Things seem to be pretty fully priced. When I first started this blog back in 2011, banks / financials were cheap, analysts were bearish, the public hated banks (well, they still do) and Occupy Wall Street was in full force. That was one of the reasons I started the blog in the first place, to say that not all banks are evil, and no, banks aren’t dead etc.

Market

I still feel the same about the market as I’ve been saying for the last couple of years. I am not really bullish or bearish, but I have no problem with valuations and don’t really see a bubble, except in certain areas.

Yeah, it was scary when the market was down more than 1,000 points earlier this year. But I was not really all that worried. If this is a bubble and a top, it’s one of the most timid bubbles of all time. At least that’s what I think. Most bears talk about how much the stock market has rallied since the low, and I think that is nonsense.

If a stock goes from $100 to $50, and then back up to $100, is it really overbought? It might be. But not necessarily. If you look at previous bubbles, markets appreciated a LOT from the previous high. In this case, we are not that far above the 2007 peak.

Anyway, that’s my view. I know many don’t agree, but who cares, really.

Also, people seem to be freaking out that interest rates are rising. But all my bubble posts used 4% as the ‘normalized’ long term interest rate, and the market is not expensive, in my mind, even with interest rates at 4%, let alone 3%. So that, to me, is not yet a big concern. Of course, interest rates can overshoot due to higher than expected cyclical inflation. But that doesn’t really concern me all that much. Sure, the market will tank on each interest rate uptick, but since the rubber band is not that stretched (in terms of the relationship between P/E and interest rates), there is no need for the market to go down all that much.

Buffett also keeps saying that stock market valuations are driven by interest rates. Critics say comparing earnings yield to bond yields is wrong as it compares ‘real’ versus ‘nominal’; bond yields don’t adjust to inflation but earnings yields do (over time as earnings will increase with inflation).

This is true, but if you make that argument, then maybe earnings yields have to be compared to the TIPs bond yields, which is ‘real’.

10-year TIPs yields around 0.9% these days, so to compare real-versus-real, the stock market should be trading at 111x earnings. But don’t forget, company earnings grow with the economy over time and not just with inflation, so stocks still have a 2% or so advantage over TIPs even at 111x P/E.

But of course, this is all just theoretical mumbo-jumbo. I wouldn’t tell anyone with a straight face that the market should be trading at 100x P/E. I wouldn’t pay that either, and if the S&P 500 index was trading that high, even I (the avid non-market-timer) would be long a boatload of puts!

Moving on…

Buffett

I watched the annual meeting and his long interview on CNBC and it was great as usual. But honestly, I don’t remember the last time a question was asked and the answer wasn’t something I would have guessed. The letter to shareholders too was the usual, and like others, I was surprised at how short it was. He is getting old so regardless of what he says, he is probably slowing down a little.

What might happen, and might be really cool, is if others contributed to the letter. Maybe Todd/Ted/Ajit /Greg can contribute a section in some way. That would be interesting, and would be a nice transitional thing to do.

Privacy/Facebook:

The latest thing in the press is about Facebook and privacy. One thing I don’t understand is that when we joined Facebook, we sort of all assumed we will have no privacy there. That’s why I don’t have my real birthday there, no credit card information nor my social security number. I remember upsetting some people when I didn’t put my real photo on the profile page. Well, my fear was that not too far in the future, people would be walking around with something like Google Glass, and they will know immediately who I am because of the facial recognition app that will no doubt be installed on it. The glasses will automatically see my face and do a search, find my image and profile (either from Facebook, Google+, LinkedIn or wherever.

If you are tagged even once on a public photo, the engine will be able to identify you anyway, even if your profile photos show a picture of Dexter Morgan. Once they know your name, the app will search through Linkedin, find out what you do and then maybe scan Glassdoor to estimate what you make etc… All of this will show up on the glasses, and will do so for anyone that is looked at. Creepy stuff. But that day is inevitable, I think. One day the IRS will get hacked; you will be sitting in the subway with your hi-tech glasses and look around and you will see the tax returns of every face you focus on. This is certain to happen, eventually. I have no doubt about that. This is the sort of thing that scares me. (but then again, I have nothing to hide, so I don’t really care. It’s just creepy)

But anyway, I was kind of surprised at all this outrage about FB; what did people expect? You fill out a questionnaire or do those silly trivia games and are shocked that someone is using that data?!

Actually, it seems like it is not affecting too many people, so maybe it’s just the press going crazy over it and making more of a big deal out of it than your average FB user.

I still think mobile phone companies and credit card companies know far more about you than FB; those guys know where you are, what you spend money on going back decades etc. Creepy. But that’s been true for a long time.

JPM

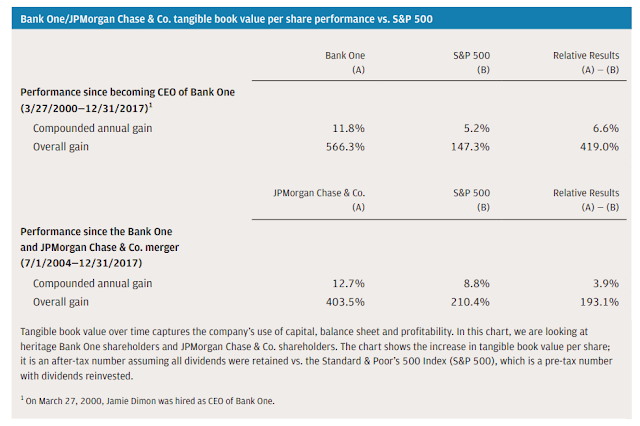

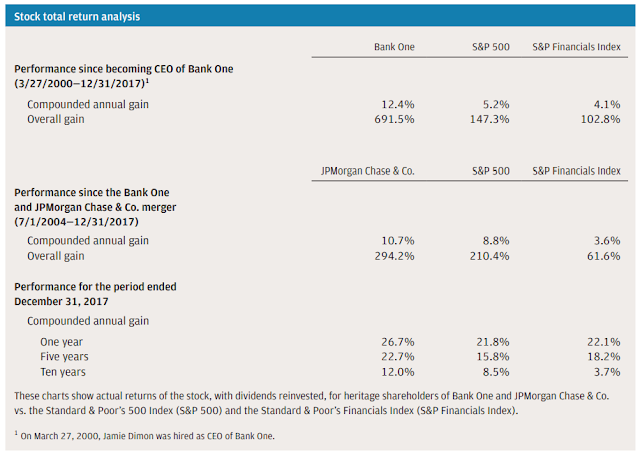

Anyway, as usual, the JP Morgan annual letter is a great read. No need to elaborate much on it, but as usual I love the charts they put in it and in the proxy. These are charts I’ve been following for years, even before they started to put them regularly in the reports.

Conference call

By the way, I usually listen to the JPM conference calls every quarter. There is a lot to learn from them, and when Dimon is on, he is usually pretty blunt, so fun (and educational) to listen to.

But one thing that I wonder about is the format. When you listen to some of the high-tech conference calls, what’s cool is that some of them totally drop the summary and go right to Q&A. Do we really need someone to read off the highlights from each slide? I would rather that be cut and have a longer Q&A session, or have topics not covered in the slides. It seems kind of silly that someone just reads off something we all have already.

Amazon’s meeting protocol is interesting. I think they spend 20 or 30 minutes reading the material (at the meeting) before they start discussing stuff. Obviously, there would be no need to have a conference call and be silent for the first 30 minutes… Maybe just release the documents 30 minutes sooner or whatever (I know they release it before the call, but just increase the time in between, maybe). Give people time to go over it so on the conference call, they can just focus on the Q&A, and maybe a short comment just highlighting important things.

But I don’t know. Maybe the analyst community likes it that way as they have to sit through a bunch of these during earnings season and they like that slow time in the beginning so they can flip through the slides etc. But for others, it’s a tedious section to sit through…

Bitcoin

I haven’t changed my mind about bitcoin at all, and no, I haven’t gone out and secretly bought some “just in case”. Nope. Didn’t do that and don’t plan to. I continue to side with Buffett on this. And he had a good point in the interview/annual meeting: these things with no intrinsic value and where people can only make money if more people come into; people get angry when you speak out against it as they need people to come in for the price to go up.

I remember the anger and emotion when people spoke against gold too. But you never really see value investors get upset when bears talk down value stocks.

Hedge Funds

What’s up with these big hedge funds? I don’t know. I am a fan of the big hedge funds, generally, but many have been doing horribly in recent years. I am especially shocked how bad Einhorn is doing, as he seems to be making the same mistake that the big funds made back in the 1997-2000 rally. If you remember, guys like Julian Robertson and Stanley Druckenmiller had trouble back then, as shorting expensive stocks and buying value didn’t work for a few years back then. One would think people wouldn’t repeat that mistake, and yet, Einhorn is short a bubble basket.

Anyway, his analysis is probably right, and those stocks will probably go down or be valued more realistically at some point. But the problem is you could have argued that with Amazon and Netflix for years. Who is to say it has to ‘normalize’ within the next twelve months? And if it doesn’t, the stocks can be up another 30%, 50%, or 100%. If the market is ignoring fundamental valuation, that just means something trading at 100x P/E can just as easily go to 200x P/E. Why would you want to get in front of that!? I don’t know. But these guys are way smarter and richer than me, so who am I to say.

Average Holding Period of Stocks

People often talk about the average holding period of stocks, and how that has been shortened dramatically. I tend to think that analysis is flawed, as many of those figures use trading volume as one of the factors. Well, with all that HFT trading going on where portfolios can turn over 100% in minutes, that sort of skews the data. Just because a bunch of quants start trading with average holding periods in micro-seconds, that doesn’t really affect the rest of us who still like to own stocks for 5, 10 or 20 years.

But anyway, not a big deal.

Ian Cumming/Leucadia

I realized way after the fact that Ian Cumming passed away earlier this year. I don’t go to many annual meetings, but I will never forget the last LUK annual meeting with Cumming/Steinberg. I wrote about it here.

Not long after that, Leucadia changed it’s name to Jefferies Financial Group and ticker symbol back to JEF. Oh well. I guess that reflects the reality that LUK is not really LUK anymore (and wasn’t after the merger).

JPM

OK, so most of these are self-explanatory but let’s look at some of the charts from the JPM 2017 annual report.

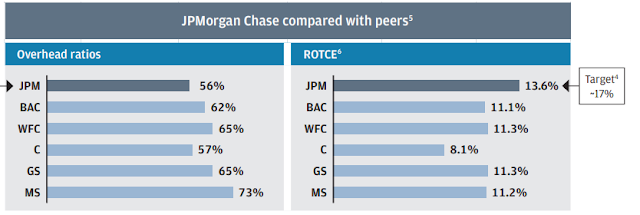

JPM is doing well against comps in terms of cost and return on tangible book.

Classic Dimon; snip from annual report:

I was recently at a senior leadership offsite

meeting talking about bureaucracy. We

heard bureaucracy described as “a necessary

outcome of complex businesses operating

in complex international and regulatory

environments.” This is hogwash. Bureaucracy

is a disease. Bureaucracy drives out

good people, slows down decision making,

kills innovation and is often the petri dish of

bad politics. Large organizations, in fact all

organizations, should be thought of as always

slowing down and getting more bureaucratic.

Therefore, leaders must continually drive

for speed and accuracy to eliminate waste

and kill bureaucracy. When you get in great

shape, you don’t stop exercising.

Meetings. Internal meetings can be a giant

waste of time and money. I am a vocal proponent

of having fewer of them. If a meeting

is absolutely necessary, the organizer needs

to have a well-planned, focused agenda with

pre-read materials sent in advance. The

right people have to be in the room, and

follow-up actions must be well-documented.

Just as important, each meeting should

only run for as long as it needs to and lead

I love these two quotes. I worked at a large company and it’s so true. People tend to spend more time building and defending bureaucracies than building businesses at big places. Dimon talks about having war rooms to tackle urgent issues. Part of why that’s so great is because the teams are put together for specific projects, and are presumably disbanded after the task is done.

The problem with big companies, oftentimes, is that a section or group is set up to deal with certain issues, but when those ‘issues’ are resolved or are no longer issues, the group or department, have to invent other reasons to keep existing. Or sometimes they don’t even have to do that; the department survives with underemployed people doing nothing all day long (I have seen this). They can’t shut down these divisions because there is no place for the managers to go, and they can’t be demoted. With ever expanding companies, this is an issue as you have to sort of create more and more of these divisions that worthy employees can be promoted into.

There probably shouldn’t even be departments/divisions at all. Teams should just exist temporarily for specific tasks and that’s it. Once you create a department, it just creates incentive for the head of that department to get bigger, and of course, they will resist change when the environment changes. So ban divisions!

But of course, that’s easier said than done. I am not a manager, so it’s easy for me to say!

Moving on…

From Proxy:

|

The Firm has demonstrated sustained, strong financial performance

|

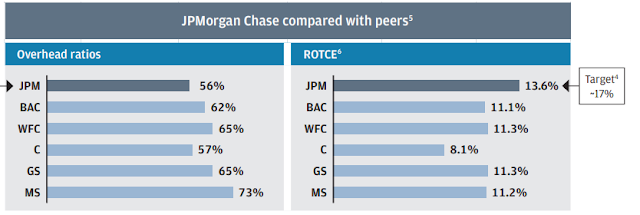

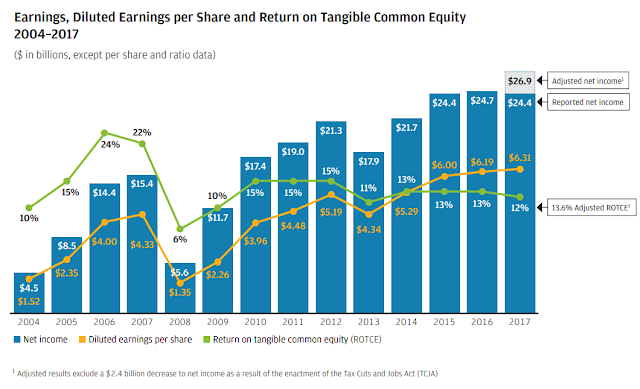

We have generated strong ROTCE over the past 10 years, while more than doubling average tangible common equity (“TCE”) from $80 billion to $185 billion, reflecting a compound annual growth rate of 10% over the period.

|

1

|

ROTCE and TBVPS are each non-GAAP financial measures; for a reconciliation and further explanation, see page 115. On a comparable U.S. GAAP basis, for 2008 through 2017 respectively, return on equity (“ROE”) was 4%, 6%, 10%, 11%, 11%, 9%, 10%, 11%, 10% and 10%, and book value per share (“BVPS”) was $36.15, $39.88, $42.98, $46.52, $51.19, $53.17, $56.98, $60.46, $64.06 and $67.04.

|

|

2

|

Excludes the impact of the enactment of the Tax Cuts and Jobs Act of $2.4 billion (after-tax) and of a legal benefit of $406 million (after-tax). Adjusted net income and adjusted EPS are each non-GAAP financial measures; for further explanation, see page 115.

|

Anyway, there is not much more to say about JPM than to say that they continue to be doing really well. Their performance since 2008 is amazing no matter how you slice it; who would have guessed this performance back in 2008 as the financial market started to melt down?

I know I spent more time talking about random stuff than JPM, but whatever… I just want to get this out now so…

Thanks for sharing. Any updated thoughts on brk? I like your style of writing.

Thanks. No, I no new thoughts on BRK. I think it's a great, solid hold. It will continue to do well, but I think people should be deciding pretty soon whether they will stay with BRK post-Buffett/Munger. I intend to hold on.

I was a little surprised when Buffett said the two T's have only matched the S&P since joining, but I guess that reflects the poor performance of many of the value guys.

No matter how good they were with their own funds, size is going to be an issue. When they take over the big equity portfolio, they will be just as constrained in their choices as Buffett is now, so the equity portfolio isn't going to outperform in a big way, in aggregate.

But it's still going to be a good long as they can contribute, as they have, in other areas.

Oh yeah, and the other thought is that people love Ajit Jain and he is apparently doing more, but part of me says, don't we want him to be really focusing on insurance where he is supposed to be a genius? If we take him away from that to do other things, don't we lose something, somehow? Or is insurance / reinsurance so terrible now that it's a good thing for Ajit to focus on other things? I don't know the answer to that…

Thanks, I think the capital allocation in the next 5-10 yrs whether buybacks or dividends will be a big factor. Lets be realistic, how many 50bn whales are for sale? brk at 1.35x bv sounds like a good whale to me 😉 Also I´ve thought why not just invest T&T portion in something like the index and free them up to be full time deal hunters. But I guess you could argue they find potential deals looking for stocks.

agree with you viewpoint of no bubble forming

Its really true what they say, people fight the last war. Everyone still remembers the great recession and the big short and think another one is coming soon. Every yr since the bottom there have been famous investors in the media calling for a crash.

Someone will be right eventually right but It may be 25 yrs from now! Just saw an article that one of the biggest hedge funds is bearish on almost every asset class. It serves as marketing to keep investors scared so they feel like they need a professional. Amazing after all these yrs and evidence, Buffett´s bet etc people largely still ignore his message. He truly is one of a kind. There may be ones that come along as good for short periods of time but to do it for that long and consistently may be impossible.

Thanks for sharing, have enjoyed reading your posts for years. Always insightful. Was wondering if you had any updated thoughts on MKL considering their moves to grow Ventures over the past 12 months, and if you had ever looked at WR Berkley?

No, MKL continues to hum along nicely. No change in story there. Increasing the number of areas they can invest in is not a bad idea, and they are not the kind of people to go rushing carelessly into stupid things, so I think it's a good thing.

I have looked at WRB off and on, and they look like a really nicely run shop, but I always thought that between BRK and MKL, I had enough insurance exposure. I tend to focus on insurance companies with interesting asset-side strategies, like BRK, MKL, Y etc… (and GLRE, TPRE too).

At current prices, around 1.35x P/B for BRK and 1.65x for MKL, which one do you like more?

Hmm… good question. honestly, I haven't really thought about that too much. But just from the size handicap that BRK has, MKL may have much more headroom for growth, so maybe MKL?

Any thoughts on E-L Financial (ELF.TO)? It's a tiny Canadian listed holding company that owns Empire Life and a bunch of value stocks (mostly international and some through listed closed end funds (EVT.TO, UNC.TO)). Historical book value has compounded at about 12% since inception (48 years). The company usually trades at a discount to NAV but it's pretty close to the widest it's ever been at 38%. The company also has no website, doesn't split the stock and is 70% controlled by insiders. Insider owned holding companies also slowly accumulate shares of ELF and the publicly traded closed end funds.

I looked at that a while ago, seemed interesting. I forgot why I passed on it, maybe as I don't like life insurance etc. But I don't recall anything toxic or red flags either… maybe I'll take another look. thanks.

On the ROTCE peers chart, Citi looks interesting as a potential turnaround. Probably Citi's price to book is well below JPM's and maybe they have a shot at closing that gap some. Just looking for value ideas.

Yeah, C is interesting. Some value guys like it for that reason, turnaround. However, I would worry a little bit about the culture; very different than JPM. I don't have any insights from the inside these days, but the Salomon culture was really prevalent on the IB side, and that's scary. I know that must have been tempered down a lot since the crisis, but who knows. In good times they can get stupid again. But still, it is certainly an interesting value idea.

Hi KK,

As usual great read. Which companies would you consider Brk like companies? My first thought would be mkl, but I am sure there are others. Also what are your thoughts on some small companies that have the potential / management to become brk like.

Hi KK,

What do you think about how an inversed yield curve can impact JPM, and other major banks? I remember jamie dimon said a while ago that short term interest rates have more influence on the bottom line of JPM.

Also, do you follow insurance brokers such as BRO ad MMC? Or regional banks such as First Republic Bank (I think it is well run but rich valuations).

AWESOME THE PROMOTION OF GIRL BEAUTIFUL SALES KLIK HERE

GOOD PRICE AND CHEAP

http://www.ayamgoreng.net

PLEASE PRICE DIRECTLY

http://gorengayammarketing.webs.com/apps/blog/show/45793177-resep-jamu-untuk-menguatkan-napas-pada-ayam-aduan-bangkok

Speaking of companies compounding their book at a good Clip. Any thoughts on EXOR? What probability can be assigned to the discount closing. Partner RE is doing more with their asset base too.

In this business if you're good, you're right six times out of ten. ypo're never going to be right nine times out of them.

mcx tips

Hi KK,

I have been following your blog for over 5 years now. You have taught me a lot throughout the years and i am always refreshing it to see if you have any new content. Now that the main reason why you started this blog is gone(cheap bank stocks) what direction do you plan for your blog? I really hope you continue to make posts despite your original thesis being met.

One bad chapter doesn't mean your story is over.intraday Stock Tips

This comment has been removed by the author.

Learnt about value investing options strategy at Value Investing Singapore. Any one recommends or support the selling of JPM option pls?

Well *&^% darn! Post was deleted as I published it. shoot.

OK, short version. was at my 11th BRK meeting, WB visibly slowing down, and first time ever lost his train of thought as he answered a question. Still amazing for an 87yo. But time gets us all. Also, Munger used a wheelchair off stage. Ajit looked very unhealthy. Visibly so. I know a couple ppl I see out there every year who interact with him a couple times a year. Still amazing energy and drive. He really runs about 15 hr days during the meeting weekend.

Strongly agree that the questions are typically softballs. #1 question should always be 'what books have you read/liked this year?'. Rarely asked. Not 'what career should I pursue, what are you buying?'

MKL sunday brunch is not to be missed in Omaha. Tom's q&a is fantastic, lots of give and take. Very direct questions, few softballs.

to clarify, the guys I know interact with WB, not Ajit….

Thanks for the color from the ground. They are getting really old for sure. They can't go on forever however much we all wish.

Hey KK. Now would be a very very good time for one of your market updates!!!!!!!! Would love to know your thoughts on where we stand. Thanks.

Hi, yeah, I've been wanting to post something for a while. As for the market, I haven't changed my view at all since my 'bubble' series. Keep in mind that my benchmark, 'normalized' 10 year rate assumption was 4%. I think I said something like, if long term rates average 4% over the next 10 years, the market P/E can average 25x over that time period.

So given that, the market to me, even with the big rise in rates is not in the sort of overvaluation zone that would feed an extended bear market. Yes, the 'E' of the P/E might come down a little as inflation starts to move up (as wages do), but I tend to think this will lead to more pricing power for companies and they will eventually make it back in price hikes.

Anyway, it's kind of crazy what's going on in the world; a lot to write about, but not really all that much new in terms of what to do, I don't think…

Thanks for dropping by.

Thanks!!! Great thoughts. Looking forward to your next post.

I wasn't sure if you had seen the story at Bloomberg about the government limiting JPM's growth. https://www.bloomberg.com/news/articles/2018-10-26/jpmorgan-s-secret-punishment-u-s-halted-its-growth-for-years

No, I haven't seen it. Thanks for pointing it out. Wow. I assume there are all sorts of discussions going on between the banks and the regulators, and even if there is no 'official' ban on certain actions, managements can feel out how regulators would react to various things (larger mergers, for example). So I imagined that they were being held down on various issues (mainly acquisitions), but didn't realize this… but not surprised, actually…

We are providing tips to earn more than your cost. .stock tips

Hello Guys

I just wanted to tell you that I really love this blog and it helped me alot.

I lately began to read books about investing.

My go to favourite is “The Candlestick Trading Bible”.

It’s about Munehisa Homma and the way he made more than 10 billion in today’s dollar trading the Japanese rice market. It’s just amazing and I think you can learn a lot from it.

So if you are interested feel free to check it out https://bit.ly/2k7tu31

Felix