Alleghany (Y) just put out their annual report for 2013, but before that let’s take a quick look at something else.

Not long after my post on Alleghany’s (Y) investor day, Weston Hicks presented at a Merrill Lynch conference. I think it’s the first time I’ve ever heard him speak so it was pretty interesting (I wasn’t there; I just listened to the replay).

You can get a link to the presentation at Y’s website: Presentation

For anyone interested in Y, it’s definitely worth a listen. It’s pretty short too (unlike, say, the JP Morgan investor day; not complaining about that. The more info there is, the better!).

Hicks talked about the history of Y. I guess it sort of shows us why they are so conservative (they survived this long because of that conservatism).

Here are some interesting slides from the presentation:

Y CEO’s tend to be CEO’s for a long, long time. This obviously is important as it leads to CEO actions that are long term in nature.

…and they have been in various businesses over the years according to what made sense at the time:

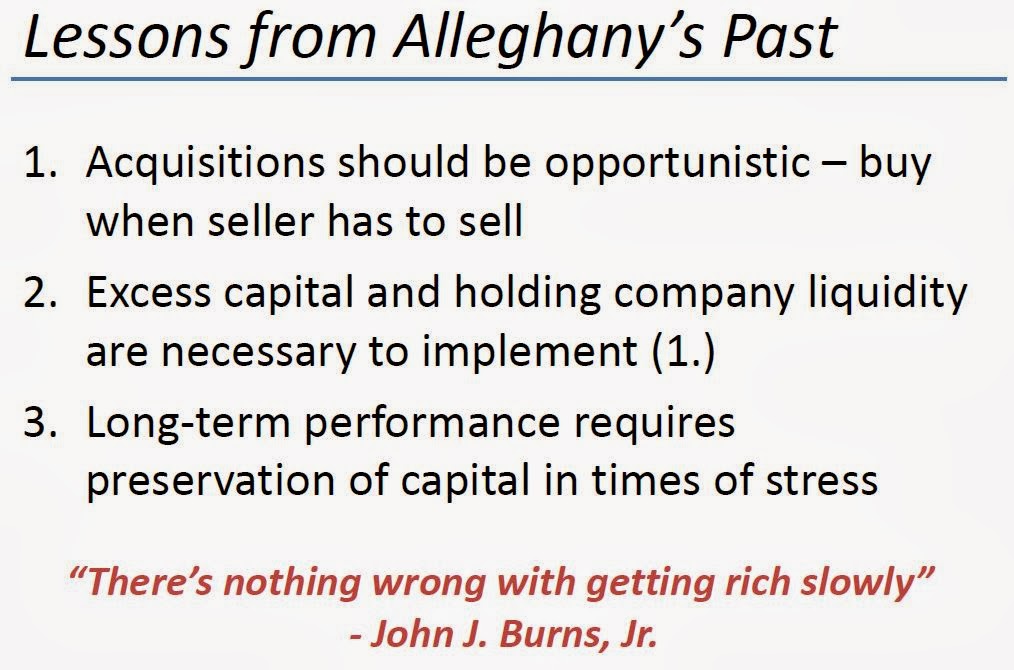

…and here are the keys to Y’s success:

Burns is right, there is nothing wrong with getting rich slowly. I suppose that was thrown in there to counter views that Y is too boring and conservative (who said they are boring and too conservative? Did I say that?). But yes, there is nothing wrong with being a tortoise. As Buffett says, to finish first, one must first finish.

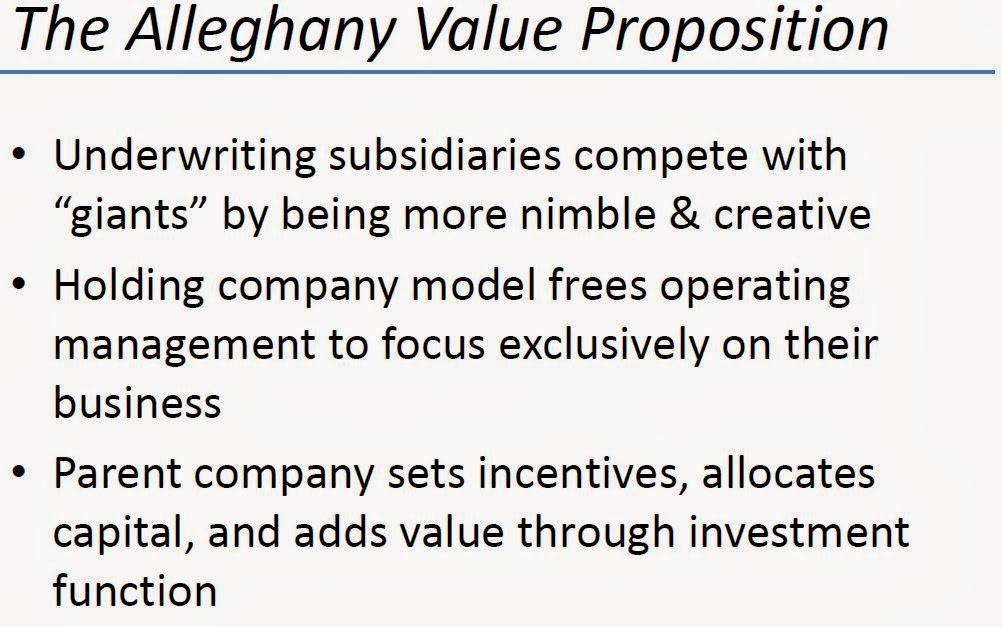

And here is the value proposition of Y which applies to other Berk-alikes:

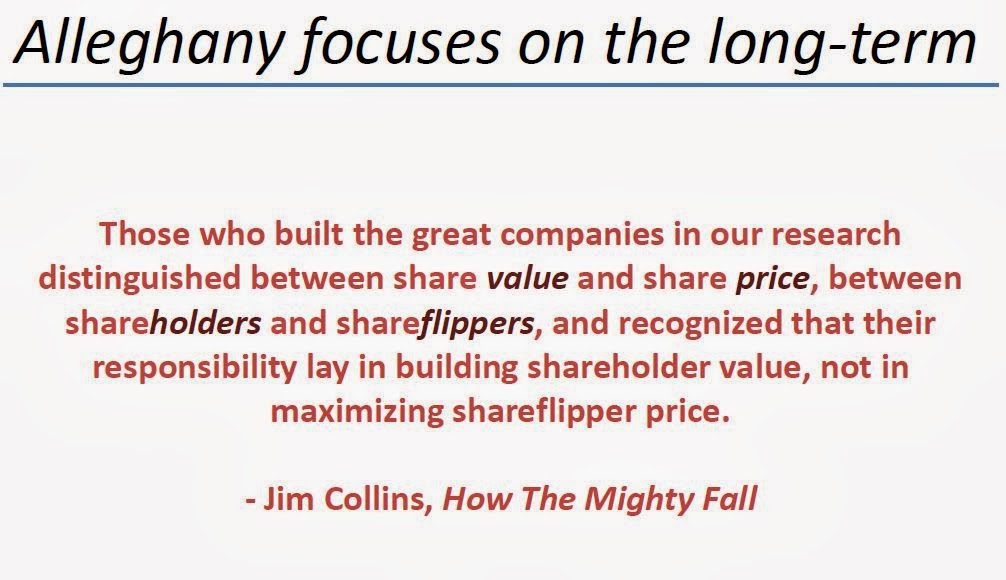

And here’s an interesting quote that he showed during the presentation which went into the annual report too:

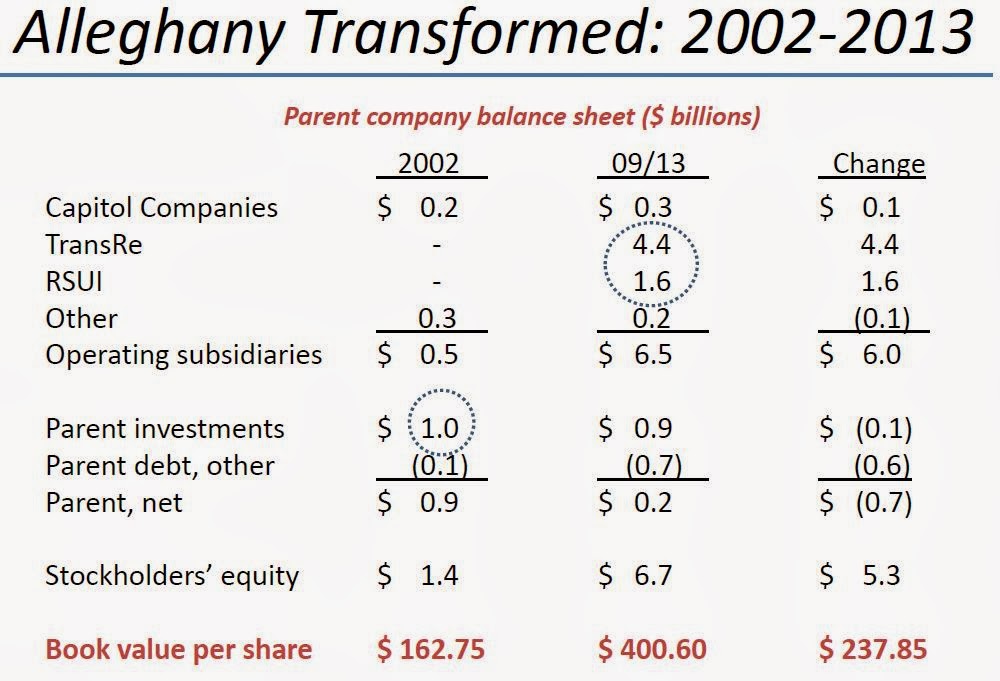

And the evolution of Y over the past decade (pretty much since Hicks took over):

As I mentioned in my last recent post, the investment team has been regrouped and renamed (Roundwood is a new name; Roundwood is named after Roundwood Manor, the home of the Alleghany Corp founders).

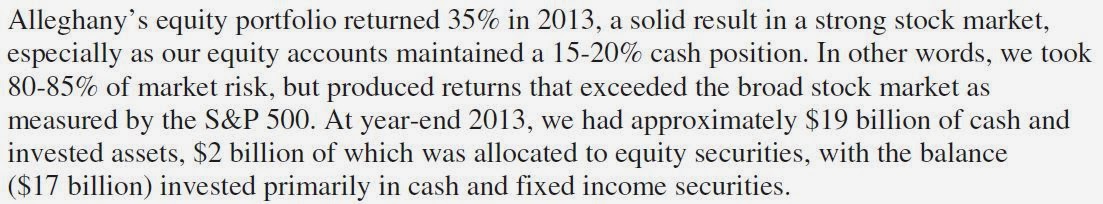

One year doesn’t prove anything, but the equity portfolio performed well in a big year for the stock market despite being only 80% or so invested. I do like that they will keep the number of positions below 25 with low turnover. That seems to me a good idea. It did say in the annual report that Y has invested with Jack Liebau before with good results.

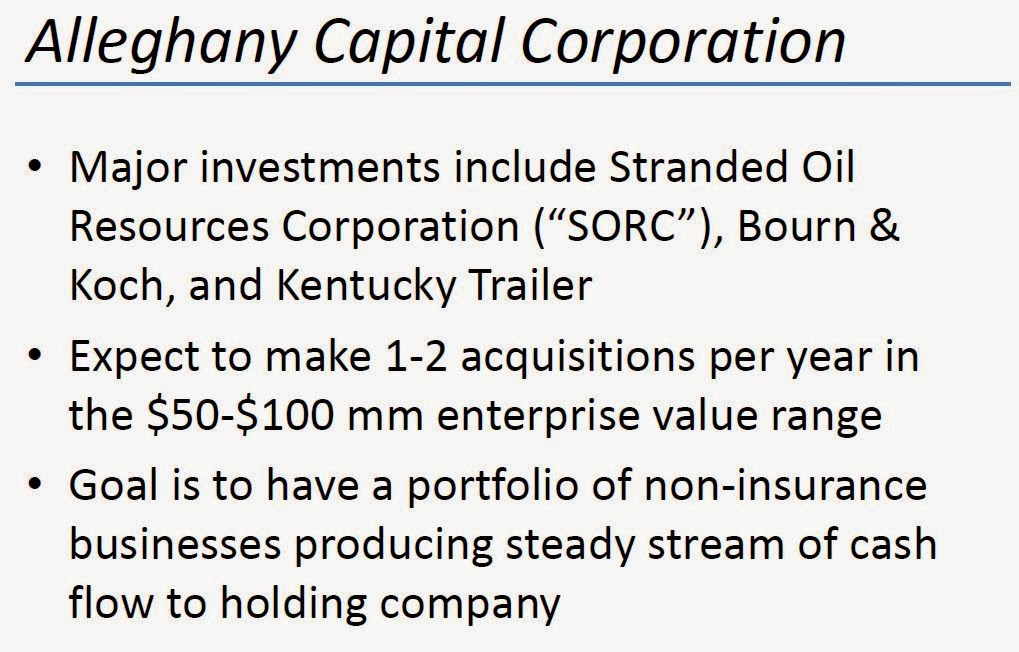

…and here’s the private business group:

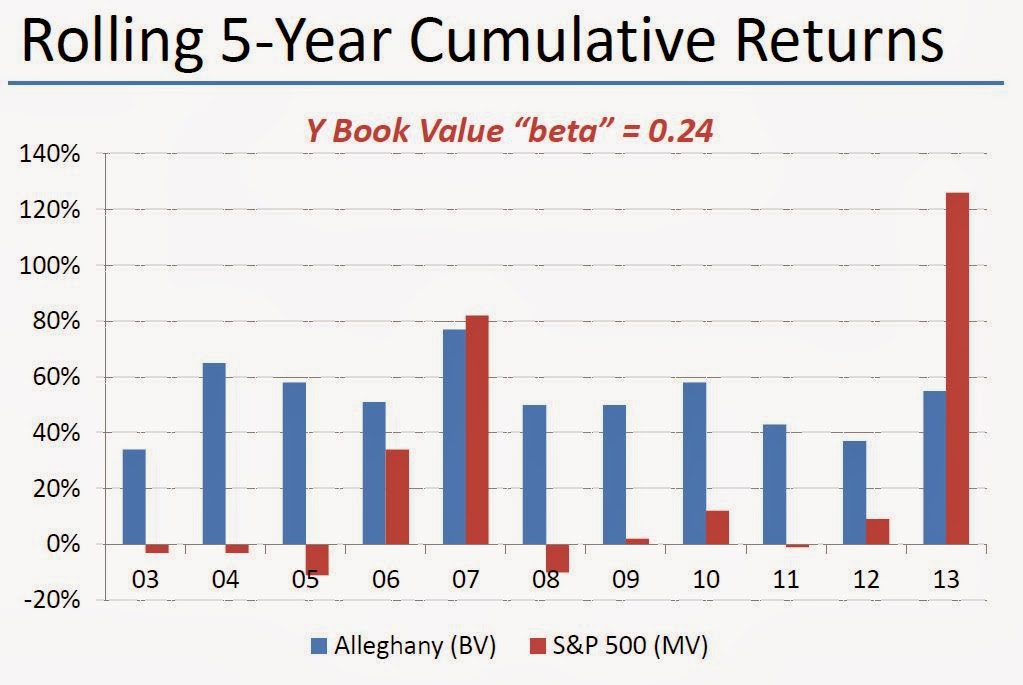

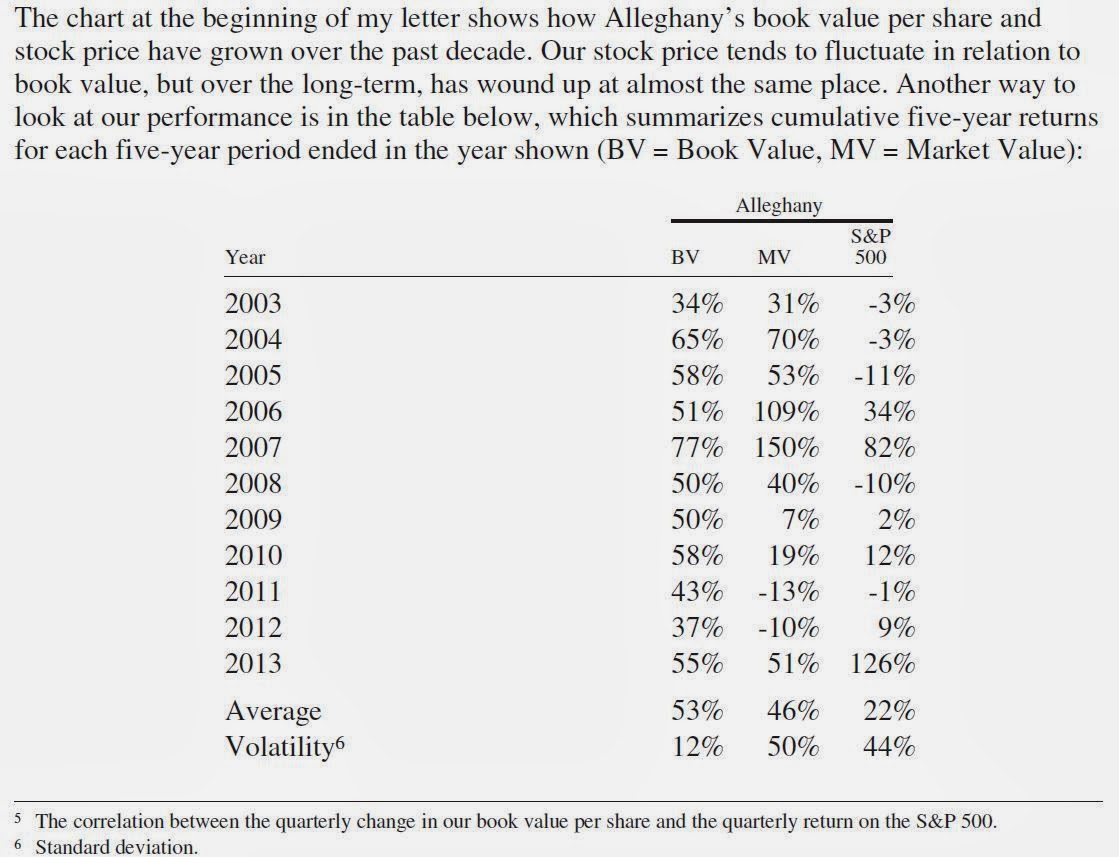

Here’s an interesting chart. There is more in the annual report which I’ll talk about later, but in the presentation he showed the rolling five year returns of Y’s book value compared to the S&P 500 index. Berkshire Hathaway (BRK) showed a similar thing in a table a while back.

Hicks jokingly said “no comment” about the last time Y underperformed the S&P 500 index on a five-year basis (which was in 2007). Y underperformed dramatically in the five years through 2013. I don’t think too many rational investors care about that since the five year return on the S&P 500 index is obviously a result of the financial crisis low and quick recovery thanks to the Fed and not representative of what the S&P 500 index can do going forward.

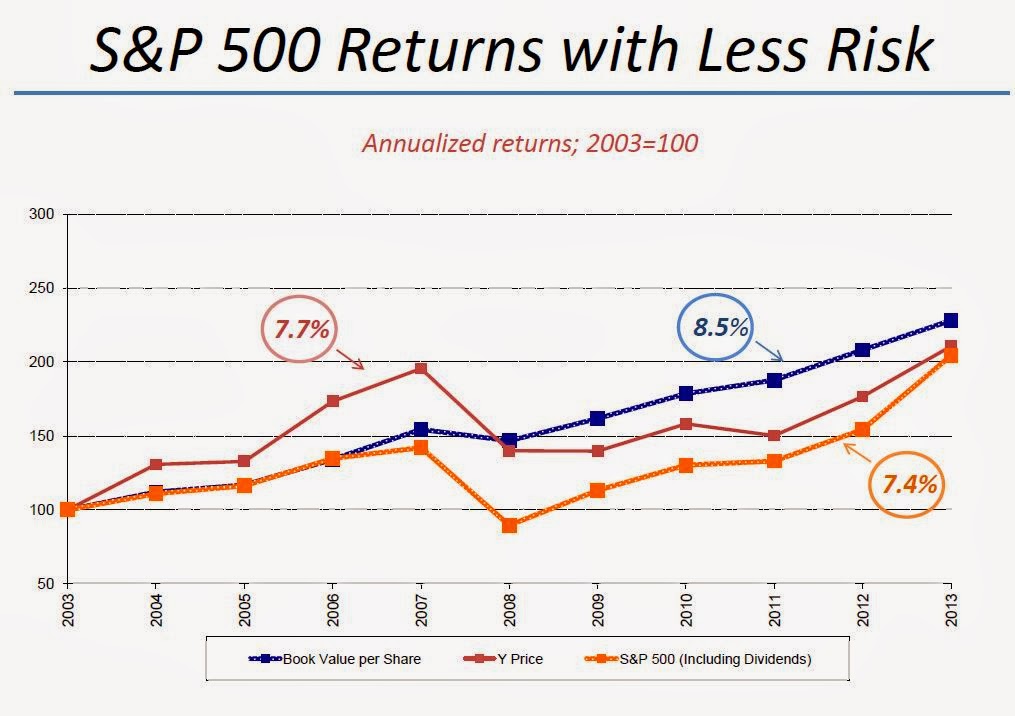

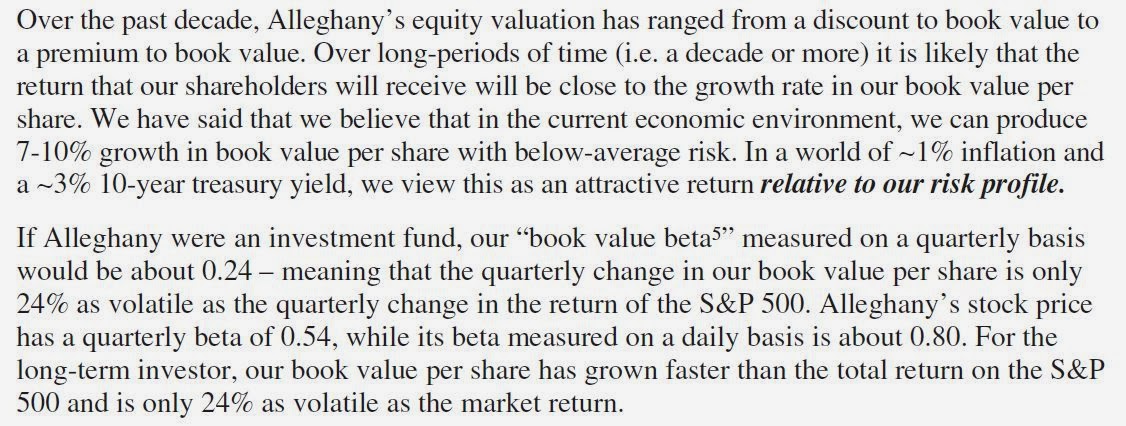

Y’s stock price has barely outperformed the S&P 500 index over the past decade, and their book value outperformed by only 1.1%/year. That’s not that exciting, but as Y explains later in the annual report, they have achieved this with a much lower risk profile.

2013 Annual Report

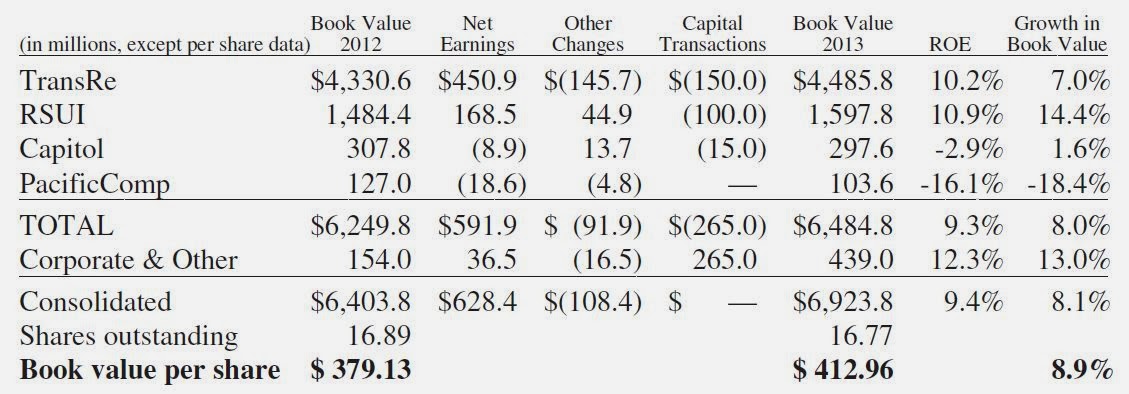

Y grew book value per share +8.9% to $412.96/share in 2013. The five year increase in BPS was +9.1%/year versus +17.9%/year for the S&P 500. But we’ll get to the discussion about this a little later.

But first, some interesting cut and pastes from the letter to shareholders:

I like the way they present change in shareholders’ equity. It’s easy to understand what drove the change in net worth in the past year:

And here’s a new table that breaks out ROE and book value growth contribution by group. This is a nice way to present it. We can see the investment return figures separately too so we get a good idea on what is driving the growth at Y.

Whale Trade!?

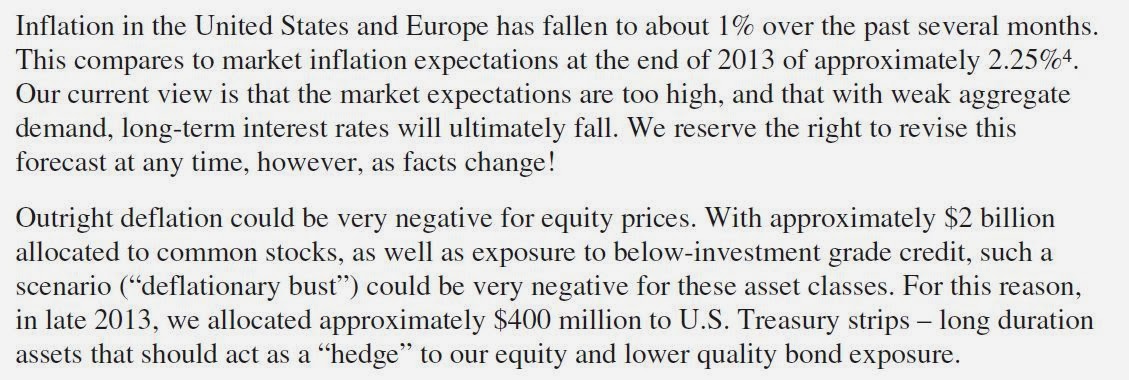

OK, I’m kidding about a whale trade, but you’ll see what I mean in a second. There was a very interesting change in this year’s annual report. As I’ve said in other posts (unrelated even to Y), Y has over the years explained that they seek equity and private business investments to sort of hedge their interest rate exposure as they saw inflation as inevitable.

But this year, I think for the first time, they said they are worried about deflation. There is talk about demographics, world trade, possible spike in energy prices causing a recession, robots and other deflationary forces (not to mention too much debt around the world).

So they have an equity portfolio as they worried about inflation (well, that’s not the only reason why they own equities). The equity portfolio was sort of an inflation/interest rate hedge. And now, they are worried about deflation, so they went out and bought zeroes to hedge against deflation. So that’s kind of like hedging your hedge, isn’t it? Isn’t this how J.P. Morgan got into trouble? They had a hedge on, but then they had too much of a hedge so they put on a hedge against their hedge. And it turned out their hedge against their hedge wasn’t really a good hedge, and that sort of blew them up.

I wrote about the risk of increasing complexity in a portfolio; it happens all the time. I called it the Rube Goldberg portfolio (read here).

In situations like this, sometimes what happens is that you get surprise inflation and the stock market tanks along with the zeroes. What can go wrong usually does in the financial markets! Inflation driven by economic recovery would be OK, but it can also be driven by exogenous events. Who knows what that might be.

But OK. The whale trade comparison is overkill here. Insurance companies routinely manage their duration according to interest rate expectations (as do banks with their ALM) so this is just a part of that, I suppose. Let’s call it a tail hedge (hedge against fat tail events).

I wonder what out-of-the-money, long dated call options on zeroes are trading at? Maybe that would’ve been a low cost tail hedge. With so much expectation of rate normalization, I can’t imagine them being overpriced.

Anyway, moving on.

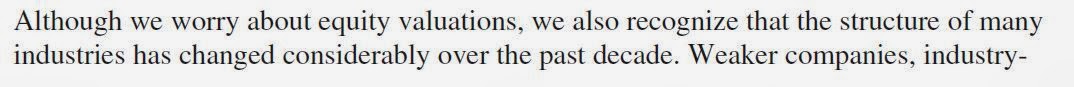

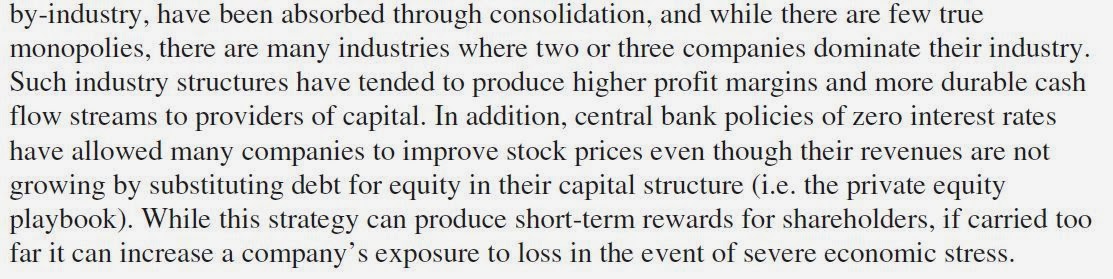

Equity Valuations

I talk about equity valuations here every now and then, but I don’t really obsess over it. I actually don’t care as those things are only meaningful at the extremes. If I see extreme valuations and many signs of speculation/bubble, then of course I get a little worried. But I still focus on individual companies so don’t worry too much about it.

Having said that, I am interested in what others have to say about valuation, and Hicks does mention it in his letter:

I too worry about unsustainable profit margins sometimes, but I notice that a lot of companies have exited commodity businesses and are moving more into specialty, higher margin areas. This is why I think it’s really important to look at this stuff on a company by company basis.

Y’s equity portfolio did well:

Risk-Adjusted Return of Y

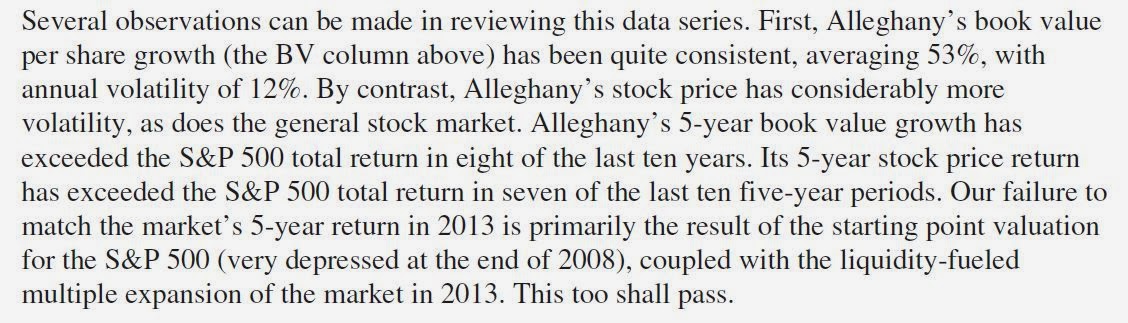

So here’s an interesting take on Y’s performance over the past decade:

This is an interesting analysis. I think much of Y’s book is marked to market unlike, say, BRK, which has a large portfolio of businesses that is not. In that sense, this may be a fair analysis, at least in terms of comparing Y to the S&P 500 index. But then this would invite similar comparisons to other companies; how does Y fair against them using the same metric? I bet Markel would look pretty good. JP Morgan would probably look pretty good too.

The letter concludes:

And to illustrate the value of their conservatism, Hicks reached back into the history of Y; they have survived for so long because of it. If that’s too boring, too bad. Better boring than dead.

If you had to build an investment portfolio, would you buy FMRO, the Paridigm Fund, or choose a handful of owner operated stocks and if so which stocks? Thanks.

I think any investment blogger would hate to ans this kind of question.

Hmmm… good question. I don't own FMRO at this point. The thing is, I think a lot of these guys I talk about here will do very well over time, and the choice really often comes down to taste. Of course BRK is always a great core holding for people who are not hands-on active, 'enterprising' investor.

It's really hard to say which is better as it may depend on your personality and how comfortable you are with the different companies. BRK is an easy one to recommend; you can recommend it to widows and orphans and not worry about anything too much. Of course, an S&P 500 index is like that too (as long as you don't buy your entire allocation at the top of a frothy market!).

I still like banks, but they can be scary to own at times as financial crises do occur regularly and the headlines might scare most people out of their bank stocks. I like GS too, but again, they may be highly volatile and prone to dramatic declines in financial panics. GLRE and TPRE are good too but much higher risk profile than a BRK, so I wouldn't recommend to people unless they limit their exposure etc… (as opposed to something like a BRK; you can own a ton of that and not really worry as long as you are prepared for the occasional 50%+ drop in stock price).

So that's really the way I see it. If you ask me which of all the people I write about will have the highest returns in the next five to ten years, it's really hard for me to say. I can say that the potential for some of the smaller, more aggressive entities may be higher, but there is more risk there too.

I would suggest building a portfolio according to what you are comfortable with and with the companies that you really understand (above and beyond what I say here; I usually only point out things that interest me but that doesn't mean I havent looked at and though about other details). And then imagine another financial crisis or near depression and imagine the stock down 70%. How would you feel? OK? Would you panic and sell out?

If you are confident that an entity can survive and do well despite short term collapses in the stock price, that the business model is solid etc… then it's probably a good idea to own that stock. Otherwise, stay away because the above *will* happen at some point again so you might as well own something that you sleep well with.

Sorry if that's a non-answer, but that's what I come up with…

Just curious, can we know about what names they have in their equity portfolio? Like top 5/10 names?

13F?

Of course. I searched for Roundwood not Alleghany. My bad.

http://www.sec.gov/Archives/edgar/data/775368/000095012314001420/xslForm13F_X01/form13fInfoTable.xml

Thanks, looks like this is taken care of (was travelling so couldn't respond).

What is your background, kk? Are you are full-time investor or is this a "second job"?

Hi, my background is in finance. Everything from investment strategy, equity and derivatives trading, proprietary trading and things like that. I invest full time on my own now.

Thanks for reading.

Hi kk, sidetrack abit.

Have u been looking at fairfax recently? Anw it's been quite a contradictory stock n wud like to get ur opinion on it (noticed that u haven't posted abt fairfax for a long while)

Hi,

Yes, I do follow it. I still think it's good and think they will outpeform over time. But since they are fully hedged in their stock portfolio, they won't outperform in strong up markets. I tend not to like that idea (of hedging out equity exposure), but they have proven over time that they can perform really well even with 'hedging'.

So long term, yes, I havne't changed my view on them, but short term, if the market keeps going they won't keep up.