Alleghany (Y) also just published their annual report for 2014. As usual, it’s a really good read.

A long time ago, Dorothy Boyd said to Jerry McGuire, “You had me at ‘hello'”.

Well, Alleghany had me with this:

BPS grew +12.7% in 2014 compared to +13.7% for the S&P 500 index. Y noted that the five year performance for Y of +9.6%/year lagged the S&P 500 index total return of +15.5%/year because the S&P 500 was coming off of a low point and that the index might be overvalued today.

Here is a summary of 1 year, 5 year and 10 year BPS changes for Y compared to the S&P 500 index:

Y BPS S&P (total return)

1 year +12.7% +13.7%

5 year +9.6% +15.5%

10 year +8.6% +7.7%

Since 2007 +7.5% +7.3%

And since Buffett mentions a “through-the-cycle” performance figure to offset the S&P 500’s crisis low point advantage in the five year performance figure, I did the same for Y. Y narrowly beats the S&P 500 index on that basis. That’s not bad at all, actually, when you see how conservatively they have been managed.

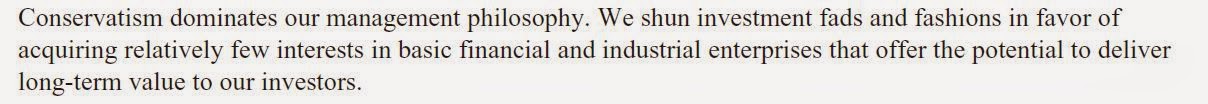

Here is a chart from the annual report:

BPS has done well in the past ten years, but the stock price lagged a little bit, but that is due (as is explained in the annual report) to the fact that Y traded at 1.22x BPS in 2004 and was at 1.0x BPS at the end of 2014.

And then there was an interesting paragraph in the letter that raised my eyebrows. I know investment managers (including Buffett) have been struggling with beating the S&P 500 index recently. I notice that even many of the well-known value investors have been underperforming.

But this paragraph was kind of interesting:

The S&P 500 is a challenging benchmark because it is not a static population of companies. Losers are kicked out of the index, and vibrant, growing companies are added. It also represents America’s leading companies, including a number of companies that dominate their industries. By contrast, the New York Stock Exchange Composite index is more representative of the average company. In 2014, the NYSE Composite returned 6.9%, and has returned about 6.9% a year over the past decade.

Honestly, I’ve never really looked at the S&P 500 that way, but I suppose it’s true. It isn’t a static population of companies. And yes, it’s true that losers are kicked out and then “vibrant, growing companies” are added. And yes, it also represents “America’s leading companies, including a number of companies that dominate their industries.”

In some sense, isn’t that sort of what you want in a portfolio? Is this why Buffett so likes to recommend people just buy an S&P 500 index fund? (And if the S&P 500 is filled with leading, vibrant, dominant companies and the NYSE Composite are just average companies, how about going long the S&P 500 index and shorting the NYSE Composite?! Long the excellent, short the average!).

McGraw Hill Greatest Fund Manager on the Planet!

So, wait a second. The S&P 500 index is actively managed (as described above) and everyone has trouble beating them. Doesn’t that make the S&P 500 index committee the best portfolio managers around? There is more than $1.25 trillion of assets directly tied to the index. If they are that good and can outperform everyone else, surely they can charge 1.0% management fee. That’s $12.5 billion in management fees right there. Assuming they can get a 50% operating margin (which should not be a problem with that kind of revenues and a single index committee) that’s $6.3 billion in operating income, and then put a 10x multiple on that and it’s suddenly a $63 billion business right there inside a $27 billion market cap company!

But, alas, it’s not so simple as we’ll see in a second.

NYSE Composite

Since the S&P 500 index is an actively managed index of great, vibrant companies, Y suggests looking at the NYSE Composite as “more representative of the average company”.

Y’s performance certainly looks better against the NYSE Composite; BPS of +12.7% in 2014 versus +6.9% and +8.6%/year over 10 years versus +6.9%/year.

But I don’t know if the NYSE Composite is a good benchmark. First of all, the NYSE Composite includes all common stocks (tracking stocks and REITs too, I think) listed on the NYSE. That includes a lot of ADR’s, which are foreign companies. If you want to include foreign companies, there are better benchmarks. The ADRs represent a skewed group of foreign stocks because it would only include companies who have ADRs listed on the NYSE.

Also, choosing companies only listed on the NYSE would skew the population as some of the best managed companies are not traded there (Apple, Google etc…).

A much better benchmark might be the Russell 1000 or Russell 3000. Maybe the Wilshire 5000.

But let’s just look at the Russell 1000 and 3000. I pulled some total return figures for these indices (and put them next to the S&P 500 index and Y BPS figures):

Russell Russell S&P Y

1000 3000 500 BPS

1 year +13.2% +12.6% +13.7% +12.7%

5 year +15.6% +15.6% +15,5% + 9.6%

10 year +8.0% +7.9% + 7.7% +8.6%

Since 2007 +7.5% +7.5% +7.3% +7.5%

Looking at this, it seems like the Russell indices are a lot closer to the S&P 500 index. This is probably because it includes the many NASDAQ-listed companies. Also, the NYSE Composite was probably dragged down in recent years due to the lagging foreign ADRs; we know Europe and emerging markets are in the gutter these days.

The Russell indices also add “vibrant, growing companies” and drop losers, but it is done mechanically. The NYSE also drops losers too (delisting) and they do add companies by lobbying companies to join the NYSE. So none of these indices are really static populations.

By the way, the Russell 1000 is the top 1000 U.S. companies by market cap and the Russell 3000 is the top 3000 companies. Since this is market cap (or float) weighted, they will correlate highly as most of the change in the index will be determined by the largest 1000 companies.

As you see, the Russell 1000 tracks the S&P 500 index very closely. This is obviously why the S&P index committee would never get 1.0% fees on assets tracking the index.

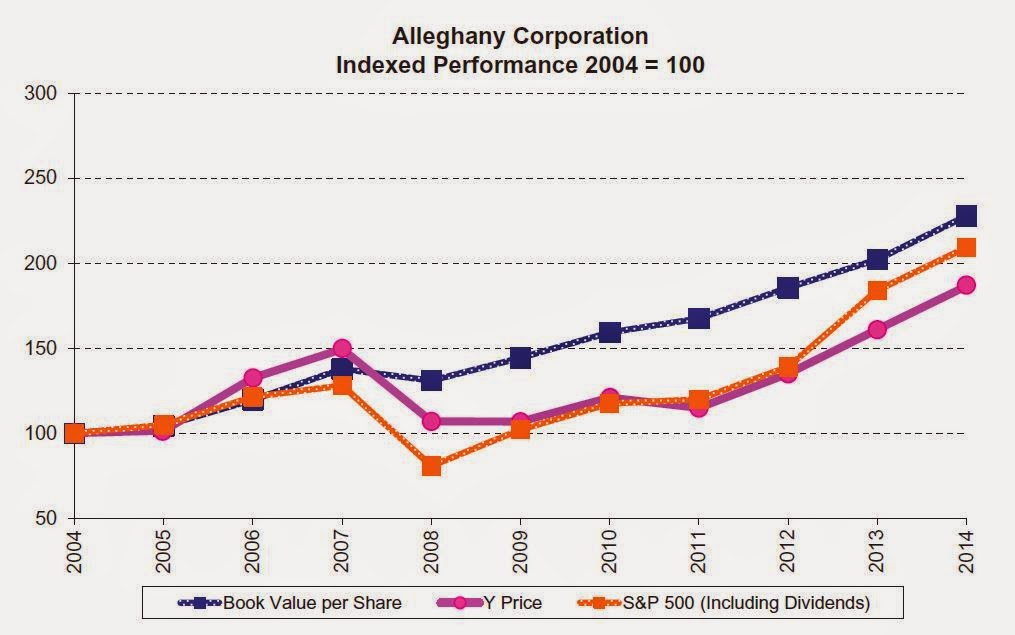

More Detailed ROE

Here’s a look at how the ROE breaks down:

Ares Management, L.P. (ARES)

Y bought a stake in ARES back in 2013. This deal makes sense in that Y needs expertise in managing their fixed income portfolio. It was mentioned in the letter:

ARES closed at $17.14 at the end of 2014 and had paid two dividends in 2014 totalling $0.42. Annualizing that, you get around 4.9% dividend yield on the closing price. And if this is expected to grow, it’s not bad at all.

ARES is now at $19.66. Economic net income per share in 2014 was $1.26/share. That’s a 6.4% earnings yield. Distributable earnings were $0.92/share, or a yield of 4.7%. ARES makes most of it’s income in fixed income so doesn’t have the big ups and downs of private equity.

Anyway, it’s an interesting idea.

Insurance Stuff

The insurance businesses have been doing really well, but a lot of that is that there haven’t been a lot of events recently.

Here are some interesting comments on the business, though:

This is the sort of conservatism that I like in Y.

And here’s an interesting commentary on the insurance business and deflation:

Investments

The equity portfolio at Y didn’t do too well; 5.6% vs. 13.7% for the S&P 500 index. They have a new manager running the portfolio and it’s still a little early so I wouldn’t give too much weight to a single year performance. We’ll see how it performs over time.

There is a lot of commentary of the current environment; the usual cautious stuff about QE etc.

And then there is an analysis of what’s going on in the energy markets. Here’s the conclusion:

I didn’t really think about it this way, that the peak was in 2008. Maybe that is correct and the latest collapse is just a part of the extended bear market in crude oil. If that is the case, then maybe a turn is a little closer than thinking about the collapse last year as the beginning of something.

They too see sustainable prices in the $70-80/barrel range.

Long Term Performance Target

There was a comment in the outlook section of the letter that made me scratch my head a little bit. Look:

It says that Y increased BPS at almost 9%/year over the past decade, “at the upper end of our stated objective of 7-10% annual growth over the long-term.”

But that makes it sound like their goal was 7-10% growth in BPS since 2004. I only remember seeing this 7-10% goal recently, so I went back to the old letters to see.

Check this out:

2004 AR: “Our long-term goal is to increase our stockholders’ equity per share at double-digit rates, but only if we can do so without taking excessive risk.”

2005 AR: “Alleghany’s principle financial objective is to grow book value per share at double-digit rates without employing excessive amounts of financial leverage or taking undue amounts of operating risk.”

This continued for another year or so, and maybe there was a year where it wasn’t mentioned at all, but the next time a goal was mentioned was during the crisis:

2008 AR: “Alleghany’s goal is to compound its book value per share at attractive rates over a long period of time. ”

This was obviously due to the fact that Y wasn’t growing BPS at double digit rates at that point.

The first time I noticed the 7-10% goal was in 2011:

2011 AR: “Our goal is to increase book value per share at a rate of growth that exceeds the total return on the S&P 500 over time. We believe that book value per share growth of 7-10% per year will achieve this goal, and that there is a good chance that our current portfolio of insurance, reinsurance, private capital and public equity investments will allow us to achieve these results over time. Importantly, our business model calls for market-beating book value growth with a low risk profile.”

I may be wrong about this; I just quickly looked through the old annual reports.

It’s not a big deal, but I thought it was a little misleading. It’s only because I’ve been reading the reports for a long time that it made me think, hey, wait a minute.

It’s still a decent performance over time and I still like Y. I do think they are well-managed. And again, this sort of performance given their conservatism is pretty good (read the letters; some will describe them not as conservative but extremely pessimistic, especially compared to Buffett’s letter!).

Conclusion

I always enjoy reading the Y annual report. I think it’s run by great people and like it a lot. It’s a little conservative for my taste, but look, they are beating or at least keeping up with the S&P 500 index without taking a lot of risk.

They are also investing in private businesses, like BRK and MKL. It’s interesting that MKL and Y are both taking a similar approach, breaking out their investments into private businesses; disclosing EBITDA of them etc.

It’s definitely an interesting situation at 1.0x BPS.

I to was surprised about performing to the higher end of their target. Have you had a chance to read leucadia's letter? Maybe I am a little use to BRK, MKL, Y, Fairfax and the old LUK, but it seemed more Jef than Luk

Yes, I read the LUK letter. It looked good to me. The style is not the same as the old LUK, but there was a lot of detail with respect to the various areas and the reasons why they did certain things. It was very clear and comprehensive in that sense. If they keep up that detail, it would be great. Of course, book value hasn't grown much since the merger but that probably has a lot to do with cleaning up, reorganizing etc. and it will take time for the new investments to start contributing.

Why don't officers and directors own more stock?

That's a good question. It's alway nice to see insider ownership. In Y's case, historically, the Kirby family held a large stake but they have been winding that down since Hicks became CEO, and he only became CEO in 2004. So this isn't so much an owner/founder kind of situation like BRK, LUK etc.

Also, if you read the annuals going all the way back, it may be no wonder Hicks hasn't backed up the truck on Y. Maybe he is sitting on a lot of cash and/or gold… Who knows.

Anyway, it's not that unusual for ownership to be a lot lower after CEO-ship passes down to the next generation. The next BRK CEO, for example, won't own nearly as much stock as Buffett does etc…

Thanks as always. Any thoughts on buybacks? It's probably apples/oranges but I'm thinking about BRKs 1.2 mark. Regards,

I don't know. They have been buying back stocks, but I don't know what their philosophy is except that they obviously like to buy back shares below BPS. There is also the issue of what else is out there to invest in. Like Blankfein used to say at GS, you might not want to buy back too much because when opportunity comes, you don't want to not have the capital around. If you buy back shares and bad times come (with opportunities galore), then you won't be able to issue shares since your own stock price will probably be cheaper at that point too…

So their excuse for not beating the s&p 500 is that it's too difficult because it's composed of America's best companies and so it's too hard? :/

Seems a bit lame..

Yeah, that explanation didn't sound too good. It made me wonder, then why isn't Y investing too in the dominant, leading companies? The better story would have been, maybe, to list up some of the bubble stocks included in the S&P 500 index and saying that we can't keep up because we refuse to play this game of paying so much for popular, faddish stocks or some such. So that part could have definitely been written better.

KK

Thanks, I always enjoy reading you commentary on annual letters. I am also a frequent poster from over here in the peanut gallery. One question stuck out in my mind (that also relates back to things you have said in the past):

Hicks worries about deflation, yet says P&C insurers should hold up well. What has been the case in Japan? Sure, they have lower ROEs than in the US but surely we could see if they have “held up well” relative to the overall market there?

Also, how do we square Hicks’ thoughts with what Buffett was writing at the same time: “Unfortunately, the wish of all insurers to achieve this happy result creates intense competition, so vigorous indeed that it frequently causes the P/C industry as a whole to operate at a significant underwriting loss. This loss, in effect, is what the industry pays to hold its float. Competitive dynamics almost guarantee that the insurance industry, despite the float income all its companies enjoy, will continue its dismal record of earning subnormal returns on tangible net worth as compared to other American businesses. The prolonged period of low interest rates our country is now dealing with causes earnings on float to decrease, thereby exacerbating the profit problems of the industry.”

Appreciate you always taking the time to respond.

That's a good question. I haven't been following insurance in Japan so I don't know. One big difference, though, is that even more than insurers in the U.S., in Japan they price for market share and not for profits so I don't know how useful comparisons would be. They've also had balance sheet problems not to mention perpetual low rates, and legal problems within their insurance operations too.

As for Buffett's comment, this has been true for a long time and Y has a good record.

Sorry I don't have much more to add to that at the moment…

Sorry, what I meant was how to do square Hicks' optimism about P&C insurers' prospects in a deflationary environment with Buffett's warning that the decreased earnings on float will lead to hard times for the industry?

I don't know if Hick's comment is necessarily optimistic. He is just saying it will hold up, which sounds more like a relative term as if comparing to other areas that may get hit from deflation (commodity type businesses) etc. They are both right; deflation will lessen costs to insurers and Buffett too is right; lower investment returns will keep pressure on pricing etc. But for Y and BRK, they don't write insurance for volume or market share so they won't be hurt as much as conventional insurers. That's the advantage that those business models have.

This has sort of been an issue for a while now as rates have been low for a while and there has been excess capital in insurance for a long time, so I don't think what Buffett is saying is anything new.