OK, so here we go. Hopefully this will be the last part in this marathon series.

BRK LTS 2005

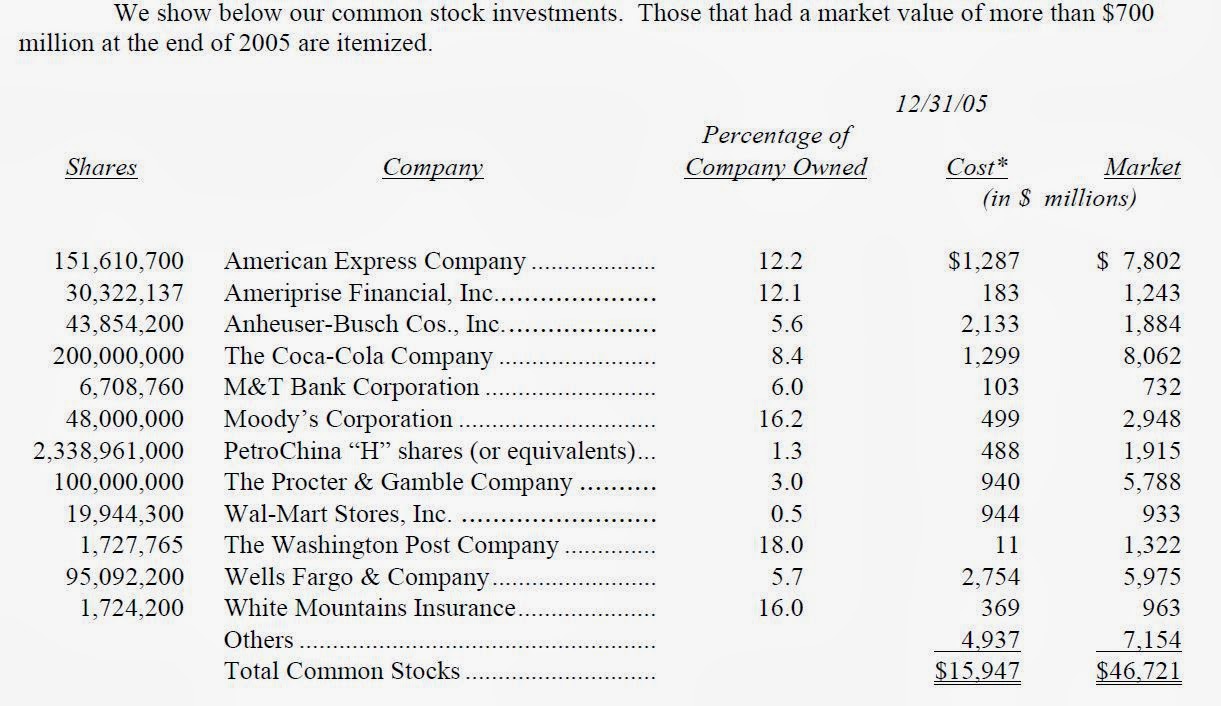

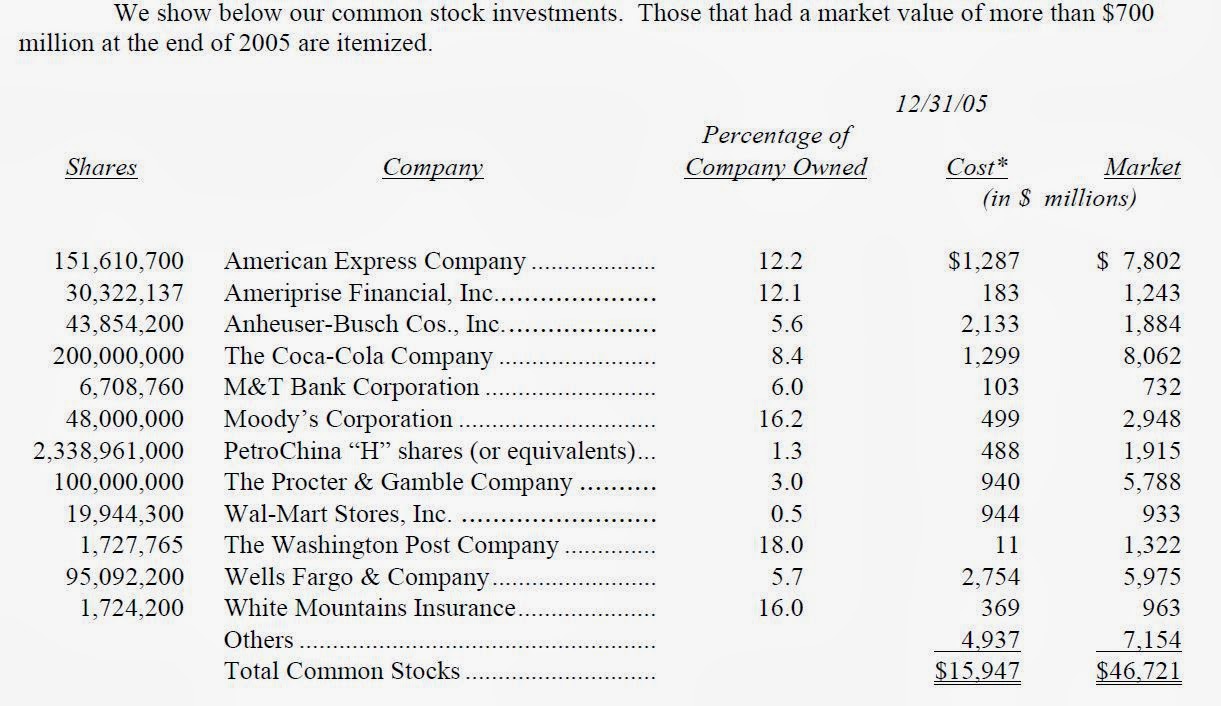

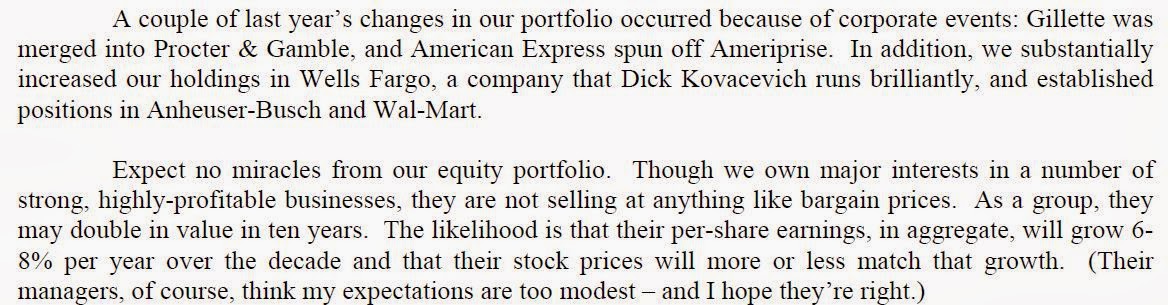

So 2005 turns out to be an interesting year. After years of not doing much in the stock market, Buffett initiates positions in Anheuser-Busch, Walmart, and “substantially” increases his position in Wells Fargo.

It’s been a while since he did something major in the stock market, but since 1999/2000 or so, he has been very active in purchasing private businesses; that’s where the relative value was, and as he said, even at the same price he would prefer wholly owned businesses.

Anyway, this is exciting because we haven’t seen much action in the stock market so these new additions will give us a benchmark (or confirm what we know) in how he values businesses.

Interestingly, here is the background of 2005: The market has been rallying since the 1999/2000 pop of the Great Bubble, and the market is heading up towards the old bubble highs. The valuation backdrop was that the S&P 500 index p/e ratio was around 18-20x and the Shiller p/e ratio was around 26-27x, both at the high end of their valuation ranges. The ten-year bond rate was between 4-5%.

Market sentiment was still cautious due to the recent bubble pop and high valuations. But this was before the 2006-2007 bubble really took off (even though people were talking about a housing and credit bubble already).

This is hardly the environment for value investors to be active. The valuation dispersion that we saw in 1999/2000 was not really there in the mid-2000’s as I recall. Value stocks went up as expensive stocks went down, so things seemed more or less fairly valued around then.

Anyway, here are some snips from the 2005 annual report:

WFC Case Study

Let’s take a look at Wells Fargo (WFC) first. I am particularly interested because I have been into banks and we all know that Buffett loves WFC. He bought WFC back during the banking crisis of 1990, so it is interesting to see him step up and buy a bunch of stock at non-bargain prices.

Here is some information about WFC as of 2005:

BPS: $24.25

diluted EPS: $4.50

ROE: 19.57%

ROA: 1.72%

Stock price range: $57.62 – 64.70

Closing price (2005-end): $62.83

Of course, this is 2005 actual data which was not known during 2005, but since WFC is a stable business, I don’t think estimates would have been far off.

We don’t even need to go find out how much Buffett paid for WFC since the price range in 2005 seemed to be pretty tight, within $58-65. Let’s take the midpoint of that of around $61.

At $61/share, that’s 2.5x BPS! Buffett paid 2.5x BPS for a big bank not long before the financial crisis. 2.5x BPS sounds like a fantasy now for banks to be valued at.

But let’s see what’s going on here. Why would he pay so much? ROE was around 20%, so that’s one factor. With EPS of $4.50, $61/share is 13.6x p/e.

Remember, though, that Buffett said in one of the letters that he wants to pay 10x pretax earnings. I also remember Charlie Munger at an annual meeting using WFC as a benchmark for valuing potential BRK investments; he said that if they can buy WFC at 10x pretax earnings, why would they look at something else? Alice Schroeder also said a while back that this is all Buffett focuses on; trying to make a 10x pretax yield. Buffett also mentioned the 10x pretax hurdle in an annual meeting.

I also made a post not too long ago claiming that Buffett would keep buying WFC right up to 10x pretax earnings per share (see Wells Fargo is Cheap! and 13% and 15% Pretax Returns Now!).

So this is a chance to look back and see how this measure applied during 2005. Pretax earnings in 2005 for WFC was $11,548 million (ignore minority interest as it’s small) and diluted shares outstanding was 1,705.5 million. That gives us a pretax EPS of $6.77/share.

That means at $61/share, Buffett would have been paying 9x pretax earnings, and was probably willing to go up to $68/share.

So my posts claiming that Buffett would keep buying WFC right up to 10x pretax earnings is not even hypothetical; he did pay something similar to that in size in 2005.

So that’s kind of exciting.

By the way, using 2013 figures, let’s see where Buffett’s limit is for buying WFC. Pretax earnings were $32,629 million. From that, let’s be more accurate now and deduct minority interest of $346 million and preferred dividends (and other) of $989 million for a pretax to common of $31,294. Diluted shares outstanding was 5,371.2 million so that’s $5.83/share in pretax EPS in 2013 for WFC. 10x that is $58.30/share. So Buffett can pay up to 18% higher than the current price ($49.61/share) and still meet his hurdle!

JPM Tangent

OK, let me go on a tangent again. Well, Buffett owns (or did own until recently) JPM so maybe not such a big tangent.

All of the above would also mean, by the way, that Buffett probably sees JP Morgan as worth far more than the current valuation (put a 10x pretax multiple on it like I did in one of the above-linked posts).

JPM had $6.50/share in pretax EPS in 2013 (pretax profit less $1.3 billion in preferreds and other distributions) so Buffett would pay up to $65/share. But there were some one-time legal expenses too, so let’s use the net income of $27 billion from the “earnings power” slide from the 2014 Investor Day presentation. Pretax, that would be $38.5 billion and less $1.3 billion of that stuff between net income and net income to common shareholders and you get $37.2 billion pretax profits, and with 3.8 billion shares outstanding, that’s $9.79/share in pretax earnings power at JPM.

So Buffett would be happy to pay close to $100/share for JPM! Am I crazy? Don’t look at me. I’m just doing the numbers. The proof is there.

What about WMT?

The figures for WMT in 2005 were as follows:

EPS: $2.68

diluted shares outstanding: 4.2 billion

Pretax income: $17,358 million

Pretax EPS: $4.14

Stock price range: $42.49 – 53.51

So WMT’s p/e ranged between 15.9x – 20x; not so cheap, but on a pretax basis, the p/e ratio was 10.3x – 12.9x.

We see that at the lower end of the range, WMT would have fit the 10x pretax earnings hurdle. I remember he said he regretted not buying more WMT as he was working to buy shares but stopped as the price got away from him. I don’t remember when he said that so don’t know if he is talking about 2005. If he was, then it makes perfect sense, right? At the lower end of the range, he was paying around 10x pretax earnings.

So now, not only do we have confirmation from Buffett that he likes to pay 10x pretax earnings, but we see him actually doing it back in 2005.

And again, it’s very interesting that he was doing this at a time when the Shiller p/e and normal p/e ratio of the stock market were so high. This is not the behavior of a market timer, but a stock picker with a very specific return target. Of course, qualitative analysis is very important too; Buffett wouldn’t buy just anything at 10x pretax earnings.

Anyway, when I started out this series of posts, I didn’t expect to realize this sort of thing (but I shouldn’t be surprised; it’s just what I would have expected).

Also, he notes that he sees modest returns going forward in the stock portfolio; 6-8%/year over time. But he doesn’t sell out despite stocks not being cheap and the overall market being expensive as the expected returns are reasonable (considering long term rates under 5% at the time).

Macro Guy

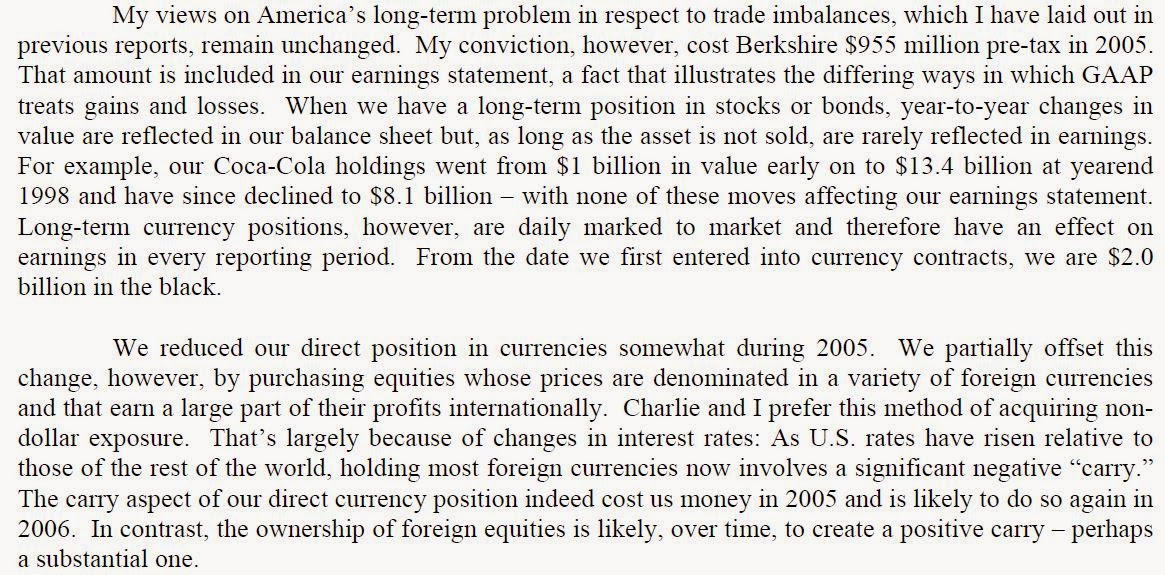

OK, so in the 2005 letter he does go back to more macro-talk:

It’s interesting that as he unwinds the foreign exchange positions, he replaced some of that with purchases of non-U.S. equities. This is very unlike Buffett. But I don’t think anyone would doubt that he would only do this if these businesses fit the very same mold as his domestic stock holdings. In other words, he isn’t just going to go out and buy foreign stocks just to get non-dollar exposure (like many people seem to do).

It’s important to remember that these macro ideas that Buffett does are not major contributors to the intrinsic value growth of BRK and importantly doesn’t take away from the productive assets in place. In other words, he’s not going to sell a perfectly good U.S. stock position to replace it with, say, a German phone company stock just to get non-dollar exposure. Nor is he going to sell the U.S. equity portfolio to buy a foreign exchange ETF, or an emerging market ETF or whatever else the dollar bears usually do.

When you read the advice given in financial magazines, they tell people to allocate assets to this area or that area so there is no capital efficiency; if you want foreign exchange exposure, people have to sell stock and then go and buy a Japanese Yen ETF, for example.

The way Buffett plays it is that these positions are often just an overlay on top of BRK’s assets so he doesn’t give up anything in the current portfolio (except maybe some credit). That’s a big difference. He continues to benefit from the existing stocks and assets in place, and then he makes a macro play on top of it where he may make or lose money. And in any case, the positions are not big enough to cause a lot of harm (these are not George Soro-sized trades).

These are almost like intellectual diversions for Buffett. It would be a big mistake to try to play crude oil, silver or foreign currencies by saying, “But Buffett does it!”.

BRK LTS 2006

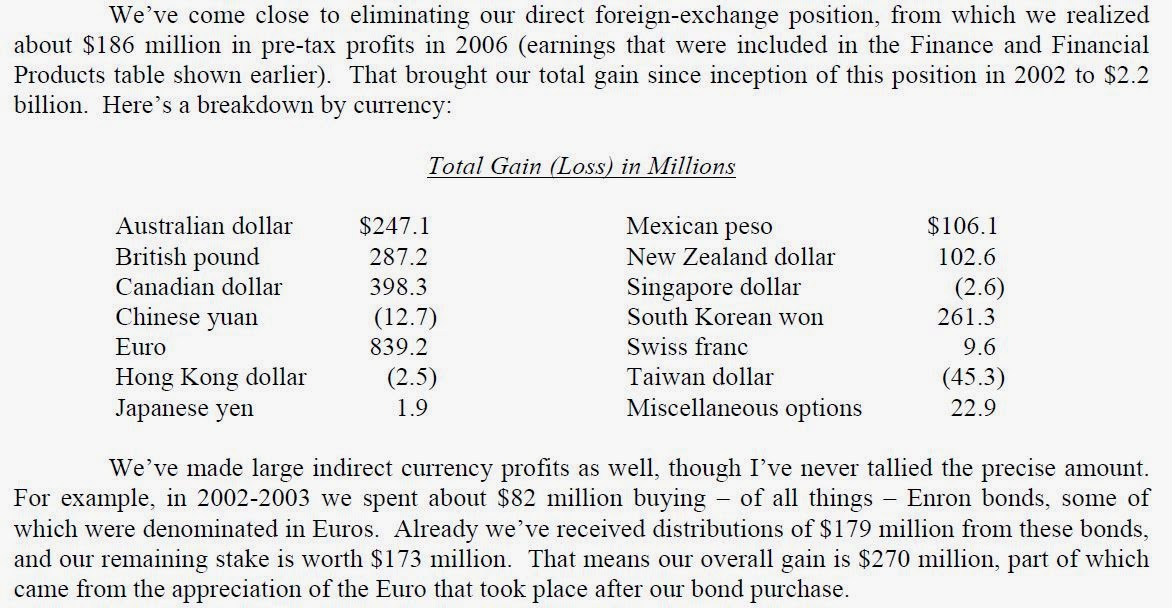

Not much stock market activity or comment in 2006, but here’s Buffett the macro guy again:

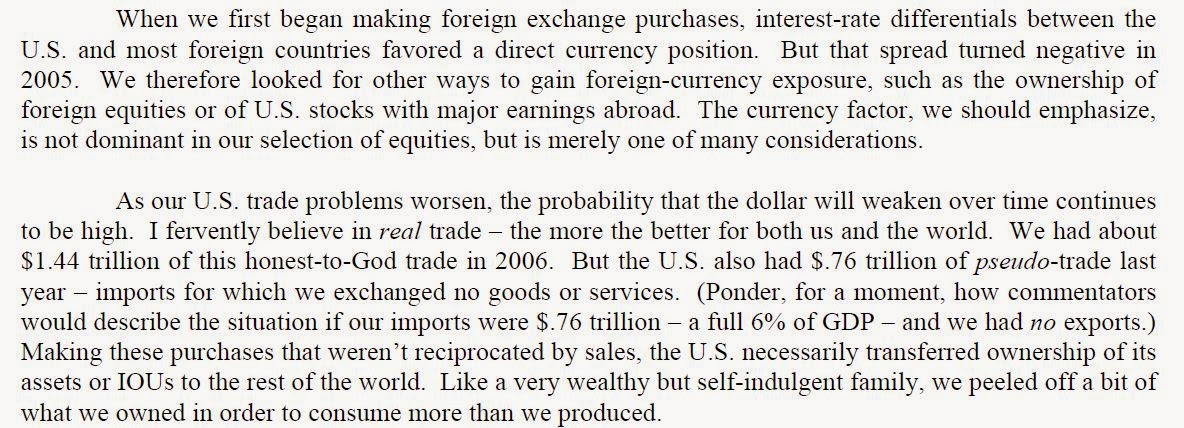

So here he is again talking about seeking non-dollar exposure via foreign equities and U.S. corporations with non-dollar revenues.

He does remind us that the FX factor “is not dominant in our selection of equities, but is merely one of many considerations.”

Compare this to some other people with a similar view on the dollar as Buffett. Some are bearish the dollar but want to spread their bets. What do they do? They short the dollar, short U.S. treasuries, buy gold and short the S&P 500 index. Why? To diversify. Hmm…

If Buffett is completely wrong on the direction of the U.S. dollar, how will he do? (Fine!)

BRK LTS 2007

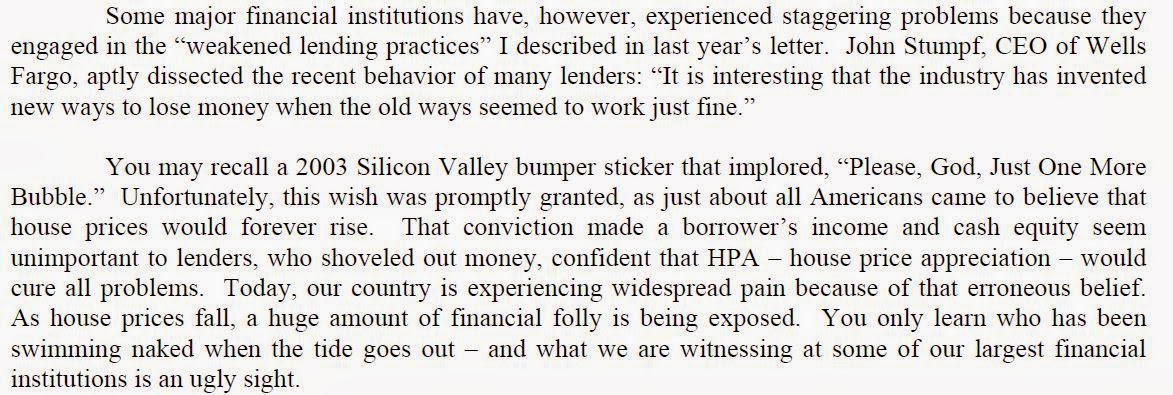

2007 is the year that things started to fall apart. There isn’t much discussion on it as Buffett had no idea how bad things would get.

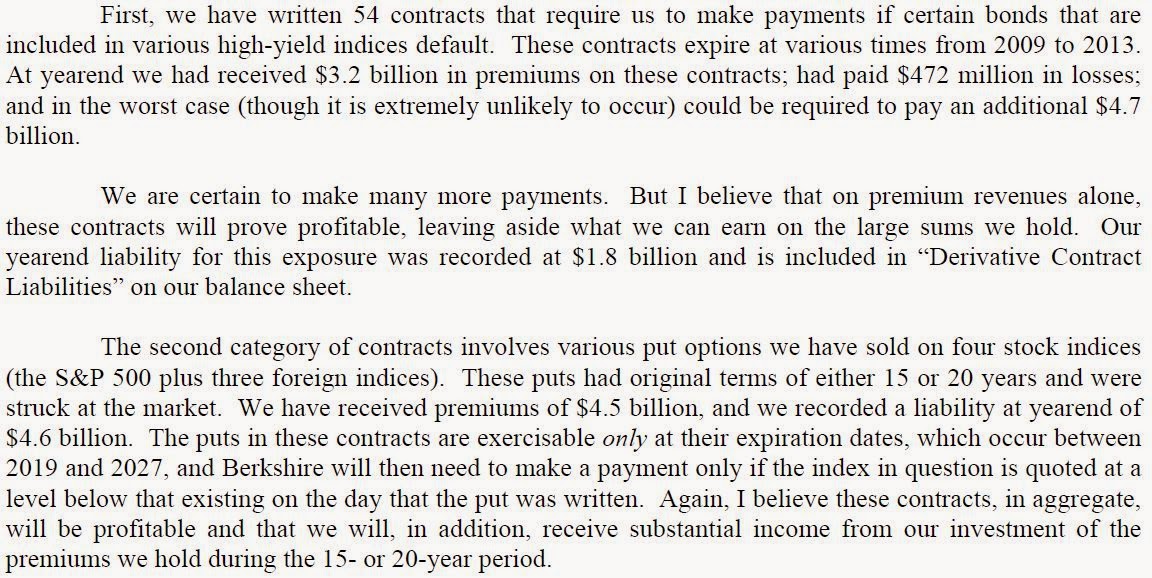

The short puts surprised a lot of people. And this was again right before the markets really started tanking in 2008 so very poorly timed. At least he could have gotten better prices in 2008. But then again, this was an opportunity based on the prices at the time, and it is a 15-20 year position so it doesn’t matter if the market crashed the next day, the next month or the next year, just as it didn’t matter when Washington Post stock went down 50% shortly after BRK bought into it. So what happened right after the position was put on is irrelevant. No matter how much people try, nobody (well, someone always does) ever really buys the low print of a stock on any given day. Just because you didn’t buy the low tick doesn’t make a stock purchase a mistake.

And More on FX

I think a lot of this stuff has to do with the fact that there aren’t that many stocks for him to look at, and when deal flow gets slow he gets bored and this is what he comes up with.

But again, whatever he is doing is not replacing what BRK is already doing so to that extent, it shouldn’t cause any harm.

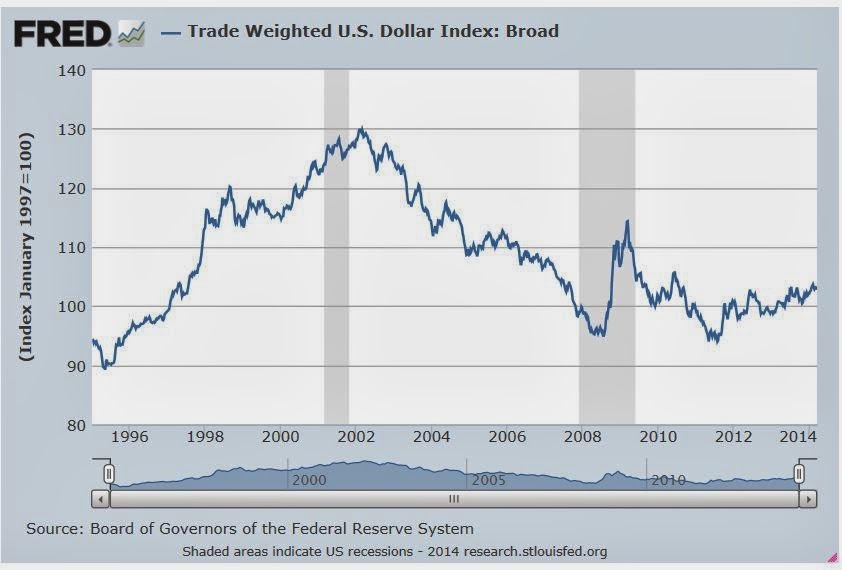

By the way, Buffett said he has been looking at a weak dollar since 2002, and his last foreign currency position (except Brazilian Real) was gone by 2007. So that’s a nice run according to this chart.

This is from the 2002 annual letter; I may have missed it and forgot to place it in Part 4 of the series:

So he put on the positions in 2002 and was out by 2007 so that’s a nice trade! He was bearish in 2007 too but got out due to the increasing cost of carry on the positions. Since then, it looks like the dollar hasn’t done too much.

The key here, again, is that if he was wrong, it wouldn’t have hurt him too much (he only made a little more than $2 billion on what looks like a spectacular run in the position according to the above chart), so if he was wrong it wouldn’t have been a big deal.

Many shared the same view as him on the dollar, including his thought that the problem could go well beyond the currency markets. But he played it in a way that wouldn’t have hurt BRK too much while many others played it in a way that they would win big if they were right or lose a lot of money if they were wrong. There’s a big difference there.

But yes, it’s a macro play nonetheless. We can argue he plays the macro (because he does), but you can also argue that he doesn’t as this stuff isn’t a very big value driver of BRK; it’s not the primary or even secondary driver of intrinsic value growth there.

BRK LTS 2008

So things really start to unravel. It’s interesting to note that in 2006 and 2007, the Schiller p/e was very high, in the 26-28x range throughout the mid-2000’s and regular p/e’s were also in the 18-20 range, the highest levels since 1929 excluding the Great Bubble (of 1999), and Buffett never talked about lightening up on stocks. Despite regretting not selling Coke during the Great Bubble, there is no talk of selling anything throughout this ‘expensive’ period.

Let’s see what he sees in 2008:

Despite all of this, he shows no indication of trying to set up a hedge or anything like that. BRK is built to survive tough times like this, so there is no talk of having to hedge, lighten up or anything like that.

Here is his view on the market during this scary time:

So he is “certain” that the economy will “be in shambles throughout 2009” and probably “well beyond”, but he still insists that “that conclusion does not tell us whether the stock market will rise or fall.”

He says they will continue to do the four things they always do, in good times and bad.

I remember at this time the parlor game was guessing who will fall next and how far down the market will go. People rushed to leveraged bearish ETFs and things like that. Others who are otherwise ‘intelligent’ insisted that the market won’t bottom until it gets to 7x p/e or probably lower since this crisis is worse than 1982 or 1974.

Anyway, Buffett’s game is not to try to forecast these things and get out before they hit and then try to get back in when the coast is clear, but to try to build an organization (and buy stocks of businesses) that will be strong enough that they won’t have to predict this sort of thing and try to adjust accordingly; that would be like driving a car and not putting on the seatbelt having the confidence to know when an accident will happen so you can just fasten your seatbelt right before impact. I know that sounds so stupid, but this is what happens in the markets!

So let’s take a look at his activity in 2008:

We already know of his big buys during the crisis; the GE , GS and Wrigley deals.

He does mention his mistake of buying Irish banks that lost value pretty quickly and his error of buying ConocoPhillips stock when oil and gas prices were so high. He said he didn’t anticipate crude oil prices going down to $40-50, but he shouldn’t really care about the short term if he is confident crude oil prices should be higher than that over time. In that sense, it really wasn’t a mistake, but only something that looks like a mistake temporarily.

Oh, and is expecting higher crude oil prices over time a macro call? He is a peak oil believer. Judging the long term supply and demand situation of a commodity may be more industry analysis than macro call (he is not expecting higher crude oil prices due to stronger than normal economic growth, for example).

But OK, if someone wants to call it macro, that’s fine. I won’t argue.

He sold some Johnson & Johnson, Proctor & Gamble and ConocoPhillips stock, but he says that was to fund the purchase of the preferreds; he would have liked to keep them but wanted to keep a rock solid balance sheet with ample cash. So that’s not really a market call or anything like that.

Buy American. I am.

In October, 2008, Buffett wrote an op-ed in the New York Times telling people to buy American stocks. He also said he is doing exactly that in his personal account which until then only had U.S. treasury bonds in it.

This is sort of a market call, but he was just warning people from panicking and getting out of stocks which would be a big mistake. He points out the non-correlation between economic outlook and stock prices.

But isn’t this market timing in his personal account? Well, not really. I think his default position in personal portfolio is cash or bonds. If he is going to spend time looking for investments, his time is better spent looking for something for BRK because his personal account is less than 1% of his net worth. Why bother even trying to double that if it will only increase your net worth by 1%?

But sometimes things get so silly and out of whack (like Korean stocks a while back) that he just jumps in with his personal funds. If things stabilize and normalize, he will probably go right back to bonds (well, he thinks bonds are the biggest bubble ever, so maybe not bonds).

BRK LTS 2009

We know Buffett put a lot of capital to work in 2008/2009. Anyway here are just some quotes:

Stock sales were made to help fund the BNSF acquisition, so it has nothing to do with the market.

And a lot of cash has been put to work:

BRK LTS 2010

People still are shaken from the crisis and Buffett tells us that things are always uncertain, but that things will be fine over time:

Before I move on, let’s look at the valuation background of the market during 2010-2013. This stuff is from the Shiller website so I’ll list the Shiller p/e and regular p/e:

Data as of January 1:

Shiller p/e TTM p/e

2010 20.52 20.70

2011 22.97 16.30

2012 21.21 14.87

2013 21.90 17.03

2014 25.30 19.30

So you notice that during this time that Buffett tells people not to worry, prices are not necessarily cheap.

BRK LTS 2011

And some major commitments in stocks again in 2011:

So let’s take a look at IBM and WFC really quickly. We know Buffett paid 5x p/e for WFC back in 1990 or so, but then paid 10x pretax profit in 2005. He added another billion in 2011. How much did he pay?

Pretax profits in 2011 was $23,656 million. Subtract minority interest of $342 million and preferred dividends of $844 million and we have pretax earnings to common of $22,470 million. With 5,323 million diluted shares outstanding, that comes to $4.22/share in pretax EPS for WFC. The stock traded in the range of $23-$34 and closed the year at $27.56/share. So WFC traded in the range of 5.4x – 8.1x pretax profits, and closed the year at 6.5x pretax EPS. Of course Buffett was buying. What were you doing?

How about IBM? Doing something similar, IBM had $17.50 in pretax EPS in 2011, and just dividing the “cost” by the number of shares held for IBM in the table of the 2011 annual report, we see the cost of the IBM position is around, guess? $170/share. That comes to 9.7x pretax EPS. Bingo.

If there is any doubt that 10x pretax earnings is his ‘hurdle’, there should be a little bit less now. I liked the 2005 WFC example, but it’s good to see that the metric hasn’t changed for the bank after the crisis as he has been buying after 2011 too.

And keep in mind that when he says he likes to pay 10x pretax earnings, that is not the same as saying that he thinks intrinsic value is 10x pretax earnings. He likes to pay less than intrinsic value, right? So businesses he likes are worth far more than 10x pretax earnings. That’s just what he would pay, not what he would fair value something at.

BRK LTS 2012

So finally we get to 2012. Combs and Weschler have started investing BRK’s capital. Also keep in mind the market levels; the market is by no means cheap at this point. Buffett didn’t tell these guys to wait and don’t invest until the market gets to an 8x p/e or 12x p/e or anything like that at all (just like Buffett ignored warnings from his dad and Benjamin Graham when he started in the 1950’s).

We also have to remember that Combs/Weschler are outperforming the S&P 500 index by a wide margin, but that’s because they are managing $5 billion or $7 billion each. If they had to take over the BRK portfolio that is now well over $100 billion, they won’t be able to outperform by so much.

For example, if they both outperform the index by 10%, that’s worth $1.0 – $1.4 billion to BRK. But if they took over the $100 billion portfolio, they won’t be able to outperform by 10%, but they only need to outperform the index by 1.0% to 1.4%/year to give BRK the same dollar benefit. If they do better than that, of course that’s great too.

In any case, Combs / Weschler can do what they do now for a while, but at some point they may have to evolve into looking for more elephants for them to really move the needle at BRK. But if anyone can do that, it is probably them.

Here are some comments on the stock portfolio. He does mention continuing to buy more WFC, which is obvious judging from it’s pretax EPS cheapness.

And here’s more comments about not trying to time things too much:

BRK LTS 2013

I just wrote up the 2013 letter so I won’t repeat it here, but he has a long discussion about investing there and it is pretty much the same as usual. Don’t try to get in and out. Look at what something can earn, the price you pay and then just let it ride.

Conclusions

So over the past few days, I went through a bunch of Buffett’s writings, primarily focused on seeing if he is actually a market timer or not.

My conclusion is that he isn’t, really, even though he acts that way at times. Not buying stuff because things don’t look interesting is not really timing as he still has much of the BRK portfolio riding on the line; he is not hedging it out or lightening it up etc.

Here are some random bullet points of thoughts that come to mind after going through all of this stuff:

Market Timing

- Right from day one in the partnership, against his dad’s and Graham’s advice not to get into stocks, he displays independence and disregard for market views, even from people he respects. This is not the beginning of a career of a market timer.

- Throughout the partnership years, he did go back and forth (in weighting) between general issue holdings and workouts leaning more towards workouts when markets were expensive. This is not so much market timing as much as moving assets to where they have the best prospective returns. I think of market timing more as people who get out and sit on cash to wait to get back in, buy puts or put on some other hedge etc.

- He did liquidate the partnership in 1969, right at the top. This was obviously partly because the markets were too high. But on the other hand, he was trying to beat the market by a wide margin and that got harder and harder to do. I don’t know if Buffett would have recommended to people to sell stocks just because they are expensive if someone had a portfolio of stocks they liked. He did hold onto his BRK shares and bought more, I think, in the early 70’s and never sold a share. He also said that he wanted to slow down, so the unwinding of the partnership was sort of a transition phase for him.

- In his last letter to his partners, he saw potential returns in the stock market of 6%/year. He noted that bonds for the first time offered the same prospective returns as stocks, though. And he did recommend an equity manager (Ruane). This expected return isn’t too different than what he said before; early on he saw prospective returns of 5% in stocks and kept running his partnership for many years thereafter.

- Even in BRK (in 1970), he sold all marketable securities with no further plans to buy any in the future. The sale was to fund the purchase of a bank. After the purchase there were other areas to deploy capital, so although market valuation may have been a factor here (no doubt a big one), it may not necessarily be the main driver (Buffett wanted to buy whole businesses more than stocks).

- He bought a bunch of stocks throughout the 1970’s responding to the bargain prices. But this isn’t really market timing either as he was just responding to market prices that are cheap.

- Note that he was very aware of inflation and it’s ill effects on stocks. And yet, he kept buying stocks. This is no action of a market timer. He even went so far as to question the validity of the legal structure of a bond (sort of a Buffett version of “Bonds are Dead” proclamation, I guess). But he kept buying stocks.

- Later in the 1980’s, 90’s and 00’s, he also responds to prices by not buying stocks for lengthy periods. He buys more private businesses, and holds cash and bonds when nothing else is available. But it’s interesting to note that cash levels are not held for very long (he always needs to hold some cash) as capital is eventually deployed somewhere.

- This is an important distinction to make: Buffett will insist on bargain or reasonable prices and a margin of safety to buy a stock, but that is not required to hold a stock. For permanent holdings, he would not think of selling even if it got substantially overvalued. Most market timers will sell or get out when prices are no longer attractive or reasonable (and wait in cash. It’s not market timing to get out of something priced reasonably to buy something cheaper). I think this is an important point and one reason why Buffett has done so well over the years. Like he says, what if something you like gets fully valued and you sell? Then what do you buy? You will have to buy something just as good at a lower price. And if you don’t?

- Buffett would not have his record if he sold out of stocks every time he thought the market or even his holdings was fully priced. He did regret not selling Coke, but if he sold Coke during the Great Bubble, what other things could he have sold that wouldn’t have been good idea?

- He did say markets were too expensive in 1999 and warned people against expecting 20%+ returns over time. But this was also not an alarm bell that a crash was coming. I think he would still have advised people to own an index for the long term as he said he still expected returns over time of 6%/year. If you sell stocks, then what do you buy? He is not one to tell you to wait for a correction and get in cheaper later. At most, he will tell you to gradually buy in over time so as not to put everything in at the very top which would make you feel like an idiot.

- And he did say Buy American in 2008. This was sort of a market call, but more a warning to people who were rushing out of stocks in panic. Also, it was based on sentiment and pricing; he warned people that there is no correlation between economic outlook and stock prices.

Macro

- So, yeah, Buffett had crude oil, silver and foreign currency positions. He is short long-dated index puts and he was watching crude oil prices when investing in ConocoPhillips. But these were never really going to drive (or destroy) value at BRK. Who knows what else there have been that we don’t know about!

- The important thing to remember is that he didn’t “tilt” his portfolio over the years according to his macro views. Most of these things were overlay positions at low cost that had little impact on BRK’s other businesses. The way other typical funds would ‘play’ these macro themes (and hurt themselves) would be to ’tilt’ portfolios to be exposed to these various factors (buy exporters to play weak dollar etc.). Individuals would buy bear funds or FX ETF’s (funded by selling some stocks or other holdings which is very capital inefficient).

- He never let his macro views get in the way of BRK’s main businesses; they had very little impact on BRK’s other businesses and stockholdings.

- If he was wrong, BRK shareholders would have hardly noticed. Funds with the same view as Buffett that hedged out their equity exposure or bought puts most likely noticed some impact on their returns (if the manager was wrong). Again, the folks at DRCVX (see here) had the same view as Buffett with respect to the U.S. dollar but had very different investment results over the years.

Just wanted to take a moment to say thanks for the very comprehensive work here. It is appreciated.

Here's to hoping you get your Annual Report Online Library/Archive realized!

Thanks.

As for the annual report library, I'm not trying to do that; I don't have anywhere near the organizational, administrative skill to do anything like that at all.

But I just thought it was a great idea; in fact, as great an idea as when Andrew Carnegie set up all the public libraries in New York City and around the country! Help people help themselves!

Is there any Adderall left in Brooklyn? 🙂 Just joking. These have been really great! Thank you!

kk, thanks as always for sharing your work with us however I regret to inform you your work isn't done !! You deserve a day off, ok maybe two, then I respectfully suggest , your mission should you agree to accept it is, your next brk post should read , the liquidation years, 2007 until forever. The foundations started to sell off buffett's life work , about 30 million shs a year which requires about 4 billion in net buying per year forever to absorb those stock sales. How has buffett's thinking changed since 2007 with respect to making shareholder friendly moves to help absorb those sales at what buffett considers reasonable prices relative to bv ? Thank you if you agree to tackle the job, if not, that's cool too !! hc.

Hi,

That's a different issue; I am only looking at what happens within BRK, not with BRK stock.

As for absorbing foundation sales, I don't know if that's a big problem. These big sort of owner-operated businesses have founder/owners selling shares constitently for many years, like Bill Gates, and that's never really an issue. The issue is more what's going on with the business and what it is worth.

$4 billion / year is $16 million/day, and BRK trades around $500-600 million per day in volume, so it shouldn't even really be an issue. The market cap of BRK is now $305 billion, so you're talking about the sale of less than 2% of the market cap every year and it's not even dilutive shares or anything; they are already outstanding and trading shares just changing hands.

So I don't know. If you asked Buffett, I think that's what he'd tell you too… that the market should be able to absorb it, that growing the intrinsic value of the business is more important and markets will eventually reflect what a business is worth etc…

kk,

This was a great series and I enjoyed it — so thanks.

With that said, I do want to make one observation. I think you may be misapplying something you heard about Buffett wanting 10% pre-tax returns. As far as I am aware, he did say at an annual meeting (2012?) that they like to pay 9-10x pre-tax earnings when they buy operating businesses (not in reference to stocks).

In reference to stocks, in his annual report one year he wrote "Unless, however, we see a very high probability of at least 10% pre-tax returns (which translate to 6½-7% after corporate tax), we will sit on the sidelines."

I think you're making a mistake translating the two into meaning he likes to buy stocks at 10x pre-tax earnings. For one thing, pre-tax earnings don't mean a whole lot for businesses Berkshire doesn't own — what matters to them as shareholders is after-tax earnings. So for him to use that as a yardstick seems a little odd to me. In addition, with operating businesses, he can reallocate all of those earnings as he chooses — meaing he can translate that 10% going-in yield to a 10% compunded yield over time through his reinvestment choices. He's getting his 10%.

You'll notice he did not phrase his reference to stocks in the same terms in the annual report. He said he wants 10%+ annual returns on the stocks over time before the corporate income tax takes its bite (no capital gains tax in a corporation). So if he buys Wells Fargo or Wal-Mart at a what he considers a fair price, expecting its earnings to grow at 7% a year, as stated, and he collects a 3%/yr yield in dividends and buybacks — he's got his 10%, no? That fair price might coincnidentally be in the 10x pre-tax earnings range, but I'm not sure he's using that as the yardstick. You'll notice he stopped buying WFC in the second half of last year even though under your defintion it was still well within his range under 10x pre-tax earnings.

I'm sure he wants even more than 10% where possible, but leveling out all kinds of different businesses with different growth rates, capital intensity and so forth, and saying he likes to pay 10x pre-tax earnings (which remember, translates to like 16x after-tax) for all of them — just strikes me as applying something he said in a way he didn't intend. I think his yardstick is earning 10%/year compounded returns before taxes — the earnings multiple he's willing to pay in order to assure that probably varies from one situation to another.

The other thing I did want to comment about was that his WMT statement (about regretting not chasing it up) was in reference to stock he started to buy in the mid-90's before it eventually quintupled.

Hopefully you get where I'm coming from here — I don't mean to be too critical, I love the work you're doing.

Thanks,

Jeff

Hi,

Thanks for that. I figured WMT might be an earlier situation as it hasn't done too much.

As for the pretax 10%, yes, someone raised the exact same issue when I posted about WFC, and it's a really good point. You are probably right. Whenever Buffett talks about expected return for the whole stock market, it was GDP growth plus dividend yield. So earnings growth plus dividend yield is probably the correct way to look at expected return on any given stock.

Having said that, the reason why I am still comfortable with the 10x pretax for listed companies is that I like to look at value companies at what some rational business person would pay for it in a private transaction, not necessarily as a stock. Many value investors (including Buffett) like to value things based on what a business is worth in a private transaction. He said that about Washington Post when he bought it years ago.

So in that sense, forgetting about WFC as a stock for a moment, he would pay 10x pretax for the whole thing, right? Forget about the fact that he can't do that (regulations etc…).

That's where I get comfortable with it. This may be totally wrong, and Buffett may in fact be closer to your approach when it comes to stocks.

On the other hand, you are right. Even if he paid 10x pretax for a listed company, he actually may not earn a 10% pretax return on it (that depends, as you say, on dividends and earnings growth).

As for stopping buying WFC, he is already coming close to ownership limit, so he may slow down anyway. Also, purchases may be tempered by potential elephants on the horizon so we can't read too much into the timing of his purchases (he won't automatically buy at 10% and then stop at 9% etc…)

Anyway, thanks for the thought and the good vibe of the question. I don't mind being corrected; this is one of the benefits of posting something publicly; if it leads to an interesting discussion and I learn something, that's a really good thing!

Oops, and I also forgot to mention, expected return over the long term on a given stock is earnings growth plus dividend yield, but this doesn't answer the question what the business is worth.

So if you take 10% pretax yield, that comes to 6-7% net earnings yield, that comes close to the long term p/e ratio of the stock market over time. So in a sense, it's like Buffett wants to pay the average price for American business over time for an excellent business. That makes sense too, even though I don't think that's the way he is thinking about it.

Anyway, again, this is an interesting discussion and I don't know the answer. Sometimes the answer doesn't even matter as long as it makes us think about all of these things and each little discovery becomes a piece of the puzzle to help us think about things in the future…

Oh, and by the way, as for valuing everything at 10x pretax no matter what, I think this is exactly what Alice Schroeder said in a speech a while ago. She said something to the extent that that's all Buffett wants; a 10% pretax yield. And I'm pretty sure she said that he doesn't fudge that number like many others so. He doesn't lower the hurdle for higher quality businesses and increase the hurdle for riskier things.

So it's not like he would accept 8% pretax for a really high moat business, but would demand 12% yield for a riskier, cyclical business. Schroeder made clear (at least I think she did) that he did NOT do that and really wanted a solid investment. If it's risky, then he's not going to up the hurdle to 15% or anything like that. He will just skip the investment. If something is super high quality, he's not going to lower the bar and accept 7% pretax, for example.

So if it's too risky, skip it. If it's too expensive, no matter how high quality, skip it.

So he does, in fact, want to price everything at 10x pretax.

Of course, I may be wrong on that… But that's what I remember from that speech…

I recalled Alice Schroeder mention that Buffett looks for a 15% annualized return on his investment. If it doesn't then he moves on to the next one.

I think it was in this video, but don't quote me on that haha.

https://www.youtube.com/watch?v=PnTm2F6kiRQ

Thanks for the link! I have to take that back about Schroeder; she does say that Buffett wants 15% and that's all he's ever wanted. But she did say 10% was the minimum when he accepted the 10% coupon preferreds (during the crisis) and she said he will get the 15% he wants, though.

You just missed Alice Schroeder IMA on reddit five days ago: http://www.reddit.com/r/investing/comments/2550vq/hi_im_alice_schroeder_author_of_the_snowball/

Could have asked her to clarify… 🙂

Some good info from her there.

Thanks, I did read that interview. It was interesting stuff for sure. Anyone who has spent so much time with Buffett would be interesting to listen to.

But as for how Buffett invests, I don't know that she has any new secrets or anything. She is right that there are a lot of people who write books about how he invests and trades and some of that stuff is really far off even judging from a casual observer like me.

On the other hand, I don't think there is any special method or formula either. He has already explained many times what he looks for so I don't really think there is that much of a mystery. If he actually ever did sit down and explain an investment, I bet most people would be surprised at how simple it is; they would probably be disappointed, actually. Look at his explanation of his real estate investments.

Of course, even if his explanation is very simple and metrics straight forward, obviously there is going to be a lot more behind all that stuff; his deep understanding of people, how they work, organizations, industry characteristics etc… That is where all the 'work' is going to take place. So at the end, if he says he expected a 10% or 15% return, that is going to be the easy part. The hard part is his judgement about how sure he is that the investment will work out.

So that's another reason why there won't be any special "Buffett method".

As for how to find picks and evaluate investments, there is a lot of great stuff out there, including the Greenblatt books and evaluation of investment ideas by great investors posted all over the place and I honestly don't think Buffett would be doing things very much differently that those guys if he was still running the partnerships with much less capital (I bet he would be focusing on Stock Market Genius type ideas, post-bankruptcy reorgs and things like that).

How he invests now is very different due to his large size; he invests in capital intensive businesses these days because he likes businesses where the capital can be reinvested at a reasonable return. So even in that sense, his goal has shifted over the years…

Yes, agreed. 🙂

A big thanks for doing an excellent job at interpreting the letters. It's a big bonus for the community.

Wow, amazing! Thanks for writing such an amazing series of posts! Can't believe you read all those BRK reports within a short time span. I'm barely on the 1990 reports and it's been 3 months.

Well, I didn't read all of every letter. I was only looking for his comments specifically regarding the stock market and investments, so for the most part I skipped all other areas of the reports (but I have read them all before).

anyone has any idea how to quantify the growth in BPS for BRK if buffett keeps buying companies at 10% pretax yield? Assuming no growth that this would translate to c. 7% growth in BPS? How does this help BRK to achieve the aim of increase in BPS by 15% (ideally) annually?

Well, Buffett wants at least 10% pretax, so not always exactly 10%. And he doesn't want to pay up for growth so any growth is a bonus, but he won't invest unless there is growth.

Thanks for all the hard and informative work!

Thanks for your follow-up kk. I had a response typed out and I accidentally deleted it (smart!), but I think we're in the same ballpark on this. I strongly suspect he's a little more discerning than just applying the same pre-tax multiples to businesses with varying attributes (tax rates, payout vs reinvestment, returns on reinvested capital, etc.) but on the other hand, such an approach would probably work out OK and has some sense to it.

Thanks,

Jeff

One of the valuable information about the brooklyn investor.Thanks for your good information on it.

http://www.australianangelinvestor.com/

Great work, I really enjoyed it! Just one quick comment, I think Buffett subtracts a certain amount from pre tax earnings to take stock option issuance into account. I think he explained at one of the annual meetings how he calculates the amount but I can't recall exactly. It should be in one of the OID transcripts.

FWEIW, I have also seen him tell college students (thru their notes) that he will pay up to 7x EV/EBIT for a good business. Even among some great companies that is a much different number than 10X pre tax. Not saying for a second that your analysis is wrong…but it's interesting to note

Sorry, wrong thread

Interesting to see both WFC and JPM on lists for obsured information. Economic earnings are allegedly 20B and 21B less than GAAP Net Income for the year.

http://www.forbes.com/sites/greatspeculations/2014/04/02/obscured-information-complicates-value-investing/?partner=yahootix

I wouldn't worry about that. The calculation of economic earnings deducts the "cost of capital" which is highly suspect in many cases. But even if you calculate an accurate cost of capital, of course the difference between net income (which doesn't deduct cost of capital except interest, dividends and other direct costs) and economic income would be greatest for the biggest firms. Since the difference would be the cost of capital, the companies with the biggest capital invested would tend to get to the top of that list.

So I don't know what value that list has, actually…

Thanks for these thoughts, very helpful. Two thoughts/questions:

1) In Buffett's recent Forbes piece, he mentioned a 10% return:

http://finance.fortune.cnn.com/2014/02/24/warren-buffett-berkshire-letter/

1986, I purchased a 400-acre farm, located 50 miles north of Omaha, from the FDIC. It cost me $280,000, considerably less than what a failed bank had lent against the farm a few years earlier. I knew nothing about operating a farm. But I have a son who loves farming, and I learned from him both how many bushels of corn and soybeans the farm would produce and what the operating expenses would be. From these estimates, I calculated the normalized return from the farm to then be about 10%. I also thought it was likely that productivity would improve over time and that crop prices would move higher as well. Both expectations proved out.

So, again, here is the 10% for something that will grow through price increases, productivity enhancements, etc.

2) It is interesting that Buffett actually picked up more shares in WMT over the past few years. Surprise, surprise–WMT again met the criteria you mentioned. Given this propensity to invest in wide moats at 10x pre-tax earnings, any thoughts on why Buffett did not buy even more WMT over the past few years? No ownership restrictions like he would have with a bank.

Hi,

That's hard to say. A lot has happened in recent years including some really big deals. Plus we know he really loves WFC. He also wants to bag an elephant too, so I think he likes to build up the cash to be able to get one (so he won't have to sell stocks to fund something later).

So it's really hard to say why Buffett wouldn't do something at any given point in time. We have no idea what is brewing and what is in the pipleline. He has mentioned some big deals that didn't happened. So if something like that is on the horizon, he wouldn't rush to buy stocks unless things got silly cheap, maybe…

But I don't know…