I haven’t posted much about JPM recently as it’s still basically the same story. Great CEO building an awesome company performing really well etc. After even a couple of posts, they are basically the same.

But since I haven’t been too active here recently, I figured why not? Let’s take a look at this. There is a lot to learn here, not just about banking and the economy, but about markets and investing too.

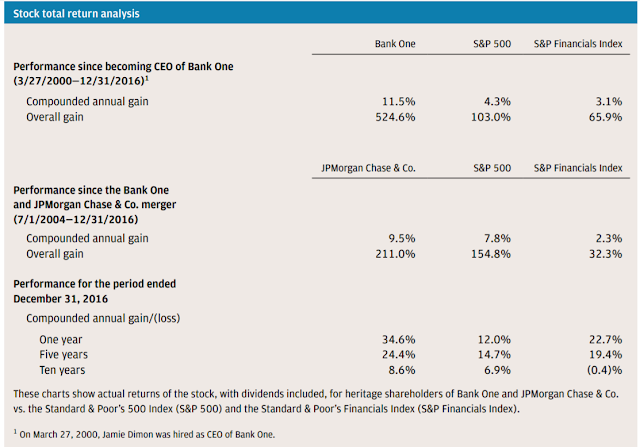

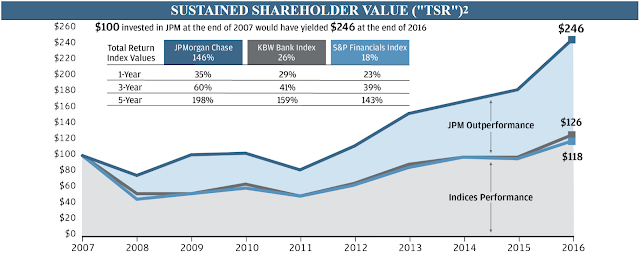

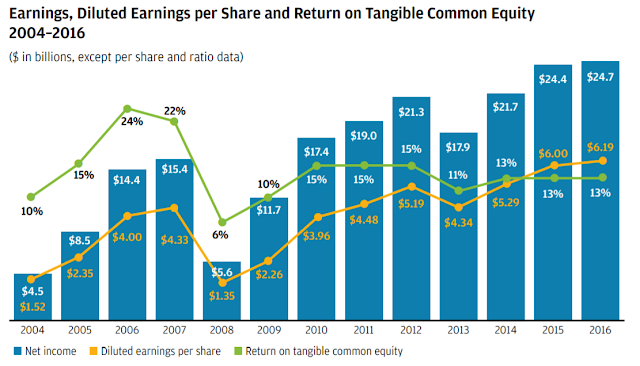

So first of all, let’s look at how well JPM has done in recent years. And it’s not just because of the huge bull market since 2008. If you look at the performance figures below, they go back to 2004, and the performance chart in the proxy is from 2007, which is the benchmark I use to get ‘through-the-cycle’ returns.

Anyway, Dimon’s Letter to Shareholders is really good so go read it if you haven’t done so already. I sort of look forward to this one even more than Buffett’s lately.

Check out the total return of JPM stock over various time periods:

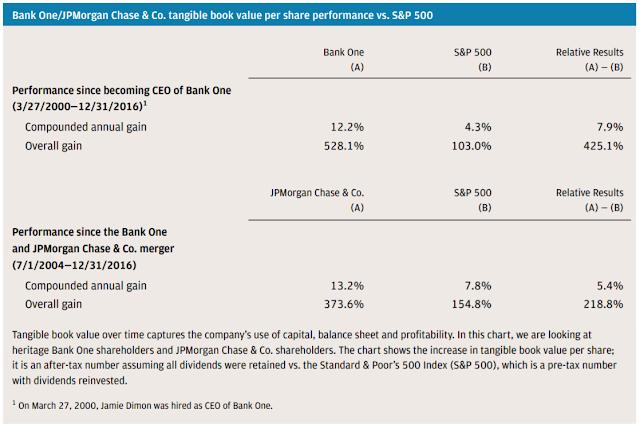

This is just totally insane. TBPS has increased even more than the stock (total return).

Here’s a chart from the proxy that is indexed to 2007:

Investment Lessons

And here’s sort of the lesson on investing. It was widely known that Dimon was a super-competent manager when he took over Bank One. I think he was already considered at the time one of the best managers in finance. When he left Citigroup, many thought C would collapse because Dimon was the detail guy that made sure everything was OK. Sandy was a big picture guy while Dimon chased after the details. No Dimon == noone looking at the details => eventual blowup. (I heard this from someone that was there at the time and watched how they worked up close too.)

But a lot of people didn’t invest in JPM because it was a large money-center bank and banking cycles tended to be severe. Everyone remembers the banking crisis of the 1970’s and the late 80’s/early 90’s.

So the thought was ‘thanks, but no thanks’. I confess I was one of those. I’ve owned Bank One since forever and JPM too, but never allowed it to become a huge position because of that. (On the other hand, I would not mind being 100% in Berkshire Hathaway, even though BRK has gone down 50% on a number of occasions).

In 2007, bank stocks were expensive and we were at the tail end of a very long credit cycle. Contrary to the claims of some best-selling books, the leverage built upon shrinking credit spreads was pretty well-known within the industry. It would have been wise to not be too exposed to financials at this point.

But, when you own a great business run by great people, it is often better off to ride out the cycles than to try to time them. And that’s another lesson here with JPM stock. This is not really hindsight trading either, as I would have told you back in 2007 (and I think I did even though this blog was not in existence back then) that JPM and GS would be the survivors in any crisis, and they would come out the other end bigger and stronger (as Charlie Munger says about how great companies grow; they grow in bad times, just like Rockefeller, Carnegie and everyone else did).

The argument back in 2007 really focused a lot on the notional derivatives outstanding at JPM. This was one of the major red flags that kept some investors away. I have managed derivatives before so understood that notional amounts outstanding is not a measure of risk. When you are a big banker and dealer, you end up with huge amounts of notionals outstanding because, for example, if you issue bonds for an issuer, you sometimes do interest rate swaps to accommodate the client’s cash flow needs. Same with FX. As a major FX dealer, you often use swaps as a tool to help risk-manage clients’ risk exposure. Those ‘straight’ swaps often have very little risk.

Cyclical or Secular?

The other lesson is that markets have cycles. After the financial crisis and after JPM has shown its resilience and management competence, it traded cheaply for a long time. Even the most prominent bank analysts would say things like, “Yes, it’s cheap, but there is no reason to own it as regulations make it hard for them to make money…”. I’ve heard that argument over and over again post-crisis.

But these folks held a linear, static model in their heads. They didn’t realize, or underestimated how the industry would adjust to new regulations and requirements. If the regulatory capital burden got too heavy in a line of business, they would drop it. They can cut expenses. They can reprice products as new regulations apply across the industry. Sure, they may not get back to bubble-era returns, but banks don’t need to to be good investments.

Maybe this was due to the short-term nature of Wall Street; with regulatory headwinds and low interest rates, bank stocks were simply not recommendable.

Either way, long term value investors look to invest in great businesses at reasonable (or cheap if available) prices.

And interestingly, now, hedge funds and others seem to be piling into banks. Nobody wanted JPM at $20 or even $40, and now they are piling in at over $80! And people say the market is efficient, picked over etc.?

I think all of this sort of just illustrates the cyclical nature of markets. The key in successful investing is being able to see the difference between cyclical and secular. It’s true that this is very hard a lot of the time. But I never thought banking itself was in secular decline. Every year, Dimon has shown how much business needed to be done over the long term in banking.

Regulations tend to be cyclical too as the pendulum can swing wildly from one extreme to the other. We are now seeing the pendulum start to swing back the other way. As Dimon says, a lot of this can be done (simplify regulations) without congressional action.

By the way, I have a lot to say about this, maybe in future posts, but I do believe that this max exodus out of hedge funds too is cyclical, as is the move towards machines (vs. people) / indexing. I do believe that most hedge funds probably don’t deserve to exist, and machines will more and more take over money management, but I think it will still be very cyclical. We have seen this before in the past; move to quantitative money management, indexing vs. active, hedge funds vs. index etc…

Buffett and WFC

And this sort of thing explains why Buffett has been buying WFC for all these years, even right before the crisis. I always heard comments like, “doesn’t Buffett see this big trouble brewing? This huge storm? Doesn’t he understand that the era of big banks is over?”. He has been buying before, during and after the crisis at ‘high’ prices.

He focuses on what a business can earn on a normalized basis over time, so he doesn’t care about the short term outlook. He doesn’t care about what other people say. He doesn’t worry about downturns as strong institutions should be managed to survive and grow in such situations. Trading in and out to avoid such dips is a loser’s game.

2x Tangible Book

Dimon says it was a no-brainer to buy back stock at 1x tangible book, but says this year that it still makes sense to buy back stock at 2x TBPS. That would be over $100/share!

But of course, stocks never trade at what they are supposed to trade at. Which leads to my next digression.

Models and Odds: Ed Thorp Book

I was actually going to make this a whole separate post; maybe I still will. But writing the above got me back to thinking about models, odds and things like that.

This goes back to the argument about stocks being expensive or not, wondering about being short because the market is overpriced and losing money for years on end etc.

I just finished this book by Ed Thorp: A Man for All Markets

And I have to say it’s one of the best books I’ve read in a long time. It’s not a manual like Securities Analysis or the Greenblatt books, but an autobiography. But it is a fascinating read. Some may be disappointed by the lack of mathematical details, but this is not meant to be that sort of book. In any case, the math involved in what he talks about is widely available now anyway. But the thinking that went behind figuring all this out is fascinating.

Other than his adventures in Las Vegas, I’ve been involved in just about every area he talks about in the book, from options, warrants, convertible bonds, closed-end funds, even the Palm stub trade, statistical arbitrage etc. (One thing he fails to mention about the Palm trade is that even though it looks like the market is inefficient, in some cases, there is no stock to borrow to implement the trade; rebates go through the roof and reduces or takes away potential profit etc… The stock lending side is often not as visible).

For Buffett fans, there is a whole chapter on Warren Buffett, which is fun to read. They knew each other and Buffett even checked him out over dinner long ago. Thorp also invested in Berkshire Hathaway but moved his money elsewhere as returns went down as BRK got larger.

One interesting fact that Thorp mentions is that the Buffett partnership returned 29.5%/year, gross, in the 12 years from 1956-1968 versus 19%/year for small caps stocks and 10% for large caps. I knew Buffett made his money buying small/microcaps back then, but it was surprising that a good half of the outperformance came from the small cap bias. Maybe I should not have been surprised. But anyway, I did take note of that as I read the book.

OK. Back to models. Early in my career, I spent a lot of time creating models; economic models, stock market valuation models, statistical models, single stock valuation models, technical trading systems, mean-reversion trading models (early stat-arb) etc…

And what struck me while reading the Thorp book was the difference between the typical economist who creates models and the traders that write models.

Economists plug in all these numbers and tell you that the economy should do this or that, and that the market should be valued here or there. And sometimes, they get all caught up in their models and think they are absolutely right and get their head handed to them. I’ve seen this happen time and again. One benefit of working at a large firm was that I sat through many presentations (people pitching big banks to fund their proprietary trading models/ideas). And a lot of the ideas lacked real world common sense.

And then you read what Thorp did. For example, he created the option model before or at the same time as Black-Scholes etc. This model told you what an option or warrant was theoretically worth. But the model would have been useless if there wasn’t a way to capture the price difference. You can hedge the option by trading the stock and capture any mispricing.

All of the strategies that Thorp was involved in had very specific odds attached to them, including the possibility of adverse outcomes. What are the odds of this or that? What happens when you are on an expected, normal losing streak? You have to have enough capital to be able to stay in the game. Traders’ models usually have a “what if this happens, or what if that happens? what are the odds of this or that happening?”. Economist models are like, “This is what will happen and all the back-testing proves it will happen… we have calculated to the seventh decimal places using 30 models and they all confirm we are right”. If you ask them, but what if reality deviates from the model? They say, “it won’t because we are right”.

Even some investors I respect had a huge hedge on their equity book that lost them tons of money. It made sense on the surface; stocks are expensive so we must hedge our equity exposure. The problem is that, as I have shown in previous posts, overvaluation is a very poor reason to go short the market or put on hedges (well, it might make sense to do some hedging).

I’ve seen the bubble in Japan in 1989 and the U.S. bubble in 1999 and I would guess that most people who correctly identified those as bubbles didn’t make money when the markets collapsed. It was stunning how many funds were hurt during the late stages of the bubble and weren’t around to capitalize when they were proven correct.

The problem with overvalued markets is that the odds of a blow-off are pretty high, and when things blow off, the more expensive things are, the higher they go. So, if you own a bunch of value stocks and hedge using the S&P 500 index or some other market cap-weighted index, you will probably be destroyed as the expensive large caps will go up the most. (This reminds me of something I did long ago; I owned some value stocks that went up 20-30% so was proud of myself, but was short Starbucks against it and that doubled… Oops. So much for hedging a value portfolio with a growth/mo-mo stock).

There was an interesting article recently that said that a bubble isn’t a bubble unless the market has gone up 100% over a period of two or three years or something like that.

This is why people like Thorp would not make directional bets on the market. One can easily observe that markets are expensive, but what is the edge that that specific observation brings to you? I remember Buffett telling someone, when shown a chart of how overvalued the stock market is, that it’s just a squiggly line and it can go this way or that way, who knows which way it would go? That seemingly ‘clueless’ response is much wiser than it seems on the surface.

If you hedge using market-cap weighted indices or go net short, can you survive a real bubble-like blow-off? What are the odds of such an event occuring? Is it really zero? I bet that this is not even incorporated in most models or the thinking of most investors. Of course, most of the quant funds would have this worked out (or hedged out); quants don’t like to take risks that they can’t hedge.

On the other hand, if you are a long manager, do you need to care about the odds of a correction? No, because if you own solid stocks that won’t go bust (like owning JPM from 2007-2016), then corrections don’t really matter. You just ride it out. The only way the market can break you is if the companies you own actually go out of business. Otherwise, you may just have to wait longer to realize value. But otherwise, there is not that much risk. This is not true when you are short, of course; it is much easier and probability of survival higher for a long to live through a bear market than the other way around.

Cheap Labor

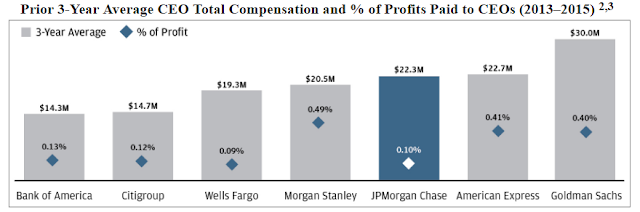

Back to JPM. The great thing about JPM is that we get all of this for so cheap. OK, ‘cheap’ may be offensive to average folks out there earning normal salaries. So I shouldn’t say that too much. But still, cheap is cheap. We paid Dimon 0.1% of profits. Compare that to other financials! (from the proxy). Let’s not get into hedge fund fees here.

…also from the proxy:

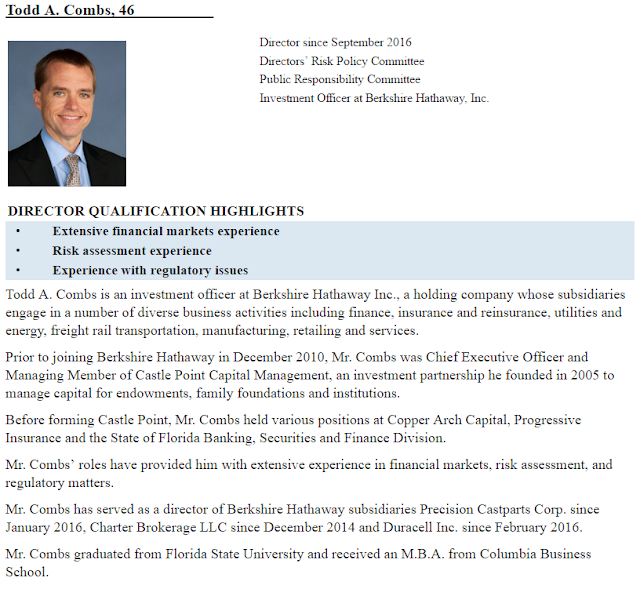

And for the Berk-heads here, a familiar new face on the board:

OK, this is getting way too long. There is a lot more in Dimon’s Letter to Shareholders so go read it. I may post more about it later (but maybe not), but let me just get this post out before more time goes by without a post!

Thanks for the update. What do you make of the comments below by Dick Bove?

http://www.cnbc.com/2017/04/07/dick-bove-rising-interest-rates-are-not-bullish-for-bank-stocks.html

I don't know, he may be right. He tends to make big calls all the time but usually not more right or wrong than anyone else. As for bond portfolios causing banks to lose money, I think JPM, at least, has structured their portfolio to benefit from rising rates so I don't think lower bond prices would cause them losses. That is probably more true for the insurance industry.

I would not worry about short term calls by analysts however famous they are.

But yes, bank stocks have come up a lot and are not as cheap as they were so they can easily correct. As for Trumps plans, not much has to get done to be good for business; even just a pro-business vibe in DC is good for the economy, I think.

Any comments on AIG?

No comment on AIG. Interesting as it is cheap etc… but will they ever get back to the great institution they once were? Who knows…

With the hedging discussion, I feel like you are talking about Fairfax?

Plus, the best part of JPM annual report, a new BI post!

Yes. Larry Tisch did the same thing a long time ago at Loews; had a big short S&P position and a huge loss etc… I like Buffett/Graham's hedging mechanism more: margin of safety.

Thanks for the new post.

I Used to be more active and have learned a lot from your blog which helped me make a decent amount of money the last few years. However, I'm starting to be more passive and would like to go towards a set it and forget it method as i have been more busy. In your post you mention again that you dont mind putting 100% of your money into Brkshire. If you were an avg investor not looking for individual stocks anymore(Me), would you dump it into S&P500 like buffet? or would you really dump all your money into Brkshire? I would really appreciate your view on this.

Sorry for the late response. Hmmm… that's a really good question. I would lean towards BRK, just because they are run so rationally which is not always the case with the S&P 500. You would have to have faith in a post-Buffett BRK, though, and be willing to sit through some of that volatility. I would think they would keep outperforming the S&P over time, even though the spread might not be that big going forward.

Good post. It doesn't look like the stock outperformed the S&P index by that much until the gains from the past few months when only looking at the stock price, but I guess the dividends make a big difference with the total return.

With the hedging discussion, I feel like you are talking about Fairfax?

Plus, the best part of JPM annual report, a new BI post!

thanks!

would you dump it into S&P500 like buffet?

Edward Gelber, M.D., Board-Certified Psychiatrist in Brooklyn … Click on Edward Gelber

Apply for Chase Credit Card, Chase Credit & Debit Card Verification, Chase Card Login

and Chase Card Activation Process and Chase Card

Chase Bank Customer Service Number.