The Loews 2014 annual report is out (OK, well, it’s been out a while). I was wondering how they would present their historical returns as they haven’t looked good recently. I’ve talked about how they have changed what they show in their annual reports for performance over time, and there was a discussion in the comments section in one of my L posts about how they use S&P 500 returns without dividends to compare long term returns. Of course, this is not fair; you have to compare total returns.

We all know that L has done tremendously well over the long term. Long term return figures are presented in annual reports in the past.

But whenever you see great long term returns like that, you have to wonder if most of the outperformance came in the early years.

Anyway, this is the sort of thing that L showed in past annual reports:

This is from their website and it shows how L has outperformed the S&P 500 index by a wide margin over time.

But the first thing you notice is that there is a large widening of the gap way between 1964 and 1969 (I am eyeballing this chart so might be off).

So the question becomes, well, how have they done since that period?

Actually, the more relevant question is how L has done since current management took over. From their website, we know that this happened in 1998:

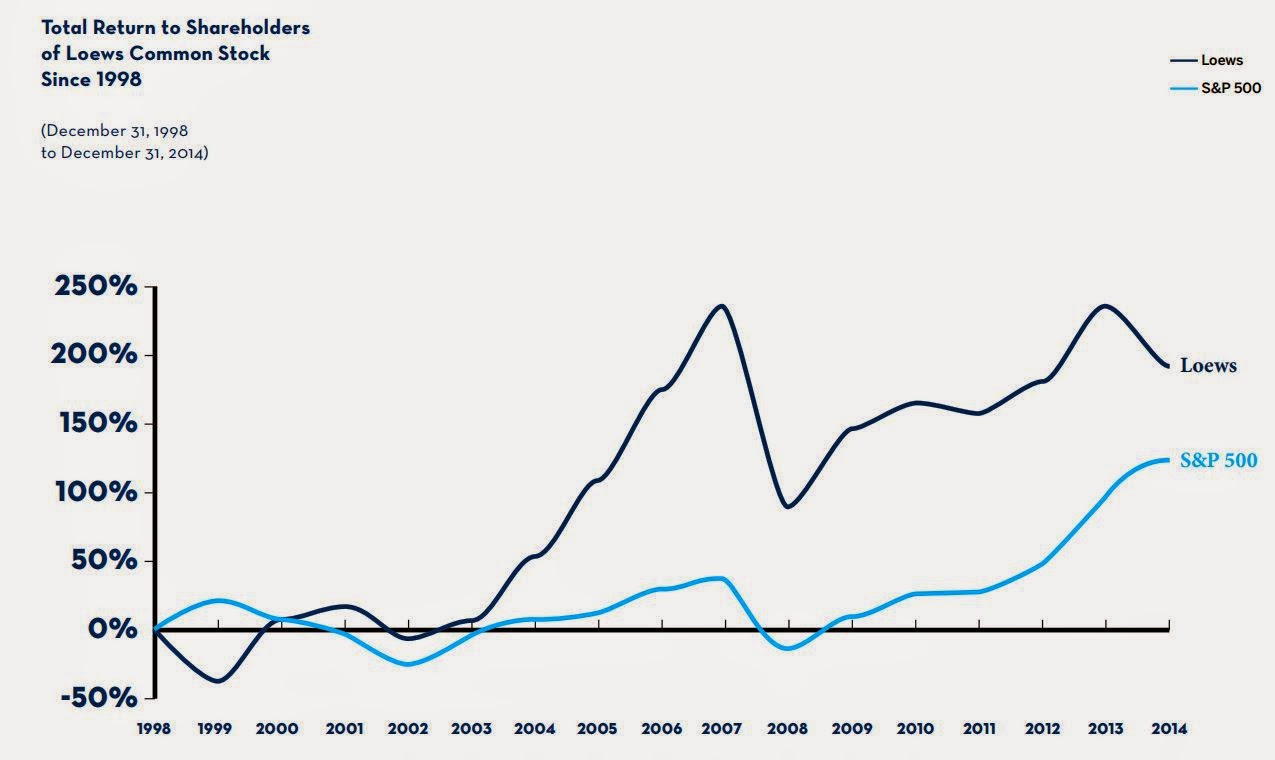

And in the 2014 annual report, that is what they decided to show:

Since 1998, L has returned 7%/year versus 5.2%/year for the S&P 500 index. Just for reference, BRK returned 7.6%/year during the same period.

Judging from this, L’s current management has done pretty well. OK, maybe not better than BRK, but not many can do better than BRK. I just compare everything to BRK because it’s a good benchmark for asset allocating conglomerates; not that I expect everyone (or anyone) to outperform BRK.

And what is important to keep in mind, I think, is that this outperformance comes at what might be a cyclical low point for L (maybe not a low point, but certainly not a high point in terms of valuation or business cycle). L has gotten clobbered in their DO and BWP positions.

I would still way prefer L to most mutual funds. They are run conservatively and do outperform over time. How many mutual funds can you name that has outperformed since 1998?

The performance recently doesn’t look good partly because of the big oil boom in 2006 and 2007. DO and L rallied a lot back then. You can’t really do anything about that (even though it would’ve been great if they sold DO! But, OK, hindsight trading is easy. They are long term investors).

If you smooth out that hump, L doesn’t have such a bad trajectory from 2000 on.

In fact, let’s take a look at that. It’s pretty close to 1998, but since 2000 was a peak in the market, let’s look at the returns since the end of 1999 through 2014-end:

Total return

Dec 1999 – Dec 2014

L +11.0%

BRK + 9.7%

S&P 500 +4.3%

Wow, check it out. I actually didn’t know this until I just did this, but L actually has outperformed both the S&P 500 index and BRK since the market peak at the end of 1999. We can’t really use the 2007 peak for “through-the-cycle” analysis because we know the energy sector was bubbled up (with crude oil at $150/barrel).

So that’s kind of impressive. And again, this is with a really bad endpoint in the data for L.

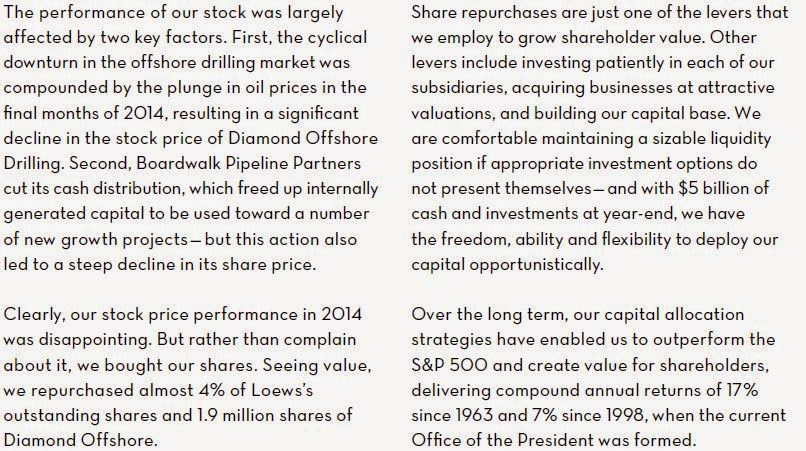

And here’s a quick paste from the 2014 letter. L bought back 4% of their stock, which is great. This is what they do. If they like L better than something else out there, they’ll just buy L. Why not?

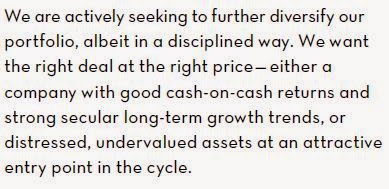

And here’s a comment on what they’re looking for. It’s a little different than what BRK and say, MKL and Y seem to look for. There is a dash of the old LUK here:

I have no objection to that. Distressed assets are great if it can be done right. And knowing the L folk, they’re not going to get into anything hopelessly and permanently distressed.

Conclusion

This is a simple post; nothing much new here. But it was good for me to take a close look at some of these longer term return figures as I too was thinking that maybe L needs a little shot of adrenaline or something.

But I think this perception that L is lagging is largely due to the distortion caused by the huge energy bubble in 2007. The stock has barely recovered levels from back then which makes it seem like they have done nothing in seven years. The current down-cycle in offshore drilling and the oil price crash sort of reinforce this impression.

If you take a step back, though, and smooth out that big boom and bust, L seems to be doing really well. Frankly, I was surprised that L has done better than BRK on a stock price basis since the end of 1999, a sort of stock market super-peak. To me, 1999-2014 is a really good “through-the-cycle” benchmark too look at.

And importantly, L has outperformed the S&P 500 index (on a total return basis) since current management took over in 1998.

Your numbers are similar to mine between the peak and the end of 2014. However, look at the total returns from the start of 1998 through the end of Q1 2015: L underperformed both the S&P and BRK. It's amazing how the choice of start and endpoints matters for these long-term comparisons. https://www.dropbox.com/s/edfylbp0jprlyzw/L%20vs%20S%26P%20and%20BRK.png?dl=0

Good point! End points can really change the picture a lot. Thanks for the chart.

KK,

Berkshire's non-insurance non-investment after-tax profits have grown at a CAGR of 23% since 1999, from $513 million to $11462 million (Item 7 of 2014 10-K and "Sources of Reported Earnings " in 1999 10-K). In 1999, insurance and investment income was most of the profits, now non-insurance non-investment forms the majority.

Since Berkshire has had very little dilution, I don't know how we end up with a 7.6% return.

I think this happened because Berkshire bought blue-chips and these blue-chips were chased to very high multiples in 1999. I wasn't investing then but I read that most of the 1990s market runup was confined to a small subset of the S&P 500. Berkshire's 1999 book value per share of $38,000 is almost the same as the total value of its investments.

So even if Berkshire's 1999 P/B doesn't look too high, the book value itself may have been too high.

Simple but effective indeed.

Loews is a very interesting story. Even with the fair p/e it sports now, the stock looks a bit undervalued. It is interesting the cash flow generation to me.

An analysis of Loews current management should consider the position they stepped into and what they have done since. When the current management took over in 1998, Loews owned 100% of Lorillard, the cigarette company. Over the next 10 years, Loews received $4.8b FCF from Lorillard and sold Lorillard for a total of $3.8b cash and $4.7b in Loews shares, for $13.3b in total proceeds from Lorillard. I believe this was all done tax-free. Since the sale, Lorillard has produced over $7b in FCF and is now worth $25b, for over $32b in value.

A few points:

1) The most important decision that current management made was to sell Lorillard.

2) The sale of Lorillard was, viewed on its own terms, a poor deal financially.

3) Loews has achieved low returns on its proceeds from the sale of Lorillard. In addition to the cash that has gone into low-return drilling, insurance, and pipeline investments, Loews swapped its last 38% ownership of Lorillard ($4.6b value) for Loews stock in mid-2008 at $50/share that is now worth $41/share. The Lorillard stock, with dividends, is now worth $15b and the Loews stock is worth $3.9b.

4) Looking at the longer history of Loews, I suspect that if you strip out the Lorillard investment entirely ($400m purchase in 1998 earning $31m net income at the time), that the returns on Loews stock look very pedestrian. Owning a tobacco company in the back half of the 20th century was one of the great gold mines in the history of business. The former management certainly gets credit for making the purchase in 1968. However, when looking at the capital allocation skills of both former and current management, if so much of the value is due to that one purchase and there have been numerous poor purchases since, it raises the question of how much luck was involved. For current management, who had nothing to do with the purchase, the question becomes much more important. If you look at the actual capital allocation record of current management, it is mediocre at best. They have put a lot of money into businesses that have had poor returns over a long period. As it relates to returns since 1998, the huge tailwinds from Lorillard are now gone and what you are left with is a pile of fairly mediocre assets.

Good point about LO. Financially it's a horrible deal, but I actually don't blame them for wanting out of the tabacco business. I too don't want to own tabacco companies as there are no mitigating factors to the negative contribution to humanity of the business. At least with alcohol, there is such a thing as responsible drinking. So I wouldn't criticize L on that deal. Of course, it's fair game to do so. It's just that I wouldn't.

As for performance other than that, I don't know. It certainly hasn't been inspiring and I have never really been a big fan of the energy investments (I scratched my head when LUK made all those energy investments too). As far as I would go is to say that over time, I tend to agree that crude has a longer life than alternative energy advocates want to believe.

And we are sort of in the midst of a crash in the sector so I wouldn't want to make conclusions based on this endpoint in the data (DO is down a bunch). It's like trying to evaluate a value investor in early 2009. I would rather wait for things to normalize and see who makes it out at the other end, and then who has the better performance then.

Anyway, I have my reservations about L, but maybe I am too much of a New Yorker and bend over backwards too much in their defense. This is certainly possible.

We'll see how it goes.

Oh, and as for L being a pile of mediocre assets, that's largely by design, I think. They are not in the business of owning top of the class, moatful businesses like KO. So that is not so much an issue as long as there is some action to improve the business and increase it's value.

Anyway, thanks for the interesting discussion. There is a lot to think about for sure here.

tobacco, not tabacco…

I understand the discomfort with the tobacco business, but if you admire Loews for its historical record and that record was almost entirely driven by the now-disposed of tobacco business, then it becomes a relevant discussion point.

I think you are overrating the impact of the oil price collapse on Loews’ performance. Per share of L, the values are $26 for CNA, $6 for DO, $6 for BWP, $9 for Cash, and maybe $3 for hotels. For the past 4 years, DO has only been worth on average $9.50 per L share, or $4.50/share above the current price. Add that back to the current L price of $41.36 and it doesn't move the needle that much.

BWP has done poorly but that is more to company-specific results than the industry. Many pipeline companies have thrived in the past 5-10 years.

If L is a pile of mediocre assets by design, that is a poor design. As I mentioned in an earlier response, buying mediocre assets only produces good returns if you are both good at buying and selling them, and even then it’s very tough to do and get good after-tax returns within the corporate structure. Given that L management rarely sells and doesn't appear to be that great at buying, it’s hard to see how this will work well. They certainly didn’t think that Highmount was a mediocre asset when they paid $4b for it in 2007, it just ended up being one when they were wrong on their natural gas price bet. And again, the past excellent results at L did come from holding a company with a huge moat.

More importantly to the discussion, the conglomerates that you often write about that have done well over time are generally run by obviously very enterprising people who are frequently able to either buy good businesses for cheap prices or buy mediocre assets and turn them into good business through operating savvy. The “Office of the Management” at Loews has failed to do either of these things over a fairly long period of time, in either public or private markets, and in my opinion is not very impressive.

Good points. Someone suggested that L is a situation ripe for an activist investor (maybe it was you, I don't remember), and maybe it is!

OK, so this is kind of interesting so I went back and looked at the total return for DO over the long term. Most of the assets at L are legacy assets (especially CNA that has done nothing over time!), but I think we can say that DO is James' baby from the beginning.

So let's look at how that has done over time.

The first stock price data point I have is October 11, 1995 of an adjusted $6.24/share. Now it's trading at $30, so that's an annualized return of 8.4%/year. The S&P 500 index over that time has returned +8.7%/year. So, OK. DO has been a dud.

But maybe the current oil crash and DO decline is temporary and is a cycle low sort of thing. DO has traded above $60 before the oil crash.

What if DO was trading now at $60? Then the return over that time period would have been +12.3%/year versus the S&P 500's +8.7% (total return basis). That's not bad at all.

From our benchmark year-end December 1998, DO has returned +5.5%/year to the current price of $30/share versus the S&P 500 index' +5.2%/year, so even at this crash low, DO is slightly outperforming the S&P (again, total return basis).

If DO was trading at $60/share, then the return would be +10.1%/year versus the +5.2%/year total return of the S&P 500 index over that time period. Not bad at all.

DO is not trading at $60, though.

Anyway, if it wasn't for the oil crash, James' baby DO is not such a bad investment at all after all.

But yes, your criticism of L still has many valid points, but I think Tisch's current management might deserve a little bit more credit that you give it. But maybe just a little bit. 🙂

I think you have not made the proper adjustment for the 1995 DO share price, and the right price is double what you cite, or closer to $12/share.

Details: DO had an IPO in October 1995 where it issued 14.95m shares for $338m, or $22.62/share. The company then had 50m shares and L owned 35m shares. The company issued 17.9m shares for the Arethusa merger and then minor stock issuance took the total to 70m shares. There was a 2 for 1 stock split in 1997 to get to ~140m shares, or roughly where it has stood since. By my calculations, L's IRR on DO stock since 1995 has been 7.2%. Also a minor note, L pays about 7% tax on DO dividends, which is small but adds up.

It is true that if DO stock price were double what it is today, the returns would be much better, and if that is the hook that Team Tisch needs to hang its hat on that speaks for itself. I would also be more likely to cut them some slack on depressed end markets if this was one underperformer in a strong portfolio. But this is supposed to be the winner! As you have pointed out, the relatively much more important investment which comprises over 50% of L value, CNA, has been a quaqmire for 20 years, in addition to the Highmount debacle.

Appreciate the perspective on Loews. It is surprising that the stock returns have been relatively strong since current management has been in charge. That certainly hasn't been the case recently. I looked at the sum of the parts today. Based on intraday prices, BWP is worth $5.86 per share, DO worth $6.77, CNA worth $25.47, and the hotels worth $3.28 (assuming they are worth 2x BV). This adds up to $41.38 compared to the current price of $40.55. Obviously this excludes the $9.97 in net cash and securities per share. In other words, the market gives a value of less than $0 to Loews's net cash and securities. Management has, no doubt, made mistakes in recent years but the current discount seems way too wide. Giving the company no credit for its net cash and securities portfolio that comprises 25% of the value of the stock seems extreme. If the Tisches haven't totally lost their touch, then the valuation seems quite compelling.

In regards to the DO historical returns, there are quite a few special dividends that started in 2006 that would affect that number quite a bit

Hi, I think my return calculations included that.

KK,

I really enjoy your articles…

One other point to the L debate: What exactly has the management team done with all that cash, especially during 2009-2011 period? If you can't swing the bat during that time, when can you? They are quite defensive about this point, noting the follow-on investments of the portfolio companies and capital infusion during crisis but arguably DO and CNA now do not need the mother ship for support. In the past, that wasn't the case for CNA as it used to be an asbestos infested insurer but that exposure has been transferred and a new mgmt team has done a decent job of improving performance. It seems the BWP is arguably the only one of the subs that really benefits from the current structure – equity investments from the GP are quite useful, capital markets can be fickle for MLP, and BWP has multiple projects, especially as it tries to send gas south. BWP has a lot of asset value, and with a supportive GP and the prospect of a restored dividend, it would seem like this is the part of L that might be attractive – I just have trouble handicapping the take or pay contracts coming up in 2017/2018.

But it is less clear to me what benefit DO and CNA shareholders receive from this arrangement – DO has balance sheet to buy new rigs, hope there is fire sale on current rigs, whatever – no need for L help. L has ~90% of CNA shares – if performance/perceptions of CNA have greatly improved, wouldn't CNA shareholders benefit if the L overhang disappeared? And what benefit do L shareholders receive from the current arrangement with DO/CNA? Dividends from the subs that are just held for cash? Clearly some optionality value in the event of a dislocation but, again why couldn't you find something in 2009-2011? I do wonder if James got a bit gun shy post Highmount – who knows. Sometimes it feels like family wants the public subs so it can easily calculate SOP value for the entire company – maybe an activist could ask if shareholders would be better off if CNA, DO were completely spun off to shareholders vs. current parent/sub approach with share repurchases?

I would contrast this holding company/sub relationship with the new team at LUK – Jefferies clearly benefits from permanent capital of LUK, Jefferies earnings stream helps chew up the tax assets at holding company, and the risk/reward investments on FXCM, HRG, Leucadia Asset Management look quite appealing – while this hasn't necessarily translated to book value growth yet, it does seem that LUK has seen better deal flow as a result of the Jefferies merger and the recent investments suggest decent possibility for gains and potentially significant ones. Time will tell – if share performance doesn't improve, you can also question LUK structure – as NP says, you have to earn the right to a conglomerate structure…but L team has been on the clock for a bit longer

Good point. I too was a little surprised that they couldn't find something to do during the crisis. They might have frozen up and fear a little bit as CNA was getting clobbered and they had to provide support. Maybe they figured a really bad worst case scenario and wanted to hold onto the cash for the sake of survival. I don't think they expected things to come back so quickly.

As for the structure, well, that's just the way they are. At any point in time they will tell you that they are doing what's best for the shareholders. If they spun out DO/CNA to shareholders, they will no longer have the cash flowing in from those entities so in that sense, as long as they like the business I can understand why they want to hold on to them. Having them listed does leave them more options (potential spin if they want to, valued by market etc…).