So JPM had their marathon investor day the other day. The slides and presentation is available at the JPM investor relations website. It’s well worth a listen for anyone interested in banking. It might be torture for those who aren’t, though, because it’s long. But long is good. We want more information, right? People keep saying banks are black boxes and are opaque. I wonder if any of those people have listened to it.

Anyway, I won’t go through too many slides. Each division had their own presentations and it was pretty detailed and well done. I do feel good about JPM management below Dimon; it seems like they do have a lot of good talent there.

2013 Result and Quick Thought on Valuation

Anyway, just as a reminder, JPM had one time charges (Madoff legal charge, mortgage related legal costs etc…), but even with that they earned 11% return on tangible common equity. Excluding those and other charges, they had a net profit of $23.2 billion and an EPS of $5.70. The return on tangible common equity was 15%. So with the stock trading now at around $59/share, it’s a 10.4x p/e stock. JPM is now trading at around 1.1x BPS and 1.45x tangible BPS.

So it’s no longer no-brainer cheap, but is still attractive as it’s a great company with growth prospects and potential for a higher multiple. I always use 10% or 10x p/e for financials, but smaller banks seem to be trading at 14-15x multiples and bigger banks are discounted due to their big-ness. JPM in particular might be discounted for their exposure to investment banking and their large derivatives book. I think the financial crisis has shown the benefit of having a diversified book of businesses but the market may not agree. But market views do change over time. If they come around, valuation might go up.

But even without a valuation increase, with 30% dividend payout and 15-16% return on tangible common equity, JPM may be able to grow 9-10% over time (or more), and that alone without valuation improvement may offer a reasonable return.

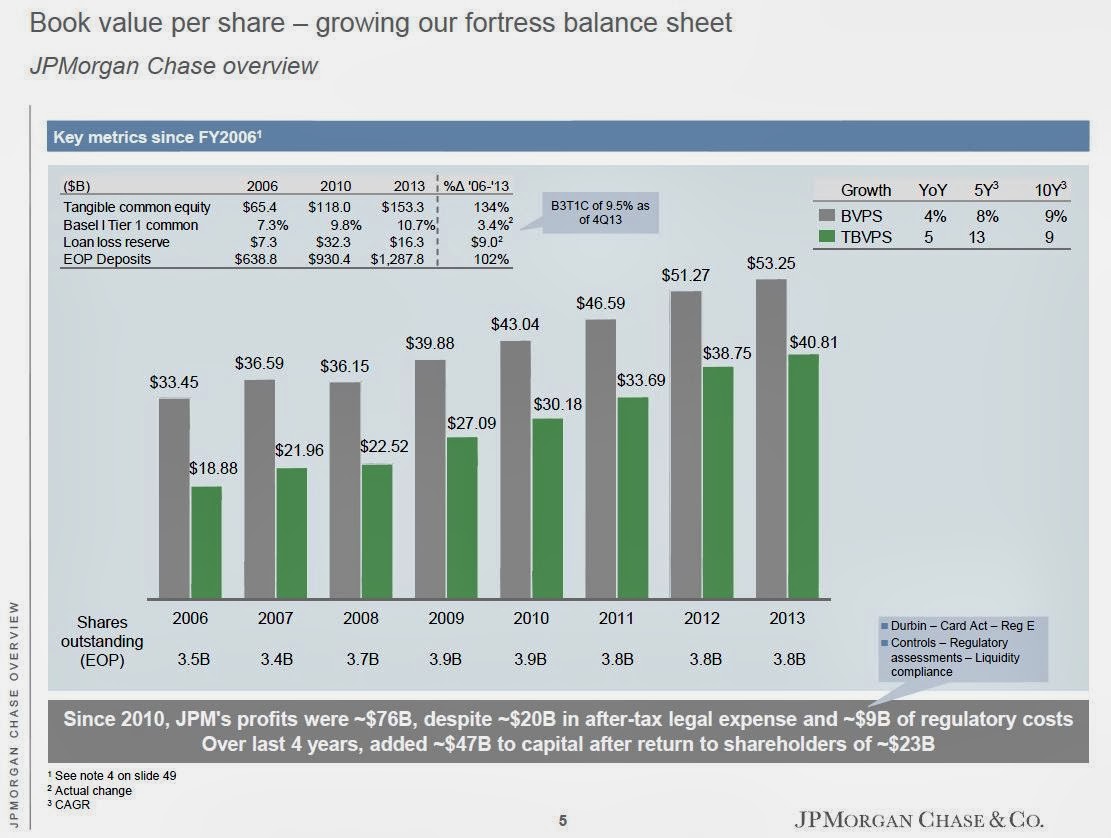

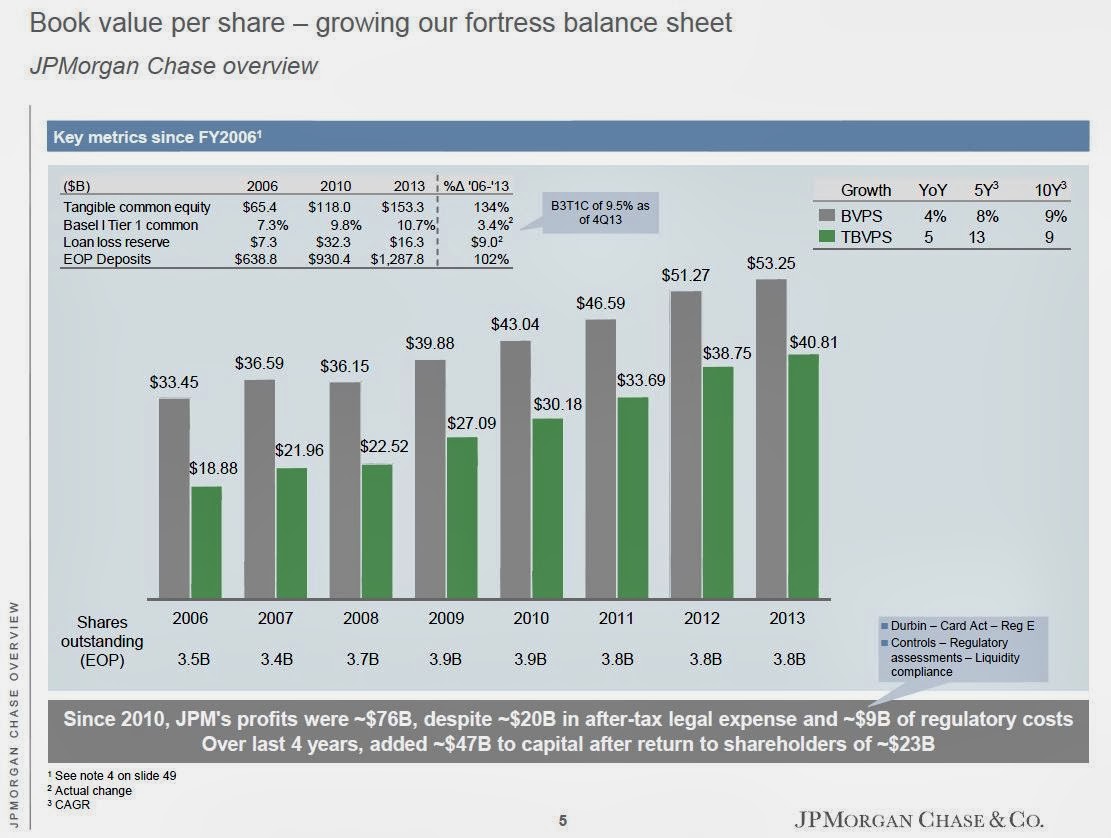

BPS Growth

Here is the usual table of BPS growth. Note that the BPS growth exclude dividends. JPM paid $1.44/share in dividends last year, so tangible book growth with dividends included would have been 9%. Not bad in a year with all sorts of legacy charges and not so exciting year for banks and investment banks (even though the stock market was up 30%+).

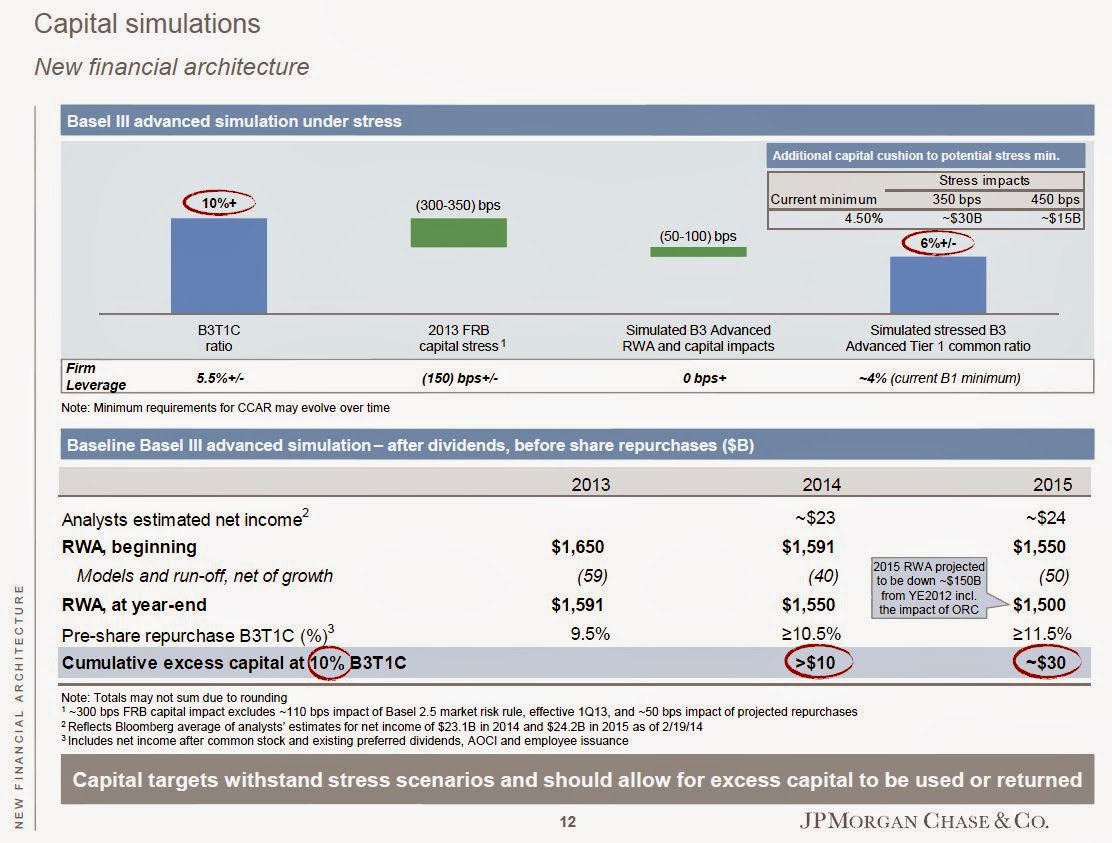

Here’s a table that shows that JPM will be accumulating excess capital over the next couple of years:

They will have $10 billion excess capital at the end of 2014 and $30 billion at the end of 2015. This can be put to use in the business, paid out in dividends, or used for share repurchases.

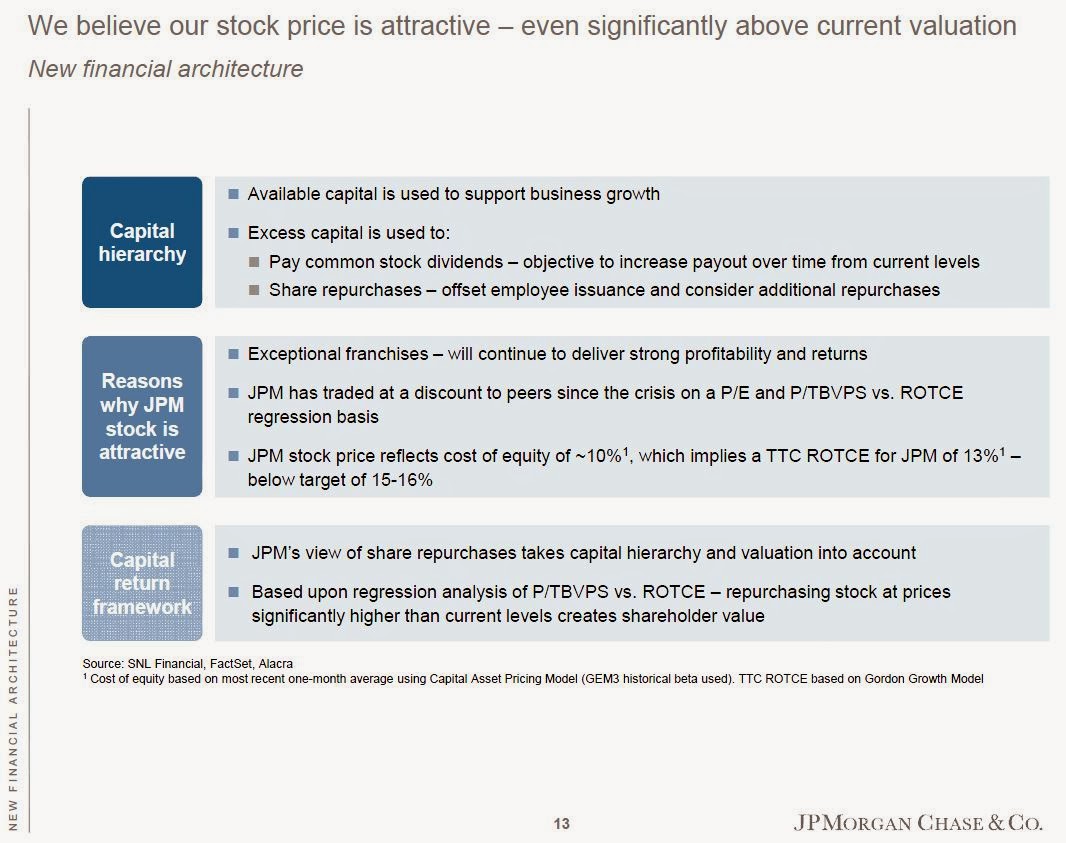

JPM View on JPM Valuation

So here’s an interesting slide that we haven’t seen before. Dimon has said that it’s a no-brainer to buy back stock at tangible book value (where it actually traded not too long ago). But JPM feels the stock is still cheap. Using various valuation techniques, they see it as undervalued by 20% and even more undervalued against peers. The stock closed at $58/share on February 24, the night before investor day, so that means JPM is worth at least $70 (as they see it).

And the last bullet is interesting too: “…repurchasing stock at prices significantly higher than current levels creates shareholder value”. Marianne Lake (CFO) said that repurchasing shares even at 2x tangible book would be accretive to shareholder value. That’s almost $82/share, or 40% higher than the current price. I suppose this would be accretive to EPS as you can take cash earning nothing and buy something at a 7.5-8.0% earnings yield (2x tangible book; 15-16% ROTCE).

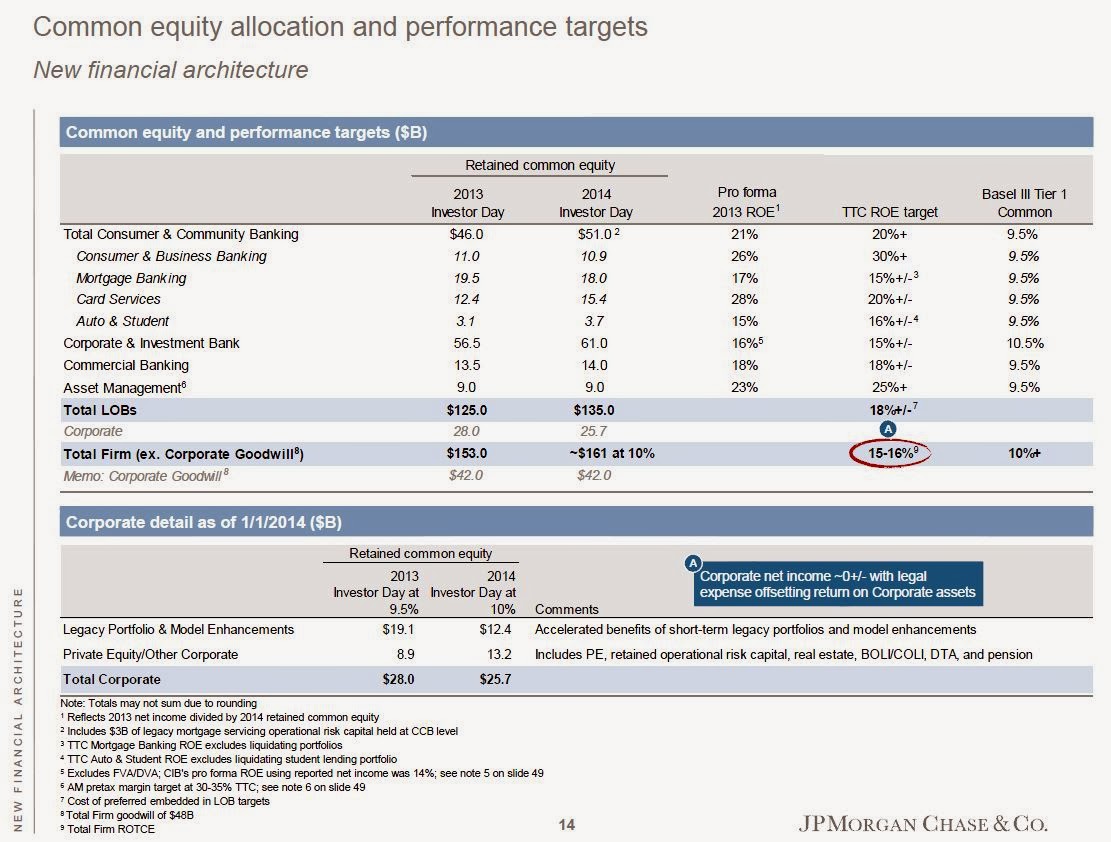

Targets by Line of Business

JPM’s good performance seems to be across the board.

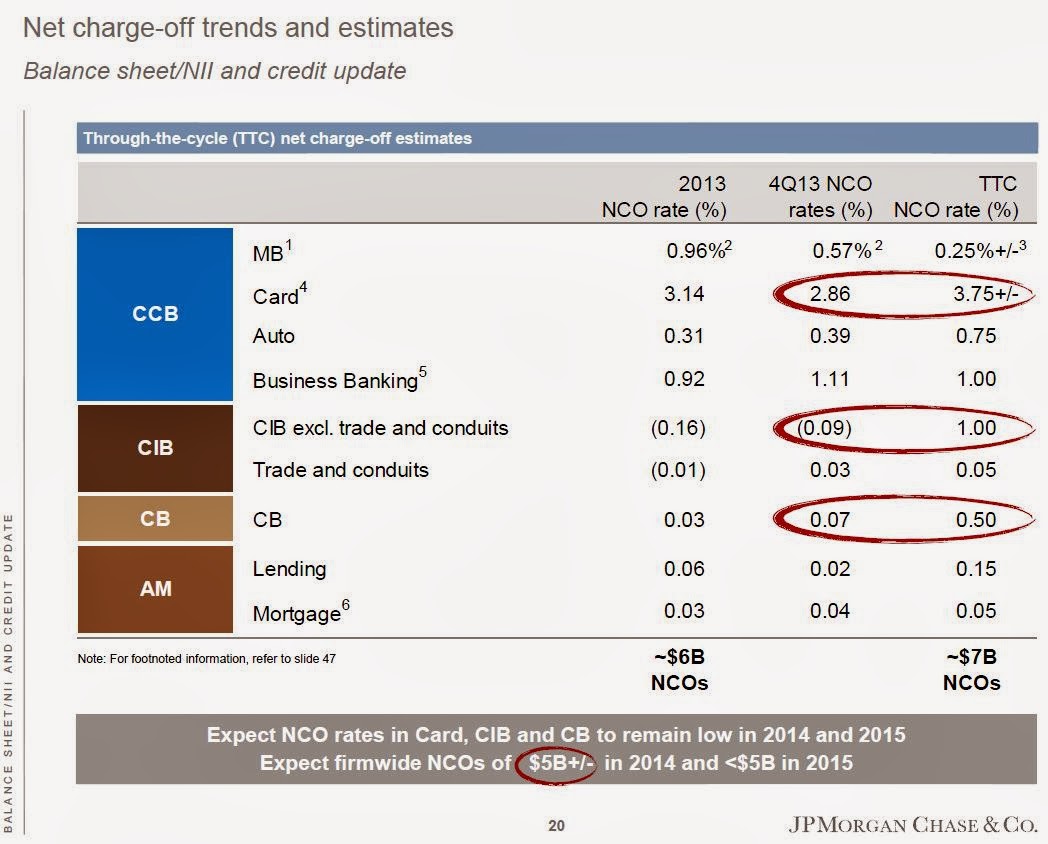

Charge-off Trends

In case you wonder if JPM’s good performance recently is driven by abnormally low charge-offs, below is a table that shows what JPM sees as the normalized level of charge-offs “through-the-cycle” compared to recent trends. You will see that it is slightly lower now, but not much.

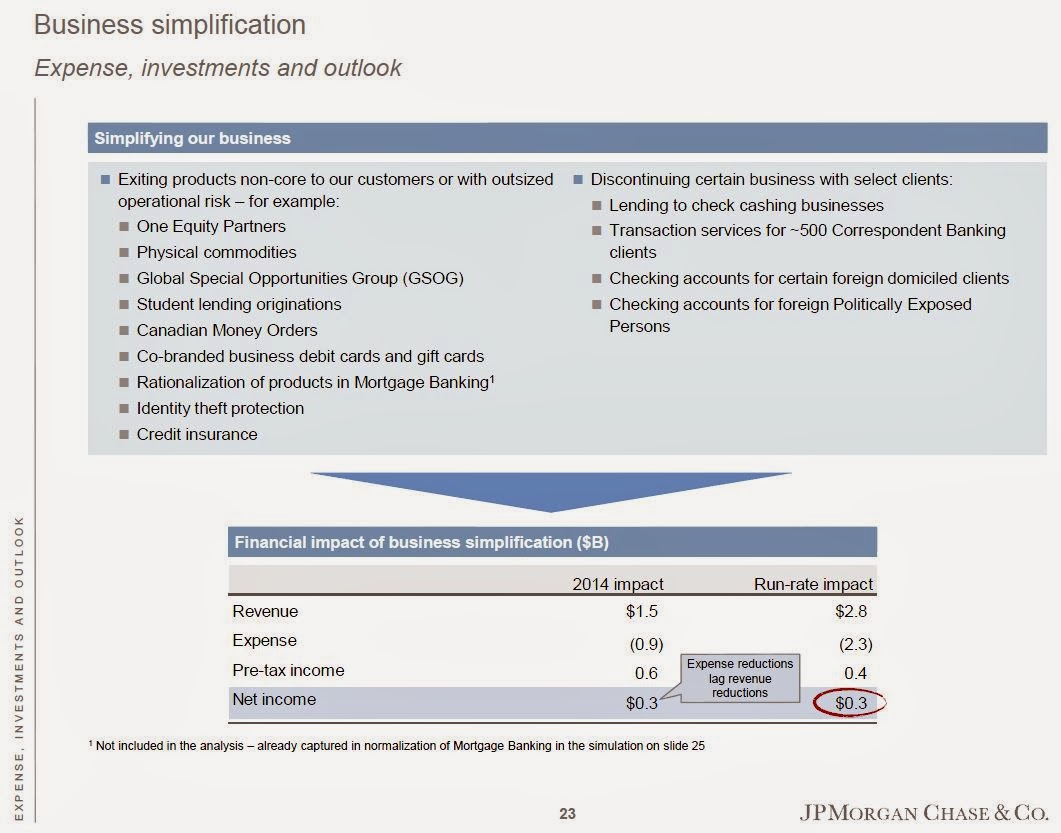

Revenue Impact of Exited Businesses

We also read a lot about big banks getting out of this or that area (commodities), and wonder what kind of revenue/profit impact there will be.

Here’s a slide that shows the impact of JPM’s recent exits:

It doesn’t seem like a big impact.

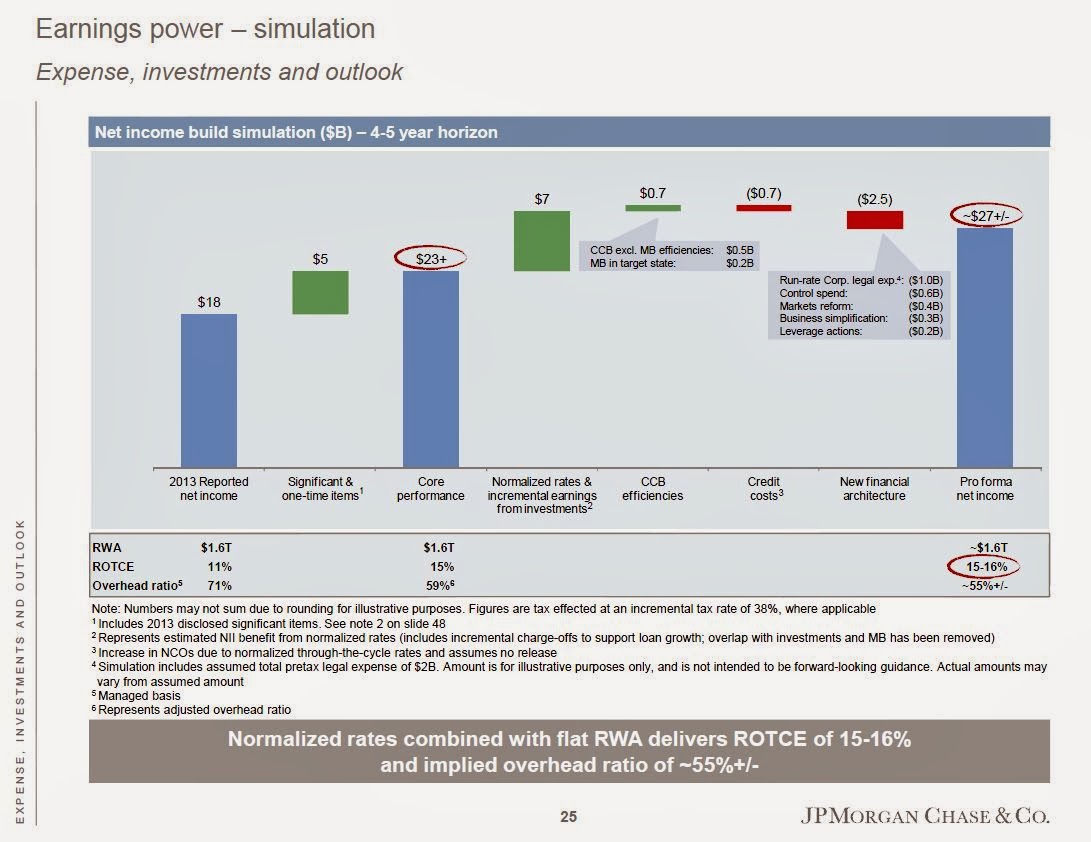

Normalized Earnings

And as usual, here’s the chart that shows what JPM can earn over time when things ‘normalize’. This chart includes the normalization of recent expenses, and the two big positives are incremental earnings from investments and normalization of interest rates. They see an inflection point in interest rates coming (though they don’t know when it will happen).

The normalized earning power is $27 billion. There is $800 million in preferred dividends so deducting that you get $26.2 billion in net income to common shareholders; with 3.8 billion shares outstanding, that’s $6.90 in EPS. So at $59/share JPM is trading at 8.6x normalized earnings power.

It says the time horizon is 4-5 years. With adjusted earnings in 2013 of $23 billion, that doesn’t seem like much improvement; $23 billion to $27 billion in 4-5 years is only 3%/year. But the above chart is only an indicative illustration of what normalization would do to earnings with things currently in place. The time horizon is for normalization of interest rates (don’t know when that will happen), and I suppose the maturing of the investments currently being implemented.

It does not include growth in the various business lines. Dimon said that the $27 billion is not a budget figure (meaning, it is not a goal or target for JPM to earn $27 billion in 4-5 years. A budget (goal or target) over that time period would be much higher).

During the Q&A, someone asked about this and Dimon initially said something like 5%/year growth is possible but quickly said that investment banking can easily go up 40% at some point. 5% growth is what JPM expects for core loan growth, so maybe that’s where that figure came from.

Dimon is very bullish investment banking, asset and wealth management (and other areas).

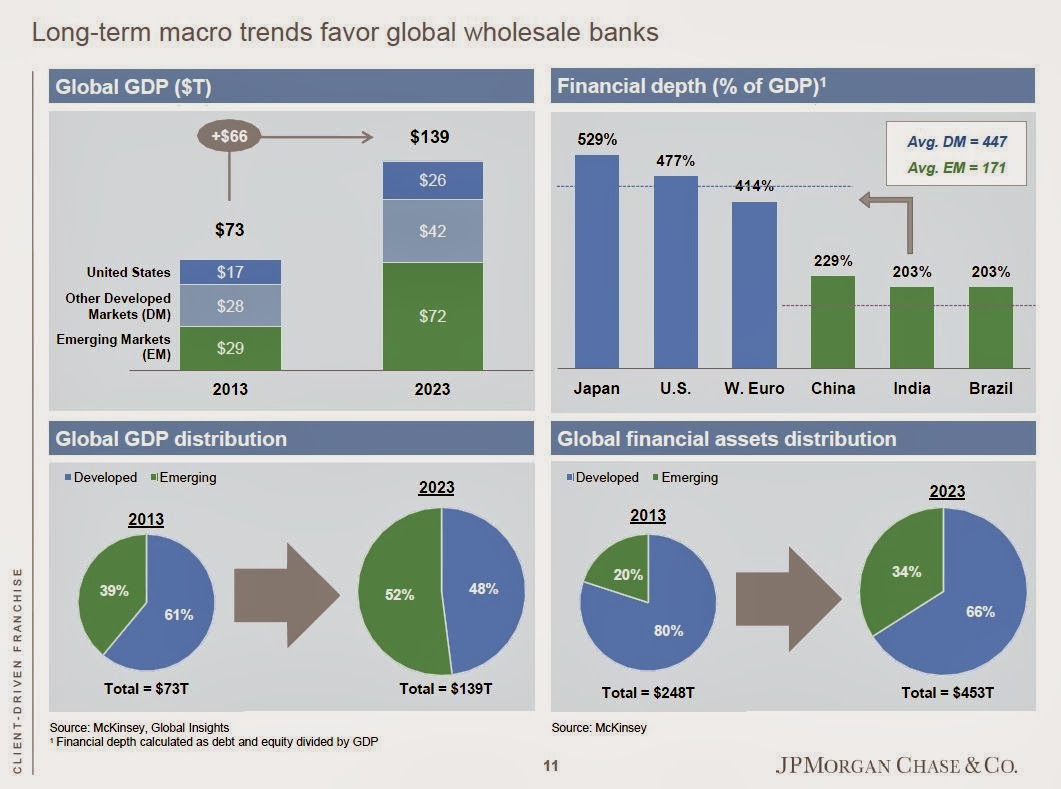

Look at this slide:

It is a very exciting slide, and it’s good for Goldman Sachs (GS) and other banks too. But on the other hand, when Japan’s “financial depth” increased, did global banks really benefit? Or was it mostly Japanese banks that benefited? Maybe banks weren’t that global back in the 1970’s and 1980’s when this happened. But back then it was Japanese financial institutions that benefited most from their financial deepening, I think.

So in the future, it may be Chinese banks, Indian banks and others that take a large piece of this increase. But who knows. It’s just a thought that came to mind when I saw the slide.

Don’t Break Us Up!

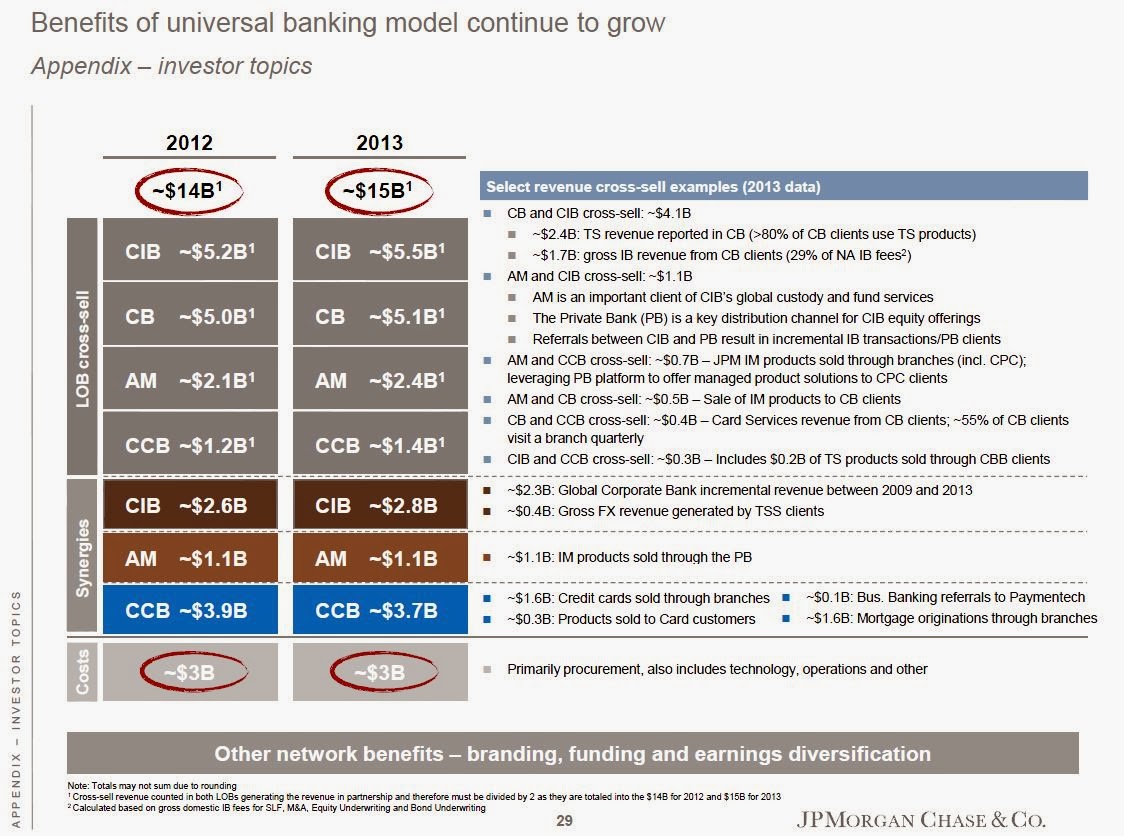

I don’t know if this is directed at regulators or activist investors (probably both), but it’s an interesting slide:

Divisions versus Peers

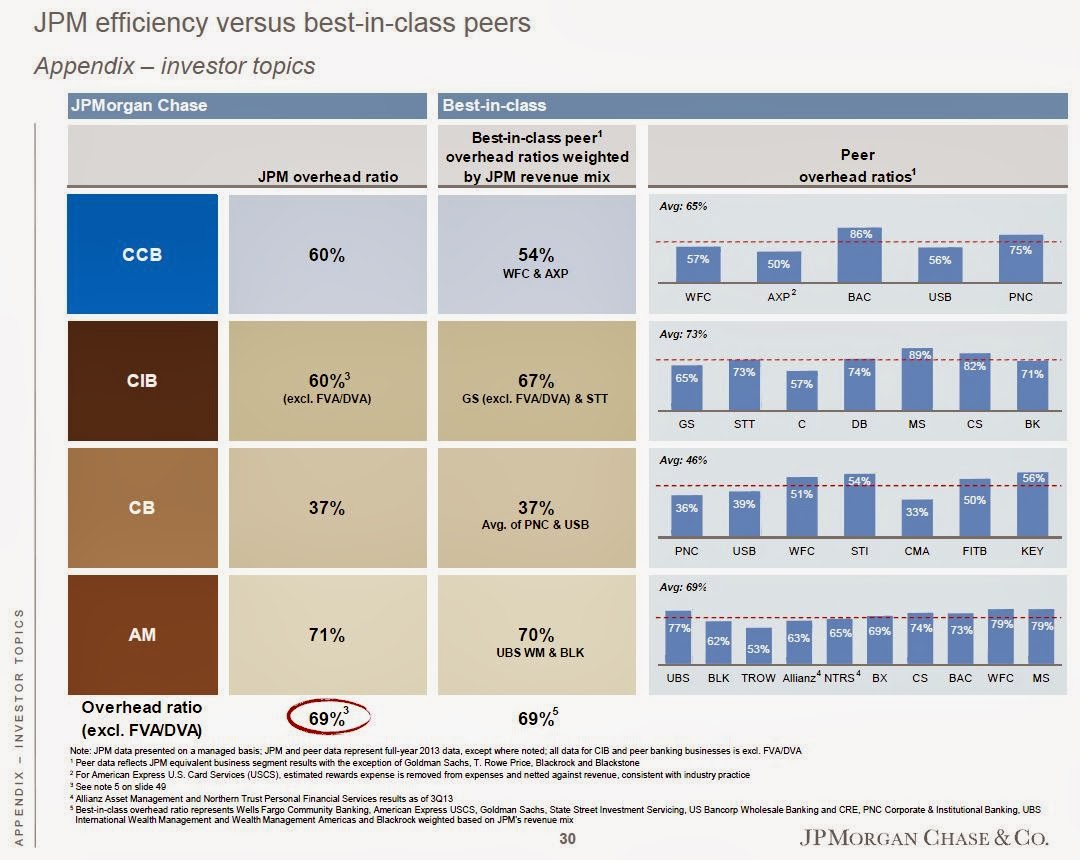

Here’s a great slide that shows that JPM’s efficiency at the line of business level is competitive with the best.

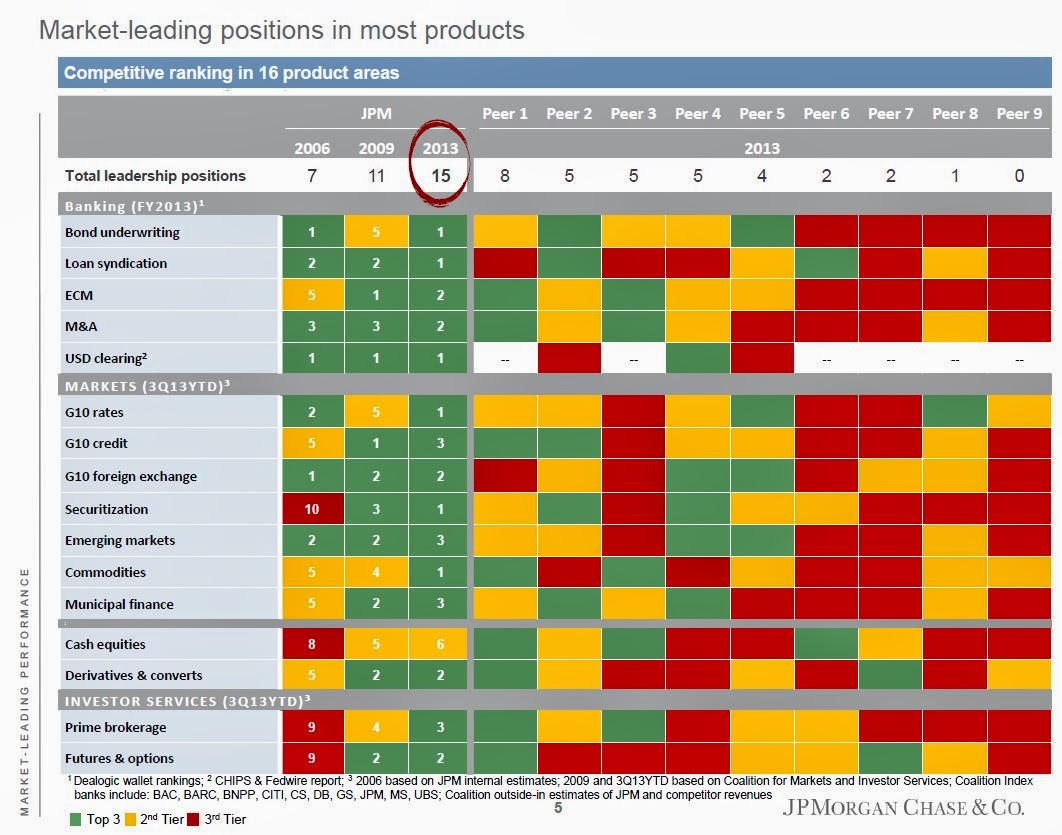

Investment Bank Dominance

And we mostly hear about how great Goldman is, but we forget what an amazing entity JPM’s investment bank is. Check out the table below and see how many areas they dominate versus peers. It’s an incredible chart:

Conclusion

Anyway, I did listen to all of this live and some parts of it again later (replay) and I think JPM is doing really well, and the management (below Dimon) seems really good. I liked what I heard.

JPM is certainly not as cheap as it has been in the recent past, but it still looks pretty interesting. There is a lot of potential for when things ‘normalize’, like rebound in housing, interest rates normalizing etc…

There was a question about why with all this great stuff, increasing market share in various businesses and growth in many areas revenues are flattish. Dimon’s response was that revenues sometimes aren’t that important. They don’t want bad revenues that aren’t profitable. So there have been runoffs, there have been pressure from NIM compression and things like that. But he insisted there will be an inflection point. These things will run off and revenues will start to reflect the strength of the franchise.

Of course there is always the risk of another recession. In that case the stock price would certainly go down. But JPM has proven that they can manage through the worst economic times.

I am really looking forward (as much as I look forward to Buffett’s letter) to Dimon’s letter to shareholders.

Hello,

As you have the habit to read those presentations, could you let me know why don't they put the real name of each peers (see last image) ? e.g. : Peer 1 = BAC …

Thanks 😉

I don't know. Some presentations name the peers, others don't. I guess they feel it's bad form sometimes to name peers. Or maybe they don't want to invite arguments from the peers. Who knows…

Just a thought, but if JPM published an admission that Goldman was the market leader in a particular thing, I bet Goldman would add that to their sales presentation when competing with JPM.

And the last bullet is interesting too: "…repurchasing stock at prices significantly higher than current levels creates shareholder value". Marianne Lake (CFO) said that repurchasing shares even at 2x tangible book would be accretive to shareholder value. That's almost $82/share, or 40% higher than the current price. I suppose this would be accretive to EPS as you can take cash earning nothing and buy something at a 7.5-8.0% earnings yield (2x tangible book; 15-16% ROTCE).

I'm a novice here (and also want to thank you for this sites great content) but doesn't that hit up to a point of the old argument against buybacks, where it would be better to return cash (dividend) to shareholders for them to decide whether they want earnings to be used this way? Or if not 2x tangible book, at some point. Can't be when there is no accretive value.

I guess I should take that back, since Berkshire sets there buyback at 1.2 book value.

Assuming that management is fair and honest AND has an idea where the fair value of the stock should be buying back stock below that level is a good deal for the remaining shareholders. At least as long as there are no other alternatives yielding higher returns (ie are even more underpriced). These are some big IFs, of course.

Lake just said it's theoretically accretive even at 2x tangible book or something lik that. They will buy more (all else equal) at lower prices and less at higher prices.

Dimon has said that they won't just buy back stock regardless of price like many other companies so I wouldn't worry.

For JPM, share repurchases is just one of many things they can do with their capital, and they have proven over time that they will use their capital wisely.

Thanks for reading.

KK, agreed that JPM resp Dimon know what they are doing. Buffet held (or probably holds) 100k shares in his PA. My comment regarding IFs was more of a general nature :-).

Hi,

Here's a paper on the Tiger Cubs that I thought you'd enjoy since you've mentioned them a few times:

https://www.novus.com/research_assets/pdf/NOVUS_Like_Tiger_Like_Cub.pdf

Thanks KK for the great article.

Like you I've been investing in the financials since the crisis. I bought a bunch of USB, WFC and BAC from 2009 to 2012. However, I've always stayed away from JPM even though I think highly of Dimon. I don't like the complexity of this bank relative to ones I invested in. Also, I didn't like the CEO being in the spotlight so much (criticizing others, etc.). Given close ties of the Obama treasury team to the thugs who used to head Citigroup, one has to wonder if the current government actions are intended to cripple JPM in favor of their masters. Just seems weird to see JPM being hammered hard for bailing out Bear and Wamu. These are just my observations on JPM. Doesn't necessarily mean it's a bad investment. In my opinion it's not as compelling as others.

Anyways, what do you think of the potential upside is for JPM vs C and BAC?

Any thoughts on TARP warrants? Dollar for dollar they've not kept up with the stock price appreciation since 2011, when I bought BAC series A warrants.

Hi,

Good question about JPM/C/BAC. JPM is getting more fairly priced so for 'potential', C may be more interesting as it is the cheapest. Their emerging market exposure is hurting them now as emerging markets are very unpopular these days, but when the cycle turns (and it will eventually), C might look pretty good.

As for the TARP warrants, they have a delta less than 1.0 so on a dollar for dollar basis, they shouldn't keep up with the stock price. But on a percentage basis, they should be outperforming when the stock is up.

do you have any updated thoughts on BAC?

No, not really. I think they are chugging along and doing well. This is similiar to JPM as elevated costs will eventually go away and earnings will come through.

Hello, I am curious if this site on Blogger generates revenues? I don't see any advertising so i'm guessing not but just curious.

No (or very little). I put some ads on here (at the bottom) for fun to see how it works, but I don't do this for revenues.

Can I ask you to elaborate more on your respect/admiration for Jamie Dimon? If not Buffett level, you seem to regard him in that tier or one below? There are things that come to mind: his being a more or less straight shooter (not a promoter, as you wrote previously) and the ability (or luck?) to steer out of the way of the worst from the recent crisis. Do you find "Outsider" characteristics? Or there's more concrete examples revealing his leadership in JPM's success?

When there is trust to a CEO (or any manager) there is a mixture of integrity and performance, right? I know there is evident of it from JPM's track record, just wondering what things led to your conclusion. Thanks.

Sure. I have been following Dimon for years, since he was a Weill protege. He has always had a reputation for being super smart and a straight, no b.s. kind of guy. I know people that have dealt with him directly and they all seem to say he is exactly what you would expect, very smart, competent, fair etc…

So I would put him right up there with Buffett for sure, but Buffett is ahead only because he's been around and doing his thing for quite a bit longer. Otherwise, I don't think he is any less than Buffett, and if he is, he is still very close.

And I don't think his getting through the crisis was luck at all. A lot of people thought that JPM would be the first to topple in the crisis because of their exposure to derivatives and investment bank, but I know people who worked on trading desks when he was around and he would sniff out risk and make you get rid of it. So I think he is as good as his reputation.

Thank you very much! Really appreciate all you writings and like very much the way you think and look at things.

I am also invested quite heavily in the US financials, especially since 2011, however the problem for me is that at that time they were trading at "normalised" PE's lower than 5, few perhaps even below 3:) and now valuations are more like 10 and above. I understand, that there is still upside to bank profits, maybe 20-30 per cent, if interest rates normalises (just like JPM presents), so in that case their valuations are more like 8-10 and of course, market valuation is way higher. However these are still highly leveraged institutions with all possible consequences if something goes wrong and at the same time in this "overvalued" market you can still buy IBM or DTV, which are also trading at about 10-13 PE, probably have comparable or better long term earnings growth rate, but more importantly are unlevered (relatively to banks) and hi quality/roe business with the pricing power, low capital intensity etc. So if, God forbid, there is something similar to 2008 behind the corner (deflation, Europe, China, commodities, choose your own), you can be almost sure, that IBM's or DTV's earnings will remain more or less the same and they will be buying back even more cheaper shares, and how sure you can be in terms of negative surprises you can experience with banks, especially with those, which are more global, with various emerging market and similar fancy exposures? So the question I am asking my self is why to assume these downsides, even if their probability is very low, if valuations are no longer reflect them? Or is it only this 20-30 percent interest rate normalisation effect, which makes sense to hold them?

Hi,

Financials are certainly not as cheap as they used to be for sure. There will always be some risk with any investment. Even IBM has macro exposure, business model risk (cloud) etc. DTV is not risk free either as we really don't know what happens over time as the current TV/video distribution model evolves.

So it boils down to which risk you are comfortable with taking.

For banks, I tend not to see something like 2008 again for a long time, and even if we do see it again soon, most banks are much healthier now than they were in 2006/2007 so they should do much better. They have better quality assets and higher capital ratios etc.

Normalization of interest rates is one driver of improved earnings, but so is a continuing recovery in the economy. At some point, companies will start spending and investing again and bank balance sheets should start to grow again. Housing too is still way depressed and is nowhere near where underlying demand is.

So there is more to it than just interest rates going up, I think.

I don't think there is any right answer here in terms of which is better, IBM/DTV or financials. It's whichever ones you feel you know more about and confident about that you should be invested in because those risk factors will look more threatening at some point and the key issue is going to be if you are confident enough to get through it, or freak out and sell at the worst time.

And which managements are going to do the right thing when these scary things happen. Do you trust that they will do the right thing for the company and shareholders? If yes, you let them worry about and just hang tight.

Thanks for reading.

Thanks for the reply and some really good points again!

Have any thoughts on the Fed stress tests? Still like JPM and WFC the best?

No, no new thoughts. The banks look pretty solid. In terms of management, yes, JPM and WFC are my favorites. But in terms of valuation, C and BAC are interesting too as they have room to move up.

Hi KK ,

I have a question regarding interest rates.

Is it the level of interest rates that matters for banks or the steepness of the yield curve ?

I can understand that if you borrow at 1 and lend at 3 your spread is 2 , if rates double your spread is 4 so you better off but not if the yield curve flattens. I understand JPM expects to make more money when interest rates normalize , is there an expectation for further steepening of the yield curve ?

What do you think are the most important drivers for JPM in the long run. Is it the growth of US and global GDP ?

Finally although this may not come under JPM and you might not want to answer it here but been meaning to ask you this question:

if you had to invest in 10 stocks but you could not touch them for 10 years what would you choose ?

Thanks

Hi, On invest day, they said that a rise in short term rates will have the biggest impact, as think they are sitting on a lot of cash doing nothing. Keep in mind they have a lot of noninterest bearing deposits that aren't loaned out which would be very profitable with higher short term rates, so it's not even really the steepness at this point that has the biggest impact.

The drivers are economic growth, normalization of interest rates (higher, non-zero rates), normalizing legal / legacy costs, housing recovery, corporations spending more (instead of hoarding cash etc…).

As for 10 stocks, I don't know which ten, but I do tend to post ideas that I like here, so for the most part, I like what I have talked about here; take your pick!

Thanks for reading.

Thanks a lot for the reply.

I also found an old post of yours Net Interest Margins etc thats was very thorough on the effect of absolute rate levels and yield curves.

cheers

Timothy Geitner's memoir heaped praise on Jamie Dimon.

"One institution that did overestimate Lehman’s ability to survive was Lehman. Hank and I repeatedly pressured Fuld to sell his firm or at least raise much more capital, but he was late to act and deeply unrealistic about the strength of his position. At one point we persuaded him to ask Warren Buffett to invest in Lehman, but Fuld demanded a much higher price than Buffett was willing to pay. Fuld often called me to complain that his competitors were spreading rumors, or to suggest it was our responsibility to help his firm get out of its worst investments. Like many of those atop the more vulnerable financial institutions in the summer of 2008, Fuld seemed to think that he was a victim and our job was to save him from an unfair world.

By contrast, the leaders of the stronger firms seemed more realistic, more willing to face the darkness. Around that time, a team of the best economists at the New York Fed gave a presentation to our board on the potential losses ahead for banks, based in part on outcomes from recent recessions.

Jamie Dimon laughed at them. He told them to throw out their historically based estimates and triple their projected losses."