons but Dimon feels that most of those reasons will go away; the economy will recover, interest rates will normalize etc…

And he goes on to explain why JPM stock is such a great buy at tangible book value.

He says (and like I said last fall):

“Our tangible book value per share is a good, very conservative measure of shareholder value”

And he explains how stock repurchases at tangible book value would be accretive to both earnings per share and tangible book value per share.

He does believe that tangible book value is a conservative measure and that JPM itself is worth far more than that.

As I said before, 1.5x to 2.0x tangible book is not a stretch at all. Dimon has said that JPM should be able to earn at least 15% return on tangible book. Earnings in a not-so-good year of 2011 would have been 19% return on tangible book excluding the legacy mortgage expenses, so return on tangible book of over 20% is not a stretch and in that case 2.0x tangible book value per share is not at all unreasonable for JPM stock.

Anyway, the letter to shareholders is almost 40 pages long so is a bit long, but it is definitely worth the read for anyone interested in stocks, investing, business etc…

Also, I do like JPM stock but keep in mind that it is a financial stock and it can be volatile. If Europe implodes or the economy takes a turn for the worse, of course the stock price can go down and can go down in some cases quite dramatically.

Hey, I liked your post on RHDGF. I haven't seen anyone analyze their individual holdings before…great work. For the BAC leaps…did you prefer those over the warrants? One positive aspect I've noticed about the BAC-A warrants is that the strike price and # of shares are adjusted lower for dividend payments over 1 cent. By the way, I didn't see a contact page…do you have an email for the blog?

Hi, Thanks. I don't have a contact for this blog at this point… The warrants are interesting for sure, but since they are so long dated they are expensive in terms of premium whereas LEAPs is shorter dated so you pay a lower premium.