So here’s an interesting situation. Some people just have a knack for getting out of bad situations. I remember when Leucadia got out of their WilTel. It was a disaster, but they got out at break-even and walked away with a big tax asset. It sort of reminds me of a silent movie scene where Chaplin or Keaton walks away and a grand piano crashes onto the sidewalk where they stood only moments before.

And here’s Einhorn’s great escape.

Biofuel Energy Corp

Greenlight and Third Point are both listed as large shareholders in the original S-1 in 2007 so were pre-IPO investors (along with Cargill) of the original BioFuel Energy.

Anyway, this has been a disaster, going from an IPO price of $10.50 down to less than $1.00 in a year and then to $0.25 not soon after that (there was a 1/20 reverse split in 2012).

Greenlight owned around 11.85 million shares after the IPO, valuing the stake at $124 million. I don’t know what his cost was (5 million of the shares had a cost basis of $5/share, 2.5 million were bought on a concurrent private offering on the IPO so presumably cost $10.50, and I don’t know what the class B shares cost). There was a rights offering at $0.56/share in 2010 where I think Greenlight spent $17 million or so bringing up shares owned to 43 million. And then there was a 1/20 reverse split bringing shares owned by Greenlight to 2.2 million shares.

Anyway, adjusting for the 1/20 reverse split, the $5/share cost translates to $100/share. The $10.50 IPO price becomes $210, and the $0.56/share they paid for more shares in the 2010 rights offering translates to $11.20/share to the comparable current price of $7.00.

So on this basis, it’s hard to say that Greenlight is going to walk away from this at break even.

Anyway, this deal happened at around the time Pacific Ethanol (PEIX) was soaring; Bill Gate’s investment company was an investor. I looked at it then but wondered why it was such a great business; both input and output prices were beyond their control and there clearly was no moat at all (not to mention some very smart people saying what a stupid idea using ethanol for energy was). For Greenlight/Third Point, the plan was probably to just build some ethanol plants and flip them to the public (which they did successfully up to there).

Either way, it’s a tiny position for these guys. It was a nice ‘punt’ on a popular theme at the time.

Here’s a description of BioFuel’s business from one of their filings:

BioFuel Energy Corp.BioFuel Energy Corp. was incorporated as a Delaware corporation on April 11, 2006, to invest solely in BioFuel Energy, LLC (the “LLC”), a limited liability company organized on January 25, 2006, to build and operate ethanol production facilities in the midwestern United States. From June 2008 through November 22, 2013, the Company operated two ethanol production facilities located in Wood River, Nebraska, and Fairmont, Minnesota, that produced and sold ethanol and its related co-products. The Company’s ethanol plants were owned and operated by the operating subsidiaries of the LLC, which were party to a Credit Agreement (the “Senior Debt Facility”) with a group of lenders. Substantially all of the assets of the operating subsidiaries were pledged as collateral under the Senior Debt Facility. On November 22, 2013, the Company’s ethanol plants and all related assets were transferred to certain designees of the lenders in full satisfaction of all outstanding obligations under the Senior Debt Facility. Following the disposition of the ethanol production facilities, we are a holding company with no substantial operations of our own. Our headquarters are located in Denver, Colorado.

At June 30, 2014, the Company retained approximately $8.1 million in cash and cash equivalents. As of June 30, 2014, the Company also retained federal net operating loss (“NOL”) carryforwards in the amount of approximately $181.3 million, which have been fully reserved against.

BIOF basically became a shell company with a tax asset and some cash, and they got a delisting notice from NASDAQ.

And here’s the company that it bought (owned mostly by Greenlight):

JBGL

JBGL is a real estate operator involved in the purchase and development of land for residential use, construction, lending and home building operations. JBGL Capital, LP and JBGL Builder Finance LLC were each formed under the laws of the State of Delaware. JBGL Capital, LP was formed in 2008 and JBGL Builder Finance LLC was formed in 2010. Affiliates of Greenlight provided a majority of the initial capital for both entities, with the Brickman Parties providing the remaining capital.

JBGL Capital (its land development business) and JBGL Builder Finance (its builder operations business) and their affiliates are engaged in all aspects of the homebuilding process, including land acquisition and development, entitlements, design, construction, marketing and sales of various residential projects in master planned communities, primarily in the high-growth metropolitan areas of Dallas and Fort Worth, Texas (“DFW”) and Atlanta, Georgia.

JBGL currently owns or controls approximately 4,300 home sites in prime locations in the DFW and Atlanta markets. JBGL considers prime locations to be supply constrained lots with high housing demand and where much of the surrounding property has already been developed. JBGL management believes that it is a leading land developer in its markets. JBGL develops lots for both public company builders and large privately held builders. JBGL also owns 50% controlling interests in several builders and provides construction financing for approximately 900 homes annually.

The purchase price was $275 million; $191.8 million in cash (partly funded by a $150 million loan from Greenlight and $70 million from their rights offering) and 11.1 million shares of stock (priced at $7.49/share). After all is said and done, Greenlight owns 49.9% of GRBK. The value of GRBK is up, but most of that increase in value came from the rights offering and new stock issued to Greenlight.

JBGL was basically funded by Greenlight to invest in the real estate business in 2008 to take advantage of a distressed industry. It is run by James Brickman, a long-time friend of Einhorn:

James R. Brickman — Mr. Brickman is the founding manager and advisor of each of JBGL Capital LP, since 2008, and JBGL Builder Finance LLC since 2010. Mr. Brickman is responsible for all major investment decisions, capital allocation, strategic planning and relationships with JBGL’s builders and lead investor. Prior to forming JBGL in 2008, Mr. Brickman was a manager of various joint ventures and limited partnerships that developed and built low- and high-rise office buildings, multi-family and condominium homes, single-family homes, entitled land and supervised a property management company. He previously also served as Chairman and CEO of Princeton Homes Ltd. and Princeton Realty Corporation, which developed land, constructed custom single-family custom homes and managed apartments it built. Mr. Brickman has over 37 years’ experience in nearly all phases of real estate construction, development and real estate finance property management. He received a B.B.A. degree and M.B.A from Southern Methodist University.

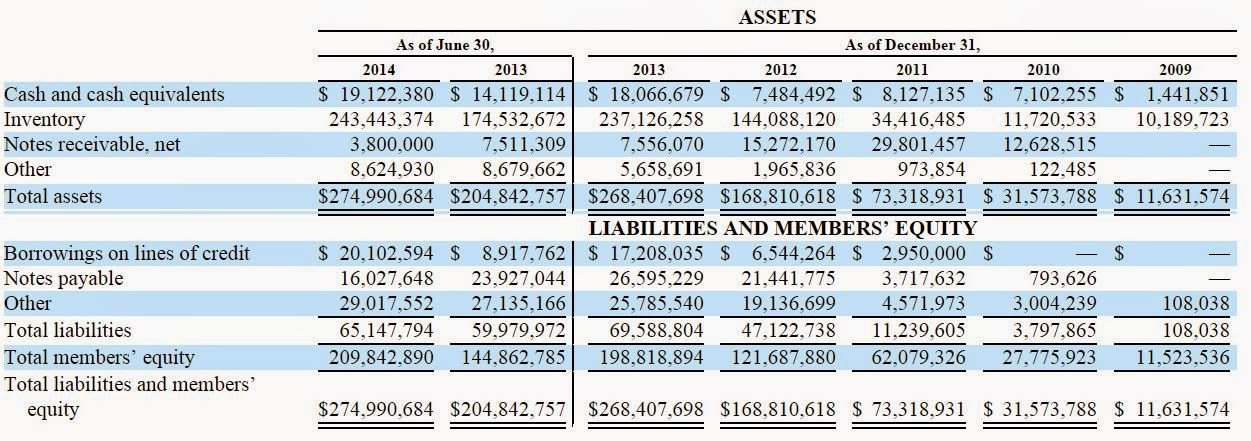

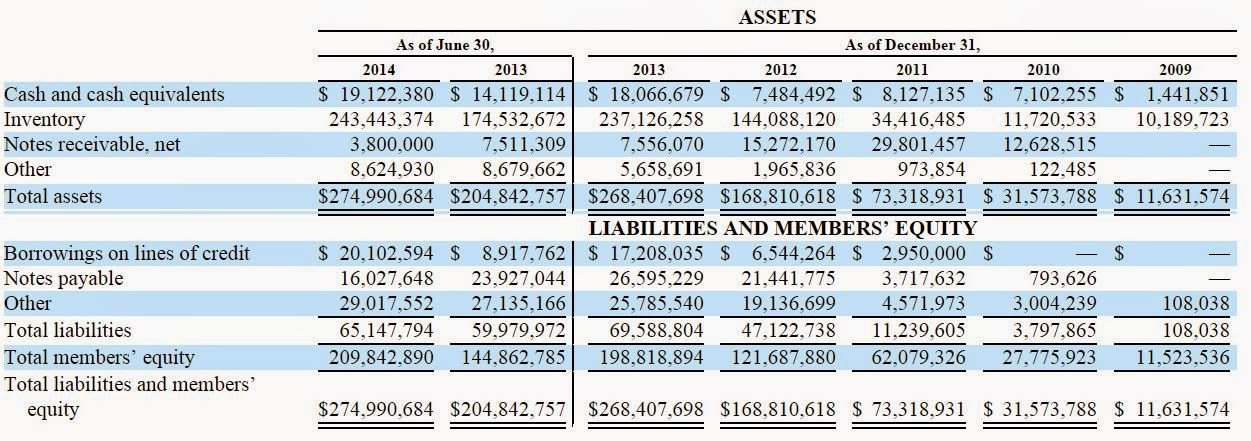

Here are the financials of JBGL before the deal from the BIOF rights offering prospectus:

| Three Months Ended June 30, | For the Six Months Ended June 30, | For the Year Ended December 31, | ||||||||||||||||||||||||||||||||||

| 2014 | 2013 | 2014 | 2013 | 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||||||||||||||

| REVENUES: | ||||||||||||||||||||||||||||||||||||

| Sale of residential units | $ | 55,048,744 | $ | 37,829,298 | $ | 104,685,088 | $ | 64,958,699 | $ | 168,591,201 | $ | 50,105,030 | $ | 9,085,785 | $ | 864,822 | $ | — | ||||||||||||||||||

| Cost of residential units | (41,219,387 | ) | (28,358,191 | ) | (78,611,754 | ) | (49,401,195 | ) | (122,616,113 | ) | (39,642,357 | ) | (7,921,806 | ) | (491,628 | ) | — | |||||||||||||||||||

| Gross profit on sale of residential units | 13,829,357 | 9,471,107 | 26,073,334 | 15,557,504 | 45,975,088 | 10,462,673 | 1,163,979 | 373,194 | — | |||||||||||||||||||||||||||

| Sale of land and lots | 10,794,690 | 8,881,770 | 24,167,258 | 14,512,393 | 33,734,513 | 22,927,080 | 6,184,206 | 8,905,967 | 2,508,650 | |||||||||||||||||||||||||||

| Cost of land and lots | (8,141,006 | ) | (5,984,826 | ) | (17,909,072 | ) | (8,580,118 | ) | (21,512,814 | ) | (15,256,065 | ) | (3,982,602 | ) | (5,540,845 | ) | (1,724,781 | ) | ||||||||||||||||||

| Gross profit on sale of land and lots | 2,653,684 | 2,896,944 | 6,258,186 | 5,932,275 | 12,221,699 | 7,671,015 | 2,201,604 | 3,365,122 | 783,869 | |||||||||||||||||||||||||||

| Interest and fees | 305,660 | 783,757 | 680,120 | 1,678,610 | 3,542,174 | 7,124,339 | 2,558,159 | 137,698 | — | |||||||||||||||||||||||||||

| Other income | 427,732 | 1,417,600 | 480,154 | 1,849,694 | 1,400,418 | 3,771,839 | 1,636,099 | 225,524 | 553 | |||||||||||||||||||||||||||

| 17,216,433 | 14,569,408 | 33,491,794 | 25,018,083 | 63,139,379 | 29,029,866 | 7,559,841 | 4,101,538 | 784,422 | ||||||||||||||||||||||||||||

| EXPENSES: | ||||||||||||||||||||||||||||||||||||

| Salaries and management fees – related party | 3,213,424 | 2,079,708 | 6,747,392 | 4,227,840 | 11,266,351 | 4,370,845 | 1,886,509 | 927,736 | — | |||||||||||||||||||||||||||

| Selling, general and administrative | 2,491,408 | 890,383 | 4,772,977 | 2,178,237 | 6,623,437 | 3,311,734 | 1,183,762 | 1,147,042 | 566,312 | |||||||||||||||||||||||||||

| Other expenses | 647,077 | 153,471 | 953,976 | 284,576 | 606,210 | 404,673 | 35,737 | 3,332 | — | |||||||||||||||||||||||||||

| 6,351,909 | 3,123,562 | 12,474,345 | 6,690,653 | 18,495,998 | 8,087,252 | 3,106,008 | 2,078,110 | 566,312 | ||||||||||||||||||||||||||||

| Net income before taxes | 10,864,524 | 11,445,846 | 21,017,449 | 18,327,430 | 44,643,381 | 20,942,614 | 4,453,833 | 2,023,428 | 218,110 | |||||||||||||||||||||||||||

| State tax expense | — | 59,000 | 337,790 | 209,500 | 327,481 | 230,411 | 34,089 | 41,888 | — | |||||||||||||||||||||||||||

| Net income | 10,864,524 | 11,386,846 | 20,679,659 | 18,177,930 | 44,315,900 | 20,712,203 | 4,419,744 | 1,981,540 | 218,110 | |||||||||||||||||||||||||||

| Less: net income attributable to non-controlling interest | 3,454,819 | 3,772,067 | 5,921,453 | 4,471,692 | 12,308,734 | 3,517,911 | 56,382 | — | — | |||||||||||||||||||||||||||

| Net income attributable to controlling interest | $ | 7,409,705 | $ | 7,614,799 | $ | 14,758,206 | $ | 13,646,238 | $ | 32,007,166 | $ | 17,194,292 | $ | 4,363,362 | $ | 1,981,540 | $ | 218,110 | ||||||||||||||||||

During the 3Q 2014 conference call, Brickman elaborated on what’s different about GRBK:

Our management is very much aligned with our shareholders. Greenlight Capital is a 49.9% shareholder and my family owns 8.4% of the equity of Great Brick Partners. Over the last couple of weeks, I’ve received a few questions regarding differences in my ownership percentage in SEC filings compared to the 8.4%. That is due to some of my family’s ownership being held in the names of my adult children. Our family in total still owns 8.4%.

Our goal is to provide superior risk-adjusted returns to our shareholders. We will accomplish this by focusing on the long-term and not giving too much weight to near-term financial results. Analysts wanting to see a smooth, linear progression of GAAP earnings quarter-to-quarter may be disappointed. For example, about 25% of our assets or $75 million is invested in two large neighborhoods that have been under planning and development for two years and have not yet produced any revenue. We anticipate that both these neighborhoods will come online in 2015.

Our business model is different than most large public builders. We are a land development company that also buys controlling interest in local builders, and we make profits in three ways. First, most of our lots are not owned by our local builders, but by Green Brick. Green Brick sells lots to these builders at high rates of return. Second, Green Brick makes first lien construction loans at above market interest rates to our builders. If our builders can turn their inventory efficiently, their interest cost as a percent of revenue is approximately 4%, which is still typical of most public builders. Green Brick should make a mid-teen unleveraged return on equity before profit sharing with our builders.

Third, we do receive profit on lot sales and loans before a builder receives any profit. Because our builders share the last residual tranche of profit, in other words, sale proceeds from a home, our builders are highly motivated to operate efficiently.

…and later he elaborates:

First, we believe we operate in two of the best housing markets in the country. Dallas has the best job growth in the country, and Atlanta is the sixth best. We believe that both of our markets are staged for significant growth. Large corporations such as Toyota and State Farm are relocating their national headquarters near where we own most of our Dallas lots. We evaluate every geographical area continuously, but we will not expand into new markets unless we believe they will provide significant future value for our shareholders.

Second, we have some of the best prime lots in supply constrained sub-markets in Dallas and Atlanta. Two of our largest investments have been in the planning and development process for about two years. We anticipate that the Village of Twin Creeks in Allen, Texas and Bellmoore Park in Johns Creek, Georgia will deliver their first homes in 2015, but will not be big contributors to our operating results until the second half of the year. To learn more about these neighborhoods, please visit our website at greenbrickpartners.com.

Three, for our strong operating partners, real estate is a very local business. We aim to find the very best builders in every geography we enter, and we have award-winning operating partners in the Dallas and Atlanta regions that have been in the business in those markets for decades. We help our builders with strategic land purchases, product design, capital allocation, and planning, but we leave the day-to-day operations to our builders.

Four, we aim to build a better product and offer it at a fair price to our customers. We offer niche product designs in both Atlanta and Dallas that appeal to downsizing homeowners and younger professionals, but stay in the affordable range of $350,000 to $600,000 with most of our product line. Our historical results show that our strategy has been successful, and we will continue to refine it as we move to open even larger planned communities that we’ve just discussed.

Tax asset

And here’s the tax part of all of this (BIOF):

3. Deferred Tax Asset

As of June 30, 2014, the Company had a $63.4 million deferred tax asset related to its NOLs. For accounting purposes, a valuation allowance is required to reduce a deferred tax asset if it is determined that it is more likely than not that all or some portion of the deferred tax asset will not be realized due to the lack of sufficient taxable income. The Company’s financial statements currently provide a full valuation allowance against our deferred tax asset due to the Company’s historical operating losses and, in accordance with applicable guidance in connection with the preparation of the pro forma financial statements, we have not adjusted this valuation allowance. As a result, the deferred tax asset is not set forth on our historical or pro forma balance sheet.

The NOLs do not begin to expire until 2029. Our ability to utilize our NOLs will depend on the amount of taxable income we generate in future periods. Based on JBGL’s 2013 and year-to-date 2014 taxable income results, management expects that JBGL should generate sufficient taxable income to utilize substantially all of the NOLs before they expire. The Company will evaluate the appropriateness of a valuation allowance in future periods based on the consideration of all available evidence, including the generation of taxable income, using the more likely than not standard.

| As of June 30, 2014 | ||||||||

| Biofuel Energy Corp. Actual |

Pro Forma Combined(1) |

|||||||

| (in thousands, except per share amounts) | ||||||||

| Tangible assets | $ | 8,841 | $ | 345,867 | ||||

| Tangible liabilities | (1,406 | ) | (216,554 | ) | ||||

| Net tangible assets | $ | 7,435 | $ | 129,313 | ||||

| Divided by shares outstanding | 6,238 | 31,346 | ||||||

| Net tangible book value per share | $ | 1.19 (a) | $ | 4.13 | (b) | |||

Pro Forma Combined Balance Sheet

As of June 30, 2014

| BioFuel Energy Corp. Actual |

JBGL Actual |

Pro Forma Adjustments | Pro Forma Combined | |||||||||||||

| (in thousands) | ||||||||||||||||

| Assets | ||||||||||||||||

| Cash and cash equivalents | $ | 8,054 | $ | 17,113 | $ | 61,735 | (a) | $ | 86,902 | |||||||

| Restricted cash | 2,009 | 2,009 | ||||||||||||||

| Accounts receivable | 366 | 366 | ||||||||||||||

| Inventory: | ||||||||||||||||

| Completed home inventory and residential lots held for sale | 42,776 | 42,776 | ||||||||||||||

| Work in process | 133,175 | 133,175 | ||||||||||||||

| Undeveloped land | 61,103 | 61,103 | ||||||||||||||

| Investment in direct financing lease | 6,389 | 6,389 | ||||||||||||||

| Property and equipment, net | 57 | 1,494 | 1,551 | |||||||||||||

| Notes receivable, net | 3,800 | 3,800 | ||||||||||||||

| Earnest money deposits | 5,600 | 5,600 | ||||||||||||||

| Other assets | 730 | 1,166 | 300 | (b) | 2,196 | |||||||||||

| Total assets | $ | 8,841 | $ | 274,991 | $ | 62,035 | $ | 345,867 | ||||||||

| Liabilities and equity | ||||||||||||||||

| Accounts payable | $ | 47 | $ | 9,628 | $ | $ | 9,675 | |||||||||

| Accrued expenses | 1,359 | 8,141 | 9,500 | |||||||||||||

| Customer and builder deposits | 11,249 | 11,249 | ||||||||||||||

| Borrowings on lines of credit | 20,102 | 20,102 | ||||||||||||||

| Notes payable | 16,028 | 150,000 | (c) | 166,028 | ||||||||||||

| Total liabilities | 1,406 | 65,148 | 150,000 | 216,554 | ||||||||||||

| Commitments and contingencies | ||||||||||||||||

| Equity | ||||||||||||||||

| BioFuel Energy Corp. stockholders’ equity: | ||||||||||||||||

| Preferred stock | ||||||||||||||||

| Common stock | 54 | 259 | (d) | 313 | ||||||||||||

| Class B common stock | 8 | (8 | )(e) | |||||||||||||

| Less common stock held in treasury | (4,316 | ) | 4,316 | (f) | ||||||||||||

| Additional paid-in capital | 191,056 | 199,058 | (271,899 | )(g) | 118,215 | |||||||||||

| Accumulated deficit | (171,789 | ) | 171,789 | (g) | ||||||||||||

| Total BioFuel Energy Corp. stockholders’ equity | 15,013 | 199,058 | (95,543 | ) | 118,528 | |||||||||||

| Noncontrolling interest | (7,578 | ) | 10,785 | 7,578 | (h) | 10,785 | ||||||||||

| Total equity | 7,435 | 209,843 | (87,965 | ) | 129,313 | |||||||||||

| Total liabilities and equity | $ | 8,841 | $ | 274,991 | $ | 62,035 | $ | 345,867 | ||||||||

| BioFuel Energy Corp. Actual |

JBGL Actual |

Pro Forma Adjustments |

Pro Forma Combined |

|||||||||||||

| (in thousands) | ||||||||||||||||

| Assets | ||||||||||||||||

| Cash and cash equivalents | $ | 7,081 | $ | 7,445 | $ | 25,362 | (a) | $ | 39,888 | |||||||

| Restricted cash | 1,987 | 1,987 | ||||||||||||||

| Accounts receivable | 5 | 81 | 86 | |||||||||||||

| Inventory: | ||||||||||||||||

| Completed home inventory and residential lots held for sale | 42,772 | 42,772 | ||||||||||||||

| Work in process | 155,215 | 155,215 | ||||||||||||||

| Undeveloped land | 58,447 | 58,447 | ||||||||||||||

| Land not owned under option agreements | 3,547 | 3,547 | ||||||||||||||

| Investment in direct financing lease | 5,930 | 5,930 | ||||||||||||||

| Property and equipment, net | 51 | 1,667 | 1,718 | |||||||||||||

| Earnest money deposits | 7,183 | 7,183 | ||||||||||||||

| Other assets | 1,693 | 1,593 | (928 | )(b) | 2,358 | |||||||||||

| Total assets | $ | 8,830 | $ | 285,867 | $ | 24,434 | $ | 319,131 | ||||||||

| Liabilities and equity | ||||||||||||||||

| Accounts payable | $ | 26 | $ | 14,074 | $ | $ | 14,100 | |||||||||

| Accrued expenses | 2,050 | 10,220 | (1,975 | )(c) | 10,295 | |||||||||||

| Customer and builder deposits | 11,397 | 11,397 | ||||||||||||||

| Obligations related to land not owned under option agreements | 3,547 | 3,547 | ||||||||||||||

| Borrowings on lines of credit | 25,344 | 25,344 | ||||||||||||||

| Notes payable | 12,352 | 150,000 | (d) | 162,352 | ||||||||||||

| Total liabilities | 2,076 | 76,934 | 148,025 | 227,035 | ||||||||||||

| Commitments and contingencies | ||||||||||||||||

| Equity | ||||||||||||||||

| BioFuel Energy Corp. stockholders’ equity: | ||||||||||||||||

| Preferred stock | ||||||||||||||||

| Common stock | 54 | 259 | (e) | 313 | ||||||||||||

| Class B common stock | 8 | (8 | )(f) | |||||||||||||

| Less common stock held in treasury | (4,316 | ) | 4,316 | (g) | ||||||||||||

| Additional paid-in capital | 191,056 | 201,781 | (308,206 | )(h) | 84,631 | |||||||||||

| Accumulated deficit | (172,393 | ) | 172,393 | (h) | ||||||||||||

| Total BioFuel Energy Corp. stockholders’ equity | 14,409 | 201,781 | (131,246 | ) | 84,944 | |||||||||||

| Noncontrolling interest | (7,655 | ) | 7,152 | 7,655 | (i) | 7,152 | ||||||||||

| Total equity | 6,754 | 208,933 | (123,591 | ) | 92,096 | |||||||||||

| Total liabilities and equity | $ | 8,830 | $ | 285,867 | $ | 24,434 | $ | 319,131 | ||||||||

Selected Public Companies Analysis

Duff & Phelps compared certain financial information of JBGL to corresponding data and ratios from the following seventeen publicly traded companies that Duff & Phelps deemed relevant to its analysis:

| • | Beazer Homes USA, Inc. |

| • | D.R. Horton, Inc. |

| • | Hovnanian Enterprises, Inc. |

| • | KB Home |

| • | Lennar Corporation |

| • | M.D.C. Holdings, Inc. |

| • | Meritage Homes Corporation |

| • | NVR, Inc. |

| • | PulteGroup, Inc. |

| • | Standard Pacific Corp. |

| • | Taylor Morrison Home Corporation |

| • | The Ryland Group, Inc. |

| • | Toll Brothers, Inc. |

| • | TRI Pointe Homes, Inc. |

| • | UCP, Inc. |

| • | WCI Communities, Inc., and |

| • | William Lyon Homes |

| REVENUE GROWTH | RETURN ON TANGIBLE EQUITY | EPS GROWTH | EBITDA GROWTH | EBITDA MARGIN | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3-YR CAGR | LTM | 2014 | 2015 | 3-YR CAGR | LTM | 3-YR CAGR | LTM | 2014 | 2015 | 3-YR CAGR | LTM | 2014 | 2015 | 3-YR CAGR | LTM | 2014 | 2015 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| High | 88.0 | % | 197.6 | % | 76.2 | % | 92.8 | % | 15.4 | % | 25.1 | % | 130.6 | % | 179.5 | % | 77.1 | % | 118.0 | % | 166.9 | % | 167.4 | % | 295.8 | % | 52.4 | % | 11.2 | % | 14.0 | % | 19.9 | % | 19.7 | % | ||||||||||||||||||||||||||||||||||||

| Low | 7.5 | % | 10.5 | % | -0.2 | % | 11.5 | % | -39.0 | % | -4.1 | % | 17.1 | % | -18.1 | % | -0.6 | % | 9.5 | % | 9.8 | % | 39.5 | % | -0.8 | % | 4.4 | % | 0.6 | % | 4.7 | % | 6.1 | % | 5.6 | % | ||||||||||||||||||||||||||||||||||||

| Mean | 23.0 | % | 45.3 | % | 27.7 | % | 24.8 | % | 0.9 | % | 8.8 | % | 61.3 | % | 99.3 | % | 33.9 | % | 37.7 | % | 77.0 | % | 99.4 | % | 85.6 | % | 25.2 | % | 5.9 | % | 10.0 | % | 12.9 | % | 13.1 | % | ||||||||||||||||||||||||||||||||||||

| Median | 21.0 | % | 38.3 | % | 25.9 | % | 19.7 | % | 4.3 | % | 7.9 | % | 53.0 | % | 97.6 | % | 30.1 | % | 29.2 | % | 61.5 | % | 92.0 | % | 58.3 | % | 22.8 | % | 6.3 | % | 11.2 | % | 12.2 | % | 13.4 | % | ||||||||||||||||||||||||||||||||||||

| JBGL | N/A | 193.1 | % | 14.4 | % | 50.4 | % | 7.2 | % | 9.5 | % | N/A | N/A | 5.0 | % | 42.7 | % | N/A | 110.6 | % | 1.8 | % | 40.9 | % | 15.1 | % | 19.0 | % | 16.9 | % | 15.8 | % | ||||||||||||||||||||||||||||||||||||||||

| STOCK PRICE AS A MULTIPLE OF | ||||||||||||||||

| TANGIBLE BOOK VALUE | LTM EPS | 2014 EPS | 2015 EPS | |||||||||||||

| High | 3.96x | 25.8x | 24.1x | 37.5x | ||||||||||||

| Low | 0.70x | 8.6x | 10.7x | 9.8x | ||||||||||||

| Mean | 1.69x | 18.3x | 16.6x | 13.8x | ||||||||||||

| Median | 1.66x | 19.2x | 15.9x | 12.0x | ||||||||||||

| METRIC | SELECTED MULTIPLE RANGE | |||

| 2014 Net Income | 14.0x – 15.0x | |||

| 2015 Net Income | 10.0x – 11.0x | |||

| Book Value as of April 30, 2014 | 1.40x – 1.50x | |||

Interest and Repayments

Amounts drawn under the facility will bear interest at 9.0% per annum from October 27, 2014 through the first anniversary thereof and 10.0% per annum thereafter, and the Company will have a one-time right to elect to pay up to four consecutive quarters’ interest in kind. The facility will have no amortization but is subject to mandatory prepayment with 100% of the net cash proceeds received from the incurrence of certain debt by the Company or the issuance of any equity securities. Voluntary prepayments of the facility will be permitted at any time. All prepayments made prior to October 27, 2016 will be subject to a 1.0% prepayment premium.

Here it is again, from above:

COMBINED AND CONSOLIDATED STATEMENTS OF CASH FLOWS

For the Years Ended December 31, 2013, 2012 and 2011

| 2013 | 2012 | 2011 | ||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||||||

| Net income | $ | 44,315,900 | $ | 20,712,203 | $ | 4,419,744 | ||||||

| Adjustment to reconcile net income to net cash used in operating activities: | ||||||||||||

| Depreciation expense | 291,857 | 53,289 | 8,142 | |||||||||

| (Increase) decrease in: | ||||||||||||

| Restricted cash | (1,063,160 | ) | (320,095 | ) | — | |||||||

| Accounts receivable | (333,226 | ) | 624,021 | (100,979 | ) | |||||||

| Inventory | (96,206,138 | ) | (98,154,339 | ) | (23,245,952 | ) | ||||||

| Earnest money deposits | (1,982,640 | ) | (1,309,366 | ) | — | |||||||

| Other assets | (981,731 | ) | 130,858 | (182,088 | ) | |||||||

| Increase (decrease) in: | ||||||||||||

| Accounts payable | 4,137,339 | 4,257,636 | 220,900 | |||||||||

| Accrued expenses | 3,956,032 | 1,156,370 | 192,234 | |||||||||

| Customer and builder deposits | (1,444,530 | ) | 9,150,720 | 1,154,600 | ||||||||

| NET CASH USED IN OPERATING ACTIVITIES | (49,310,297 | ) | (63,698,703 | ) | (17,533,399 | ) | ||||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||||||

| Investment in direct financing leases | — | (13,284,446 | ) | — | ||||||||

| Proceeds from sale of direct financing leases | 3,168,000 | 1,767,150 | — | |||||||||

| Issuance of notes receivable | (4,200,840 | ) | (17,788,385 | ) | (35,276,206 | ) | ||||||

| Repayments of notes receivable | 11,916,940 | 32,317,672 | 18,103,264 | |||||||||

| Acquisition of property and equipment | (687,115 | ) | (490,784 | ) | (26,444 | ) | ||||||

| NET CASH PROVIDED BY (USED IN) INVESTING ACTIVITIES | 10,196,985 | 2,521,207 | (17,199,386 | ) | ||||||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||||||

| Borrowings from lines of credit | 39,000,000 | 28,203,718 | 4,675,000 | |||||||||

| Proceeds from notes payable | 21,462,727 | 22,876,514 | 5,102,796 | |||||||||

| Repayments of lines of credit | (28,336,229 | ) | (24,609,454 | ) | (1,725,000 | ) | ||||||

| Repayments of notes payable | (16,309,273 | ) | (5,152,371 | ) | (2,178,790 | ) | ||||||

| Contributions from controlling interest members | 57,285,535 | 41,500,000 | 29,847,500 | |||||||||

| Contributions from non-controlling interest members | 1,756,417 | 1,214,766 | 424,587 | |||||||||

| Distributions to controlling interest members | (19,477,755 | ) | (1,028,437 | ) | (357,130 | ) | ||||||

| Distributions to non-controlling interest members | (6,749,083 | ) | (2,789,978 | ) | (31,298 | ) | ||||||

| NET CASH PROVIDED BY FINANCING ACTIVITIES | 48,632,339 | 60,214,758 | 35,757,665 | |||||||||

| NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | 9,519,027 | (962,738 | ) | 1,024,880 | ||||||||

| CASH AND CASH EQUIVALENTS AT BEGINNING OF YEAR | 7,164,397 | 8,127,135 | 7,102,255 | |||||||||

| CASH AND CASH EQUIVALENTS AT END OF YEAR | $ | 16,683,424 | $ | 7,164,397 | $ | 8,127,135 | ||||||

| Cash paid for: | ||||||||||||

| Interest | $ | 496,574 | $ | 345,584 | $ | 23,695 | ||||||

| State income taxes | $ | 664,880 | $ | 137,620 | $ | 10,344 | ||||||

Here is the breakdown of their inventory as of September 2014:

Completed home inventory and residential lots held for sale: $43 million

Work in process: $155 million

Undeveloped land: $58 million

EBITDA Valuation

In the conference call, Brickman said that they don’t want to give guidance, but there was guidance with respect to JBGL in the prospectus. In the above table, JBGL revenue growth is expected to be +14.4% in 2014 (already more than 20% year-to-date through September) and +50.4% in 2015. EBITDA margin is expected to be 16.9% in 2014 and 15.8% in 2015. These aren’t official guidance to investors so maybe we shouldn’t lean too hard on them. Merger proxies often have projections that management uses to evaluate deals etc.

Anyway, 2013 revenues were around $200 million for JBGL in 2013 (just adding the home sales and land sales). Assuming this grows +14.4% for the full year 2014 and then +50.4% in 2015, that gets us to revenues of around $344 million. And put a 15.8% EBITDA margin on that and we get 2015 expected EBITDA of $54 million.

With the stock trading at around $7.00/share, that’s a market cap of $219 million. Add $188 million in total debt and $7 million in noncontrolling interest less $40 million in cash we get $374 million in EV. That values GRBK at 6.9x EV/EBITDA. At 10x EV/EBITDA, the stock would be at $11/share; this is excluding cash and DTA.

You can do the same sort of exercise using earnings, but I thought EBITDA would be easier. For earnings, you can just add back the losses generated by the old Biofuel, which should roll off to zero. But with noncontrolling interest, taxes and whatnot, I figured just looking at the EBITDA would be easier.

You can get to EPS using the EBITDA above, but the trick would be figuring out what the deduction for noncontrolling interest would be; it doesn’t seem to be a linear relationship.

I played with some numbers above, but I don’t know if I got everything right (or anything!); it’s a messy situation. But that’s why it’s an interesting one, right? Particularly, the EV/EBITDA seems quite low (but it does assume 50% sales growth in 2015 which may or may not happen!). There is something to be said about the low noncontrolling interest on the balance sheet versus the high amount of income deducted for them; this may distort the EV/EBITDA too.

On the other hand, the market may just not be discounting a 50% growth in revenues for 2015, which admittedly may or may not happen.

All we got from Brickman on the conference call is that there are two big, new developments that will feed growth for years to come (that opens in 2015).

Stay tuned!

For your EV calc. I believe you should be subtracting the NOL or the DTA. In that case, GRBK would appear to have a lower multiple. Another interesting aspect is that management has received and will received stock based comp at $7.49. Incentives are aligned to create value. Management also alluded to using equity to fund growth opportunities.

Good point. I guess the DTA is going to be realized with a high probability (and it's an NOL DTA) so it (at least the discounted amount) can be subtracted from EV even if it's not cash.

I was curious about funding growth opportunities; they've bought up a ton of inventory recently so hopefully they don't need more massive amounts of capital; they have to work through what they already own. I suppose equity financing for acquisitions may happen forward.

One small note on valuing out the 3,517 lots for $100,000/lot to $352 million. Expenses will definitely bring the value down, but also time. Seems unlikely they sell that many lots in a year or two. Probably not worth it to go through the trouble/headache/spreadsheet but best way to really hammer it down is estimate the expenses and rev. from lots sold per year, then do a DCF on the annual net CF steam over 3 or 5 years or whatever reasonable amount of time to sell all those lots

Yes, good point. I thought of that, but the idea was "liquidation value", so you have to assume that someone can buy it and will have the capacity to develop it immediately or sell off the pieces they can't develop. That's the idea of "liquidation".

But yeah, in reality, that's not going to happen and the value will be some sort of discounted value over time, however long it takes to develop and sell the lots.

They actually own 3,289 lots and control 719 (based on September financials). You can estimate costs pretty easily since they arrive before revenue (they are on the balance sheet). Most of the proceeds will be tax free so the proceeds should mostly turn into cash. This will provide the fire power for future opportunities. Key here is management (judging them on current and future deals) and capital structure which I believe can be financed with lower cost debt. The combination of Brickman/GL makes this interesting. Agreed other similar investments might not be worth the time.

I apologize for the off topic question, but how do you save clippings from SEC filings? I am slowly transitioning to digital note taking, and this trick would be very helpful.

Hi, I just cut and paste with the mouse (and then control-c/control-v) off of the html document. If it's a pdf, then I just "snip" and save as a picture whatever I need (this is a windows thing).

Thank you, on behalf of myself and other oldfarts,

An Oldfart.

Great analysis. This has looked appetizing since I've been looking at it the last couple of years. And those DTAs will definitely come in handy down the line. Thanks again!

This was, hands down, one of the best explanations for Einhorn's "Get Out of Jail Free" card. I had stock in both Pacific Ethanol (PEIX) (which I was able to sell last year, thank the Gods, for a small profit) and BioFuel Energy Corp, which has turned into GRBK for those shareholders who bothered to open their mail and check the box. So, thank you. I am still holding fast to Beacon Power (the flywheel guys) hoping that dog will hunt at least to my break even point.

Have you had a chance to revisit this? Seems interesting and cheep again.

WMM. I am not sure what's there to "revisit"? It's cheap, the fundamental story has not changed much except that they raised cash at a very opportune time to pay off expensive debt. There is some anxiety over real estate in Dallas as a result of energy downturn but that has been the case for some time now. The COO was fired for undisclosed reasons but appears that whatever the reasons were, they weren't material or the company would have had to legally disclose them. Guidance was lowered but not for reasons that would impair the long term or even midterm value from the co. The stock is mostly down due to lack of liquidity and a major pullback in small cap stock. I think that sums it up. What else do you want to know?

Hi KK,

I would like to ask you if you have some current opinion about GRBK?

Thanks.

Hi,

They apparently had some operational issues, but my initial thoughts haven't changed much. Of course, the world has changed a lot, though. Oil and some of the industrial sector is getting hit hard so I can't imagine it not having an impact in some of their markets.

But this is more of a timing problem; whatever we thought would happen might take more time. The big factor is the asset value here, and I don't think that changes much other than some near term issues (based on the economy etc…).

KK,

Thanks. OK. Sorry if i didn´t understand, but when you said that the big factor factor is the asset value that is almost unchanged; the asset factor is more of a positive or negative in this case?

Thank you very much.

They own a lot of land, and that's good, usually. The market may not like that now if housing slows down and their markets get hit from the oil/gas 'depression', but that is not a permanent thing, I don't think…

kk,

It´s clear now. Thanks. Off topic here, have you been looking at some new stocks in the downturn?

Thanks again.

Is this one still on your radar? Third Point selling on the stock offering today…. Thanks.