Every now and then, BRK comes up in conversations with people (and often with people not in the business) and the topic becomes, what to do with BRK post-Buffett. I tell them I own BRK and plan to own it for a long time, and sometimes I wonder why myself.

Too Big

First of all, it’s really big now so it’s going to be hard to grow the way they used to. With a market cap of more than $500 billion, it’s going to be hard to keep growing at a high pace. This used to be sort of the cap in big company capitalizations; a lot of the bit techs went to $500 billion in 1999/2000 before they all came crashing down. The barrier today seems to be $1 trillion; Maybe these $1 trillion companies hit that wall and come crashing down. Who knows.

In any case, BRK is just too big to get too much alpha going forward.

Buffett

Buffett is not so young anymore, so the historical performance is getting increasingly less relevant; Buffett created the performance of the last half a century, but he is clearly not going to lead the charge for the 50 years. This doesn’t mean BRK can’t outperform.

Buffett hired some great managers to help manage the equity portfolio, but their historical performance is sort of irrelevant too. Those guys posted great returns with a much, much smaller capital base. They will eventually inherit a $200 billion+ equity portfolio. If they want to stay focused, they will need to invest in companies they can buy $10-20 billion worth of. And there aren’t a lot of those. Their universe will be no bigger than the one Buffett is fishing in now, so it’s hard to imagine they will improve on what Buffett can do with this size.

Returns Not So Great Lately

And people say that BRK hasn’t even been performing all that well lately, underperforming in the past five years. The rolling five-year BPS growth vs. the S&P 500 index total return has been negative for the last five years in a row (through 2017):

2013 -4.0%

2014 -3.9%

2015 -2.3%

2016 -3.2%

2017 -2.7%

People often point to this to show that the era of BRK outperformance is over.

But this sort of misses the fact that back in 2008, the S&P 500 was down -37% while BRK’s BPS declined only -9.6%. So in a sense, the S&P 500 index had a lot of catching up to do compared to BRK. Looking only at the above table of the last five years misses a lot of crucial information.

Having said that, it’s true that the supergrowth of BRK ended back in 1998, but has been a steady grower since then.

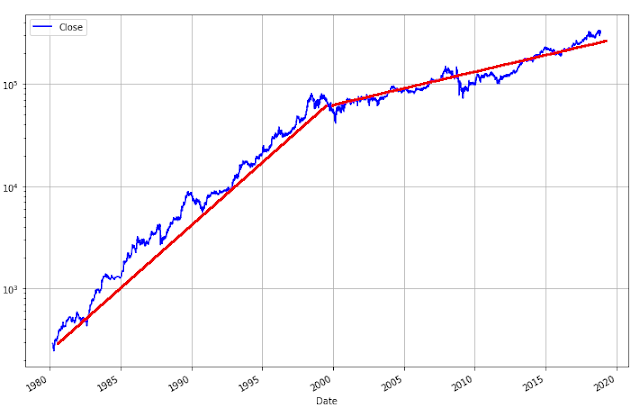

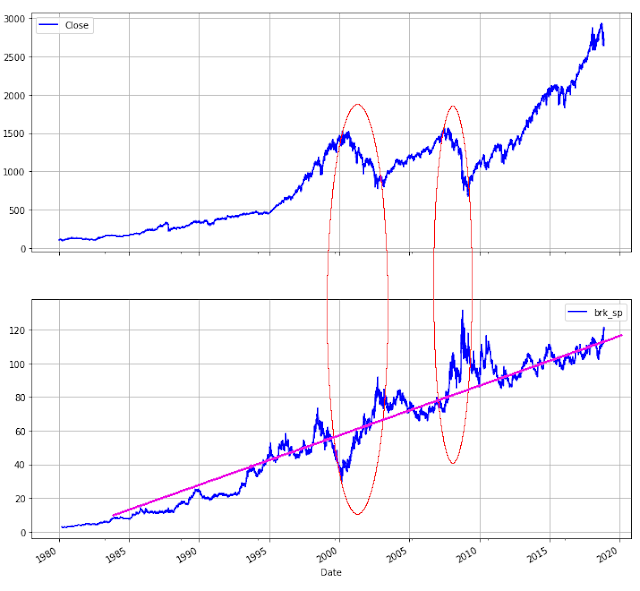

Check out the below log chart since 1980. You can see two clearly different eras in terms of performance. 1980-1998 was just amazing, but 1998-2018 has been much more modest (data just happened to be available since 1980 as I was playing with daily data; no cherry-picking start/end points. Good enough for this analysis).

BRK, Log Scale Since 1980

BRK’s BPS grew +28%/year from 1980 through 1998 vs. +18%/year for the S&P 500 index for an outperformance of 11%/year. BRK’s stock price rose +33%/year in that period, beating the index by 15%/year.

Since then, things have flattened out a little, but the returns aren’t that bad at all.

BRK vs. S&P 500

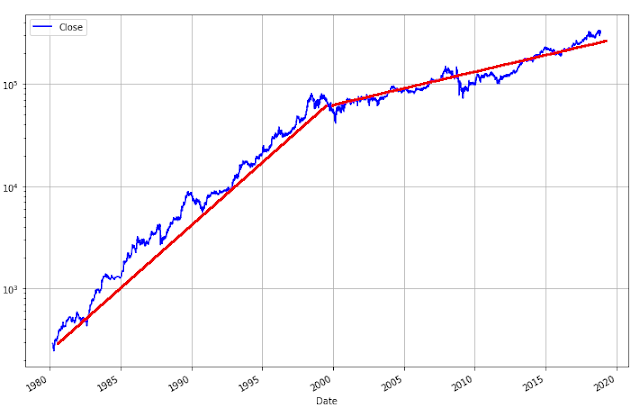

I haven’t updated this table in a while, but let’s take a look at BRK’s performance against the S&P 500 index (total return) in various time periods.

Of course, we know how great the performance has been since 1965. But check out the past five years. On a BPS basis, BRK underperformed the S&P 500 total return, but outperformed based in BRK’s stock price.

If you look at all the time periods, though, BRK has outperformed both on a price and BPS basis in most time periods.

This year, it just so happens that the 2007-2017 is the same as the 10-year comparison so be careful to not double count…

But to me, more interesting than looking at the past 5 and 10 year returns (which are no doubt important), is to look at ‘through-cycle’ performance.

The lower part of the above table shows returns from various market peaks (year-end basis). You will see that on a BPS basis, BRK has outperformed the S&P 500 index since the 1989, 1999 and 2007 market peaks, and also on a price basis in most of those time periods.

The 1998-2018 BRK log price shows a more modest pace of growth than the 1980-1998 period, but you will see that BRK has still grown 10%/year since then, bettering the S&P 500 index (including dividends) by 3%/year on a BPS basis and 2%/year on a price basis. Not like it used to be, but not bad! (How many funds can you name that has done as well?)

So all this talk of Buffett not performing well is not so relevant to me.

It looks funny to have both 1998 and 1999 in there, but 1999 is there as a market peak, and 1998 for sort of a momentary peak in relative performance of BRK, and sort of the end of the high-growth era for BRK.

Why BRK?

Despite the size, and the potential risk of a post-Buffett BRK, why do I still like BRK? First of all, the recent performance, I don’t think, is as bad as people make it out to be. They are still outperforming in most time periods, especially from various market peaks.

There is something about BRK that makes me more comfortable than owning the S&P 500 index, even with the post-Buffett risk. The first thing is that BRK will probably not do anything irrational or stupid. This is not an assurance we get when investing in the S&P 500 index. The index committee will add bubble-ish stocks at bubble-ish prices. BRK will not be ‘forced’ to buy stocks just because they are ‘big’. They will only buy stuff when it is high quality and is priced rationally. These are two things that the S&P 500 index committee do not seem to care about too much.

Sure, this inflexibility with regard to price and quality will be a drag on performance during certain time periods (like now, and back in the late 1990s), but I would feel more comfortable when my money manager is not chasing big stocks.

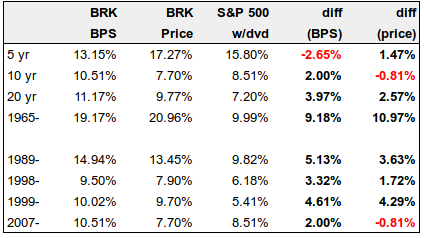

Also, check out the below chart. It’s just the S&P 500 index since 1980 along with the BRK/S&P 500 index ratio. I just wanted to see, visually, how BRK has performed (price-wise) versus the index over time.

And what I see is kind of interesting.

BRK seems to not do too well in late periods of raging bull markets (like the late 1990s) but seems to pick up a lot of relative performance during rocky times. This is kind of important for conservative investors. Whatever you think of the stock market now, there are pockets of bubbliness, and if that pops, it wouldn’t surprise me if BRK has another big step up in relative performance like in the two circled periods above.

This sort of makes sense, right? As BRK doesn’t have a whole lot of exposure to FANG/FAANG stocks. And if the market does decline a lot, that will provide a lot of opportunities for BRK to deploy cash so you are kind of sitting on cash optionality by owning BRK.

Yes, BRK declined 50% during the crisis, no better than the S&P 500 index, but if you look at the above table and charts, you will see that BRK does ratchet up relative performance during tough times. So just comparing peak-to-trough drawdowns sort of misses some important information.

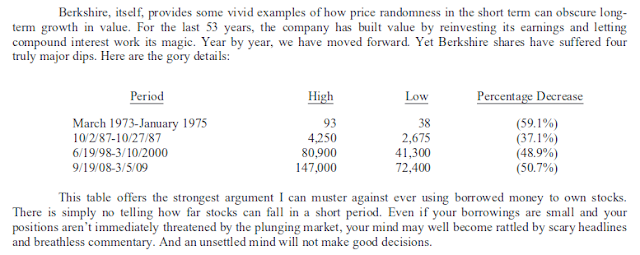

By the way, here are some large declines in BRK stock over their history (from the 2017 Letter to Shareholders):

Stunning Discovery

OK, maybe not. But I just noticed something. Look at the above chart again; BRK price / S&P 500 index ratio. If you look at this chart, you will notice that the uptrend is pretty consistent and linear. OK, I am not going to go back and put a regression line on it (too lazy), but you can sort of imagine a straight line going through it from the mid-90’s even through today.

Here is the chart again with the line I sort of see (this is not a regression line, but one I just drew by hand). The lower chart is the BRK/S&P index ratio:

And, importantly, there is no kink, bend or flattening after 1998!.

What does that mean?! It means the rate of BRK’s outperformance against the index has been pretty consistent and hasn’t tapered off at all!

The ratio will measure the ‘rate’ of outperformance, not the absolute difference.

Here’s what I mean. The above chart is based on prices, but I will look at BPS growth instead as the prices data is a little too spikey (and too sensitive to start/end points). As we saw above, in the period 1980-1998, BRK’s BPS grew at a rate of 28.2%/year versus 17.7%/year for the S&P 500 index (total return), for an outperformance of 10.5%/year. Since then, BRK’s BPS grew 9.5%/year vs. 6.2%/year for the index for an outperformance of 3.3%/year. Looks like big degradation in relative performance.

But the linearity of the above ratio chart made me look at this another way. The 1980-1998 28.2%/year is 1.6x the index return, and the 1998-2017 BPS growth of 9.5%/year is 1.5x the index return!

So, from now on, I am inclined to answer the question, “How do you think BRK will perform vs. the S&P 500 index in the future?” with, “I think it will do 1.5x better!”.

Nonsense? Maybe. But it looks interesting to me. This is the danger with playing with charts.

Optionality at Low Cost

Moving on. This is not a new idea, but we can see all the cash at BRK as optionality (even though I have long said that the cash is matched pretty closely to float so wonder how much of the cash is actually immediately deployable. Some of the float might be ‘fast’, meaning maybe they actually can deploy a lot of that cash and run down the float if necessary).

A lot of funds held a lot of cash since the crisis and have severely underperformed the index. The worst fund managers have actually been net short since the crisis and have catastrophically posted negative returns for years on end. Sure, these guys had plenty of opportunity because they were short; if the market went down, they could profit on the decline and then use the profits to go long and make even more money! But, those guys were neither prudent nor rational, and it is unlikely they will ever be able to make up the damage as it is just too big to overcome.

And yet, here, we have BRK with all that cash and it seems like they haven’t sacrificed all that much in terms of performance. That is really amazing when you think about it.

Leverage

By the way, BRK has $97 billion of cash/cash equivalents on the balance sheet just looking at the Insurance and Other segment. This makes people say that Buffett is bearish the stock market. Well, it’s true that Buffett has been having trouble finding stuff to buy, but that doesn’t necessarily make him ‘bearish’. There is a difference between not finding things to buy, and being bearish (and expecting a market decline).

One thing that occurred to me when thinking about this huge amount of cash and short term investments on the b/s is how small the investment in fixed maturity securities is: $18 billion.

So first of all, the amount of cash/cash equivalent sort of seems to me like more of a bearishness or unwillingness to buy bonds than stocks. There is only $18 billion worth of bonds in the insurance segment versus, what, $200 billion in stocks? That’s not bearish stocks to me, that’s more like, bearish bonds!

Not to mention BRK has been net purchasers of stocks; not the act of a bear.

Here’s the other thing. When we look at insurance companies, we often look at investment leverage. For me, since I like risk, I look at the percent of shareholders equity invested in stocks. Markel looks at and talks about that, as it’s a big source of their expected BPS growth.

So I think about BRK in the same way. Forget about cash vs. float and all that stuff for now.

Let’s just look at how levered BRK equity is to ‘equity’.

First of all, the portfolio (including KHC) is $219 billion at the end of 3Q 2018. That’s against $379 billion in total shareholders equity (including minority interest). So the ratio of shareholders equity invested in stocks is 58%. That’s a lot higher than any other insurance company, and I think higher than MKL has been recently (maybe they are much higher now; too lazy to check now).

Of course, this is not like the old BRK, but not at all overly conservative either.

Now, keep in mind that BRK has a lot of unlisted businesses. For example, the various businesses in the railroad, utilities and energy used to be listed companies. If these were still listed, they would be included in equities. As far as growth potential is concerned, other than not having to mark to market, these businesses are basically no different than the equity portfolio (ignore the advantages of wholly owned businesses etc.).

So from the ‘leverage’ point of view, we can add this to the equity portfolio. The book value of this segment is $96 billion. With a similar argument for the Finance and Financial Products segment, we can add another $24 billion.

Sum that up and you get ‘equity investments’ of $339 billion. That’s against total shareholders equity of $379 billion. So that’s already like 90% of BRK’s shareholders equity invested in equity of businesses. That’s really not all that bearish!

This, by the way, doesn’t even include the other unlisted businesses, the Manufacturing, Service and Retailing Operations (MSR), which is the ‘other’ in the Insurance and Other segment. BRK doesn’t disclose the balance sheet in detail for this segment, but in 2016, BRK equity in the MSR segment was $92 billion or so. Add this to the above $339 billion and you get $431 billion worth of equity investments at BRK against it’s shareholders equity of $379 billion.

This is why you get equity-like returns on BRK despite BRK having so much cash/cash equivalents on the balance sheet. This is hardly the balance sheet of a bearish CEO.

Conclusion

I haven’t even touched valuation here, but from all of the above, I like BRK a little more now than I have liked it in recent years.

I don’t want to time the market and call a peak or anything. I have made it clear that even though we may enter a bear market or have a severe correction at any time, there doesn’t seem to me to be a strong case to be made for an extended bear market in the U.S. at the moment (famous last words… I know!)

But the more frothy things seem (well, less so now with the October/November corrections), the more interesting BRK becomes for the above reasons.

AND, it is possible that you won’t give up much in terms of performance to buy this ‘optionality’, with, of course, the greatest investor of all time ready to pounce if we have any big disruption in the market. And we can’t forget that BRK has a lot more levers to pull than most conventional funds or even hedge funds; they can buy private businesses too, or do add-on deals to augment the many businesses they already own.

Plus, all that cash on the balance sheet doesn’t mean it’s as much a drag on BRK’s performance as people make it out to be.

As for a post-Buffett world, I think what we need is intense rationality and discipline not to do stupid things. We know BRK is not going to jump into Bitcoin, or buy into bubble stocks (I fear we may find AMZN in the 13-F at an entry price of $3000 some day; that may be a sell signal!), panic and sell out stocks during a crisis or anything like that. And they will not be subject to quarter-to-quarter performance pressure in fear of redemptions. Many of these (and other) advantages are enough to keep me comfortable with BRK for a long time.

Also, even though BRK is not growing the way it used to, and it doesn’t look like they are outperforming as much against the index, it looks like a lot of this is due to lower returns in the market in general as the rate of outperformance has been remarkably consistent even after 1998.

By owning BRK, you sort of get paid at least market performance while you wait for the optionality to be exercised!

Great post. It seems that BRK's stock picking hasn't really generated much alpha for quite a while already (emulating their 13F as a fund which only has 4 portfolio switching annually – an exercise I am trying to automate and eventually would like to cover as many 13Fs as possible to see if I can discover anything interesting). I think BRK would continue to outperform even if it only buys SPY in its equity portfolio. That's actually a question on this in the last annual meeting – Buffett thought a while and didn't say it was a dumb idea, but rather along the lines of wanting to preserve cash now. The BRK outperformance seems to be attributed by its solid and highly cash generative operating business, as well as the inherent leverage of the investment portfolio in its insurance segment. Whatever BRK bought on its 13F, or just bought SPY, seems do not affect the stock performance that much. Would you agree?

It would be great if you could share with us your current thoughts on its valuation, as I would think BRK is now more fairly valued than cheap, yet they are buying back stocks at this level.

Hi, 1.4x book seems really reasonable to me. I haven't really dug deeply into valuation lately.

As for the alpha of the equity portfolio, that's a good point. I still think it is sort of cyclical (cyclically outperform, underperform etc… we are now in the down cycle, a long one).

As for indexing it, that's also interesting. I guess even if BRK's stock portfolio outperforms, it's not going to be huge alpha… maybe 2-3% at most, which would add 1-1.5% to BPS growth over time assuming 50% of BRK BV in stocks.

Difference is that if BRK has large position in say, KHC, they can become 'active' on it if they want. This is not possible on the SPY. So maybe they haven't done much recently, but at some point, having some influence or level of control would be worth something, I think…

By the way, I've thought about creating a superinvestor return calculator too using the 13-F's. I think I've discussed that with someone here before, maybe it was you.

I haven't looked into it in a while, but I remember back then, I was scratching my head how to tie the 13-F filings with ticker symbols. How would you do that? I sort of hate matching names (text comparison) as it can get messy, and maybe there is a table somewhere that matches cusips with tickers…

How about creating a S&P 480 or something like that via negative stock selection, i.e. excluding the 20-50 stocks that Buffett/Combs/Weschler think of beeing a fraud, playing accounting tricks or are strongly overvalued. This should be doable and result in at least moderate outperformance.

Hi KK, I think that was me talking about 13F. Yes it's quite painful if you work from the raw filings.

My idea is to have a top-down approach and start from all the 13Fs filed to see if I can discover anything interesting (e.g. long-term alpha, low turnover, non-index hugging, not concentrated in only a few stocks). To discover future Todd & Ted.

Whalewisdom is the solution but it is a paid service. As I have access to Bloomberg, I combined the free version of Whalewisdom with Bloomberg. I am sure there are other ways to do it.

Whalewisdom has a list of all 13Fs where I can sort by return, AUM, no. of stocks and portfolio turnover. I ignore the return column as do not find them reliable, ususally I use Bloomberg to verify. But the full list is useful. I screen out the filings with too many stocks (like Vanguard?) or too few stocks where we value investors can study closely (perhaps 10-50 stocks per portfolio?). Screen out the ones that just filed 13Fs not long ago (at least 5 years of history?). Screen out the small funds (perhaps starting from $300mn?). Screen out the ones with too high turnover (with a 45-day delay quarterly filing, too high turnover makes it meaningless). Then you will be surprised the list will come down to a manageable number.

Then I will individually look at these candidates on Bloomberg's PORT function, which you can see what stocks they buy or sell each quarter, with other features like volatility and drawdown. Bloomberg can turn that into an "index" for each 13F.

This has become a leisure activity for me – sometimes you discover some interesting funds you haven't heard before, then you do a bit of digging and find that the CIO was ex-Tiger. Sometimes you discover this new mid-cap value stock you didn't know before (like DVA?).

if you'd like you can check out a crude google-sheet that i put together that aggregates several of my favorite funds… it wouldn't be too hard to modify with your favorite guys – just gotta know their CIK code which you can find on the edgar website… just send me an email and i'll reply with a link

Semper Augustus put out an annual report, describing Buffett's brilliant pivot away from stocks in 1998 using the GenRe deal. Its argument is that Buffett knew KO was overvalued and didn't want to sell and trigger a tax liability, so he issued BRK stock and bought GenRe's cash and Tbill portfolio. And then used that portfolio to buy more businesses. Semper thinks that while the stock portfolio underperformed, Buffett was able to engineer a stock sale through this deal and use the proceeds to buy businesses that outperformed, and thus generating the 9-10% increases in book value despite the terrible stock returns.

Buffett is a mastermind.

I really hope they announce a massive tender. Buffett even admitted recently it was a mistake to not be buying back shares over the yrs and linking IV to what he thought it was worth vs a number like 1.2x. I just don´t see how they can buy back any meaningful amount of stock except in a 2008 scenario in which case he probably would be busy buying other stuff and rightfully so. Putting say 75bn to work in a tender at 10-15% above current stock price will pay off handsomely in 5 yrs. I like apple and the other stuff he buys but I think brk is a better buy now. At 1.37x bv and assuming a 10% growth a fwd p/bv of 1.25x seems pretty cheap to me.

This is a great analysis. Thank you. Your point about BRK outperforming by 1.5x the index over time is very significant. I would note that what this doesn't capture in the BPS growth is that since 1998, BRK has shifted from a strategy of primarily investing in marketable securities to a strategy of primarily acquiring wholly own businesses. Increases in the value of the wholly owned businesses do not show up in the BPS since they are are not marked up on the balance sheet as they increase in value. For example, BNSF was acquired for approx $32 billion in 2010. Using UNP as a proxy, it's now worth $100 Billion – so that is $68billion over 8 years which did not show up in the BPS gains – and that's on one acquisition alone. This doesn't include the increases in value of geico (also in the tens of billions) and many other growth businesses. So if you include these, BRK would have outperformed by more than 1.5x the past 10 and 20 year periods. This, along with the recent buybacks, indicates the stock is significantly undervalued currently.

Another way to see how recent BPS and share price performance does not indicate BRK's performance is simply to look at look-thru earnings growth. This is the method Buffett used to refer to often in his annual reports. Look thru earnings in 1999 were $1,050 per A share. As the stock was trading in a range of 50-80k during this period, the look-thru p/e was very high, as it was for most companies during what Buffett refers to as The Great Bubble. Given that BRK spent the past 20 years acquiring wholly owned businesses, and reinvesting nearly all capital into more of them and into equities – and given that taxes were cut from 35% to 21%, BRK look-thru earnings in 2018 are expected to be approx 23,000 per A share. This is astonishing. If you assume that the $100billion cash position is invested at even a 20x p/e – or used for buybacks -that would bring normalized look-thru earnings per share in 2018 to $26,000 per A share. This is a 25x increase in earnings power over 20 years, or approx a 17% annualized rate of gain.

As the Sp500 grew by 6% since 1998, that's an 11% per year outperformance in earnings power – about what BRK has done since 1965. Astounding given that it's grown so much in size. It also means it's valuation has gone from a look-thru p/e of around 50 to a p/e of 13.

It makes sense since the float leverage of 1.5x equity provides 3-5% per year outperformance, depending on what the sp500 does. Security selection and margin of safety another 3-5%, and perhaps another few percent from asset allocation.

Also look at BRK's look thru earnings gains in comparison to the EARNINGS gains of the SP500 itself for he past 10 and 20 year periods.

For the 10 year period, per share look thru earnings were approx $7,700 per A share in 2007, which indicates a rate of gain of 13% the past 10 years in earnings power of BRK. Meanwhile, the SP500 has grown at 8.5% since then, giving BRK an outperformance of 4.5% the past 10 years, even with the SP500 after a long bull run. If you look at SP500 earnings, the index earned 44/share in 1998, which grew to 124/share in 2017 -or a 5.4% rate. Compare this to BRK's 17% rate. In 2007, the SP500 earned 82/share, growing to 124/share in 2017 – or a 4.3% rate. BRK grew look-thru earnings at a 13% rate since 2007 – about a 9% outperformance over the past 10 years.

Why would BRK stock sell at a p/e of 13? Using a 10% discount rate, this indicates the market is pricing in an earnings growth rate of 2% annually for the next 10 years. Assuming 10% earnings growth, the stock would need to be at a 22 p/e, or about 600k per A share. I'll note that the SP500 currently trades at a p/e of of about 22 times 2017 earnings (2650/124). Yet BRK outperforms the SP500 over all periods, so rationally deserves a premium, not a discount.

https://www.cnbc.com/2018/10/17/jp-morgan-berkshire-hathaway-shares-look-really-cheap-using-buffett-method.html

As they have since 1965, it seems the world is vastly underestimating the world't greatest investor – as indicated by the price of BRK stock. (it's been proven by subsequent performance that for all of those years the stock was undervalued)

He switched strategies in the late 90s, and the world has not caught on to the fact that he continues to increase the earnings power of his businesses at a rate 8-12% per year faster than the broad market. This amount of outperformance leads to miracles in price gains, as shown by the 10% per year advantage over the SP500 since 1965.

"Why would BRK stock sell at a p/e of 13? Using a 10% discount rate, this indicates the market is pricing in an earnings growth rate of 2% annually for the next 10 years."

Don't forget that Berkshire's earnings are growing faster than that because they retain all earnings. You can't discount each years earnings in your model *and* get the growth from retaining earnings, you are basically double counting.

Interestingly and for comparison. WTM performed 2 dutch auction style buybacks recently for roughly (i believe) $2B and their shares still remain below book value. First question is how did this help WTM shareholders, and second question is why would it be different for BRK shareholders if they did same? As a WTM shareholder, i'm genuinely interested in responses.

Good points jj. I do think Buffett shold have been buying back stock over the past 10 yrs. My main concern is there is no way they can meaningfully buyback stock. If they are buying back a lot now (I hope so) then when he next 13f comes out the price will adjust and then it will be impossible to buy back at a decent price. I think he has to do a major tender. I like apple but its future is less knowable than brk. Even the great Buffett may feel pressure to buy stuff if the money is burning a hole in his pocket. Also the only way to convince people to sell is to do a major tender of say 75bn when the mkt is under pressure like now not when things are going well.

Here in this interview with Charlie Rose from 2007, Buffett states that 'the real goal at Berkshire is just keep building more and more earning power'. If you judge BRK on Look-thru earnings growth, the outperformance over the SP500 is still in the 9%-12% range over the past 10 and 20 year periods. This is simple fact is not recognized by the market, as it focuses on BPS growth. The result is that BRK now sells at a historically low P/E (13), while it's record of outperformance remains very high.

I will also note that fears about size anchoring performance have not so far materialized in a meaningful way. Also, the SP500 has a Market Cap of $22 Trillion – and it still grows at 6-8% or whatever – so BRK, using safe leverage from float, buyback etc – and at just $500 Billion market cap – has a long way to go in outperforming the SP500.

Charlie Rose: The priority is acquisition rather than equity position?

Warren Buffett: Absolutely. I hope — we have 73 businesses now. And they go all the way from Dairy Queen and the deli bars, you know, to 737s at NetJet. So we've got a little bit of everything. But I want more of everything. I would — you know, I hope that 73 becomes a much bigger number. I like buying stocks too, and it is a game I know to some degree. But the real goal at Berkshire is just keep building more and more earning power from operating businesses with terrific managers doing — that means I don't have to do a damn thing. I just sit there in the office and, you know, play my ukulele or whatever.

Charlie Rose: There is more than that.

Warren Buffett: Well, but it is — the truth is, if you get a good business, you know, it's the gift that keeps giving. I mean, it gets better over the years. And instead of going from flower to flower, like you do more in the stock market, you can — if our 73 businesses we have now are very likely to be earning appreciably more money just by themselves 10 years from now, on top of that we will add more. And that's — I love doing it, I love the managers that we associate with. And it's a lot of fun.

Great article as always; thanks for sharing your expertise. Given how BRK traded after the Apple announcement, did it trigger any additional thoughts? Or is this what one should expect as responsibilities continue to grow for Ted and Todd?

I would be surprised to see them grow more than say 9 percent per year going forward, but I'd also be very surprised to see them growing less than 6 percent per year

Dumb question… when you talk about BRK's BPS are you talking about basis point comparison? so taking the price at one particular time and measuring growth vs just the price increase in percentage terms? I guess I am confused by the BPS vs price comparison

Changes are just percentage change. A 100 basis points is 1%.