Not to beat a dead horse, but this Wells Fargo situation kept lingering in my mind so I thought I’d make this followup post. It is well understood by value investors but since I have a pretty wide readership in terms of stock market experience, I thought I’d post this because there is something to be learned from thinking about WFC, Buffett and how the market works.

What Mr. Market Sees

- Mr. Market sees a volatile stock. WFC went from $40/share to below $10/share during the crisis; way too volatile. A 75% decline is just unacceptable to own for a conservative portfolio. Of course, Mr. Market is the cause of this volatility. The volatility just illustrates the manic-depressive nature of the stock market.

- Not only is the stock very volatile, but it has gone nowhere for a long time.

- Mr. Market views banks as too risky not only because of the stock price volatility and gone nowhere-ness, but because it’s too complex, opaque and leveraged. Mr. Market prefers the ‘safety’ of bonds, the ‘safety’ and non-correlatedness of private equity funds, hedge funds and other alternative investments as the stock market has done nothing in the past decade and is just way too risky.

- Mr. Market sees no future for the banking industry; higher capital requirements and heavier, more extensive regulation makes the future of the industry bleak. Also, the size of some of the bigger banks (like WFC) makes it unlikely it can grow more in the future. Skeptics point to the lame top line growth at many financials in recent years.

- Mr. Market reads newspaper and magazine articles that predict a repeat of the most recent crisis; people tend to spend a lot of time fighting the last war. There is a weird obsession in the media with large, ‘evil’ banks who have gotten away with murder unpunished.

What Mr. Buffett Sees

- Mr. Buffett does not care about stock price movements. He only cares about the health of the underlying business. He believes that stock prices will generally reflect the value of the business over time, but not every single day, month or even year. Stock prices can be misvalued for long periods of time. This does not bother Mr. Buffett in the least. If a stock goes down 80%, he doesn’t care as long as the intrinsic value of the business hasn’t gone down 80%. He worries about permanent loss of capital, but never worries about temporary loss of capital due to stock market volatility (if you want to avoid this temporary loss of capital, as in anything else, there will be a cost!).

- Mr. Buffett is in no rush to get rich (or richer, I should say). Much of the folly in financial markets comes from the need for people to get rich quickly. In fact, I’ve had people tell me that they speculate in foreign currencies at 100-1 leverage because they said they are not rich enough to be able to buy stocks and wait for them to go up over the long term like Mr. Buffett, nor are they smart enough to be able to pick stocks like Mr. Buffett. Another favorite is that they simply don’t have the time to be reading annual reports. Of course, it never occurs to them that if they are not smart enough to pick stocks, who says they are as smart as Soros to be able to make money trading FX? Needless to say, I’ve never heard of a good outcome from people who have said this to me.

- Going back to bullet point one, Mr. Buffett only cares about the underlying fundamentals of the business. While Mr. Market focuses on the stock price movements in the above chart, Mr. Buffett focuses on the following table which shows how WFC has grown BPS over time (including dividends):

WFC BPS growth (including dividends)

2002 +19.1%

2003 +21.4%

2004 +19.2%

2005 +17.5%

2006 +21.0%

2007 +15.1%

2008 +20.8%

2009 +27.1%

2010 +13.2%

2011 +11.7%

2012 +15.8%

- The above table is just astonishing. Show this to someone without telling them what it is. Ask them, would they invest in a fund like this? If this wasn’t a major bank, people would be all over this thing. How many funds or hedge funds have this kind of track record? This is what Mr. Buffett looks at; not stock price history (except when buying shares, price is important so as not to overpay).

- Having looked at this, it solves another puzzle. For years, Berkshire Hathaway (BRK) fans have been calling for share repurchases and dividends and things like that. People seem to be very upset that Mr. Buffett hasn’t bought back more shares. Now we can see why he hasn’t been buying back more shares; he sees something better. Here is the above table with BRK’s own BPS growth right next to it (be sure to be seated when viewing this table, or hold onto something):

WFC BRK

2002 +19.1% +10.0%

2003 +21.4% +21.0%

2004 +19.2% +10.5%

2005 +17.5% +6.4%

2006 +21.0% +18.4%

2007 +15.1% +11.0%

2008 +20.8% -9.6%

2009 +27.1% +19.8%

2010 +13.2% +13.0%

2011 +11.7% +4.6%

2012 +15.8% ?

5 year avg: +17.6% +7.3%

10 year avg: +18.2% +10.2%

OK, so I cheated as we don’t have BRK’s 2012 BPS yet. BRK five and ten year periods are through 2011. But I don’t think it makes a difference in the story it tells. WFC’s performance is just amazing compared to BRK. It has beaten BRK in every single year, and in most years by a pretty wide margin. This is unbelievable. And this is the decade that included the financial crisis?! You’da thunk BRK woulda done better than a major bank with tons of mortgages.

Go through the table again, starting at the top and slowly look at both figures, year by year, and imagine the headlines in those years. You would never have guessed the outcome of these two entities in any of these years.

There is a tremendous bias against banks these days, but if there wasn’t, Mr. Buffett’s thinking should be as clear as anything. You would be insane to call for him to be buying back BRK stock when he can be buying WFC at an attractice price.

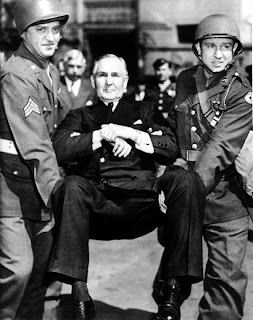

In fact, if Mr. Buffett starts to buy back large amounts of stock when WFC is trading at these levels, this is what I think should happen:

I am not tech savvy enough to cut and paste Mr. Buffett’s face over Sewell Avery’s. But yes, if he chooses to buy back BRK stock (right column) over WFC shares (the left column in above table), that would mean he has finally lost his marbles. Call in the troops. Take him away!

Back to Bullet Points

- While Mr. Market seeks comfort in the safety of bonds and alternative investments that promise to make money year in and year out no matter the environment, Mr. Buffett understands that this is nonsense. Bonds are bubbled up right now and have a lot of risk, and again, the history of folly in the investment world is often caused by not only the need to get rich quick, but to get low-risk returns. The promise of consistent profitability, low volatitily and non-correlation manufactured by financial engineering often delivers on the promise for a time until it blows up. The cure is often worse than the disease. Mr. Buffett understands this very well.

- While Mr. Market sees the end of banking as a profitable business, Mr. Buffett disagrees. He concedes that the days of 20x leverage and 30% ROE are over, but it’s still a very good, profitable business. We don’t need another bubble for banking to be a good business (again, look at the above table!).

- Mr. Buffett doesn’t worry about top-line growth as he sees that it will come when the economy recovers. He sees a housing recovery as the key to lower unemployment and a stronger economy and he sees that coming, eventually. He has tried to time the recovery before and got it wrong, but he still has no doubt it will come.

- Even if the top line doesn’t grow too much, Mr. Buffett understands that if you have a profitable business model and excess capital, it can be returned via stock repurchases. He doesn’t need a company to grow; intrinsic value per share of a business can grow a lot without a lot of top line growth. If you earn 15% ROE and see no top-line growth and just repurchase shares with the profits and you do so at book value, you can grow your BPS 15% (well, even if you don’t repurchase shares BPS will grow 15%, but then ROE will go down next year if you can’t deploy that 15% at 15% ROE). If you pay 2x book, you still grow BPS at 7.5% (yes, it would be dilutive to BPS, but can still grow it. If my other other post is right, then you can still grow intrinsic value per share even if you buy stock above BPS). If management is competent, businesses can be managed to enhance per share intrinsic value. There are a lot of value creating levers.

- Mr. Buffett is not worried about the riskiness of banks. He has been investing in banks for decades and knows banking better than most bankers. A few obsessed journalists writing scary stories about how opaque the banks are (who probably have never even read a 10-k all the way through) is not a concern. Some of these writers have only lived through one cycle. Buffett (and to a lesser extent, Dimon) have seen many cycles and understands that it’s the same thing over and over.

- He agrees with Dimon who pointed out when people were skeptical of the Fed stress tests that they have actually just lived through a real-life stress test and passed with flying colors. WFC too has passed this real-life stress test amazingly well. People will argue that that is thanks to TARP, but even the Geithner hating, big bank busting Sheila Bair has said that WFC and JPM are well managed and weren’t in trouble and didn’t need TARP. It’s amazing that these banks did so well in a 100-year crisis; particularly when WFC was one of the biggest mortgage lenders and the bust centered on residential real estate.

- Mr. Buffett finds it ironic that people say banks were bailed out by the government (so won’t invest in them) but are fine with investing in hedge funds, private equity funds etc. When they bailed out the big banks, they bailed out the financial system. If the financial system failed, many hedge funds and other investors would have lost a ton of money; look what happened to prime brokerage clients at Lehman, clients at MF Global etc.

- Mr. Buffett finds it ironic that banks are accused of being opaque when they consistently file hundreds of pages of material with the SEC every year, and yet people invest in hedge funds with nowhere near the disclosure. Dimon said the other day something like, “We file a 400 page 10-K every year, what do you want to know?” Perhaps if Madoff had to file with the SEC (in similar detail), people wouldn’t have lost money. Mr. Buffett has been reading annual reports for more than half a century. I doubt most journalists have even read one all the way through. (I don’t blame them; much of the low quality in journalism is due to deadlines and quotas; I don’t think any journalist is any dumber than anyone else. It’s just that if you are an investor thinking about spending billions of dollars to buy into a stock, you are going to do a little bit more work on it than someone who needs to get an article to his editor by 2:00 pm Thursday. This is why TV journalism can be even flakier; their deadlines may be shorter and they need to fill airtime with stuff. And you just can’t put out a lot of high quality stuff all day. I am always shocked at how little financial journalists seem to know and understand even when many have more years in the business than me. Are they that stupid? I realized it’s not that at all. They don’t have a deep understanding because they never dig that deep as they don’t have the time. They only have to dig deep enough to get the story out. Then it’s on to the next story. That’s why my sister understands more about business than some of these so-called veteran journalists; it’s not the journalist’s job to understand. It’s their job to sell newspapers, magazines, and fill air time) Oftentimes, you’re better off going with the guy with decades of experience and someone who probably has read every single filing for hundreds of companies going back decades over some guy rushing out an article for a deadline where the ‘story’ is already predetermined (and probably the headline too).

Anyway, this can go on and on so I’ll stop here. I thought it would be an interesting post for some (but same old, same old for us value people).

WFC's BPS growth table is enlightening. BPS growth is surprisingly good, even for a well-run bank.

I tried running the same numbers on some other banks. Here are the annualized BPS growth numbers I calculated. The first number is the annualized BPS growth since 2001; the second, since 2007.

JPM: 8.8%, 7%

GS: 13.4%, 9.9%

BBT: 6.6%, 3.3%

PNC: 11.4%, 9%

USB: 7.3%, 9.6%

Only GS and PNC seem to be in the same league as WFC. I expected USB to have better numbers overall, although they have done quite well since 2007.

Hi, thanks for posting.

Did you include dividends? I included dividends in the WFC figures. It's book value growth plus dividends.

When I talked about growth in tangible book value at JPM, that excluded dividends.

No, my numbers do not include dividends. Also I used book value, not tangible book value.

In this post, I used regular BPS, not tangible. Sorry to confuse you.

I think it is vital to draw a distinction between the recent and new Buffett. In his partnership days, significantly timely, it appears as if Buffett was terribly tuned in to temporary portfolio volatility. He went thus far on segregate his portfolio across varied buckets and guesstimate however every would perform in an exceedingly down market. http://www.debtconsolidationloans4uk.co.uk

Just a quick comment FWIW on permanent vs temporary loss of capital.

I think it's important to draw a distinction between the old and new Buffett. In his partnership days, particularly early on, it seems as if Buffett was very aware of temporary portfolio volatility. He went so far as to segregate his portfolio across various buckets and guesstimate how each would perform in a down market.

Also, the following quote, particularly the last sentence, from his 1966 letter seems to suggest that he was keenly aware of near-term portfolio volatility.

"Proponents of institutional investing frequently cite its conservative nature. If ‘conservatism’ is interpreted to mean ‘productive of results varying only slightly from average experience,’ I believe the characterization is proper…However, I believe that conservatism is more properly interpreted to mean ‘subject to substantially less temporary or permanent shrinkage in value than total experience.’"

As he gained a more stable base of capital, it seems as if he's become less worried about short-term price volatility. He likely has never really cared about it personally, but dealing with new investors, establishing a new track record is another matter entirely.

Anyway, nice set of posts and keep up the interesting writing.

Hi,

Thanks for posting. That's a very interesting observation, and you may be right. But since he was willing to put 40% of his fund into a single idea, he was obviously not very volatility averse.

There really is now way to predict what Mr. Market can do to a stock no matter how attractive someone thinks it is. I have no data from Buffett's partnership years, but we know that WPO (Washington Post) went down another 50% after he bought into it.

There is no way he could have predicted that, and that is sort of the point. He didn't need to predict it and since he didn't buy on margin (and therefore couldn't get margin called), it was OK.

As you say, though, BRK is permanent capital so he was able to do this. Maybe it was not so easy during the partnership years. That's a point I never really thought of.

Big fan of your blog, although I don't comment often. Just wanted to say thanks for sharing your thoughts.

I think you've clearly shown how superior WFC is as a business (and very well done). However, you said this is well understood by value investors, and yet, I don't see you making any attempt to value the company here.

Not trying to poke fun, and honestly I didn't expect you to "value the company for me", I just was curious how you might go about valuing WFC. At a premium to book value already, it's tough for me to know exactly how to pick a decent entry point. It's generally why I stay away from bank investing.

I guess I just prefer companies where I can understand the economics. With banks, it is quite difficult for me.

Hi,

I did suggest 1.5x book is a good valuation for WFC, and I also mentioned that Buffett would be happy to pay 10x pretax earnings for it. Those are two valuation data points for you. You can adjust up or down if you want to.

Thanks for reading.

Your post remembered me that I once met Mr. Market at this fast-food.

We got friendly. You know he is an obliging fellow so soon enough he acquainted me to his buddy, Mr. Ecstasy (Mr. E). We bonded like brothers. One day, while having dinner at the Neverlands (the chicest cruiser "dive" ever), Mr. E said: "Oh my! There she comes. She is to me like the Moon is to the Sun, a running valentine …". He split no more hairs but quite vanished into thin air …

This is how I met Miss Agony. She sat straight at the table and begun tapping into my lobster. I had to step up to the plate, pay the bill and walk away in the dead of night.

I left town for a while. When I came back, Mr. Market, friendly as ever, greeted with open arms and brought to pass an invitation for free lunch at the Neverlands (to catch on with the crowd, the new feeding trends and all that…).

I touched on my scars while answering:"I beg your pardon, Sir. The old heave-ho to the chaps and to Neverlands. I only cook my own meals now… all boiled down oysters."

He palmed the invitation and nodded: "Within rights, within rights…. By all means, help yourself! Who am I not to oblige? I may tip your hand to the crowds, though. Right on the boil. Got to go… Lads, hear, hear! Hush, hush, you know! Lobsters …"

Yours truly,

W. Bucket

Those guidelines additionally worked to become a good way to recognize that other people online have the identical fervor like mine to grasp great deal more around this condition.

intraday tips

In response to this sentence:

There is a weird obsession in the media with large, 'evil' banks who have gotten away with murder unpunished.

What do you make of articles about foreclosure fraud like this one?

http://www.nakedcapitalism.com/2013/01/bank-of-america-foreclosure-reviews-part-iv.html

Is this just sour grapes? I don't think so.

Hi,

Thanks for posting. Banks are not perfect. There are problems to be sure, and articles like this are fine. They talk about specific problems. I don't mean that journalists should never run negative stories on banks or corporations.

But most articles I read are not like this at all.

Thanks for reading.

I found your comments on WFC to be among the most interesting thoughts on an important investment opportunity that I have read in quite some time. While the market is crowded with stock investors seeking more stable companies to purchase, most equate a stable business with a stable share price. Buffett's comments over time make clear that he doesn't see it that way. Instead, he sees a volatile share price as an opportunity.Your post is one of the few to direct the reader's attention to relevant financial data, a much steadier result which almost any investor would find acceptable.

Kudos for pointing out what most journalists and many stock analysts miss.

I think it's probably overly generous to add the div and compound it along with book value. It presumes a level of growth that was never actually there.

Let's say WFC achieves a ROE of 15% long term. Let's also assume that going forward, long term growth is 6% annually. That leaves 9% for shareholders each year (divs and share buybacks). Now at the current price/book value of 1.26, the 9% return translates into a yield of 7.2%. Adding the long term growth of 6%, you get a rough total return of 13.2% at the current share price, which is still a very good return. Obviously if they are able to grow faster than 6%, the total long term return will move closer to the 15% ROE, but given WFC's current size, it's probably not likely.

Having said that, I think it's possible that then can do better than 15% ROE, maybe 17%. Capital regulations are stricter, but for the same reason, there's also less competition.

Hi,

Thanks for the comment. Yes, you are right about that.

But you can't compound at ROE either (as dividends are paid).

Think of this metric more as a "comprehensive ROE" which includes gains in net worth that doesn't pass through the income statement (which then gets into the ROE).

So it's still a good metric to look at, just as ROE is good to look at.

But you are right that we can't expect the company to compound at ROE or my comprehensive ROE.

Thanks for posting.

By the way, it's not overly generous to add back dividends to change in book value because that is in fact what management has achieved for the year. Book value is reduced every year by the amount of dividends it pays, so just looking at BPS growth misses something.

And it can be achieved and compounded if WFC traded at BPS and you invested in a tax-free account.

Or management can compound BPS at that rate if they retained their earnings instead of paid it out as dividends, assuming the opportunity is there to deploy that capital (which may not always be the case).

Dimon, for one, has said that he hates to pay dividends. He would rather deploy the capital or buy back shares. He said he only pays dividends because that's what the board wants to do because that's what bank investors want. Or some such thing.

Anyway, it's a good metric but you have to understand what it means, I guess. As I said in someone else's comment, I will have to make this more clear the next time I use the metric.

Have you looked at DVA, another company who's shares BRK has been buying? Fascinating company.

Hi,

Yes, I have taken a quick look at it but not too deeply. I have no thoughts on it at this point. Thanks for posting.

I would love to share my thoughts, but they are fairly lengthy. Should I post here or do you have an email address?

Hi, You can post them here, or at least just the summary. It might be an interesting discussion.

OK, for comparison here are the BPS numbers:

2002 7%

2003 312%

2004 68%

2005 57%

2006 43%

2007 36%

2008 16%

2009 10%

2010 -1%

2011 11%

2012 ?

5 year average 15%

10 year average 56%

8 year average 30%

The 8 year average throws out the anomalous 2003 result.

Great, just tell me what industry is going to receive a $500 billion injection and I too can invest for the long term like Warren Buffett.

Thanks for sharing the information. That’s a awesome article you posted. I found the post very useful as well as interesting. I will come back to read some more. best advisory company

Having trouble replicating your calculations. 2002 BPS + Div = 9.53. 9.53 is 12.11% increase over 2001 level. 2012 BPS + Div is 28.52, a 12.18% increase over 2011 level. Am I missing something?

Hi,

Yes, you are adding dividends back to the previous year book value. So let's say in year one, the company grew book value by 20%. Say it went from $100 to $120 before dividends are paid out. Management earned a 20% ROE. Then they pay $10 out in dividends. So the book value at year end is now $110 instead of $120.

So if they do the same 20% the following year, book value would grow to $132. That's a 20% increase in book value before dividends are paid out. $132 / $110 = 1.2. I think what you did was do $132/$120 instead.

Thanks for reading.

Got it. Your earlier discussion on 1/30/13 with 'Unknown' breaks it down. [(Current BPS + DVD) / Prior BPS], but he raises an interesting point that that assumes dividends are reinvested at book. Still, amazing results.

Tremendous blog. Thanks for generating such thoughtful content.

Your blog is very useful to all the people especially for commodity trader. So much important information is there in your site.

Stock Tips | NIFTY Tip | Commodity Tips

A great article written with great hard work…i must say….a great work of your which shows…I like your site its quite informative and i would like to come here again as i get some time from my studies. And I will share it with my friends.

This really is my very first time i visit here. I discovered so numerous fascinating stuff in your weblog particularly its discussion. From the plenty of comments on your content articles, I guess I am not the only one having all the enjoyment right here! keep up the great work.