So Apple has fallen below $400 and it seems like most people still talk about how cheap it is. Yes, it does look really cheap. But others have pointed out that Apple is only cheap if they can maintain their sky-high margins.

I decided to take a quick look at this since I sort of follow Apple and have posted about it before. I still don’t like Apple as a long term hold and am short the stock off and on (I did flip long once after my Apple LEAPs post, but sold out of it deciding that it doesn’t make sense to go long a stock I didn’t like just because the stub/LEAP idea was interesting).

Anyway, my views on Apple hasn’t changed much (see Apple is No Polaroid). The JC Penney fiasco (I followed JCP too but fortunately stayed away from the stock as I thought it was ‘too hard’) sort of reinforces the idea that Jobs was indeed an incredible talent and people who have done well with Jobs may not be able to retain that ‘magic’ without him. Of course, this probably has nothing to do with JCP as Ron Johnson was a successful retail executive before going to Apple. But anyway, that’s whole other topic.

Back to Apple.

Apple Looks Cheap

First of all, a quick look at the cheapness of this stock. As of the end of the last quarter, Apple had $137 billion of cash and marketable securities. Taking 75% of that (net of taxes), we get $103 billion and with 939 million shares outstanding, that comes to around $110/share in cash and marketable securities.

Analysts estimate that Apple will earn $44/share in the year ended September 2013. 10x that gives us $440 (interest rate income should be deducted from this, but since rates are so low I won’t bother). At 10x that, we get $550/share in total value for Apple. With Apple trading at $400/share, that would be a 30% discount to what it’s worth.

Margins

One of the keys in the Apple story is the margin. Can this be sustained? Of course, what Apple comes out with next is the big story for the long term of Apple; if they can’t keep coming up with hit products like the iPod / iPhone / iPad, then Apple is not worth anywhere near what it is today.

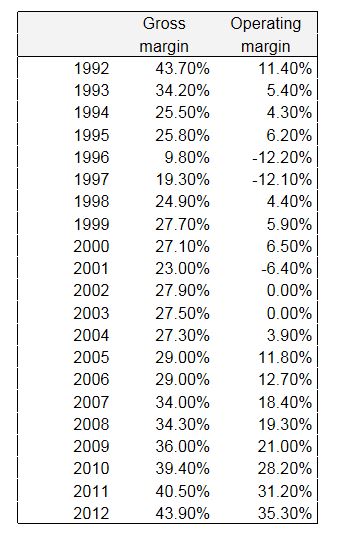

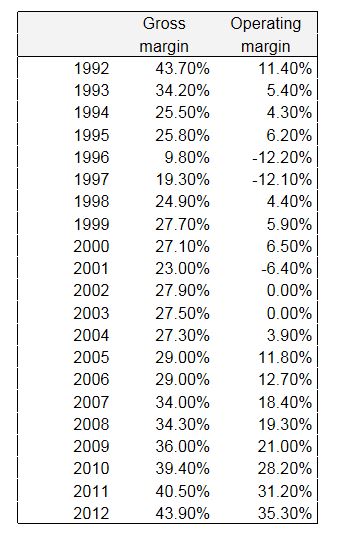

But never mind that for a second. Let’s just look at what they have now. In 2012, their gross margin was 43.9% and their operating margin was 35.3%.

People say that this can’t be maintained as their competitors operate with half those margins. If the gap between products keep closing, how can the spread in margins be maintained? I think that by many accounts, the difference between Apple products and others are rapidly shrinking.

Anyway, I think the one big competitor is Samsung. They do break out sales and operating profits for their mobile segment (IT & Mobile Communications). This segment in 2012 had operating margins of 18%.

If Apple had operating margins of 18%, how cheap is Apple stock then?

Analysts predict revenues for the current year to be $181 billion. 18% of that is $32.6 billion. With a 25% tax rate, net earnings (excluding other income) would be $24.5 billion, or $26/share. 10x that is $260, and adding back the cash and securities from above of $110/share, that gives us a total value of $370/share.

Suddenly, Apple stock at $400/share doesn’t look so cheap anymore!

Of course, there is no reason why Apple’s operating margin has to go down to 18% right away if ever. But I do think that the historical tendency in these fluid, fast moving industries is that excess margins get competed away.

So anyway, maybe we can’t really compare Apple to Samsung. They are different beasts, and Apple does in fact own the operating system and the eco-system whereas Samsung only provides the hardware. This is the tricky part. We know that software has much higher margins than hardware (look at Dell versus Microsoft, for example). So maybe Apple will always earn a higher margin.

I figured that Apple always did both, so why not take a look at Apple historically?

Here is the gross and operating margin history for Apple since 1992 (I can only get data back to 1992):

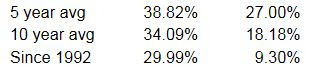

So even though Apple did both the hardware and the software, their gross margins were never above 30% until the iPhone era. Their operating margins were subpar too for most of the period since 1992.

Yes, we know that Jobs left in the 80s and Apple was mismanged for years. But Apple products were still loved by fans and were often said to be the best computers out there. And yet this is their margin history.

Things are different now for sure once Jobs came back and fixed the place up. But there is no guarantee that Apple won’t go back to what it was before Jobs came back. It can still be making the best products, but the above shows that that doesn’t guarantee fat margins.

The last time Apple had gross margins above 40% was in 1992 and it went down since then. Here is what the 10-K said about the drop in gross margins in 1994:

“The downtrend in gross margin was primarily a result of pricing and promotional actions undertaken by the company in response to industrywide pricing pressure.”

And for the 1992-1993 drop, they also said it was:

“primarily the result of industrywide competitive pressures and associated pricing and promotional actions”

And here’s a chilling quote too:

“Although the company’s gross margin was 27.2% for the fourth quarter (1994), resulting primarily from strong sales of Power MacIntosh computers and the PowerBook 500 series of notebook personal computers, it is anticipated that gross margins will remain under pressure and could fall below prior year’s level worldwide due to a variety of factors, including continued industrywide pricing pressures, increased competition, and compressed product life cycles”.

If operating margins go to 10%, which would be respectable for a manufacturing company and happens to be the long term average for Apple since 1992, let’s see what Apple looks like. With $180 billion in sales (never mind for now that if Apple takes pricing actions to reduce margins, sales would change too but there is no telling by how much). That would give us an operating profit of $18 billion. At a 25% tax rate, that’s a $13.5 billion net profit and $14.40/share in EPS. 10x that would be $144/share and add to that the $110 in cash and you get $254/share total value for Apple.

Of course, I don’t expect Apple to post a 10% operating margin any time soon. I’m just fooling around with figures to get a sense of this thing.

I know that the universal view is that Apple will keep creating new products just as industry-changing as the iPod, iPhone and iPad. But if they don’t, Apple may, over time, start to look more like the long term Apple than the short term Apple (with hit after hit).

In that case, the stock would be worth much less than it is now because you will have years of good hits and years where nothing really interesting happens and industry competition eats away at margins (like it has before).

Again, this is not to say that this has to happen any time soon.

Increasing Pricing Pressure

I don’t cover this industry so this is just a casual viewpoint, but I do think that there will be a lot more pricing pressure in the next couple of years. I’m not just talking about Samsung and other gadget makers catching up.

I think the mobile industry is getting more and more competitive and it seems like that maybe growing through acqusitions and subscriber growth may be coming to an end. When they are adding new customers and growing through acquisitions, Apple did great because the iPhone was a great way to add subscribers.

As this starts to peak out, you then get more and more price competition. When that starts to happen, then mobile operators start to look to cutting costs to provide cheaper service.

John Malone was on CNBC the other day (I may post about that later too as it was a fascinating interview on why he bought Charter Communications) and he said that he wants to consolidate the cable industry as an offset to the content providers. He says that cable bills (due to content prices rising) has gone up so much over the years that people can barely afford it anymore. The business model, he says, is unsustainable (mostly due to the expensive sports content that 80% of the people would not willingly pay for at wholesale). He thinks cable will be unbundled and the old cable model will be gone in a couple of years.

This is not the perfect analogy, but I do sort of feel like the same thing is happening in the mobile market. Phones get better and more expensive to the point that people can barely pay their phone bills. And like ESPN in the cable world, a lot of dollars seem to be going to the phone makers (Apple).

When phone companies start to see their subscriber growth stall, growth through acquisitions plays itself out and margins get pressured due to competition, it’s only a matter of time before they start looking at where those dollars are going and demanding better deals.

But again, I don’t follow the industry so this is just a casual observation and not expert insight at all. We don’t have to be experts in an industry to know which direction things tend to go (increasing competition = lower margins. When customers (mobile operators) face margin pressure, they pressure their providers (phone manufacturers) etc…). Only the timing is difficult to get right.

Conclusion

This is just a quick look at Apple. My view hasn’t really changed, but with the stock down so much it’s not as interesting a short as it was last year. But there could still be a lot more downside if these margins can’t be maintained.

For these companies that depend on ‘hit’ products, I think it’s really dangerous to normalize, or capitalize super-high margins far into the future (which is what you’re doing when you put a 10x multiple on it).

I understand the bull argument too. Apple has the eco-system, it’s not just a gadget marker. It has the great stores. But to a large extent, I think these things are tied to and depend on Apple making cool gadgets. Who the heck would go to an Apple store if they didn’t have cool products? Who would download anything from the app store if they didn’t have the latest cool gadget?

Lollapaloozas (Munger’s definition), like leverage, can work both ways.

Although I am way less bearish than last year, I am still very skeptical of this stock. And yes, I know, to the bulls this whole post must come across as totally ludicrous. I have no idea what is going to happen. This is just sort of a thinking out loud thing.

Oops, and the title of the post: I was going to make some comments about Newton’s laws of motion, the apple etc… but forgot to do so. But never mind. You can imagine for yourself all the bad jokes I might have come up with…

A few comments:

1) Margins: People love to talk about compressing margins. Yes, but… it ain't just about margins. It _is_ all about FCF per share.

Compressing margins with flat/declining revenue = bad

Compressing margins with growing revenue = good to OK

You can't talk about margins without also talking about revenue. People do it in sort of a hand-waving kinda way about boring/stale products, but in the words of Charlie Munger, "It's all twaddle and bull$hit." International is a big market and all the US Apple stores I've ever been to show no signs of fading attendance. Let's just hold our breath and wait before saying the Company is the next Blackberry.

2) Cash: not saying AAPL's going to do this, but it's not correct to tax-affect their cash balance. Companies "stealth-repatriate" their off-shore cash all the time by issuing US$ debt, then using the proceeds in the US to their liking.

I mean, for God's sake, AAPL set-up a cash management office in Nevada to avoid California state corporate taxes on interest income. They're not dumb about being tax efficient.

3) References to Scully era: people who do not know the history of the computer industry frequently cite the way the PC market played out. They however do not understand WHY the dynamics played out the way they did. Very different dynamics around compute power & software lock-in. Those dynamics don't exist today. That also means that iOS will not have 95% share like Windows did, but AAPL at $400/sh certainly doesn't require that.

Good points. You are right about the folks that obsess over margins quarter over quarter. But my point is that over time, it's questionable whether these margins are sustainable. And yes, if revenues outgrow margin compression, that is good. But I don't have a view on that. It does seem to me to depend on new product offerings over time, though.

Popular stores are always packed until they're not. I love Apple an Apple stores myself and I'm always amazed at how great the products are and how packed all the stores are at seemingly off-peak hours too.

As for cash, you can deduct it or not. That's up to you. I don't have a strong view either way, but analysts tend to net out the cash, including even Einhorn, I think. Loeb nets out tax for Yahoo's overseas cash / investments too.

As for references to the Scully era, yes, that may not be fair or relevant to today's Apple, but it seems like the story is very similar all around. Nokia was great too, until one day it wasn't (and yes, I know, Apple is way better than Nokia ever was, but still…).

The dynamics in the industry are different today than before, but that doesn't mean Apple is immune to competition.

My honest opinion is that this one is just too hard.

But in this post, I tried to 'kill' Apple and it was too easy. If I couldve said, even if Apple achieves Samsung like margins, it's STILL cheap, then I can pound the table (maybe). But that isn't really the case.

Thanks for reading.

I think that you are exactly correct in characterizing Apple as being in the "too hard" pile. If I think back 10 years, there is no way I would have ever thought of or predicted the type of phones and tablets in use today and I have no reason to think that I can predict what the industry will look like in ten years, or even in five years. If Apple can "gracefully decline" in terms of margins while maintaining market share and realizing moderate revenue growth, then it is cheap at today's price. If Apple comes up with another round of hits, it is crazy cheap at today's price. But it is indeed too easy to "kill" the current bullish thesis at $400. I would want to see the point of maximum pessimism where the market is predicting some sort of spectacular blowup (which I view as unlikely) before I invest in Apple shares. In my opinion, that would probably be below the $250 level at which point half of the market cap will be represented by cash. Will we get there? I have no idea but how many people predicted sub $400 prices just a few months ago!

Hi KK, first off, I appreciate the way you run your blog and your conciliatory way of answering my comment. Upon further reflection, my 3 questions were posed in a too aggressive "Apple Fanboy" fashion.

The truth is I've always thought Apple was a big fad and the stock was trading at an absurd forward multiple. I don't even own an iPhone — I have a Samsung because I'm cheap! But after the January earnings release, I actually looked into the numbers to find the world's premier consumer brand was trading at 5.8x trailing FCF — "That's what it reached at the trough of the recession!" I said. Surely I must be mistaken, right?

Anyways, to respond to your points…

1) Revenue = "I don't have a view on [revenue]. It does seem to me to depend on new product offerings over time, though" = my honest belief is that so many Value Investors have been burned by Motorola (RAZR), Palm (Pre), Nokia and Blackberry to believe that there's such thing as permanence in the phone business. And since the Growth Investors have all bailed ship because FCF might be flattish this year and not +25%, there's this massive air pocket of an investor base. So until Tim Cook and the BoD decide to start buying back massive amounts of AAPL shares to wave in the Value Investors, the stock will be in no man's land. I'm OK with that, because that gives Apple the chance to make some highly accretive share repurchases for investors who believe in the Company.

2) Cash-Affecting Taxes = "Loeb nets out tax for Yahoo's overseas cash / investments too" = I've forgotten what Third Point's math was on the Alibaba / Yahoo Japan assets were, but my recollection was that they were applying a liquidity discount to them because they are fairly large equity stakes in these businesses (so would need to discount them, like any secondary offering). At any rate, I agree with you that this doesn't impact valuation much around these share price levels, although I reserve the right to alter my position if the stock gets down to $150/sh :).

3) Competition = "I know, Apple is way better than Nokia ever was, but still…" = yeah, see, this is just something that Apple is simply going to need to execute on in 2013 and 2014 in order to disprove. My anecdotes and beliefs are as worthless as the next guy's — Apple just needs to demonstrate that customer loyalty in its financials, and no amount of buyside or sellside analyst is going to be able to datamine so-called "leading indicators" otherwise. "Just Do It" should be Apple's motto (oh, you say that's already taken?).

Thanks for the comment. Yeah, there's really no point in getting nasty and arguing like you see on the internet all the time. At the end of the day, nobody knows anything anyway, lol… What's the point of getting into heated arguments? I like rational discussion and I never intend to change any minds on anything, ever. Look at it this way; people argue about politics all the time and two of the smartest people on the planet are on the opposite ends of the spectrum (Buffett = Democrat, Munger = Republican). On just about any issue, you are going to see very smart people on opposite sides. So if the smartest folks on the planet can disagree on many issues, who am I to pound the table one way or the other about anything?

You may be right about value investors and Motorola/Palm etc… and I do think it's a little lazy to dismiss all tech automatically as too hard. That's what I did intially with Apple too when the iPod came out. I told people that these gadget makers will come and go. Look at the top PC makers in 1980 and see who is left now etc…

And then part of the way through, I changed my mind and I actually did go long Apple and did well with it (I did make some bullish posts on it, but it was just basically the "ex-cash it's cheap" argument and nothing much more than that).

And as it kept going up and I saw bubble-like things going on (articles about people living off of Apple profits, Apple shareholders laughing at and ridiculing bears on CNBC etc…) I got a little worried and started to change my mind.

My background is in trading and we used to say, if it's obvious, it's obviously wrong. So many fund managers started saying, "I own an iPhone and an iPad, my wife owns an iPhone and iPad, all of my kids have iPads and one of them has two of 'em; that's why I'm long Apple…" and I was like, uh oh… Well, if everyone already owns that stuff and you are long, that doesn't sound right… I would like it better if they said, "Well, I don't have one now and neither do my kids, but I tell ya, I'm gonna go out and get one soon!".

But anyway, it just felt too bubblish even though the valuation never got up there.

And then I thought really hard about Buffett's ten-year rule; can I tell you what this company and industry will look like in ten years? That was a big, fat no from the day I bought Apple. So it was a long in my portfolio that violated an important rule (this rule doesn't apply to special situations, and I told myself that this was sort of a special situation; the extreme cheapness being special).

So for me, it's just sort of going back to putting Apple in the 'too hard' pile, and my shorting it is definitely just a supply/demand, speculative action that may not really fit with this blog…

So anyway, that's my Apple story, lol…

Thanks for reading and commenting.

Why did you take $44/share times 10 to get $440/share ?

Hi, $44 is the average eps estimate for AAPL for the current year, and 10x is a common multiple used to value AAPL.

Thanks for reading.

OK, thanks

Another thing on margins (please do forgive me if I say something naive).

Let's assume that operating margins can go down to say 18% as is the case Samsung: that could be due to higher unit costs (difficult, the cost of labour in producing an iPhone can rise a bit but components are likely to get cheaper) or (most likely) to Apple's gadgets losing the price premium for the increased competition.

If it's the latter, revenues will probably decline even if Apple manage to maintain its large base of supporting fans. So we are exactly in the situation introduced by Anonymous in the first comment: compressing margins with flat/declining revenues, which will significantly impact earnings/FCF and a conservative valuation will be much lower than $370.

thanks

I think your worst case is a bit harsh because even if their margins fall over time it should happen gradually. Hard to see them not generating $40 in cash in this year. They should get credit for the additional cash they generate before margins reach 10%. If normalized FCF is $15/ a share and they generate $45 in 2013 they should get credit in the valuation for that additional $30 . And you can discount that somewhat if you like.

Also, the reason for the 10 P/E is because margins are high & unsustainable. If margins were to go down to 10% the stock would likely deserve a higher P/E. Maybe 13 times. Making these adjustments would get the worst case above $300

Yes, good point. I wasn't trying to really nail down any sort of valuation. I guess the way I am looking at it, and what the street is indirectly arguing about is not so much the p/e ratio itself, but what the sustainable margins are going to be over time and that's why I just played with that 'lever' a little bit just to see what happens.

Of course, cash will build, revenues will grow (or not) as margins shift, so modeling this over time is not really possible…

Thanks for reading.

Good idea to compare to Samsung

Here is a simple analysis I'd recommend (note the numbers are from bloomberg)

Apple Market Cap: 366b

Apple Cash: 137b

Apple EV (no tax adjustment): 229B

FCF that you get: 47B

Intangibles you get: an operating system, and ecosystem, potential for significant international expansion, repeat sales for a couple years due to customer base loving their products

Samsung Electronics Market Cap: 194.6bB

Samsung Electronics Net Cash: 13B

Samsung Electronics EV: 181.8B

FCF that you get: 8B

Intangibles you get: this is primarily a hardware, and components manufacturer — just had their best phone ever and highest FCF ever

You did a nice job going through margins (albeit painting with broad strokes).

I agree with one of the other commenters. Revenues are a huge issue. I think there is massive volume risk here (and/or pricing risk for related reasons).

It could end up OK, but data on the replacement cycle is not all that robust at this point with way less than 10 years under our belt for most of their major products. The last few years have constitued a wonderful window for these guys – introduction of the iPhone, introduction of the iPad, last legs of the iPod, and relatively strong laptop sales as well. A couple points to consider:

(1) New adopters of the iPad and iPhone without question constituted a fair bit of the demand base until recently. Going forward – notwitstanding int'l growth – the demand for subsequent models of the iPhone/iPad will rely almost exclusively on replacement demand. Let's be honest the incremental value of annual upgrades is getting smaller each year.

(2) The unbelievable increase in computing power in mobile devices makes you wonder if there will be device consolidation going forward. The fact that we have a separate device for tablet use, desktop use, and fully mobile use is entirely predicated on computing power constraints for the smaller devices. When your iPhone can do whatever you want, there is no need for the incremental CPU, ram, OS, etc. Eventually you just plug your phone into a monitor or into a larger housing w/ screen to recreate the iPad/laptop/desktop experience. Someone will make a product to do this, and all the smartphone manufacturers will face competitive pressures to make their handsets compatible if there is demand.

Good points. I agree.

My analysis is broad strokes for sure; if I can't make sense of this thing on a broad stroke basis, I sure ain't gonna understand the details.

These high margins have been achieved for extended periods of time by very few entities in the past and as much an Apple product fan that I am, I just don't think this is going to be one of them. But that's just my opinion and anything could happen.

Thanks for reading.

This post from Horace Dediu provides an interesting data point:

http://www.asymco.com/2013/04/16/escaping-pcs/

In the fiercely competitive PC market, Apple makes 19% op margin. So, I do think your 10% bear case is too harsh. Take the more reasonable 18% op margin scenario, you put Apple's share at $370. To me, this is cheap because you pay nothing for the optionality that it may introduce another hit product or two, or grow at frenzy pace in China.

I still think to have a complete view of Apple, one can't ignore the "brand" angle. That's what I argued in my own blog post.

That said, John Hempton has dropped a bomb shell that has forced me to rethink my thesis:

http://brontecapital.blogspot.com.au/2013/04/guessing-about-future-apple-in-china.html

A risk that I've never thought of. Without the growth engine in China, Apple's upside is less certain…

(Long Apple. Long gravity.)

Hi,

Good post on your blog. I don't really buy the brand angle of Apple too much as I do tend to think that tech is primarily driven by function. To me (and I know I am a fluke in this regard, according to friends and family), a lot of the value of brands is not functional at all. A $50,000 Rolex tells time no better than my $100 Casio (in fact, my $100 Casio is solar power driven and synchronizes the time by satellite every night so is functionally *better* than most expensive watches!).

Of course, the following examples are not nearly as 'strong' as Apple is now, but I heard similar brand loyalty arguments; like Palm (people absolutely swore by them and some said they couldn't live without it), Blackberry (people swore by it and said they couldn't live without it; they don't give a crap about the iPhone or iPad; Blackberry is what they want and all they want). Sega had a pretty good brand too and so did (or does) Nintendo.

But unfortunately, in the world of tech and gadgets, I really do think functionality trumps all. Apple still does in fact probably have the best product, but the spread is shrinking, I think.

Anyway, I can't really prove my 'opinion' one way or the other. We just have to see.

Also, I wonder what the operating margin of Macs are; is that just the segment margin? In that case, it may not include SGA, R&D and other things so may not really reflect real operating margin.

Anyway, good discussion; thanks for posting.

John, I've liked your blog for a while — good job. Also good job on bailing on RIMM when you had the chance. I'm pretty sure it's a zero unless some other player (like Lenovo) comes along to buy them or they scrap the BB10 idea in favor of Windows or Android. They're simply way, way too late.

The other John (Hempton) also makes a good point, but I think he's overstating the idea [I'm answering it here because his blog tends to get too many spammy or snarky comments]. Factor #1 is the brand in China — it's extremely popular, as much as in the US. Factor #2 is what the commenter Sean said, "What % of Chinese will be comfortable with unlocking bootloaders + flashing ROMs, kernels, radios?" My answer is, "Not many." It would be one thing if Apple were going for the hard-core hacker types with revved up hardware specs. They're not. They're going for the equivalent of soccer moms in China, those who just want a smooth, clean UI with loads of games and applications.

Anyway, again, all this tea leaf reading is pretty useless… time shall tell. Let's just wait for 2013 to pass before we stick a fork in Apple.

If anything, the 24-7 global news cycle has made Graham's Mr. Market all the more excitable and less efficient than ever.

@kk: Good point on segment margin.

@anon: Thanks for your thoughts. Hempton's point reminded me what happened to Google in China. The chance of that happening is low. But I didn't consider it. It's a failure of my process.

The issue with the margins is that RIM or NOKIA have had more than 30% gross margins even losing the smartophone wagon. So I have to asume that Apple makes a big mistake and loses the next wave in smartphones so margins contract and sales decline to justify a valuation lower that this.

Of course this can happen, but not in the next 2 years. Only bc of replacement I think apple can maintain Margins>30% on similar sales levels. Not to mention Ipad will grow in sales for sure.

In 2 years thay have been generating another 80bn Free cash flow, so will have around 230/sh in cash. Quite a good floor.

The financial analysis is interesting, but of course, financial analysis is only part of the picture, and financials reflect the quality of a company's management, employees, and overall operations. For consumer-facing companies, it is helpful to bring in qualitative, real-world experience.

As someone who owns many Apple devices (iPhone, iPad, Mac Book Pro and Apple TV) and also, a couple of Samsung internet-enabled "Smart" TV's, I can tell you that the idea that Samsung can outcompete apple seems like a joke to me. Samsung is supposedly a CONSUMER electronics company, but the interface on their "smart" TV's is so slow and unpleasant to use, you wonder if Samsung understands the first thing about consumers or designing products. I just bought another Apple TV, so I could use Apple's wonderful, intuitive, easy-to-use interface and simply use the Samsung Smart TV's as the dumb screen. Which is all they are good for.

Who knows what market Apple will attack next. With Apple TV, I think that they have a great start on the television, which has of course been rumored for some time. All I can say is that as a user of both companies' products, I would much sooner bet on Apple, which starts off in a better margin position AND, from my experience, knows how to design and product products the engender enormous consumer satisfaction and loyalty. Something that crunching the numbers can never tell you.

Did you attend the Biglari Holdings meeting this year? Any notes?

Hi,

No, I didn't go this year; my schedule didn't work out.

I read the post and all the comments. It's all quite sound arguments on both sides. And for that reason, I'm staying away from the stock.

Apple—-> too hard pile.

As someone pointed out, Apple makes 18% margins in PCs, a 30+ yr old industry with extreme price competition. It is reasonable to consider this as a absolute worst case scenario downside, but it's not even close to reasonable to think that this has any realistic chance of happening in the short term.

And even if their margins were to trend towards this, it would be over a number of years. That is the benefit of the ecosystem. Look at MSFT's windows margins– margins have contracted from 70+% to just over 50% but due to slow revenue growth, operating income is stable or has grown.

People who say "look at XYZ hardware vendors margins, that could happen to Apple!" dont realize that Apple is a software vendor that by the way, packages its software in world class hardware. Look for most people to pay up for iOS and increasingly OSX because they are used to it, for a long time.

I expect Apple's margins to trend towards 20% over 10 years but revenue will be much higher.

Does that samsung unit have some of their other commodity businesses like DRAM and Hard drives in it? AAPL is a tough comp. Samsung doesn't make their own software or run their app market, google doesn't make its own hardware (generally). Seems like under the reasonable assumptions you lay out at the beginning of the article, it is a 30% up or a 10% down with zero positive product surprises or other good news.

Correct. Samsung Electronics no longer has HDDs (was sold to Seagate ~18 months ago) but a major portion of revenues come from Memory, other Semis ("LSI"), commodity LCD panels, and TV's/PC's/other devices.

Hi, The 18% operating margin I mentioned is only for the IM segment, which includes mobile communications (phones/tablets), laptops and I think printers. All the other stuff, TV's, LCD screens, semiconductors, cameras, consumer electronics etc. are in other segments.

But still, it's not the perfect comp for sure as Apple does do their own software and run their app stores.

I was thinking about the software part of this argument, but doesn't Samsung pay nothing for android?

Also, during the PC era (I speak of it as if it's already extinct), Microsoft had fat margins versus the PC markers. What was it in the old days, 80% gross margins on software versus 18% on PC's? (I'm talking way long ago).

But we have to remember that this was an 18% gross margin on a $1,000 or $2,000 product whereas Microsoft charged $50 (or as little as $15-35/PC) to the OEM makers (depending on who you ask and what you read on the net!).

So the fact that Apple does their own software surely should help margins, but it's not like it's going to make Microsoft-like margins on the iPad sales price, but just a little bit more.

Anyway, this is a tough one and interesting to think about.

If I remember correctly, Samsung pays Microsoft $10-$15 per Android device.

Here are Apple numbers, going back to 1980s.

https://docs.google.com/spreadsheet/ccc?key=0Ao2QxGxfnoG3dE1manlqajFWeXFRZ1JzcGlDeHJFcGc&usp=sharing

Wow, thanks! All companies should be required to post something like this on their website. It would cost them nothing to do so.

Yes, definitely. So far, I only know of a few companies (Wal-Mart, Sandvik, SKF…) that does this.

If you have couple more companies that you'd really like historical numbers for, let me know and I can dig around to see if I have them.

You're assuming (incorrectly) that future growth will come from hardware sales (even in product categories we don't know about right now) which yes, you are correct, excess margins do get "competed" away as you put it. But this is a bad assumption. Apple's future growth will come from payment processing, and content sales (specifically the destruction of the cable/satellite model w/ per channel pricing packages) of which they'll get 50% margins like they do selling songs on iTunes. If we look at the market caps of companies like TWC, DISH, V, MA ect…, and project that AAPL does the same to those industries they did to the "impenetrable" music industry, then not only will they maintain (if not increase) margins, but continue to experience the type of hyper-growth they have for the past decade.

That's a good point. I thought of that but couldn't really quantify it. You can look at Amazon, Netflix, Nook etc. for examples, but I don't know how to value those things, particularly when they are so tied to the hardware. If you have netflix, you don't care if you see a movie on your iPhone, laptop, desktop or iWatch (I just made that up…). But I think Apple stuff is tied pretty much to Apple products.

Anyway, that side of the business is going to get pretty competitive too with Amazon, Netflix and others doing the same thing. If they are just offering content available elsewhere, it's going to become an issue of price at some point.

One thing that Apple management might do to boost value of Apple shares is to actually disclose more detail about that stuff. Then we can just value the things separately and we might come up with a higher valuation; some value for the hardware sales, and then a higher multiple for the revenue stream from content sales etc…

Actually, I think that's really a great idea… Someone should email Apple investor relations and say it can boost the stock price!

Thank you for your write up – Interesting that you reach this conclusion taking exactly the same focal point – margins – and reach a different conclusion to a very good apple thesis posted on the VIC website. The author in that case argued that if margins fell to Nokia-like levels, apple would be darn cheap. Worth a look! check it out 🙂

"Apple used to be cool… then my mom got an iphone."

So much for the brand appeal. Margins will be under pressure for a while.

Apple is a "good to have" product than a "need to have" product. Just from this aspect- I don't like apple. When apple is "good to have" then pressure is on apple to show how good they are. When apple is "need to have" product, pressure is on people to decided whether they can afford to pay for apple or now. These last 5 or whatever years that iphone has revolutionized, I never used the iphone and used the go phone and I was okay. I don't need too much of information. I need a break in life. So the craze for iphones fade away sooner or later. Everyone considers steve jobs to be this and that but I think the real guy who made the change in the technology of communication is Martin Cooper and nobody wants to making him a living legend. Steve jobs is luxury. And only the affordable can afford. Apple to me is more like angry bird. Angry bird is still very very fun to play but it was more fun back then when everyone else was playing. I wonder how the scientists working at R&D in Apple and other Tech companies work. How much pressure they may have to go through to make that next "certain" stuff. Good luck to all the Technology loving value investors! You're on the right track to become the next generation of value investor. I'll rather stick with furniture stores. When Sony was selling tons and tons of walkman back in the 90s, how many of you felt that you had a gem in your collection of portfolio?

Good point. People keep talking about the eco-system and I agree with that to some extent. But on the other hand, what is in the eco-system? iTunes (music, movies, TV shows), Apps (games, mostly? I don't know if people do taxes on the iPad with a tax app or not)?

This sort of eco-system doesn't seem to me as sticky as, say, an IBM system implemented with high cost of change in corporate back offices, or even Microsoft Windows and windows based software/servers running many software programs for corporations.

To date, I haven't seen an iPad do anything that something else couldn't do just as easily, and many apps seems to me to be so cheap that people would gladly leave it for something else any time.

Anyway, that's just my opinion…

Thanks for posting your thoughts.

thanks for share....

From the quarter there are clearly two key themes:

-Bulls/Value Investors are very excited about the capital return strategy

-Bears highlight that 37% gross margins are the new normal (not a concern if it stabilizes, a concern if it doesn't) and no near term product announcements (which I don't think is important to the long term business value)

What are your thoughts?

Personally, I see the capital return as the major news because now a $350 or $300 stock price means better returns in the future

Hi,

This is a tough one. Sure, AAPL is going to return $100 billion through the end of 2015 so that looks like a 10% yield. But to take 10% yield at face value, you have to assume they will be able to keep paying out $40 billin/year and that's where I have some trouble. If this is not going to happen every year and then grow over time, then the 'current yield' is not so relevant to me.

One scary insight was that a prominent analyst said that AAPL is in the part of the product cycle where gross margins should be going up but they went down. I don't care too much about short-term, quarter-to-quarter results, but that comment (during the conference call) scared the crap out of me.

Apple/smart phones might be coming close to the point where technological advancement outpaces consumer needs (from Innovators Dilemma), at which point the product gets commoditized.

The future of Apple is really completely dependent on what they come up with next. As I said in previous posts, I tend to think of Apple's success as a Steve Jobs story, not an Apple story. I think Jobs was very good and lucky to be able to have three superhits in a row; iPod, iPhone, iPad.

The phone market was a HUGE market and they hit it out of the park. The opportunity was there, Jobs was there and they made a ton of money.

What market can they have similar impact? Watches? TVs? I have no idea.

The more I think about the bull Apple story, the more it feels like a "This time it's different" story. Most gadget makers dominate for a little while and then lose their position. It happens all the time and we all know the precedents. Apple is quite a bit better due to the eco-system etc… But that doesn't mean they can continue to dominate, unless, of course, this time it's different. I don't like to make those kind of bets.

Also, people keep saying eco-system, eco-system, eco-system. But what exactly is that? We bought an iPad, downloaded a few apps for $1.99 or $2.99 each. Apple gets 30% of that. Great. But they already got 40% of my $800, right? (actually, they get 40% of wholesale, not retail, but…).

I bet these app sales have a tendency to be concentrated in a short time after purchase of the iPhone or iPad. People download what they want and those purchases taper off over time.

So as much as people say Apple is a software/app company and not a hardware company, I can't get my head around the fact that they make so much money from the hardware…

Anyway, I would love to see some analysis/work on the eco-system. If someone can prove that it is not really linked closely to hardware sales (and doesn't have that tendency I mention), then we should be able to value that separately from the hardware.

This is an interesting discussion. We'll see how it goes.

Same poster as the previous post,

On "This Time is Different" I certainly agree that history has shown many tech companies declining over time. But, a key difference is that the company currently has a reasonable valuation (on conventional metrics), and a new committment to return cash. Whereas, prior big tech declines from the beginning of the decade were at very high valuations.

I'd say one of the most surprising declines has been Microsoft, due to the robust performance of the business over the past decade — but we have to remember that when it peaked it traded at >100x and was above 40x for a few years; hence, the decline/stagnation has really been the company growing into its valuation

Anyways, the reason I like the stock is that I do not see an enormous amount of near-term downside (due to the dividend yield, repurchases, and installed base of loyal customers), though I admit that I am not as bullish as many others on the upside.

Truly appreciate your blog and thoughts. Very helpful

Same poster again,

On your ecosystem comments: I think when most people discuss ecosystem they are referring to the fact that apple has a loyal client base of repeat customers. I don't generally rely on survey data for ANYTHING but I think Kantar said 94% of iPhone users intend to purchase an iPhone as their next phone.

Hence, although almost ALL the earnings come from hardware sales – the recurring nature comes from people continuing to purchase iPhones every 2 to 2.5 years because cell phone contracts make it affordable

Note: Carrier consolidation, and TMobile allowing customers to bring their old cell phones in exchnage for a cheaper contract — WILL impact gross margins, and could impact the recurring nature of the business

Same poster again,

Here is a great visual graph for seeing the importance of hardware sales —

http://cdn.shopify.com/s/files/1/0185/3574/products/iTunesBizReview_1_1024x1024.png?487

Anonymous — first off, that's an (insanely) great visual graph. Pretty cool. I'll look forward to seeing that format in Bain / BCG / McKinsey presentations for other companies in the future 🙂 :rollseyes:

Secondly, I think you really nailed it when you said "when most people discuss ecosystem they are referring to the fact that apple has a loyal client base of repeat customers… [and] cell phone contracts make it affordable."

The difference between AAPL vs. Nokia / RIMM / PALM / MOT is the loyalty to the brand. This comes from more than a decade of making a suite of great products. In Munger's terms, a Lollapalooza. I know that's going to make many investors shudder because they say, "Well people had loyalty to Blackberry, and look what happened there." The truth is consumers COULDN'T have loyalty to Blackberry because it was *just* a phone — once something better came along, the party ended.

The unanswerable question is, "Has Somebody Else come out with a better mousetrap?" Because if they have, the Lollapalooza will end.

So we can talk all day about whether AAPL has stopped innovating, but the answer is, "We just don't know."

Only 4Q-2013 and 2014 will tell us.

The Market at 5.8x EV/FCF ($400/sh) hates uncertainty and therefore is pricing in the idea that AAPL has stopped innovating since Jobs died — or in KK's words, "I tend to think of Apple's success as a Steve Jobs story, not an Apple story."

I think he's wrong (or that he just doesn't know), but I still respect his opinion and how he gets to that opinion.

The next 18 months will bear out whether AAPL's all tapped out of cool ideas, but the evidence "proven" by a large Samsung screen size phone doesn't put the fear of God in me like it seems to do for others.

Maybe I’ll be wrong, but if AAPL does come out with some "cool" stuff, I'd expect a more normal market FCF multiple on the Company.

Very interesting discussion. We all know the numbers of APPL and so instead of arguing on the numbers let me lay out my theory on AAPL from a Qualitative angle. Love to see counter arguments.

1. I use Iphone and IPad, I use Itunes to organize and sync all the music, not to mention all the Apps I bought which I use regularly. Now I might not have paid too much for my apps but I should be really motivated to switch my hardware to another ecosystem if I have to go through the trouble of organizing all my music and apps again in another ecosystem. One thing we all forget about Apple is it makes sure whatever works in Apple products works very well, now I may not have the biggest screen and some pretty powerful hardware Samsung phone has but the bottom line is I do not care!. There may be a few tech geeks who jump ship on the latest shiny hardware, but most do not. There have been numerous studies that demonstrate that it is very very hard to change default human behavior and for the millions of installed base of IOS users, the default is Apple and the incentive should be very high for us to change.

2. The second point is, if so many people already own IOS devices, what is the incentive to upgrade the hardware, without switching the ecosystem? This is where we need to look at what is possible without any constraints. The smartphone thought it is called smart is still dumb. It does not know not to ring my phone when I am in meetings, unless I switch on "do not disturb" manually. This is just one example, there are numerous ways you can link the different apps within the phone, (calendar, facebook, twitter, itunes etc) with intelligent rules so that the phone can be really smart. I think Apple might find a way to do this in a user friendly way not a geeky way. As someone already mentioned , using phone to pay is a huge potential and we have only scratched the surface. Now my argument is if I can get all these new features(and many more- use your imagination) without having to redo all my current apps and music , I would prefer that meaning I would upgrade to Iphone6 or 7 instead of changing the ecosystem.

3. The potential of services. Going by the above examples and adding additional ones like, subscription based video, audio and other entertainment, turning its itunes store into another utility is a huge possibility. As Apple will just act as a broker, the margins on this business will be higher. I know we are starting off a low base here but any increase in hardware sales due to lower margins on hardware can be compensated with services based revenue. The larger the installed base of hardware the higher the services revenue can be.

4. You are completely ignoring the 'human capital' inside Apple. There are thousands of engineers in Apple and Apple spends a lot in R&D. Yes currently they do not have anything 'hot', but you are assuming there will be NO future hits from Apple. That is extremely pessimistic.

Hi,

Great points. I have thought of those points, which is why I was bullish before I turned bearish (to paraphrase John Kerry).

The ecosystem has value for Apple for sure. The question is how much?

One big threat to iTunes is something like Spotify. I'm still an iTunes user, but some hardcore iTunes people have switched over to Spotify. With Spotify, you can get what you want, where you want, on any device, any time, anywhere. Why bother "synching"?

For movies/TV, there is Netflix / Amazon and many others that will offer stuff to people any time, anywhere, any device. That's highly convenient. No synching necessary. Just log on and get what you want.

Call me old-fashioned, but I tend to like these 'open' systems that are device independent. I can't prove it off the top of my head, but that's what I think.

As for services, yes, there is a lot of potential. But nobody has a lock on any of the services yet so that's wide open. We don't know who will dominate if anyone.

As for human capital, yes, Apple has a lot of great people. But Sony did too. They prided themselves on their R&D and the fact that they hired the best engineers in the country every year. Same with Microsoft. Polaroid had great people too and a great culture. I worked with many people over the years from Bell Labs too (ATT).

But just having a lot of great people doesn't guarantee anything, unfortunately.

As for future hit products, I am not assuming they will have none going forward. I just wonder how big future hits can be. They can be huge, of course. Or they might not be as 'big' as iPhones.

So I do think they will continue to make great products in whatever category they choose to enter. But you have to wonder if they can keep doing it at the level and scale of the iPhone.

Anyway, I don't know the answers to the above.

A key turning point for me on Apple was reading Walter Isaacson's Steve Jobs book and reading the various Polaroid books (that I talk about in my other APPL posts).

Thanks for commenting, and yes, this is a fascinating discussion.

I am impressed your blog because your blog words is very impressiveness for business growths so thanks a lot for sharing this Information.

Nice Article ,Thanks for Sharing the information.Customer Satisfaction is very important to grow up the business.

Though you are probably tired of discussing it, any updated thoughts?

+ most of the recent quarters cash flow went to repurchases

+ I know a lot of people with the iphone 4 and 4s, who are anxiously awaiting a new model

– the lower margin story is playing out

– the lower ASP story is playing out, but the reported numbers are probably skewed by a good phenomenon (i.e. selling iphone 4 at a lower price is expanding the market)

– US Wireless consolidation is not a good thing

No, my view hasn't changed at all.

It's interesting that the debate seems to be about whether or not Apple is still a great company. Or if it can innovate or not. I think it's still a great company and can probably still innovate (but not just as well as Jobs was able to).

But what the bull thesis lacks to me is a story on whether the next big thing is big enough to support the current market cap when iPads and iPhones aren't making so much money. I don't think those products will go away any time soon, just like the Mac went away (even when cheaper competition took over the PC market).

So the question to me is about profitability to support the market cap.

My view has not changed, and so far what is happening is exactly as I expected.

Thanks for reading.

Oops, I meant just like the Mac never went away even after cheap PC's took over the market. If the same happened with iPhones and iPads, could AAPL support their current market cap? Will new products fill that hole? To me, that's the question that seems like a big leap of faith.

I came back and re-read this post (I've re-read a bunch of posts – you have a nice blog) and I think there a couple of things that bugged me about it. In hindsight, the stock has gone up a lot since you wrote this and my sense is a lot of that has to do with lessening fears about the company's future but I still think there a couple of things worth pointing out.

1) I think the biggest danger to Apple would be a strong competitor, and there really aren't any in the markets in which Apple competes. In lower income markets, you typically find android phones and Apple isn't a strong competitor but in many higher income countries Apple's market share is very, very strong, especially in the US and Japan (there are exceptions, like South Korea). In these markets, most customers are post paid and an iPhone on contract costs as much as an Android phone, giving people less incentive to take a cheeper phone. Sure, the carriers could drop the subsidies but the carriers that have tried to go without the iPhone have had problems.

Basically, if I want an iPhone cheaply and ATT offers me a subsidy and Verizon won't, I'll can switch carriers. There's a good amount of evidence this happens, suggesting the pricing power is really with Apple and not the carriers. It helps with margins that Apple can take advantage of enormous economies of scale, pretty much something only Apple and Samsung can do. Another things is that you're really not seeing more innovative products out of the competitors. Many of them are similar and a lot of people prefer the competitors products, but the innovators dilemma really only comes into play if they are cheeper.

2) Phones, tablets and computers more generally represent a major new technology, one that has substantial economic externalities (i.e. other people are building very successful companies using these technologies). I think a better analogy for a device maker than Apple is Ford. Like Ford, Apple has provided an innovative new technology for the masses that's quickly become infrastructure. There are other parallels (each customer pays for their own use of the infrastructure, limiting the need of massive and risky outlays trains like trains or airplanes, for example). Ford eventually ran into problems, but that largely had to do with GM making better cars. Blackberry and Nokia ran into the same problem, someone started making better phones.

So, I don't see a reason why Apple can't have a good run iteratively updating the products they already sell. Their design process seems to be superior to Google's or Samsung when it comes to phones and tablets and they have an engineering lead. Both of them, as well as Amazon and Facebook are too focused on their core businesses to displace Apple. The short life cycle of the devices is problematic as it allows their competitors a chance to win their customers every 2 years or so, but the short life cycle is also why the company makes so much money. I don't believe the ecosystem is a competitive barrier at all, its harder to develop for android because the fragmentation of hardware and software but if someone else builds a demonstrably better system, people will migrate.

I think it's easy to overthink but I think sustain the margins and growing revenue really all come down to product quality. Tim Cook often describes the company as like BMW or Mercedes and I think the comparison is apt, if you could by a BWM for $200.

Anyway, thanks again.

Thanks for the thoughtful post. Yeah, Apple is doing good now, but my views is really long term. I don't have a view short term so I wouldn't try to trade this anyway. I had conviction once when it was really bubbled up, I had a good short trade, did well and have been out for the most part since then.

So maybe Apple does well for a little longer than I think. But even still, that's really irrelevant to my argument as my thesis is quite simply that Apple was a Steve Jobs story, and that's it. However long they can milk what he created is a question I can't answer, but I tend to think they are not going to keep changing the world as Jobs did, and that's the main point. And it's pretty clear to me from reading the Jobs book (Isaacson).

Also, Innovators Dilemma might be another good model here. It's a great book, by the way. The argument is basically that innovation really keeps a market going and dominant suppliers can do well on succussive upgrades, but eventually a ground breaking innovation comes out and the dominant players typically DON'T dominate the new breakout innovation.

The other problem is that these incremental upgrades and improvements eventually outrun the needs of the consumer and when that happens, people just don't care anymore.

Each time the PC got better, people rushed out to get the new upgrade as Moore's law just kept making PC's more and more powerful. But at some point, PC's got so powerful that further upgrades just didn't matter to the average joe anymore. Who cares if your computer is faster than before if it's already as fast as you need it? That's when the product cycle can hit the wall and the entire industry craters…. That sort of seems like what happened… well, that and tablets / mobile taking over the easy job of watching TV, updating facebook/twitter and sending emails which is what most PCs are used for anyway (and not much more).

So you have that aspect of it. At some point, the incremental innovation makes people yawn and then the industry is up for grabs (and with low margins after that) until the next big thing.

Anyway, this is a fascinating topic and I love talking about it, but from an investment point of view, I just don't know. This is not one that I can answer the question, "what will the industry/sector look like in 10 years?". I have no idea. I know people say Apple is not Motorola, Commodore, Nokia etc… but it's not Coca-Cola either…

Hi there. An interesting article about the post Steve Job Apple: http://daringfireball.net/2014/06/only_apple