I spent yesterday listening to the JPM investor day on their website (replay). They have a bunch of great slides so if you are interested in JPM at all, I would highly recommend at least flipping through them. There is a lot going on there that looks really interesting.

Anyway, as usual, this is not going to be a summary at all; I’m just going to point out things that interested me.

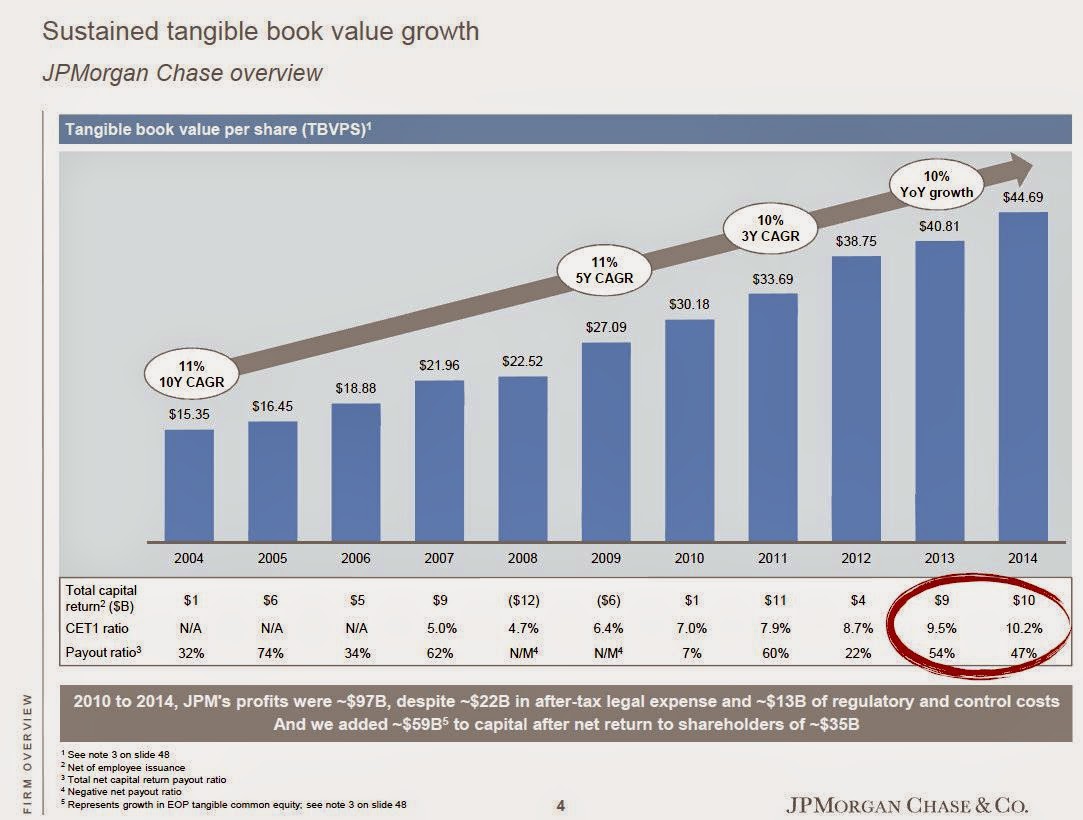

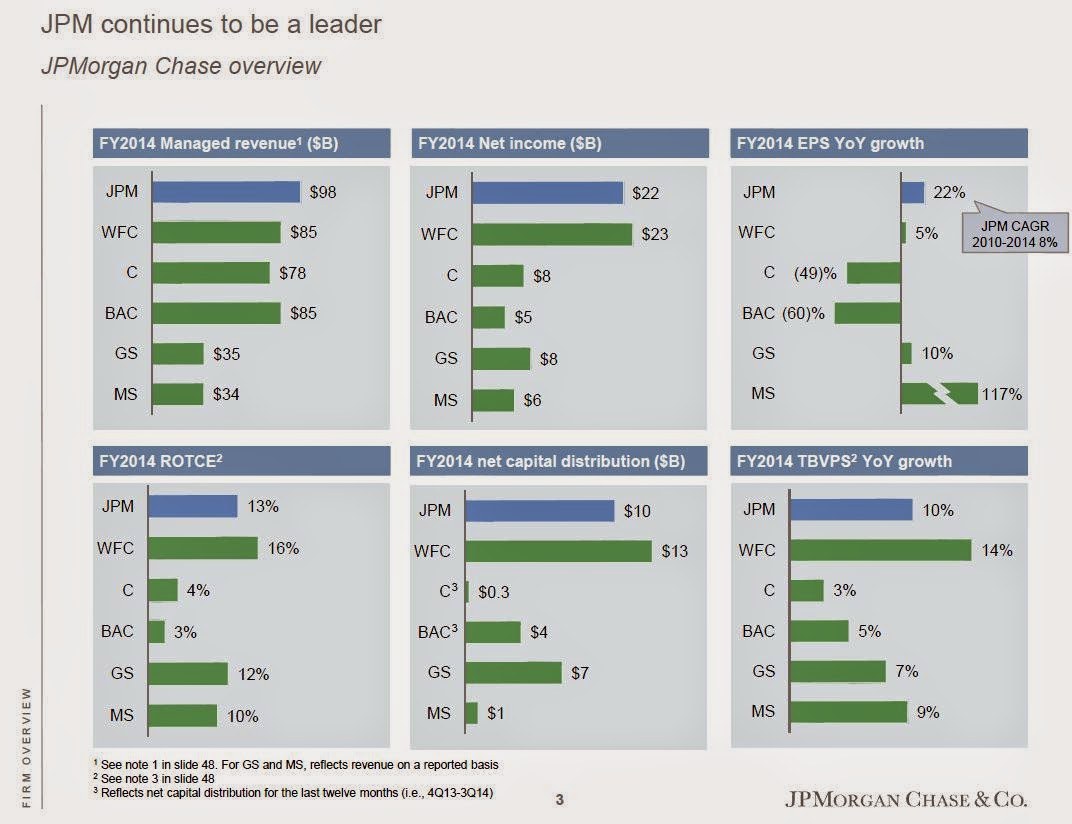

As usual, JPM is doing really well despite higher capital requirements. Here’s the usual chart that I like:

JPM grows their TBVPS at a remarkably consistent 10-11%/year. What is really striking about this chart (and I keep saying over and over) is, where is the financial crisis? Where is the whale trade? This is based on raw TBVPS so doesn’t include dividends paid.

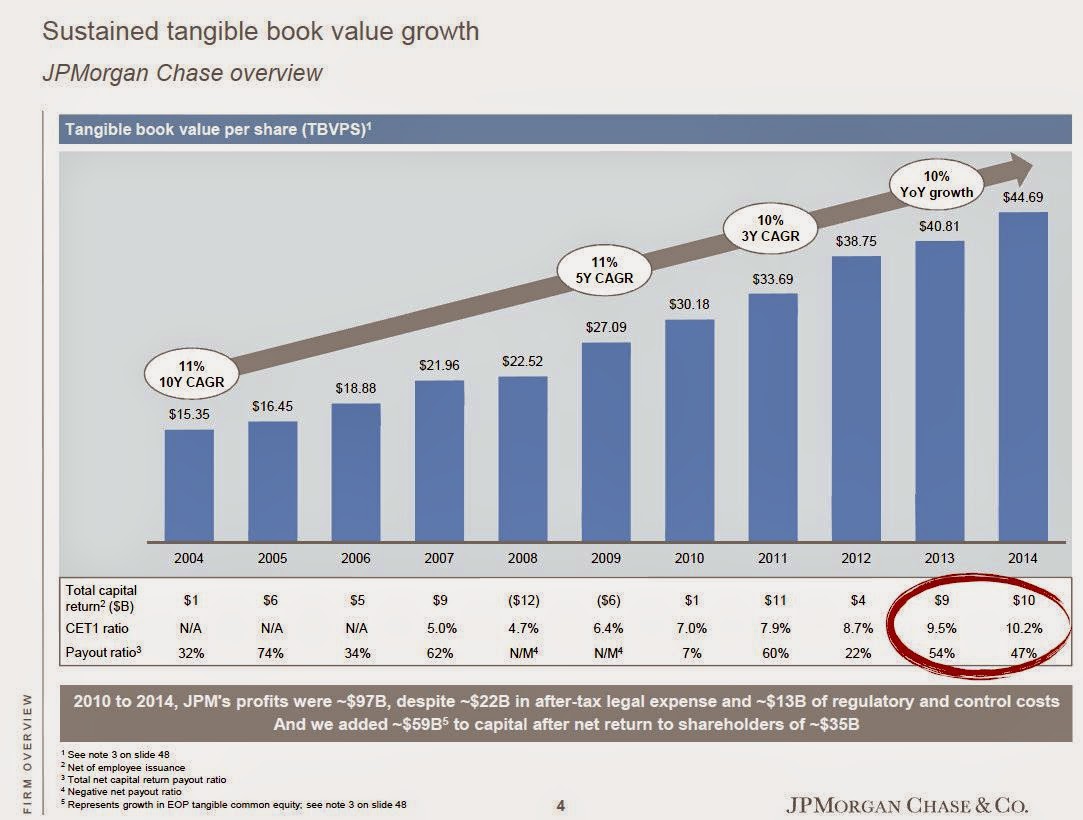

And much of this consistency comes from the diverse set of businesses:

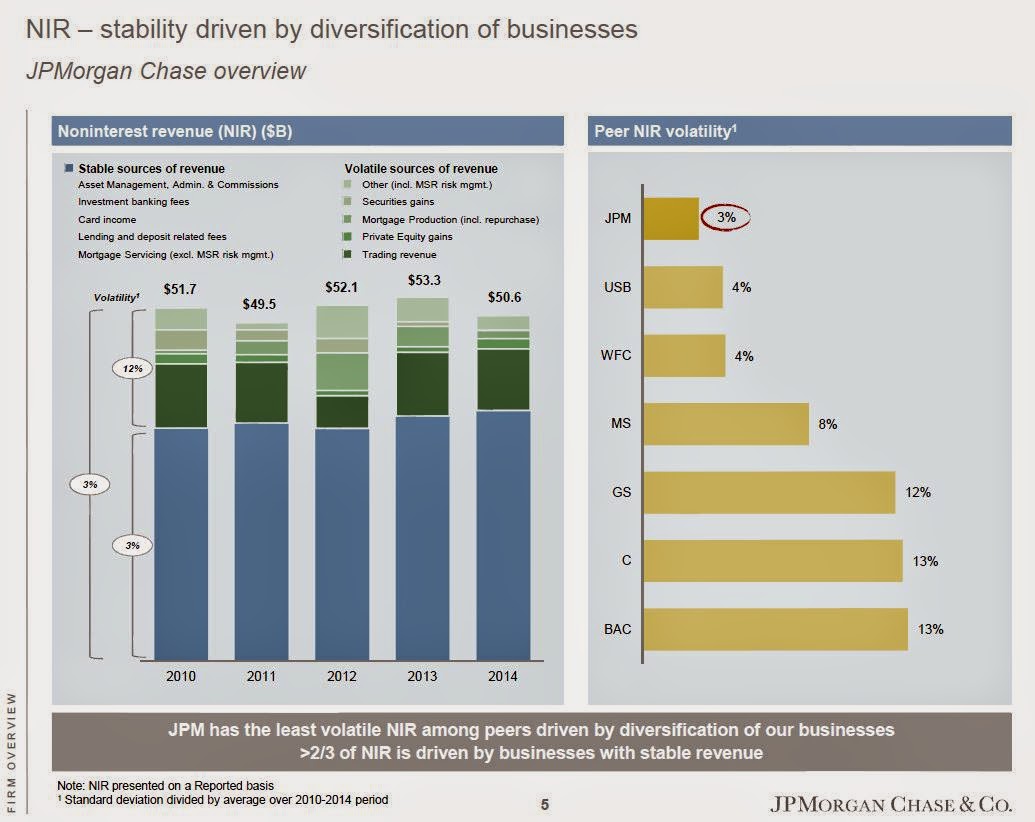

And JP Morgan will benefit from the normalization of interest rates: A 50 bps increase in net interest margin from normalizing interest rates would lead to a $10 billion increase in net interest income.

We’ll look at this interest rate stuff again later in their earnings simulation.

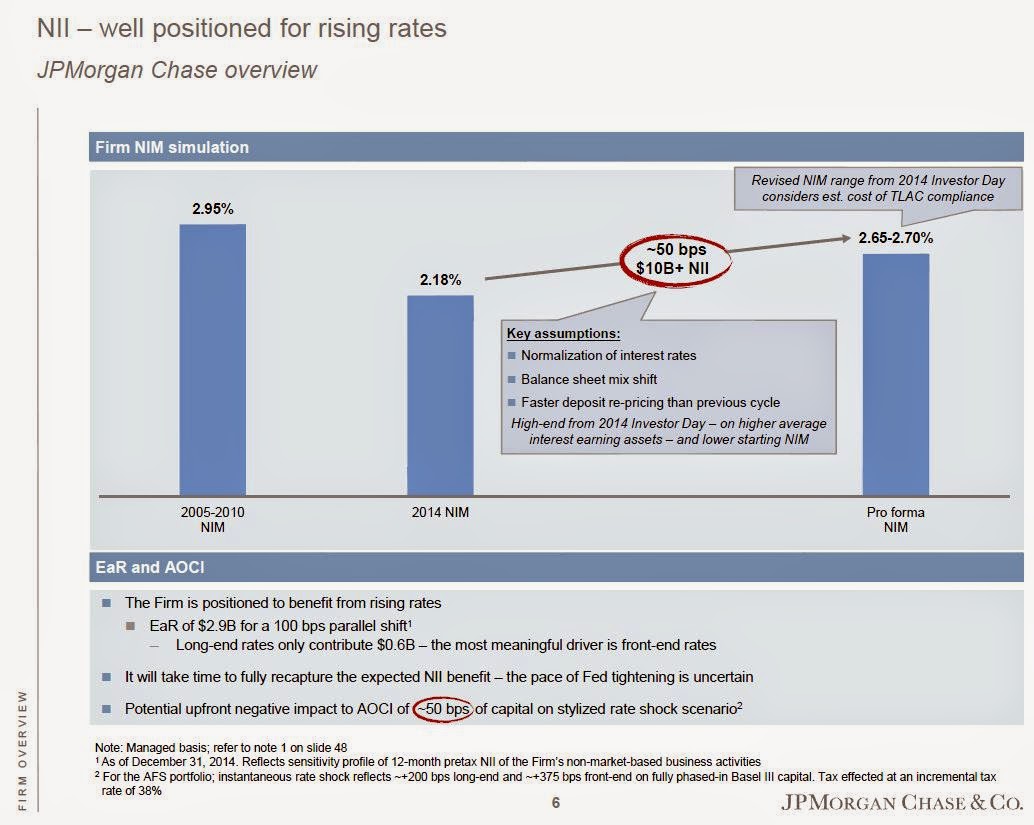

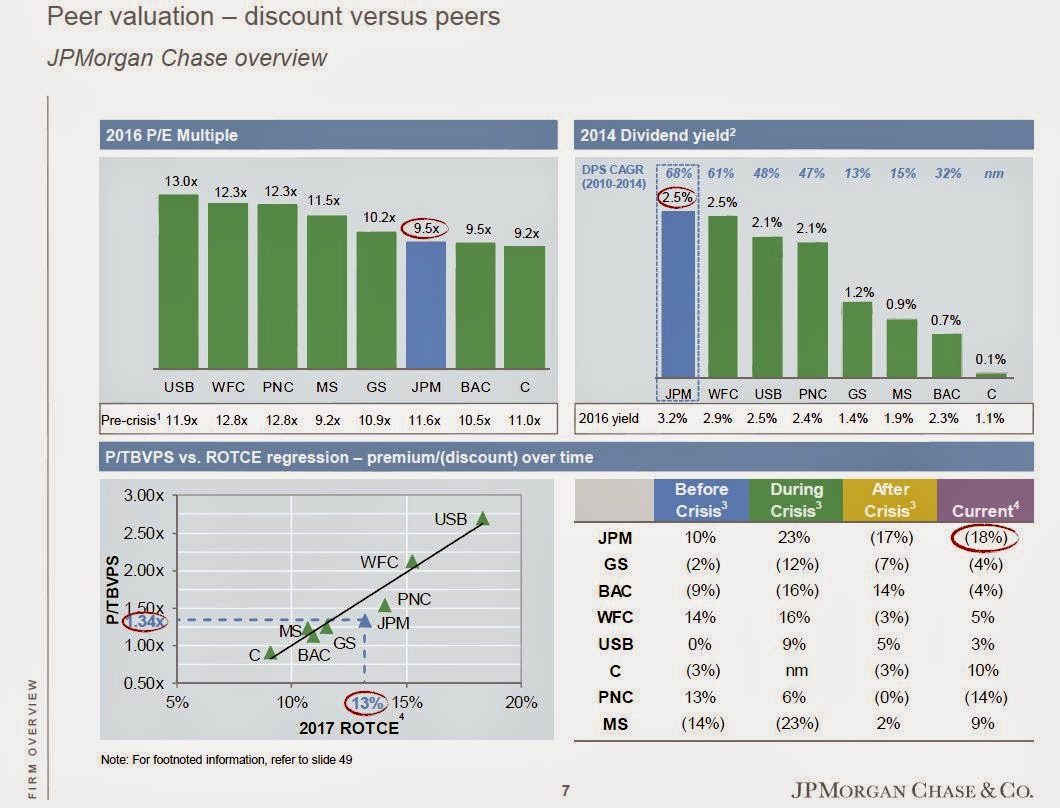

But first, here is a comparison versus peers:

The pre-crisis P/E in the top left chart is based on next-twelve months earnings estimate P/E average from January 2005 to June 2007.

For the table on the bottom right, the “before crisis” period is from January 2005 through June 2007, “during crisis” is July 2007 through December 2009 and “after crisis” is January 2010 through February 20, 2015

Pre-crisis, JPM traded at 11.6x P/E. We can just call that 12x. And it is now trading at 9.5x based on 2016 estimated P/E. Regressing P/TBVPS with ROTCE, JPM is 18% undervalued today (or as of February 20). Before the crisis, JPM traded at a 10% premium, and then 23% premium during the crisis and has been trading at a discount ever since.

Dimon on JPM Valuation

During the Q&A at the end of the day, Dimon talked about valuation. He said that the stock is cheap. His personal opinion is that this cheapness is temporary. He said the market is wrong. The market is always wrong. And it means nothing to him. JPM will always do the right thing for the right reason. Someone asked about a conglomerate discount and Dimon said that JPM is not a conglomerate. Conglomerates are groups of unrelated businesses, whereas JPM is in related businesses. So he doesn’t feel the valuation discount is due to it’s structure.

Huge legal and regulatory costs and uncertainties related to them, he feels, is why JPM is at a discount now. But he feels those things will eventually subside and JPM “may well trade at a premium”.

Split-up

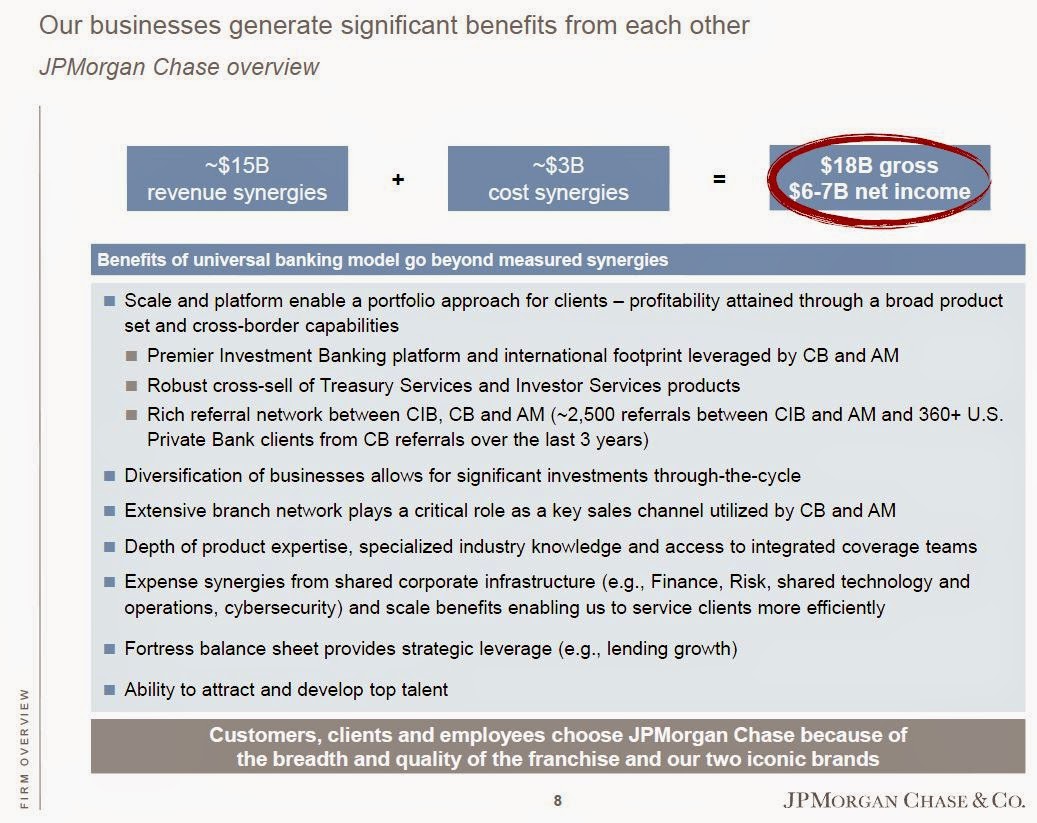

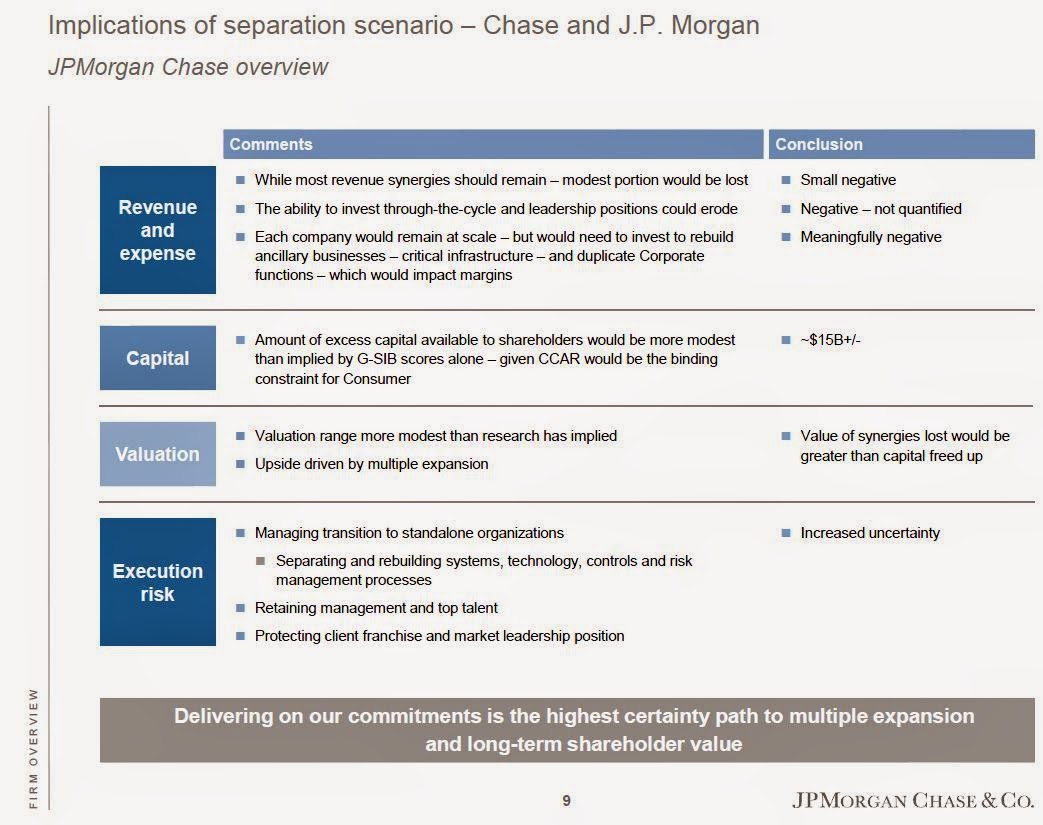

The segment presentations often mention the benefits of being part of JPM. In the overview slides, there were a couple of slides about splitting JPM and how that would not be a good idea at this point. There are two points that I noticed given my post about it earlier this year.

One is that JPM feels that much of the revenue synergies would not go away on a split. I guess that makes sense; just because you opened an account for a specific reason (Chase customer opening an investment / mutual fund account, for example) doesn’t mean that a customer will close that account just because of a split. I calculated that the synergies would go away on a split, but that isn’t necessarily the case (the cost synergies would go away, though).

And the other point is that I used last year’s investor day slide so used 2.5% for the G-SIB capital requirement, but in December the Fed jacked that up so JPM falls into the 4.0%-4.5% bucket. But that analysis is also moot because JPM says that the capital release from a split would only amount to $15 billion, so there isn’t that much of a capital benefit from a split-up.

But anyway, here are the slides:

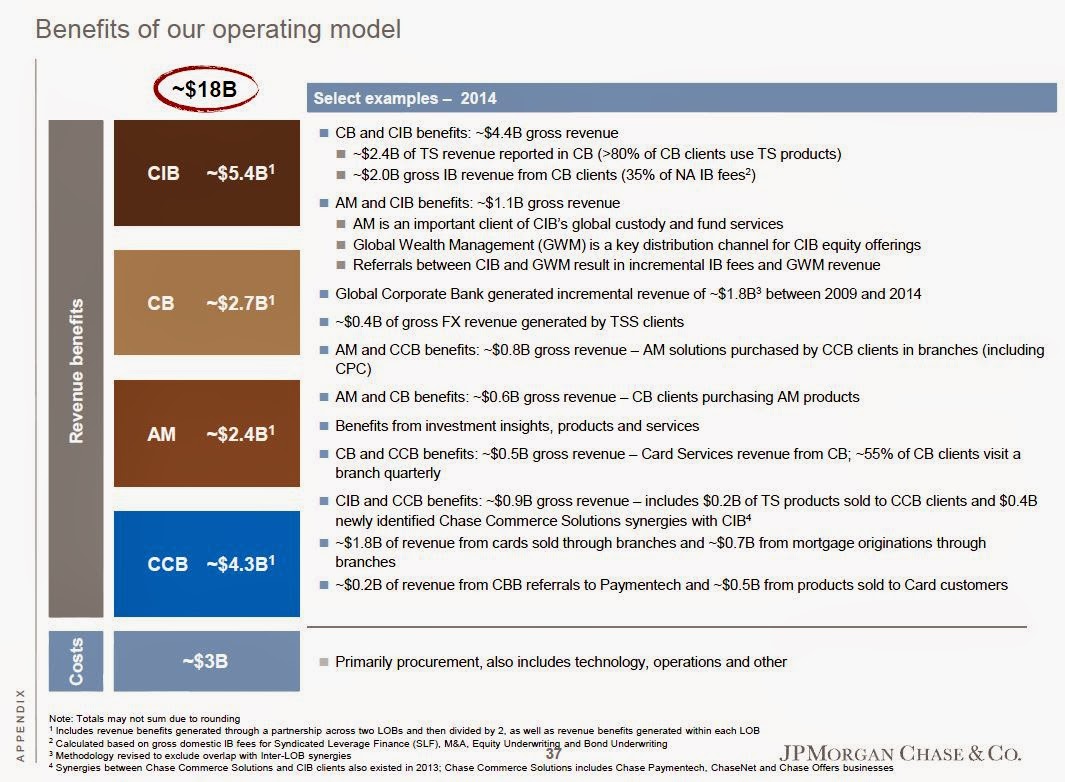

I still think the diversification effect is one of the main benefits to JPM’s business model.

Here’s another slide that sums up benefits to JPM’s current model:

Simplification

Moving on, here is a slide of JPM’s simplification:

They exited businesses with basically no P/L impact.

Earnings Simulation

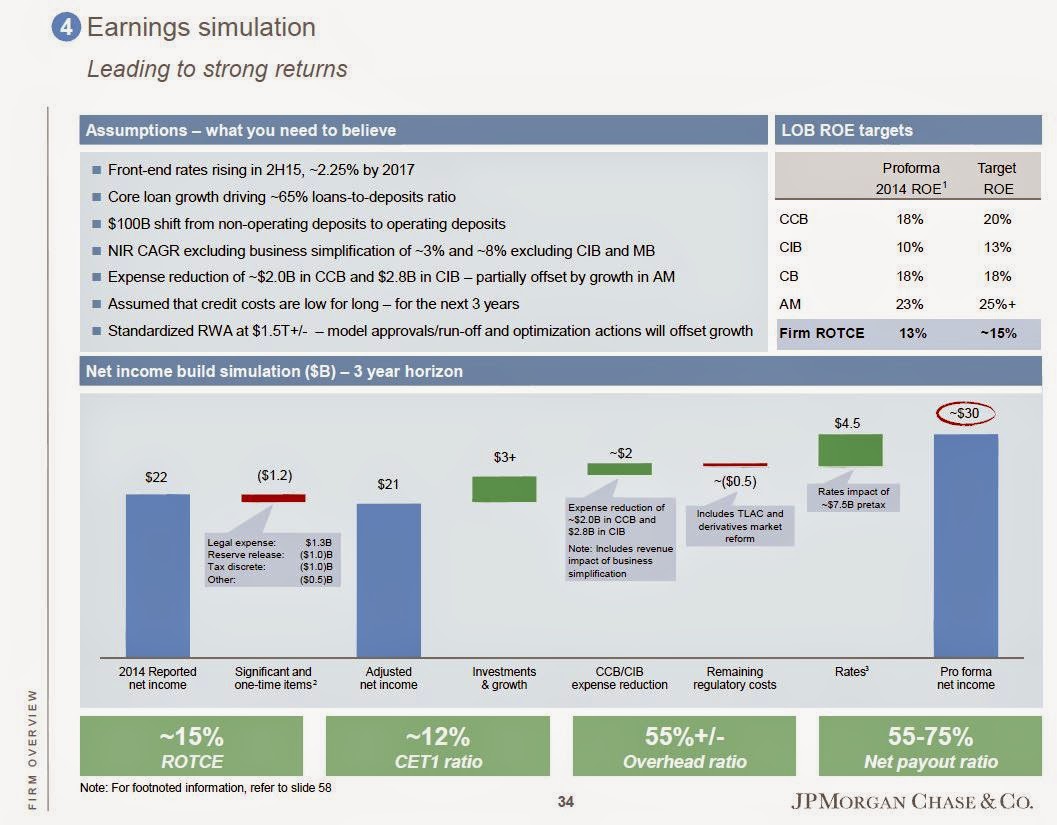

So this is the main slide that most investors are interested in. What can JPM earn in a more normalized environment? What can they earn over time?

Here is JPM’s earning model looking three years out:

JPM sees net income of $30 billion by 2017 (or I should say JPM will have earnings power of that much). In 2014, there was $1.1 billion in preferred dividends paid and $544 million of “undistributable earnings allocated to participating securities” between the net income line and net to common shareholders. So that takes net to common down to $28 billion or so. With 3.7 billion currently outstanding (which may go down from repurchases), that’s $7.57/share in EPS. At a pre-crisis P/E of 12x, JPM can be worth $91/share. JPM is now trading at around $61/share.

Since the 12x P/E is a forward earnings P/E, if JPM is on the path to $7.57/share EPS by 2017, JPM should trade at 12x this amount at the end of 2016. That’s a potential +49% increase in 1.8 years or +24%/year. That’s not at all a bad return in this market.

But there are a lot of “if’s” in this return projection. Rates have to normalize and the stock has to get to a pre-crisis P/E ratio by the end of 2016. The earnings simulation holds no such contraints; they will get there at some point and the stock price will eventually follow.

This earnings simulation used to not be a projection over a given period of time, but just a guidance on what JPM can earn when certain things normalize; it showed normalized earnings power. I suppose it still is, but there are components in there that have a three year time frame (cost cuts, interest rates normalization etc.).

I guess it would be fair to say that this $30 billion net is not so much a projection, target or forecast, but more of the earnings power of JPM if the currently ongoing projects (that will take three years) are completed, interest rates normalize etc…

So let’s look at the components a little bit. Regarding “investments and growth”, I think those are things already happening and they probably have good visibility; open a branch and get xx in deposits etc. “Expense reduction” is something that JPM has been able to achieve so that’s probably not an issue. They will get that done.

The big piece here is $4.5 billion from normalizing interest rates. In the 2013 annual report, Dimon talked about normalizing interest rates and he mentioned something like 3-4% on the short end and 5% on the 10-year treasury yield. In this presentation, they expect short rates to start going up in the second half of 2015 and then up to 2.25% by 2017. 2.25% by 2017 seems reasonable to me.

By the way, the Fed Funds futures implied rates look like this:

December 2015: 0.500%

December 2016: 1.325%

December 2017: 1.845%

But as you know, I have been skeptical of rate normalization for a while so who knows what will happen. If rate normalization doesn’t happen, what does that do to JPM earnings in 2017?

Let’s look at the $30 billion and then back out the $4.5 billion. That gives us $25.5 billion. And then take out that stuff between net income and net to common and you get $24 billion or so. That comes to around $6.50/share. Give it a normalized, pre-crisis P/E of 12x and we get a stock price of $78/share by the end of 2016. That’s 28% higher than the current $61, or a +14%/year gain through 2016. That’s not such a bad return given the current investment environment.

Also, the simulation assumes low credit cost over the next three years. This, usually, would be aggressive given the cyclical nature of credit. But one thing you can say is that the credit quality of loans on JPM’s books is much better than in the past. Also, the economic recovery has been very subdued. This suggests that there may not be a lot of systemic problems being built up in the banking industry ready to blow up any time soon. So this may extend or prolong the cycle since there isn’t some big party going on somewhere in the economy.

Abby Joseph Cohen of Goldman Sachs long ago called the U.S. economy a silly putty economy. She said that the economic cycle was prolonged, with shallower highs and lows; as if the cycle was printed on silly putty and you stretch it out sideways so that the booms and busts occur over longer periods of time.

It sort of feels like that now in the U.S. so maybe credit costs remain low. I would have more confidence in the $30 billion number, though, if they used a more normalized, “through-the-cycle” credit cost instead.

The above simulation, I think, doesn’t assume any dramatic changes in the environment, though, other than interest rates. There is no big housing recovery or global economic recovery or anything like that built in. So I would think it is conservatively estimated.

Size ≠ Risk

Conclusion

JPM looks really good. The various segments look good. The investment bank isn’t looking too great now, but they are still very profitable with strong franchises and a lot of levers for growth over time. It seems like they are managing to higher capital requirements.

There are obviously a lot of risks, but for me, the one thing that still concerns me most is the interest rate structure. Everyone is waiting for some sort of normalization. But the Japan scenario still nags at me as a possibility. It’s true that Europe imploding, causing a strengthening dollar might keep already low rates in the U.S. lower for longer than we expect.

But still, JPM is one of the best managed companies on the planet and it is trading at a very reasonable level, and there is a clear path for higher earnings going forward.

Totally agree on your JPM analysis. Frankly, I don't see why I can't trade higher than 12x given that it grows faster than the average US company and, I would argue, is less risky despite the "leverage". One thing that does puzzle me is why there is so much turnover of the minions that operate under Dimon. The following line from a bloomberg story early in 2014 was telling.

"A 2008 Fortune magazine story about JPMorgan’s leadership included photographs of Dimon’s 14 top lieutenants. Today, just three of them remain."

Given that Dimon may retire in a few years even if he stays healthy, does this succession issue concern you given that most of the stock's value are cash flows delivered beyond the next few years?

This is totally different than Berkshire where you basically see 0 voluntary turnover beneath Buffett.

I guess if you don't think you are paying a premium in the price for management then you shouldn't be concerned if management leaves, and JPM doesn't appear to have any such premium now. But for a manager so iconic like him or Buffett when they do step down the stock will probably take a hit and then you'll have to hope the next guy is good enough to dig you out of the hole.

Of course AAPL has done fabulously since Steve Jobs died – he was holding them back!

Hi,

The high turnover at senior levels doesn't bother me that much. Some of it was from the whale trade and others are from top lieutenants going on to CEO positions at major financial companies (Sharf, Cavanaugh etc.) which sort of shows how good they are (sort of like the old GE).

Succession is a good question. I don't know how comfortable I would be post-Dimon. They look like they have a deep bench, though. But it's true that I am a big fan of Dimon so I may not be as excited about JPM after Dimon even though I suspect they will do well for a while after he steps down.

AAPL, to me, is still coasting on the brilliance of Jobs. They may still keep innovating and still coming out with great products, but the problem with AAPL for me is that it's not enough to keep innovating. They have to come up with something huge to replace the iPhone at some point. I don't know how many more cycles they can keep upgrading with the same p/l etc… Apple pay and other services is great, but can't fill that whole if the iPhone slows down, I don't think.

Oops, forgot to mention BRK. BRK turnover is very low because Buffett buys whole businesses intact; the CEO of those businesses aren't going to move on and go somewhere else. So BRK is a collection of a bunch of independent businesses. JPM is one large corporation so it's natural that talented leaders move on when they get the opportunity. Buffett buys businesses where the people are doing exactly what they want to do where they want to do it so won't go anywhere after the acquisition etc…

Came across this this morning.

http://www.wsj.com/articles/j-p-morgan-emerges-as-ceo-breeding-ground-1424997413?mod=WSJ_hppMIDDLENexttoWhatsNewsSecond

That sounds really interesting. I don't know Standard Chartered that well, but I think they have a pretty good reputation over the years. Now they are having legal / regulatory problems and their exposure to emerging markets are hurting them. So it might be a case of a good business down temporarily. And then add to that a management change that might be able to turn this thing around. This emerging market boom and bust is very cyclical and emerging markets are highly out of favor now, but they will be back at some point.

So in that sense, if you can get into Standard Chartered on the cheap, it looks interesting. I will be taking a close look at it over the next few days/weeks for sure.

If someone like Winters comes on board, it does indicate that there is a lot of potential here (or else he obviously wouldn't take the position).

A personal question, I know you have talked about dimon and jpm a lot, i would be interested in what percentage of your portfolio you have in jpm or even wfc?:) I have them but I would wonder how great of an investment you consider them based on its impact on your portfolio. Thanks

Hi,

I still own some, but I owned a lot more when it was lot cheaper. But it was never big as 20% or anything like that.

Oh yeah, and as for the market not valuing JPM higher, I think the market has PCSD (post-crisis stress disorder). But as Dimon says, the market may come around some day as they usually do.

Great Post, I'm going to buy some of the warrants. On a different note I guessed (incorrectly) we would see an update on GHC after the cable spin news last fall.. Love to know if u have looked at it. Great blog.

Hi,

Sorry fort he late response. Yeah, GHC is interesting. I figured there would be some upside in liquidating some assets, but didn't see a spin coming. So there was little more upside than I thought.

My bottom line for GHC is simply that I don't have any faith in the capital allocation skills of Graham. I think most of the value created there were assets acquired before his time, and I don't see what his recent investments are all about. Maybe he does well, maybe he doesn't. I don't really know. But from following him and reading his reports over the years gives me no confidence.

We'll see. As for the cable spin, we'll have to see the valuation. My guess is that it ends up somewhere else as cable businesses consolidate. I think that's why the CEO wanted it spun out of GHC so it can play too (and have the freedom to sell out when it wants to instead of being stuck under GHC).

What's the math on the 10% growth rate on tangible book? If ROE is 13% and Payout is 50%+ shouldn't book value grow at ROE * Payout or 6.5%?

Yes, that's the math, basically. But in the recent past return on tangible equity was higher than 13% and actual payout lower. The payout in the table includes share repurchases.