So Buffett finally buys some JPM. He owned a bunch in his PA years ago and said it would be a conflict to own both JPM and WFC within BRK, or some such thing. I guess recent events (WFC scandals) have made him change his mind (as he may be starting to dump WFC). I’ve been a big fan of JPM for years, so naturally, I like this move. I wonder if Jamie Dimon would ever make it onto BRK’s board; he would be a great fit there and would give the board some real, hands-on expertise in the financial industry (there is plenty of talent there, but noone with Dimon’s experience/background).

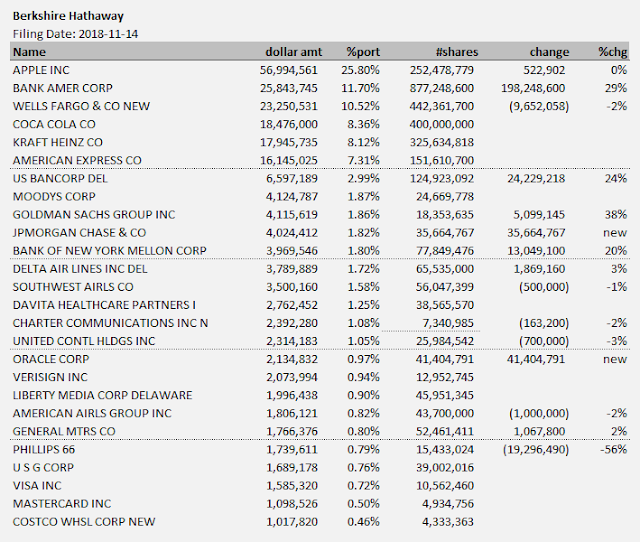

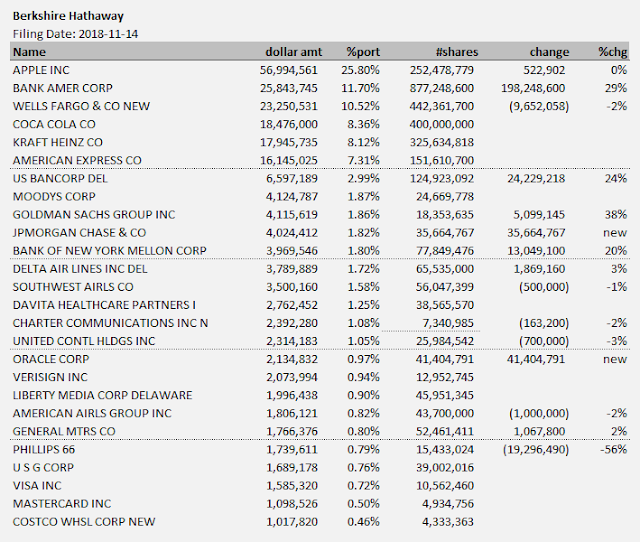

This is the 13-F that was just filed (includes only positions over $1 billion):

Market Cap to GDP

Someone asked in a comment the other day what I thought about the market cap to GDP ratio, Buffett’s once favorite stock market valuation indicator. This, like many other valuations measures, is really dependent on interest rates. If you believe (like I do) that interest rates drive the valuation of assets, then prices are high when rates are low and vice versa. So, of course, if interest rates are low, the market cap to GDP ratio will be high. But that tells us nothing about the valuation of asset prices as it has to be compared to interest rates. Plus, it doesn’t really tell you anything about interest rates either. (A lot of bears like to point to ‘overvalued’ indicators, like this market cap to GDP, P/E, CAPE, EVITDA/EV, Dow-to-Gold ratio etc. But often, it’s all the same thing, so it’s like double counting. They all point to one thing: asset levels are high because interest rates are low. But, people still think of these above factors as separate, discrete pieces of evidence to show the market is overvalued.)

Not to mention, many U.S. companies are growing globally, so their sales and earnings from non-U.S. business will be capitalized in the U.S. stock market while the GDP will not include those new territories. If a U.S. company merges with a European company, the stock market valuation may well increase (while GDP does not). Also, when Yahoo owned Alibaba as Alibaba took off, the U.S. market cap of Yahoo (and therefore the U.S. stock market) increased (with no increase in GDP).

So in that sense, I don’t think it’s a relevant measure of anything these days. I still like to adjust interest rates to what we might think is a normalized rate, and then price assets off of that.

BRK Corporate Governance

Again, from the comment section, someone mentioned an analyst or author that is comparing BRK to fraudulent companies; BRK’s corporate governance standard is comparable to historical frauds (ENR etc.).

Well, I am preaching to the choir here, and maybe I am just an ignorant, blind, cool-aid drinking BRK groupie, but every time I read these comments, I think it’s ridiculous. It just takes a little bit of common sense to figure out the difference between BRK and the big corporate frauds in the past.

First of all, just for fun, I took a quick look at the corporate governance score of BRK on the Yahoo Finance page, and was surprised at the high score: 9 out of 10!

Corporate Governance

Berkshire Hathaway Inc.’s ISS Governance QualityScore as of November 1, 2018 is 9. The pillar scores are Audit: 1; Board: 10; Shareholder Rights: 8; Compensation: 6.

Corporate governance scores courtesy of Institutional Shareholder Services (ISS). Scores indicate decile rank relative to index or region. A decile score of 1 indicates lower governance risk, while a 10 indicates higher governance risk.

Not bad! But then, reading further, I realized that 10 means high risk, lol… Oops. So it is, in fact, the way I thought it would be. Just to be sure, I checked this at the ISS website.

From the ISS website:

THE METHODOLOGY BEHIND THE SCORES

Governance QualityScore uses a numeric, decile-based score that indicates a company’s governance risk relative to their index or region. A score in the 1st decile (QS:1) indicates relatively higher quality governance practices and relatively lower governance risk, and, conversely, a score in the 10th decile (QS:10) indicates relatively higher governance risk. Companies receive an overall QualityScore and a score for each of four categories: Board Structure, Compensation/ Remuneration, Shareholder Rights, and Audit & Risk Oversight.

Microsoft Corporation’s ISS Governance QualityScore as of November 1, 2018 is 1. The pillar scores are Audit: 1; Board: 1; Shareholder Rights: 1; Compensation: 3.

OK, and check this out from the proxy:

My MSFT Experience

After going out on my own, I stuck to Windows, but I got increasingly frustrated at how often Windows would crash/freeze. Some days, I thought I spent more time waiting for things than actually doing any work. And then they killed XP (which I had on some of my old machines).

One thing holding me back was that a lot apps written for Windows is not available in Linux (well, you can still run Windows apps with Wine, but I was a little skeptical/worried that there would be issues if there was another layer). Otherwise, I loved everything about Linux. I use GIMP now all the time for photo processing (like the Buffett photo in my last post), Libre Office is great and is getting better etc. Plus my Linux machines never just randomly go into these long updates.

Also, Windows 10 comes with Ubuntu bash so if you like Linux command line stuff, you can do it all in a bash terminal right on the Windows 10 machine and in those drives/folders that Windows runs on (goodbye cygwin?!).

But OneDrive was so easy and is basically already set up from the get-go in Windows 10. Now my most active folders are on OneDrive, I never have to worry about syncing anything; it’s all done automatically.

I think this is one of the big things that got me tied to Windows now.

Plus, I am playing with Azure now and it is very easy to create Linux instances (basically virtual machines in the cloud) so you can write bots and set them up to run as cron jobs and your tasks will be done whether your PC/laptop is on or not. Plus they have databases and many other cloud services (I use Amazon too, but mostly for fun/experimenting).

So when you think about how all of this is integrated and everything works great with each other, you can see how excited I am about MSFT. A programmer relative told me a few years ago that MSFT sucked for most of their existence, but that with C#, Azure and other cool things, they are becoming a really incredible company. (I am also experimenting with C# but haven’t created anything for actual use). Of course, at the time, I didn’t really look into it or understand.

Oh yeah, and I really enjoyed Nadella’s book: Hit Refresh.

With the FANG/FAANG stocks so popular, who knows, maybe MSFT is the tortoise that surprises everyone!

This list doesn’t show a group of people who really need the money. I think the average compensation for a big company director is something close to $300,000. If you wonder why so many board members seem to be yes-men to the CEO, this may be one reason why; it’s good money! Don’t rock the boat, keep quiet and keep cashing your checks!

It’s clear from the above table that BRK directors are not there for the money. And sure, they are friends with Buffett so are they really independent? I would rather have directors that understand Buffett and BRK well, and have enough of a spine to express themselves if they see something they don’t like.

There is a lot more to say on this but one of the biggest arguments in support of BRK’s structure is that Buffett himself is the largest shareholder of BRK, so if this was a fraud, who is he defrauding? Himself? That’s laughable. He takes a $100,000 salary but the bulk of his wealth is created by BRK’s stock.

This is the opposite of most situations, where managements own token amounts of stock (and dump their stocks whenever they exercise their options) and pay themselves massive amounts of money. When you own very little stock but pay yourself huge amounts, I think that incentivises fraud more. Don’t you think?

When a CEO has 99% of their wealth tied up in a stock, that is stronger than any corporate governance factor I can think of.

But corporate governance specialists, critics and academics don’t seem to understand that. They would rather check the boxes on what they inflexibly think of as good corporate governance practice and that’s it. I guess part of it is laziness, and part of it is just practicality.

Institutions that own a large number of companies can’t possibly evaluate that many CEOs, BODs, etc. so they need some simple measure to save time. Like P/E ratios, maybe. Those that don’t know how to evaluate businesses may have to depend on P/E ratios to evaluate cheapness, but if you know how to evaluate businesses, P/E ratios often don’t really matter (as they don’t tell the whole story, like, in the case of BRK!).

Abdication/Transparency

I mentioned this in the comments section of another post, but the other issue is that Buffett is so hands off the businesses to the point of abdication. But this is misleading. We all know Buffett watches numbers like a hawk. He said he gets faxed sales figures every day from various businesses and he looks at them carefully every day.

What he means when he says he is hands off is that he doesn’t micromanage. He doesn’t insist on seeing every ad before airing. He doesn’t want to interview and approve every new hire. He is not going to approve every paint job of a store, or pricing/marketing strategy of each business. He is not going to approve each detail of every budget for every line of business.

But this doesn’t mean that he isn’t watching every penny that goes in and out of the businesses. We all know that all of the free cash of a business is sent to Omaha, so if something is wrong, he will know right away.

For the businesses where things may get funky, like the insurance businesses, those are highly regulated, and Buffett is very closely monitoring those businesses and is very involved as he says, with big blocks of business (talks to Jain several times a day etc…).

As for transparency, I don’t know. I never thought BRK lacked transparency. It could disclose more, of course, but I never thought of BRK as a complete black box or anything like that. Major business lines are presented clearly and in detail. Some of the non-insurance businesses might be opaque, but each of them are just too small to disclose separately.

Some fuss is made about the Sokol incident, but those things will happen every now and then to any company. Goldman Sachs has a lot of legal and compliance infrastructure, is highly regulated and constantly audited, and yet we now have the 1MDB scandal. So I don’t know that the Sokol incident proves anything about BRK either way. You have to look at the big picture and see the kinds of problems they’ve had over the years, and the record is pretty good. Will another scandal happen? Yes. These things will happen. It’s how management deals with it that will determine the fate of BRK, and I have faith that they will deal with any issues in the future promptly.

As Munger says, it’s all about incentives, and I think BRK people are properly incentivized.

Remember what Buffett said after the crisis. He said that there was a regulator who had one job, and that was to regulate FNM and FRE, I think. And they failed. So just because you have someone watching and regulating, if the incentives are not correct, you are going to have problems.

Market Volatility

But it made me curious. Why are we so scared of big market moves like this? 600 points is a little more than 2%. Back in the late 1980s and early 1990s, a 2% move would have been a 50 point move. 600 points is psychologically shocking because Black Monday was a 500 point drop. So it feels like Black Monday again (that was before my time!).

I tend to buy into narratives I don’t really care about. The HFT/quants are making the markets more volatile. ETFs, especially leveraged ETFs are making the markets more volatile. More regulation in the markets and the resulting decrease in liquidity (thinner bid/ask from market-makers/specialists) are making the markets more volatile etc…

I go, hmm… OK. Probably true. But whatever. Doesn’t matter to me.

But sometimes, I suddenly think, wait a minute. Is all of this true?!

Let’s take a look!

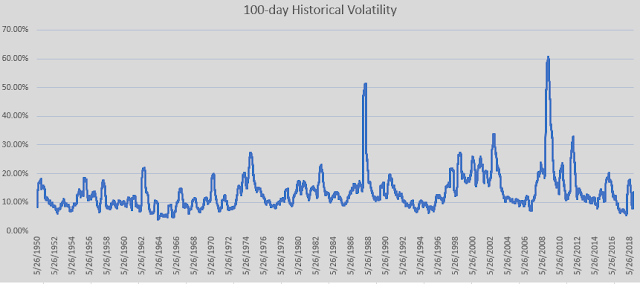

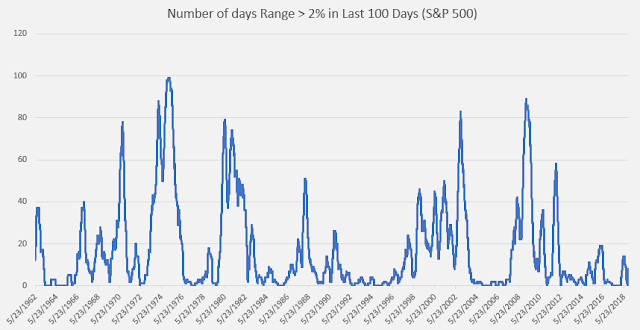

First of all, let’s just take a look at the market’s volatility on a rolling 100-day basis. This is what derivatives traders would call the 100-day historical volatility. I looked at this going back to 1950. All of the following charts include data up to this past Monday (11/12/2018).

So, looks pretty normal. Even with the big moves in the past few weeks, nothing out of the ordinary here. In fact, I would have guessed things were pretty wild since Trump was elected, but if you look back to even 2012, 100-day vols have been in a normal range. It certainly doesn’t feel that way.

OK, so maybe vols don’t tell the whole story. Let’s look at some other things.

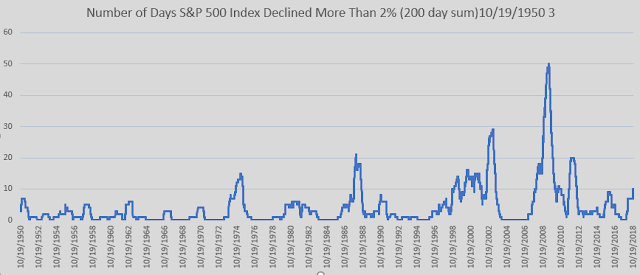

We’ve had a few days where the market was down more than 2% recently. Or it feels like it happens a lot. So, I looked to see how often the market went down more than 2% on the day. To make it a readable chart, I just summed up how many times the market declined by more than 2% in the past 200 days.

Here’s that chart:

So yes, it’s a little elevated, but nothing really out of the ordinary. Look at the period during the crisis! Also, look at the mid to late 1990s, even before the bubble collapsed.

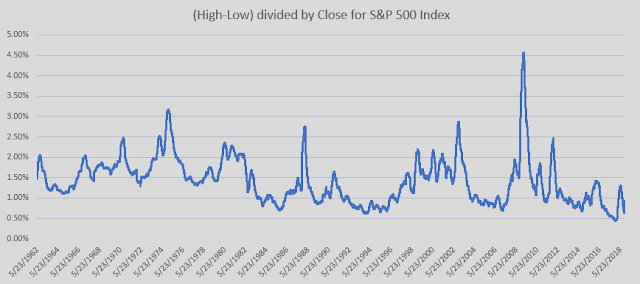

What about those days the market opens down 800 points and closes up 300, or some such crazy thing? It seems like that sort of thing happens a lot these days. If I had to guess, I would tell you that that happens more often these days than in the past.

To measure that, I just subtracted the day’s high from the day’s low and divided it by the day’s close, and then took a 100-day average of that.

Here is that chart going back to 1962 (hi-lo data only goes back to 62):

…and surprisingly, this too is in a very normal range, and far below the levels of even the mid-90s (I guess the day traders used to make this really wide). Nothing out of the ordinary here.

Conclusion

JPM is now a BRK stock. Get Jamie on the board! He would be the person I trust most next to Buffett.

BRK scores low on corporate governance, but so what? Look at the incentive structure, which is more important than committees, bureaucracies like compliance/legal departments etc.

People who write to complain about BRK are people who just don’t understand, or just use BRK to grandstand and gain attention by making astounding claims against consensus (this is why people like to say “the market is going to crash 50%!”, or “the market will get to 500,000!”). So ignore those people.

Microsoft is pretty awesome. I never made a post about it as an investment; I should have when I started to get interested, but oh well. Maybe eventually, but I don’t really have anything to add to MSFT in terms of financial analysis/valuation.

And, the markets seem like they are crazy and more volatile than ever, but the above charts don’t bear that out. People, the press, keep freaking out over 2% moves as if they are 10% moves. The markets, despite all the things that should make markets more volatile than ever, are just as volatile as they ever were and no more. So relax!

> I still like to adjust interest rates to what we might think is a normalized rate, and then price assets off of that.

Im a simple person so this might be an overtly simple rephrasing, could even be straight up wrong, but from what I can gather is you're trying to say here is to use interest rates as some sort of "ruler" to measure theses assets. This isnt anything new tbh and I'm perfectly ok with what you said, but what I'm trying to get at is how do you account for the changing nature of that ruler (the interest rate) based on the current political/business environment. How do you have confidence in determining what a normalized rate is? What does normalized interest rates even mean?

I look out at interest rates in just my lifetime (I'm 30) they have fluctuated so much. 12 inches in my view, I maybe wrong, has never equaled 12 inches…In other words. interest rates in the 80s (when I was born) was around +20% (for my analogy 20inches) and more recently near 0% (for my analogy near 0 inches). The ruler seems broken or at the very least not as reliable as once thought (or maybe this is just the way its suppose to be and my assumption is wrong.).

tldr: What do you consider properly adjusted interest rates? How do you go about normalizing something thats constantly changing and has no normality?

In one of my bubble posts, I showed that long term interest rates usually spend a lot of time pretty close to the nominal GDP growth rate. Historically, it's been a good indicator. I am assuming that real GDP can grow around 2% over time, and inflation will be about 2%, nominal GDP growth is around 4%. That's where I get my 'normalized' interest rate. You can argue that inflation could be higher, or that real GDP could be higher, but with population growth, productivity growth, the maturity of the economy etc., I think it's hard to sustain higher than 2% for long periods of time. I hope I'm wrong about that, but that's just how I view it. Same with inflation.

But at the end of the say, we can never really know. You have to just stick to what you feel comfortable with and use it as sort of a benchmark…

As always, great Post BI.

Don't you think WEB's JPM position was "forced" to him by maxing out on Wells and BofA? He has to sell Wells every quarter to be under 10% and within 5-7 quarters will have to start selling BofA every Q (because of buybacks).

My speculation is that he thinks banks are cheap and there are only so many of them he can deploy large amounts.

If anything, I'd say that committing $7B to BofA when he knows he will be a forced seller in 18 months is more bullish than the $4B in JP. But I'm biased owning BofA 🙂

Yeah, you may be right. I just thought it's interesting that he would be buying JPM *now*, after all these years of admiring Dimon.

Right, no, that's definitely an interesting point.

WEB invested in JPM on his personal account several years ago.

At that time, WEB decided to invest in WFC on BRK accounts because he thought it was a safer investment compared to JPM.

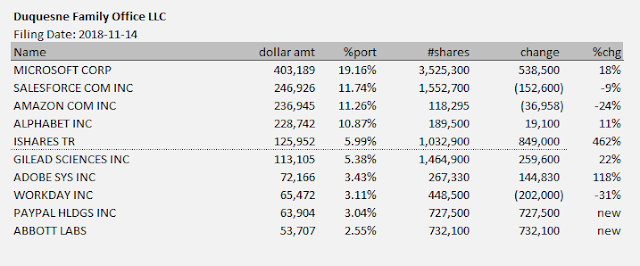

Druckenmiller also purchased BofA (new position), albeit small!

I agree with everything you said about MS but never bought them because I always felt they were just a little too pricey (even when they were sold at 45$ or so. I believe that a big part of their strategy now days is around gaming. Anyhow, just wanted to say I love you blog and it would be great if you DO write about them in one of the future posts

Yeah, their gaming business is doing really well. But their cloud business is really going to make the difference, I think. I am not a big fan of the gaming business as it's just seems so unstable to me. Xbox/Playstation has been able to maintain leadership the past few years, but don't forget we've had Sega in the past, and Nintendo is still around.

I tend to think the future of gaming is on PC's and in the cloud (Overwatch, Fortnite etc. even though many play these on consoles. I think it is going to be more fun over time to play them on PC's). But either way, it's hard to make long term bets in that business, I think.

Anyway, if I have enough to write about, maybe I will make a post about MSFT some day…

Thanks for dropping by.

Hi! I am a big fan of your blog. I appreciate the effort!

And an even bigger fan of Brk and Msft!…

I agree with your points in the article.

One point however bothers me regarding governance at BRK: the Seritage transaction…

W.Buffett buys shares for his portfolio.

Just before things start to get hot, BRK makes a large loan.

It's probably a good deal for BRK, but without the loan, WB shares might have beem impaired…

Hi, thanks for the comment.

Yeah, it looks 'conflicted' at first glance, but the key is if it's a good deal for BRK. If it is, then it's not an issue. If it is done as a bad deal for BRK and favorable to SRG, then it can be a problem as that would look like Buffett is using BRK resource to save his personal investment. But as you say, this is probably not the case; it's probably a good deal that would have happened anyway.

KK,

Why isnt there an mutual fund based on BRK holdings ? Esp if it can generate 1.5x SP500 ?

There is a difference between BRK itself, and it's stockholdings. The 1.5x SP500 refers to the growth in BPS of BRK which includes holdings other than stockholdings, plus the benefit of holding 'float'.

There have been funds with large holdings in BRK, but if it is the dominant position in any fund, it is just cheaper to own BRK itself directly so there is really no point (in paying another manager fees to just own BRK).