So the long awaited annual report came out last weekend. As usual, I thought it was a great report. For most Berk-heads, though, it’s mostly the usual same old, same old. There was one big difference, though, this year. Buffett changed the performance page of the letter to include change in the stock price of Berkshire Hathaway. This is the way Leucadia reported their performance during the Cumming/Steinberg era; they had a column for both book value per share and stock price. I wish others like Loews would do it like this too (but using total returns of the S&P 500 index instead of just the price change).

Tracking the stock price can be tricky as a stock can be overvalued or undervalued at any given point in time. But over long periods of time, as Buffett says, the stock price should track intrinsic value. Buffett feels that over the 50 years, the stock price has actually tracked intrinsic value better than book value (because book value overstated intrinsic value back in 1965 and understates it now).

Book value per share grew only +8.3% in 2014 versus a +13.7% total return for the S&P 500 index. BRK’s stock price, though, increased +27% on the year. As we’ll see later, BRK’s intrinsic value might have grown something closer to 13%.

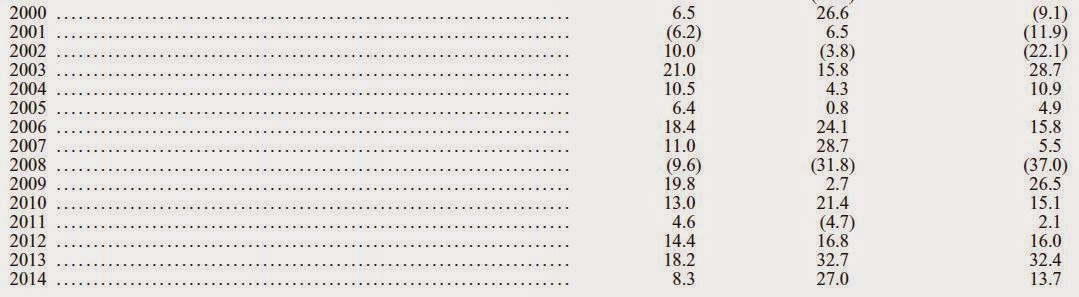

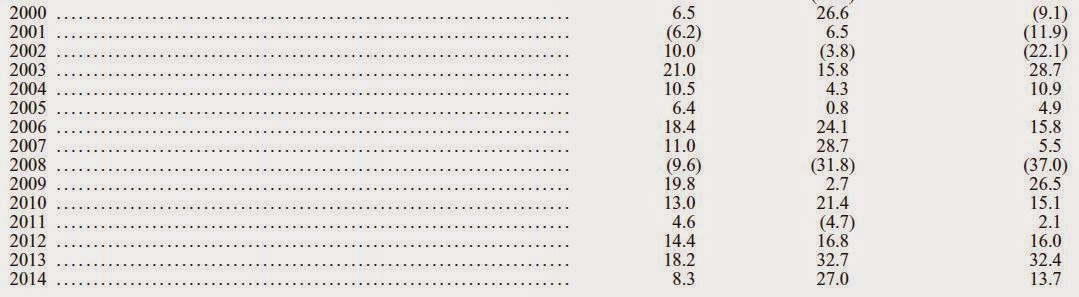

This is a snip from the annual report. The left column is the change in book value per share, the middle column the change in the stock price and the right column is the S&P 500 index total return.

You will see that BRK outperformed the S&P 500 index on a BPS basis only once in the last six years. On a stock price basis, it outperformed three times in the past six years. But that’s mostly because 2009 was a low point for the S&P 500 index. BRK’s BPS fell a lot less during the crisis.

In last year’s letter, he said that things are good as long as BRK’s BPS outperforms the S&P 500 index through the cycle. This was in response to questions with respect to underperforming over a rolling five year period.

Looking at it on a through-the-cycle basis, BRK’s BPS growth is still looking good. Last year he used the 2007 BPS as the previous peak. From 2007 through 2014, BRK grew BPS at a pace of +9.4%/year versus +7.3%/year for the S&P 500 index (on a total return basis).

By the way, the trailing 5, 10 and 20 year returns based on BPS compared to the S&P 500 index looks like this (annualized):

BRK BPS S&P 500 total return

5 year +11.6% +15.5%

10 year +10.1% +7.7%

20 year +14.3% +9.9%

The five year return still lags, but again, that’s largely due to the S&P 500 index coming off of a low point during the crisis.

The main reason Buffett included the stock price on the front page of the annual report is that due to the ever-growing operating businesses (as opposed to the stock portfolio), book value of BRK is increasingly understating intrinsic value.

To direct shareholders to a more accurate measure of intrinsic value, he has been guiding towards looking at the two main components of BRK’s value; the investments per share and pretax profits per share of the operating businesses.

I don’t want to get too involved in the valuation of BRK here as that would be another lengthy post (or series of posts); I just wanted to see the difference in BPS and a valuation based on the two-column valuation method.

BPS Growth versus Intrinsic Value Growth

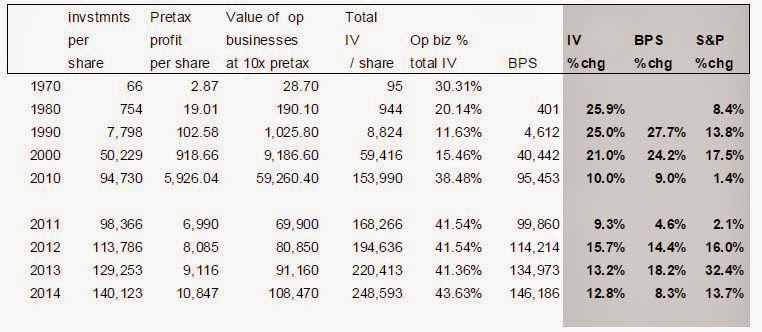

In the 2014 annual report, there is an update of a table he put in a previous one. It’s the investments per share and pretax profit per share of BRK over time. From 1970-2010, he shows the figures for every 10 years, which is fine. We don’t need too much detail for what I am going to look at.

For the period between 2010 and 2014, I pulled the figures from each annual report as he has included the most recent figures in every report since 2010.

Again, I don’t want to get into what the right multiple is to value the operating businesses, but for simplicity I just used 10x pretax earnings. 10x pretax is what Buffett said he would pay for businesses with similar quality/characteristics to what BRK already owns. And we know he wants to pay a fair price for a wonderful business, and not a wonderful price for a fair business. So I guess 10x pretax earnings is a fair price (and not a bargain basement price).

In any case, you will see that it won’t matter much what multiple I use for this analysis; the direction is what interests me.

Anyway, in the table below, I put the investments per share and pretax profit per share in the two left columns. This is right out of the annual reports so should be correct.

For the value of operating businesses, I use a multiple of 10x.

For total intrinsic value of BRK (Total IV), I just added investments per share and the value of the operating businesses.

The column after that, “Op biz % total IV” is the value of the operating businesses as a percentage of total IV of BRK.

BPS is just BPS as reported by Buffett, and the following columns in gray are annualized changes in the respective items (S&P is total return).

BPS is used as a proxy for intrinsic value and it has been a decent one over long time periods.

However, his view is that recently, the operating businesses has become a bigger part of BRK so BPS is an increasingly less accurate indicator of BRK’s IV (understates it by a large amount).

So the first thing I did was look at how much the operating businesses are as a percentage of BRK’s total IV.

Back in 1970, the figure was 30%. That makes sense as it started initially as an operating company. But in 1980 this figure went down to 20% and then in 1990 to 12%. So back then, investments really determined the value of BRK. Even in 2000, the figure was 15% or so. And then in 2010, that has increased to close to 40%. So yes, BRK is more and more turning into an operating company.

On the right side of the table in gray is the change in BPS and intrinsic value over time. The top half of the table represents annualized changes over 10 years. So the 2010 figures show the annualized changes for the period 2000-2010. You will notice that BPS and intrinsic value tracks each other closely.

And the lower half of the table from 2011 through 2014 are just year-over-year changes.

The interesting thing is that to me, it still looks like it tracks pretty closely. Between 2010 and 2014, BPS grew at a pace of 11.2%/year but IV grew at 12.7%/year. I guess 1.5%/year is a pretty big difference in this world. But as a tracker of value, it seems close to me.

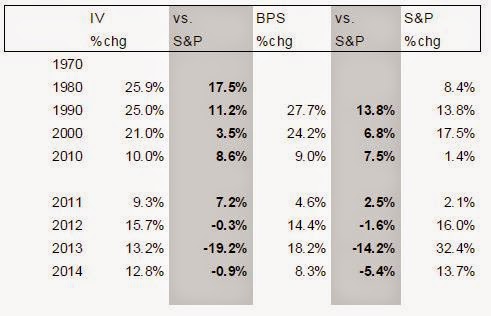

Here is a table that shows the same as the above, but with comparisons versus the S&P 500 index (total return) in bold:

It looks like even using the IV growth instead of BPS, BRK underperformed in three of the last four years. But again, the S&P has been roaring back from financial crisis lows, so this is not representative of any four year period by any means.

Moving the Target

Of course, this will lead to people bickering about how Buffett moved the goal post after the fact. Well, I don’t care about that. We know how well BRK is doing and we understand why Buffett changed the front page so it doesn’t matter what other people say. Who cares, really.

All Glass House

And by the way, Buffett was on CNBC the other day, and he really ripped into David Winters of the Wintergreen Fund. Winters criticized the Coke compensation plan and I wrote about how his analysis was just plain wrong. Buffett agreed that the plan was too much, but didn’t want to endorse the figure Winters was throwing around as being totally wrong and misleading. And then Winters started getting personal with Buffett, even going so far as selling his BRK stock saying that if he can’t stand up for shareholders in the KO situation, how can he trust Buffett to run BRK?

I thought that made no sense whatsoever.

Anyway, Buffett said that Winters criticized Coke, but said that Winters has underperformed in every time period (including since inception) and charges 150 basis points (when you can get into an index fund for 17 bps) in fees so he is throwing rocks from an “all glass house”. He said you are paying a high price for negative value creation.

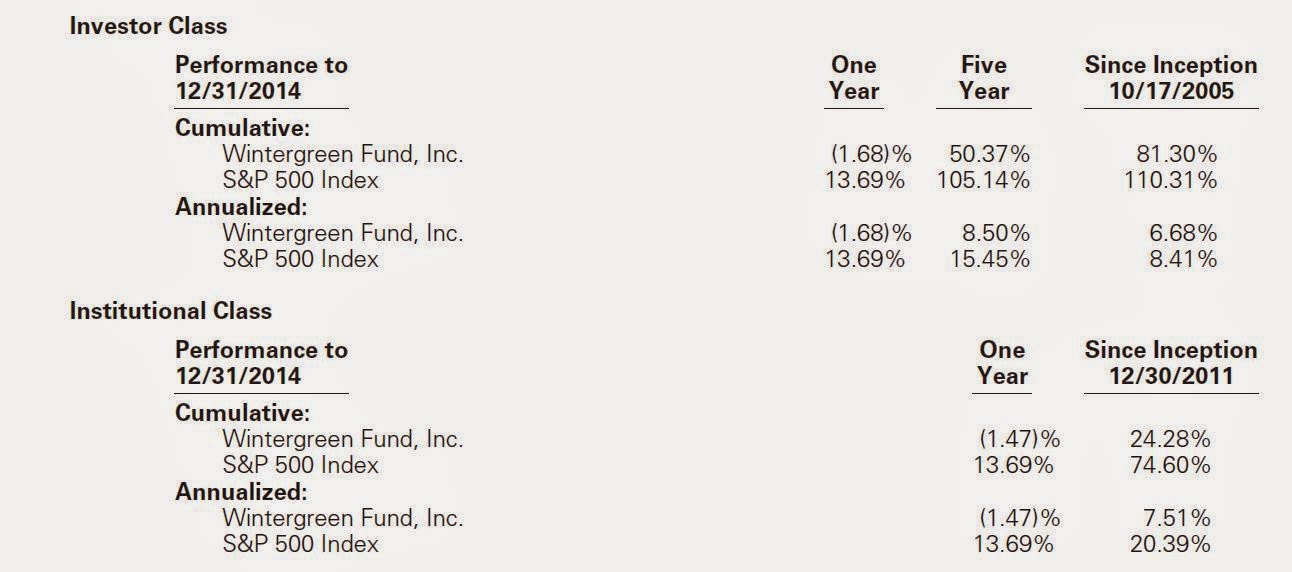

Here are Wintergreen’s returns from the 2014 annual report:

Total expenses are 1.85% and 1.63% (for Investor class and Institutional Class respectively) which sounds pretty high in this day and age. If we are looking at 5-7% returns in equities going forward, these expenses are 30% of expected gross returns!

Apparently, you can get airtime any time by criticizing Buffett (the other surefire way is to call for a stock market crash), but I guess one should be careful and think hard about whether you really want Buffett to take a close look at you.

Optimistic as Usual

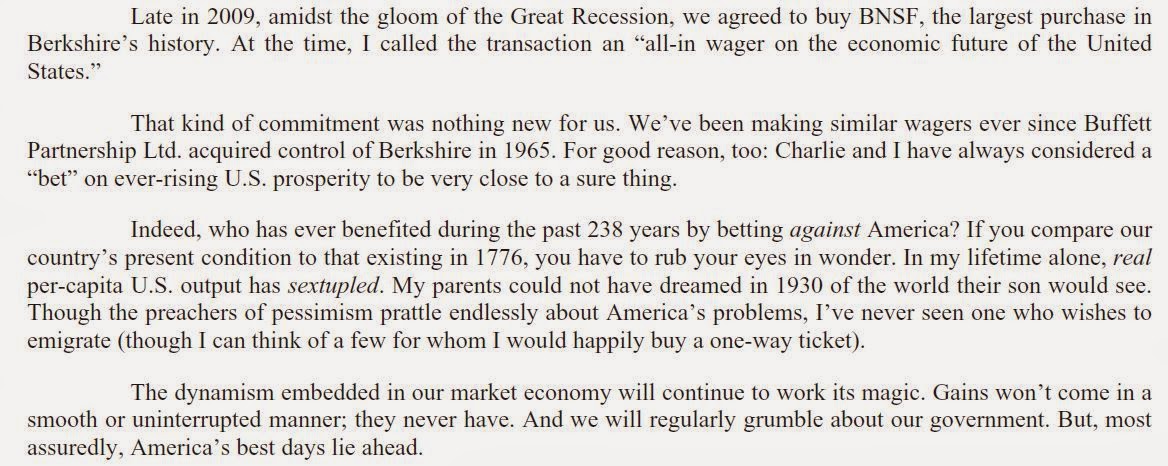

Back to the report. As usual, Buffett is very optimistic:

And it occurred to me that BRK keeps doing really well despite it’s size even compared to the other Berk-a-likes. Many of them, to me, seem far too pessimistic and conservative. And that may have hurt their results over time.

And yes, we are in a raging bull market now so of course optimists will look better than less optimistic people. Things will surely look different when the cycle turns and things head down.

But Buffett has sort of always been this way and he has been tested in down markets, including in the financial crisis. His optimism didn’t put BRK at risk of permanent impairment in any area. That’s the difference. Optimistic traders can get killed pretty quickly (due to the leverage they incur). But if you run a rock-solid, Gibraltar-like operation like BRK, optimism pays.

The key, again, is not to be optimistic and right short term (by forecasting and avoiding downturns by taking protective measures), but to be optimistic long term and solid enough to survive any downturns that will inevitably come in the short term.

Buffett seems to me to like the guy that has his seatbelt fastened and does a smooth 60 or 70 mph down the highway, and traders that get in and out are like people going 120 mph on a highway without their seatbelts fastened thinking that when they see trouble ahead, they’ll have plenty of time to put their seatbelts on before impact. Otherwise they sit at a rest stop waiting for 100% clarity (which never happens anyway).

Investment Advice

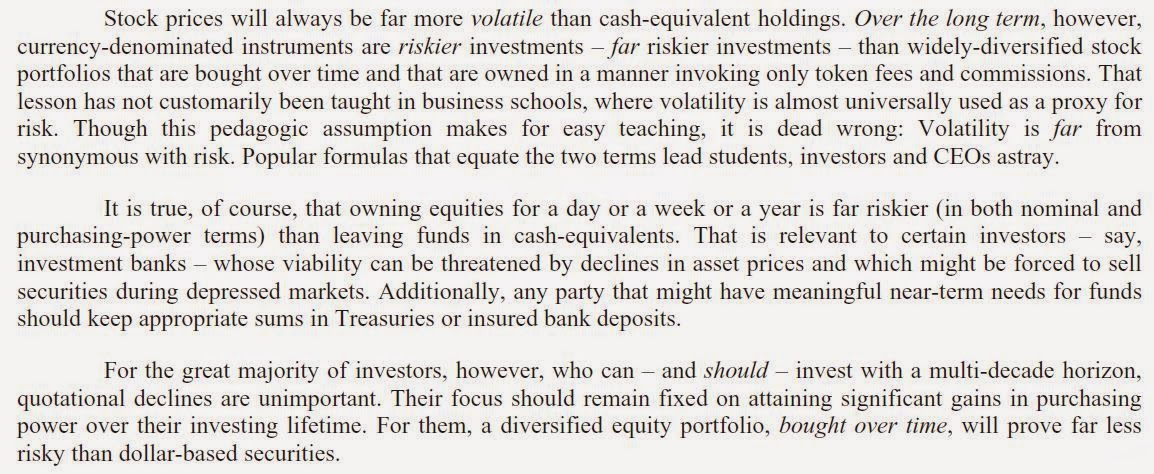

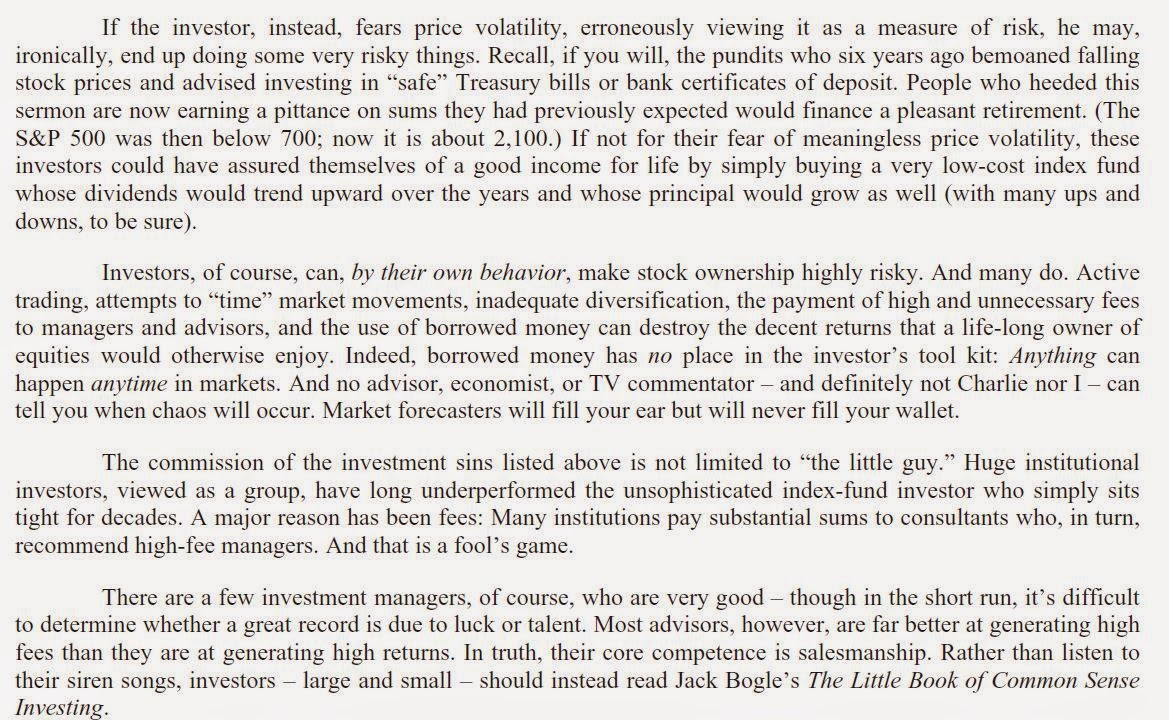

And as usual in recent reports, Buffett gives advice on investing.

It’s amazing to think that the dollar has declined 87% since 1965. A lot of the stock market bears have mentioned the declining dollar as a major part of their bear thesis. I’ve been hearing that sort of talk since the beginning of my career; the dollar is going to go down so you should own gold, land, houses, land bank stocks, Japanese stocks, Chinese stocks, emerging market stocks, frontier market stocks, any foreign stocks, commodity funds, commodity-linked ETFs etc… on and on…

And yet one of the best investments during that time has been U.S. stocks.

Having been in the business for a long time, I can tell you that yes, a lot of the errors and losses in the financial markets are due to people trying to avoid the perceived risk of the stock market (while trying to earn stock-market-like returns). So much money is burned by trying to avoid “temporary” mark-downs.

Of course, the financial industry loves this. There is more options and futures to trade, more swaps, more funds to sell etc.

There was a story recently about some janitor or something that never made more than $17,000/year or some such, who just passed away and donated $40 million. Every now and then we hear these stories. None of these people are highly trained geniuses like Buffett. They just sat on stocks for a long time and didn’t fudge with the portfolio.

I don’t know if I mentioned this before on this blog, but one day a long time ago, a co-worker whispered to me that he was a millionaire. And he was a low-level clerk that never made a high salary or bonus. He never made six digits in any single year (up to that time). And yet he was a millionaire (and no, he wasn’t 80 years old or anything like that). But he just really underspent and never sold any stock he bought. Once he bought something, he never sold it. Of course, this causes some to go to zero. But so what? Sometimes you lose less letting some stocks go to zero than buying and selling all the time trying to avoid the occasional zero.

Berkshire – Past, Present and Future

Both Buffett and Munger wrote about BRK’s 50 year history. They are great reads. I’m not going to write anything about it here; just go and read it yourself.

We always wish Buffett would write a book, but he sort of has. If you look at all of his annual letters (including the partnership years), he has written way more than a book. And Buffett’s review and outlook for BRK is a great addition to the real time “book” he has been writing since the 1950’s.

Oh yeah, and I almost forgot. One thing he said in his 50 year essay on BRK; he did sort of give a valuation hint on BRK:

He says 2x BPS is an unusually high price that might make even BRK a “rash speculation”. So we know that 1x BPS is very cheap. The middle of that is 1.5x BPS. BRK is willing to buy stock at 1.2x book, so maybe 1.2x is attractive and 2.0x is ‘rash’. The midpoint of that is 1.6x BPS.

I have been of the school that BRK shouldn’t trade at historical average P/B ratio due to it’s increasing size and lower prospective returns, but Buffett’s argument that BPS is less and less relevant as the operating businesses become a bigger part of BRK is a valid one. But that’s a whole other discussion so maybe for another time.

Conclusion

The annual report is a great read! Go and read it if you haven’t already. Or go read it again.

So if you perform poorly, as a shareholder, you can't criticize management for being incompetent and greedy?

I don't see how the two are related.

Buffett has also underperformed in the last 5 years (or was it 7?).

Of course you can criticize all you want. I think Buffett's point about the "all glass house" is, "don't be a hypocrite".

Buffett doens't take a whole lot of compensation and he has done tremendously well over the years for his shareholders. I doubt you will find anyone else with such a low total compensation / shareholder wealth creation ratio.

In Winter's case, it looks pretty high.

I admit this isn't apples to apples, but a quick look shows that Buffett created $177 billion in wealth to shareholders over the past five years and took total comp of $100,000/year, or $500,000. That's not even a basis point. OK, so total comp was closer to $500,000 if you include security and other expenses. But that's still 0.00003% or whatever (I probably got that wrong; too many zeroes I can't keep track).

And even the egregiously greedy Coke NEO's make around $40-60 million in total comp over the past few years. Five years of $60 million is $300 million, those greedy bastids. But they created $44 billion in shareholder wealth in the past five years. So they took 0.7% of that wealth creation. Dammit.

And then Winters of the Wintergreen fund takes 1.5% management fee, but I tend to think the 12b-1 fee is a scam so I would even include that. So total expense is 1.83%. Given Wintergreen's performance in the past five years, that comes to 15% to 17% of wealth created for his shareholders. That's almost hedge-fund-like.

He took 15 to 17 cents of every dollar he made for his shareholders compared to almost nothing for Buffett and less than 1% for Coke's NEO's.

This is not a totally clean comparison, but it does put things in perspective a little bit…

Shouldn't KO's creation of shareholder wealth be measured against the S&P 500 as Buffett's is? Both Winters and KO management underperformed the index over the last five years so you could argue they both created negative value and should be replaced. KO is also a way better business than the S&P in general so I would argue the proper threshold should be even higher.

Good point about evaluating KO. Sure, I think performance versus S&P is important for corporate CEO's, but there are many other measures too, growth, ROE, margins etc. For a portfolio manager, it's just performance versus the S&P 500, otherwise you would just buy an index fund.

For operating businesses, it's not that simple. This isn't as simple as my original comment…

How much wealth would KO have created if the CEO was replaced by your idiot neighbor? My guess is it would still have created quite a bit. I happen to think most CEOs get way too much credit (and way too much money).

Cash keep rising and rising and rising (and he gets inflows every month). Indicates that at the size he looks at there aren't many great deals to be had – and he could buy the SPYs! He has $117B in stocks and $40B in cash above his minimum threshold (25% in cash) – a fund manager with that level of conservatism would probably be getting grilled right now. He would probably have even lower exposure if he could sell the stocks without incurring huge tax gains. Buffett the affable granddad will encourage investing in indices at these price levels, but Buffett the stockpicker is behaving very differently.

I think this comment gets at a very good point, something I have been noticing a lot more since the Financial Crisis. The anonymous commenter above is right, two Buffetts have emerged. Buffett the private investor still appears very much to believe in The Superinvestors of Graham-and-Doddsville, and he invests Berkshire accordingly. As valuations have risen so much, he has let cash build and invested in Berkshire Energy and capex across existing subsidiaries. Those investments are likely to be profitable but not spectacularly so and mirror what he did in the high valuations during the run-up to the Financial Crisis.

However, the second Buffett is the public persona who is very aware of his effect on markets and investor behavior. I think he advises a low cost S&P 500 index fund because those are not size constrained. Imagine what would happen if he recommended a mutual fund, as he did with Sequoia when he shut the Buffett Partnership. The mutual fund would be overwhelmed with inflows. I also think Buffett is purposefully a little generic when discussing investing, sticking to Hippocrates' "first do no harm" maxim.

In summary, I guess you could say that there has emerged an element of "watch what he does, not what he says" to the Buffett persona, although not nearly as negative as that phrase usually implies.

That's a good and valid point. I thought so too for a while. In some sense, it's definitely true. But when I looked closer, it may not be as much as you think.

First of all, I do actually think Bufett is trying to make BRK more of an operating company. It is easier to pick up businesses where capital can be deployed like energy and rails. It's much easier to invest $5 billion for a decen return there, than say, finding stocks. And don't mean Buffett. I mean post-Buffett. The more of a non-investment vehicle Buffett makes BRK, the more post-Buffett-proof BRK becomes. So he probably actualy wouldn't mind the stock portfolio gettng much smaller as a percentage of total assets.

And I do think that he is saving up for an elephant. He has always favored bagging a elephant to buying more stock, I think.

Also, I too thought BRK was getting very conservative, but some of that is an illusion. For example, BNI went from being a stock holding to an operating business. If BNI was still listed, it would be worth $72 billion. Just because it's not in the equity portfolio looks like Buffett is being more conservative. But we all know the risk profile is the same whether it's owned outright or as a stock (but more tax efficient wholly owned).

So we see the stock portfolio as a percentage of net worth go down a lot, so it seems bearish. But if you include operating businesses and look at the equity of those businesses as just as good as stocks, then things look different.

The stock portfolio is $117 billion against $240 billion in total BRK shareholders equity. That looks timid compared to the past. But if you look at the net worth of the MSR segment and RUE (rails/utilities) as just as equity-like as stocks (as opposed to cash/bond-like), then the picture looks different. MSR equity was $52 billion and RUE equity was $88 billion so that's a total of $257 billion in "equity" against shareholders equity of $240 billion.

So from that point of view, BRK is fully invested. That's why BRK can grow intrinsic value so much despite holding so much in cash and bonds. That's all extra stuff.

Every dollar of shareholders equity at BRK is working in an equity-like manner and is NOT sitting on cash and bonds earning low returns.

Anyway, I didn't really realize this either until I took a closer look after a similar discussion a coupe of years ago…

By the way, just to be clear, the above MSR and RUE segments include some cash but I assume that's cash required for operating purposes. Most of the cash and bonds are held in the insurance segment and that is not included in my above analysis except for the stock portfolio.

So in that sense, the equity of MSR and RUE is basically all operating stuff and includes minimal cash etc…

BRK is way more fully invested (and even slightly levered) compared to most mutual funds despite the huge cash holdings!

If you are thinking of the Vermont janitor, I think he must have been an above average investor. Looking at some of the companies that was in his portfolio (Bank of America, General Motors), it suggests he tinkered and was opportunistic. Though probably with a buy and hold, disciplined mindset. I could be wrong, but it would be interesting to get some flavor on how he built his fortune.

Otherwise, it's getting to a point where when I don't see your site mentioned in whatever best financial blogger list, I get really annoyed.

Hi, yes, maybe that is so. Maybe the janitor was an incredible investor. I haven't taken a close look; I only heard it on TV. But it doesn't surprise me either way, because when it comes to stories like this, I hear it around me too. The guys that are always talking about complicated financial stuff, telling me how smart they are about the market and what great funds they own, those are the guys that don't have much money, or even if they do, they haven't done well over time in the markets (this includes a lot of professionals! I don't know why, but I always got the sense that people that worked on Wall Street did horribly in their PA's).

And then the quiet ones that know what they don't know (sister, mom, other relatives, friends), they are the ones that surprise me with what they have accumulated and what their portfolios are worth, lol…

And thanks for the comment about the blog. I don't need that sort of attention so it doesn't bother me at all. I know I am narrowly focused here in what I post so it's not going to interest most people.

I can tell you for sure that traffic here will go up 1000-fold if I start posting about the "three domes and a castle" or whatever that crash indicator was, and other things like that, and maybe if I posted about options strategies on how to double your money in two weeks etc…

No way that frugality alone accounts for what happened to that janitor, or the many others. Doesn't mean they were somehow hidden geniuses that could write VIC writeups, either. I really do thin that in the long run, a One Up On Wall Street level of aptitude, *combined* with some innate numeracy and or understanding of odds, *combined* with rare emotional discipline, can produce great outcomes (they might not, but they can).

I think any best financial blogger list is suspect. They're usually based more on the bloggers' aptitude for self-promotion and/or their real-life public profile than the actual quality of the content.

That may be true for the janitor, but in the more modest cases I know, that isn't really the case at all. True, it's very Peter Lynch-like in that the own stuff that they understand in terms of product/services, but they don't have an understanding about income statements/balance sheets or odds/numbers particularly. And they do have a very safe indifference to what happens; they just let it be.

It's really about knowing what they don't know; they don't try to do anything fancy at all.

Would be curious to hear your thoughts on the other BH (Biglari Holdings), which has had a lot happen to it since you last wrote!

I don't have any particular insight. I watch with interest like everyone else (I do own some, but not a lot). There is some shareholder action going on as Biglari pays himself well and has a licensing contract that acts like a golden parachute. That sort of thing wouldn't bother me if he performed as his compensation plan is more or less like any private equity or hedge fund and the licensing deal would only kick in if things don't work out. But yes, it's no good to get kicked twice if things don't work out there.

I know this view is way more lenient than most other Biglari-watchers.

As for how things go going forward, I don't know. He says that the recent downturn in earnings is driven by investments for growth. That may be true, but we'll have to see. It's an increasingly crowded market he is playing in (hamburgers).

I have a couple of problems with the 2 column method of measuring IV. Let's say Buffett adds a couple of billions debt and buys stock with it, according to this method IV would increase which simply doesn't make sense – and Buffett has increased leverage somewhat in recent years. Or if he would sell Coke to redeploy the proceeds into something with higher expected future returns that would trigger paying the defered tax liability and therefore lower IV which doesn't make much sense either. How do you deal with this?

Good points. I have issues with this method too. You have to just use it as one indication of intrinsic value. I don't want to get into all of the issues with this method (it would be too long to post here in a comment), but to address your issues; Buffett wouldn't issue debt to buy stock. We just assume the investments come from float and shareholders' equity. The debt would be paired off with the respective operating segments that use the capital. So if you think that's a reasonable assumption, it's not an issue.

As for deferred taxes, you are right too. That's why some people deduct a portion of deferred taxes from any valuation (BPS already deducts it). But Buffett's view is that deferred taxes is a perpetual, interest free loan as he has no intention of selling his major holdings.

So again, there is an assumption that he won't sell.

In any case, you have to make certain assumptions to come up with any valuation method, and this one has some assumptions you have to agree with too. Some people don't so they ignore this method. That's fine too.

I just used it here not so much to get a valuation for BRK, but just to see how the growth rates differed using BPS and a common IV methodology. I was interested in the direction.

Well in my view it doens't really matter whether Buffett issues debt to buy stocks or levers up to buy a business as he did with BNSF or Nevada Energy because the effect is the same, investments per share are higher than without the additional debt.

Or if you take BNSF's planned 6 billion capex, funded with debt it doesn't have an effect on IV calculated this way but if funded with cash it decreases IB by the same amount.

Good point. I understand what you're saying. I think, though, that Buffett manages the debt in those areas independently; BRK doesn't guarantee Energy's debt, for example. So if BNI takes on debt to fund capex, they will only take on debt that BNI can actually carry. I don't think Buffett would allow them to leverage more than the business can carry with the assumption that BRK will one day step in as a back stop.

So that's how I think I would look at it.

I think it's interesting that you are using a static 10x pretax to value the operating business, whereas the P/E for the S&P 500 fluctuates all over the place over a number of years. Not saying you're doing it wrong, but it kinds of makes for an apples-to-oranges comparison.

In theory, maybe Berkshire's companies would trade at a P/E multiple similar to that of the S&P 500, so maybe slapping the S&P 500's multiple (for each year of comparison) onto Berkshire's operating companies earnings would give a better comparison? Of course, then "intrinsic value" ends up fluctuating more every year so IV becomes less helpful as a stand-alone figure.

That's a very good point. Using some ratio linked to the market might give a more realistic indication of change in intrinsic value.

This method with a fixed valuation may not be too fair in terms of changes in valuation of the businesses, but over time that shouldn't matter too much. I just wanted to know what the growth in the operating side of the business was like in terms of earnings power; the flaw with the BPS is that valuation of businesses carried at cost is not adjusted upwards when earnings power increases, so this method just adjusts for that. But it doesn't, as you say, adjust for changes in valuation levels that is experienced by the left side of the column (investments).

Anyway, this shouldn't matter too much over long periods of time, though, as things would average out. And as long as you use a conservative figure like 10x pretax, you are not at risk of overvaluing BRK and then overestimating value created.

Outstanding post as usual. A few quick points. The two column valuation is a very conservative, short hand valuation method that WEB devised for shareholders because BRK had grown very complex. Using the value of investments per share grossly understates the value of float and its growth. For instance, way back in 2007 I used a growth in float method because it had been compounding at 10% +/-…even though Buffett and Munger kept saying it could not happen from there ( $58B then). Well now its $84B and they are creating new commercial insurance ventures from scratch. My float based valuation was enough to keep me invested in BRK at various levels, but still proved too conservative. In the past, WEB has said that float is more valuable than equity and if you think about that for a while, you will agree because your smart and he's right. Similarly, 10X pre-tax earnings…or about 14.5X after tax based on 31% tax rate…is also a very conservative number when the operating earnings grew 19% last year and have grown 20.6% since 1970. Stability in a growth rate like that is usually afforded much higher multiples. I think its appropriate to be conservative, but like to remind myself that is what I am doing.

He added a third column a few years back and that is how long will you be able to continue to deploy the capital appropriately. So far so good there as well, which is totally amazing.

I recently looked at price/bv from 1993 forward. It regularly trades above 1.75 for a high and the post crisis years here have been the anomaly. If the Two Column is right, it puts the IV at 1.7X. Anyway, thanks again for posting your thoughts. (PB)

Great insight. Float is more valuable than equity. Increased ROE without the downside of debt. In Berkshire's case, they make an underwriting profit.

This IMO should give BRK a higher P/B multiple than other insurers for the insurance part of BRK. Almost every other insurer posts an underwriting loss.

What do you think? Will brk fall in price when buffett leaves as ceo?

Probably.

Dear KK,

I saw many fascinating articles in your website, which are very useful. Could I translate your articles into Mandarin Chinese, and share this great thought with investors in taiwan? I will put your name as author. At the end of articles, I will link to original page.

Hi, thanks for the interest. You can link all you want, but I would be a little uncomfortable if the articles were translated in whole. A short summary would be fine, though.

Thanks for your understanding.

Thanks for your replying. Sorry to make you uncomfortable. I didn't say it clearly. In our website, if we translate someone's articles, we will put the author's name at the beginning of articles. At the end of articles, we will put the link. We respect copyright. People who have articles in our website, have a brief introduction that let our readers know the detail of authors. We hope people who don't understand English also can invest in U.S stocks. That's why we hope if it is possible, we can translate your articles into Mandarin Chinese. We believe that there is a win-win situation that we post high quality articles in our website. Authors can let more readers know about his/her ideas, and readers can get more information directly from other countries. We not only translate articles, but also use graphics to make this articles easy to understand. you can see an example here: http://goo.gl/KDofkr Do you think that is ok for you or you just want us write a short summary?

Thank you, and have a nice day.

Hi, I understand what you are doing. I don't feel comfortable with my material being posted elsewhere. Links are OK. Summary is fine, but complete articles posted is a problem for me. I have declined people paying me for my articles. Thanks again for your interest.