Munger

Munger is looking and sounding great at the DJ annual meeting (I wasn’t there; just watched the video). His ‘wretched excess’ seems to be more about private equity and venture capital than the public stock market. In fact, he said that tech stocks now are not like the Nifty Fifty stocks (he mentioned Home Sewing (?) trading for 50x earnings, and said that the current big tech companies are better businesses).

TSLA

Munger also said he would never buy or short TSLA. As I wrote in a response somewhere on this blog, I can’t believe how many people got caught in a short squeeze on this stock. If people don’t care about the valuation of a company, then obviously, a really expensive stock can get much more expensive. Trying to short that is like trying to short soybeans during a drought. You know with 100% confidence that the price will mean revert at some point, but there is no way to tell when it will revert and how high it can get before reverting. I saw this in Japan in the 1980s, in the U.S. in the late 1990s etc.

Bubble

I’ve said this here many times before, but for the stock market to be in a real bubble, at these interest rates, the P/E ratio would have to get up to 50x or some such. Who knows, this might even happen. One of the greatest traders of all time recently said that this might happen; the NASDAQ could double from here if we have another late 1990s-type bubble, which is possible with the current, ongoing massive stimulation combining low rates and huge budget deficits. How can this massive stimulation on a historical scale not be matched by an equivalently massive bubble?

Of course, I would not invest with that expectation, but if it happened, it would not surprise me at all. Remember, from my previous analysis, I would find it completely normal and not at all out of line if the market P/E averaged 25x over the next 10 years… and that may include times the market trades at 50x P/E, and times it trades at 10x P/E. But we just can’t know when these levels are reached; only that it is probable that they will be reached.

Again, this is not my prediction at all; I would not invest expecting such an outcome. I am just making a single statement that seems reasonable from the data I’ve seen.

Coronavirus

The market seems to fluctuate with each breaking news about the coronavirus, but I view it as a non-event. As value investors, we care about what a business is going to be worth five, ten years out, so it doesn’t matter how bad this coronavirus gets. Well, unless it gets really, really bad. I didn’t take any action, but my instinct during SARS was to just buy all the Asian stocks that were hit hard, especially airlines (Cathay etc.).

I feel the same way now. If the market tanks further on coronavirus (well, I know we are at highs recently but…), just stay sane and buy what becomes cheap and available. As Munger says, keep your head as others lose theirs (well, he was quoting Kipling).

But wait, I am no expert, so let’s just say this does get really bad, like the 1918 Spanish Flu. That was bad. 50 million people died around the world back then including 675,000 Americans. Quick googling shows that the world population at the time was around 2 billion, and the U.S. population was around 100 million. So the flu killed 2.5% of the world population and 0.7% of the U.S. population. A similar event now would kill 193 million people around the world, and 2.3 million Americans.

That would be quite a shocking event. By the way, did you know that the flu has killed 12,000-61,000 per year since 2010 in the U.S.? Between 291,000 – 646,000 people die of the flu around the world each year. I don’t mean to trivialize the coronavirus. We have to do what we can to stop it, of course.

Anyway, let’s take a look at the economic impact of such a worst case scenario (well, I know, there can be worst cases than 1918, of course. I am a big fan of The Walking Dead, 28 Days Later, World War Z, Shaun of the Dead etc… )

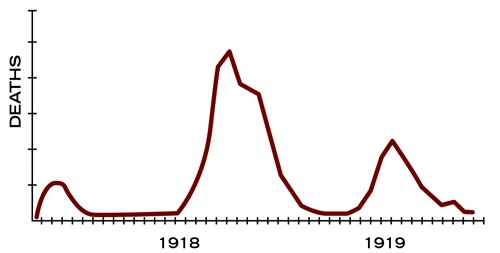

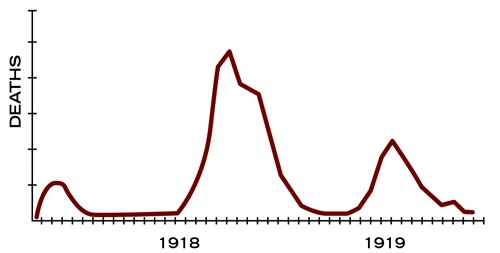

This is the chart of deaths from the 1918 flu from the CDC website. Not easy to read, but I think the deaths peaked in the 4th quarter of 1918.

Now, hold this image in your head while you look at the next chart. I couldn’t find anything to take a close-up view of this, but if you look at GDP from 1915-1920, there is no real visible blip.

Same with the stock market. Close-up views of the market between 1915-1920 also doesn’t really show much worth responding to in terms of stock market activity. There really is no visible or actionable blip as far as I can see. Again, you can google for a close-up and you won’t really find anything, I don’t think.

Of course, coronavirus is a terrible thing and it is disrupting a lot of people’s lives. There is no doubt there is a huge impact to many people all over the place.

But as investors, we have to keep our cool and not freak out over every new data point. There is no doubt that the numbers will rise over time, and I honestly don’t believe at all that there is no coronavirus in NYC, for example. I think the odds of that are ZERO. There is no way that there is no coronavirus here. It’s just that we don’t know yet how many we have, as apparently, NYC still doesn’t have a test for it so has to send samples down to Atlanta. Plus, most people I know do NOT go to the hospital for a fever and a cough. I certainly don’t, unless there is a reason to do so, or else I am told to.

So honestly, nobody knows how much is already here in NYC, and how much it is spreading. We won’t know for a long time, and we may never know.

This can get worse, may peak out soon, or they may come up with a vaccine soon too. Who knows.

Many argue that the globalized supply chain will make the impact of this flu worse than previous cases, but there are positives about globalization too, like communication and technology, that might make responding to the virus much more effective. But again, who really knows.

I just don’t think it’s worth spending too much time on.

Bullish

Well, actually, I am not bullish or bearish. I just am. But if I had to guess, I tend to think these ‘events’ are hugely bullish. This is sort of true for most exogenous events. Why? Because governments / central banks tend to overreact. We are so afraid of negative economic impacts that they will overcompensate. This often leads to bubbles, which is usually not good.

Think about the bubble in Japan in the 1980s; much of that was a response to the yen-shock (Plaza accord of 1985); the fear that the strong yen will destroy the Japanese economy contributed to the bubble in the late 1980s there. In fact, the same sort of FX bickering between the US and the UK contributed to the 1920s bubble. Greenspan’s fear of Ravi Batra’s Great Depression contributed a lot to the bubble in the late 1990s (and the various meltdowns from Russia, Turkey, Asia, LTCM etc. all of these contributed to the bubble as the Central Bank(s) overcompensated).

This happened again after the Great Recession, and will now happen again due to fears that the coronavirus will plunge us into a recession (and was sort of happening due to fears that the trade wars will kill the economy).

So every time something bad happens, it has just been enormously bullish, every time. Of course, this can’t go on. At some point, we will start pushing on a string, and the old tricks will stop working. That is also a certainty. And bubbles will pop every now and then, but only after a bubble becomes a real bubble, usually.

But, we can’t really know when this (the end) will happen. Unless you are sure that we have reached the end of the line, you have to asssume that these negative events will just be hugely and incorrectly overcompensated for resulting in huge rallies everywhere.

Anyway, this is not really a bullish proclamation on my part. I will remain neutral (but invested), but just an observation.

Love your insights. Rational, analytical, humble. Please keep posting. Always looking forward to the next one. Thank you!

Hey, the problem with WuFlu is not the body count. It's the friction it creates in any transaction. Education? If you are a Principal and a kid is diagnosed, you close the school. But when do you open it? How can you be 100% sure no more kids are coming to school with the virus that seem asymptomatic?

Supply chains? Obvious. Germany exports a big % of gdp to china, but that's shut down. What are multiplier effects overseas?

China's central bank has said that 3% GDP growth means the top 10 banks capital is zero. Running 6% now. With economy shut down…?

Just counterpoints to 'it's ok in the long run'. Best, J

True, body count is just an indication of the magnitude of the event. And yes, supply chain / economic impact is what people are worried about; cities shut down completely in China etc. For sure there is an impact, and that's the first level gut reaction of the markets. I just took a step back to see what the possible longer term impact is and I am not sure there is a real, actionable market event here, unless you are a HF trader… I'm sure this is great for the folks at Renaissance etc… who *love* emotional market overreactions… All I can be sure of is that you will lose money if you trade off the headlines… (again, unless you trade against them, or trade so fast that you are in and out before most other people).

On the "home sewing" comment, I believe that Simplicity Pattern which sold sewing patterns was one of the Nifty Fifty (or at least a stock with high valuation during the Nifty Fifty era).