Bubblicious?

People still speak of bubbles a lot, bubble in the bond market, stock market, unicorns etc. But I still don’t really see a bubble except in certain areas of technology. Otherwise, things seem to be in a normal range to me, except interest rates. They do seem a bit low, but having said that, I still see 4% as a decent ‘normalized’ long term rate for the U.S. (as I have said here before many times).

The Valuation Sanity Check shows the Dow trading at 20.6x current and 16.4x forward P/E, and the Berkshire portfolio (largest holdings) trading at 17.4x and 14.3x their current and forward earnings. Browsing down that page, there is nothing really alarming about anything, really. Some things look expensive, but nothing insane.

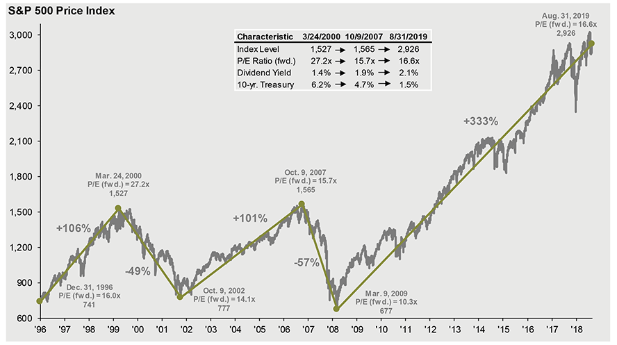

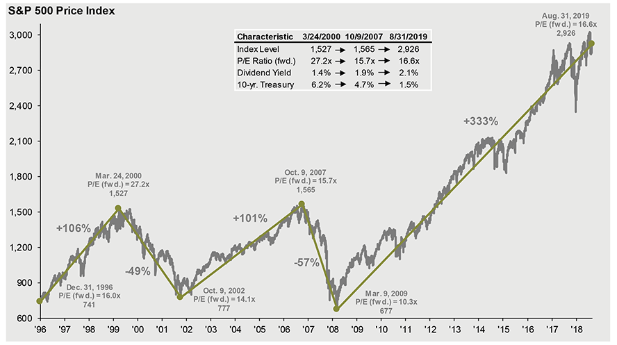

Also, here are some charts I plucked off the internet. The first bunch is from the JP Morgan Asset Management’s Guide to the Markets. This is a nice report that they put out every quarter, and is fun to flip through.

These charts too show nothing really crazy.

I keep hearing people talk about how crazy it is that the market is up 20% this year, but given that a lot of that is recovering from losses last year, it doesn’t sound crazy to me.

Also, people keep saying that the returns of the last 10 years suggests the market is overvalued. But again, given that the much of the returns is recovering from the financial crisis bear market, I think it’s irrelevant. If the market had double digit returns over 10 years from a market high, then I would be more inclined to agree; something bad might be about to happen.

But this is clearly not the case here. In fact, from the October 2007 high, the market has gone up less than 6%/year (excluding dividends), and 3.4%/year since the 2000 peak. This is hardly the long term performance figures you see in a real bubble.

I won’t look for them, but look at the similar figures for the 2000 peak, Nikkei 1989 peak etc. It is very different from today.

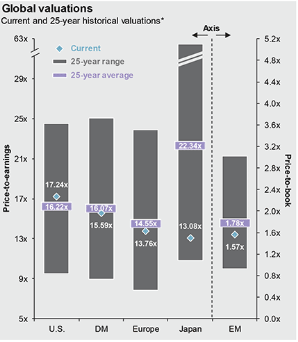

The above forward P/E chart shows a normal range, nothing alarming. Of course, people will argue that the market has been consistently overvalued for the past 25 years so this is not indicative of anything. But interest rates are a lot lower now than in the past too, and this chart doesn’t show any abnormally high P/E level due to lower rates. I suppose one can argue about the validity of EPS estimates a year out. That is certainly a valid point.

This X-Y plot of forward P/E ratio versus future returns show potential returns solidly in the positive. I did something similar using Shiller’s CAPE ratio and found similar results.

One year forward returns based on P/E

My analysis goes back to 1985, so is longer term than the JPM study (which goes back to 1994), but hasn’t been updated (a couple of years shouldn’t make a difference!).

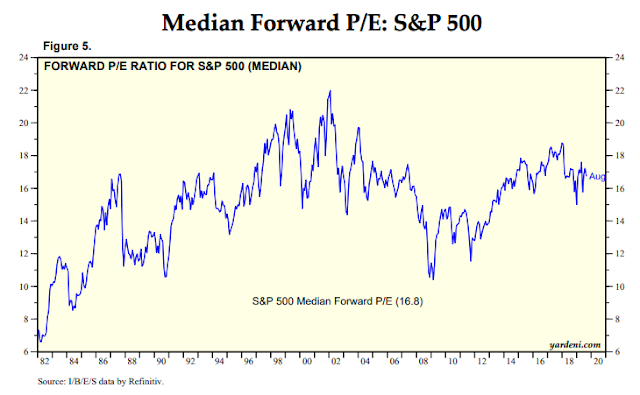

Median P/E Ratio

And here’s something I found. The S&P 500 is market-cap weighted, so the index P/E ratio tends to be influenced by the large cap stocks. When you have a bunch of large caps that are overvalued, it tends to push up the P/E ratio of the whole index.

To get a more ‘typical’ P/E ratio of the random stock, a median P/E can be more useful, as half the companies would be more expensive, and half would be cheaper than this level.

I found this chart in Yardeni’s September report: Yardeni P/E report

Here’s the median forward P/E ratio:

Again, nothing spectacular here. Looking at this (and the other charts), if someone is net short the market, you would have to examine their brains. Why would anyone be net short in a market like this? It doesn’t really make sense to me.

Just flip through these charts again, and imagine you are the head of the trading desk at a hedge fund or bank somewhere. And say some guy is massively net short the market. You ask him why he is so short, and he tells you that it’s because the market is way overvalued. What would you say? Would you feel comfortable going home and sleeping well? Of course, this trader may contribute to reducing the overall exposure of your desk, but don’t think of it that way as you can always adjust your market exposure with futures.

If you think of it this way, it’s sort of insane.

The other non-bubble thing is that you don’t hear people talking about the market at all. Usually, in a real bubble, people really like to talk about the stock market in situations where that is not normal. A couple of years ago, everyone was talking about bitcoin. I don’t hear much about that anymore these days.

Also, the news flow is so negative these days, whether it be Brexit, Trump tweet, U.S./China trade, Iran… Wherever you look, it’s just bad, scary news. And yes, the market responds by going down, but it comes right back up. This is not to say that the market will always come back up. We will have a bear market at some point.

But if you are net short and all these ‘favorable’ developments to your position is not making you money, that’s kind of a serious problem. What happens when any of these things resolves itself? What if we do get a blowoff that has happened in most other bubble tops (2007 top was not really a bubble in terms of valuations, so bear markets can happen from normal valuations too).

Value-Growth Gap

The other thing is the huge gap between growth and value stocks. I am not that big a fan of this as the division seems arbitrary and kind of meaningless. But what is encouraging is that despite this slightly higher valuation of the overall market, the gap between value and growth seems to suggest that one can avoid a lot of pain by being more in the value area than growth.

Back in 2000 when the market was actually really overvalued, value investors did fine despite a 50% drop in the S&P 500 index as the drop was driven mostly by expensive companies going down in valuation. I think value stocks actually went up back then.

This may be true this time around too.

Market Timing

Most of us value investors don’t believe in market timing at all. It is so amusing to watch the market go down 200 pts (or more) on a tweet only to reverse itself within a day or two by another tweet. Why anyone would trade based on this stuff is beyond me. I am a believer that headlines almost never mark turning points in the market. If the market is making a new high and then plunges on some negative headline, you can bet that that high will not be a high of any significance. I have seen various attempts over the years to analyze peaks and troughs in the market and matching it with news headlines; there usually is no headline that marked the top or bottom of a market.

It’s just silly to try to figure out when the next bear market will happen.

There is one thing, though, that I would watch out for. If the U.S. market goes into a situation like the Japanese stock market in 1989, then I would obviously react. I would definitely lighten up equity holdings (still on a case-by-case basis based on valuations, of course) and maybe even consider buying puts, going short or whatever (OK, maybe not as I watched many bears lose a lot of money in 1998-2000 period only for them to be proven right but already having lost too much money made no money on the decline).

In any case, it would be a valuation call; I would lighten up when I can’t accept the valuation levels. And it would be by each individual holding, not some vague notion about the directions of the overall market or economy.

Japanification of Markets?

The other worry is the Japanification of global markets. We were all baffled by the low interest rates in Japan for decades, and here we are with multiple countries and trillions of dollars in debt trading with negative interest rates.

Many commentators thought it won’t happen here, and yet here we are with long term rates under 2%.

What about the stock market? Can the U.S. go into a bear market like Japan’s that lasts 30 years? This sort of thing worries me too a little. We can’t say it won’t ever happen here as we were wrong about interest rates. Well, I’ve actually been in the camp of “lower for longer” so am not really all that surprised by how low our interest rates are.

But it would not be fun if the market went into a 30-year bear market.

Here’s why I don’t think it would happen, at least any time soon:

- The Japanese market went up to 60-80x P/E at the time. That sort of valuation takes decades to grow out of, and it’s that much harder when there is no growth! We are nowhere near that kind of valuation.

- The Japanese government and companies spent most of the time since then hiding things rather than fixing them. When the U.S. had a credit crisis, banks were encouraged to raise capital and fix their problems, not hide them.

- Regulations are meant to maintain the status quo, protect large companies (who are contributors to the LDP) etc.

- In Japan, companies are discouraged from right-sizing. They run under a system the Canon CEO, Fujio Mitarai, calls corporate socialism. He says that since the Japanese government doesn’t offer much of a social safety net, that burden falls to large corporations; they are strongly discouraged from firing employees. This is why there is a word for this category of employee: madogiwazoku (google it!). Here’s an article about it: Boredom Room. It’s no surprise that the stock market has been dead for so long with so many zombie employees at zombie companies. This is very different than in the U.S.

There are many other problems, but those are just some big ones off the top of my head… You may think of better reasons why Japan has been stuck for so long.

None of these are true in the U.S. That doesn’t mean we can’t go into a 30-year bear market, of course. But it just seems to me that it is not likely at the moment.

Hard Left Turn in Politics?

Others worry about the progressive left; Leon Cooperman joked the other day that if Elizabeth Warren gets elected, the market won’t open. I understand that fear, and as a big fan of JP Morgan, I totally get it.

I am actually pretty progressive myself (I used to be conservative but have been moving left over time), but I wouldn’t worry about this at all.

First of all, we really have no idea what’s going to happen. We don’t even know who is going to be the democratic candidate; it’s possible that someone else not even running now will come up out of nowhere (well, not sure if that’s possible, actually, but we still have a long time to go).

We do know that Warren is as progressive as she presents herself, so this may not apply, but it’s possible that she runs hard left to take Sanders’ and other voters only to run back towards the middle if she wins the nomination.

We don’t know what she can accomplish even if elected, right? This is a president, not a dictator. Did FDR or Kennedy destroy the country? I haven’t looked at the market action around their elections, but I don’t really think there is a big, visible dent or bend in the long term charts based on who was president.

So this is certainly a risk factor, but my guess is that things, as usual, will not turn out the way we expect even if Warren wins the election. It’s a complex model and things aren’t going to be so easy to predict.

I always appreciate your perspective, thanks. I'm curious what you think about Andrew Yang's chances of winning the nomination and his policies? Also, if you have any views on the dollar shortage theory?

Hi, Yang seems to be popular and I like him, but after watching the debates, he sounded more like a one-trick pony. OK, he will give everyone $1000 per month. But what else? He didn't seem to evolve and develop but kept saying the same thing, so not sure he can get the nomination. As for dollar shortage, I don't know. I am not all that interested in the mechanics of the short term money market (unless there is a real problem somewhere…).

I think Yang’s strategy at the debates was to focus on the Freedom Dividend because he gets so little air time from the moderators. He has loads of policies on his website and hopefully as the field narrows, he gets more time. Right now, it’s about introducing himself and the big idea first.

By the way, did you ever look at E-L Financial (ELF.TO)? I thought you mentioned you would previously. I also like Terra Firma (TII.V) in Canada these days. Both relatively unlevered illiquid financials trading at giant discounts to book/liquidation value with decent ROEs.

In Poland you can find companies with more cash than their valuation. P/bv for a broad market is below 1. And no one is interested in stocks. To diversify I started buying value stocks in US: Weyco group, Nucor Corp, Domtar, US steel, Kraft Heinz. I'm aware that some of these companies can face real problems but from outside they look like opportunity in long term.

Hi kk

It has been a while since your last post!

One area of the market which is prima facie not in a bubble, are beaten down and cheap active asset managers. I know you have written extensively about some examples in the past. What are your thoughts about them at this point in time?

The big asset managers seem to be a in long, bruising, and losing battle against passives. However some companies that operate in niche areas (such as PE funds) or are specialists (such as Ashmore Group in the UK) seem to be bringing in AUM still.

Hi, yes, good question. Asset managers are tough. I tend to like the private equity guys but with AUM growing so much, I wonder how they will achieve the high returns they used to get. Also, the ones with a lot of fixed income is problematic too, with such low rates… Can't really charge much with rates so low.

So that's my dilemma with the asset managers. If you are good, your AUM grows, and then your returns suffer… How do you deal with that? As a business, asset gatherers are much better, like Fidelity (not public), Blackrock etc. but they face the same issue… How do you keep growing AUM? Not sure.

I don't have a strong view either way at this point, even though the passive/active argument is interesting to me. Passives will have issues and the pendulum will swing, somewhat, back to active, but not all the way as even in the pre-index/passive era, managers rarely outperformed.

So that's the other thing; who is going to keep outperforming? Not sure there either… (again, mostly due to the size issue… if you are good, you get big. Then how to do outperform with the new, bigger AUM?).

I should think about this more as there may be something interesting to do… I will post something if a light bulb goes on…

Thanks for dropping by…

Hi, for example KKR seems very cheap at the moment…

In sum, at ~$27 per share, we pay for the value of the investments on the balance sheet, plus a conservative value for the recurring revenue business.

The market does not price in (i) value of the carried interest from current AUM (and any additional AUM to be raised in the future); (ii) AUM already committed but not yet generating management fees; (iii) any management fees above a growth rate of 6% into perpetuity.

Very curious to know your opinion about this.

Many thanks!

Yes, I tend to like the good private equity guys. Only issue over the really long term is their AUM. They are just getting so big, and their main area of expertise, pure private equity, gets smaller and smaller as they get into real estate and other areas. So as usual, great businesses looking back, but not so great going forward, probably.

I do tend to think they are well-managed, though. This includes APO and BX…

oops, meant to say smaller as a percentage of total AUM…

how do i get your posts on my mail?

how can i follow your blog ?

thanks

Hi, sorry, the email seems to be broken here at blogger, so there is no way at the moment to follow.

Never trust anybody that ages and moves left.

Does it concern you that the developed world is dependent on elevated risk assets with little hope for safe income at a time of aging demographics in most developed countries? The average older person needs dependable income. Pools of money that require safety (no risk) earn less than 2%? S&P Yield is 1.9%, price to sales ration near all-time high. Seems like high potential for a bad outcome for pensions and individuals next time there is a significant decline for any reason. Just thinking!

Actually, yes. I do worry. The Japanification of interest rates around the world is worrisome. At this point, it just seems like people will just have to work longer, which is fine with me. I always thought retirement seemed a little long for many people. So getting older people more active and participating in the work force will be an issue going forward.

In terms of markets, I am not so worried at the moment as I don't see a big bubble. As we see in Japan, rates can remain low for a very long time.

Love your blog. Please post more! Have learned a lot and always find your posts informative, thought provoking and full of insight. Thank you!

Hey KK. Any updated thoughts on the markets, valuation, coronavirus, yield curve inversion, and recession? Thanks.

Hi,

Not really. An update is long overdue, but nothing really too exciting to update. First of all, from an investor standpoint, this coronavirus is a nonevent, as if you are interested in what a business is worth 5 or 10 years out, then this is just noise. Won't matter over the long term, unless this is one of those end-of-the-world type viruses that will leave us in a world like the Walking Dead… but A. that's probably not going to happen, and B. if it did, then nothing will matter anyway, lol…

Otherwise, I tend to think these bad news things are enormously bullish as long as it doesn't end the world. Whether it's the fiscal cliff, trade war, coronavirus, brexit, they are all insanely bullish for the simple reason that the Fed / govts tend to overreact to make sure we don't go into a recession. That's just the way it is. This will work, of course, until one day it doesn't. But you can't really make a living betting that we are at the end of the line and that there are no more ways to kick the can down the road, or stimulate the economy…

But until then, every crisis is just another event with predictable responses by the govt which will overcompensate.

Plus, we are in no way a real bubble zone in terms of valuation. if it's true what Paul Tudor Jones said on TV the other day that this is a historically unprecedented era of stimulation that may be matched by a historically unprecedented bubble in stocks, then stocks should be a LOT higher… At least double what it is now, I think.

Now, this is not a forecast or prediction, and this is not what I would bet on, of course. But it would not surprise me if we did see such a bubble develop in the next year or two.

As I said in earlier posts, I think it would be completely within historical norms if over the next ten years, long term rates averaged 4% and the P/E ratio averaged 25x. It would be completely within historical range (based on relationship between rates and PE).

If that is so, then the current market is not even overvalued at all…

When you think of it this way, it's kind of scary. I would NOT want the market to enter a bubble as I would fear what's on the other side. But history tells us that this might happen.

I do not actually understand people who are short, and I am baffled that guys like Einhorn got caught up in the TSLA squeeze. If a stock is ridiculously overvalued, usually, there is nothing to stop it from getting even more ridiculously overvalued… I thought he lived through the internet bubble (which tarnished Druckenmiller and Robertson's records) and would know better… It's a cliche but true, the markets can stay irrational longer than we can stay solvent…

Oh yeah, and this all goes back to what Soros talked about in his Alchemy of Finance book. He rants against conventional economics as it's based on the tendency towards stability driven by rational market participants. His view was the opposite, that humans drive economies towards disequilibrium and instability due to self-reinforcing nature of trends, causing booms and busts.

A lot of fund managers operate under the assumption of mean-reversion. There is a tendency for mean reversion for sure (especially in the very short term and very long term), but mean reversion models break down due to this reflexivity that Soros talks about.

But anyway, that's a whole other topic…

Okay, I saw that this blog have so much value to give and so much valuable content. But I'm still amazed that why the author of this blog, whomever he or she is why he hasn't created his blog like other professional bloggers did on wordpress and why the author hasn't shared his name any where in the blog.