So my posts about the perils of market timing and market valuation have led to some interesting discussions in the comments section.

Anyway, I wrote about the Gotham funds last year and since a little more time has passed, I thought I’d look at their performance to see what’s going on.

But first, let me just say that if you *must* invest in some sort of hedged vehicle (in mutual funds), or something that mitigates stock market volatility, as I said in my original post (What To Do In This Market II), I would recommend one of the Gotham funds.

As I always say, I am not usually a big fan of long/short (unless they are run by people who have real track records like Loeb, Einhorn etc…). I would definitely stay away from the long/short stuff that are put out by the mutual fund giants.

Why Gotham? Well, we all know what a great manager Joel Greenblatt is. He does have a long track record of outperformance. OK, so it wasn’t a long/short fund. But he knows stocks and markets very well, and he has often spoken against the idea of long/short. But he is doing it now. What does this suggest? It means that they have really dug in and figured out how to manage the risk inherent in a short book. Otherwise he wouldn’t do it. He knows why long/short funds usually don’t work out.

Plus, the funds will be operated according to the simple ideas laid out in his books, and I feel I do understand those well, and do have faith that they will continue to work over time.

He said on CNBC once (when the first Magic Formula book came out) that if he shorted the most expensive Magic Formula names against the long portfolio, the portfolio volatility would have been far greater than the long only portfolio, and I think he even said that the portfolio lost 90% or something like that at one point. I’m not sure he said that, but I do remember him mentioning a huge drawdown with the long/short.

So I am sure he will not have a huge drawdown on the long/shorts like that as we know he is aware that is possible if you just bought the cheapest and shortest the dearest names.

Macro Based Mutual Funds

But first, let me get back to the macro, top-down mutual funds that I would caution people away from. As I said in the comments section, my caution against market-timing funds is simply that there isn’t any fund that I am aware of that has done it well over time and through cycles, never seen a newsletter or investment strategist that called things consistently over a long period of time (there are always stars, though, that have called the most recent correction, rally or both. Maybe we can make a list of them).

As I said, for value investors, there is a Graham and Doddsville and the resident superinvestors. Where is the Graham and Doddsville of market timers?

One thing you can do is subscribe to Hulbert’s Financial Digest for a while and check out the long term performance of timers. It is dreadful. And many of them use the same things everyone else uses; P/E ratios etc…

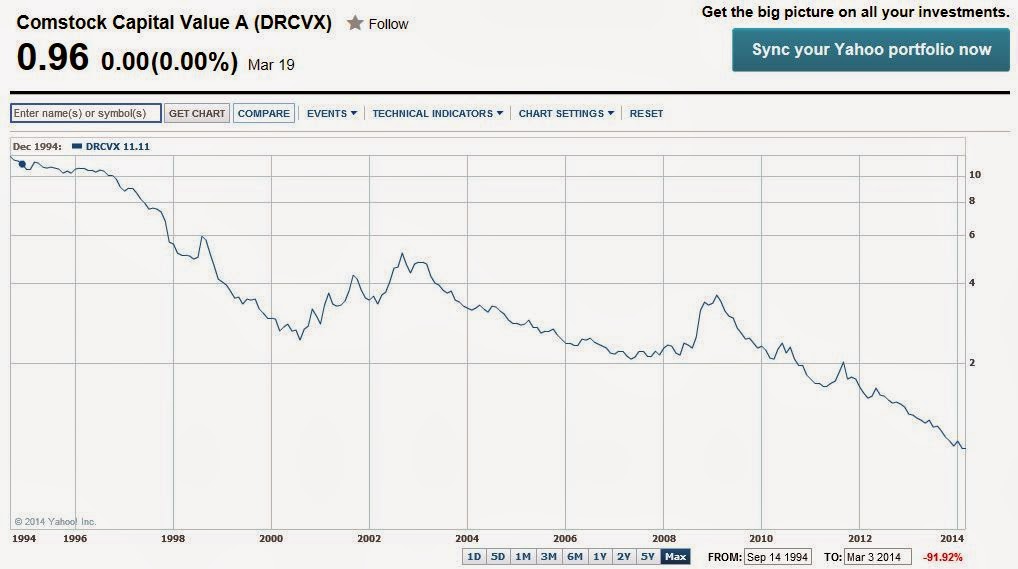

So why do these funds come and go all the time? And how can a fund like this, below, even exist? Well, it barely does. I think AUM is now $34 million.

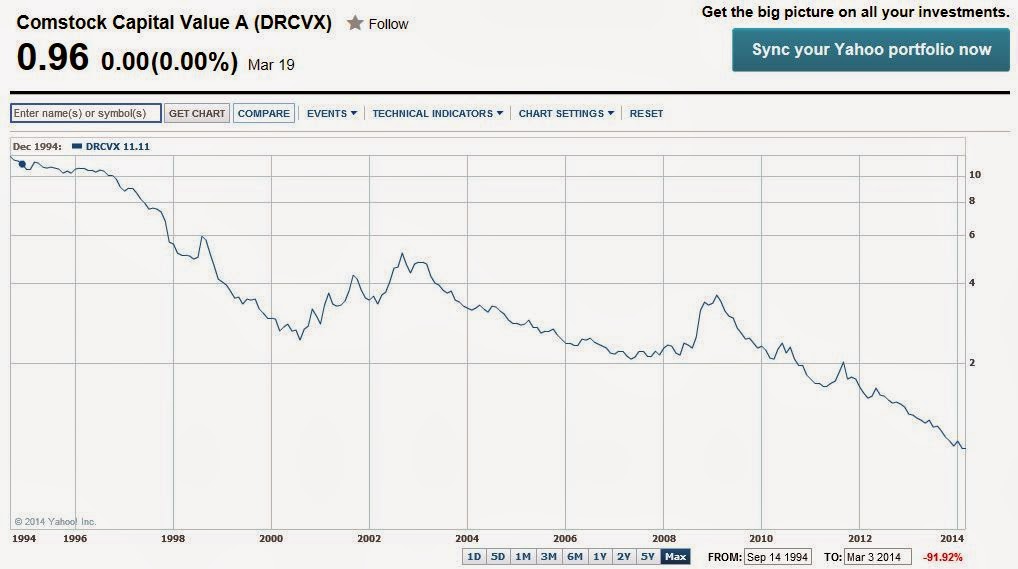

To understand this, check out the performance figures below. This is from the fact sheet for the fund from their website, The above chart only starts at 1994.

So this fund started in 1985. It is interesting to note that the arguments made back then are very similar to the arguments made today. Especially going into 1987 and then after that throughout the early 1990’s, the argument was about high stock prices, too much leverage (junk bond driven LBO mania), twin tower of deficits (budget and trade deficits), and there were no shortage of calls for another great depression to come.

In that environment, this fund came out and then nailed it in 1987. Look at that. They did OK in 1985 and 1986, and then absolutely hit it out of the park in 1987, no doubt due to their cautious stance. That stance cost them in 1988, but it looked like things will be OK in 1989 (I don’t know if that gain is due to the UAL crash, or from longs, but…).

And then from 1990 on, things start to go wrong, and then from 1994 on you can just look at the chart and things go horribly wrong forever after.

If you go to their website, there is a video of Charles Minter making some persuasively bearish statements in 2003.

The funny thing is, as is often the case, I totally agree with so many things the bears talk about. They are right but I just tend to disagree on what to do about it (Buffett too often says things that are in agreement with the bears but acts totally differently so it’s not that he is stupid and he doesn’t see it, or that he is complacent. He just has a time horizon long enough (and holdings solid enough to survive that long) for it not to matter.

These funds get very popular after a bear market because there are usually some people who absolutely nailed it. Maybe they get the bear right and even get the turn correctly and rides up a rally. Maybe they can even get the next bear etc.

But it is very hard to keep doing that and at some point, inevitably, your luck runs out and you can’t keep calling the turns anymore. This is true with newsletters and investment strategists too.

Cursed by Early Success

And their early success is the reason why they can’t evolve or change. When their best relative performance (and rise to fame) occurred during bear markets, it’s only natural that these managers will almost always lean towards the bearish side. Looking at the above table of Comstock’s early success (1987), you can suspect that the management there has spent the next 27 years trying to replicate that success; kind of like Jay Gatsby trying to relive a summer of his youth.

I suspect other similar funds will do the same thing and if they fail, it will be because of the irresponsibility of the Fed. In other words, it’s won’t be their fault.

Speaking of which, I remember in the 1980’s and 1990’s, the hedge funds and macro guys loved the central banks and governments because they were so inept. It was very easy to trade against them and make tons of money. So it’s kind of ironic that many of them are now complaining that their bond market / interest rate manipulation is interfering with their ability to make money. But that’s another story for a different post.

And by the way, sometimes in the trading world, we say that making a killing on the very first trade can be the worst thing that can happen to you. The thinking is that the trader will spend the rest of his career losing what he made and then some trying to replicate it. (Imagine how much money has been wasted on S&P 500 index puts in the years following Black Monday?)

Value Funds

Of course, this inevitably leads to the argument, “gee, but value funds don’t outperform the index either!”. Well, that’s why Buffett says index investing (the S&P 500 index) is the right way to go for most people.

But I’ll add that even if a value fund underperforms (hopefully they outperform over time, though) usually they end up making money. You can still do pretty well. I know someone who has become pretty wealthy just owning the Magellan fund for many years (I mean, many, many years!).

Why Do I Waste Time on This Topic?

Well, as I said in a response in the comments section, when people realize I am involved with the stock market, the discussion almost always ends up not being about stocks, but about what to do because the stock market is dangerous, dishonest and rigged, too expensive and bubbled up etc.

Also, I am not at all against the idea of market timing. I don’t write this stuff because I have something against them and I don’t feel like I am trying to prove anything idealogically or anything like that at all. In fact, I am very curious about these things and have always been. True, I don’t spend a whole lot of time on it, but I am curious about what others have to say about it and about attempts to do it.

If I find someone who can do it consistently and has a track record (or a group of such people), I would be very interested in what they do.

But the fact is that I just haven’t found any yet.

In fact, early on in my career, I was very into this stuff and what lead me to value investing is that there was no Graham and Doddsville of market timers. It turns out most market timers make the bulk of their money selling books / newsletters etc. Every time I read a book about it, I couldn’t verify the author’s performance. If they were newsletter writers, their letters performed horribly.

Back to Gotham Funds

OK, so back to Gotham. Why am I OK with Gotham versus the others? Because Gotham does not try to forecast the economy and structure a portfolio around it! They don’t get bearish and put on a hedge, and then get bullish and take off their hedge. They simply buy the cheapest stocks and short the dearest stocks.

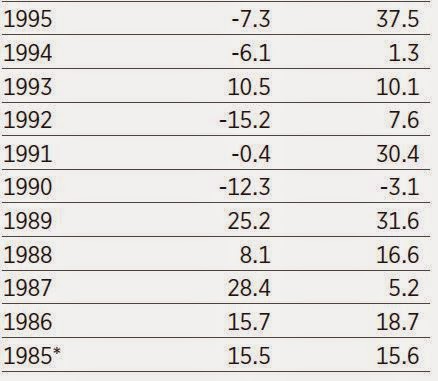

Here are the funds that they offer from their website (gothamfunds.com):

And here is how they’ve done:

These funds are still too young to really evaluate them, but so far it looks pretty good.

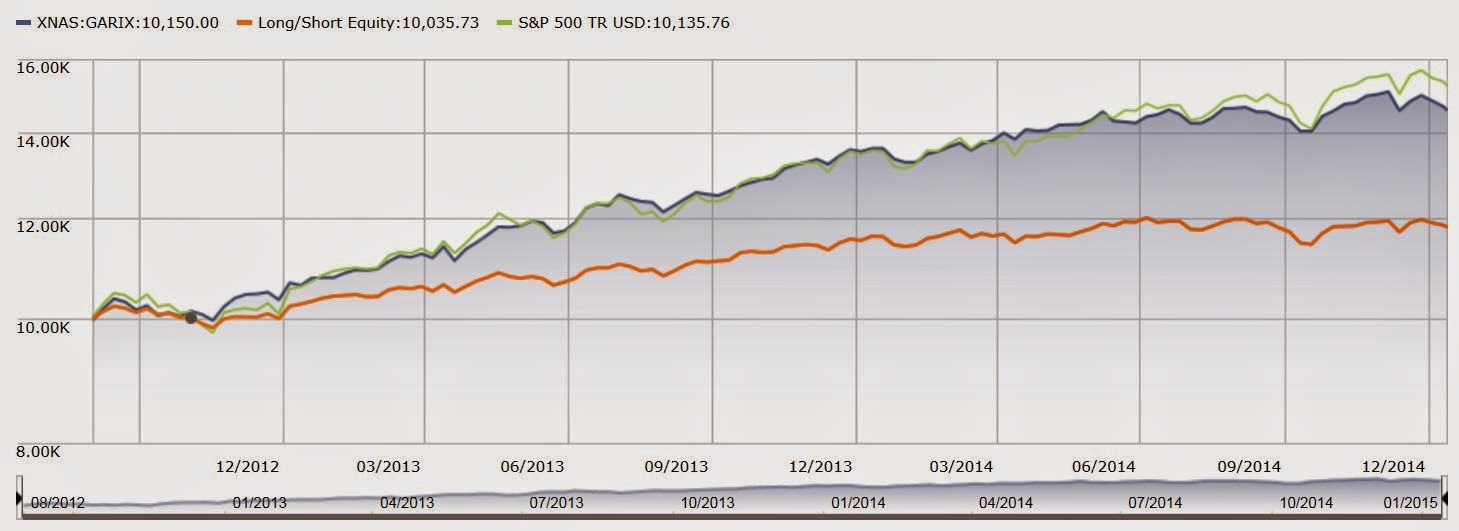

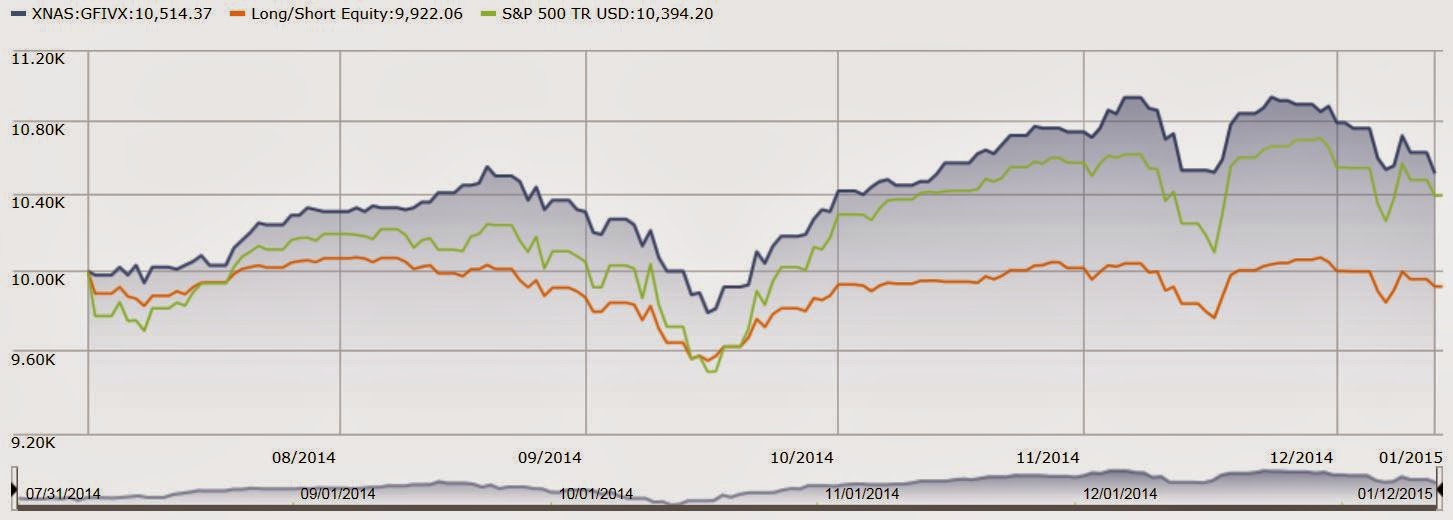

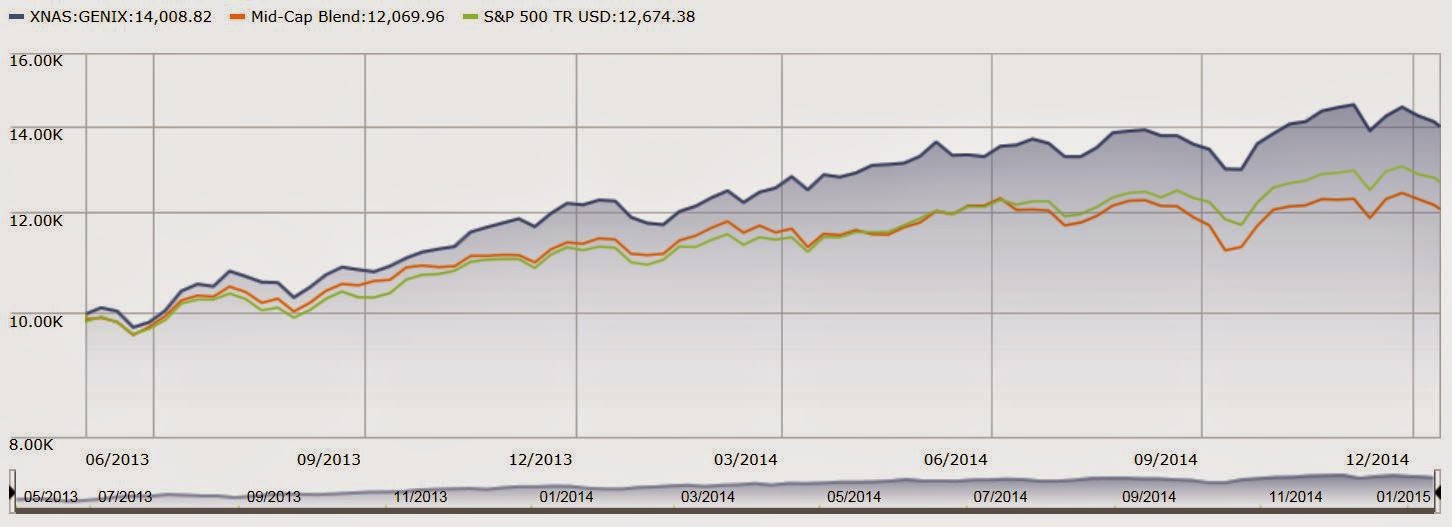

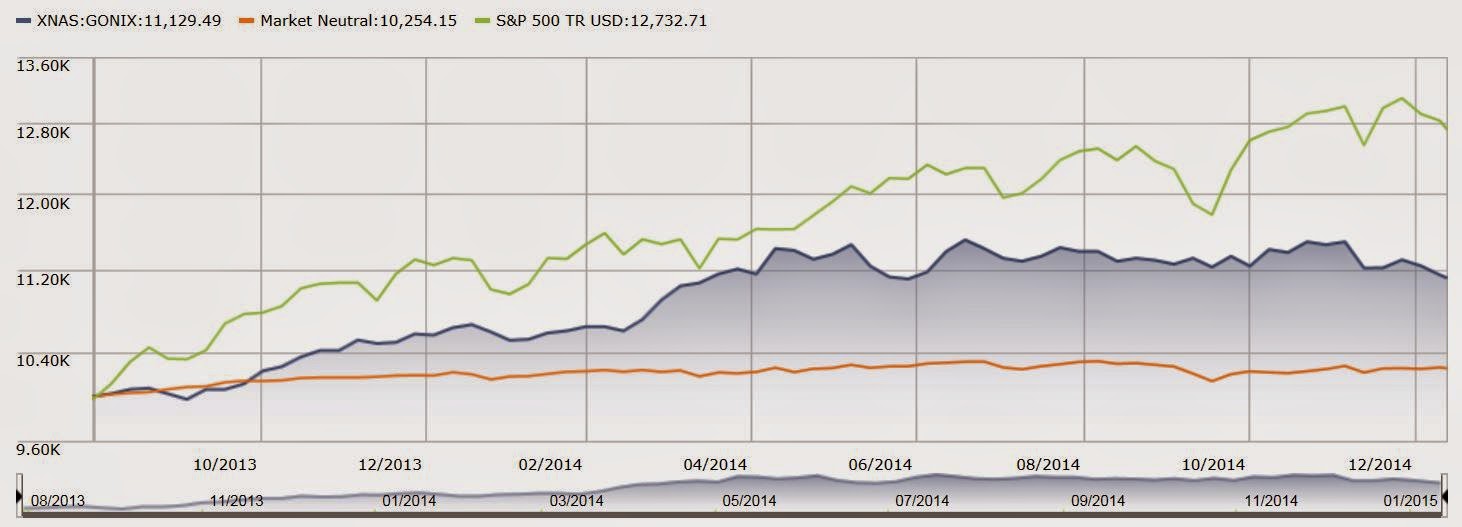

Check out how they have done versus the S&P 500 (Morningstar charts via Gotham’s website):

If I had to choose one to hold for the long haul (or recommend to, say, your sister or some non-market person), I would say Gotham Absolute Return. Gotham Neutral is interesting, but that seems too cautious. Also, the Enhanced Return looks exciting, but seems to have more leverage than I might be comfortable with to recommend someone who doesn’t follow the markets. The Absolute Return long/short allocation is similar to how the typical long/short hedge fund operates.

Anyway, again, I would be very skeptical of the long/short funds coming out of the big fund families. Think about how their funds tend to underperform most of the time anyway. And add the risk of short-selling to that underperforming long portfolio. Short-selling tends to be very tough, and in my experience, long-only managers suddenly being allowed to short have often lead to dreadful results. It’s just a lot harder to do.

If a stock is cheap you can buy it and if it goes down, you can just buy more. But if you short a stock and it goes up, you can’t just sell more. If you try, you can really get killed. And shorting wrong stocks can easily offset gains on longs.

Oh, and not to mention that the best short-sellers/stockpickers tend to go into hedge funds where the fees are higher (and therefore their own salaries/bonuses).

This Time it’s Different

Over the years, when I get into this sort of discussion about the markets (and talking people out of market timing), they argue that the bulls are saying “this time it’s different”.

But it’s never different. Some things do differ, though.

For example, what’s not different?

- Value still matters. Cheap stocks will do better over time, and expensive stocks will do worse. Gotham funds can exploit that.

- Asset values have always been valued against the U.S. treasury market. Sure, there might not have been a close correlation in some periods in the past. For long duration assets, U.S. long bond yields have always been the “risk-free” benchmark. And against that, the U.S. stock market is not at all overvalued.

- Even if the stock market is not overvalued versus bonds, it is expensive on an absolute basis which implies lower returns going forward. This is a mathematical certainty that can’t be denied. But it doesn’t necessarily follow that someone can earn a higher return than this projected low return by getting in and out of the market on a timely basis. All evidence I have seen to date seems to suggest otherwise (most would have been better off in August 1987 to just hold on and ignore the headlines).

- But having said all of that, even I wouldn’t be comfortable if stocks got up to 50x or 100x P/E (to catch up to the bond market). I think the stock market is acting prudently by not going there!

- And, in general, people who try to time the market will get one, two or maybe even three turns right and will look good (and get a lot of face time on TV). But the odds of that success continuing is very low. This is not a judgement of anyone in particular. Even Buffett has said that in his fifty+ years of life in the markets, he hasn’t seen anyone do it.

So most things don’t change. I think the world will go on as it always has in the above sense.

But what is different?

I was going to make a list, but I think the biggest difference is monetary policy. In the old days, the Fed can just lower rates and things were hunky dory. Now, all sorts of stimuli are having a much lower impact than in the past. I think that’s due to the amount of leverage already built into the system. There is something going on that most of us don’t understand; why are rates so low for so long? I tend to believe it is not just about the Fed. Why are rates still lower despite the end of QE? We may be in a long term Japan scenario where deflationary pressures (and not Fed bond buying/manipulation) keep rates low. This is sort of uncharted territory so old models may not work as they have in the past.

Conclusion

So maybe I sound like some idealogical extremist in terms of this stuff (anti-market-timing, pro-value investing) but there is a reason. I have no horse in this race, really. I don’t sell a newsletter or book, don’t own a value investing shop or anything like that. And I have no relationship with Gotham, Greenblatt or anyone associated with either of them.

But I’ve been in the business a long time (well, maybe not as long as some of you!) and feel like I’ve seen it all. I didn’t experience Black Monday or any of the big bear markets before then, but I’ve been through all of the other crises, and they are all the same.

Heroes inevitably emerge from each of them (sometimes multiple heroes). Some of them are wire-house investment strategist (that go out afterward to start a fund after making a great call), newsletter writers, economists etc. And most of those guys that make their name in bear markets don’t go on to make great long term track records.

Again, I exclude some of the really good trading oriented hedge funds (think traders in the Market Wizards book). A lot of those guys are very good and have long, consistent records of profit. But they are very different from the macro-based mutual funds (maybe that would be a topic of a future post).

So in a sense, no, this time is not different.

If you must invest in some hedged vehicle (again, I am only talking about mutual funds), then go with the Gotham funds. They don’t try to do the impossible (guess where the markets go) and they stick to fundamentals / valuation in stock selection. It is a fund run by a successful manager with a great track record, great books with a method of picking stocks that have worked over time etc.

Of course, it may not work out at all. Who really knows with these things. But I can tell you that if you are going to do something in the long/short world, or ‘hedged’ world (to temper volatility), I can’t think of anything (in the mutual fund world) I would feel more comfortable with.

Looked at them recently. High initial minimum investment – keeps a lot of the retail money away and if that's the case, stickier assets won't compound drawdown during a poor performance period. Hasn't prevented the fund family from attracting assets, though.

This comment has been removed by the author.

Man I just lost a whole long comment that I don't feel like retyping. Anyhow, here's below is a post on drawdowns for the MF L/S. Yeah greenblatt said it "blew up" in his backtests. He discusses it in Schwager's HF market wizards book among other places.

http://www.alphaarchitect.com/blog/2014/11/04/face-ripping-drawdowns-and-the-magic-formula/

Man I'm hoping Gotham will launch an ETF now that some of these new structures not requiring daily reporting are getting approved. JG really gushed about the tax efficiency of efts on his recent wealth track appearance.

Thanks for continuing to cover this topic after our discussion in the comments last time!

As I said in the comment section to my Seeking Alpha article yesterday about the Magic Formula, I think one decent alternative to the Gotham Funds is simple naively and mechanically applying the Magic Formula. Sure, you will likely underperform because your data isn't as good. But you're more tax-efficient and are on the right side of Bogle's "low-cost hypothesis."

I am inclined to always give Greenblatt the benefit of the doubt, as long as he continues to make the Magic Formula screener freely available on the Magic Formula website.

It's funny how many of the most interesting debates are Greenblatt v. Greenblatt.

It's also interesting that you imply that Magellan is/was a value fund!

Oops, yeah. Good catch. I wouldn't call Magellan a value fund. It was the only fund I remembered of the top of my head with a really long record. I guess there is Windsor and some others…

Magellan definitely used value investing as one of their strategies. But then they also used growth and quality factors too. To me it was a multi-strat fund in a time of one trick pony's. I think that's one of the reasons it did so well.

I believe it was in the intro of the revised edition of "The Little Book That Beats the Market" where he mentioned that especially smart students would point out that it would make sense to short the most expensive decile, but in fact the strategy would have made you go bankrupt in the dot com bubble. I wonder how he's accounted for that risk. My guess would be re-balance after a certain threshold, but I'd be curious to see him asked that in an interview.

Thanks. I think he also said it on CNBC too.

Part of the short risk is managed by holding smaller positions in shorts. I think it's a more diversified position so as to reduce bubble risk.

The other big factor is that these funds are rebalanced daily. The old MF approach was to just hold stuff for one year. If you short a bubble stock and leave it for one year, it can be totally catastrophic. But if you rebalance every day, you would be forced to buy the stock as it goes up every day so as to keep the percentage allocation the same as the day before. So you would lose money in a bubble stock, but will at least reduce the position so as to keep the damage limited.

This is interesting because if a long goes down, they have to buy more (assuming it is still as attractive), which is good. For shorts, if the price goes up, it may be more attractive as a short, but your allocation to it has also gone up already as the price went up, so you might have to buy back some.

So in that sense, it sort of has this built in bias to buy more cheaper stocks, but not necessarily short more expensive names that go up, that acts as a protective mechanism.

I wonder what the incremental benefit of that is versus the expenses of daily re-balancing via commission and taxes. Also hard to manage with the timing of earnings releases, etc.

Good question. But it may not be as bad as you think. The original MF required 100% portfolio turnover, right? OK, maybe not 100% if a stock in one year is carried over to the next year. But the idea was to sell the portfolio after one year and then buy the new basket in the following year. Actually, Greenblatt advocated laddering that so you don't do it all at once on the same day. But still, that was a possible 100% portfolio turnover every year.

This new approach of daily rebalancing sounds expensive, but they are not turning over the entire portffolio every single day. They are making small adjustments such that in aggregate, over an entire year, it may lead to turnover of 100% or not. I'm sure there are threshold levels so they don't have to say, buy and sell a single share.

But anyway, it's a good question.

I read the Magic Formula book and have the section highlighted that discusses going long the cheapest vs. short the most expensive. I saw Joel a couple of months ago at an event he did in NYC and asked him about it. Frankly, I couldn't understand his reasoning about why he wouldn't have the same huge drawdown. This could be cynical, but I believe the only way Joel can make any money at his ideas in his book he needs to do it in a mutual fund format. He is reluctant to just do a long portfolio because of the volatility so he has long/short…you're probably right in that he thinks he knows how to do it without a blow up. I bought a ton of the GARIX, i'm a financial advisor. I bought it for clients as well as for myself. I also have a portfolio of my own money using his free website. I've outperformed spx by 500 basis points a year for more than 5 years. its volatile, but it works and is simple to do.

Thanks for sharing your experience. It's good to hear from people actually following the MF. I'm not sure either about short book risk mitigation other than what I wrote above; more diverse short book and daily adjustments (so one or two bubble stocks won't kill you)…

Yep, I felt that I could hear his hesitation in the latest Wealth Track podcast when explaining why he was opening the L/S fund. It's basically that people couldn't handle the volatility of an all long MF portfolio. This L/S isn't necessarily better in true performance, but it seems that in practice the average investor will get better returns because they will stick with it if there is less volatility.

I think I misunderstood you. You couldn't understand why it wouldn't blow up and think he's just ignoring the risks because thats the only way he can raise funds? Yet, you bought a ton and put your clients in it?

Anyhow regarding the ignoring risks to cash in on the book. No way. He could open a 2 and 20 hedge fund tomorrow and raise one of the biggest funds in the world, just off his first book and record. He's the effing godfather.

The 250k min investment likely keeps most ppl out

250K is waived if you have a fee based account at a brokerage

As for the market timers similar to graham and doddsville, you could look at Soros and Paul Tudor Jones and Bill Dunn.

Hi,

Check out my post on the difference between macro hedge funds and market timing funds. They are very different beasts. And I do know some of the macro funds (or did back in the day) really well.

Big fan of Greenblatt but see this for the counterargument to buy cheap, short expensive http://www.alphaarchitect.com/blog/2014/10/31/long-cheap-short-expensive-buyer-beware/#.VLgzeyvF-ts

Hi,

Thanks, that's really interesting. I think the drawdown of the simulation is higher than it would've been because they only rebalance once a year, right? Gotham rebalances every day so they would have covered the bubble stocks. You would get killed just shorting something and leaving it for one year (or even two months back in the late 90's).

I think that is the key to their short risk management; not just short-and-forget but to limit exposure in the short book; if a stock goes up and over the limit, buy some back etc…

Good point. DIdn't realize the rebalance was that often. Actually saw Greenblatt speak at a conference last year about the fund. Didn't seem too concerned about the cost of shorting when asked about it. Said he was fairly certain the fund had a high probability for success over the long-term and he doesn't care about short-term performance. Very even-keeled guy.

Hi!

What you think about energy sector at this moment ( shale oil companies) – like EOG, RRC, AREX. Is they already good if there will be oil prices bounce or still expensive?

Thank you

Hi, I don't really follow energy stocks so I don't know. It surely is an interesting time to look at them so I should be looking. One interesting thing is that the crude forward curve still shows prices close to $70/barrel going out, so prices should eventually get back up there. If people are modelling earnings using current prices, they may be off.

I think the best way is to look on 5Y forward ( and they are near 80 usd) – this price must be in this environment right price for consumers and producers- now high cost production like ultradeepwater drilling is off ( new projects) from break even side, also high cost production like oil sands, some shale basins and etc. And demand is rising via consumer auto preference changing and etc. So oil must be higher medium term, but what is now based in EPS predictions dont know )). I looking on AREX because it is small shale player with good geology reserves, low break even, and hedged book on this year ( approximately 75 usd per barrel) and also strong balance sheet ( certainly if we compare it with others shale oil players 🙂 ), but not so good from NAV point. Also Russia is cheap, but it is not very fundamental case 😀 🙂

Wouldn't you consider Baupost a market timer? Their quarterly letters are all macro and Klarman holds >40% net cash at some points… sounds like market timing to me.

Thanks for the question. That's a good one. We all have different definitions of what a market timer is, but for me, a market timer is someone who goes in and out of the U.S. stock market trying to outperform by avoiding bear markets etc.

Klarman is not like that at all. If you read "Margin of Safety", it is clear what he is all about. He, to me, is a special situations investor. He too doesn't think he can predict the economy, interest rates, the direction of the stock market or anything like that at all.

He looks for special situations like those described in his book, and also in other areas outside the stock market.

If KO traded at a very reasonable price, for example, he wouldn't buy it because that's not his game. His game is special situations and KO at a reasonable price or even a cheap price wouldn't be of interest to him unless there was something going on there that made it a special situation.

As far as I know, he's had 40% or more in cash for most of the life of the fund, and yet he has returned 20%/year or close to it. And that's not because he timed the market well or anything like that at all.

His quarterly letters is full of macro stuff, but I doubt much of his portfolio is based on his macro views. Yes, he had options on treasuries (puts) and things like that, but much of the performance has come from buying distressed assets; figuring out what they are worth and then paying a big discount to it. That's where the performance has come from, I think.

So anyway, yes, it's hard to tell the difference but in my mind, Klarman is not at all a market timer.

Appreciate your response. Love the blog.