So the 2012 annual report is up on the website. They revamped it and Loews even has a new logo.

Here is the new logo:

I’m not an art major or anything like that so I don’t know anything about it but my first impression was that this looks a little retro, even Art Deco-ish. Loews is going for a more contemporary look with this, apparently, but it looks more retro than modern. But then again, what do I know. I’m sure they paid good money to a well-schooled designer to create it so it must be good.

For reference, here is the old logo:

Not to complain too much, but many of the materials on the website including the ones updated in 2013 still has the old logo. That sort of spoiled the ‘freshness’ of the new website.

Anyway, what the heck am I talking about? Who cares. Let’s look at some stuff in the annual report. This is not a summary by any means, but just random comments that came to mind as I read through the report.

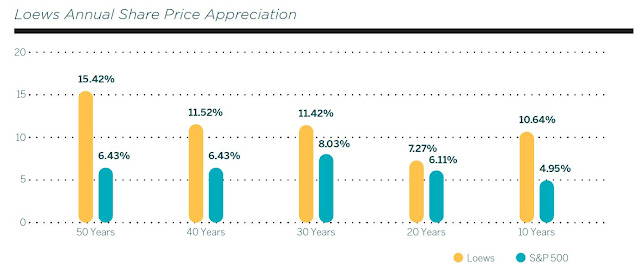

There is really nothing new here, just stuff we already know. In this year’s annual report, they put in the stock price performance versus the S&P 500 index for 10, 20, 30, 40 and 50 years:

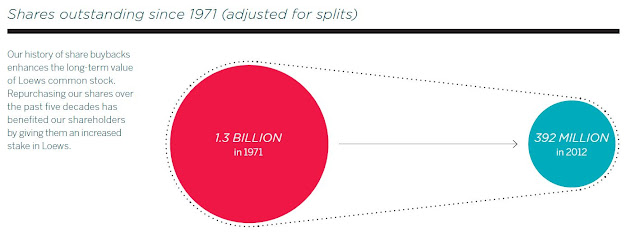

…and the usual shares outstanding comparison. They are very good allocators of capital and they do buy back a lot of stock. Share count is down by 2/3 since 1971 which is very reassuring; these guys aren’t going to go on a buying binge just to get bigger or use up excess capital.

They explain their approach to investing. I think investors are antsy that L is sitting on so much cash; they wonder when they will do a big deal that might get the market excited about L. So this is their response to that, I suppose.

Substantial Investments

Tisch did say that although they haven’t done any large acquisitions, they have been investing actively at the subsidiary level. L has spent or committed $6.5 billion since 2010 through their subs.

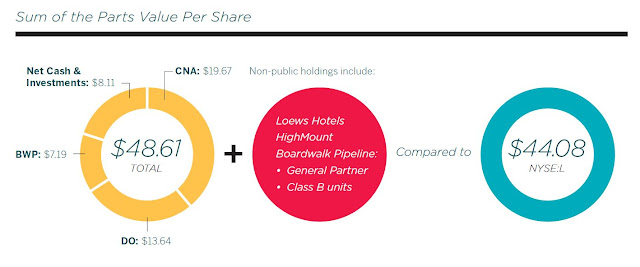

Sum of the Parts Valuation

And as usual, here is the sum of the parts valuation of L they include in their annual reports and presentations (stock price data as of Feb 1, 2013). I haven’t talked about the numbers in this post at all since I already did some work on the 10-k in my previous posts: Loews Adjusted Book Value Update and More Adjustment to Loews Book Value.

Hedge Funds

L mentioned hedge funds in the annual report, that they invest 5% of CNA’s investments in limited partnerships. People are always asking who they allocate capital to, or what the performance is like. In the annual, they said that in the past 15 years the partnerships have earned 11%/year. In a recent interview, Tisch said that the hedge funds over time have earned 5-10% more than the 3 month treasury rate.

Also, at the website on the annual report page is a presentation called “Company Overview” which is worth reading.

From there is a little more about L. I won’t summarize everything that’s in there but here are some interesting things I’ll cut and paste here.

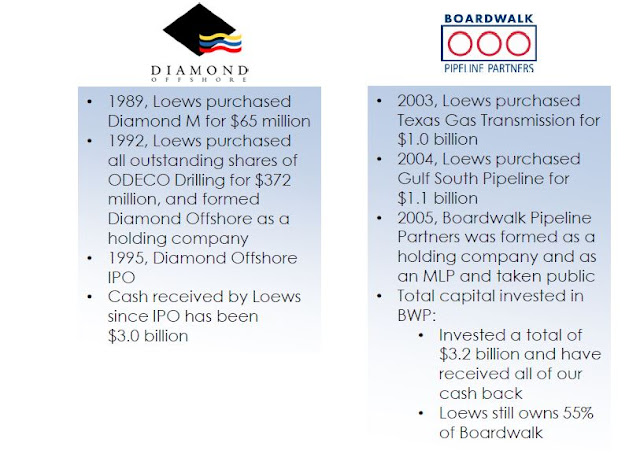

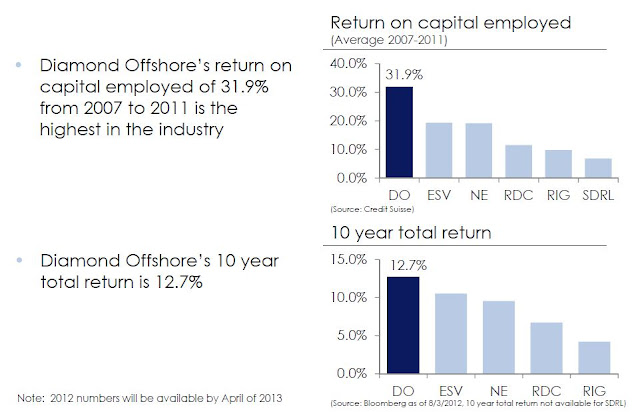

First is how well Diamond Offshore and Boardwalk has done for L. People criticize Diamond Offshore as having an old fleet, but Tisch explains in the annual report that the age of the fleet might be old, but they have spent a lot of money building new rigs and rebuilding old ones and these rigs do get contracted out at good rates so that’s what counts. Diamond’s returns over time is shown in a table below. Also, L has taken a lot of cash out of Diamond over the years. Boardwalk has also done well and even though they just invested in 2003, they have already gotten back their total investment (invested a total of $3.2 billion and got it all back already and they still own a bunch).

That’s pretty good.

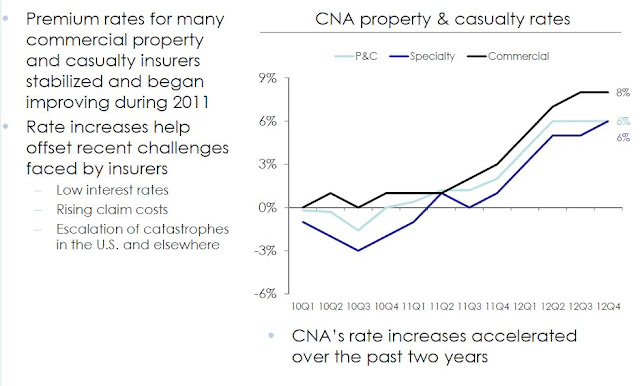

The company overview presentation shows some promising trends in their subsidiaries. Here’s one that Tisch has been talking about; the firming of pricing in P&C insurance:

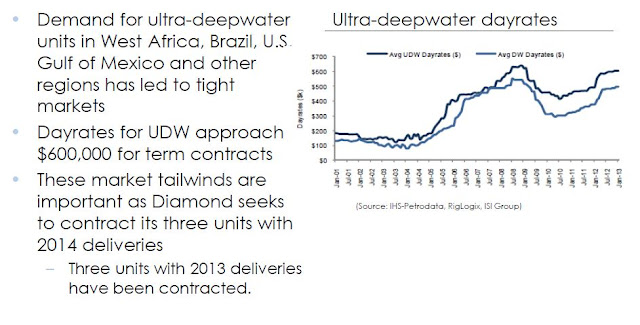

Contrary to what you would imagine, ultra-deepwater day rates are trending nicely, getting back up to the 2007-2008 highs. This is good for DO, of course, since they have some new rigs coming online soon.

DO has performed well over time:

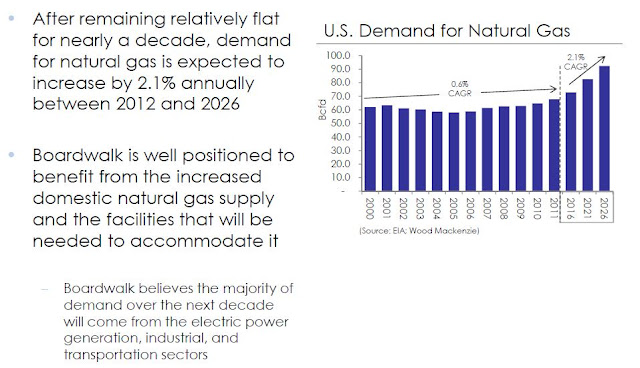

And they think that natural gas demand will rise over time:

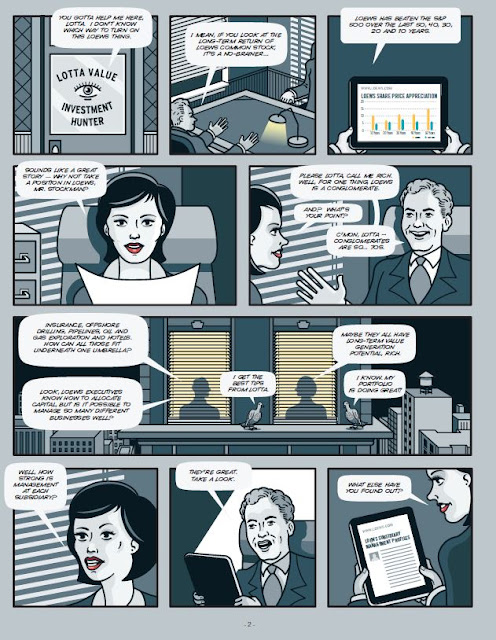

Lotta Value: Investment Hunter

And I don’t know if this is desperation, but they put up on the website a comic book, oops, sorry, I meant graphic novel (this makes it OK for adults to read, I suppose) to tell the Loews value story. I know they have been frustrated for years that L doesn’t trade at or above the sum of the parts. Tisch believes that L is worth more than the sum of the parts, and it has been frustrating for him for many years.

So this is where they go. They turn to a comic book! Oops, I mean graphic novel. I suppose it’s OK. There’s nothing wrong with having some fun. But I would be shocked (and scared) if Lotta Value helped narrow the discount between stock price and intrinsic value.

I know Warren Buffett has been frustrated too with the stock price of Berkshire Hathaway, pounding the table recently in his annual reports insisting that BRK is worth far more than book value.

If Buffett did a comic book, maybe he would borrow some talent from Iger (Disney) and do a better one. Who knows.

This one certainly won’t appeal to the younger crowd… but then again, the younger crowd is not the ones with the money, I suppose.

This is just the first page. You can download the whole thing at the L website.

For people who are too lazy to even read a comic book, they did a video so you can watch that instead.

I suppose it’s good that they are trying new things to get the word out and try to narrow the discount.

Conclusion

The new website is nice. Simple and fresh, with some new stuff on there. It would be really great if they put more meat in the history section. I’m sure there is a lot of interesting stuff they can put there. The new logo to me is nice even though it doesn’t seem contemporary to me. But what do I know, and why am I even talking about it? What difference does it make to an investor?

Flipping through the annual report and company overview, I get the sense that L is really on top of things and are working hard to create value. There does seem to be a lot of potential in their various areas of investment. If the CNA turnaround really works and they get their combined ratios down, premiums go up and rates keep firming, there can be some real upside in the stock as CNA is still trading cheap. Interest rates might have to go higher, though.

Diamond Offshore looks good too in the longer term as it does look harder and harder to find cheap oil and oil companies will need to keep drilling.

I’m actually surprised at how well Boardwalk is doing despite low natural gas prices and L sees a lot more growth ahead which is good.

Loews Hotels too seems to be more active. For a long time, it seemed to me that it was just there. They owned some nice hotels but it just didn’t really do anything. Now it seems like there is some activity going on, so we’ll see how that goes.

Anyway, other parts look interesting too. Have a look for yourself.

I dont get the comic. It's like Buffett said about Apple: "If you have the cash and you think your shares are undervalued, buy back the stock."

Unless Tisch thinks he can get a return on his cash better than buying a $1 of his stock for XX cents, just shut up and buy back your stock. In fact, the LAST thing he should be doing is jawboning minority investors — last time I checked, I prefer buying my popcorn on sale rather than in a movie theatre.

Yes, I agree, but something is going on here as Buffett too seems frustrated with an undervalued stock.

When I saw the comic, I didn't jump up and down excited that things are finally going to happen, lol… nor do I think they have lost their minds. Maybe they just wanted to do something different. As long as they didn't go out and spend too much of our money, it's OK, lol…

I'm not sure if Buffett is frustrated by BRK's stock price or not, but if he is then its probably because he's in the process of gifting his personal holdings to the Gates Foundation at a rate of about 5% a year. Since building this wealth has been his life's work, I'm sure he'd like to see it turn into as much money for Gates as possible.

As far as the comic goes, its pretty odd. I'm normally suspicious of management that is overly promotional, rather than simply running the business, but Loews has kind of proven themselves with time. Maybe they just thought it would be funny.

+1.

you keep 20% of your mkt cap in cash, you have no right to complain. get to work mr chairman.

Did you attend the Biglari annual meeting?

Hi,

No, I didn't. Things were too busy around here so I decided not to go.

The new logo is a better concept but I hope they didn't pay real money for it. It is unfinished in my view. Corporation must be justified against Loews. They had this right before why would they change that? Sign of an amateur for sure.

All well and good. But you'd have +50% more if you would have just invested in RSP (S&P500 equal weight) instead of L since Dec 31, 2007.

Hi,

Indexing and equal-weight indexing are not bad ideas at all. The period since 2007 is a pretty short time period so I wouldn't put too much emphasis on that. Note how many different time periods L has done well over it's history.

I tend to think rational behavior by very competent people tend to do well over time, but not necessarily better than everything over every time period.

Having said that, again, indexing and equal weight indexing are not bad alternatives.

Thanks for reading and posting.

LOL. You are funny.

I wish I had more time to spend on Loews – I've glanced at CNA briefly, but it seems like calendar year 2002(ish) reserves developed poorly. I'm not sure the details on it, but it's always been a point of caution for me.

Have you looked at the 2013 annual report? Seems like the dynamics have changed somewhat over the past year with both DO and BWP share prices getting crushed and trading at (what I believe to be) very attractive prices now. Also, seems like with both the huge writedowns of HighMount over the past few years and the higher natural gas price that those writedowns should stop and book value should begin to grow again at rates closer to the long term average. Based on the special dividend paid by CNA earlier this year and the dividends from DO and BWP (reduced in the case of BWP), Loews will receive dividends of 5.8% of enterprise value in 2014. I ran the adjusted book value calculation that you did in a previous post and based on my numbers, Loews is trading at a price/adjusted book multiple of .84, which is in-line with the past based on your calculations. As such, even though Loews's share price is trading where it was well over two years ago, it hasn't really gotten "cheaper," it is just trading at a historical range of adjusted book value as DO and BWP have fallen, CNA has risen, and massive writedowns have been taken on HighMount. However, I think buying Loews today is a good value primarily because both DO and BWP seem very underpriced in addition to the points about strong management that you have made in your previous posts.

Yes I did. So they fired Lotta Value, oh well. There isn't much going on at L, but as Tisch says, at the subsidiary level there is plenty of investing going on. The investments look boring, but they have returned a lot of cash over time. I think L's conservatism also makes things look boring, but that may not be a bad thing necessarily. They always say they don't want to do anything stupid. There is a chance that they are too conservative, but it's better for them not to play if they don't feel comfortable with anything.

These are the kind of guys that wouldn't look good in a roaring bull market like we are seeing now. Well, Buffett is like that too but somehow managed to match the S&P 500 return last year..

Some of the things, I think, are cyclical too and cycles do turn.

Thanks for dropping by.