Value of BRK Float

By the way, a while back, my big thing was that Buffett and others kept saying their float is more like equity, and some even proposed to add float into the valuation of BRK stock. Like, literally, take book value of BRK, and then add to it the amount of float as if it were equity etc. I thought this was interesting, but sort of nuts. My argument then was that this “float” was actually never even invested in stocks or even their operating businesses as, up until that time, the amount of cash and fixed income on BRK’s balance sheet was always around what their float was, and never below it. This was true, by the way, only post Gen Re.

And with interest rates so low, I argued that the float is not worth all that much to BRK in that case. It adds some incremental income for sure, but nothing big enough to value all of float as equity. But now, with rates rising, the value of float is increasing.

Float at BRK as of the end of 1Q 2023 was around $164 billion, and cash / fixed income was around $150 billion, so it is still very close to the amount of float. But what has changed since my last post about all of this stuff is that interest rates are now in the 4-5% range. OK, so on the short end, let’s say it’s 5%. Assuming all of the cash / fixed income can earn 5%, that’s $8.2 billion in additional pretax income for BRK, or $6.5 billion after tax (assuming 21%). With $500 billion in shareholders equity, that adds 1.3% of incremental return on equity to BRK. If you value BRK at 20x P/E, this float earning 5% will add $130 billion to the value of BRK ($6.5 billion x 20). Well, this is kind of circular; assuming something earns 4% after tax, revaluing it back at 20x P/E etc… Anyway, $130 billion comes to 26% of BRK’s book value. That’s a nice bump compared to when interest rates were 0-1%.

Value of Float in the Old Days

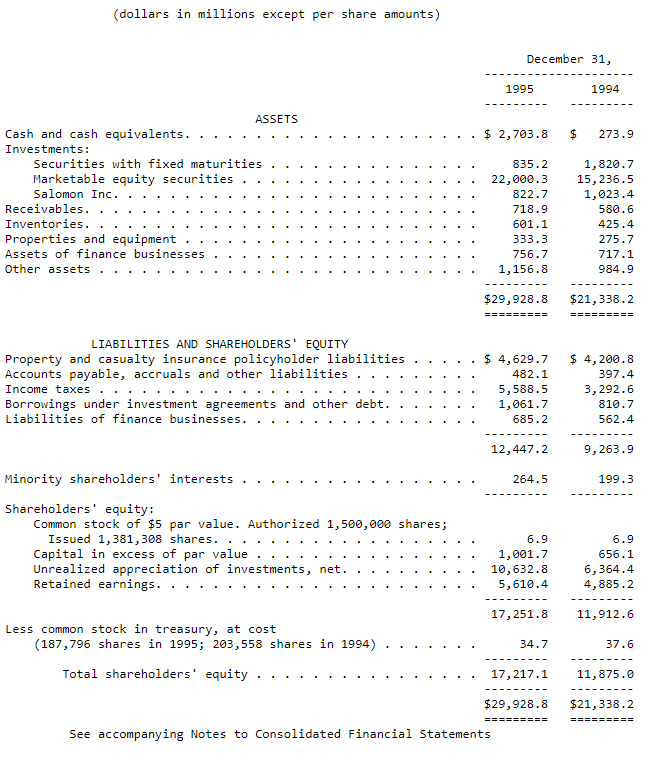

By the way, if you look at the balance sheet in 1994, 1995, it is kind of crazy, and shows you why BRK has such a strong record going back. This is before the Gen Re acquisition which dramatically changed the nature of the balance sheet.

If you look, the net worth of BRK in 1994 was around $12 billion, but they had more than $15 billion in stocks! And you can see that much of this was funded by, guess what? Float! $4.2 billion of property and casualty insurance policy liabilities, right there on the balance sheet (someone correctly pointed out in the comments that this is more funded by the taxes, not so much float. But float did fund things other than cash/fixed income back then). 1995 shows similar figures; $22 billion in stocks against $17 billion in net worth. BRK back then was actually, really levered to the stock market! OK, so this is not new to you guys as we’ve looked at all of this before.

How Bearish is Buffett?

This is also another thing we talked about here a lot. Sometimes, people look at the cash flow statement (1Q 2023), see that BRK sold $13 billion in stock but only bought $3 billion, so he is getting bearish. First of all, we all know that Buffett doesn’t use market forecasts to buy or sell stock. He is not going to sell something because he thinks the market is overvalued, or because he thinks a recession is coming. So reading into short term market activity is meaningless in any case. Also, one has to consider that BRK is buying businesses too, other than stocks. In the 1Q 2023 you will see that he bought more of Pilot, something that won’t show up in purchases of equity securities, but to me, is exactly the same thing, meaning, he is converting cash to equity exposure of some business. From the 10Q:

On January 31, 2023, we acquired an additional 41.4% interest in Pilot Travel Centers, LLC (“Pilot”) for approximately $8.2 billion. We previously owned a 38.6% interest in Pilot and accounted for that investment under the equity method. We now control Pilot for financial reporting purposes. We applied the equity method through the end of January 2023 and began consolidating Pilot’s financial statements in our Consolidated Financial Statements on February 1, 2023.

People also talk about the large amount of cash on the balance sheet as an indication of Buffett’s bearishness. Yes, this is sort of true. Buffett has complained about not being able to find things to do in this expensive environment. But the large amount of cash, even compared to shareholders equity is misleading.

For example, it is true that BRK only owns $328 billion in stocks against $500 billion in equity. This looks bearish, compared to say, back in 1994/1995 as you see. That looks like equity exposure of only 66% or so.

But as we all know, BRK has been buying a lot of operating businesses. For example, Burlington Northern now is a wholly owned subsidiary. Owning 100% of something is no less ‘equity exposure’ than owning just some of the stock. Right? So our equity exposure is much higher than 66% if you include all the other operating businesses. What is that number? Let’s say we include equity method investments (which is clearly equity) of $26 billion, and the book value of the Rails, Utilities and Energy business of $140 billion. That’s $166 billion. Add that to the $328 billion stock portfolio and you get $494 billion. And this doesn’t include some stuff in the “Insurance and other” (where I assume manufacturing, services and retail is), and we are already pretty much at 100% equity exposure. That, to me, is as good as “fully invested”.

How is that bearish? It’s not, actually. Bearish is if you take all those businesses / stocks and actually sell it down so your actual net equity exposure to all business is way below your shareholders equity. If you tell me that the above $494 billion is actually $250 billion, and the rest is cash, then I would agree BRK is waiting for the end of the world.

As it stands now? Not at all.

OK, so I did all of this stuff quickly, so I may have missed something here or there, but I think the gist of the argument still holds. This is a very different situation than when a mutual fund holds a lot of cash. It’s not the same in this case at all.

What Does Buffett Think of Interest Rates?

This is the sort of thing that Buffett would hate because I am going to tell you what he is thinking, and I will do so without having any idea. So, having said that…

Rates are now back up to over 5% on the short end, and almost 4% on the long end (10 year). What does Buffett think of interest rates? Well, he won’t tell you. He will probably tell you he thinks long rates are too low and that it can’t stay low forever, but that’s all.

But let’s see what he is doing to see what he thinks of interest rates. With the long end approaching 4%, does Buffett think bonds are interesting?

Below, I went back through the recent 10-K’s (when you get old, even going back 25 years is recent, lol…) and jotted down the cash and fixed income investments at BRK. This way, we can actually see when he started to get allergic to long term bonds, and then we can see if he is getting interested again.

First of all, I can tell you that fixed income on BRK’s balance sheet has been steadily in the $20s billions, despite net worth, cash etc. increasing over the years. Spoiler alert: in the 2023 10Q, this is still $23 billion, so he is not expressing any interest in bonds yet.

| Cash | TBills | Fixed income | FI% of Liquid | |

| 1998 | $13,582 | $21,246 | 61% | |

| 1999 | $3,835 | $30,222 | 89% | |

| 2000 | $5,263 | $32,567 | 86% | |

| 2001 | $5,313 | $36,219 | 87% | |

| 2002 | $10,294 | $38,096 | 79% | |

| 2003 | $31,262 | $26,116 | 46% | |

| 2004 | $40,020 | $22,846 | 36% | |

| 2005 | $40,471 | $27,420 | 40% | |

| 2006 | $37,977 | $25,300 | 40% | |

| 2007 | $37,703 | $28,515 | 43% | |

| 2008 | $24,302 | $27,115 | 53% | |

| 2009 | $28,223 | $35,729 | 56% | |

| 2010 | $34,767 | $33,803 | 49% | |

| 2011 | $33,513 | $31,222 | 48% | |

| 2012 | $42,358 | $31,449 | 43% | |

| 2013 | $42,433 | $28,785 | 40% | |

| 2014 | $57,974 | $27,397 | 32% | |

| 2015 | $56,612 | $4,569 | $25,988 | 30% |

| 2016 | $23,581 | $47,338 | $23,432 | 25% |

| 2017 | $28,673 | $84,371 | $21,353 | 16% |

| 2018 | $27,749 | $81,506 | $19,898 | 15% |

| 2019 | $61,151 | $63,822 | $18,685 | 13% |

| 2020 | $44,714 | $90,300 | $20,410 | 13% |

| 2021 | $85,319 | $58,535 | $16,434 | 10% |

| 2022 | $32,260 | $92,774 | $25,128 | 17% |

10-year treasury yield

Bond Allergy

So when did Buffett start to get away from long bonds? It is clear from the above table that he really started to dislike them in 2003. There is a clear pivot in that year, when cash rose a lot and fixed income investments went down. He seemed fine with bonds in 2001 and 2002, when they were around 5% or so (from the above chart. Please ignore the crosshair and mark on 8/3/1998; that is totally irrelevant; it’s just where the mouse happened to be when I “snipped” the image and saved it… Geeky as I am, I couldn’t figure out how to do this without that appearing (but I didn’t spend time trying to figure it out either…))

So it is clear that Buffett started to really dislike bonds when it started to go below 5%. I was going to argue 4% is the level, but you see rates above 4% for a few years after 2003, but Buffett didn’t bite; fixed income levels remained low, which seems to suggest 5% is the level he won’t accept anything below. The slight rise in this during the financial crisis could be from the emergency financing he did for GE, BAC and others, but I didn’t check. I think those were factors other than the general level of interest rates, so we can ignore that rise in bond holdings during that period.

5% is Buffett’s Bond Floor!

So, reasonably or unreasonably, I am going to assume that 5% is the point Buffett won’t go below for long term rates. This is interesting to me for various reasons. But the most important one is that I am sort of anchored to my own scenario of 2% economic growth, 2% inflation, so long term rates are 4%, so fair market P/E is 25x. I know, I know, I still feel very uncomfortable when I type that, lol… This is not easy. I am no bubblehead as you guys know. I am just leaning against my own biases and anchors.

But I was trying to think what Buffett would think of this, and the above analysis is relevant. If he is not going to accept 4% long term bond yields, then he really can’t accept 25x P/E ratio for extended periods of time either.

But 5%? If he can accept 5% yields, would he accept a 20x P/E? I think he would accept that.

I think years ago, someone asked him what his discount rate is for pricing stocks, and I think at the time he said it was 8%. This is very vague memory so I may be totally off. And then he was asked if he would adjust it for declining interest rates, and he said he would, but not all the way. Meaning, he has a floor below which he won’t go regardless of how low interest rates go.

Could 5% be that floor? I don’t know. But I am going to assume that may be the case.

Again, I am just typing some random stuff, so don’t go taking this as gospel. I’m sure some people would think this is interesting and nod along, but many others will just laugh.

Advice For Younger People

By the way, a hallmark of this blog are the long, unrelated tangents so here we go again. I am actually in no position to give anyone advice about anything, but for my own kid, I did encourage early STEM exposure. I do think math and technology is really important, even if you are not interested in becoming a programmer or engineer.

Look at it this way. JPM, during their investor day, proudly announced that more than 3,000 of their regular employees were trained in Python (a popular programming language). They said they are not trying to turn all of their employees into engineers. They hire good engineers, so they don’t need that, but they do want their employees to be more productive, and being technologically competent goes a long way in doing that. I totally agree with that.

If you are young, get some exposure to it. You don’t have to be like Gates or Zuckerberg. I dabbled in programming in high school (just BASIC and some machine language on a TRS-80), but was never a serious programmer (well, I did spend a lot of hours on it, though), BUT that exposure back then helped me immensely later on (like when I had to write trading algos in C, it was not that hard).

I have noticed over the years that there was a huge difference in kids who had some exposure to that stuff, and those that didn’t. Not always, but often, adults who had no exposure to any of that stuff had trouble learning when they needed to. You all know those guys that can’t even do the simplest things in spreadsheets. Well, imagine trying to teach them to do some very simple data analysis in a Jupyter Notebook if they have never done anything like programming before. Someone asked me recently to teach them, and they had trouble getting through a beginner book. It was very hard for them (he was in his late 40s, early 50s range), and they gave up.

Language doesn’t even matter. Python, Java, C, C++, whatever…

There is no doubt that in my career, having that tech edge helped me immensely. I was never as able as any of our engineers or scientists, of course, and I really suck at math but I was way above all the other non-engineers. Traders, management etc… So that gave me an edge for sure, wherever I went. And I was able to interface with engineers way better than others too just because I understood what they were doing.

In fact, in my first job in finance, the research department initially had only one computer,and it was a Univac. lol… Seriously (even then, it was already really outdated). But guess what? I was the only person in the whole research department to be courageous enough to even approach it. Same with when we first bought a bunch of IBM PC’s. Obviously, this gave me a huge edge, and people thought I was really smart (but I really wasn’t… I just knew stuff they didn’t know because I had dabbled with computers before).

Now, for many people, it won’t matter. People will say, just spend all your time reading annual reports, SEC filings, learn as much as you can about any and all businesses etc… This is definitely true. Nothing wrong with that approach, which worked for Buffett and many others, and will continue to, probably.

Also, for math, I tell people if they listen to do calculus and linear algebra. Again, doesn’t have to be to a mathematician’s level, you don’t have to become an engineer, but just basic undergrad calculus and linear algebra (and probability / statistics, but I think everyone does that anyway, especially business majors).

Well, having said that, if you do study probability / statistics, do it well and thoroughly. I think I mentioned before I was horrified at how often I had serious arguments with people, college grads working on Wall Street, explaining to them what gambler’s fallacy is. So many people think that if you flip a coin and get head 4 times in a row, that your next toss is likely to be tails, lol… I am not kidding. These are not your Jay Leno Jaywalking people, but people who have graduated expensive private colleges and work at major Wall Street banks.

Anyway, my kid asked me why calculus is important, and I told him it is very important because everything depends on it. Linear algebra too. Where is linear algebra not used? Economics? Yup. 3-D gaming (cuz he loves games)? Yup. It’s all linear algebra. Financial / stock market modelling? Yup. Machine learning / AI? Yup. There is literally nothing it doesn’t touch in some way.

But you don’t have to become an expert. We have computers and calculators. But you have to know what those computers / models are doing at some level. I guess it’s kind of like how we learned how internal combustion engines work way back.

For older people well into their careers, I don’t know, this may not be all that meaningful. If you are looking for a hobby, I do think it’s a great one. There are a lot of hobbies out there. Pickleball is all the rage now in NYC (probably across the country). I won’t knock sports / exercises; they are great things to do. But learning programming, doing some math can be a lot of fun too. The thing about programming is that it is something that you can actually use and do something with.

I do wish I spent more time on some of this stuff when I was younger. I didn’t realize how much I enjoy it until much later in life.

A funny conversation, though, was when I was out with a good friend; we’ve been friends since elementary school, and my kid. He is a professional programmer and I am a Wall Street dropout. We were talking, and I told my kid, if I had to do it all over again, I’d go into tech. And then my friend said, if he had to do it all over again, he would not do tech, but would do business. I said, why? You are so smart, and you love figuring shit out. He is just an engineer, to the core, even when we were kids. He said, well, he lived in Silicon Valley for years and worked at startups and never really got paid (he said less than 1% of people in the Valley get big IPO paydays), but noticed that all the business people always walked away with tons of money, lol… Oh well…

So there is that, so maybe just ignore all of what I just said. Well, my advice was not to go into tech, necessarily, but just get some exposure to it early so you plant a seed there that might grow in the future. But yeah, you ask 10 people for advice and you will get 10 different answers, for sure…

Good post BI. One comment, when BRK had stocks > equity that may have less to do with levering the stock port and more to do with the effect of deferred taxes.

Oh yeah, good point.

Thanks for penning down your thoughts.

I am kind of curious to know why the impact of interest rates in totality has NOT been considered when calculating the incremental value addition to shareholders?

For example, rates rising by 4% (let’s assume for a moment that is ALSO the rate of inflation) adds 130 bps to RoE%. But in real terms, am worse off when inflation rate has risen from 0% to 4%.

Good question. Inflation is certainly not a good thing, but that is usually reflected in interest rates as rates go up. But over time, good businesses have pricing power to be able to make back rising costs. The dollar has lost 98% of it’s value over the past 100 years but the Dow has gone from the depression low of 40 to 35000, more than making up for it.

Nice avise on programmming.

Nice post

I had lost you and thought you’d stop posting b/c your old site wasn’t updated. So glad I’ve finally found your posts once again. Your posts remind me to stay grounded in my endeavors at intelligent investing. Thank you.

Seems to me Buffett bought several billion in high-yield bonds around the turn of the century…he put a slide up at the beginning of one of the annual meetings (my recollection was that TYCO was one and the yields were astronomically high resulting in Buffett saying “you don’t need to many investments like this in your lifetime). Perhaps price dislocation may explain the increase in fixed income during early 2000s more so than higher nominal interest rate. As an aside, I think Howard Marks made similar investments and likewise profited handsomely. Nevertheless, I too have used BRK’s balance sheet as a way to “read the tea leaves” on what Buffett is thinking…I’m not sure it’s really been that helpful but it has helped me thought about diversification and risk management.

Good point! He did buy $8 billion in junk in 2002, but he also had a lot of fixed maturity investments before that. But you are right, we can’t assume all of this is just due to nominal rates etc…

Hi

I have worked in Big Tech for years and your story about your friends advice 100 % resonates with me. I tell my son as well if I had to do it all.over again instead of getting a PhD in STEM field, I would have rather gotten a business degree or better yet figured out a way to start my own business.

Yeah, I sort of understand that too. I guess you have to understand some business to do well. This is true for artists / musicians too; they need to understand business more so they don’t keep getting screwed by business people, lol…

But my reservation with business education is that there are so many people I know in business that are totally clueless and have, like, no skills at all, and oftentimes, it’s the people who just bullshit their way through everything and somehow makes money, others don’t, they end up in a cubicle for decades… they then get fired in middle age, and they have no skills at all as they worked for one or two companies for decades (and therefore, their internal company rolodex is not transferable, so are therefore useless to any other organization).

Even MBA’s, are often totally useless, know very little, and have zero skills (spreadsheet is not a skill, in my mind, lol… and yet some people put Microsoft Office, Excel, on their resume, lol…).

Anyway, yeah… it’s a tough question…

Thank you for this. This is your first post I read, and I really enjoyed your prose and ideas.

Would you mind answering two questions for me:

When you went back 25 years on Buffett’s fixed income and hypothesized WB likes 5% long-term yields, did you map out where inflation was relative to the treasury? I wonder if he’s also looking at the arb spread he gets. I.e., if inflation/inf. expectations still give him that arb at 4% long-term yields would he bite?

Additionally, just so I make sure I understand when you say long-term rates at 4% give you fair market p/e at 25x (5% 20x), my interpretation of your sentences is the stock market would be priced fairly at 25x (20x). So equity yields=debt yields. Is that what you’re implying? I must be missing something here because if bonds are trading at 4%, that should pull back equity valuations, so a fair market equity P/E would be considerably lower to get that same equity risk premium (idk how to do the quick math and you would seem to know better).

No, I haven’t looked at real yields at all. These are just really simple, broad observations. And the 4% = 25x P/E is just the old FED model, how Greenspan presumably estimated the fair value of the market. I may be overstating that, but that is sort of what people called it years ago; equating 10-year yields and earnings yield. If you look at old graphs, they used to track well in the 70s into the 2000s until rates got really, stupid low… Anyway, I may write something about that again.

Also, for expected returns of the market, Buffett said in an old Fortune article from 1999 that it is simple nominal GDP growth + dividend yield, is what you would expect the market to return over time.

As for equity risk premium, the Buffett / Munger crowd has no interest in that sort of thing, even conceptually. I think someone asked them about equity risk premium (and lack thereof in recent market valuations; this was years ago…), and Munger said it’s nonsense… He said he’s never seen it before and doesn’t mean anything. Of course, Buffett/Munger have both long dismissed CAPM and these financial models etc… so that’s no surprise.

I don’t know what to do with it either, although I used to read a lot about it. But I don’t know that anyone has ever gotten rich off of the concept (except for maybe selling books).

Thank you for the detailed reply back. Much appreciated.

I was unaware of the “Fed Model” until last night and did some reading up on it.

we are one nuclear accident away from MINUS 10% interest rate. Think about that when you consider the possible outcomes.

on the other hand, supply shocks in that environment we could be at PLUS 100% interest rate too. The outcomes are so extreme and possible in a risky world I would be very worried to anchor on anything like 5% , but who knows, which is why interest rate predictions are rather difficult. What you want is a fortress company. Whether that means lots of cash, or lots of real world industry..I’ll bet on industry over cash. However low debt seems prudent either way.

Exactly. In fact, my next post is going to be partly about inflation, and owning fortress businesses etc. I would not anchor anything on 5% either, of course. I have no idea what interest rates will be in the future and it is utterly foolish to try to guess it and make investment decisions based on it. This is why I don’t spend so much time on things like that. In investing, it’s more important to not miss the trees for the forest! (Munger says, invert, always invert!)

BRK float is actually about $116 Billion in cash + FI (page 34 of Q1). The amount of cash plus fixed income seems to roughly equal the unpaid losses, but it seems like they’re ok investing the retroactive reinsurance float into equities. The rest of the cash is not held inside the insurance company, some of it required by the operating companies to use day-to-day, but about $20 billion of it at year end 2022 was held by the parent company to be deployed in buy-backs (page K-116 of 2022 report).

tbh i’m a bit confused. Let’s say brk shows 130b on the cash side. How much of that is part of the float and how much is outside (i.e. investable 100% in equities). If part of that figure is inside the float, I assume it can mostly only be invested in fixed income , just like any insurance company, with some amount allowed for equities. They said they can do more than a regular insurer but not sure if that means 30% or 50%.

It’s going to vary based on the regulator. Generally an insurance company’s float is about 80% of assets, and invested assets are about 80% + fixed income (funded by float) and 20% in common stocks (funded by shareholder’s equity). See Progressive’s 10k for example.

BRK is different. Cash and fixed income is about 25% of assets and common stocks are 75%. Float funds 37% of total assets. There is so much additional shareholder’s capital that regulators seem to be ok with float funding some common stocks.

also, regulators are also ok with BRK being even more aggressive: “Without prior regulatory approval, our principal insurance subsidiaries may declare up to approximately $35 billion as ordinary dividends during 2023.” (page K-92).

So, at year end 2022, you have $164 billion of float funding $438 billion of assets, of which $116 billion is cash and fixed income, but $35 billion of that can be distributed. So really, only $81 billion of the $164 billion of float is required to be kept in cash+fixed income.

I would imagine it’s likely that they could get approval to be even more aggressive .

Testing