So the JPMorgan Chase (JPM) annual report is out. After the Berkshire Hathaway report, this is my favorite read of the year. I say “annual report”, but I actually just mean “letter to shareholders”.

Anyway, here are some comments as usual. This is not meant to be a comprehensive summary or anything close to that; I will just comment on what comes to mind. So I would highly recommend reading the whole letter; reading this post is no substitute! It is definitely worth your time even if you don’t have any interest in investing in JPM. Read it here.

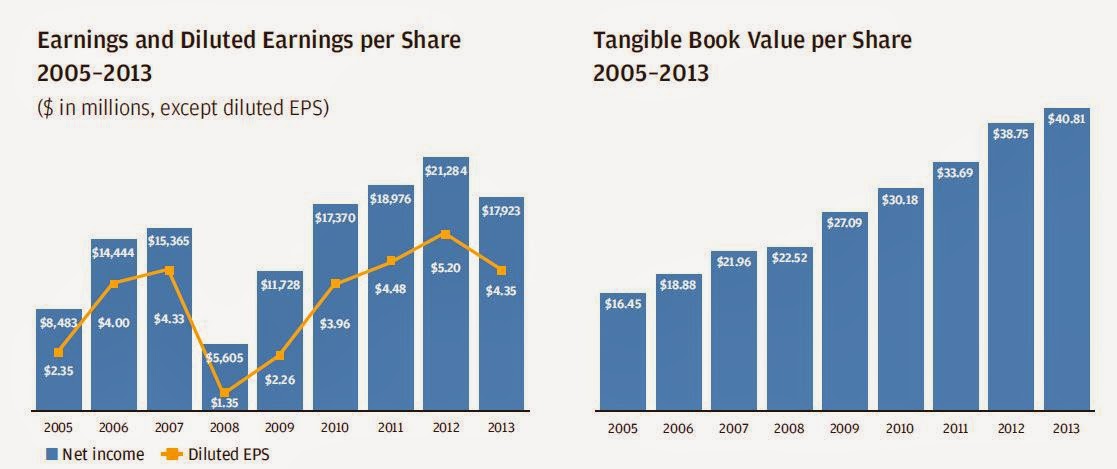

Earnings

More on earnings later, but Dimon points out that excluding the legal expense and some gains on asset sales and some benefits from reserve releases (which he has never considered “real” earnings), JPM earned $23 billion in 2013 versus the reported $17.9 billion. Deducting preferred dividends and other stuff that go between net income and net to common, that leaves $22.5 billion net to common for an adjusted EPS of $5.94/share. With the stock at $57.40, JPM is currently trading at 9.7x p/e. That is cheap for such a high quality company. I understand that people think JPM has a lot of risk (derivatives, is a money center bank subject to many new regulations that will hold them back etc.), but still. That’s cheap.

Dimon makes some comments about growth initiatives and normalization of interest rates, so we’ll look at earnings again a little later. But just hold these figures in your head for a moment.

Performance Over Time

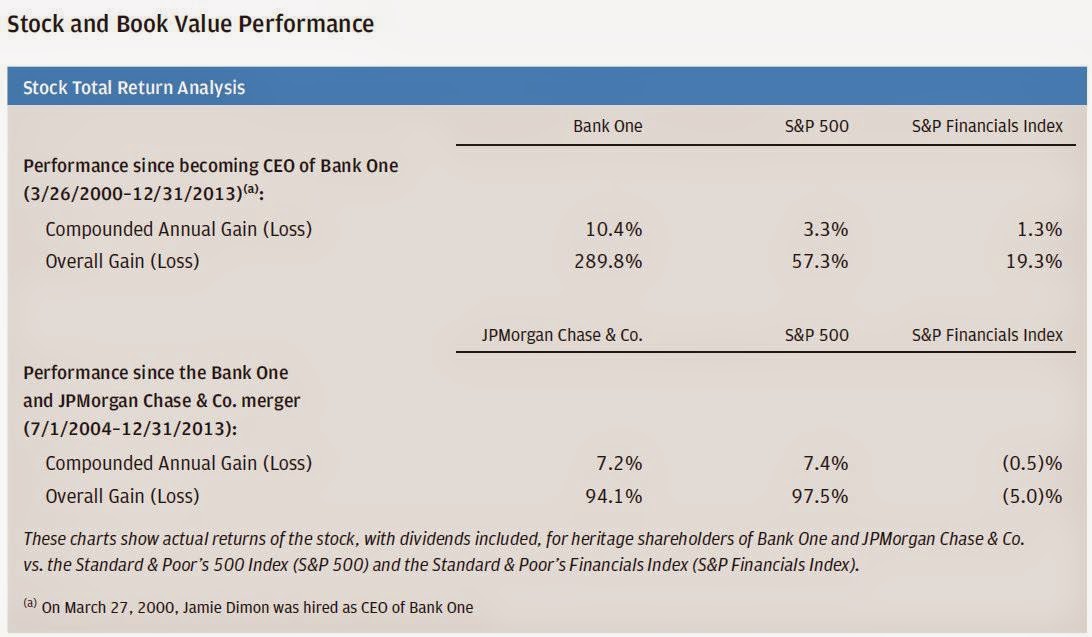

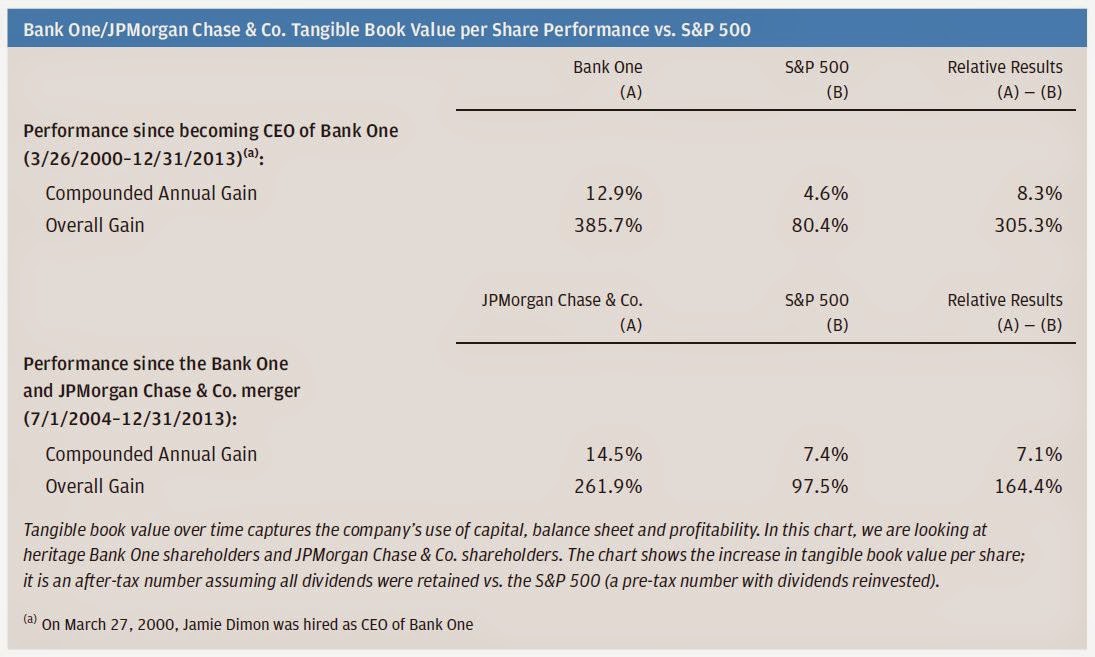

So here’s the usual stuff. Tangible book value per share has grown +12%/year between 2005-2013. As I always say, that’s pretty amazing when you think about what has happened over the past eight years; Great Recession, Whale trade etc. If you said back in 2005 that JPM will grow tangible BPS +12%/year over the next eight years, people would have laughed at you. They would have told you that with that huge derivatives book (and credit cards, mortgages exposure), one speed-bump in the economy and *poof*, JPM will be gone. If you said that tangible BPS would grow +10.9%/year over the next six years in 2007 or +12.6%/year over the next five years in 2008, they would have laughed even harder.

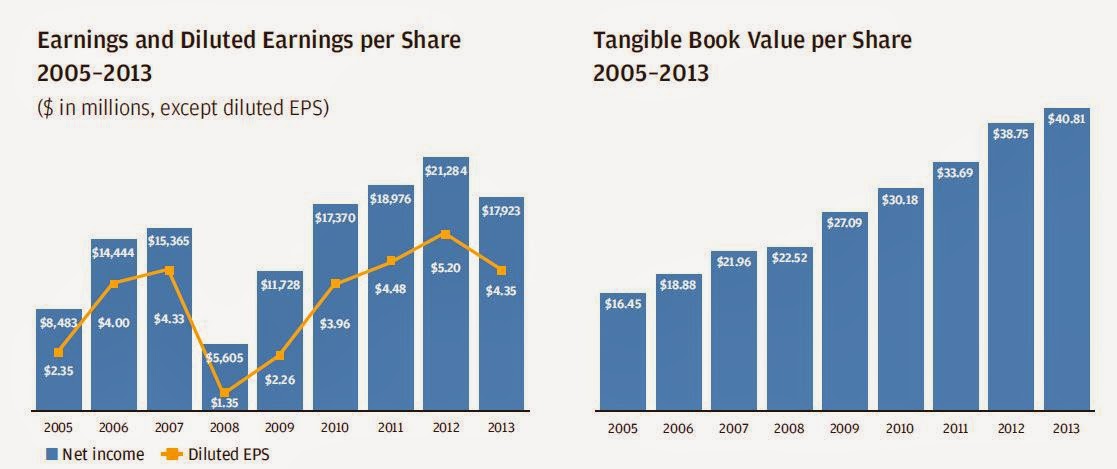

Here is a look at the stock price and book value performance since Dimon took over Bank One (and since the merger):

The stock has outperformed both the financials index and the S&P 500 index since March 2000. Since the merger, the stock has outperformed the financials index by a wide margin but slightly lagged the S&P 500 index.

But on a tangible book value basis JPM has outperformed the S&P 500 index in both periods:

And all of this has been achieved with higher capital ratios:

And the high returns on equity are across the various business lines:

So let’s take a look at this. ROE is pretty stable at 15% or so (on a tangible equity basis) while capital ratios are going up.

Check this out for a second:

Basel 1

Tier 1 ROTCE

2007 7.0% 21%

2008 7.0% 4%

2009 8.8% 10%

2010 9.8% 15%

2011 10.1% 15%

2012 11.0% 15%

2013 11.8% 15%*

For 2013, I used the figure excluding the legal charge, one time gains etc. For all other years, it is as reported in the annual reports. So even as capital ratios creep higher, ROTCE remains constant. The peak was in 2007, the height of the bubble. 2006 ROTCE was 20%.

So one can argue that the capital ratio went from 7.0% to 11.8% and ROTCE went from 21% down to 15%. All else equal, a 21% ROTCE should have gone down to 12% (still not a bad business), but has been pretty consistent at 15%.

But wait a minute! 2006/2007 was the height of the bubble so may be on the high side of normal. Plus, we know that the abnormally low interest rates now are holding down earnings at the banks. More on this later, but Dimon did say that normalizing of interest rates can improve after-tax profits by $6 billion. Of course, this will not happen in a straight line or overnight. It may take three to five years. But just for the sake of comparing ROTCE under the higher capital standards, let’s say that interest rates were ‘normal’ last year.

Tangible common equity averaged $149 billion last year, and $6 billion is 4% of that. So if yield curves were normal, they would have earned 19% ROTCE last year. Another way to look at it is to say that the drop in ROTCE from 21% to 15% was more driven by abnormally low interest rates than higher capital ratios. Of course, higher capital ratios dampen ROTCE, but that can be and has been managed around.

And think about it, this is 19% ROTCE with the current subdued environment; this only accounts for a normalized interest rate environment and adjusts for the legal cost (and one-time gains) of 2013. Imagine the potential if housing really picks up, capital investment picks up etc.

Also, this is just a simple, static look at this; if the yield curve was different last year, other things would have been different too so this is way too simple, but it is interesting nonetheless. Actually, if higher rates are driven by a stronger economy, then this analysis might be good and even conservative (as loans and business volume would increase).

Lower Returns Due to Higher Capital Standards?

OK, so we sort of looked at this above, but Dimon addresses this issue going forward in the letter:

Lower Return Guidance?

And to summarize all of this, Dimon said he has usually guided a 16% through-the-cycle ROTCE but lowered that to a figure somewhere between 15-16%:

In the past, we told you we would expect our average return on tangible equity through the cycle (by this, we mean in average times with normalized credit losses) to be 16%. With higher levels of capital, significant regulatory changes and some remaining uncertainties, we moved the number to be somewhere between 15% and 16%.

This is not a huge adjustment given the complexity of issues involved.

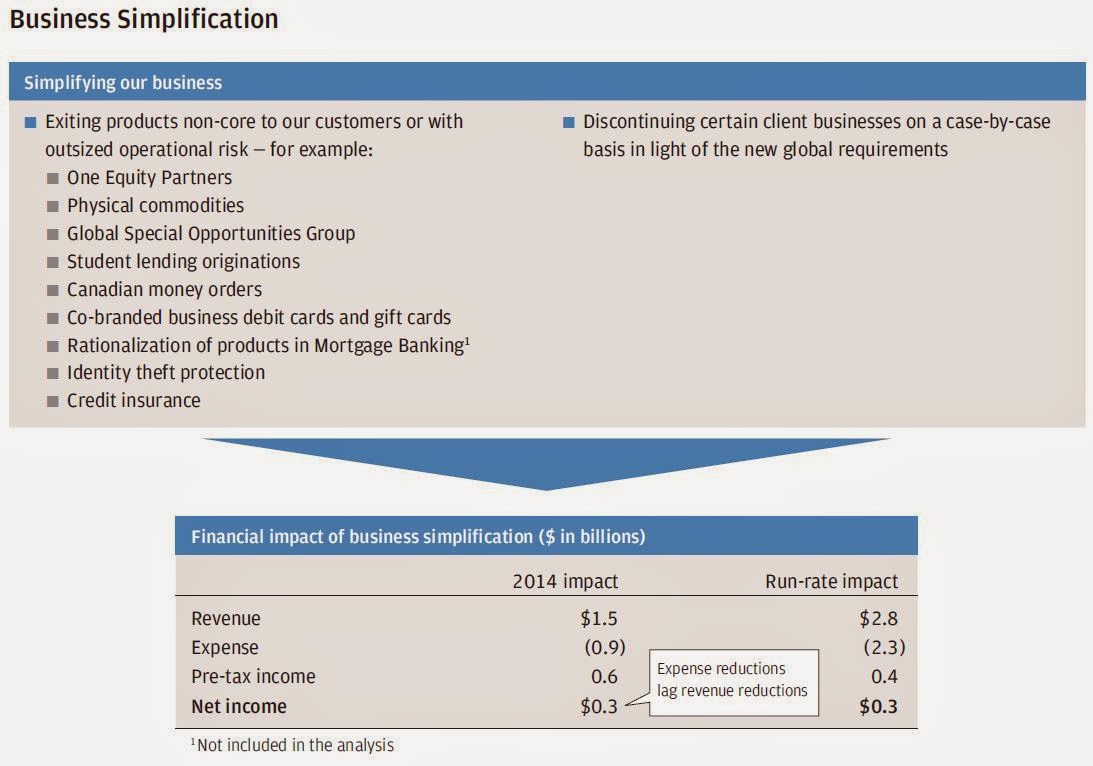

Also, here is the table of businesses that they are eliminating and the financial impact:

Earnings Over Time

Other than this 15-16% ROTCE range, he said that current investment initiatives ongoing will add $3.5 billion or so in net earnings to the 2017 run-rate, and normalized interest rates may add $6 billion after-tax by increasing net interest margins by 2.2-2.7%. He sees short rates at 3-4% and 10 year treasury rate of 5% as normal. This may happen over three to five years and not in a straight line. Also, the $6 billion figure, he cautions, is an “all else equal” number but we all know that all is never equal.

But just for fun, let’s tack this on to the 2013 adjusted earnings of $23 billion. So adding the $3.5 billion and $6 billion from the above, that’s $32.5 billion. And deducting $525 million of stuff that goes to other than common shareholders (preferred dividends etc), that leaves around $32 billion. With 3.8 billion shares outstanding, that’s $8.42/share in EPS. As Dimon said on investor day, the $3.5 billion from ongoing investments doesn’t incorporate business growth over time; that’s just the earnings that will come directly from the growth initiatives/investments.

So just on the above two, JPM stock can be worth $84 at 10x this figure, or $126 at 15x. A 12x multiple will get you to $100. JPM closed at $57.40/share today.

Anyway, this is just playing around with some numbers, not projections or forecasts; just some numbers to think about.

Other things Dimon talks about are:

Scale and breadth create large cross-sell opportunities and strong competitive advantage

Presumably addressing regulators and potential activist investors, Dimon makes the case for why JPM works with the various business units together. Don’t break us up! He says there is $15 billion in additional revenues due to the businesses being together.

New Global Financial Architecture

Dimon goes into detail about what JPM is doing to prepare for the new world. This includes CCAR, capital/liquidity issues, Dodd-Frank, Volcker rule etc…

Long term Outlook is Bright

- The world is getting better, not worse: He mentions the book, The Better Angels of Our Nature by Steven Pinker. Pinker talks about how mankind has improved society throughout the centuries.

- Abiding faith in the U.S. (the usual, best universities, strongest army, (among the) most entrepreneurial people, best financial markets etc…)

- World GDP to grow 7%/year to 2023

- World’s exports grew 11%/year from 2002-2012; many expect trade to grow faster than GDP over time

- $57 trillion in infrastructure spending needed to support this GDP growth between now and 2030; this is 60% more than in the past 18 years. 40-50% of this will be in emerging markets

- 7000 new large companies (sales greater than $1 billion) will develop between 2010 and 2025; 70% of them in emerging regions.

- By 2025, 230 of the Fortune Global 500 will be from emerging markets versus 85 in 2010. 120 will be from China.

- Total global financial assets grew to $248 trillion at the end of 2013; expected to grow +6.6%/year to $453 trillion in 2023.

- concern about excessive regulation and red tape

- uncertainty related to Obamacare

- inability to face fiscal reality; Simpson-Bowles would have been good

- entitlement spending

- uncertainty related to Fed’s QE

- political gridlock/government shutdown/debt ceiling crisis

- inefficient corporate tax policy

- immigration policy; good immigration policy can add 0.2% to economic growth. 2% over ten years / 3 million jobs

Also, Dimon says uncertainty and hypersensitivity to risk is holding us back. He says,

It seems that just about everyone has become a risk expert and sees risk behind every rock. They don’t want to miss it – like they did in 2008. They want to be able to say, “I told you so.” And, therefore, they identify everything as risky.

- Corporations seem unduly conservative

- U.S. gross capital formation to GDP lower in last five years than any time in last 40 years.

- Big corporations may be more conservative as ratings agencies are tougher: In 1993, there were 413 AAA and AA issuers. Now there’s 147. Financial metrics (debt to equity etc) are the same but defaults are lower. Ratings agencies may have overreacted to the financial crisis.

- Other than in Silicon Valley, failure is severely punished.

Taper Fears

At the end of 2007, before QE started, banks had $6.7 trillion in deposits, $6.8 trillion in loans and only $20.8 billion in deposits at the Fed. Today, banks have $10 trillion in deposits, $7.6 trillion in loans and $2.6 trillion in deposits at the Fed. You can see that loans increased very little, while deposits and reserves at the Fed increased dramatically.

So anyway, as usual, it’s a really good letter. There is a lot of stuff other than what I mention in there, so you should definitely go read it.

Excellent, as usual.

nice!

would love to see the same analysis for other big banks (WFC, C, BAC, USB etc.)

Why oh why must you always begin your posts with "So"….as if you were responding or elaborating upon a question or statement previously asked or made?

lol, OK, so, it's because I feel like this blog is one big train of thought, I suppose. But yes, it's not a good thing. I don't pretend to know anything about grammar, spelling or anything else related to proper writing. I write this blog as if writing an email, not that that excuses incorrect usage of the language.

Thanks for reading anyway.

irrelevant comment here, but i like the "so…"

makes it feel like this is a casual/friendly read (which it is) rather than a policy paper or analyst report.

Nice work. If "normal" ROTCE is 15-16%, then to get to your $8.42 in earnings implies around $54 in tangible equity per share. Starting from $40 today, and adding about $5/year to that for earnings (that accounts for dividends and lower TBV given likely share repurchases), it seems quite reasonable to get to $55 in 3 years. That would suggest that the $84 price is ~1.5x TBV… another fairly reasonable metric. I don't have an investment in JPM, but it doesn't take heroic assumptions to get a reasonable return for owners.

I was impressed reading The Big Short that JPM was pretty much the first bank to get out of the CDS and CDO game seeing that it would blow up and you can see that is exactly why they have been so resilient through the crisis.

Great management, even Buffett has spoke highly of Dimon

Hi,

During the financial crisis JPM bought Wamu and Bear Stearns at a bargain price think paid 3.5 bio for both.

Subsequently it had to face writedowns and legal settlements related to the purchases.

I read somewhere that legal settlements cost close to 19 bio and writedowns cost 45 bio related to Wamu and Bear.

Not sure if the numbers are correct but what do you think of the net effect ? I assume with current market valuations after costs it has been beneficial for JPM.

Thaks

Hi,

I haven't worked out the figures, but I don't think it was such a great deal. Dimon said that if he knew this would have happened (government penalties for things that happened before JPM took over) he wouldn't have done the deal.

But I think most of it has worked it's way through the books now so it shouldn't be an issue going forward..

Hi

Thanks for the great Analysis. Seems like the warrants are very good option also at this point. Higher risk but still 4.5 years to experation (11% premium for the leverage) and 2.3% CAGR for break even at these levels. and also Div Adjustment kicking in

In financials where do you think the biggest opportunity lies? Banks seem cheap but I'm turned off by the increased regulations which will keep a lid on returns as well as the low interest rate environment. I've been looking into asset managers like Oaktree (which you've also written about). OAK seems fairly cheap as well (especially within the last week) and they seem positioned well with some of their strategies in Europe. Insiders seem to be decreasing their stakes over time and Howard Marks and some other principals look like they could be close to retirement. What do you think about OAK's prospects going forward?

Hi, I do like the banks precisely for that reason; I think it's cheap due to the coming regulation and current low interest rates. But Dimon has explained pretty well what the impact would be and how they can manage around new regulations, but noone seems to believe him. BAC, C and some other might be cheaper, though.

I do like OAK, but if rates do go up, I wonder what kind of headwind they will face. As Marks has explained, the spreads are low but within historical range so rising rates may not affect OAK as much as, say, PIMCO or other bond funds.

But for the long haul, I do like OAK and I don't worry too much about Marks retirement as he seems to have built a good organization.

Great Analysis. Always the best reading in this Blog

This is by the way the only positive review for the JPM earning in the universe)

Hi kk, thanks for the article. Your blog is always my first website to visit when I go online everyday. At the current price, which do you like better – WFC or JPM? I thought previously you said Buffett would be happy to buy WFC up to $50/share, which is about the price now.

Hi, that figure for WFC is actually up to close to $60 now on 2013 figures. I tend to like JPM as it seems cheaper; it is being penalized for being half investment bank, but this too will change eventually (meaning the discount will go away).

I'll be very interested to hear kk's response to that question. In the meantime, let me compare that claim about Buffett buying WFC to what kk said about JPM in part 5 of his recent (awesome) Buffett market timing series:

"All of the above would also mean, by the way, that Buffett probably sees JP Morgan as worth far more than the current valuation (put a 10x pretax multiple on it like I did in one of the above-linked posts). JPM had $6.50/share in pretax EPS in 2013 (pretax profit less $1.3 billion in preferreds and other distributions) so Buffett would pay up to $65/share. But there were some one-time legal expenses too, so let's use the net income of $27 billion from the "earnings power" slide from the 2014 Investor Day presentation. Pretax, that would be $38.5 billion and less $1.3 billion of that stuff between net income and net income to common shareholders and you get $37.2 billion pretax profits, and with 3.8 billion shares outstanding, that's $9.79/share in pretax earnings power at JPM. So Buffett would be happy to pay close to $100/share for JPM! Am I crazy? Don't look at me. I'm just doing the numbers. The proof is there."

What about this and things like it coming down the pike?

Yellen Prepares Wall Street for More Wholesale Funding Rules from Fed

http://www.foxbusiness.com/economy-policy/2014/04/15/yellen-prepares-wall-street-for-more-wholesale-funding-rules-from-fed/

I know Dimon said they will manage the new regulatory regime, but isn't that what he has to say? Is he going to say that prospects for JPM are poor now and you should look elsewhere? I'm not sure quoting the CEO is the best way to understand a company.

Pretty much everything has gone up a lot in the last five years making the bullish case seem very right. But won't these regs and more like it – which can be put in place now that banks are healthier – going to hurt ongoing profitability? Why won't the huge banks like JPM basically just be regulated utilities?

We don't know what that is going to be yet, but these things aren't decided without some input by banks and other interested parties. And yes, Dimon is supposed to say that he will manage the new regs because that is what his job is; not to say that, but to actually manage the new regulatory regime. Change is always happening in the economy and markets and good companies keep evolving. The ones that don't die away.

Quoting a CEO is not the best way to understand a company for sure if you don't understand the CEO or the company. Much of corporate press is just marketing/promotion. But I feel like I have a strong understanding of JPM's business and also Dimon; I have followed him for years and listened to what he had to say and watched what he did and he is one of those guys that actually means what he says, does what he says he will do etc.

So it is only with that understanding and context that I take what Dimon says seriously. There are many, many other CEO's that I completely ignore as I don't have that sort of 'trust' etc…

JPM and other big banks might become like regulated utilities some day, but again, this is not a one-way street. When these new regulations are set up, there is a lot of input from a lot of parties so just because some people want banks to become like regulated utilities, it doesn't mean it's going to happen.

Also, as for managing regulations, JPM will simply do less of things that don't have attractive returns in a new regime. Look at the business lines they recently dropped; the p/l impact is very small (commodities, private equity etc…).

And if overall banking returns don't look attractive over time, in an extreme case, Dimon would just start buying back tons of stock instead of allocating shareholder capital to businesses with subpar returns.

Anyway, you raise good points and those are things people have to think about and get comfortable with before investing.

Off topic. Do you follow Dundee Corp?

Not really too closely; I did look at them not too long ago. It looks interesting. I didn't really agree too much with his Goodman's views, though, but I should look at it again. Thanks for reminding me.

Any thoughts on JPM's earnings? Or BAC's for that matter?

On Dundee Corp. yeah he is extreme,but now it is trading at one half book.seems like even if he is wrong it is cheap. As the big stocks go up and fear recedes ,it is going down. The assets seem solid and would hedge inflation.

Hi, I do follow bank earnings on a quarterly basis but don't really comment on it too much as they don't mean too much to me. I care about what the banks can do over time and through cycles, not what they will earn this quarter or next quarter. I will comment if I see something particularly interesting or worth pointing out, but otherwise, I usually have no comment.

Thanks for reading.

Kk – I started reading your blog about 6 months ago and u turned me onto the book the outsiders. I really enjoyed the book and it really changed my perspective on investing so I appreciate that. Not sure if u saw today or not, but ackman used the book today in his presentation about valeant and made the case for mike Pearson being an outsider CEO. It was a good presentation and well worth listening to. I've followed valeant for a while and thought the same thing but could never get past the valuation and pull the trigger on the stock. Anyway thought you would find the presentation interesting and I'd love to hear your thoughts if u have looked at valeant. At this point I'm just curious how much further the story can go.

Hi, yes, this is very interesting. I haven't heard or seen the presentation yet but I will certainly check it out. And yes, I did think VRX is sort of outsider-ish and is owned by some great investors; Valueact, Sequoia, Weitz and a tiger cub or two…

I too have looked at it off and on and wondered about how much more they can keep growing as fast as they have been. Obviously, the bigger they get, the harder it will be to do deals big enough to maintain their 'scary' growth rate.

I may post something about it if I have any thoughts to add…

Please don't dignify Valeant by connecting it to Outsiders. The Outsider CEOs are legends – they were not medieval barbaric plunderers.

Valeant CEO's point of view is that people should not plant trees. Instead raid the neighbor's orchard, pluck the fruit and burn the trees. Its great in the short term for Valeant shareholders, but I think that game is over.

Allergan is a far better company than Valeant. It has much better organic growth than Valeant and is not leveraged like Valeant. It can easily buy an Irish company and do a tax inversion itself. It can also acquire other companies and put itself out of Valeant's reach. Allergan has lot more firepower than Valeant.

Anything Valeant buys from here on would have to be a public company to move the needle. Since Valeant's CEO is despised in the industry, any such acquisition of a public company would have to be hostile. Therefore a large premium would have to be paid implying a low rate of return. Glenn Greenberg also said the price for Allergan cannot generate a good return.

People like Ackman and Pearson didn't become scientists and engineers because its too hard for too little money, requires more IQ than they have. Where are the families of scientists who get laid off supposed to go? Move to another state or change careers? Will they tell their kids to never get into R&D?

Who will plant the trees that Pearson wants to strip and burn? Buffett is a desired acquirer, Pearson is a despised acquirer. Not good in the long term for Valeant shareholders.

Thanks for the input; I appreciate differing views here. I am not in the industry so don't have a view on your comment, but Pearson is well regarded by some investors I really respect and they do tend to kick the tires on businesses they invest in.

Anyway, thanks for commenting.

A lot of those investors would have started selling in the wake of this news (like Glenn Greenberg). Jim Grant's and Jim Chanos's short thesis suddenly looks valid.

Valeant has low organic growth – most of their organic growth is annual price increase in the range of 6-10%, with very little volume growth.

They have no drug pipeline, no R&D. Their claim was that they can buy R&D cheaply, that R&D productivity in the industry was low. It looked believable to a lot of people.

What they didn't mention was that so far they had been buying small private or private equity-held companies and that they would now need hostile acquisitions of large, public companies to maintain their growth rate. Their lack of organic growth and pipeline will now scare more investors. Also remember that they are in the drug business, their products can get outdated pretty fast.

Ackman compares Valeant to Procter and Gamble. But Procter and Gamble's products don't get outdated like pharmaceuticals.

Besides, why do we call Valeant the acquirer? Allergan has zero net debt whereas Valeant has 17 billion in debt. Allergan has more firepower right? Valeant had never done a hostile public company acquisition so far, suddenly Valeant's business model doesn't look as good as it used to.

Valeant had so far paid 2-3x sales, now with hostile public company acquisitions they are suddenly paying a lot more.

Thanks for commenting. It's good to hear the various views.

Actually, I don't work in the drug or medical industry. It just seemed unjust. Note that the Outsider CEO's business plan wasn't hostile acquisitions, they made friendly deals.

Besides, if the market really believed this deal would go through, VRX would be trading at $200 instead of $134. Perhaps the big investors who hold VRX are selling right now.

Nowadays it seems that any CEO who takes on a lot of debt is called an Outsider.

The strange thing is that Bill Ackman compares his amassing the Allergan stake to Buffett buying Coke stock in secret.

Buffett has hated greenmailers and activist investors all his life. Ackman is ruining Buffett's good name by saying its the same as Buffett.

I can now see why Soros, Icahn, Loeb, Stiritz etc. took the opposite side in HLF – Ackman is really sneaky. The Starbucks CEO called Ackman "despicable" here http://www.businessinsider.com/starbucks-ceo-bill-ackman-comments-2013-8

I owned Allergan until last week. I sold it at 125.4. I guess I must have sold it to Ackman.

Is what Ackman did legal? I mean if it is legal, why isn't everyone else doing it?

I don't think anyone can ruin Buffett's good name by comparing themselves to them so I wouldn't worry about that at all. Ackman is certainly a controversial figure; when you rock the boat and make a lot of noise, it tends to bother some people.

Ackman apparently had done a thorough check on the legal issues so I'm sure it's legal. Why else isn't everyone doing it? Well, you can imagine a lot of people are thinking about doing it now.

KK,

Here is an article about an Canadian Outsider manager,

http://www.theglobeandmail.com/report-on-business/rob-magazine/the-most-successful-canadian-dealmaker-youve-never-heard-of-and-will-never-see/article18134950/?page=all

Hi,

Thanks, that's a great article. I did look at Constellation when someone mentioned it as an outsider type company and I was impressed with what I saw. I don't own any shares or haven't made a post about it yet, but I might. I should spend more time getting to understand it better…

Hi kk,

Off Topic. I was reading 1966 Buffett Partnership Letter and he said that some mutual funds and investment partnerships had even better long term performances than his partnership. Do you have some idea about those?.

Thanks.

HI,

No, I don't know what Buffett is referring to, but my guess is that he is referring to the go-go funds of the 60's. Many of those had spectacular returns for a while, until of course they eventually blew up. That's my guess. In the late 1990's, there were a bunch of funds with great long term track records too that looked amazing. But then many of them blew up after 1999/2000 too.

So that would be my guess. The hint is that Buffett says he has no idea about the methods used by those funds or something like that which implies those funds were not value funds (so were probably go-go, momentum funds like we saw in the 90s).

Speaking of off-topic: have you ever seen how involved and elaborate the valuations of Aswath Damodoran are? Is it even worth it to try to learn from him in your opinion?

Hi, sorry I didn't respond to this. I try to respond to all comments but I missed this one. I will respond to the new question below.

to follow up on the above damodoran question but maybe make it less personal (ie not to attack damodoran)

i'd be curious to hear your thoughts on the value of financial models. buffet has said that he never uses spreadsheets etc. others make ridiculously detailed models… that like all models are flawed by "garbage in, garbage out."

i recently started working at a well known "value" shop and was surprised to learn that analysts here for the most part rely on quick and dirty operating models (ie basically just income statement, net income to FCF conversion (including working capital build), and then assumptions about use of capital like debt pay-down, buybacks or growth in order to get to next year's share count and net cash for EV purposes). there is no effort to build working 3 statement models, which makes life from an analysts point of view much easier.

of course, at this shop they have always thought about what the business and earnings power will look like 3-5 years out rather than worrying about quarterly earnings which is really the only sensible way to operate in my view.

anyway – would love to hear from KK or other buysiders on their views of modeling and how important it is etc.

Hi,

I am one of those that believe that models don't blow portfolios up, people blow them up. A model carefully thought out and constructed will be exactly right, whether it be the Black-Scholes options model or a dividend discount model. Those are mathematically exact. If the future turns out exactly the same as your inputs, your valuation will be precisely correct.

The problem is not that the models are wrong, it's just that we just don't know what the variables are before the fact. And when we pretend that we *do* know what will happen in the future, that's when blowups will happen. Long Term Capital Management didn't really blow up because of flawed models, they just leaned on them too much and were overconfident in their "guesses" that they input into the models (which again, were probably all very correct and accurate; it's just that they were wrong on their inputs).

So this is similar to valuation models. They are obviously very accurate and useful if you can guess the cash flow streams and interest rates accurately out into the future. Some of the more elaborate models seem silly to me. Not academically / intellectually; they do make sense. The problem is how the heck are we supposed to come up with the inputs?

As a hint, you can go back and read every great book written by a great investor (Stock Market Genius, Little Book that Beats the Market, Margin of Safety, Intelligent Investor, Securities Analysis, biographies and autobios of some of the great value investors in the past, interviews with great investors talking about their stock ideas etc… ) and you will notice that nobody ever mentions anything about financial models or cash flow models. Sometimes they augment their analysis with a comment like, the cash flow discount models puts fair value at $100/share or some such.

But that will never be central to their analysis. It will be more like, "We like xxxx trading at 12x p/e versus with a higher ROE and growth rate and margins than yyyy trading at 18x p/e" or something like that.

If you spend many hours reading stuff like this, you will almost never encounter these valuation models. And that is a big hint, for one.

Also, think about all the great investment errors in the past. It doesn't matter what it is. Your own. The market's in general. Buffett's mistakes and anyone else's.

And very few of those mistakes would have occurred due to not using a valuation model, or most of them were not due to lack of precision in getting to a valuation level. OK, some might argue that valuation models would have prevented people from getting caught up in the internet bubble. But then you really don't need models to tell you to stay away from stocks trading at 100x p/e or whatever.

The biggest cause of investment mistakes are probably due to misunderstanding the economics /. nature of a business, misjudging management and things like that.

This is the sort of thing that guys like Buffett, Julian Robertson or any other great investor spend their time on. Evaluating the business and management is where you're going to make a difference in your performance.

OK, so I couldn't fit it into one response so here's the rest of the above post:

Fine tuning valuation with intricate models where you don't even know what the inputs are going to be might be fun and it's a good academic exercise, I suppose, for teachers. But in the real world, I don't think it's a big factor at all. Like you notice, I don't think most value shops spend a lot of time on models, but most of their time on trying to evaluate the business. And the valuation would be much simpler; comparing valuation to peers/markets and figuring out a simple expected return etc… (for example, if you can buy something at a free cash flow yield of 10% and that is expected to grow, who cares what the theoretical value is? It's sounds like a good investment!).

So anyway, those are my thoughts.

Damodoran has created a franchise for himself by aggregating all sorts of valuation methods and I think that's great. But on the other hand, do I care about his models? Not really. It's good to have a general understand of some of that stuff, but I think there are better places to spend your time (namely, getting to understand people, businesses, industries etc…)