This name has been mentioned on this blog a few times in the comments section, but I never wrote about it. It is well known in the value investing community and I said I’ll make a post about it in the near future so here it is.

First of all, BAM is sort of an outsider/owner-proprietor business as it has been run for a long time by a single CEO, and the great track record is attributed to him.

Story Fits Too Much

The only thing that I am not so excited about in recent years is that the story sort of fits the environment a little but too much; pension funds and others need to increase returns to be able to make obligations, with interest rates low and stock market scary people need alternative investments. With the perception of higher risk (or high cost, low return) of hedge funds and private equity funds, fear of future inflation due to global perpetual pump-priming (global PPP?), hard or real assets and real asset managers look really, really interesting.

Oftentimes, when everything is just too perfect, the investment doesn’t pan out. So that’s what I’ve sort of been worried about. Plus, honestly, I’ve never really been a big fan of commercial real estate. There have been some great wealth created in real estate for sure, and it’s a solid investment if you have good people investing. But it’s just never been something that excited me. Don’t tell Ackman I said that, though…

Lou Simpson’s Concentrated Bet

What’s really interesting is that Lou Simpson bumped up his bet on BAM this year. Lou Simpson probably needs no introduction here, but just in case, he’s a portfolio manager that managed GEICO’s investments for many years with great results (I think beating Buffett). He now runs SQ Advisors, after retiring from GEICO.

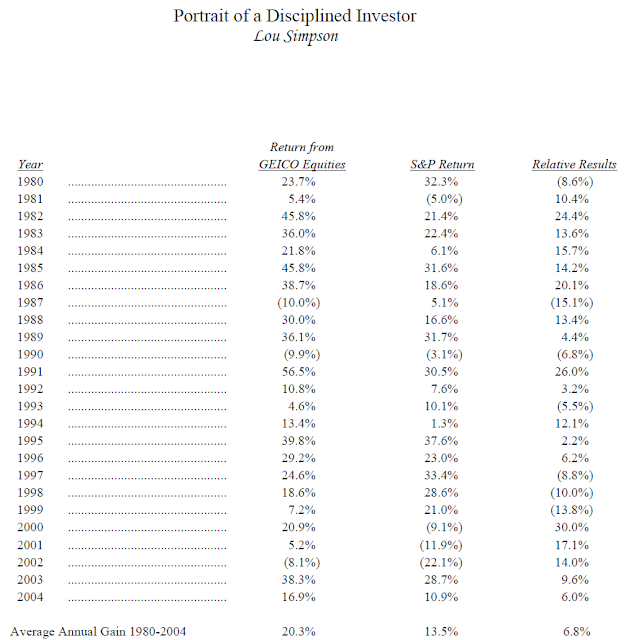

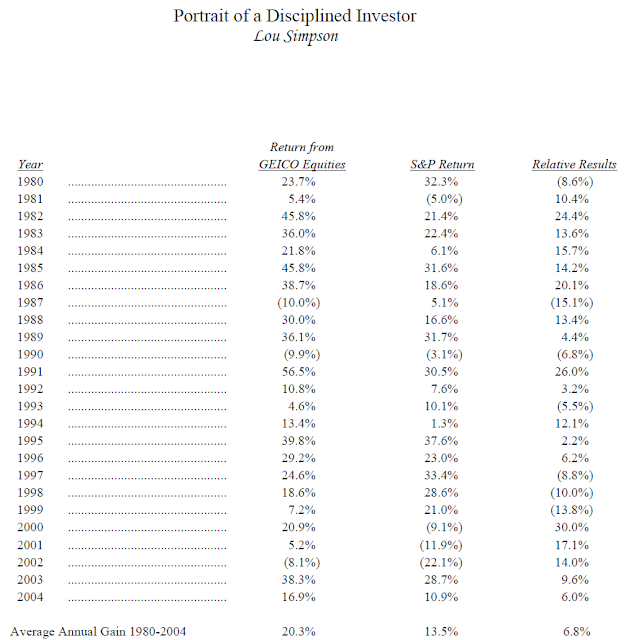

Just as a reminder, here is Simpson’s investment performance at GEICO from BRK’s 2004 annual report:

And then when he retired at the end of 2010, this is what Buffett wrote in the annual report:

Here is the history of Simpson’s BAM holdings in the past year:

shares owned

6/30/2014: 3.8 million

9/30/2014: 4.0 million

12/31/2014: 4.5 million

3/31/2015: 6.8 million

This looks like the effect of a 3/2 split, but that didn’t happen until May, so Simpson really bumped up his investment in BAM.

BAM now accounts for a whopping 12.5% of Simpson’s portfolio, second only to his Valeant (VRX) position. BAM is also bigger than his positions in BRK and WFC each of which constitute 11.5% of his portfolio. (It is interesting how Munger absolutely deplores VRX (he said it’s worse than ITT in the 60’s) while it’s Simpson’s top holding. This is why when people disagree with me, I don’t care too much. Even the best and the brightest don’t agree on things. Who am I to expect people to agree with me?!)

Anyway, this might have gotten some of your attention. This also makes this post timely.

And by the way, this is Simpson’s current portfolio (as of March 2015):

| NAME OF ISSUER | TITLE OF CLASS | (x$1000) | PRN AMT | PRN |

| BERKSHIRE HATHAWAY INC DEL | CL A | 4,568 | 21 | SH |

| BERKSHIRE HATHAWAY INC DEL | CL B NEW | 333,927 | 2,313,799 | SH |

| BROOKFIELD ASSET MGMT INC | CL A LTD VT SH | 364,970 | 6,810,878 | SH |

| CROWN HOLDINGS INC | COM | 226,804 | 4,198,521 | SH |

| LIBERTY GLOBAL PLC | SHS CL C | 246,015 | 4,939,071 | SH |

| ORACLE CORP | COM | 91,216 | 2,113,921 | SH |

| PRECISION CASTPARTS CORP | COM | 283,949 | 1,352,140 | SH |

| SCHWAB CHARLES CORP NEW | COM | 247,566 | 8,132,923 | SH |

| UNITED PARCEL SERVICE INC | CL B | 154,544 | 1,594,226 | SH |

| US BANCORP DEL | COM NEW | 249,124 | 5,704,686 | SH |

| VALEANT PHARMACEUTICALS INTL | COM | 376,646 | 1,898,540 | SH |

| WELLS FARGO & CO NEW | COM | 334,057 | 6,140,747 | SH |

Back to BAM

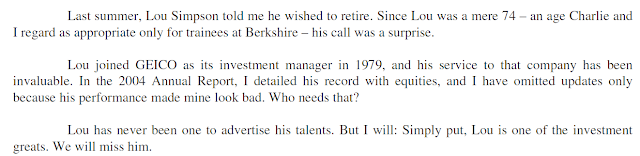

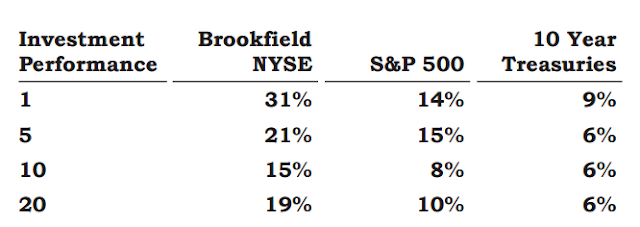

Here is the long term performance for BAM from their 2014 annual report:

Pretty good, I think.

Presentation

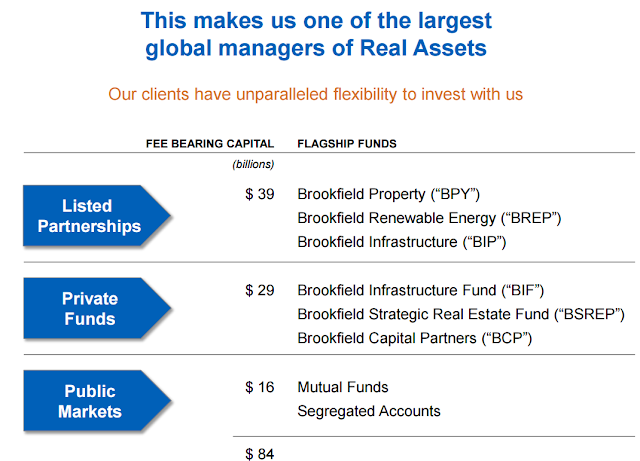

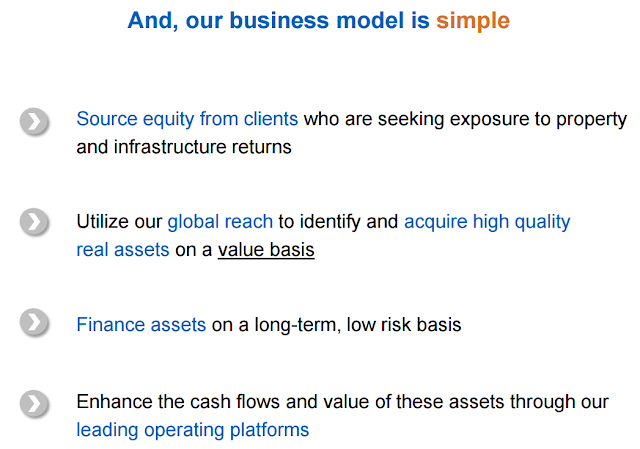

There was an investor day back in September, 2014, so let’s take a look at some slides from that presentation. (Check out their website for their annual reports, presentations etc: BAM Investor relations)

There was a 3/2 split in May of this year, so the above share price targets is actually $100 – 130, which corresponds to 12-15% annualized growth from the current price of around $36/share.

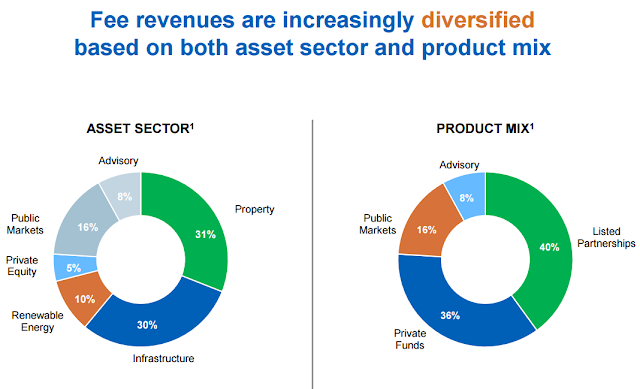

They have really diversified on many fronts; geographically, investment vehicles, asset classes etc.

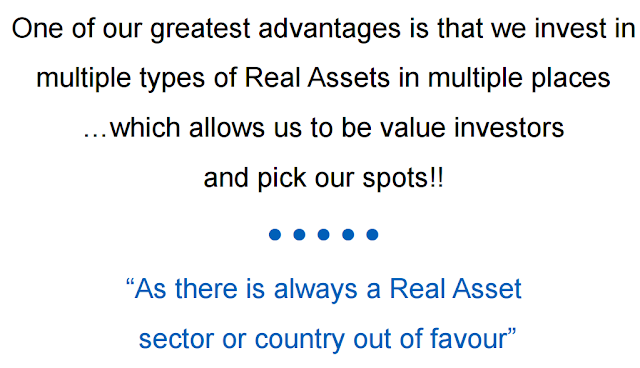

And the fact that they are in so many areas serves as a big advantage for them:

This is a section from their first quarter 2015 report that talks about their culture and why they think they can continue to do well going forward. By the way, critics complain about the lack of disclosure at BAM, but I find their reports to be very informative. How many companies write their quarterly reports almost like annual reports? (in fact, BAM’s quarterly reports are better and more thoroughly written and more informative than most annual reports!):

Culture as a Competitive Advantage

We are often asked whether Brookfield can continue to increase the amount of capital we have invested in global opportunities,

on a profitable basis. The short answer is that we believe we can.

While acknowledging the normal challenges, we believe we have three distinct competitive advantages which will help us

accomplish our goals:

- Team Approach – The first advantage is that over the years, we have invested significant capital and human resources to

build out the backbone and support structure of our operations, creating a first-in-class global company. Operating decisions

are a culmination of the views of approximately 40 members of the management partnership, our 18 senior managing

partners, our 700 investment executives and our more than 28,000 employees. We try to mix entrepreneurship, institutional

stewardship, best-in-class professionalism, global scale and localized expertise; all with a focus on generating long-term

capital appreciation. Our team approach to our business, the pursuit of excellence and commitment to our colleagues and

investment partners drives this success.

- Our Global Reach – Brookfield’s second advantage is the scale and global reach of our operations, enabling us to invest

in and manage assets and opportunities across many investment products and jurisdictions, efficiently and effectively. The

flexibility to opportunistically invest capital in this manner is rarely possible with smaller firms. We have built a global

company operating today in the major cities of the world including London, New York, Sydney, São Paulo, Toronto,

Shanghai, Dubai and Mumbai and many other locations. We are diversified: culturally, financially and geographically.

As an investor in our company you acquire exposure to global economic and business diversification which few other

investments offer.

- A Distinct Culture – The third advantage and possibly our most important is our distinct corporate culture. We have written

extensively over the years on our first two advantages, but seldom have we attempted to explain “how” we operate and

“why” we believe our culture provides us with an important competitive advantage.

While admittedly it is difficult to define culture precisely (the Oxford Dictionary defines it as “the attitudes and behaviour

characteristic of a particular group”), ours is based on the following key principles.

- Principles of Business – Our core fundamental business principles are set out in our annual report and were formed by our

early founders, and refined over the years. These principles include: building our business and all our relationships based

on integrity, value investing in how we allocate and invest capital, fair-sharing in our relationships and measuring success

based on total return on capital over the long term. We are required to report quarterly, but regardless of short-term reported

results, our investment focus is always on creating long-term sustainable appreciation on invested capital.

- Personal Financial Commitment – We promote long-term ownership stability and orderly management succession

and encourage our senior executives to devote most of their financial resources to investing in Brookfield. As a result,

collectively our management partnership owns approximately 20% of Brookfield, which is consistent with our efforts to

align our interests with investors and clients throughout the organization.

- Operating as a Partnership – We operate internally as a “true partnership” with long-term investment horizons. Our

management partners are highly specialized, but all recognize that by working collaboratively together as a team, we can

achieve far more than if we were structured on a more traditional basis.

Our global platform enables us to finance and invest in a wide variety of opportunities, and few asset management firms offer

as diverse a platform of specialized investment products. As we look forward to future decades, we believe that we are well

positioned to build on our successes.

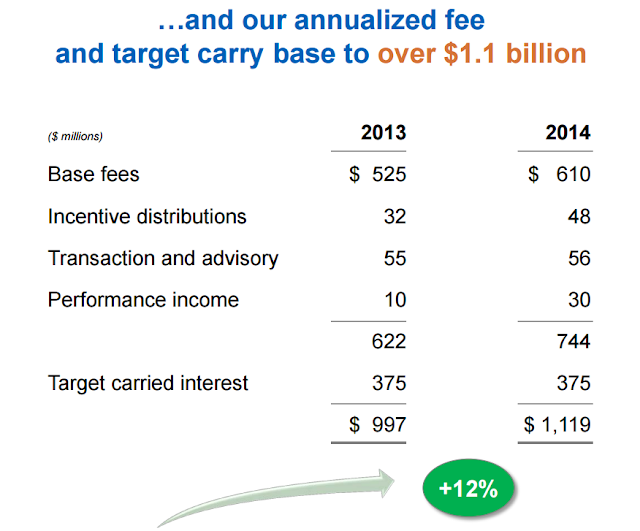

Asset Management

One of the big drivers in the value of BAM is their asset management business. They have high quality assets on the balance sheet, and at the same time they raise more funds from outside investors and earn management / incentive fees and carried interest and this is really growing. This is the key to the BAM investment.

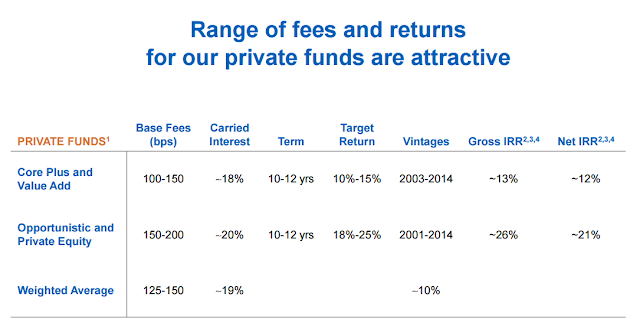

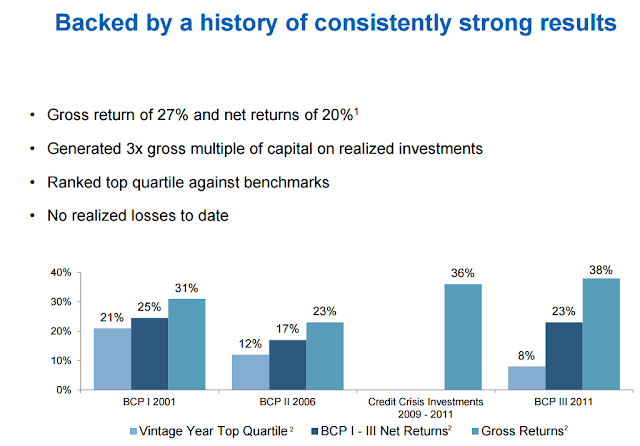

Importantly, they have performed very well so far:

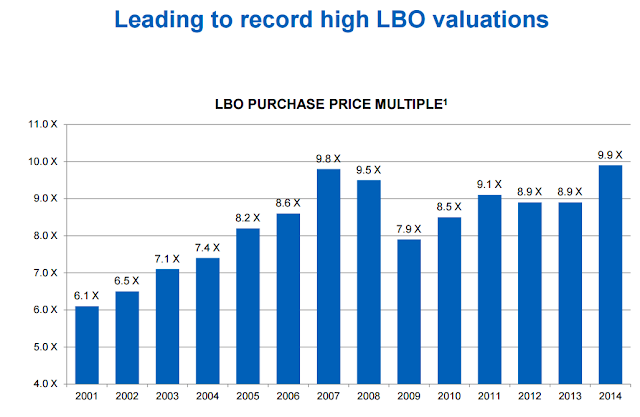

One chart in the presentation is not so exciting. They talk about the improving environment and then show this chart, but this is not so exciting for people who want to invest in a private equity manager; valuations are high now (so forward returns will be lower). But then again, BAM is not doing conventional LBO’s.

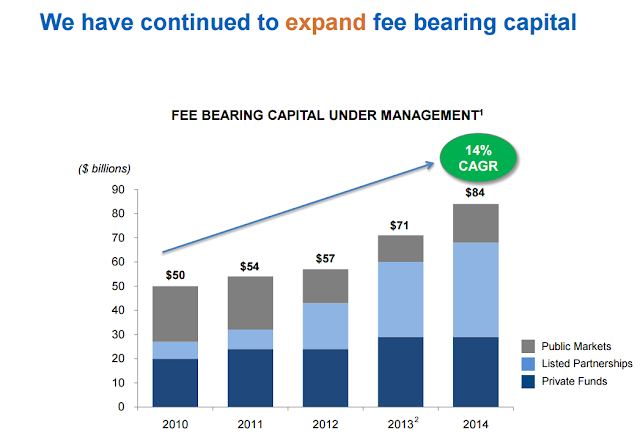

Their AUM continues to grow:

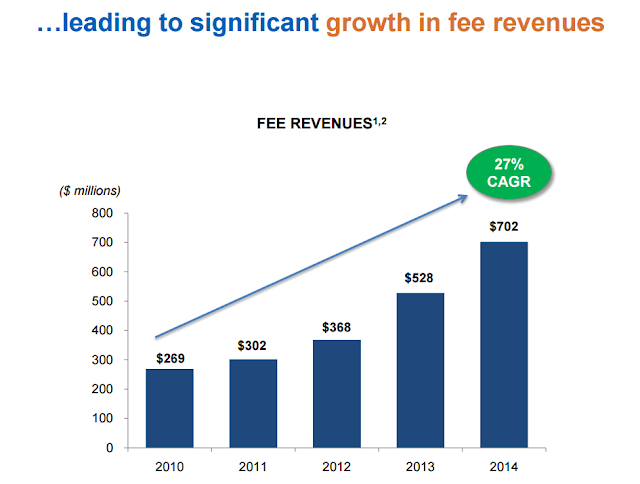

…and a big factor in this investment:

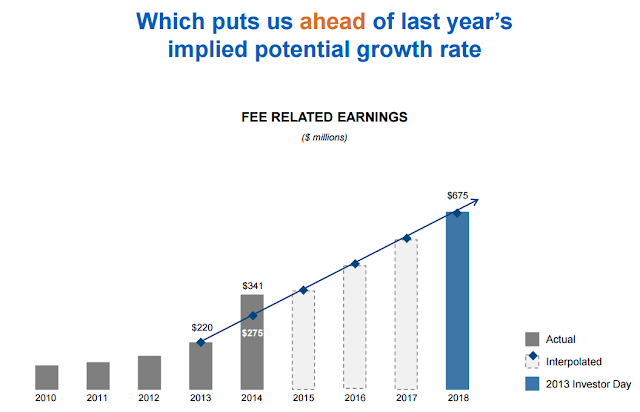

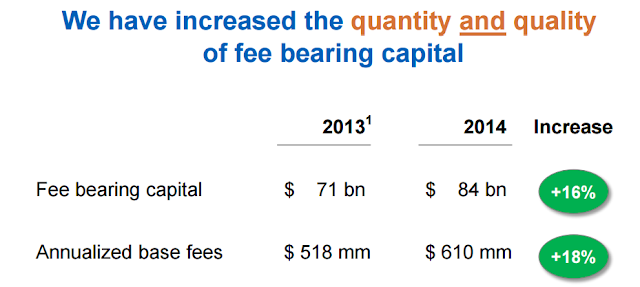

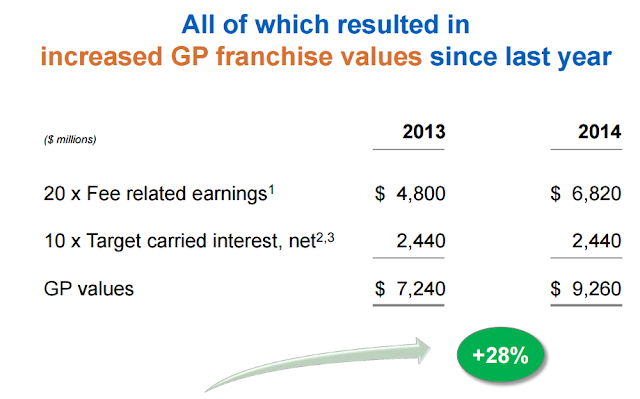

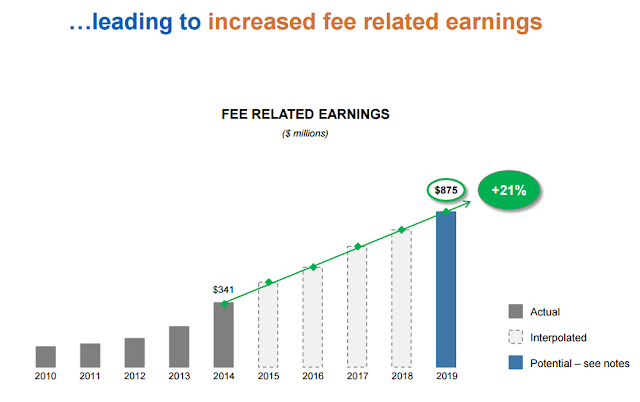

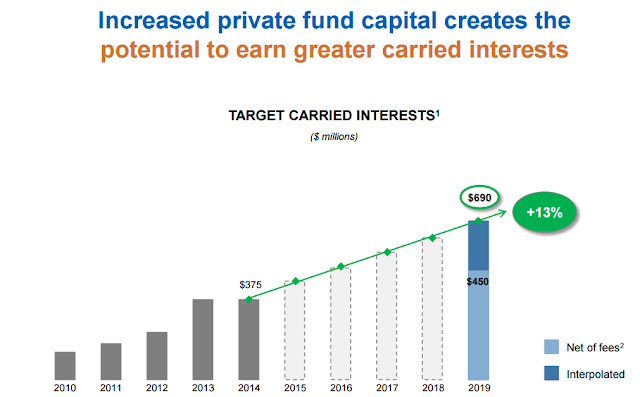

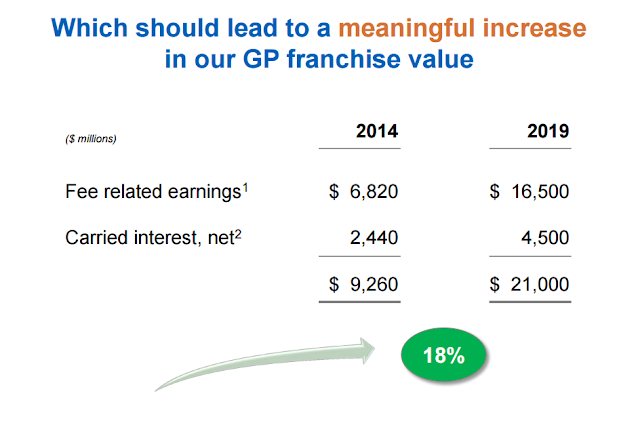

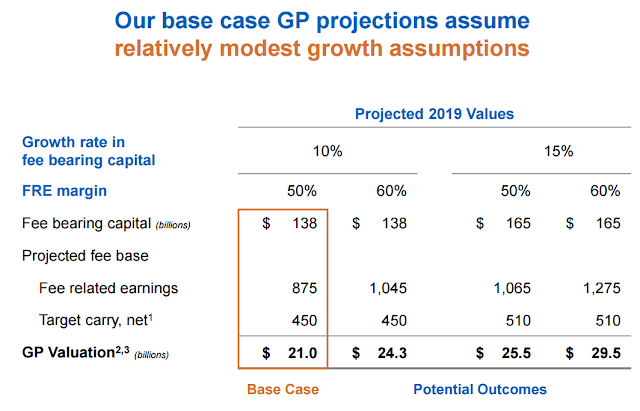

At the 2013 investor day, they said they plan to grow fee bearing assets at a 10%/year rate between 2013-2018. Fee-related earnings was projected to grow +25%/year, target carried interest +18%/year and GP value (value of the asset management business) +20%/year from 2013-2018.

Their value of the asset management business (GP value) grew +28% last year. With 983 million share outstanding at the end of March, 2015, this business is worth around $9.40/share. This value is not reflected on the balance sheet, so adding this to the common equity per share of $19.70/share gets us to a full value of BAM of $29.10/share. Common equity per share may be different from the LP value that BAM uses in presentations, but I used common equity per share as the LP value didn’t seem to deduct some corporate things that I wasn’t sure about. Common equity per share, in that sense, might be a conservative look.

Big private equity firms seem to be trading these days at something closer to 10x earnings, so using that, BAM’s GP value would be more like $6.00/share instead of $9.40/share. Traditional asset managers used to typically trade at 20x P/E, but using 15x P/E would give a GP value of around $8.90/share.

These figures are pretax, though. Many of the listed private equity funds do similar analysis with mostly pretax figures. Since those are partnership units, taxes are paid by the LP unit-holders. You can argue that the conventional asset managers who are valued at 15-20x earnings are valued on after-tax, net income, but the private equity folks will argue back that if those earnings are paid out to shareholders, shareholders would pay taxes on that too, so it is effectively pretax income if you compare it to owning LP units. This is an interesting point. If a corporation doesn’t pay a lot of dividends, though, those reinvested earnings wouldn’t be taxed at the personal shareholder level (until paid out later, or until capital gains are realized).

Anyway, BAM was trading between $34-38/share when Simpson added to his holdings in the first quarter.

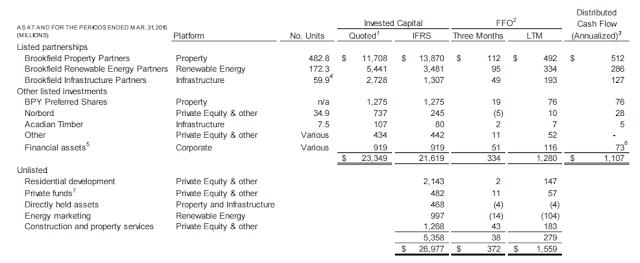

BAM marks their assets to fair value in accordance with IFRS, and this value may differ from the publicly traded prices of the listed entities. A reconciliation of this is shown in the quarterly report so you can make adjustments there.

Here it is:

Maybe BAM is worth a little bit more using market prices rather than IFRS fair value.

BAM expects to grow fee bearing capital 10%/year through 2019.

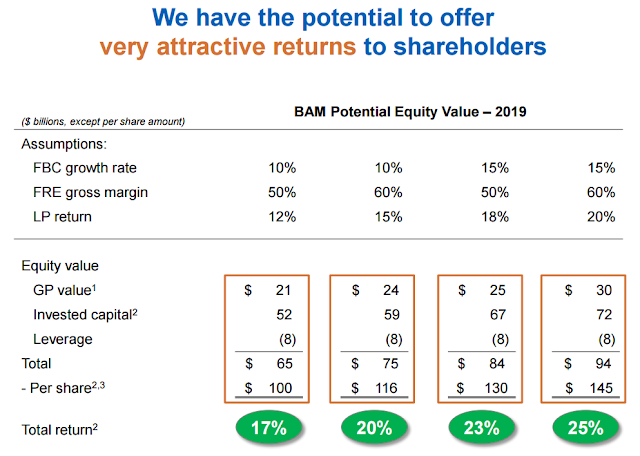

Using BAM’s valuation, the asset management business could be worth more than $21/share by 2019. At 10x earnings, it would be worth $13/share or so, and at 15x, $19.50/share.

If BAM does better than the base case, it can be worth a lot more. The above per share figures are before the split, so after the split, the above per share values would be $67, $77, $87, and $97, versus the current $36/share.

IFRS Fair Market Valuation

There was some criticism of BAM because they switched to fair market accounting saying that a lot of the gains in recent years have been due to BAM just marking their positions up. Also, there was a time that some listed entities were trading below where it is marked on the balance sheet; critics said that these positions had to be marked down.

But this isn’t really a big issue. BAM, before going to fair market value, used to show what they thought everything was worth in their reports and many investors looked at them. Yes, there is some management judgement involved here. But traditional book value has problems too.

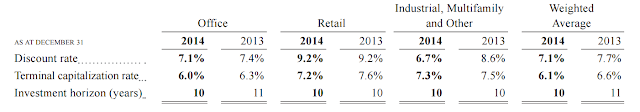

What’s good about BAM is that they show you how they derive their fair market valuations.

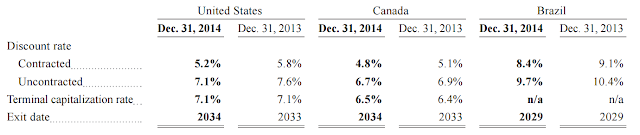

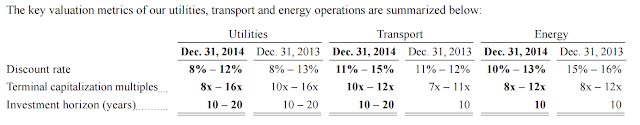

Just to make sure they aren’t marking things up with 2% cap rates, look at the assumptions used. You can find this in their reports.

You really can’t tell if these discount and cap rates are fair without really knowing the properties, but you can see that they aren’t all that low given 2.5% bond yields. These look pretty, ‘normal’.

Real estate

Renewable Energy

Infrastructure

Interest Rates

Pretty much everyone expects higher interest rates to come. This will (if accompanied by a stronger economy) help banks and other financials, but it might hurt BAM.

I see BAM (the funds) as sort of more fixed income substitute than a substitute for equity. People who have large fixed income portfolios tend to get into real estate, infrastructure, utility stocks and things like that; low volatility, steady-income-stream type investments. I don’t think people go, “gee, the stock market looks dear, I’m buying commercial real estate!”. It’s more like, “gee, interest rates are too low… let’s get into an infrastructure fund as stocks and hedge funds are too volatile for us…”.

So in that sense, BAM is prone to a double-whammy. Rising interest rates may push up cap rates (reducing values), and may slow the flow of funds into their funds (or even outflows).

This is true for stocks, too, to a certain extent, but I have shown in an earlier post that even if interest rates went back up to 6%, the stock market now wouldn’t be out of line valuation-wise going back 30+ years.

I don’t have that sort of confidence in this asset class. Well, BAM is pretty diversified so it’s not in any single asset class, but it is sort of the ‘real asset’ type stuff.

But even for real assets, as you can see from the above discount and cap rates that BAM uses, there is probably a big cushion against rising interest rates.

At the 2013 investor day, they showed a chart of cap rates against interest rates and showed that there is a substantial cushion between the two, just like I showed in stocks.

Check out this chart:

From 2013 investor day presentation

But that doesn’t mean there won’t be some upward pressure on cap rates when rates really start rising in a serious way.

The Good Part

On the other hand, Bruce Flatt has proven himself to be a very competent manager, and Lou Simpson seems to be buying into this in a big way (Murray Stahl has been a fan for a while too). BAM is on the right side of all sorts of trends, whether it be capital moving to alternatives (CALPERS notwithstanding!), potential (or inevitable) inflation coming down the line due to Global PPP (so real assets == good), potential growth in emerging markets, pent up need for infrastructure invesments etc…

And this management seems to adjust to changing circumstances, so if you own BAM, you don’t have to worry about this being a shoot-and-forget, static investment. Even if your position in BAM doesn’t change, you can be sure that BAM management will adjust to the ever-changing world; they are not inflexible, unadjusting automatons (like so many large companies seem to be)…

thanks for the writeup – i realize that this blog is not about market timing etc, and that BAM has proven they can adapt well, but it may be worth mentioning that on a recent conference call Sam Zell made comments along the lines of that at this point in the cycle, he'd rather be a seller of anything commercial than a buyer. maybe not important b/c as you said w/ the munger/simpson analogy great minds can disagree on the same investment, but something worth thinking about!

Well, it's good to be aware of where we are in the cycle, and we are definitely not at the bottom of one in this asset class. But one thing about BAM is that owning BAM is not the same as owning a static portfolio of real assets. They are very active; they will sell 'mature' properties and roll into developing ones (forgot what terms they use). So they are not interested, really, in owning a trophy asset and holding onto it for 100 years or anything like that. They will sell those at full price and buy something that needs work, or something that is sold by a distressed seller etc…

Plus if their AUM keeps growing, their fee income will keep growing.

And then even if you have a dip, like Munger always says, the strong ones will use that dip to get bigger and better. And BAM is pretty active and has many levers to get bigger if we hit hard times.

So in that sense, it's pretty interesting. You have to keep in mind, though, that even if BAM does really well in a downturn, the stock price will get hit hard just like it did in the crisis. That's inevitable and something people have to keep in mind before getting into this thing, or getting into it too big… (well, even BRK went down 50%!)

Oh yeah, and in the slides, BAM says that they are globally diversified (and by asset class) so they have more opportunities. If the U.S. is fully priced, they can go elsewhere. I think they said emerging markets and Europe is where opportunities are now. There is always some place having trouble, and that's where they will go to find assets.

This is very different from those guys that focus only on NYC commercial real estate, for example…

I am still thinking about BAM as an investment. I have been a fan of theirs (and BIP) for 5 or so years now. To loosen up language a bit, I would say BAM is playing the same game as a lot of sponsors of MLPs out there, except MLPs are overwhelmingly tied to the oil and gas sector (and hence the selloff in crude and related capex decisions). BAM on the other hand is largely focused on global real estate, but also has its hands in renewable energy and general infrastructure investments.

While I am quite unhappy with market valuation, sluggish growth, negative real interest rates, etc. it has occurred to me that BAM may flourish in exactly this sort of environment — which has already persisted much longer than I thought or what any of the market forecasts have indicated. It would seem to fit in nicely from a risk / reward perspective with my current "i don't like the market or the economy" portfolio.

One other thought: while I do like management and its track record, the scale of the projects they are undertaking is quite large. Execution risk does remain an issue.

Hi kk,

How do you think about valuation? Is the fair value about $29 as you cited, or perhaps you think it's still not expensive considering other factors?

Thanks for your thoughts.

Hi, I think it's pretty straight forward; balance sheet value plus gp value. But the question is what you think the gp is worth. Is it worth 20x? 15x? I don't think it's particularly overvalued or undervalued. But if they grow as they say, it can perform pretty well….

Nice article. I have never really looked in depth into BAM but I know it can be quite a controversial stock. For example I know a few ppl that view their financials with suspicion. http://sirf-online.org/2013/03/11/paper-world-of-brookfield-asset-management/ and not everyone is in love with their CEO.

Asset Management companies are a great business and the same case for GP earnings can be made for BX, KKR and other, FYI.

On the ground BAM has been a shrewd buyer and seller of assets so I have to give them that but I currently have no idea about the stock. I do know that if they simplify the B/S and continue to focus on being a pure play AM, their multiple and stock will probably do very well.

Thanks for the Lou Simpson tip

Yeah, I read all the sirf stuff and I didn't see anything. It seemed like they were reaching a little bit to make a bear case, but it didn't really seem like there were any problems. You can take anything and present them in a positive or negative way. I think one of the arguments was that BAM is a pyramid, like the trusts in the 1920's, but that, to me, is way, way off.

And yes, BX and KKR and others have the same sort of economics as BAM. BX is the gold standard in this area and I have always wanted to make a post about BX here, but never got around to it. APO is also pretty interesting; I may make a post about them soon.

abee, what's the criticism on the CEO?

Abee –

I thought the paper you linked to was an interesting counterweight. But it was written in early 2013 and mostly seemed to cover the 2010 to 2012 period. Based on more recent history, I am having trouble buying some of the financing based arguments. But I do agree that the complex structure makes BAM much more difficult for amateurs like me to get a handle on.

What do you think of Glenn Greenberg opening up a big stake in BAM?

It is interesting.

What do you make of these new allegations?

http://www.valuewalk.com/2015/11/brookfield-asset-management-sec/

I don't know that there is anything new there, and the comparison to Enron is a stretch. There can be investigations for all sorts of things, and often nothing much comes from them so I wouldn't worry too much about each little investigation here and there.

As for the black-boxness of BAM, I'm not sure about that either. It's true that it's hard to come up with a value for the assets, but I think you pretty much know what the assets are. Berkshire Hathaway is a black box too as there is no way to really analyze the various parts of it, not to mention the insurance reserves. But we depend on the conservativeness of BRK and how they have performed in the past to reassure ourselves that the reserves are sufficient.

JPM, a favorite of mine for a while, is a big, black box too. No way to evaluate the trillions in derivatives positions etc… But here too, you have to depend on the history of the management, culture etc… How have they done over time? And JPM has done really well in a real-life stress test in 2008-2009, and came out really well.

So even if things are black boxes, there are ways to evaluate them.

As for BAM, I don't know it as well as, say, BRK or JPM, but I lean towards trusting that management than not.

https://bam.brookfield.com/en/events-and-presentations

I read your article quite often and now compared the graphs you referred to above wit hnew numbers. That's impressive:

– Fee related earnings in 2019 are expected at around 1.150mn dollar as of june 2016 (above: 875mn dollar)

– fee bearing capital: Was expected to be below 100bn dollar as of today – stands at 108bn dollar

And so on. And the price seems quite cheap – cheaper than when you wrote the article. In comic language: BAM!

Would be quite interesting to read, what you think about the progress of BAM, Brooklyninvestor.

Hi,

I haven't followed too closely but I think BAM is great. My only reservation is where we are cyclically in the area. I think a lot of capital was driven into infrastructure/real estate looking for income due to the extremely low interest rates. So for me it's just been an issue of worrying about too much capital going into a certain area.

Having said that, if anyone is going to do well in the area, BAM is certainly a great candidate to put up great numbers going forward whatever the environment (meaning, if things turn bad, they will probably do better than others).

Just watched the speech "evolution of a value investor" from Tom Gayner once again, while I am in the middle of analysing BAM in these days (your analysis being very insight- and helpful, thanks!".

So I focussed on the "4 lenses" of Gayners investment process. (1. High Returns on Capital, 2. management with integrity and talent/ability, 3. reinvestment opportunities, 4. valuation). Focussing these lenses on BAM, you seem being positive on the points 2 and I guess 4, as the price has stayed constant, while FFOs have been rising.)

If I got you right, than it is the reinvestment opportunities and the returns on capital – but the latter only for the next years – that leave questions, as the market seems being "too perfect" and it might or should deteriorate (.. your graph with the "cap rate spreads" above). And that – as for you I guess – left me with a stomach rumble. These points seem to be the key.

Starting with lens 3 (which is the most important, following Gayner), it isn't that hard to me, getting to a conclusion. Flatt is a proven value investor and he is willing and able to recognize, what's best for the cash inflows – paying out dividends, buying back stock, investing into new real assets etc. You haven't written that much about that above – but still I guess, you'd agree.

Reading your article here again and looking at the cap spreads it hit me, that even the problems with narrowing spreads in any case would only be a temporary problem. BAM has a proven record for a much longer timeframe and to me it doesn't seem, as if the change in spreads have had a meaningful impact on the overall picture over the last decades. It was just growing and compounding. If that's true (and I am not completely certain – it's just thinking loud about a thesis), that would let look BAM like having a worst case scenario of underperformance (deducted from your arguments above) in results only for some years. It wouldn't change the longterm outlook for real assets in general and for BAM regarding the 4-lens-test in particular. So looking at BAM from this standpoint, BAM would pass the most important lens number 3 of its 4-filter-test. Putting it the other way around: A bad outlook for a security for some years combined with a cheap valuation should be seen as an opportunity. Or do you think the outlook will be bad for decades to come?

Thinking about why BAM has outperformed over decades regardless of spreads between bonds and real assets I guess that is for several reasons (repeating some points from above and adding new ones):

– Flatt is a value investor with a worldwide focus. Thus spreads in the US might shrink; but maybe at the same time in Greece, Africa, Brasil od India those might widen? Why should BAM loose it's ability to find assets with bigger returns, while it's growing and widening it's focus? The growth of inflows should – if anything – lead to presences in further countries, thus this moat of opportinities would widen.

– Thinking about cap rates alone, falling cap rates might not only have a negative impact. BAM positions part of its equity alongside with investors investments into real assets. Thus if the cap rates go down, the value of BAMs equity tied to real assets goes up and so does carried interst; so if the spread narrows only because of falling real asset rates, that would push earnings for some time.

My conclusion is BAM is both able and integer. they have a great culture. They have been able giving high returns on capital and even if that wouldn't work for some years, I see no reason in your arguments above, why this should ultimately end.

Would be interested to read, what you think about my thoughts, as I appreciate your thoughts and experience a lot.

As I just posted to a comment above yours, I like BAM a lot, and I like the management etc. There are no problems as far as I'm concerned. My only issue is that it feels like the extremely low interest rates pushed a lot of capital into their area. Cap rates following interest rates makes sense so it's not really a problem; that's natural.

But if feels like a lot of institutional capital has run into infrastructure/real estate in a chase for yields. Of course this is also true to some extent with the stock market, but the stock market is usually considered much higher risk so is not a substitute for fixed income investments whereas infrastructure/real estate sort of is (due to the stable cash flows).

And I just feel like the magnitude of it is so big that I worry about what happens when interest rates normalize. There is plenty of cushion, I think, as there is in the stock market for interest rates to go up without it being too damaging to asset prices.

But for me, it's just a vague feeling.

Plus, I have never really been a big fan of real estate / infrastructure in general. But if I wanted exposure in those areas, I would definitely consider BAM.

Sorry for not being very helpful…

Just watched the speech "evolution of a value investor" from Tom Gayner once again, while I am in the middle of analysing BAM in these days (your analysis being very insight- and helpful, thanks!".

best asset management companies in mn Minnetonka

Asset management advisors help companies manage their assets in a variety of ways. They provide useful information regarding how assets must be managed properly and are also responsible for organizing these assets into easily accessed and easy to use formats which makes for convenience in the part of their clients. nam group