OK, so this is a company I really, really would love to love. I grew up with their products and thought they were great. But things haven’t gone well there.

I’ve been short this stock for a while, but without too much research. It was just a short on Japan in general and Sony’s (SNE) total disregard for shareholders (for example, their CEOs have been quoted as saying that they will never exit the TV business because the engineers are very proud of their work! What the heck kind of management would say something like that?!) and the typical, slow-moving, no-sense-of-urgency in general in corporate Japan.

Also, I kept walking around trying to think of U.S. television manufacturers and wondered if Japan isn’t going through the same phase that the U.S. went through (Japan did to U.S. manufacturing what Korea and China are doing to Japan; only Japan refuses to admit it is happening).

Anyway, enough of that. The stock is getting mighty cheap now so maybe it’s not such a safe short. Also, I see that SNE is starting to turn up in value screens as it is trading well below BPS and some have said it is trading cheap ex-cash and investments on the balance sheet (but this is assets in the consolidated Sony Financial Holdings, so you can’t look at it that way).

So first of all, since it is cheap (and has been cheap) on a P/B basis, let’s take a look at the long term trend in book value per share, ROE (I will just use return on beginning equity; EPS / BPS at the prior year-end) and see how the stock traded against that over the years to see if Sony even merits trading at BPS (it would have to have a 10% or more ROE to merit P/B > 1, right?).

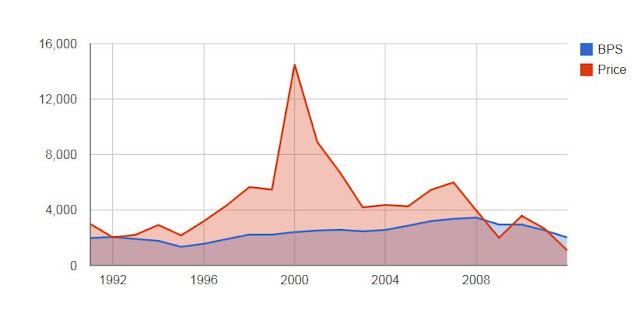

This is a chart of SNE’s stock (in yen) versus it’s book value per share since 1991. The symmetry is nice, but we don’t really want symmetry in a stock price. Sure enough, the stock looks cheap here dipping far below book value for the second time since 1991 (this is just an annual chart so maybe it’s not the second time, but…).

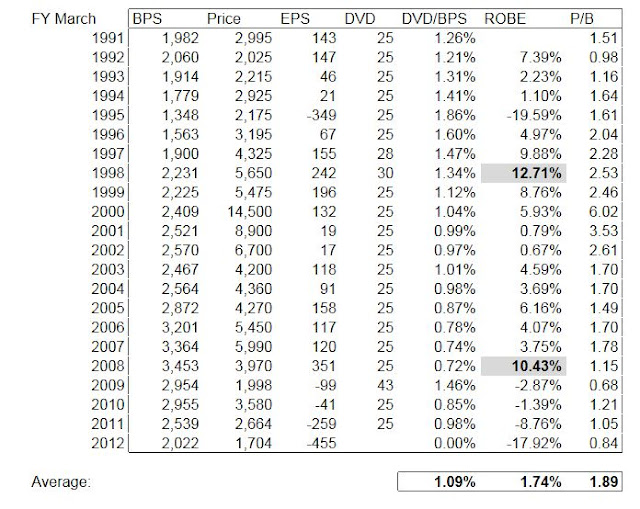

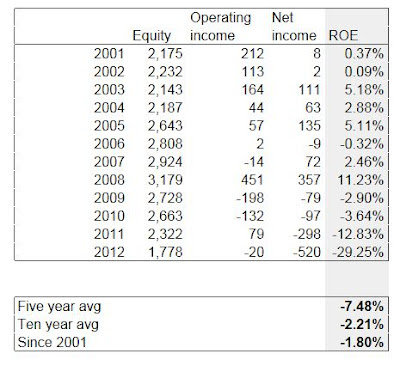

Here is a table of some key figures for SNE since 1991.

Wow, so this is pretty awful. In the past 21 years, Sony has only generated a doubt digit ROE *twice*. Just twice. OK, so let’s be generous and throw in 1997 as 9.88% rounds to 10%. But that’s still just three years out of twenty one.

From this table, you can also see that SNE has not grown book value at all since 1991! Of course, that’s hard to do with such a low ROE. OK, so they paid dividends. But dividends only averaged around 1.1% on book value for the past 21 years, so a shareholder would have only earned around 1.2%/year over 21 years! (That’s not a typo; the BPS did increase 0.1%/year so 1.1% dividend to book + 0.1% = 1.2%/year return)

Value Destruction

Over different time periods, book value per share growth was as follows:

BPS growth

Since 1991: +0.1%/year

Past five years: -9.7%/year

Past ten years: -2.4%/year

So SNE managed to lose -10%/year in book per share over the past five years and -2.4%/year in the past ten years. That’s really stunning given that’s it’s not even a bank, investment bank or in the housing industry.

So judging from that, SNE stock certainly doesn’t look worth book value per share. Why would it be if they haven’t created value in 21 years?

Let’s take a look at ROE over that time.

ROE in the past 21 years has averaged 1.74%/year. I just used return on beginning equity since SNE doesn’t include ROE in their financial summary and I just pulled these numbers from there. (It’s very telling when management doesn’t display ROE anywhere on the annual report! It means they aren’t even paying attention to it).

But it’s been a rough couple of years…

OK, so we’ve had a near depression, spike in the yen and a huge earthquake/tsunami and other exogenous events. Perfect storm after perfect storm. Fine. Let’s then just look at the average ROE through March 2008; the year-ended March 2008 was a record year for SNE at the peak of the global economic bubble.

So if you look at the ROE over the years and stop at 2008, the average is still only 4%/year. Is a business that can earn only 4% ROE worth book? I don’t know. I wouldn’t be interested in such a business.

Why is Sony So Cheap?

I hear this question sometimes, but I think the question is the reverse: Why was SNE so expensive?! With this horrible record of ROE and book value growth, SNE stock still traded at an average of 1.9x book value for the past 21 years. That’s almost 2x book for something that returned 1.7% on equity over the years. To me, the price is more reasonable now than what it has been trading at before, even BEFORE the 3/11 earthquake, yen spike to 80 yen/dollar, financial crisis / Lehman shock and all of that.

Sum-of-the-Parts

I tried to put together long term financials for SNE but it was a nightmare trying to put together a history of segment data revenues and earnings. They seem to keep rejiggering the segments so it’s a pain to get a continuous history of segments. The Music segment used to be the Music segment and then Sony Music turned into Sony BMG, which was booked as an equity method holding and the domestic music business was put into “Other”, and then Sony BMG bought out the other 50% it didn’t own so it became a wholly owned subsidiary again so it’s back to being the Music segment (and domestic music business is out of “Other” and back into “Music”). And then there was all that shifting around of games, consumer products etc…

So I figured, forget it. I will clump all the legacy SNE into “other” and then get a value for the other more discrete parts: The movie business, the music business, and the financial business (at least these segments have been stable for the past five years).

It turns out that over the past ten years, these three segments pretty much made all the profits and the rest of SNE didn’t make any money at all (or very little).

Since 2000, SNE earned a total of 1.87 trillion yen in operating earnings. Of that, the above three segments earned:

Operating earnings

Segment for past 10 years

Pictures: 504 billion

Music: 236 billion

Financial Services: 871 billion

Total: 1,611 billion

Together, that’s 1.6 trillion yen in operating earnings from these three segments. Actually, the Music segment should be higher than that because at one point, part of the Music business was booked as equity method income (Sony/BMG) and not reported as a separate segment (so it’s not included in the above “Music”). The music business outside of Sony/BMG (domestic music etc…) was booked in the “other” segment which I didn’t include in the above.

You can see that Financial Services alone earned more than half the operating profits at SNE over the past decade.

What, you thought SNE was a TV and game console manufacturer?

So let’s take a look at the sum-of-the-parts of SNE, as maybe some-of-the-parts have some value (not that Japanese management would be interested in realizing that value in any way)

Sony Financial Holdings (SFH)

This one is easy as SFH is a listed stock. We can let Mr. Market tell us what this is worth. SNE owns 60% (261,000,000shares) of SFH. It is trading at around 1,162 yen/share so it’s worth 303 billion yen now.

(Note: SFH is consolidated so the above table results are for all of SFH. Again, this is U.S. GAAP based so differs from numbers reported on the SFH annual report (based on Japanese GAAP). The difference is beyond the scope of this single blog post…). The minority interest is deducted below the line; Sony actually only has 60% of the above table figures.

- Advice to SNE management: The financial statements are horribly complicated due to the consolidation of SFH; it’s a nightmare to read! Sure, there is a separate balance sheet, income statement and cash flow statement if you dig into the 20-F in the back, but it makes all the other figures virtually meaningless. Either spin-off SFH to simplify it, or take a look at GE’s annual report and see how they separated out GE’s industrial business from GE Capital so it’s easy to read. Given that SFH earned more than half of the operating earnings at SNE over the past decade, it’s not too small to ignore and put in the footnotes anymore.

Pictures

I wouldn’t know how to value a movie business, but some googling around gave me some hints. One of them is that Dreamworks LLC (not the animation one, but the live action one run by Spielberg) was purchased by Paramount for 1x revenues. Also, the NBC/Universal deal was valued at 10x EV/EBITDA (I don’t know if that includes NBC too or was just the movie side, but a sum-of-the-parts analysis of VIA or some other company sited NBC/Universal’s 10x EV/EBITDA to value a movie studio). Also, another analysis used 12x operating earnings to value the film group of NBC/Universal.

So here are my reference points: 10x EV/EBITDA, 12x operating earnings and 1x revenues.

(I won’t use Pixar or Lions Gate as they seem to be very different (and expensive)).

Since the movie business is a hit/miss business, I’ll use the past five years average for sales, operating earnings and OIBDA:

Operating

Sales income D&A OIBDA

2008 858 59 9 68

2009 718 30 8 38

2010 705 43 8 51

2011 600 39 8 48

2012 658 34 8 42

Average: 708 41 8 49

(actually, the D&A of this segment wasn’t in the earnings release for 2012 so I just used 8 as it seems pretty stable over the years).

So according to the above, Sony’s picture business can be worth:

Method Value

1x revenues: 708 billion yen

10x EBITDA: 490 billion yen (I used OIBDA)

12x op income: 492 billion yen

So the movie business is worth somewhere around 500 – 700 billion yen.

Music

The music segment, too, is hard to value. There aren’t a lot of comparables. I think EMI was a disaster so I won’t use that as a datapoint. I think the Sony-BMG deal valuation is obviously a good starting point as it’s the same business (even though the current music segment includes music business other than Sony-BMG; the domestic, Japanese music business etc…).

The Sony-BMG deal done in 2008 was priced at 4.2x OIBDA. The other datapoint is Warner Music Group that was acquired in January 2011. The deal was valued at 7.7x EV/OIBDA (adjusted for one-time charges/costs).

So the music business is worth anywhere between 4-8x EV/OIBDA.

Again, I will use a five year average since this business is also hit-miss driven:

Operating

Sales income D&A OIBDA

2008 229 35 7 42

2009 387 28 10 38

2010 523 37 13 50

2011 471 39 12 51

2012 443 37 12 49

Average: 411 35 11 46

So according to the above, the music business is worth:

Method Value

4x EV/OIBDA 184 billion yen

8x EV/OIBDA 368 billion yen

Value So Far

So far here is what we have for some of the parts of SNE:

Low High

Sony Financial Holdings: 300 billion 300 billion

Pictures: 500 billion 700 billion

Music: 200 billion 350 billion

1,000 billion 1,350 billion

So these three segments together are worth anywhere from 1.0 – 1.35 trillion yen.

There is 719 billion yen of cash sitting on the balance sheet (excluding SFH), but not all of that is going to be available. There is also 176 billion yen in “investments and advances”, which is where the equity holdings are booked. Historically, this held Sony-Ericsson and the LCD joint venture and maybe some others, but they haven’t been profitable so I won’t give it any value here (until I otherwise learn what value it may actually have).

Long term-debt is 749 billion yen, short-term debt is 400 billion and “accrued pension and severence cost” is 294 billion yen, so that’s 1.4 trillion in total debt and accrued pension and severence cost. There is non-current “other liability” too but I think that is tax related and may be offset by tax assets, so I will leave that out (I deduct short term debt here too because it seems like that is often current portion of long term debt).

So, we have total asset value of the three segments we looked earlier of 1.0 – 1.35 trillion, cash (excluding financial segment) of 719 billion yen and 1.4 trillion of total debt and other liabilities (not total liabilities; just the accrued pension and severence).

If we are generous, like many valuation models are out there, we can give full value to the cash. In that case, the “stub” value of the rest of Sony (games, TV, audio/visual, computers etc…) would be:

Three segments value: 1.2 trillion (mid-point of 1-1.35 trillion yen range)

Cash: 719 billion yen

Total: 1.9 trillion yen

less total debt and liab: 1.4 trillion yen

500 billion yen

With around 1 billion shares outstanding, that comes to 500 yen/share. So the above three profitable business plus cash less debt equals 500 yen/share.

With Sony stock trading at around 1,100 yen/share, the value of the rest of the businesses is 600 yen/share.

Is the rest of Sony worth 600 yen/share? Remember, excluding the three segments (Sony Financial, Pictures and Music), Sony hasn’t made any operating profits over the past ten years.

Also, remember this is being generous as we are giving full credit to the cash even though the businesses need some cash to run; it can’t all be distributed out in a breakup. Some cash will go to the various businesses.

What About Spinning Off SFH?

So what about just spinning off SFH? It’s already listed so a spinoff shouldn’t be too hard to pull off. Since SFH earned half of the operating profits in the past decade, the SFH-less Sony would just look horrible. I’m not even sure it can survive.

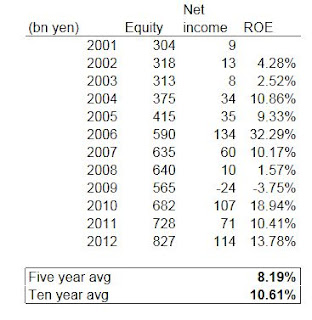

Take a look at the table below. I just put together some figures from the 20-F filings that show Sony excluding the Financial segment.

It’s pretty ugly.

How much would you pay for a business that has earned a -7.5% ROE over the past five years, -2.2% over the past ten and -1.8% since 2001?

And remember, this *includes* the profitable Pictures and Music segment.

Now you can sort of understand why Sony wouldn’t want to spin off SFH. What is left over afterward may not survive very long.

On the other hand, maybe the profitable SFH allowed SNE the luxury to do nothing over the years and have no sense of urgency or crisis. If there wasn’t SFH income to soften the income statement, maybe they would have more of a sense of urgency and do something drastic.

Obviously, since the movie and music segments too are profitable, selling those would only make SNE look much worse. No wonder why they are in no rush to sell those businesses; they need the profits from the three good businesses to subsidize their bad businesses.

Total Liquidation

Judging from the above “stub” calculation, if you assume that the rest of SNE (other than the SFH, Pictures and Music segments) is worth nothing and you just sell everything and pay back short-term and long-term debt and the pension and accrued severence costs, you would be left with 500 yen per share; less than HALF of what SNE is trading at now.

But that assumes that you can shut down the rest of SNE at no cost, but that’s not going to be true. It would cost money to lay off workers (severence), shut factories, and there is no telling what the 1 trillion+ in product inventory is going to be worth. I assume generally that current assets and liabilities fund each other (recievables versus payables, inventory versus trade payables etc…).

But in a liquidation, that is probably not going to be the case.

So at this point, I don’t see any clear value for SNE as a whole, even though SOME of the parts or even many of the parts have great value.

Conclusion

So this is just a quick look, even though it took me a lot of time to go back and forth through all of these filings to figure some stuff out.

I see that there is some great value here, but then there is a lot of debt too.

It sort of does look hopeless to me, but I have no real view on the other parts of SNE’s business. I have no idea if Playstation 4 is going to come out and knock the X-box out of the game (like how Playstation put Sega out of business). I have no idea if SNE’s mobile phone business will do well against Apple. I don’t have a view on digital cameras, camcorders and things like that as I see it as increasingly commoditized. This is the same with TV’s and other AV products.

I get the sense that the Koreans are catching up much more quickly than the Japanese anticipated, and there really doesn’t seem to be an answer for them.

Their computer business too, seems iffy to me. What is their edge? Can they do better than HP and Dell? How are they going to compete with Apple?

I would not be comfortable long this stock; there is just no clarity for me in how SNE can generate value here. As I said above, just by looking at their ROE history, it’s just not worth book.

Risk of Being Short

On the other hand, there is a lot of risk being short this down here. One thing is that investors in Japan may look at book value as a valuation measure (I’ve seen it mentioned that way; that book value is fair value). So positive sentiment in the Japanese stock market can take this stock up.

Also, foreign investors tend to buy SNE as a blue chip, core holding like IBM or Coke (well, actually I’m not sure but it sure does look like there are a lot of foreign owners).

SNE has gotten hurt by the rapid rise in the yen, so a collapse in the yen that so many are calling for would lead to a big rally in all exporters in Japan regardless of ‘real’ future prospects.

And as we all know, in this world of technology, you just never know. There was a time when people thought Sun Microsystems was dead (just before the internet boom and it made tons of money on that). Of course, there is the Apple story and some others.

So a hit product or two can really change things but that’s not something we can predict.

Anyway, at this point I think I will stay short this one for now.

Nice analysis. Really enjoy your breakdowns.

Hi

The analysis of various stocks is comprehensive.Many companies would pay big for these ideas. Pl keep up the good work.

Thanks for the nice comments… Let's see how you feel when you start losing money on these ideas, lol…

Really enjoy your dissection of Sony.

Which part produces and is in charge of the Playstation?

The games business is now in the "Networked products and services" segment.