Every now and then, people do ask me about Bitcoin. And my usual response is, I have no idea what that’s about. But if they are interested in buying some so they can make money, I tell them don’t do it. If there are other reasons (like arms or drug dealing), then it might be a good idea. But whatever you do, don’t do it if it’s just to try to make a quick buck.

I’ve seen this happen (on an individual basis too where one person I know went from one bubble to the next seeking wealth (and losing every time)). They get into the stock market, and then there is a correction or bear market. They freak out and sell out (at the wrong time) and lose money.

So they think stocks are no good. They go to real estate. In this case, I strongly argued against them investing in vacation time shares. Back then, unscrupulous promoters (maybe now too) used to try to sell them as “investments” in paradise. Of course, when you are offered a piece of “real” property for a fraction of what a real condo would cost, it is very attractive. But with monthly and annual fees, it’s basically a prepaid vacation (forever!). It’s not a real estate investment or a hedge against inflation!

And then after being talked out of that and then, yes, even penny stocks, they got into foreign exchange trading. Yes. The leverage offered was irresistable. I said, why? They say, well, I can’t pick stocks like Warren Buffett, so I’m going to speculate in foreign currencies on leverage. OK, so they are not as smart as Warren Buffett, but suddenly they are as smart as George Soros? I don’t get it.

So maybe this is just another one of those things. People got burned in the past decade in stocks, real estate, foreign currencies etc. They need something else.

Back to Bitcoin

I remember the argument last spring when Buffett dissed the Bitcoin saying that it’s a “mirage”. I too felt the same way and wondered why it was such a big deal. I get the technology and things like that, but I didn’t get why people would necessarily rush to it, unless they really thought the dollar was going to zero soon.

Anyway, having said that, I actually don’t have that strong an opinion either way about Bitcoin. To me, it’s just another one of those things. Will it last? Who knows. Will the whole world soon only transact in Bitcoin? Will it get to $10,000? I have no idea. It’s all possible.

But what I do know is that the pound-the-table-Buffett-doesn’t-get-it crowd was telling us that the Bitcoin is better than the dollar and they were telling us when it was trading over $600. That really reminded me of the last two times people said that Buffett is wrong (and interestingly, they all seem to get angry when they disagree with Buffett, and the angrier they sound, the more I lean towards Buffett); the internet bubble in 1999/2000 (Buffett is a has-been; he doesn’t get technology so his career is over!), and gold back in 2011 (Buffett doesn’t get it; how can someone so smart not see that all the central banks are debasing our currencies?!). I remember how red-faced and angry gold bugs got when Buffett said all you could do with gold is cuddle up to it or something like that.

And then last year there was the Bitcoin. Buffett doesn’t get it. One of them even said that investors can’t ignore how much the Bitcoin has risen. I was like, what? So this is about speculation?

Even a famous value investor went on CNBC telling us that Buffett is wrong about the Bitcoin.

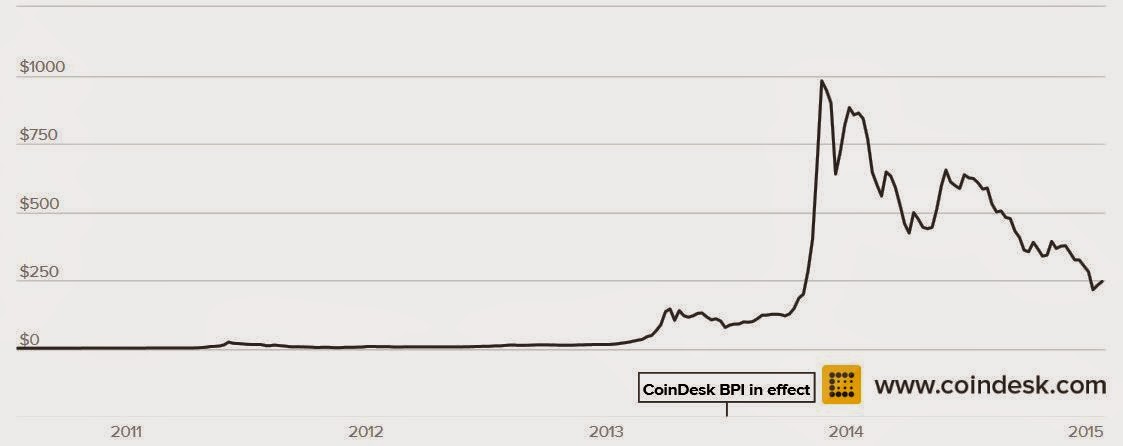

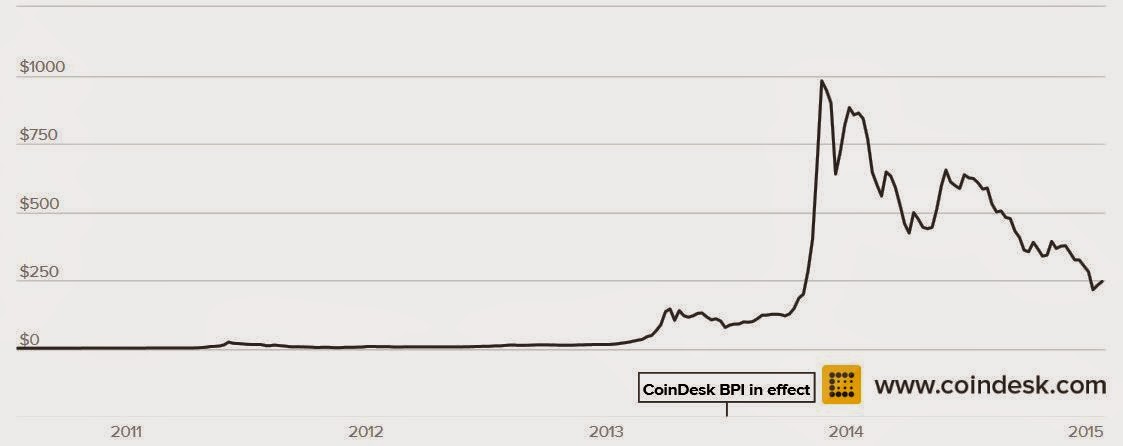

Anyway, check out this chart. The last Bitcoin “Buffett is wrong” fever happened in March/April 2014. Bitcoin was over $600 in March.

And since then, Bitcoin tanked to below $200. Now it’s a little above it. But at $200, that’s a 67% depreciation. That’s like, worse than the Ruble, isn’t it? Bitcoin was over $1,000 in late 2013. From there, it’s an 80% drop.

And no, this is not a “ha-ha, you guys are wrong!” post. Bitcoin may very well end the year at $2,000. I have no idea. I’m not making this post because I wanted to say how wrong those guys are. Not at all.

What’s the Point?

So here’s the point I wanted to make, and it’s something that just recently hit me. I couldn’t really explain why Bitcoin is not a great idea, and neither is gold (most of the time). Buffett explained it simply by saying that with these things, there is no real intrinsic value. You can value a farm because it generates income. You can value a business or a bond. But you can’t value a piece of metal, however precious. The price will just depend on market sentiment. Sure, production cost will act like a floor, maybe. But anything above it just depends on sentiment. What is the value of a Bitcoin? I have no idea.

And it doesn’t matter if I don’t know.

Imagine This

But let’s imagine that I did like Bitcoin and I told my mom to buy a bunch (grandma, sister, cousin, best friend; just imagine somebody that really trusts you and doesn’t know much about markets/finance). In fact, you hate the dollar and other paper currencies so much you tell them to get out of all their cash and put it into Bitcoins. Or, OK, you tell them to just buy a little.

Now let’s say you did that after seeing these folks on CNBC when the Bitcoin was at $600. Now it’s at $200. Your mom calls you up and asks, why is my $100,000 now worth only $33,000? What happened to my money?

Or what if you were really unlucky and you paid $1,000. And then mom’s $100,000 went down to $20,000. And she calls you up; what the heck happened?

What do you tell her? Can you explain why the “better-than-paper-currencies” Bitcoin went down 60-80%? I don’t think so. Can anyone?

With Most Assets, We Can Know What Went Wrong

I can tell you this. If I told someone to buy stocks and then stocks went down 50% or 80%, I can probably tell you why it happened, and I can probably even tell you what I think the stocks would be worth in three to five years. I would have strong conviction about that (and in fact, I did talk to many nervous investors throughout the crisis and I assured them that things will eventually turn).

If I told someone to buy a stock and it tanked a lot, I can probably tell them why it went down and what I think will happen going forward. There might have been some permanent impairment of intrinsic value; nothing is totally safe. But I would still be able to tell them what that stock would be worth over time. I can explain it in detail.

When we make mistakes in the market, it’s usually one of two things; we mis-evaluate the business, or we pay the wrong price.

Even with bonds, if interest rates rose and bonds tanked, I will be able to tell people what the bonds are worth. I can’t predict interest rates, but I can give a reasonable range of where I think rates should be and what the bonds would be valued at.

But can anyone do this with the Bitcoin? I doubt it.

I know this is just a long way of saying that some things just don’t have an intrinsic value to measure a price against. But when you put it this way, that you can’t explain these extreme fluctuations, you have to wonder about the wisdom of investing any meaningful amount in them.

Margin of Safety

And then this leads me to the interesting old concept about the margin of safety. Check out this excerpt from Benjamin’s Graham’s classic book. It really nails it.

From Security Analysis: The Classic 1951 Edition, page 656:

We return in consequence to our earlier conclusion that market analysis is an art for which special talent is needed in order to pursue it successfully. Security analysis is also an art; and it, too, will not yield satisfactory results unless the analyst has ability as well as knowledge. We think, however, that security analysis has several advantages over market analysis, which are likely to make the former a more successful field of activity for those with training and intelligence. In security analysis the prime stress is laid upon protection against untoward events. We obtain this protection by insisting upon margins of safety, or values well in excess of the price paid. The underlying idea is that even if the security turns out to be less than it appeared, the commitment might still prove a satisfactory one. In market analysis there are no margins of safety; you are either right or wrong, and if you are wrong, you lose money.

The cardinal rule of the market analyst that losses should be cut short and profits safeguarded (by selling when a decline commences) leads in the direction of active trading. This means in turn that the cost of buying and selling becomes a heavily adverse factor in aggregate results. Operations based on security analysis are ordinarily of the investment type and do not involve active trading.

A third disadvantage of market analysis is that it involves essentially a battle of wits. Profits made by trading in the market are for the most part realized at the expense of others who are trying to do the same thing. The trader necessarily favors the more active issues, and the price changes in these are the resultant of the activities of numerous operators of his own type. The market analyst can be hopeful of success only upon the assumption that he will be more clever or perhaps luckier than his competitors.

The work of the security analyst, on the other hand, is in no similar sense competitive with that of his fellow analysts. In the typical case the issue that he elects to buy is not sold by some one who has made an equally painstaking analysis of its value. We must emphasize the point that the security analyst examines a far larger list of securities than does the market analyst. Out of this large list, he selects the exceptional cases in which the market price falls far short of reflecting intrinsic value, either through neglect or because of undue emphasis laid upon unfavorable factors that are probably temporary.

Market analysis seems easier than security analysis, and its rewards may be realized much more quickly. For these very reasons, it is likely to prove more disappointing in the long run. There are no dependable ways of making money easily and quickly, either in Wall Street or anywhere else.

Note: Viewing the two activities as possible professions, we are inclined to draw an analogous comparison between the law and the concert stage. A talented lawyer should be able to make a respectable living; a talented, i.e., a “merely talented,” musician faces heartbreaking obstacles to a successful concert career. Thus, as we see it, a thoroughly competent security analyst should be able to obtain satisfactory results from his work, whereas permanent success as a market analyst requires unusual qualities – or unusual luck.

Graham talks about market analysis here, but this applies to things like gold and Bitcoin, I think. I know Bitcoin and gold advocates are not telling people to trade these things, but to actually own them for the long haul. So in that sense, it’s OK.

But what clicked for me in the above passage was the concept of margin of safety. See, when you buy gold or Bitcoin, where is the margin of safety? OK, maybe with commodities, the production cost can be seen as a floor. But what about Bitcoin?

When I buy a stock, I can tell you what the range of expectations are. They may not be accurate and maybe I can’t tell you exactly what will happen. But I can give ranges. But with Bitcoin, I can’t do that, and I haven’t seen any analysis to suggest that anyone can. All the talk about Bitcoin is about how great it is. Sure. I’m sure it’s amazing.

But if I can’t tell you why it was under $100 and then over $1,000 and then under $200, then I have no business being involved in it (or telling anyone else to be in it).

Does that make any sense? It’s just a long way of saying “I don’t know!”.

Most people seem to want to get involved when it’s going up, and not so much when it’s going down. This suggests to me that it is, however amazing the technology and concept is, at the moment, an instrument for speculation.

Margin of Safety in the Current Stock Market?

OK, so you will read this Graham passage and say, gee, where the heck is the margin of safety in the current stock market at historical high valuations? Graham said:

We obtain this protection by insisting upon margins of safety, or values well in excess of the price paid.

Well, where is that now? What about indexers? Buffett says 90% S&P 500 index fund and 10% cash. Where is the margin of safety in buying the S&P 500 index today?!

Good point.

But let’s put it this way. The alternatives are, bonds, cash, or some sort of alternative investment (including funds/hedge funds that may not correlate with the stock market, or maybe macro funds that can benefit in a crash, or a market-timer that will stay out until it’s OK to get back in etc.).

If you look at bonds and cash, stocks are easily much better. And with the alternative investments (and here I am talking mostly about timing-oriented funds; private equity, value and activist hedge funds and others might be playing with a lot of margin of safety within their portfolios), then that’s the part where you get to Graham’s claim that there is no margin of safety. The market analysts are either right or wrong. And if they’re wrong, they lose money.

Yes, stock market investors can lose money too in bear markets. But here’s the deal. Even if we have a bear market, we know that markets eventually turn and businesses will recover (not all of them, of course).

Buffett’s Hedge Fund Bet

Remember Buffett’s hedge fund bet? He said that a low cost S&P 500 index fund will do better over the next 10 years than any group of 10 hedge funds or something like that. And I think he is far ahead on that bet.

And think about this for a second. He made this bet back in January of 2008. This was right before things really started to fall apart in the financial crisis. The market was not cheap. Things looked really, really ugly. Who the heck would bet on the heavily financials weighted S&P 500 index back then?! And hedge funds are supposed to benefit from this sort of volatility. Back in the day, Soros would have been on fire in that sort of environment.

So the last few years should have been a big advantage for the hedge funds.

And yet, Buffett is winning his bet with the S&P 500 index.

If you go back and think about what Graham wrote, this margin of safety applies even when you just passively own an index! It’s the hedge funds that don’t have any sort of margin of safety (I am speaking in general; there are good hedge funds too).

Would Buffett make the same bet today? What if he had to bet between the S&P 500 index and someone who will time the market in and out (to avoid taking the risk of investing in an overvalued market); I bet Buffett would bet on the S&P 500 index (and so would I!). And yes, even at this valuation level.

At this valuation level, the returns may be lower than historically, but I bet a lower stock market return would still be much higher than the return of the timers.

So that’s what you have to compare against; margin of safety in owning a highly valued stock market, and then the margin of safety in investing in someone who claims to go in and out on a timely and profitable basis (or use some other strategy to beat the market).

Conclusion

So I’ve made some posts recently about market-timing and I didn’t really mean to post more about it. I know that this is one of those things, like politics and religion where everyone has their own view about it and it won’t change.

But I brought it up again because this little passage in Security Analysis: The Classic 1951 Edition seems to sum up my feelings about both market-timing and investing in things like gold/Bitcoin.

It’s all about the margin of safety.

Another great post.

It does get down to intrinsic value. The issue muddling stocks is that they can be traded like collectibles, so they can be seen like pieces of art, which has no intrinsic value, but you sure can make a profit off of them! The difference is that if public sentiment went to zero on a piece of art, your painting would be worthless. But if public sentiment went to zero on a company, and the company was still making money, it would either: get acquired, pay out a dividend, or have its stock bid back up to a less unreasonable price. No one is going to let an absolutely free dollar pass once they realize it. The market puts a lower bound of sorts on money-making companies. There is no upper limit (where it becomes a collectible), but there is a lower limit (because it has utility, as you own a piece of the cash flow of the company).

"Buffett explained it simply by saying that with these things, there is no real intrinsic value."

With Bitcoin you have for example

1. Super cost-effective way to transfer value anywhere where there's internet (so basically anywhere)

2. There are no middle hands and it's completely transparent

3. They effectively can't be stolen unless you screw up or get scammed

There is definitely intrinsic value if not in Bitcoin itself, then in the blockchain technology which has AFAIK a lot more uses than being a public ledger. Bitcoin just has the advantage of being the biggest and the prettiest of using the technology (for now).

You could argue that with good enough infrastructure, Bitcoin becomes direct competitor to Visa, Mastercard and AXP. Because of it's superior cost structure, if merchants adopt it and pass the savings to customers, there's definitely something there. I guess the problem is that a lot of merchants rather take the extra income than pass the savings to help the infrastructure, in addition to customers finding it very hard to adapt to Bitcoin as they don't have good enough reasons to use it.

Still, measuring the intrinsic value of Bitcoin is hard, if not impossible which makes it into a highly speculative investment. You can easily justify as high price as $1000 if your assumptions include high degree of adaptation+other bull signs, but then again, you can do the same with stocks and we know all too well where that usually ends up in.

The biggest problem is that it's definitely hard to understand and for tech-illiterate very hard to adapt to so there's a lot of room for innovation there.

I'm not arguing that it's cheap or that the drop in price is not justified, but rather just clarify the potential that it offers.

Yes, I understand the benefits and it does sound like a cool technology. But going back to the imaginary conversation in my post, when mom says, "What the heck happened? Why did I lose 80%?!", I don't know if she'd be happy if you said, "well, you dropped 80%, but at least noone can steal it, you don't have to pay credit card fees and no more dealing with checks!". I bet most people would say, dammit, gimme back my 80%; I'll gladly pay my credit card fees and go to the bank to cash checks (or pay for wire transfers).

As usual, something might be really great, but there is sometimes a hidden cost / risk associated with it.

Yes, in the end it comes back to the hardness/impossibility of determining intrinsic value for it.

Sounds like the intrinsic value would be in the delivery of bitcoin (or things related to it), not in the currency itself.

Yup, Samuel Brannan. History repeats!

I think it's important to note that the hedge fund bet was not group of ten hedge funds – it was "a portfolio of funds of hedge funds."

1.5% and 20% is high, but obviously many hedge funds have been successful despite these fees over long periods. Of course, you would expect better investors to charge higher fees (until they get so rich they don't need the money anymore a la Buffett). Fund of funds – if they can even pick the best hedge funds – then tack on another 1% and 10% on top of this. One also has to wonder – if someone were so good a picking hedge funds – why wouldn't they either 1) run one themselves or 2) get in a seeding position where they get a slice of the management company (this is what Greenlight now does I believe).

It's a small distinction with a big big impact on Buffett's odds of success.

http://longbets.org/362/#adjudication_terms

Gold is pretty polarizing, but in a little known occurrence when Buffett was making the rounds after his 2011 report someone did point out that many people don't own gold as a replacement for stocks, they own it to diversify some of their cash holdings out of USD which have been printed by the trillions the last few years (and may one day have negative yields like Switzerland and Denmark!). Buffett basically said "[gold bugs] are right to be scared of cash (implying it's a bad long term asset too)".

As for stocks, the most money investors in aggregate will get from them is the money the businesses earn. So you can bid them up to be at parity with bonds….and then you'll get a bond-like return with equity-like risk.

Great points. A lot of the Buffett bet is about the fees for sure. But it's also a strong belief that most people will not be able to outdo a simple index strategy; the fees just make it all the more impossible for anyone to outperform over time.

I have never been a big fan of fund of funds for this reason. I can't really understand why anyone would invest in a fund of funds. In the old days, some of the fund of funds were basically hangers on of the big successful funds. Most were closed, and the FOF had access; the only way to get into xx fund was through such and such FOF. Or they had lower investment limits (maybe you don't have $10 million mininum so you invest $1 million in a FOF that invests in the other fund etc.).

And gold is polarizing for sure. I've owned it in the past and may own some again at some point in the future. But if I do own it again, it won't be when everyone is waiting for QE-infinity to cause inflation. It will be when everyone expects deflation…

And for stocks, at this level, I would hate to see stocks get bid up to parity with bonds. But even if it did it would still be different than bonds; the coupon on a bond is fixed but the coupon on a stock changes; hopefully it goes up as earnings grow. That's a pretty big distinction and can make a huge difference over time.

Anyway, thanks for the interesting discussion.

Cash-flow based assets have the most robust theory of investment value, developed by John Burr Williams, Ben Graham and others. But other types of assets also have their own functional models of investment value.

With currencies you can look at purchasing power parity and debt levels to estimate their value.

With commodities you can look at production costs, supply-demand balance and historical pricing.

With bitcoin, you can look at it as an alternative to payment systems like Western Union, Moneygram, Paypal and credit cards. Matt Levine's article last year was a very perceptive take on this: http://www.bloombergview.com/articles/2014-01-02/bitcoin-is-an-expensive-way-to-pay-for-stuff

When bitcoin was at $900, mining costs were uncompetitive with other payment systems. At the current price, bitcoin's mining costs are competitive. (Although maybe they are still a bad investment if you adjust for the risk that a new cryptocurrency or payment system will outcompete them in the future.)

Thanks for the thoughtful post. And yes, the "hidden" cost is an interesting concept. It's like my view of "hidden" risk; you can this or that, but oftentimes, people overlook the hidden risk. They may think they are reducing risk, but often are just exchanging one risk for another. I made a post about that somewhere recently.

So in the case of Bitcoin, I don't claim to understand it as well as tech folks, but I can see that the price of the Bitcoin has moved around a lot, sometimes going down 50-80% in a short period of time. So, yes, maybe we can avoid the 2-3% transaction cost of credit cards or wire tranfers. But you may risk tremendous loss just to avoid some fees here and there.

I can load up paypal with a big balance, for example. But it would still be in U.S. dollars, so I don't think the value will shrink 50% in a few months. Not at all. So I'd rather take whatever fee paypal charges than take a risk that my 'balance' may shrink 50%…

But then again, why would I ever load up a paypal balance or any prepaid card or anything like that at all? I wouldn't. And if I did, it would be a minimal amount, like an amount I might use in the next few months. But never more than that.

This is why, despite the amazingness of Bitcoin, at the end of the day, it's a speculation for most people who buy it; they want to see it go up in value versus the dollar. That's not the role of a payment system.

I agree with you mostly.

Another way to put it is that the price is set by the ~90% of people who are speculating, while the value is set by the ~10% of people who are actually using it as a payment / transfer system. They do exist.

But for most purposes it is more expensive than Paypal, once you add in currency charges. It would need to get quite a bit cheaper for me to buy bitcoins.

I've been a bitCON basher from very early on. Yes, even when it was <100. But when the mania hit, and the morons from cnbc (fast money talking head, name escapes me, he's the goofy looking one, oops, that could be any of 5) started pumping it at 600-700 1000, well.

It's a ridiculous scam, has zero value, can be duplicated for 5 cents, and why anyone but a simpleton would want to INVEST in something like this is beyond me.

The only reason merchants accept it is to drive incremental sales from zealots. I would expect the btc is transformed into REAL $ in about 1 nanosecond.