OK, so this is another extension of the footnote to the book post. Someone mentioned in the comment section that Colfax (CFX) is the younger analog to Danahar (DHR) and it is owned by some Tiger cubs and BDT Capital, a firm run by Byron Trott (Buffett’s investment banker).

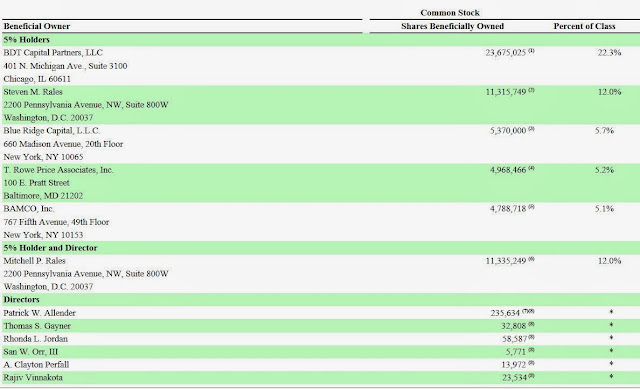

Here’s the 2013 ownership section from the 2013 proxy:

Of course, what is interesting is that BDT Capital owns such a large percentage. They did sell some shares in a public offering earlier this year but still own a large stake (or at least they didn’t sell their entire position on the offering). Probably the most important owner is Steven M. Rales; this is the Rales that founded Danahar (DHR).

Blue Ridge Capital, of course, is run by the Tiger cub John Griffin. Tiger Global and other Tiger cubs own shares too.

Maybe interesting to the Buffett followers (other than Trott’s involvement) is that Tom Gayner of Markel has been a board member of CFX since 2008 and Markel has owned a million shares or so since early 2012 (when CFX bought Charter, no not Malone’s Charter, the Irish welding company… I know, this can get confusing). Markel paid $23.04/share and BDT Capital got a bunch of shares at that price too in January 2012, related to the Charter acquisition.

Markel still owns it, and it looks like it’s 2% or so of their equity portfolio.

Anyway, let’s look at the chart:

CFX IPO’ed at $18/share back in 2008. That was just when the world was falling apart and it shows in the stock price. But over time, it has done incredibly well. By the way, the red line is the S&P 500 index and the green line is Berkshire Hathaway.

History

Anyway, I have never heard of CFX until someone mentioned it the other day here. CFX was originally started back in the mid 1990s with the backing of the Rales brothers. As I was looking around the SEC filings, I found an S-1 filing for CFX from back in 1998. I guess they filed an S-1 and never did the IPO.

So here’s a cut and paste from the August 1998 S-1 filing on the start of CFX:

Philip W. Knisely, with the support of the other Principal Stockholders,

embarked in 1995 to acquire, manage and grow world class industrial

manufacturing companies in the fluid handling and industrial positioning

industries. These industries were targeted due to their size, highly fragmented

nature and the Principal Stockholders’ belief that these industries provided

the opportunity for accelerated growth and for improvements in operating

margins.

The Principal Stockholders have significant experience in acquiring and

leading multinational industrial manufacturing companies. Mr. Knisely, the

Company’s President and Chief Executive Officer, has experience in managing

global industrial manufacturing operations for more than 15 years, including as

a group president of Emerson Electric Company and president of AMF Industries.

The Rales, who will serve as directors of the Company, are also directors and

principal stockholders of Danaher Corporation (“Danaher”), a New York Stock

Exchange (“NYSE”) listed company and a leading manufacturer of tools,

components and process/environmental controls with a market capitalization of

approximately $5.6 billion as of July 31, 1998.

The Company intends to expand its operations through internal growth and

acquisitions. The Company believes that there is a significant opportunity to

increase the internal growth of the Acquired Companies and of

future acquisitions by implementing the Colfax Business System (“CBS”), a

disciplined strategic planning and execution methodology designed to achieve

world class excellence in customer satisfaction. CBS is a customization of a

system which has its roots in the world-recognized Toyota Production System. A

similar system has been successfully deployed at Danaher for more than 10

years. Management has begun implementing CBS in each of the Acquired Companies

and believes that it has resulted in cost savings that have contributed to an

improvement in the Company’s pro forma results of operations, as shown in the

following table:<TABLE>

<CAPTION>

UNAUDITED PRO FORMA

SIX MONTHS ENDED

JUNE 30, 1997 JULY 3, 1998

————- ————

(DOLLARS IN THOUSANDS)

<S> <C> <C>

Net sales………………………………….. $272,006 $277,201

Adjusted operating income(a) ………………… 22,155 33,364

Adjusted operating income margin……………… 8.1% 12.0%

And like the other outsider companies, the main growth strategy is:

GROWTH STRATEGY

. INTERNAL GROWTH

The Company believes that there is significant potential to increase the

internal growth of the Acquired Companies and of future acquisitions.

Through the implementation of CBS, the Company will seek to grow internally

by focusing on customer needs and striving to improve product quality,

delivery and cost. Specific actions to accomplish these goals include: (i)

leveraging its established distribution channels; (ii) introducing

innovative new products and applications; (iii) increasing asset

utilization; (iv) using advanced information technology; (v) increasing

sales and marketing efforts; (vi) expanding and diversifying the customer

segments served; and (vii) expanding the geographic markets served.. ACQUISITION GROWTH

The Company believes that the fragmented nature of the industries in which

it participates presents substantial consolidation and growth opportunities

for companies with access to capital and the management ability to execute

a disciplined acquisition and integration program. The Company’s

acquisition growth strategy is to acquire companies in the segments in

which it participates that (i) have leading brands and strong market

positions; (ii) will expand its product lines; (iii) have reputations for

producing high quality products; and (iv) complement or enhance the

Company’s existing worldwide sales and distribution networks. The Company

also believes that the extensive experience of its management team and the

Principal Stockholders in acquiring and effectively integrating acquisition

targets should enable the Company to capitalize on these opportunities. The

Company intends to take a proactive approach to acquisitions and has

currently identified approximately 50 potential acquisition targets in each

of its two business segments located both in and outside the United States,

although it does not currently have any agreements or understandings with

respect to the acquisition of any such potential targets.

Their growth strategy is more detailed than this in their 2008 prospectus. But the above pretty much shows you what the original intent was.

I don’t know what happened since 1995 until the late 2000s when we get more information through the public filings. Knisely no longer runs CFX; at some point it seems he went to work for Danahar (executive VP), retired and now is an advisor to Clayton, Dubilier and Rice (private equity shop).

Anyway, the Rales are still involved as owners and Chairman (like DHR) and that’s the important thing. We are looking for another DHR, right?

By the way, here’s the current CEO. He’s a DHR guy:

Steven E. Simms has been President and Chief Executive Officer since April 2012. He has served as a Director of Colfax since July 2011. Mr. Simms also served as Chairman of the Board of Directors of Apex Tools and is a former Executive Vice President of Danaher Corporation. Mr. Simms held a variety of leadership roles during his 11-year career at Danaher. He became Executive Vice President in 2000 and served in that role through his retirement in 2007, during which time he was instrumental in Danaher’s international growth and success. He previously served as Vice President–Group Executive from 1998 to 2000 and as an executive in Danaher’s tools and components business from 1996 to 1998. Prior to joining Danaher, Mr. Simms held roles of increasing authority at Black& Decker Corporation, most notably President–European Operations and President–Worldwide Accessories. Mr. Simms started his career at the Quaker Oats Company where he held a number of brand management roles. He currently serves as a member of the Board of Trustees of The Boys’ Latin School of Maryland and is actively involved in a number of other educational and charitable organizations in the Baltimore area.

He’s only been on the job for a little more than a year.

Anyway, let’s take a look at how CFX has done over the years. I’m too lazy to make a table so I’ll just snip stuff from the annuals so you can get a sense of how they’ve done:

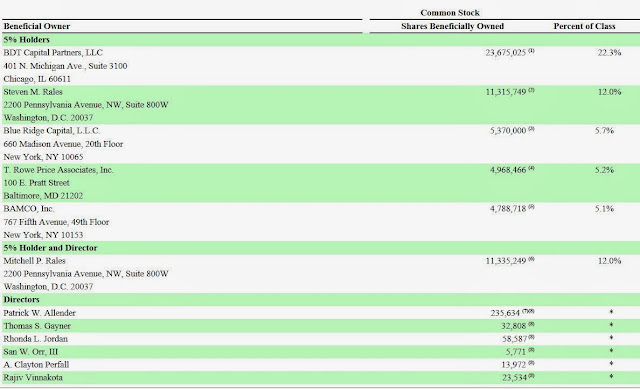

This is from their 2008 annual report; the first annual after their IPO. Things looked fine. Sales are up, margins are going up etc. Adjusted EPS is $1.22, so the IPO was priced at around 15x the current year EPS. Their margins were going up thanks to CBS (Colfax Business System), and was up to 15.0%. Hold that thought because we’ll need it. By the way, DHR has operating margins north of 15% (17.3% in 2012).

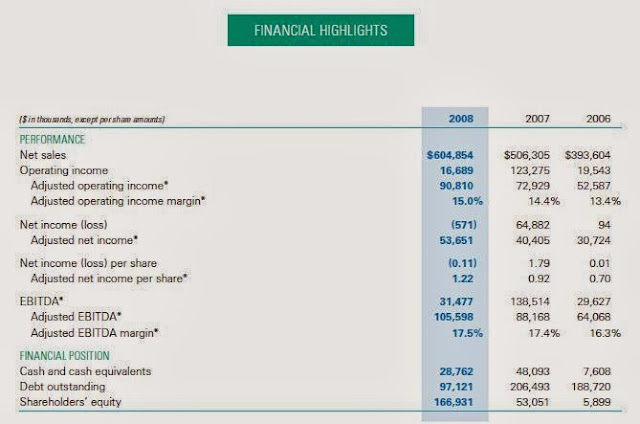

And things sort of start falling apart along with the economy. This is from the 2009 annual report:

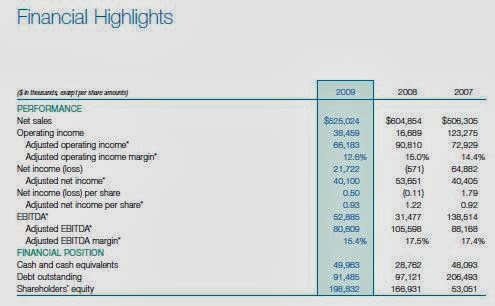

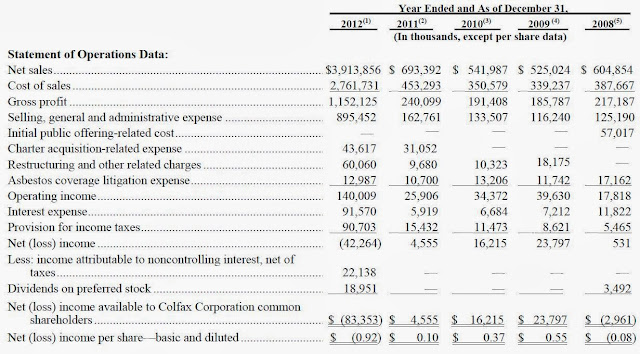

And finally this is the five year financial summary from the 2012 10-K:

So it wasn’t smooth sailing through the great recession like some of the other outsider companies. But look what happened in 2012. In January, they did a huge deal, obviously. I guess we can call that a tranformational acquisition since it’s so big. That’s the Charter acquisition that brought in Markel and BDT.

Now look closely at the operating margin. Even excluding all that acquisition-related and restructuring charges, operating margin is really low.

Remember, how is CFX going to grow? Through acquisitions and CBS (Toyota-like improvement system), right? Yes, organic growth too. But acquisitions and margin expansion are two big drivers. So for CFX to make such a huge acquisition and for BDT, Markel and others to support it by providing equity funding for the deal, there must be some huge operational improvement potential at Charter, right?

So that’s the story right there. Of course, the main, full-time story is that CFX will grow like DHR did and like other outsider companies. But the story now is this huge deal that they did, and I think it’s obvious that they know Charter’s business well enough to have confidence that they can really get their margins up.

Valuation

So let’s get to the interesting part. Yahoo finance says that CFX is trading at 60x ttm P/E and 22x next year’s estimate EPS. CFX is guiding $2.00 or so for December 2013-end full year EPS. At $56, that’s 28x P/E. I notice that there are people calling to short this overvalued stock based on this P/E.

But with shareholders like the above, we know this can’t be right. We have to look beyond the headline metric to see what is actually going on.

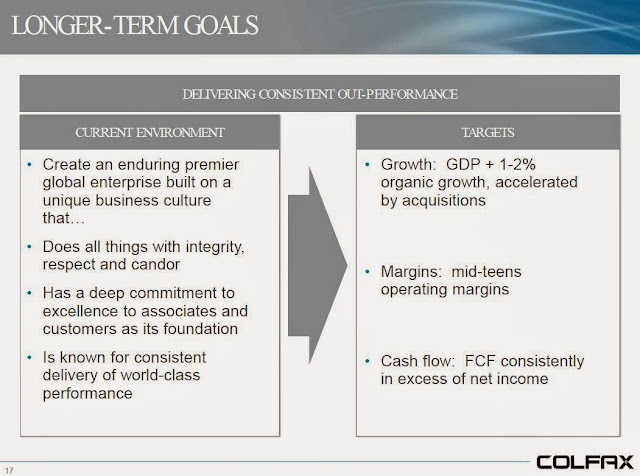

So check this out. This is from their June 2013 investor presention:

So the model for the top line is to outdo GDP by 1-2% on an organic basis and then add to that via acquisitions; something that the Rales have sort of been good at doing historically.

And here’s the key for my current back-of-the-napkin analysis: Margins. They target mid-teens operating margins. Let’s call that 15%. This was once achieved by CFX (see above 2008 annual report) and is currently done by DHR, so there is no reason why it can’t be done here. In recent years, there was the financial crisis and then this huge megadeal. But when they work through this huge deal, there’s no reason why they can’t get up to 15% operating margins. Well, yes, things can go wrong. The economy can fall apart etc.

Also, like DHR, they will get free cash flow above net income. There’s no reason why they can’t do that either.

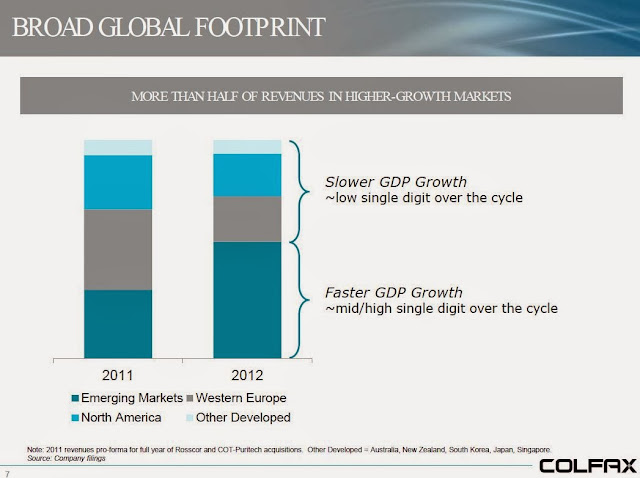

By the way, here’s what the big deal did to their revenues:

They have higher exposure now to higher growth markets. This may have backfired in the short term as it seems like former high growth markets are having problems (China, Brazil etc…). But that’s probably a short term cyclical problem, and over time, the growth markets will tend to grow faster than the mature markets.

So let’s get to the fun part. This is going to be really rough work so don’t take it too seriously. I am just going to play with the numbers to get sort of a reality check on valuing CFX.

What if CFX gets operating margins back to 15%? What would earnings look like then?

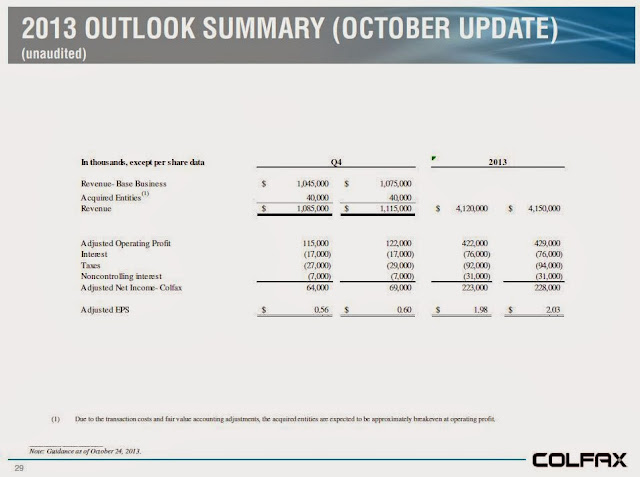

Here’s the 2013 guidance from their 3Q earnings slide:

You will see that on the low end, they are guiding revenues of $4.1 billion, adjusted net income of $223 million and adjusted EPS of $1.98/share.

Now let’s just adjust the above to a 15% operating margin instead of 10%. Then the above table would look like this:

Revenues: $4,120

Adjusted operating profit: $618

Interest: ($76)

Taxes (@27%): ($146)

Noncontrolling interest: ($31)

$365

I’ll just use 115 million shares (102 million shares outstanding plus 13 million dilutive shares) and we get $3.20 in adjusted EPS. That’s 17.5x P/E ratio if, all else equal, operating margin was 15%.

Wait, but there’s more. CFX seeks to have free cash flow exceed net income. DHR had free cash above net income for 21 years in a row. If the Rales are focused, they can get that done here too. Why not?

For a quick guestimate, I just looked at depreciation and amortization against capex. For the first nine months of 2013, D&A was $102 million versus capex of $51 million. So cash earnings were $51 million higher than net earnings so far this year. Annualize that and you get around $70 million.

Add the $70 million to the above $365 million and you get $435 million in free cash. That comes to around $3.80/share. With a $56 stock price, that’s 14.7x cash earnings, or free cash per share. That’s a 6.8% free cash yield.

So think about that. And as they get their margins up there, sales will probably continue to grow and some of the softer emerging markets will start to come back. So even without any sales growth, just by doing their Toyota thing, they can get almost a 7% free cash yield… and then add to that the GDP plus 1-2% growth organically and maybe some potential acquisitions and more margin improvements there and you are talking about some serious potential compounding.

Oh yeah, on the earnings calls, they sort of talk about margins for their segments. Segment margins and overall company operating margin will differ; segment margins don’t include corporate overhead.

I would think that CFX should get company level operating margins up to 15% at some point, but let’s say that they only get their segment margins up to 15%. In that case, we will have to lop off around $50 million for corporate SGA from the above $365 million. This would make the above figures around 14% lower.

Conclusion

I don’t know why I keep writing ‘conclusion’ on these posts when I don’t often have one. I just wanted to take a look at this company as there seemed to be so many reasons why I should;

- it’s an outsider-type company with a similar strategy

- and it’s actually run by the Rales who have done it before with DHR (or at least Chairman’ed by them)

- has a distinguished shareholder list even though BDT seems to be selling. Blue Ridge seems to have gotten in in the past year or so, so it’s still fresh. Markel still owns it.

Anyway, my analysis above is admittedly very rough, but I don’t think it’s a stretch to imagine that CFX can keep improving the operations and get their margins up. This is what they do and what they are good at. If they do so and they keep sales growing organically and through further acquisitions, I would not be surprised at all if CFX stock does really well.

Having said that, I’ve only spent a day or two on this so even though I like a lot of what I see, I can’t say I am comfortable with it enough to own the stock (or at least own a big position in it). Maybe I’ll get more comfortable after looking more closely at DHR (and get familiar with the way the Rales operate) and following it in real time for a little.

I was looking at this yesterday, based on the suggestion in the comment section as well. The company is too expensive – I through this into a DCF model (yes, I know, DCF==Bad) with 4% top line growth and operating margins growing linearly to 15% in five years, and I got that it was worth ~$60 a share.

The company looks great. Their model is simple and I have every confidence that it will go well, but we're supposed to be value investors, right? I think that means not betting on optimism and waiting for the right price. I think that's closer to $40 than $55. Another thing, they're heavily tied to oil markets, so a good amount of their future revenue is dependent on oil prices, which I'm not comfortable with. What happens to their revenue if oil prices collapse?

Hi, yes, these outsider stocks are not conventionally cheap. That's why I haven't been following most of them. This stock wouldn't show up on the radar of many value investors I follow for sure.

Having said that, I think your 4% top line growth might be a little low. Sure, this year their sales aren't growing much; +5.2% in the first nine months of this year, +6.3% in 3Q and their guidance for the year shows +5.7%. But some of this may be due to their still working on the Charter integration and improvement.

Keep in mind that historically, before the Charter acquisition, CFX grew sales +12%/year from 2004 – 2011. Sales grew +12%/year for the five years ended 2011 too.

As for oil prices, I have no idea about that. I still think that over time people will have to spend more money to find it and get it out of the ground (even with our shale boom).

But that's the beauty of these outsider companies. We are not supposed to have to worry about details like that. We are interested in it not for the sector they are in at the moment, but because we believe that these guys will allocate capital to where it can be put to good use. In the short term, though, yes, the stock and earnings will take hits according to what happens in the various areas they are involved in.

Thanks for reading.

Hm, that's interesting. You're right about the revenue – if they can grow revenue quickly then the company would be substantially under valued. It is certainly a very interesting company, thanks for posting about it and the reply

I think this is spot-on and I agree that this is a stock that is 20% too expensive for me and always will be…

I have been really enjoying these "outsider" posts so thank you very much! One company that is (kind of) similar is Melrose Industries. Rather than "buy and hold", these guys "buy, improve, sell". They are listed in London and their IPO was quite recent: 2004. Since then they have tripled shareholder money. They estimate that shareholders have invested £1bn net and the current market cap is £3.3bn. The net bit is important as they have returned a lot of capital, mainly through dividends (I think). They do keep growing the deal size but the large capital returns have obviously inhibit growth a bit. I have a looked at the company a few times but it is quite expensive. It did get very very cheap during the 08/09, I think this was a leverage thing as the company does use debt. It actually went below the IPO price. I am also not too sure about the background of management, they all came from a company called Wassall Plc. The company seems to have done something similar through the 1990s, although it was a lot smaller, and returned 18% per year for 12 years. If you want to look I should add that google/yahoo don't have the full price history for some reason, it is available on the company's website though.

On the above comments, I find it very hard to buy these companies. I think about them in terms of 5yr forward P/E. To make a decent return you want the 5yr forward P/E to be <= 10, the justification for this number is a study by Sandy Nairn (was Director of Research for John Templeton). This makes clear that high P/E stocks can be cheap and gives you a clear EPS hurdle to aim at. The problem is getting comfortable with the assumptions which in these cases often involves faith in management.

Hi,

Thanks for the comment. And yes, I noticed Melrose Industries. It's funny you mention it because I just came across it when looking at CFX. Guess who was also trying to buy Charter? It was Melrose. Melrose, I think first put a bid on Charter that they rejected. This is all in the merger proxy for CFX. It's a fascinating read on how CFX came upon Charter, the process etc…

So I did jot down Melrose. If they are interested in what CFX is interested in, there might be something there.

And yes, I hear you about high p/e stocks. I tend not to like them either and yes, it's really all about the management. That's sort of what the outsider book is about too. And I think there have been studies that show competent managements tend to stay competent etc…

Most people, though, believe in mean reversion and don't believe outperformance can last. They call people like Buffett statistical flukes and not indicative of anything.

But if you follow great management, they really do tend to keep doing well, whether they are the Buffett-like entities I always mention here (L, LUK, Y, MKL, FRFHF etc…), the superinvestors, good hedge funds and even good private equity. The good ones tend to keep outperforming.

I think the mean-regression belief comes from people looking at typical growth stocks; restaurant stocks, retailers, where they have a tremendous growth period and then peter out at the end or companies that benefitted from a specific fad or movement (internet bubble etc…). So these things tend to reinforce the belief in mean reversion… Cisco can be smart and awesome in one era but a total loser in another; that is more indicative of the fast changing nature of the tech industry than the competence or incompetence of management.

So I would distinguish the various situations.

Thanks for reading.

Oh yeah, we can put banks and investment banks in this category too. Good banks tend to stay good banks; Wells Fargo, USB etc… Goldman, JPM etc…

…you got it spot on with Google as well and they are a growth company with high P/E.

What is the ROIC on this one? I think this is the magical ingredient to determine if it is worthy of a higher P/E

If you take the normalized cash earnings from above of $435 million against equity of $2.3 billion, that's a 19% after-tax, cash ROE so not bad at all. It's hard to see that right now with the big acquisition last year and the CBS efforts not completely showing through in earnings yet.

Hi kk,

Have been quietly reading your blog for a while now. Thanks for the great ideas on outsider companies. Got the book on my shelf and looking forward to reading the book.

Just want to throw a name out there: Middleby Corporation. CEO Selim Bassoul is just 56. Focused on niche in commercial kitchen and food processing equipments. Built through numerous acquisitions. He does pay himself well, but can't argue with shareholder return. It's literally off the charts.

Thanks for the name. I haven't looked at Middleby but I will now.

Thanks for reading.

Hi kk,

Keep up the amazing work on the blog! Every time I read there's always something new to learn from you. So many thanks!

Like 2t, I'm also throwing out some names. These are fairly smaller companies and could one day be consider "outsiders" in their own rights. I own a few, but they rarely trade at attractive valuations.

RAVN, MLAB, CAKE, NDSN, ROL, KONA, and SNHY.

Thanks. Yeah, I know some of these names. RAVN has an amazing record. CAKE is a great company; their annual reports are really a joy to read but I've never owned the stock.

I will take a look at the others (I am familiar with KONA and ROL, but not intimately; I know KONA has had problems in the past)

Thanks for reading.

Hi kk,

I will echo previous comments by saying thank you making your work available to other investors. Each blog post seems to offer an opportunity to learn something new.

As you canvas the investing universe for Outsider type investment opportunities, I'd like to bring to your attention $FRMO. Perhaps its already on your radar. Perhaps not, since it continues to be listed OTC. It is managed by Steve Bregman and Murray Stahl–a couple of value investors with a great track record of superior performance. If those names sound familiar, its likely because you've come across Horizon Kinetics, a private asset management firm, which they are co-owners.

$FRMO owns a sizable interest in the revenue stream (not earnings stream) of Horizon Kinetics, as well as a small percentage of the company itself. $FRMO also generates operating income through expense charges associated with a couple of ETFs they've launched recently. Finally, the company has a growing balance sheet reflecting long-term investments both long and short.

There are virtually no operating expenses. Management does not earn salary compensation, and investment research is leveraged through Horizon Kinetics, a private entity.

EB

Thanks. Yes, Horizon Kinetics sounds familiar but I don't know them well. FRMO does sound interesting. I will have to take a look. The ticker sounds familiar so I think I jotted it down in my notebook at some point without following it up.

Thanks for reading.

Yes I agree that you may be interested in FRMO Corp., although its has already gone on a huge tear this year and may be priced a bit high now. Either way, I do think you would really enjoy the research to be found on both the Horizon Kinetics website and the FRMO Corp. website. They have also talked a little bit about Colfax Corp in one of their market commentaries.

Thanks a lot for the posts, I always learn a ton, and recommend your blog when I get to talking about stocks with friends.

I also just happened to start reading this paper, https://dl.dropboxusercontent.com/u/28494399/Blog%20Links/October_Quest_2013.pdf , which talks a good bit about good businesses tending to stay good businesses which you were saying in a previous comment , especially around page 21. Sorry if the link is a pain to get to, I am pretty bad at tech. sometimes. It is a really interesting paper, and has some valuable advice, especially for value guys.

Murray Stahl in his interview with Value Investors Insight talks about Ascent Capital, ASCMA. Its a home security business run by one of John Malone's TCI deputies, and Malone owns significant amounts of B class shares, though he just sold half his stake.

I entirely agree on valuation. It has to be considered relative to market position, management and quality of business. Coke, Mastercard, Priceline are a few examples of companies that have rarely been cheap on traditional metrics but the investment returns are in a class by themselves. You are really doing good work here. Thanks for your efforts.

Thanks for your analysis and thoughts. I see the Buffett interest in XOM as comparable to his interest in IBM: both have huge skill and technical prowess such that they can tackle and manage highly complicated projects in a way few other can do. In XOM's case it is developing huge fields in often hostile environments where smaller competitors lack financial or technical resources. So that creates a moat that suggests long term value. The capital allocation skills only increase the advantage because XOM can wait for the better pitches.

If wishes were horses, beggars would ride. If you're willing to assume a company's operating margin is going to increase by 50%, then every stock is a great buy. In reality, it is hard to move the operating margin up by much. It could equally well fall rather than increase. CFX is a hugely overvalued stock on hype and hope. Look for it to breach $30 in the next downturn.

Well, if every company is going to be run (or chaired) by the Rales, then every company might be great buys. Operating margins generally don't move much for sure, but some managers specialize in this sort of thing and they don't buy businesses if they don't see at least some ways to get margins up.

In this case, their competitor in their Charter purchase was a British private equity-type company named Melrose. Their model is to 'buy, improve, sell" (this may be another post at some point). And they typically buy a business and have improved margins 5-6% before selling them. They would not have bid for Charter without seeing how that can be done.

This is true for CFX too; I'm sure they already have seen how margins can be improved or else they wouldn't have bought it.

So this is not a case of picking any old company and saying, gee, if only these guys can get their margins up, this stock can really sky rocket! It's more like, hey, this is a company where management is good at that sort of thing and has spent decades of their careers doing exactly that (Danaher), and this happens to be the latest vehicle.

But anyway, yes, I agree with your comment in general, but not in this case.

This is not to say that margins won't go down. It might. Nothing is risk free. Just because something has been done repeatedly doesn't mean it will always be done flawlessly and automatically.

Anyway, I appreciate conflicting views. For every buyer, there has to be a seller, so…

Thanks for reading!

I don't think Markel and BDT are great investors by any stretch of the imagination. Both are associated with Berkshire – but for non-investing reasons. Markel because it wants to think of itself as a mini-Berkshire. If you look at Markel's equity portfolio moves, you wont find great stock picks. They made some really bad ones in the financial crisis. Their outperformance is from dollar-cost averaging and adding more when the market tanks. Not from brilliant stock-picking. From their 2008 annual report:

"We also suffered permanent losses in our capital

from the equity positions we sold in Citigroup, MBIA,

LandAmerica and miscellaneous smaller holdings.

Consequently, we experienced permanent losses of

capital from our debt holdings in Lehman,Washington

Mutual and Fannie and Freddie"

Hi,

Markel seems to do OK in investments. Despite the bad stock picks and the financial crisis, they outperformed the S&P 500 index +9.2%/year versus +7.1% or so total return for the S&P 500 index and that's not bad at all for the 10 years through 2012. BPS of MKL increased +13%/year over the past decade which is even better than BRK's BPS growth.

Sure, they made some mistakes. Buffett also bought some Irish bank stocks that went to zero during the crisis too. People do make mistakes but the key is to make sure that the mistakes don't kill you.

I don't know anything about investment returns at BDT, though.

Thanks for reading.

I meant to add that there are 2 big assumptions with CFX without knowing what the competitive advantages of their current businesses are: operating margin becoming 15%, FCF > earnings. CFX seems a black box and we would have to rely on "hope and change" to invest in it. It wouldn't be right to extrapolate DHR into CFX – unless we really understand the businesses inside both CFX and DHR. I couldn't really understand DHR and CFX is even harder.

Go through CFX recent investor day and it's not too hard to understand the model. Yes, you have to have a high degree of confidence in the management team to continue to execute at a high level for a long time, but it's far from a "black box".

Colfax has come back quite a bit.. Do you know why? Insiders seem to be buying at or around current prices.

Well, I don't know if the stock has come back "quite a bit"… I think a lot of the sell-off was related to the general stock market decline. It's also true that CFX has exposure in power and energy area where people are expecting capex to plummet due to lower crude prices and weaker than expected economies around the world (Europe, China etc…).

I think these are short term cyclical issues, though, and CFX will be fine looking out longer term.

Thanks for your response kk. Sorry, you are correct, not down much from your post, but down almost 30% from the high in April. I haven't been following and just wondered if there was some fundamental reason for the decline. I guess there is not and thats good. Thanks again.

http://ycharts.com/companies/CFX

FCF has been over 300m the last 2 quarters combined. All of 2013 was less than 300m.

PE ratio has fallen to 16.

Stock's trading at 47.68 (off a high of 75 in 2014)

KK,

Any comments on quarterly results announced on 23 April 2015?

No, not particularly. We know some of their end markets are not doing well, and then there is the FX. So it's ugly, but I am assuming this is a cyclical issue.

Hi kk-

At 37.70 just hit about a 3 year low. Based on the Q2 report looks like segment margins are holding steady around 10-11% while sales were down (but not as much as you'd expect given the cyclical trends). Seems to me like we're getting into buy territory. Thoughts?

Hi, yeah, I do like CFX, but it's going to be tough there for a while. You got the energy biz in horrible shape, emerging markets submerging, the dollar hurting sales figures etc… It's just really hard to read over the short term. But over the long haul, you can expect them to manage out of this sort of thing but hard to know when.

Given the significant price decline it might be interesting to do an update post on this name.

Yeah, an update would be great. I thought about that, but I don't think I have much to add. The end markets are just in horrible shape. China, the emerging markets, FX impact, oil/gas, everything is just going the wrong way for them so it all depends on when those markets turn and nobody really knows anything about that.

I believe they will do well over time, but it's hard to say how deep the 'valley' is going to be before they get to the other side. Otherwise, I don't think anything has changed.

Thanks for sharing this great post. It is very enlightening. I absolutely love to read informative stuff. Looking forward to find out more and acquire further knowledge from here! Cheers

bed