It’s been a long time! Sorry about that. Very often this year, I planned on posting more, but one thing after another keeps popping up. All good stuff, and it’s good that there is so much for me to do, but it does take me away from spending time writing here. As for markets and whatnot, I thought I would be spending more time digging for more interesting things, but as I said, I have sort of become a lazy investor in the past few years, just letting things that work ride. Why mess with what’s working? Of course, this has led to my portfolio becoming quite tech heavy, and as I said last year, I did start trimming some things, and I have done some of that this year too. And, in fact, this morning too (the market is up 1400 points! Congrats to the MAGA people!).

I have not been shorting at all over the past few years but I may start looking into it going forward. I don’t have any specific ideas, but it’s just a thought.

For the first time in a while, I feel like we may be coming closer to some inflection point of some kind. It feels like I am going to have to start rolling up my sleeves and do some work to find some other things (I am and have been fully invested all this time, but maybe time to move some things around). I remember a few years ago, I sold out of almost everything and started fresh and performance was really good. I guess it’s good sometimes to sort of clean out the closest! Anyway, I am not sure. If so, I will post here, of course.

Mean Reversion / Value

Over the past few years, people have kept talking about mean reversion to value and whatnot, but I have ignored that for the most part for the reasons I’ve been saying here. The growth / value spread just seems to me so much reflecting values being taken away from the old economy into the new one. Yes, sounds like 1999 bubble, but it just seems true. Retail just seems to be going down the drain, old school marketing / advertising just seems to be losing to online marketing etc. I shop more and more on Amazon, Costco online for things I used to run to the corner drug store to get; soap, shampoo, paper towels, whatever. I don’t even bother going to those places anymore because in NYC, they just lock everything up so you have to call staff to get it opened. But of course, to cut cost, they fired everybody so there is nobody around to open them for you. What’s the point?

Who watches linear TV these days? Except sports? There is just a massive transfer of wealth going on at so many levels, and the market sort of reflects that. So the growth / value convergence argument just sounds more like a long horse carriage makers / short auto makers trade. Well, OK, given that most auto makers that were ever launched has failed, maybe that’s not a good analogy.

The massive transfer of wealth has been going on for decades, or more than a century. Industrialization just sucked the wealth and value out of skilled workers / craftsman and transferred it to large corporations via factories. Formerly skilled workers were transferred into factories that required no skill (therefore, lower income). All the value-added accrued to the owners of the factories (capitalists). Same with national chain restaurants and retail. WMT transferred wealth from the local shops / restaurants to Arkansas; former store-owners end up having to work at WMT for lower pay (as unskilled workers). This is nothing new.

Now, the same thing is happening at so many levels at the same time that it is quite frightening. Just as a simple example, I’ve mentioned this before, but companies like Squarespace and Wix (or free options like WordPress) have sort of wiped out a large part of the web development world. People who knew a little HTML / CSS / Javascript might have been able to make a living not too long ago, but not now. All that ‘wealth’ is transfered to the companies that provide the platform for people to build it themselves.

Photographers are complaining for similar reasons. You no longer need to hire a photographer for low-end projects. You can just buy photos from various photos sites for very low prices, or even have AI generate the exact photo you need. I have used AI to generate artwork, photos and text in various volunteer work, and it is scary. I thought to myself, jeez, I would have paid an art student $300 for this 3 years ago; now I do it for free online via AI. Same with music. I can create my own music using AI with no skill / expertise at all, but just creating it via a prompt like, “A hip hop song with a Brooklyn 1990s vibe that talks about how value investing is dead”.

Everywhere you look, entire categories of work is just being completely wiped out, and all that ‘value’ or ‘wealth’ is simply transferred to the owners of the technology that provide the platform to do this.

Anyway, I know I’ve talked about this stuff before and I’m just repeating myself, but this is why when people say the stock market as a percentage of GDP is going up, the concentration of stocks in the market is getting too high etc., I think it is obvious that this is happening because the wealth and value is actually being more and more focused and concentrated, so the market is only reflecting reality. I don’t think it’s a stock market problem. It might be a social problem, political problem, or whatever. But to me, it’s not really a stock market problem. Wealth is actually being transferred to these top tech companies on a massive scale, and they are gaining more and more control.

Industrialization transferred a massive amount of wealth from laborers to capitalists. Now, big tech is taking everything over, and there is a massive transfer of wealth from labor and industry, even, to the technologists. OK, this seems a bit oversimplified, as industrialization has benefited more than just the owners of capital, just as technology is benefiting many more than just GOOG, MSFT and AMZN.

Munger

Yes, I know, Munger passed away about a year ago. Of course I thought about posting something but never got around to it as I didn’t really know what to say. I can’t add anything to what everyone has already written. I just hope Buffett is OK. The first thing I thought of was how this would affect Buffett.

Some of you younger folks may have missed this book, but I really enjoyed it when I read it years ago:

Buffett Liquidating!

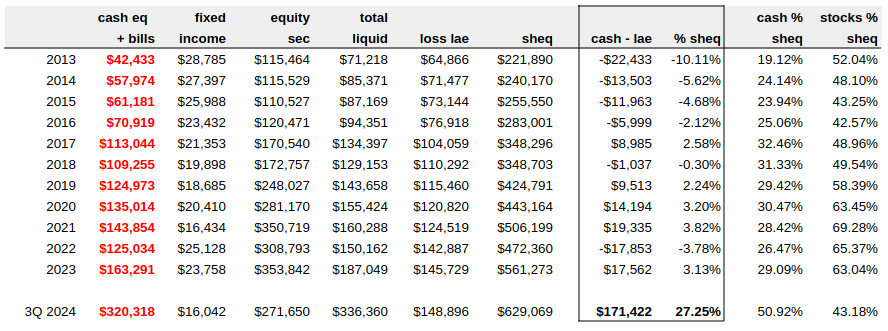

OK, so getting to the topic of this post. Berkshire’s cash position has been a topic for a very long time. I posted something a while back about how that cash is actually not a drag on the BRK portfolio as it pretty much covers, dollar for dollar, BRK’s float. I created a similar table starting in 2013 to see what’s going on in that respect, since the 3Q 2024 (and earlier 2024 quarters) report has been raising eyebrows.

The table below is just some stuff I pulled from the 10-K’s. Loss lae is just that, the loss and lae (including from retro contracts), so this is not really the ‘float’ that Buffett talks about (which would include unearned premiums and other items), but I just use this as a lazy proxy… Close enough.

And you see that what I said years ago still held true from 2013 all the way, pretty much, through 2023. If you look at the excess of cash equivalents plus T-bills vs. my fake float, it has tracked closely, and has been less than 4% of BRK’s shareholders equity in most years. I know Buffett was asked about this at one of the annual meetings a while back and he said that it is a coincidence and that BRK does not intentionally hold cash to match float.

Anyway, look at 3Q 2024. Nuts! Cash went up to over $300 billion. Cash as percentage of shareholders equity is 51% vs. the usual range of 25-30% in the past 10 years. And cash excess over float is itself now $170+ billion, or more than 27% of BRK’s shareholders equity. So this is big.

Interestingly, though, equity holdings as a percentage of shareholders equity is still 43%, down from 69% in 2021, but it’s not a huge change from what it was in the 2013-2017 period.

Anyway, these percentages are not all that relevant, actually. I am just looking at it to get some perspective. Equity portfolio as a percentage of shareholders equity, as I said many times before, is not so meaningful when BRK owns so many businesses in whole. What’s the difference if BRK owns BNI as a stock (and shows up as an equity investment), or owns the whole thing outright (and doesn’t show up as an equity investment)? None, really. It’s still equity ownership.

Anyway, OK, so where am I going with this? Why does Buffett have so much cash on hand now, way more than before? Of course, nobody can say for sure. But some things do come to mind. First, Buffett did offer a hint that he doesn’t like asset prices up here, and is skeptical that rates can remain this low. Look at the fixed income holdings column. Despite long term rates going up to over 5%, back down to 4% and heading back up, he has not bought any bonds. Also, taxes are really low now, and he has said this is not sustainable either. He probably feels that tax rates will go up from here. So selling now and realizing a lower tax rate is not a bad idea, especially when his favorite stock is so expensive now.

But I don’t believe this is market timing, necessarily, either. He is just doing his usual thing. This large selling and huge cash pile may be more a function of how successful the Apple investment was, and how dominant it became in the portfolio. I know he is not the type to rebalance a portfolio because of too much concentration, but selling an expensive stock for a low tax rate before it may go up certainly feels right. If Apple didn’t do so well and get so big, would BRK have $300 billion in cash now? Nope. It is more about how incredible the Apple investment was rather than how bearish Buffett has become, I think. Without Apple, he would have had to sell his entire equity portfolio to raise cash so high. Instead of seeing this as a way to get more defensive by raising cash, it feels more like going back to normal after Apple boosted the equity portfolio so much (but again, he wouldn’t do this to rebalance. Definitely about Apple valuation and tax rate). As some fund managers say, the cash position is a result of investment actions, not the goal.

So I think the above is most of it, but something else nags at me, and that is something I thought about years ago. As he gets older and starts to slow down, I wondered if he would start to simplify the portfolio and sell things that might not be so great anymore and leave the next generation a more liquid, fresh slate to work with, so as not to have to worry about any sacred cows. But again, he is not selling AXP, KO or anything like that, so maybe this has nothing to do with it. But if he did start selling things like that, I would not think it’s a horrible idea.

Market Valuation

As for the market, my views haven’t changed at all. I still stick stubbornly to the old Fed model. I’ve heard the arguments against it, but it is what it is. I don’t claim this to be the correct theoretical fair value of the market or anything like that. I just use it as a sanity check for myself; if the Fed model is in line, more or less, then I am fine with the market. However, as I’ve said before, if the 10-year interest rate goes down to 1% (which it did), I don’t believe the market should trade at a 100x P/E ratio (which it didn’t). So there is some floor to this. And the market, to me, was rational post-crisis in not chasing down earnings yield along with long term rates. So, with the 10-year at 4%, I am fine with a market P/E ratio of 25x, and at 5%, 20x P/E sounds totally reasonable to me.

A lot of people a lot smarter and richer than me say the market is and has been overvalued, but I just don’t agree with them, unless long term rates move up a lot for an extended period of time.

Deficits

A similar group of very rich and smart people are saying that long term rates can’t stay low and they must move substantially higher due to these unsustainably large and growing federal deficits. Do I worry about that? Yes. But, I look to Japan as the model of an aging society and growing government deficits. Sure, there are plenty of differences (Japan is a high savings nation), but I still can’t get around the fact that slowing population growth and maturity of the U.S. economy would make growth harder to achieve going forward. Almost certainly, we can’t get back to the growth of the post-war baby boom generation. So given that, how do interest rates go up? Deficit-driven inflation? We haven’t really seen that in Japan, and even in the U.S. until Covid and Ukraine. So is the recent inflation really deficit-driven inflation? Or exogenous event-driven inflation? Maybe a combination of both.

This is not to say I don’t care about deficits. Of course it’s a problem, and we need to deal with it at some point. My opinion is just seeing things as an investor. I am just telling you why, as an investor, I am not yet concerned too much with the deficit and inflation.

This is not to say that we won’t have crashes or mini-crashes now and then, say, when a treasury auction fails (maybe for some technical reason or glitch), or some other trigger.

When I was in the hedge fund world, the Japanese bond market was known as the widow-maker, as so many funds lost so much money shorting JGB’s, mostly on the argument that their deficits are unsustainable. That is my analog / model when looking at this in the U.S.

Again, this is not a Cheney “deficits don’t matter” argument (he actually probably meant it only in the sense that it doesn’t matter for elections). Just a, “as an investor, deficits don’t matter”. Of course, at some point, this will lead to impacts on the economy and the stock market, but then we start to tread into economic forecasting territory, and we all know how that sort of thing ends.

CMG / CAVA

By the way, I posted about Cava not too long ago. It’s a great place to eat, and the stock is doing well. I don’t own it and am not particularly interested in it at the moment. I don’t need another CMG; I would rather look for something else.

But one thing I do think about when I walk past a Cava is that as much as everyone says it’s the next CMG, I don’t know if people realize that Cava now, even if it is just like CMG and is run as well as CMG (not sure about that, but let’s just say…), Cava is competing in a very, very different environment than when CMG was coming up.

I remember people coming up and asking me all the time back in the mid-2000s on, hey, is there another chain like CMG? Something that’s better than fast food, but faster than sit-down, full-service restaurants? At the time, I said no, not really… There weren’t a lot. Maybe Panera came up at some point.

But today, you walk around, and you have Sweet Green (I love the food), Just Salad, Shake Shack, Five Guys, and many, many other fast casuals / upscale fast food, that serve food above the traditional fast food quality. Food courts too have popped up all over the place serving decent quality food, even though those sometimes feel like mediocre food at super-high prices ($20 burritos etc…). But it is still definitely better than fast food!

Post More?

Yeah, I am tempted to say I will try to post more going forward, but I think I said that a year ago. One of the things I promised myself when I started this blog (what’s a blog?!) back in 2011, is that I will only post stuff when I have something to say. The sort of internal rule for me was that I would only post when something was meaningful enough and I did some work on something. This is why, going back, you will see that most of my posts will have some sort of table, chart or some data. What I did not want to do was to just post a bunch of opinions, rants, and things like that, that take no time. Often, that sort of blog just turns into an endless stream of rants about the same thing over and over again, with no additional information or added value.

So yes, I often see stuff and I will want to say something, but if it’s just some criticism of this or that, that is not even actionable or interesting, I won’t post it. It’s just a waste of everyone’s time.

Glad you’re back! Did you see the Brooklyn Investor Bat-signal?

https://x.com/LibertyRPF/status/1851340836992155786

Cheers 💚 🥃

lol, no I didn’t see that, but that’s great!

Well, I hope you follow your historical pattern and we get at least a handful of posts before you disappear again.

I’ve been reading for over 10 years, and I hope you keep writing for a long time!

I applaud your “I’ll talk when I have something meaningful to say”. Imagine all the people doing that, what a wonderful world!

I disagree on the US-Japan comparison and long term prospects about America, echoing a Buffett-calling himself”Pollyanna” (I don’t remember exactly in which meeting)….Many immigrants (and not) like me will continue to put money, talent, ingenuity (hands and brains) in the american system provoking the vicious circle of greatness that the country experienced in the baby boom or you name it. It ‘ll be different and it can be less staggering, you don’t need to grow at a crazy pace to experience a great progress.

If you have experience of investing or running and owning a business abroad (I can tell about Europe) you will find how they are still struggling to figure out the secret recipe America found many decades (if not a couple of centuries) ago..

Just to clarify, I didn’t mean that the U.S. would follow Japan into a lost decade or two. I agree we are much better off and I doubt we would go down a similar path in that sense.

But what I meant was that I don’t think we will go back to the high growth we had post WWII (demographics, mature economy etc.), and therefore, interest rates would not really go back up to 7-8% over time (if you believe my long term interest rate model of LT rates = nominal GDP growth) etc… And as for the federal deficit, it is a problem, but my point was Japan has been increasing their federal debt to GDP for years, levels much higher than the U.S. without causing higher interest rates, so it is possible this can happen in the U.S. too; much higher debt to GDP without too much adverse impact on interest rates… That’s sort of what I meant that Japan is the canary in this sense. One could argue Japan self-funds their debt domestically, but the U.S. has some advantages too…

That was more the point I was trying to make.

Anyway, the U.S. system is much more dynamic, U.S. companies much more responsive, flexible, agile etc… than Japan…

Such a great post! Always enjoy reading your perspective!

Thanks!

+1

Thanks for your article and great that are back

Another welcome back! I have enjoyed reading your thoughts and appreciate you taking the time to share them with us for many, many years. I hope to hear more from you but if not…patience is a virtue. Thanks again!

Thoughts on a potential major P&C or financial svcs acquisition by Buffet? Chubb, etc?

No opinion, really. I know insurance has been their strength all these years, but with Buffett slowing down, and Jain too, not so young, I wonder about the insurance business going forward…

Thanks for your thoughts on BRK. Always insightful and appreciated.

Allways happy to read your thoughts, thanks! Buffett is selling not only Apple though (BAC, BYD), but I can not believe it is some kind of a market timing either. I guess more likely related to the inevitable transition. As for the market, I think for me this relationship between rates and PE would brake somewhere in the 30-40x area, until then, this formula is just fine:)

Great stuff as always. The $320.318 Billion Q3 “cash” figure is not directly comparable to the rest of your table because of the $14.868 Billion liability for T+1 settlement of T-bills. I would knock that figure down to $305.48 Billion to keep it consistent.

Nice catch, but this is close enough. I just mechanically listed the same items without checking offsets (float is very rough too) etc… Thanks for pointing it out, though.

What importance would you ascribe to Jain’s Berkshire sales?

This was an epic post!

Thanks. I don’t know, but when I saw the headline, I just assumed it must have something to do with estate planning, or maybe realizing low taxes or something… I didn’t really think much about it. More importantly, if the Buffett-Jain dynamic duo was so central to the success of BRK’s insurance business, we have to wonder what happens going forward…

So nice to read something from you again. If you look at your Blogs Webstats, you’l probably find some hundreds visits from Germany since your last post. So obviously after browsing maybe 200 times to your blog, I am quite happy, having success in finding a new blog post on November 6th… 😉

And it’s a great read, a great inspiration again. I asked myself many times this year, what you would think of valuations with regards to the risk free rate and you address that here, so that’s interesting. Just some remarks and questions regarding that topic: We seem to be stuck between 4% and 5% (that seems to be the reason, why you dress 4% and 5%), so a reasonable valuation would be between 20 and 25. So let’s say 22.5 would be around reasonable. So where does the S&P500 stand? 30.5.

Okay, so the market would have to fall over a quarter and it would be “totally normal”. So to me, a pe ratio 30.5 seems a bit high; not like a bubble, maybe still on the high site of reasonable, but it’s definitely not cheap. One could discuss about what the Mag7 do to the average and that it’s all not like it seems for the whole market… But I don’t won’t to dig that deep into that topic here. All I think is: One can always ignore parts of any index for some (and maybe good) reason; but in the end if the valuation of an index is high, than there is some overvaluation in the market. So my question would be: Do you agree with that e direction of my thinking?

Okay, and let’s get some steps further: What if the interest rates would change a bit? Let’s say to 3%. A pe ratio of 30.5 for the S&P500 seems reasonable, even a tiny, tiny bit on the cheap site.

And if it goes to 6%? Uh, than a pe ratio of 16.7 for the S&P500 seems reasonable; that’s nearly half the current valuation. That could hurt!

And that’s a bit my point: No bubble territory here, still a bit lofty and even though “everything’s possible” is always right when thinking about interest rates, it feels a bit like: We could face more volatility looking through the windshield than through the rearview mirror (if we don’t look to far). And than an index etc feels a bit like “Tails I win nothing, heads I loose a lot”. Maybe not that bad, as still the market and its businesses grow, and they could grow out of that. Still that’s a bit the bottom line for me.

So what can we do? My personal answer is: Look for stocks and sectors, where rising interest rates are not a headwind but even maybe a tailwind. And again I landed at insurance companies. As long as interest rates don’t move back near 0, they should do really okay. BRK, MKL, Fairfax & Co earn a lot since interest went up, like they should have (there are other reasons too like a hard market etc. – but rising interest rates helped a lot).

But how are they valued? I always use your post from 2011 or 2014, where you had that table “translating” roes to pb and pe ratios for insurance companies (I think you were discussing MKL and BRK but maybe only one of them). So with the three being between 1.3 and 1.6 pb ratio and roes of 12% (BRK) and 15% (Fairfax and Markel; Fairfax likely even above 20% ROE on average for the next 4 years; look out at http://www.cobf.com), that’s between a pe ratio of 9 (Fairfax/Markel) and 13 (BRK).

Putting pe ratios of 9 and 13 against the markets 30.5 – in comparison that’s more than reasonable, that’s really cheap. So after all those are businesses with above average roes (in other words: above the average S&P500 company), rock solid balance sheets (again better than average) at very, very reasonable prices (better than average) in today’s environment. Wow, what could be a better combination?

But what about the risk profile with regards to interest rates? While the market (or parts of it) might get in trouble with valuations, when interest rates should go up, “my” businesses will profit all the more. And if it goes to 3% I don’t loose much. Tails I win, heads I don’t loose much.

Would be really interesting to read, what you think about that!

Best

Hamburg Investor

Wow, that’s a lot! I can go through this and get back to you later maybe in more detail. But for now, let’s just say that I don’t really care all that much about the market P/E too much. I just look at it to understand the environment we are in. The more important, relevant question, I’ve always said, is actually the valuation of your holdings. Remember, during the 1999/2000 bubble, Buffett didn’t touch his core holdings. His forever holdings. He just held on through it all. Similar for me. Look at what I own, and if I am comfortable with the valuation of that, it doesn’t matter whether the market is at 5x P/E or 100x, right? Even though you will still be wearing a lot of beta risk if the market is 100x P/E (even good stocks, cheap stocks, may go down in a bear market. BRK was cut in half too when the market went down). So we must remember, if we own individual stocks, those valuations are going to be the relevant questions.

As for interest rates, yes, they are volatile and they will swing around. Rates went from below 1% to over 5%, and the market was fine (well, this is because the market EY didn’t chase BY all the way down). But my above reference points are just that, not accurate, day-to-day, month-to-month fair values. When I first wrote about this, I said something like, if interest rates average 4% over the next 10 years, I would not be surprised if the market P/E averaged 25x over the same period. There will be wild swings in above and below that, even this came true.

The other piece of the puzzle I didn’t mention here that I put in the original post was where I actually got 4% long term rates. When I wrote this before, I think rates were 1%, maybe 2%. But I made a long term assumption of long term interest rates of 4% based on the history that the long term interest rates (10 years) tended, over time, to track nominal GDP growth. I had a chart that showed it tracked closely. And then, I assumed, it is reasonable to assume sort of a long term average of say, 2% inflation and 2% real GDP growth, for 4% nominal GDP growth, and therefore 4% 10-year bond rates. That’s where this 4% came from.

I still think it’s not an unreasonable assumption. And this ‘overshoot’ to 5% and over, I think, is a function of the recent, post-Covid, post-Ukraine inflation, which I always assumed was a one-time, event-driven thing, and not some longer term secular thing that many believe it is. Of course, many economists thought it was short-term Covid driven, but that argument was discredited when inflation persisted for longer. But I never really changed my mind… I thought it was still Covid supply-chain related and Ukraine related… those are huge impacts. The mass pump-priming, QE and all that did not drive inflation for more than a decade after the financial crisis. Again, I am not arguing MMT, which I can’t say I really understand, lol…

Anyway, my interest rate / market p/e argument is just an ‘over time’ sort of thing, not a, ‘if the bond yield hits 6% next month, the market will go down 50%’, necessarily…

I may post more about this stuff later, but that’s my response for now.

Thanks for dropping by!

Oh, and btw, not you, but for those who criticize the Fed model, it’s all fair; this is not perfect. But let’s put it this way. I am (possibly unreasonably) anchored to this old, archaic model. I admit that. But I would rather anchor myself to this, that sort of makes sense to me, rather than anchor myself to the ‘the market p/e has averaged 14x for that past century, therefore we are overvalued’. People who are anchored to that have been wrong for decades, I think, and that thought has destroyed many track records of otherwise great investors.

Thank you for your detailed answer. You are right, I remember that you meant longterm average with the 4%. For whatever reason, the main thing that stuck with me was that you – like me – are of the opinion that you can say little, if anything, about the short term. You can put forward hypotheses, and if no war or overarching crisis actually develops, then of course you could be right. But these are coincidences, in my opinion. However: 2% growth and 2% inflation, i.e. 4% over time seem possible to me, yes.

But maybe I am a bit more skeptical because I’m German. We had different rates than the Americans in my family’s memory. In 1923 there was hyperinflation (in the end money was worth less than its calorific value – no joke. People literally burnt billions of marks), then there was a new currency “Rentenmark”. Black Friday came in 1929, followed by deflation. In 1945 the money was worth nearly nothing again and the German mark was introduced (at least in the West) and now we have the euro here.

In any case, inflation went through the roof worldwide after the oil price shock in the 1970s. Who had that on their radar a year earlier and had predicted it? And inflation remained high for a long time; from around 1967 (so before the oil price shock kicked in) to around 2008. For over 40 years, it was between 5% and 10% and sometimes even significantly higher. Is it conceivable that inflation could be very high for a long time against the backdrop of a new global regime? I wouldn’t bet on it – but I wouldn’t rule it out either. The world keeps turning. There are times of war, times of relaxation, times of expansion and times of returning to the homeland. Sometimes democracy is on the rise, sometimes autocracy. There is indebtedness and over-indebtedness. So what comes after ‘the old West’ possibly falls apart? Will this strengthen the dollar as the world’s reserve currency or will it become lonelier? What would an escalating trade dispute with China produce? What would an invasion of Taiwan by China and the associated global shortage of chips mean?

As always, today’s concerns usually don’t materialise – and then something completely different comes around the corner, something that nobody expected. Nobody predicted 1929 (and it only appears so clear and predictable from today’s perspective; from the time itself it was not). In 1936 the world was still celebrating the Olympics in Germany – and 3 years later Hitler’s Germany started the second great war. How many of us saw the financial crisis coming? There was a fear of runaway inflation in Germany in 1923, which then materialised; was there a similar (subsequently unfounded) fear in the USA in the early 1980s? As long as it’s short-term stuff, it’s just noise that needs to be ignored. And it’s not interesting and you should be careful not to base investment decisions on it. Like Buffett, I believe that ‘America’s best days are yet to come’. And it has never been a good idea to bet against the dollar. It has always been a good idea to invest in companies with low debt, reputable management, a moat and possibly at a good price. Through all these times. At least that’s what I think I’ve understood since I started investing. Ignore macro, think micro.

Where am I going with all this? Am I saying that 2% + 2% = 4% is implausible? Not at all. But maybe in my view it only has a 75% chance of coming in around that and there is also a risk to 2% (and less) or 6% (and more) over more than a decade on average.

I have held insurance companies for most of the low interest rate period; because yes, I too saw low interest rates as temporary. And I see myself as a long-term investor. So in reality, I don’t see us being very far apart. In the end, you can only prepare yourself by choosing the right investments. In my view, it is no coincidence that Berkshire, Markel and Fairfax Financial have all suffered during the low interest rate phase (the businesses and the share prices). And the high interest rates of the 1970s combined with the low buy prices were certainly anything but a headwind for Buffett. My point is that insurance stocks at P/E ratios around or below 10 are certainly a buy, especially if higher inflation also presents some opportunity from an investor’s perspective. That’s true not only for an outcome of 4%.

Happy Healthy Holidays, welcome back !

Fantastic post thank you BKLN

Thank you for this thoughtful post. Not directly relevant to building the cash pile, but I am curious if you believe BRK is transforming from an investment-oriented firm (run by Buffett and Munger) to an operation-oriented firm (run by Abel, Combs, and Jain), owning and running high-quality businesses rather than just buying them and leaving the managers alone? If so, will they need a corps of in-house managers to pull it off? What else will have to change in the next 5 years?

That’s a really good question. I have no idea, but it sure looks like things are moving that way. One interesting thing in a recent annual meeting, forget if it was this year or last year, but Buffett said capital allocation decisions will be made be Abel. In the past, it was sort of assumed that Combs/Weschler would manage the stock portfolio, and Abel would manage the operating businesses, but recently, Buffett hasn’t indicated that at all.

Also, I do think you are right that they will become more hands on with the operating businesses to improve their performance. There has been indications of that already in the past, with ‘problem-solvers’ dispatched to operating businesses to fix things up etc. And maybe that’s where there is a lot of value to be realized. There has been more talk about how the operating businesses may be subpar, especially GEICO, BNI etc…

I remember suggesting that in a post years ago. I was wondering how good the operating businesses were as we were not really able to see margins, returns on capital and things like that, except in large groupings, and I think in the past, when you look at the old MMR as a block, the return on equity didn’t look so great.

Anyway, yeah, things will probably change a lot in the future, and that may very well be more operating business stuff and less investment stuff. It seems like T&T underwhelmed Buffett in terms of investment performance, and maybe that’s why their focus is shifting. Plus, as Buffett kept saying, to move the needle with equity investments is very hard… So going forward, who knows, maybe they start to look more like Danaher… that would not necessarily be a bad thing, of course…

Btw, having said all of the above, this is not to diss Ted and Todd… I’m sure if we gave them $10 mn each, they would knock it out of the park. But size is an issue for them too, as much as it is for Buffett.

So part of it is that, that size makes it hard to make a difference with the equity portfolio, just as Buffett has a problem. Too, the market condition is not very helpful either as the market is not cheap. If there was a real recession and big bear market, things may be a little different. If huge whales become available at very cheap prices, then BRK may allocate talent to fishing in the listed market pond, right? So that may be part of it too… If things are too expensive, they are too big to look at small ideas, then there may not be much to do (Buffett has said he can only fish in a pond with maybe 100 or less names in it; of course, the largest cap 100 or some such).

And in that situation, what do you do with all that talent?

So there is that…

oops, also, the MMR above, I probably meant MSR (manufacturing, services and retail)…

With all due respect I think T and T results actually is a disapointment and not sure it has much to do with the size. I myself am managing peanut sums comparatively, but made my bigest gains with a large caps or even mega caps in the last 10 years, e.g. there were many opportunities to swing big during pandemic or especially during big tech meltdown in 2022, yet they had not did much (including Warren himself) and/or even worse just stuck with some seriously structurally impaired businesses, like CHTR etc. Also there are many questions what is going on with Geico under Todd’s watch so not sure this kind of operational focus has proved either.

Fair enough. But you have to give credit to Weschler for AAPL a little, right? That was sort of huge to make Buffett buy something he would not have even considered before. Not sure what other things like that may be happening behind the scenes. Anyway, we can say that things didn’t really work out the way we thought it would, but even still, I thought early on that those guys would not be able to get around the problem Buffett has (size) either way, even if they performed amazingly with $7 billion each or whatever it was…

I think in 2022, they bought TSMC in the 60’s, and then Buffet probably overruled and sold the entire position due to geopolitical reasons (Taiwan). TSMC is at $190 recently. But Buffet’s investment rational is so different from small individual investors. They also sold out of AMZN. So T&T did some nice things, but the philosophy is just different when you are in charge of billions, instead of millions. That is where I see the cultural difference.

Please add me to your list of subscribers.

I’ve just across your blog and thought this was great! I’m going to read some of your other articles. This is the first place I think I’ve ever come across that recognizes/acknowledges that BRK’s cash pile was actually about the same size of it’s insurance float. The financial press always seems to sensationalize it as “Berkshires cash pile grows” without stating that BRK owes about the same in debt obligations (ie the float) and that if BRK spent the cash on a mega acquisition it would actually become a leveraged company.

One (rather sinister I’m afraid) thought I had in addition to your well thought out reasoning is that Buffett knows he’s on the way out and he’s giving himself ammo from the grave to buy into a potential BRK sell off on the back of this (he did say at the 2017 annual conference when asked about his demise that he thought the shares would sell off in the short run but then ironically become worth more as investment bankers come knocking to offer leverage and divestment opportunities). Even though it’s sinister, investment from beyond the grave is perhaps something he’d enjoy.

Thanks. Yeah, the first time I talked about this cash = float was years ago, and the argument was the other way, sort of. Many of the more aggressive folks wanted to add float to book value to get a fair value / intrinsic value of BRK because float is like equity as it never really has to be paid back. I looked at that, and then realized that, still, that amount in ‘float’ is never actually even invested in stocks or operating businesses, as you always see the same amount as float held in cash; so therefore, how can you value it like equity and just add float/share to bps for an iv estimate?

That was my argument then. Anyway, this is not to say float is worthless, of course, as they earn underwriting profits, and now, some decent yield on cash etc…

And yes, I think part of this may be Buffett prepping a hand-off, but honestly, the locking in of lower tax rate and selling something at30+ p/e is more than enough reason for him to do this… and still, he has a large position. It will be interesting to see how much more selling there is to be done…

‘What is the value of Float’ is a question that is discussed again and again. Apart from the fact that float naturally yields different amounts of return depending on the CR (over the long term, but also currently – think hard versus soft market), where the risk-free interest rate lies (also long term and short term) and how an insurance company generally invests its money (short or long term), there are other points and perspectives that concern me but that I hardly ever read:

1. It’s true: Buffett has in principle mostly invested almost exactly the amount in risk-free investments that he had as a float. But he also made a profit from the insurance business (on average) and the float grew. In theory, 5% risk-free investment interest is added to the profit (let’s say 98% CR – so 2% ‘on top’) and then the float itself may grow (let’s say 3%). I’m not quite sure how to calculate the return then, but roughly certainly 5% + 2% (+3%? I’m unsure about that). That would then be a return of 10% on the base (float or premiums – usually about the same). Then the question would have to be: Why should this be valued differently than equity with a ROE of 10%? From that point of view, float would even be worth more than its plain value; at least if you would value a business with a ROE of 10% over 1 x book value.

2. Another point: very simplified (too much), we could assume that an insurance company earns 10% on its equity (ROE 10%). Assuming that the float would be twice as large as the equity, and the float would ‘only’ yield 5% (CR + interest on float), then the ROE would increase from 10% to 20%. In other words, a company with only the float would be worth very little. And a company with only the equity would be worth little as well. But when both take place in one company, the returns during the year add up to a much higher ROE. Two companies with a ROE of 10% and another with a ‘return on float’ of 5% (which could be equated to ROE imho very simplified within this context) are worth less than a company with a 20% ROE.

3. A much simpler float question is: Even if Buffett does not invest the float in equity – without any float at all, he would have to withhold part of the equity as a security reserve, like other companies. In this respect, the float at least ensures that a larger portion of the equity can actually be invested as equity. In this respect, a portion of the float would at least ‘free’ the equity, and this freed equity would at least have to be credited to the float as value.

hi again thanks for coming back!

Hi! Thank you for posting. Content like this such a rare gem these days. Giving out a framework to think for the readers is just pure pure stuff. I guess no better tribute to Mr. Munger than writing such blogs! So thank you again.

I have gone through most of all your past posts (and I apologize if I missed it). It does not look like you have shared a lot on what investments you own. And I understand that might be personal decision and respect it. However, I would love to read on your mental model and framework on,

1. How you assessed a investment you came across and actually decided to pull trigger and buy it?

2. What mental models you used when it came to position or sizing on the amount of your investment?

3. Once invested, what sorts of things you follow up on a periodical basis to make that quick decision of continue to let it ride or sell it?

Thanks!

Thanks for dropping by. Yeah, there is a reason why I don’t really talk about specific investments unless I find something interesting to talk about. For example, I do own MSFT, GOOG, CMG and things like that, but for the most part, I don’t really have much to say about them that you haven’t heard before. Even when I talk about BRK, you will notice that I try to talk about things others aren’t really talking about, like the float / cash issue and whatnot. Otherwise, I would leave the standard, regular analysis to others as there is no shortage of them.

When I first started this blog, it was for a couple of reasons. One was that I found myself explaining simple investment concepts to people over emails, and I started to realize I am starting to cut and paste the same email to different people, so I figured, well, I might as well make that a blog post.

The other reason was that I was really motivated to write the blog due to the many inaccuracies, misconceptions that I kept seeing out there in the financial media, newsletters, blogs, whatever. Just a lot of misinformation. For example, when I started the blog, I think in September 2011, that was the time of Occupy Wall Street and bank-bashing. Banks were worth bashing, but a lot of it was based on misinformation… for example, that the FDIC is underwriting risk bank traders take (at taxpayers expense)… while this may be true, it is also true that the FDIC doesn’t lose money as they make back any payouts over time with higher FDIC fees… I think the FDIC over time has not lost money. Same with TARP… it was not a ‘handout’. I think all of it was paid back with nice interest. The other one was that JPM is a OTC derivatives ticking time-bomb with trillions in notional amounts outstanding (whereas most of that is netted out, and the true net exposure is far less).

Etc… So every time I see that sort of misinformation, I have a strong itch to point out that some of these ‘facts’ are misleading.

This is exactly what got me to write the most recent post about Buffett’s $300 bn+ cash. While everyone seems to scream and shout this and that, I just look at it objectively and shrug my shoulders…

Anyway, that is the primary goal of this blog, not really to make investment recommendations. I will do that too when I see something interesting, AND, I think I have something interesting to say about it that others may not… or I can add to the discussion…

I will keep your question in mind, though, for future post ideas.

Thanks!