Before I start, I came across this great quote in a totally unrelated book so let me start this post with that:

“Obstacles are those frightful things you see when you take your eyes off the goal.”

– Hannah More, British writer/novelist (1745 – 1833)

With the market tanking and people obviously wondering what they should do (“Should I sell?!”), I thought it’s a great quote. Someone asked me about a stock; what should they do? The stock is tanking! I asked them if they are in for a quick trade or as a long term investment. They said it’s a long term investment. So I asked them if what is happening in the market today will change your view of how the company will be doing in five years.

Back to Alleghany (Y)

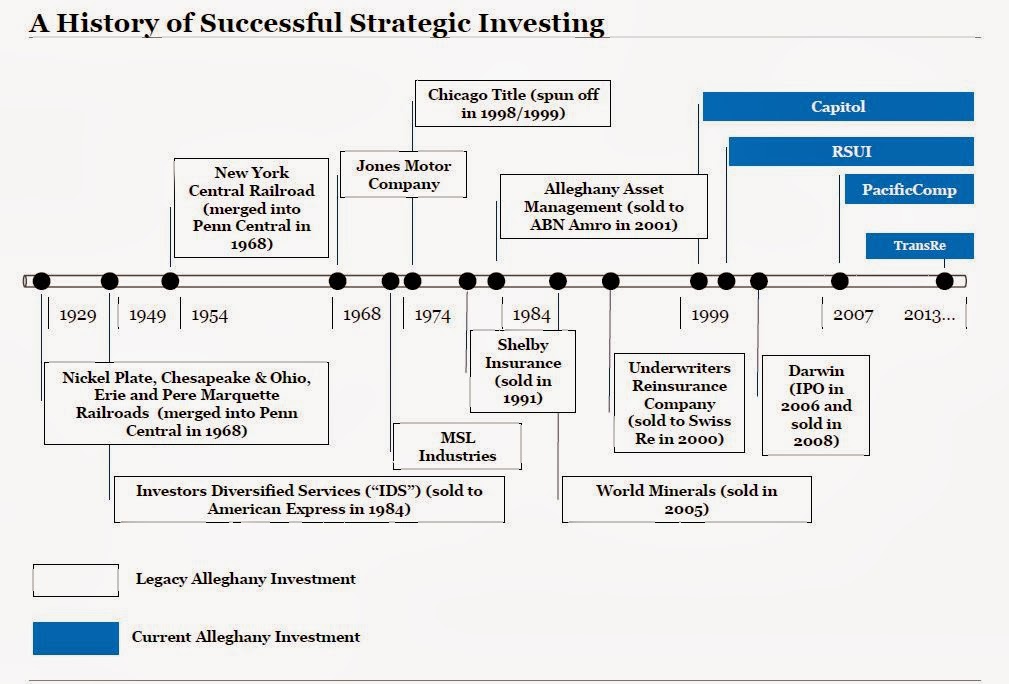

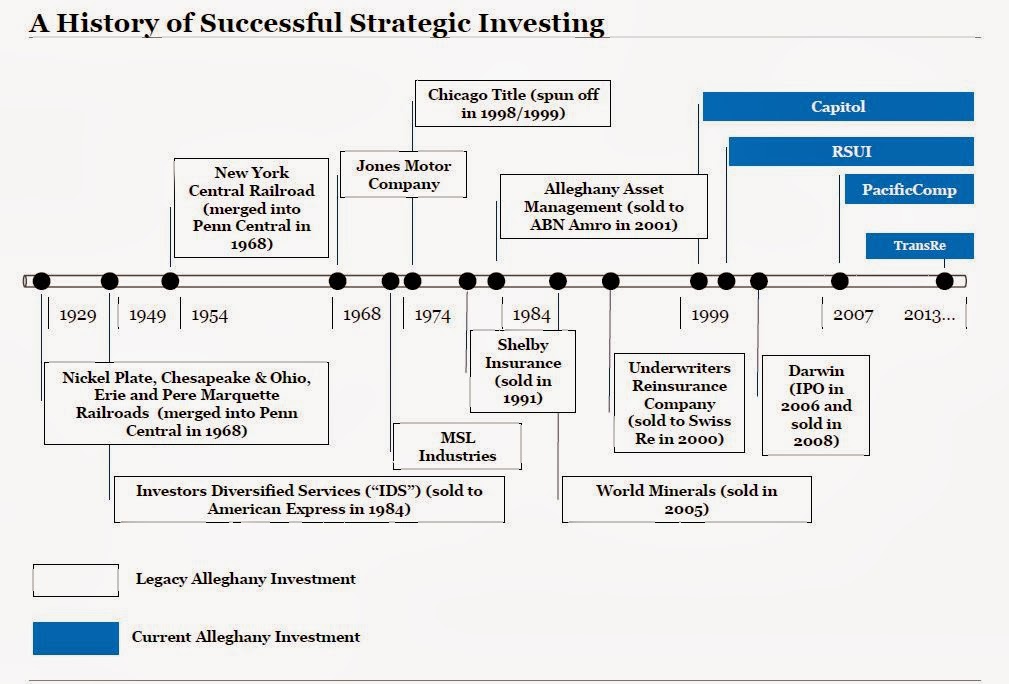

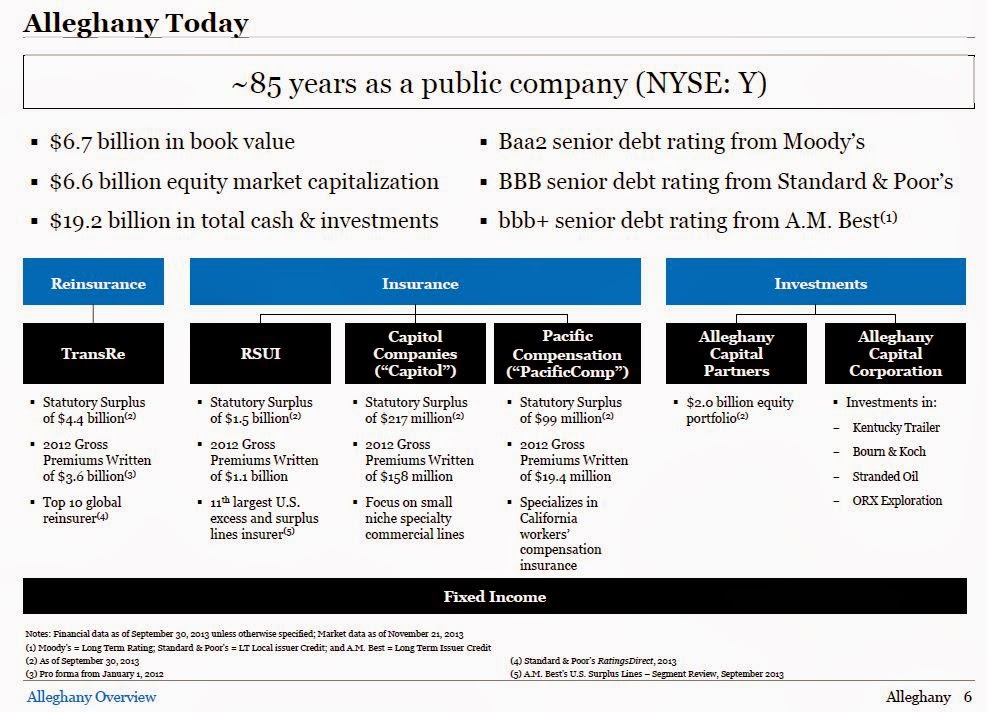

OK, so this is kind of old, but I stumbled upon the Alleghany Corp investor day presentation that happened a while back, in November 2013, actually.

Here’s the link: Alleghany Investor Day Presentation

And I noticed that they are killing insurance stocks now and Y is trading at 0.9x BPS. Well, OK, it’s September 2013 BPS but BPS should be up by year-end, and even the current stock market decline leaves the market higher than it was back then.

Y has been a pretty quiet company in the past, but due to the Transatlantic merger last year, it is becoming a more transparent company.

Y is one of the Berk-alikes, like Markel and some others. But these guys have been around for a long, long time.

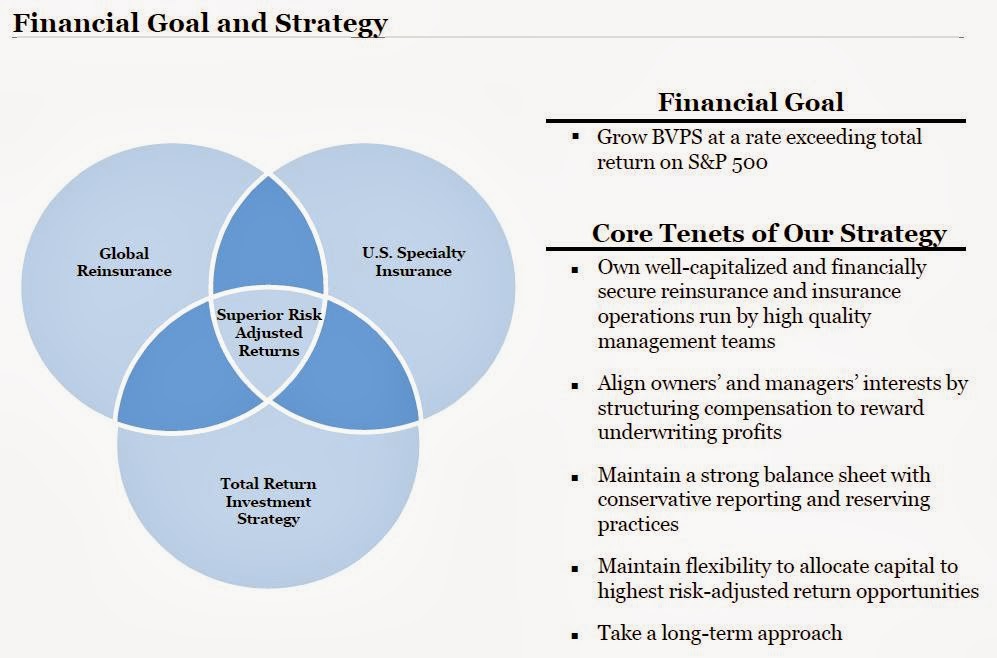

Here are some snips from the presentation:

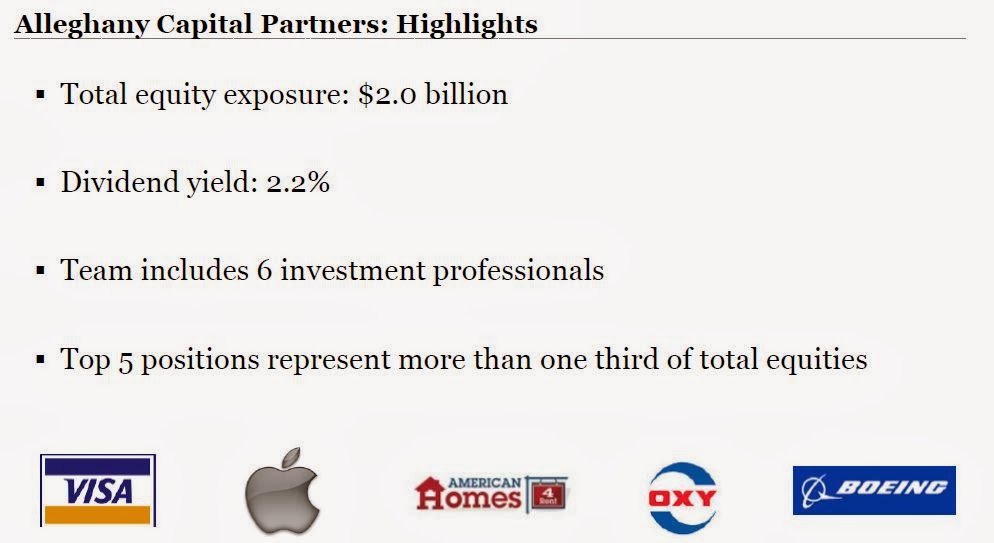

I like the fact that they are focused investors. Some may feel it is risky, but I lean towards the Buffett/Munger, Greenblatt school of focusing investments. It’s better to really know businesses well and when it’s attractively priced, piling in instead of buying a little of this and a little of that. There are managers that perform well with big, diversified portfolios, but I think those portfolios are filled with smaller cap names.

I don’t think it’s possible to outperform the indices by much with a diversified portfolio of large cap stocks.

As we’ve seen before, they have done pretty well over time:

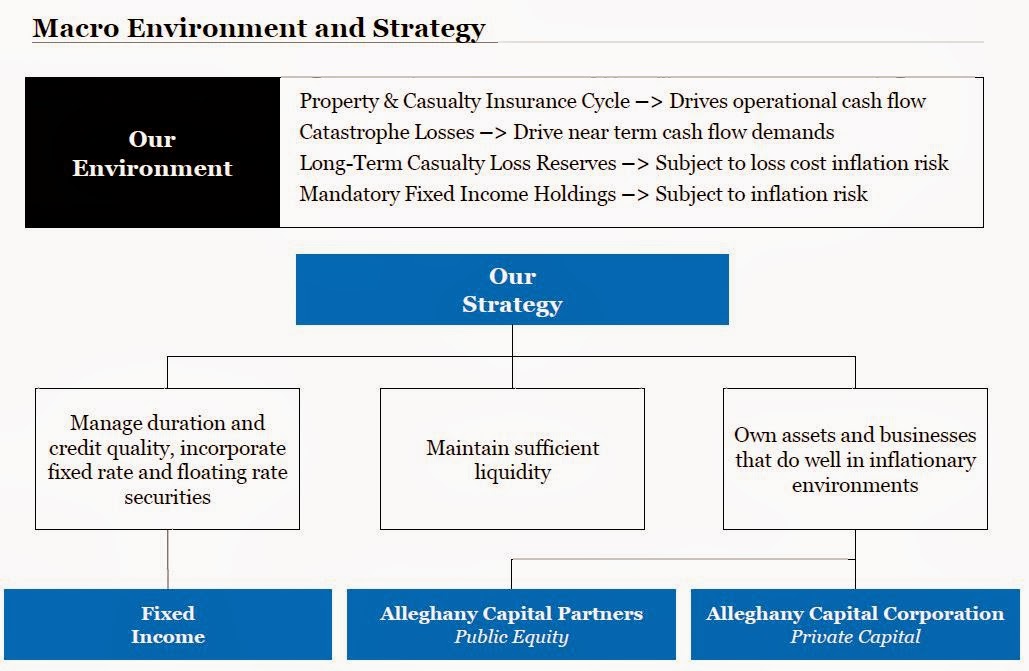

Y has often said that they structure their equity portfolio to hedge against inflation risk as they have inflation risk on the insurance side and large fixed income portfolio.

I often run into people who are worried about inflation so want to sell their stocks or homes. They think about the short-term, immediate effect of inflation; inflation goes up -> interest rates go up -> asset prices go down. But they don’t think about the long term. In the short term, selling stocks and homes might look smart when interest rates go up. But over time, there is no guarantee they will be able to get back in when asset prices readjust to the higher price level.

All you need to look at are New York City property prices in the 1970s and now. Sorry, I don’t have any data handy, but ask the guy sitting next to you what a brownstone on the Upper West Side sold for in the 1970s and what it is selling for now (or ask Jim Rogers; he made a killing like that).

Anyway, Y uses their equity and private equity portfolio as an inflation hedge because they think about the long term. It’s important to keep that in mind.

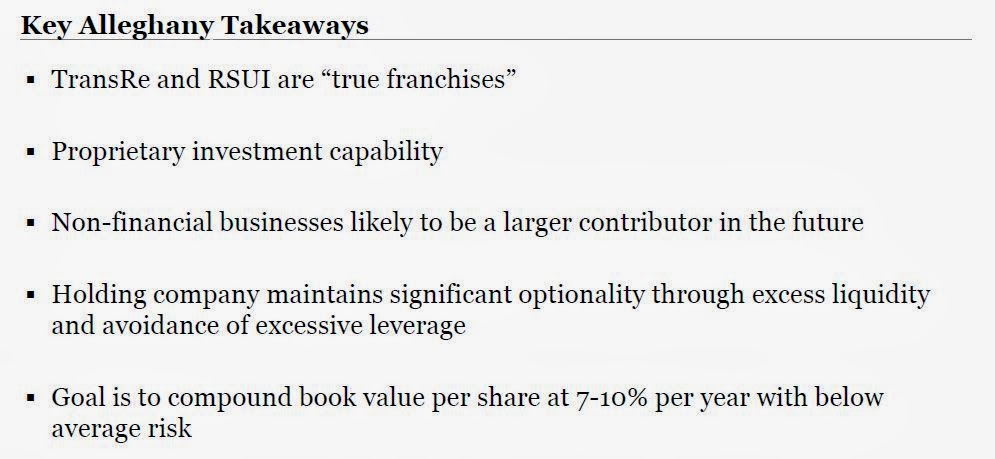

In this environment, if Y can grow book at 7-10%/year, that would be great. They can obviously do better if an opportunity comes up along the way as they do have a lot of balance sheet fire power.

A 7-10% book value grower at 0.9x book sounds good to me.

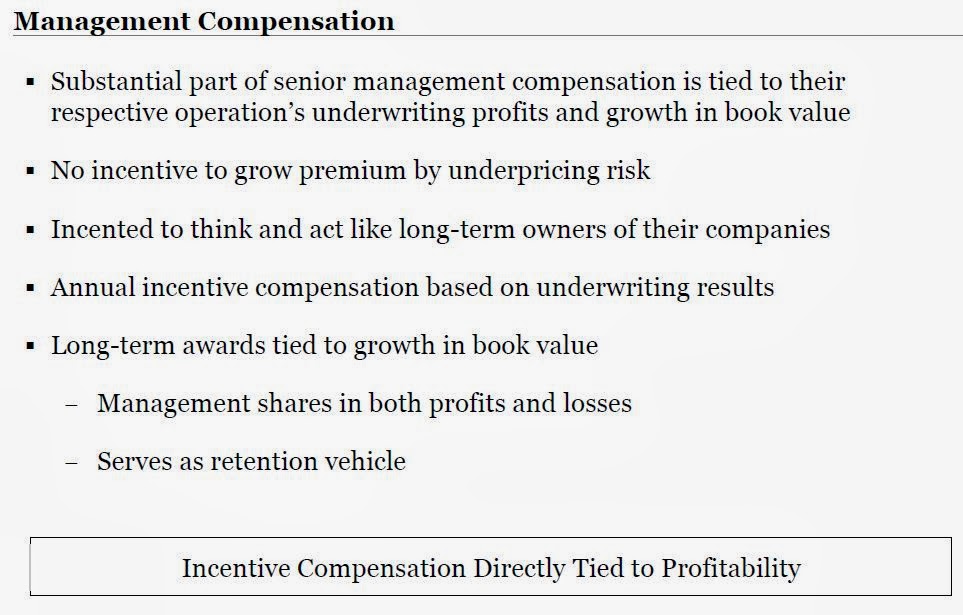

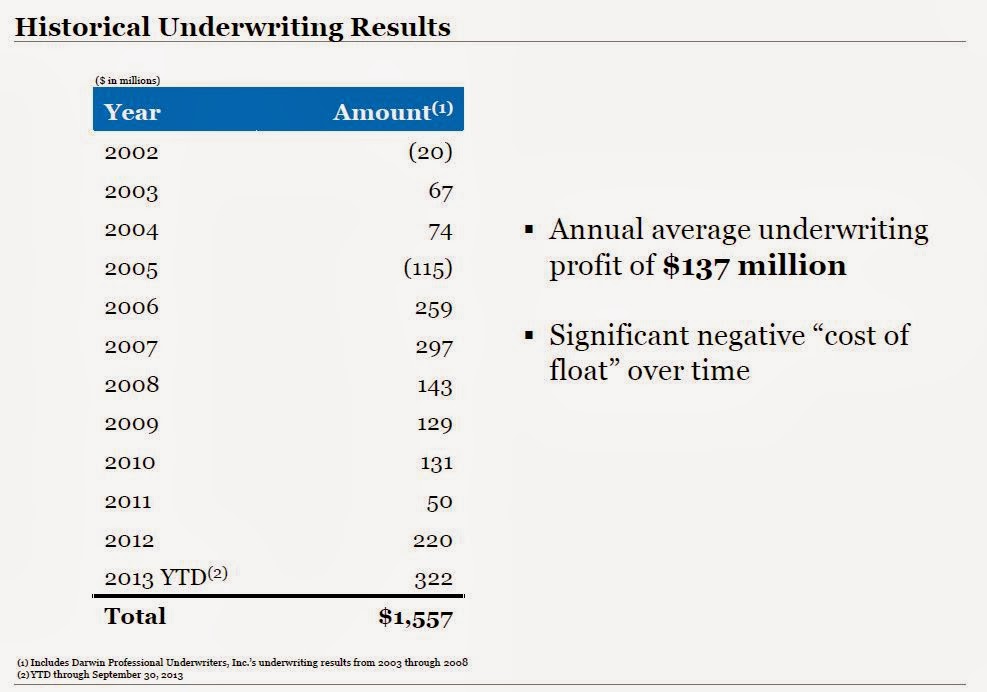

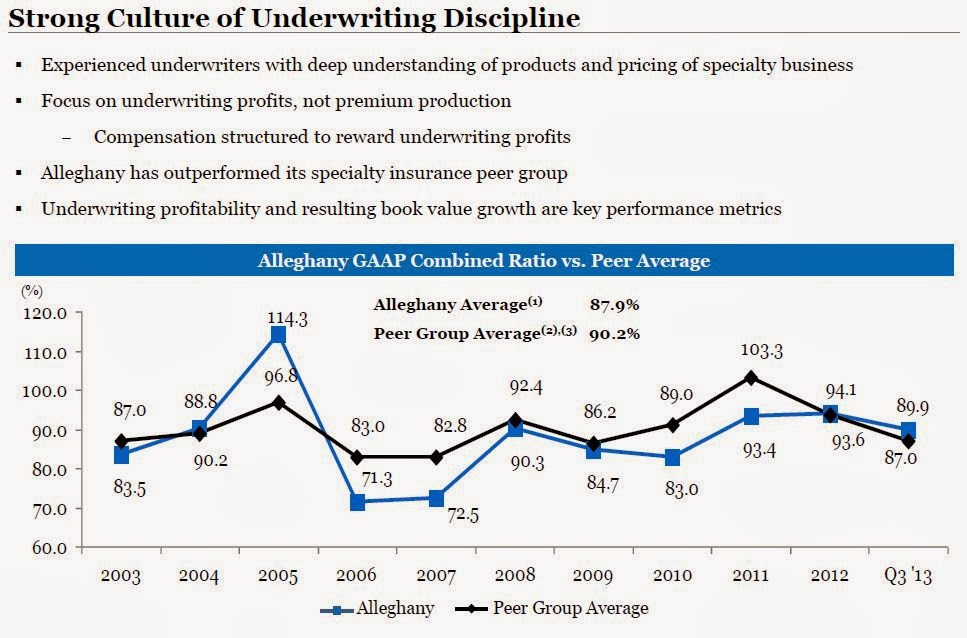

Y, like Berkshire Hathaway, focuses on profitability and won’t write business just to grow premiums. It’s important that the employees are incentivized in that way instead of the CEO just talking the talk. There seems to be a lot of pressure in the reinsurance business (capital market solutions depressing prices, new hedge fund reinsurers coming in, Berkshire Hathaway expanding (but they will not write underpriced business)), so it is really important to know that Y will not get caught up in price wars and write business for the sake of writing business.

Their history of underwriting shows that they do walk the walk.

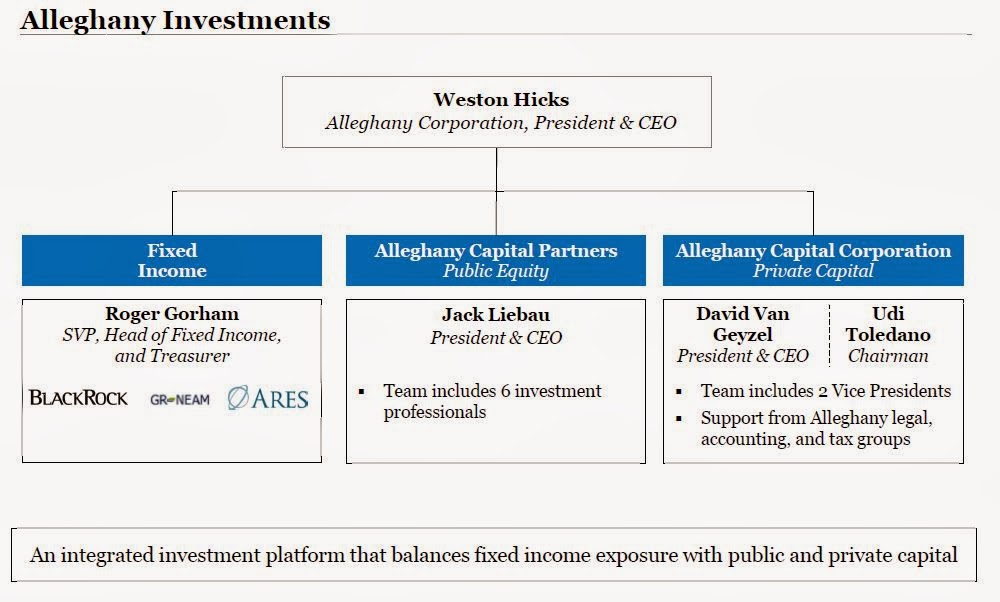

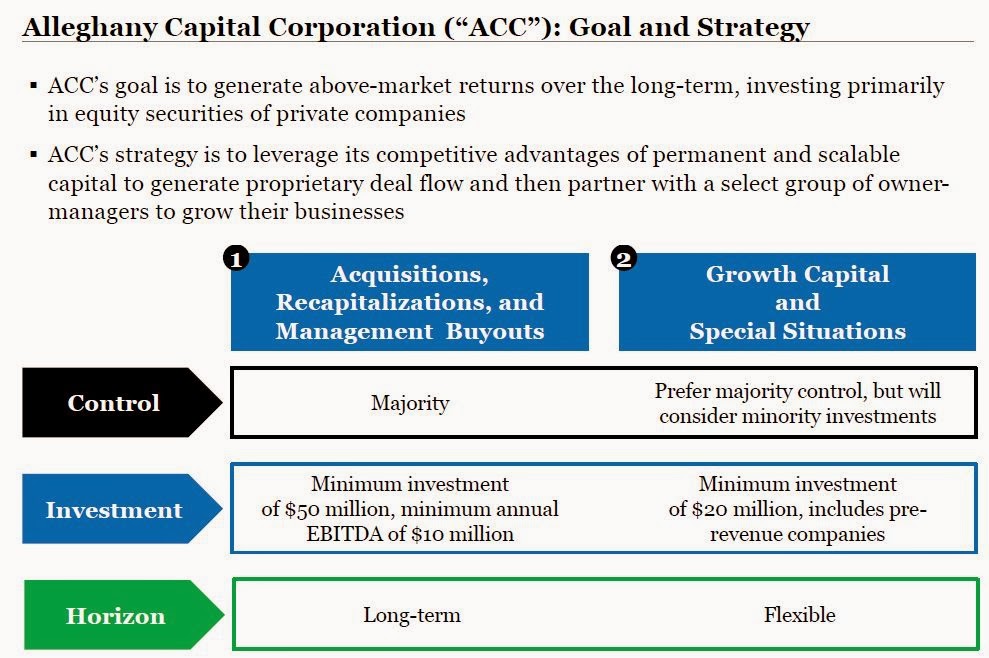

This is cool how they break down the investment operation of Alleghany. Just like at Markel, they have a private capital group that they hope will grow over time (this combined with Public Equity):

There are some new names here on the chart. Jack Liebau seems to be the new guy in charge of public equities. A quick googling shows that he started at the Capital Group, then PRIMECAP, and then eight years running his own firm (Liebau Asset Management; the 13F’s are available at the SEC website. It looks like his fund was a portfolio of 50-60 blue chip names (mostly)). He shut his firm in September 2011 and worked at Davis Advisors for two years before joining Y in July 2013. So he will be doing something a little different than he used to; going from diversified to a more focused approach. Let’s hope it works out!

I wonder what the incentive pay structure is for the portfolio managers. Since they’re not NEO’s, they probably don’t have to disclose that in the proxy.

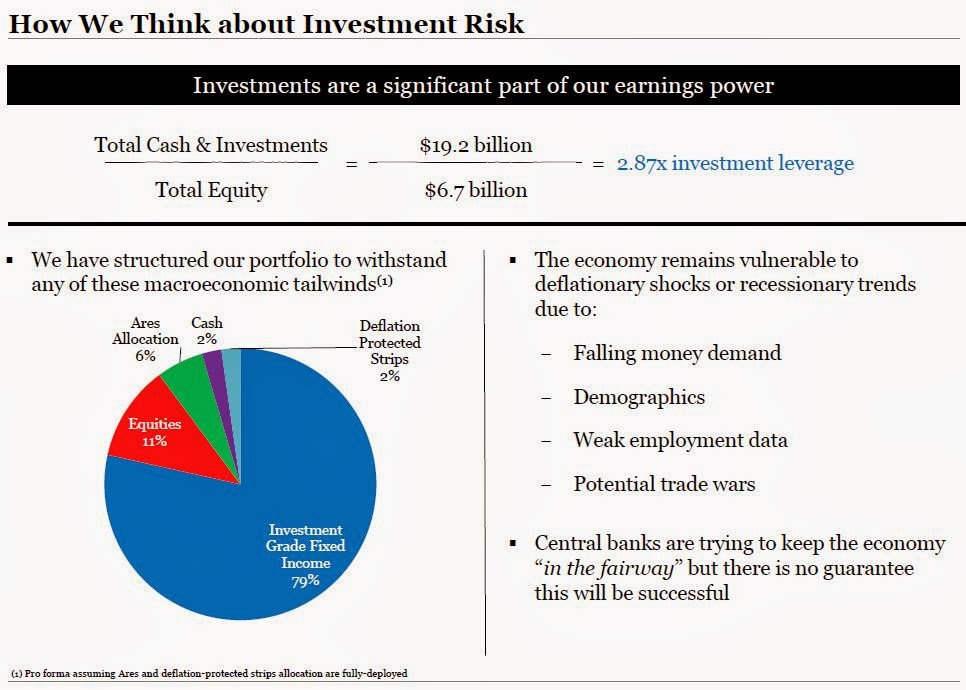

This is an interesting way of illustrating their portfolio strategy, which applies to similarly structured companies (like MKL and BRK):

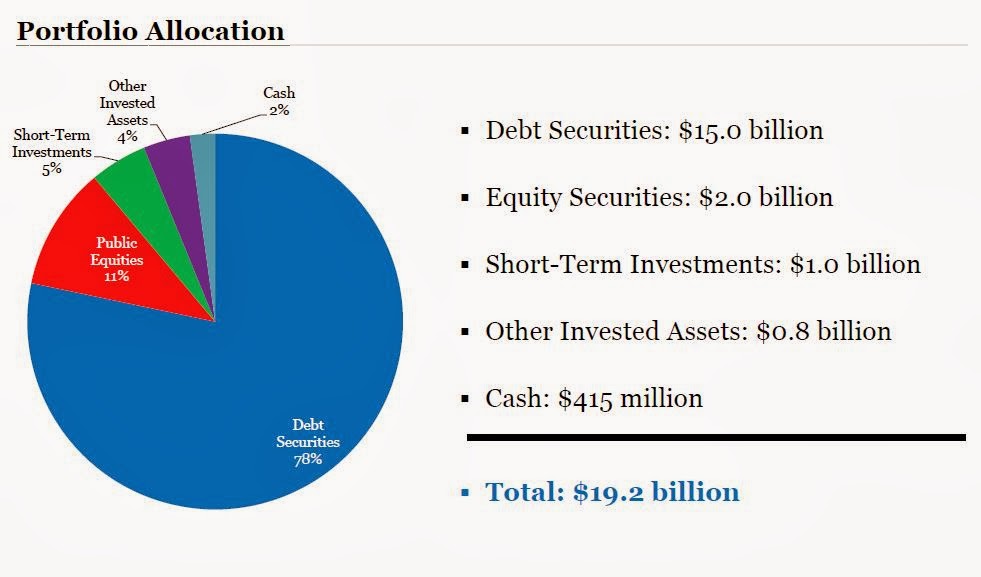

Their $2.0 billion equity portfolio comes to around 30% of their shareholders equity (of $6.7 billion). That’s a little lower than close to 50% at Markel. In the past, I think it was higher at Y; on a year-end basis it was as high as 52% in 2010 and 42% in 2007 while dipping into the low 20% in 2008 and 2009 (partly from equity price declines). I thought they would bump this up more after the merger with Transatlantic, but as we know from reading the annual reports in recent years, they are not particularly bullish on equities. But still, 30% is not too far out of range and is far higher than other insurance companies.

I like “intense fundamental research, concentrated positions, and long-term holding periods”!

I did see Apple stock in their filings before and was kind of surprised. To me, Apple is the sort of business that really long term guys would avoid since it is impossible to see what the industry would look like in ten years (or I would argue even five years).

I am familiar with the other names, but haven’t looked at American Homes (AMH); I will have to look at that. I just noticed that Blue Ridge Capital owns a big piece of it too. Hmm… this may be a future post here.

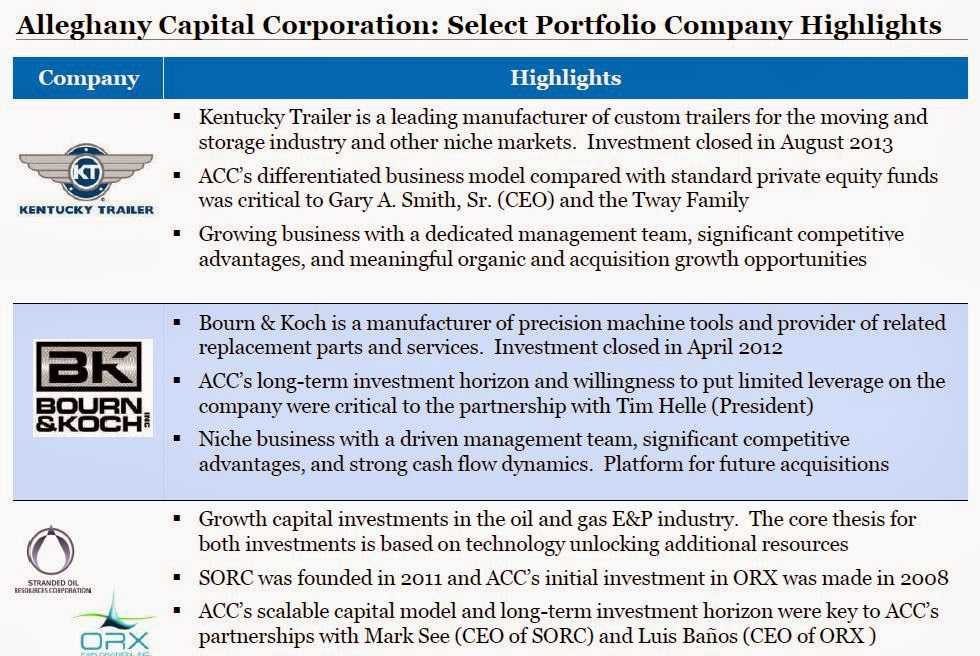

Here is a description of their private capital business. This is good because if the insurance market really doesn’t improve and the market stays soft for a long time, Y will be able to reallocate capital into their public or private equities. This gives them an advantage over other insurance companies (that may feel pressured to write business to stay in business).

Conclusion

I have been following this company for many years and really like it and I have owned a stake for a while, but a small one. I’ve never had a big position here even at book value as they seemed to be a bit too conservative for my taste.

Reading the annual reports gave me a feeling that they won’t be out doing much due to their bearish view. I do think they will make decent returns and won’t lose money in bad times, so it’s certainly a safe, conservative investment. But it just wasn’t something that I wanted to pile into.

But at 0.9x book (well, 0.9x outdated book; we will get 4Q and 2013 earnings soon), I think it is getting interesting.

They actually did the Transatlantic deal last year and some of the equity portfolio liquidation was related to that, so I guess it’s not fair to say that they aren’t doing anything.

Anyway, let’s see how this plays out.

Hi kk, thanks for your write up and updates on these insurance companies. Anw, wonder if you have taken a look at lancashire holdings before? would love to get your op on LRE.

Hi,

No, I am not familiar with Lancashire. I just took a quick look at their presentation and annual report. It looks quiet impressive. They even have an investor relations "app" on the website. I don't believe I've seen that before. That would be great; it would make working on an iPad much easier.

The ROE and growth since 2005 is surely impressive, especially with there balance sheet leverage so low. I don't know how they do that; it makes me wonder what U.S. based insurance companies are doing; why can't they find that business?!

So I will dig a little deeper. I have to say, though, that 2005 to now is not that long of a track record when it comes to insurance.

Also, I am not at all an insurance expert. I am more interested in capital allocation and things like that so I am attracted to businesses that focus on value investing etc. And some of these insurance companies focus on that along with their underwriting. It looks like Lancashire is pure fixed income on the asset side of the balance sheet, which is fine, of course. But I tend to find more interesting the companies that try to do both sides of the b/s well (underwrite well and manage assets well, like Berkshire Hathaway).

This is not to say that Lancashire is no good or anything like that. I know that there are a lot of good insurance companies that don't do the two pillar thing but it's just not where I tend to focus.

Thanks for reading.

This might help – http://www.cornerofberkshireandfairfax.ca/forum/investment-ideas/lre-l-lancashire-holdings-ltd/

Thanks for the great site, kk.

Thanks, I'll have to take a look at that. Thanks for reading.

While on the topic of insurance companies, have you looked at WRB? Mr. Berkley fits the mold of an outsider CEO quite nicely. Straight shooter, great underwriting and very rational capital allocation.

Yes, that is a great company. I am familiar with it but don't own it. As I said in my other response, I tend to follow more the two pillar guys (trying to do well on underwriting and investments). But WRB is good too.

This is one of my favorite websites. You always have great research but never list what you own. Would you mind positing some of your core positions? Thanks.

Hi,

Well, I do write about things that I like so you can assume that I own things I like, and a lot of what I really like. I do own other things too, but things I really like I would tend to post about here.

I would rather not start listing things I own, though, as they do change over time and I don't intend this to be a stock recommendation site or anything like that…

Thanks for reading.

some modest insider purchase around $380 level late last year. It is one of Michael Price's core position as well (ranked 4th). Goodheaven is buying as well

"This is one of my favorite websites. You always have great research"

+1

I've got this, Musings On Markets, Value And Opportunity, Wexboy Value and The Corner Of Berkshire And Fairfax all bookmarked.

Best investing blogs/forums out there, in my opinion.

Can't really seem to get enough of any of them.

Made from bits of real stock certificates, so you know they're good.

Hi, thank you for posting this write up. While you are profiling insurance stocks, do you think you could do a write up on AIG? It is trading at less than 70% of book value, conducting billions in buybacks and is looking way underpriced in my opinion. Would love to hear your thoughts on it. Their next earnings release is on Thursday.

Hi,

I have looked at AIG in the past and sort of watch it. If I come up with something, I will make a post. I tended to like the other financials more during this post-crisis recovery. AIG is certainly cheap and interesting, but I like to focus on managements (as you probably noticed). And that's sort of where I get lost with AIG. Benmosche is certainly a great manager and doing a good job, but he is not a permanent CEO by any means; he is there to clean it up and move on.

But that doesn't mean AIG is not a good idea. It is cheap and interesting for sure.

Anyway, if I come up with something I may post about it in the future.

Thanks for reading.

So who are your top 5 owner/operates from here going forward? Thanks!!!!

Hi,

Good question. I tend to like a lot of them so it's hard to pick. Also, the definition of owner/operator might be a little fuzzy for me as I tend to view some as owner/operator-like businesses even if it's not technically an owner/operator situation. Post Holdings is a great example… I tend to think they have the capital allocation skills and owner mentality of an owner/operator business, but it isn't.

Anyway, I'll pass on choosing five for now… Stay tuned here and I'll keep posting about what I like…

Oxy!!!!

MKL is compounding BV at over 15% and Y is doing 8%–hmmm?

MKL is a great company!

and that's the reason why MKL is trading at 1.1+ times book (with quite abit of goodwill on its books) vs Y's 0.9 times.

i just went through Y's investor day and merrill presentation. Curious to hear your thoughts re: the comparison of mgmt team between MKL and Y, and which side do you prefer?

Hi, I tend to like both of them, but if you had to compare, one big factor would be that MKL management has been in place for a long time; pretty much since the beginning. Also, importantly, Gayner also is the long running equity manager there so is fully responsible for the great long term track record there whereas Y just recently hired an equity manager. He has done well, apparently, in his previous job, but we don't know what that performance looks like compared to MKL.

So on that basis, I would have to lean towards MKL.

Hi,

Thanks for the great writeup. I was curious, if you were looking at investing in an insurance company right now and have long-term/captive capital over the next 10 years, which ones would you invest in?

That's a really good question. I think a lot of it is a matter of taste. I think the guys I talk about here willl do well and outperform over time, but whethe BRK is better than MKL, or if MKL is better than Y is a good question. BRK is rock solid and something you can feel comfortable recommending to your mom or sister; they can hold a bunch of it and not worry at all. But on the other hand, it may not do that much better than the S&P 500 over time. It will most certainly do better, but the margin will be pretty small, I think.

MKL is more interesting in that regard. They are much smaller so have more potential to grow. FRFHF and Y are interesting too, and I bet they outperform over time too, but some don't like FRFHF's hedging their equity exposure (smells too much like market-timing, even though FRFHF has done it well in the past), and Y tends to be a little boring (too conservative?). But that doesn't mean it can't do well going forward.

These days, I tend to like the hedge fund guys, TPRE and GLRE. But these are a bit riskier than the above. If Third Point has another year like 2008, that can be a disaster for an insurance company. But I like the potential for these guys to compound book value per share tax free over time. There are risks on both sides here; the investment management side (which is a hedge fund), and the insurance side (which may involve seasoned veterans, but as an entity they are not, like MKL, WTM and others).

So take your pick. I like them all. If you can afford some risk, I would like GLRE/TPRE, but they are not BRK solid, so wouldn't be comfortable with 80% of net worth in either one of them…

Y annual report is out. Y stock price has gone nowhere for LTM. any comments on Y kk?

Hi,

Yes, I saw that. I will probably make a post about it next week. Y has gone nowhere, but that makes me like it more (valuation). It is a 'boring' stock as Y admits, so this is not a 'get rich' stock, but neither are most of these Berkalikes (including BRK). They will do relatively well over time. Maybe I should post about it, but these stocks are (and have always been in my mind) stocks for the conservative investor as opposed to the enterprising investor (Graham's definition), except for when they get really cheap.