My posts come in bursts, sometimes, I guess because when I have some thoughts and a moment to post something, that leads to other thoughts and more to post. This is another one of those. I talked about BRK a little in my last post and then realized I had this post in the queue that I started to write last year and never finished. So I am finishing it now. Also, in my last post, I said I haven’t done a sanity check in a while, but realized I just did one just a few months before. Oops. I should look back at my other posts now and then. But, OK, not so important.

OK, so Warren Buffett is no longer the CEO so will no longer be writing the annual letter to shareholders but instead will be writing an update every year around Thanksgiving.

It is natural to wonder what will happen to BRK going forward. We have been expecting this day to come for some time now so I think we were all ready for this. Especially after the passing of Munger, I thought this day would come really soon. I just hope his health will allow him to stay with us for a while longer, even if not as CEO.

This is probably a good time to review the special letters from both Buffett and Munger in 2014; about the past, present and future of BRK. This was published in the 2014 Annual report, and there is a link to them at the BRK website.

First of all, I was a latecomer so never had a substantial portion of my net worth in BRK like many of the old-timers who have been in since the 80s and 90s. So this is not as big an issue for me as it is for many others. But I was certainly aware of and even a fan of Buffett back when the A-shares were trading at $5,000, so it’s not like I didn’t have the opportunity.

If You Own it Now, You Can Own it Going Forward

I know there must be a lot written about this, the post-Buffett BRK, but I haven’t been reading much about it except in major publications.

But for me, here’s the thing. Whatever gave BRK their huge performance in the past has not been there for a long time now. What do I mean? Well, BRK was so big that it was already very, very hard for Buffett to be able to exploit his skills for our benefit. For example, stocks? He has said for many years that he can only choose from a smaller and smaller group of stocks as BRK gets bigger and bigger. Finding great ideas where he can’t deploy billions at a time wouldn’t move the needle for BRK. Yes, he found AAPL and that was an insanely good investment. This is also true for private investments. Increasingly, he needs big ideas. Small ideas like See’s Candy or Nebraska Furniture Mart is not going to move the needle today. Plus, when you start to get into large businesses, then you start to butt heads with private equity, who seem to have an infinite pool of ‘dry powder’. This has been true for quite a while now.

So Buffett was already losing his edge, just from sheer size of BRK, nothing to do with his stock-picking skills. So my point is this: Buffett has been unable to do much with his skill in recent years anyway, so post-Buffett, how much difference is it going to make?!

Ted and Todd

Looks like Todd Combs went to JPM. I sort of suspected that this is not really going to work out as planned. Both of these guys are really smart, and can probably shoot the lights out and out-invest anyone with $100 million, but once given $7 billion, that was already a big challenge. If Buffett can’t outperform with $250-300 billion, we can’t really expect anyone to. So it was not really that Buffett / Munger made a mistake in picking stock-pickers, or it wasn’t that Ted and Todd suddenly, upon joining BRK, became dumb. It’s just simple math. So I don’t really blame anyone here for this. They tried, it didn’t work out, so they move on. Good thing it was done while Buffett is still around and in good shape.

Could Things Get Better?!

This is sort of repeating what I said in my last post, but I will leave it mostly as written.

The consensus, or analyst views seems to be that without Buffett, the Buffett premium would disappear, so BRK is no longer a buy. There was a downgrade on the stock the other day (late 2025). Fair point. Yes, Buffett is the ‘key man’ that was a factor in the success of high returns of BRK over the years. But as I said above, it has been less so in recent years.

So could things actually get better post-Buffett? This is certainly possible. I don’t want to sound too Pollyannaish, but hear me out.

First, check out this snip from the 2014 special letter:

And guess what, 2024 is ten years from 2014, so we are in the window of “probably between ten and twenty years from now…” where the directors “…will need to need to determine whether the best method to distribute the excess earnings is through dividends, share repurchases or both.”

As I said in my last post, I think there may be things done at BRK that Buffett would never do and would never have done. But the fact is BRK has been run the same way for decades, but the world has changed dramatically. Yes, most of the key principles are valid in any era, but other things may not be. You can’t run a business the same way as when it was much smaller and nimbler when it is a massive conglomerate with 400,000 employees! And as “forever” is Buffett’s favorite holding period, things just keep getting bigger and more complex.

OK, so let’s say Buffett can manage this the same way and get away with it. It is unlikely that anyone else could step in and do the same. Keep in mind, it wasn’t just Buffett. It was Buffett and Munger. You had the two greatest minds in the business managing this beast. Things can’t go on the same way, I don’t think.

So, as in my previous post, I think we can take some lesson from John Malone in selectively creating tax-efficient value for BRK shareholders. I admit this will take time as BRK does not like financial engineering or anything that smells remotely like it. Some centralization and increased efficiencies might be in order. Cleaning up some bad businesses that don’t earn their cost of capital etc. All of us can benefit from going through our portfolio and dumping things that don’t make sense. We can move away, even slightly, from the “Buffett abdication.” This is not necessarily a bad thing. It could be bad, of course. As I said in the other post, more and more, it is unlikely that this “hands off” approach will be a factor in attracting family businesses that want to sell as BRK is just getting so big that those deals may not move the needle all that much anymore. If you want to argue size doesn’t matter, that BRK can buy a lot of small ones, that just increases the complexity of BRK and harder to manage.

So, as I summarized in my last post, as BRK gets bigger and Buffett’s skill gets less relevant (stock picking skill, private business acquisitions), Abel may actually find ways to add value in other ways.

The ability to make very quick, big bets will go away, and this would affect the insurance business too. Some of the big deals they were able to do were based on the confidence of Jain and Buffett; they can take massive (calculated) risk that others would not. We will lose this. But even this, arguably, as BRK gets bigger, is just less of a factor in moving the needle.

Board

When thinking of all this, one thing keeps nagging at me and it’s BRK’s board. Of course, all the board members are highly qualified and highly respected people; I have no issue with anyone in particular. But when thinking of the future of BRK, and even the recent past, I get this sense that this board is kind of out of date and maybe not best equipped to oversee BRK. Yes, it is great, if not perfect, in maintaining the culture at BRK.

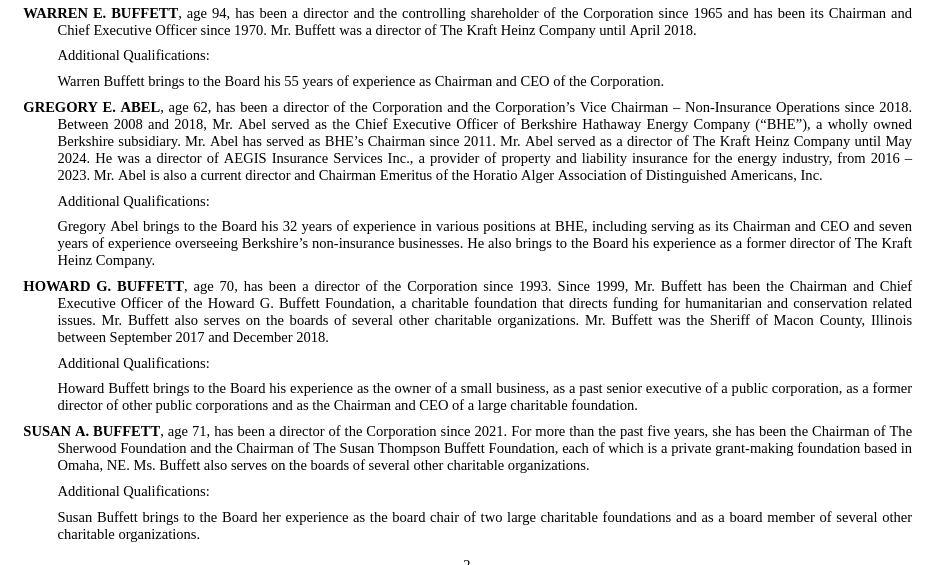

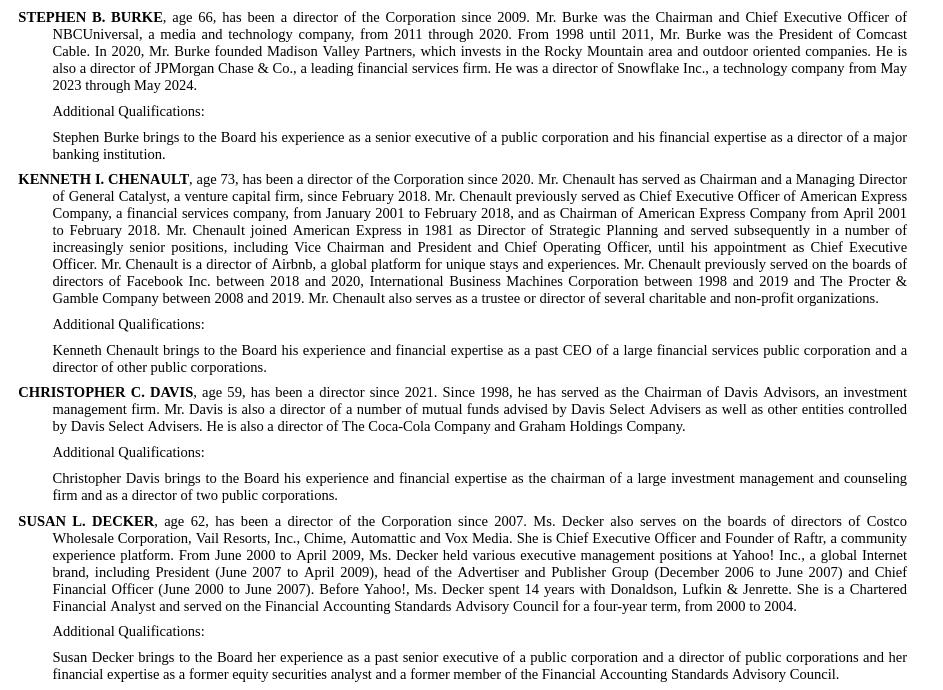

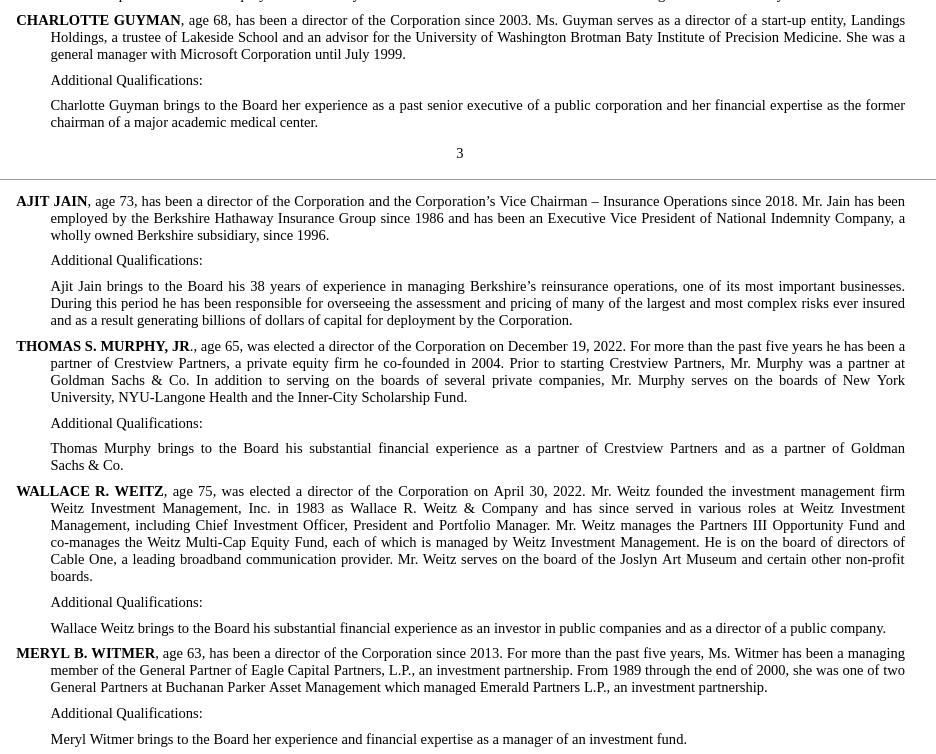

But first, here is the list from the 2025 Proxy.

BRK Board of Directors

To me, what seems stunningly lacking is financial and tech expertise. Sure, there are some financial professionals here, and some fund managers. With BRK becoming less and less of a stock-picker entity, I am not convinced we need so many fund managers on the board. I am not saying none of these people have any financial or technical expertise.

For example, as a dream candidate for the board, for financial expertise, imagine Jamie Dimon on this board. I have no idea if he was ever invited, or if there is some conflict somewhere or other reason he is not on the board, but that would be amazing. He is the kind of level of risk manager that BRK can really benefit from. Buffett / Munger / Jain just had this natural risk-detector that risk management is not something any shareholder would have worried about in the past. Yes, plenty worried about his stock market index put shorts and other things. But most of us never really questioned risk management at BRK.

Also, tech seems severely under-represented too. Bill Gates used to be on the board but is no longer there. I sometimes wonder if GEICO lost out to PGR partly due to not enough awareness / knowledge about tech within BRK, including the board. Maybe this contributed to Buffett missing out on GOOG and AMZN from the early days (when they knew how great those businesses are). I still remember clearly having drinks with a programmer friend of mine a long time ago when most of us only had a vague sense of what AWS was, and he said he is invested in AMZN just because of AWS, that he didn’t care about the online retailing business. He told me this when I was still making spreadsheets trying to figure out the online segment (if it will ever be worth anything). I bought AMZN soon after, and also stopped tracking AMZN’s retail business! So we need exposure to younger people with different experiences to open our eyes to interesting opportunities. Oh yeah, and I think I mentioned that I bought MSFT for the same reason years ago when people thought MSFT was dead, but a programmer told me they really love what MSFT is doing with Azure. So I bought MSFT based on Azure, and didn’t care at all about Windows or Xbox.

So, some diversity on the board would be great, I think. Not race and gender, but just more different areas of experience. Sometimes it feels like some on the board are there based on being huge fans of or friends of Buffett, not so much on what they might be able to contribute. Of course, family members are keepers of the culture so they are the inevitables, and I have no problem with that (I know others do, but I don’t mind that).

I mentioned Dimon as a great addition for financial expertise and risk management, even just overall management experience and skill of running a large business, not to mention his experience dealing with Washington D.C and various alphabet soup of regulators.

But for tech, I have no idea who would work. Of course, Jeff Bezos come to mind, but that can be a divisive name, I don’t know. Eric Schmidt? Probably not Mark Zuckerberg or Elon Musk. BRK doesn’t need DOJE, even though some may argue they might need a mini-DOJE. Satya Nadella and Sundar Pichai, too, are very interesting. But I understand there may be various issues with some of these names if they are current CEO’s (they may try to get BRK to move to AWS, Azure or GCP etc..)

How about Washington D.C.? Did we not get blindsided by some decisions out of D.C. that hurt some of our businesses? Do we need someone who has experience in D.C.? Not a lobbyist, necessarily, even just someone on the ground there that may provide important input.

I know that these ideas are really not what BRK is all about. Buffett would not be interested in such things as the above, I know. But we are talking about a post-Buffett BRK, and to me, these seem like reasonable additions to the board. Is it crazy? Is it wrong? I don’t know. These are just some thoughts that are popping up in my head at the moment, trying to get my arms around a post-Buffett BRK.

Would love more BRK content and a message board!

Check out thecobf.com lots of Berkshire and Fairfax message boards.

Would always love more Berkshire points.

Would love to know your thoughts on Constellation Software which has Berkshire like returns but also facing a major leadership change as the founder stepped down (far more unexpectedly than Buffett).

I wrote it up but am keenly aware of ownership bias so please tear it apart.

https://tidefall.substack.com/p/saaspocalypse?r=at0y1&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true&triedRedirect=true

The post didn’t show up right away due to links; I have to approve post with links to stop all the spam bots.

Anyway, interesting, and I too agree that software can’t just be replaced overnight by vibe coders, so I am not sure I quite understand this software selloff… Some of them, I do, like say Adobe, if you can just have AI generate photos you need, why bother etc… but CRM and all that other stuff, yes, I am not making that connection.

As for Constellation, yes, that’s been popular in the BRK / Fairfax crowd for a while. I remember having a conversation not too long ago with a value hedge fund manager and this name came up. I never really dug into it all that much, but I just didn’t feel comfortable with it. But that’s just me. Nothing really wrong, but my feeling was like, it’s a roll-up, but we don’t really know what they are rolling up. It’s software, yes. And some description. But hard to assess for me, is what they are rolling up good stuff?

It sort of reminded me of Affiliated Managers, which is kind of an asset manager roll-up. They looked really interesting early on when they were really focused on value managers, like Third Avenue Value, and whatnot, but they have been investing in all sorts of alternative managers. But even at the time they were focused on value managers, it seemed like they were acquiring management firms at the end of their decades long run and buying for the next generation. Third Avenue for example. Without Whitman, how long will assets stay? Equity mutual fund assets tend to be sticky.

But as an investor, it is concerning when they are buying up all this really nice names, but they are about to enter their next generation. Do you really want to be owning a group of second generation businesses of legends? I wasn’t too sure of that.

I sort of felt that with Constellation. Are they rolling up businesses of people with one foot out the door? Are they all past their prime and they are just helping founders with their estate planning using investors capital? I have no idea, but that’s always the fear with these roll-ups…

Anyway, not a very educated response, but just my feeling without much research into it…

Good, common sense, remarks.

My only real concern about BRK is the extent to which family voting control – Warren, Howard, Susan – on the board will changes that are needed. Berkshire is now in a different world that the one in which it prospered. The other side of winning a game is when that game is no longer being played. What now?

Increased oversight and operating efficiency under Greg is the obvious next step. If Exxon can squeeze $15+ billion a year out of an already well run company, there must be lots of opportunities in a company twice its size. I understand they are very different companies – centralized versus decentralized – but there must be lots of opportunities to reduce costs that were never addressed by Warren. When Ajit took over insurance and Todd Geico, they found lots of opportunities that had built up over the years. These were in businesses that Warren had praised for years as being well run when left without supervision. That should demonstrate something.

I endorse making board changes to ones that will not just endorse Warren but will focus more on opportunities and changes needed in the world going forward. What’s best for shareholders?

Did Warren ever even ask the board for permission on anything? Or even Munger when he didn’t want his opinion?

I’ve prospered under Buffett, appreciate it, and wish him a good life going forward. But I don’t want him ruling from the grave.

Yes, that’s exactly it. Many shareholders didn’t really care much about the board because who is smarter than Buffett / Munger? What board is going to be smarter than them and be able to tell them what to do? To assess risk better than they can? They can’t. So we didn’t care who was on the board until now because we fully trusted Buffett / Munger. If they are happy with the board, who are we to say anything? We have full faith in them.

This will no longer be true going forward. That’s the key. And yes, Buffett may have chosen Board members according to who he wanted to invite to a cocktail party, lol… but this should not be the case going forward.

“He told me this when I was still making spreadsheets trying to figure out the online segment (if it will ever be worth anything). I bought AMZN soon after, and also stopped tracking AMZN’s retail business! So we need exposure to younger people with different experiences to open our eyes to interesting opportunities. Oh yeah, and I think I mentioned that I bought MSFT for the same reason years ago when people thought MSFT was dead, but a programmer told me they really love what MSFT is doing with Azure.”

Funny, I was at a Boston Children’s Invest conference and heard a very articulate pitch for AMZN for the same reasons re: AWS….But, my value investor training said to myself: Where’s the moat in a giant server farm someplace and isn’t AMZN known for creating copycat products? Who would want them to host their data that might be valuable to AMZN in other ways?

Similarly, I owned MSFT when everyone hated it around Windows 8, the Surface, etc. Saw the change to the cloud coming and felt like they would be punished for a while by the decelerating revenue of switching to a subscription model, as much as I liked the idea of not having a mail server anymore and letting them handle that, etc!

Both were mistakes obviously. I think your points about the world changing with AI and tech may be spot on for BRK. the opportunity cost of not buying high quality tech that gets displaced has been very large for BRK. ( I like the recent GOOGL buy) I’m giving Able a little time here, but he’s not going to be loved like uncle Warren and those are very tough shoes to fill.

As always thanks for sharing your thoughts. Why do you suppose google, meta, Nvda, etc initiated a small dividend? Now is the appropriate time for brkb to initiate a quarterly dividend by year end. 25 cents to 1,00 quarterly would help to increase demand for brkb. Happy healthy new year. Hc

I agree, yet Abel just said he won’t do it ( (but reviewed by the board annually)

Correction re my comment on Brooklyn Investor:

……My only real concern about BRK is the extent to which family voting control – Warren, Howard, Susan – on the board will PERMIT or OPPOSE changes that are needed.

I will add that I’m not some young activist – I’m only 5 years younger than Warren. Soon my daughter and grandkids will inherit my BRK stock. I’m thinking of what’s best for them if they chose to hold the stock.

So I’m a bit confused. Let’s see a few points clarified. I’m a 25+ year Berkshire holder, who has read every one of his letters back to the ’70s.

1. Board composition – Susan Decker isn’t listed, so I’m curious what your source is of who is on the board.

2. Board age and nepotism – that’s the real concern; despite holding the stock a quarter century, I’m younger than everyone on the board. You don’t get novel new ideas from an average age of 70something. Howard Buffett has no interest in these business dealings, and Warren’s positioning of him on the board to “preserve culture” is highly dubious. Ajit and Greg will do that far better.

3. Investing lieutenants – we all knew Todd was departing, but Ted? There is no press on his departure; if anything, Greg Abel will have Ted fill a bigger role as Greg will be learning more about the corporation, and serving in a bigger/more public/outward facing role, and have less time for capital allocation. As for Todd and Ted’s performance, Warren flat-out said in one of the annual letters that they were doing better than he. Assuredly, Apple – Berkshire’s biggest raw dollar gain in securities in its history – was not Warren’s idea.

I think I may have botched the board list; I will fix it. It’s from the 2025 Proxy. I agree with your #2, age is an issue, but figured my comment overall would fix that if we get some tech people. Dimon is not young, though…

I think Buffett said T&T were doing better, but that was quite a whle ago. He has stopped saying that a while back.

Anway, I gotta fix the board list, lol… thanks for pointing that out…

… and yes, I knoe Decker has been on the board for a while, but to me she is more like a financial person working in tech; not an engineer. But, probably still valuable so no need to boot her from the board.

Anyway, I am starting to think my next post will be what I would do if I was suddenly in charge of BRK! That would be a fun thought experiment.

Again, great read, thank you!

BRK was my first „big“ investment and that‘s 19 years ago and I think Buffett has influenced my thinking the most.

You make really (!) good points and being just an amateur I learn a lot from this perspective and thinking about it.

But please let me counter it and I would be really happy getting to know your thinking about the following:

My overall thinking is, that „culture ests strategy for breakfast“ and that overall the wholly owned subsidiaries are better than the average American company; imho I see value in the Berkshire culture even without Buffett and I highly value imho a board, that obviously is good at culture.

But I am obviously not in the board meetings etc. so after all I might be off and this is just wishful thinking.

Another thing is, that historical (so over many, many decades), tech stocks weren’t good investments as a sector group. Railway was bad, Airplanes were bad investments, dot com era. Some Nifty Fifty tech stocks disappeared.

It’s hard to imagine these days with Mag7 dominating the stock market by such a wode margin. But who talks about Netflix these days and they were part of FAANG?

IBM was a clear winner and it felt like it would last forever. Cisco. Nokia. Radio Corporation of America. Polaroid. Xerox. Kodak. Konica.

How sure can you be, that Mag7 will be dominating in 10 or 20 years when Quantum computing kicks in (… not to ask what it will do to Crypto…)?

Don’t get me wrong: Your points are really good. You need young people, investment opportunities are structurally rare to find etc.

But maybe we are living in a world in which tech stocks just seem to be the thing of the future (it feels like, no question about that!), as we are looking back at a time with so many tech winners behind us and an ai revolution before us – so it just seems natural that tech stocks will be future winners, right? So just buy the obvious names and then that’s a relatively sure bet, at least odds are good for outperforming the markets.

But if we move out, it’s not so clear, that investments into new technology stocks are winners in the long run. Railway stocks in the 19th century were really bad investments as an asset class, even though the technology itself was a clear winner. Today it’s a better asset class, as far as I can see…

So, why do I highlight these points? As I think, that over decades BRK can be a winner without or even because it’s not going to invest too much into tech and without having too much expertise in that field. And maybe culture is really much more important and it’s great for all the wholly owned businesses to have the opportunity of longing for longtime success (and not wuarterly results)? Maybe that’s an asset overwaying much more than we think these days, where maybe the inability of BRK to identify the tech winners of the last decades just masks BRKs real potential? Maybe finance will dominate the next decade or energy or logistics or consumer brands and we‘ll see BRK outperformibg the market by much more than the maybe 1% or 2% per year that some of us might think of as being realistic? I am just playing around with scenarios; this is not a prediction.

Just another thought: If BRK begins paying dividends and/or buying back stock, the problem of too much cash isn’t growing at the same pace than before. So reinvesting might be a smaller problem tomorrow than today. Hopefully.

Thanks for the response. Yes, culture is important and I hope BRK’s culture endures. But a lot of the ‘culture’ at BRK to me feels like Buffett is kind of the glue that makes it all work; a lot of what we call culture can be attributed, in my mind, to a deep sense of loyalty to Buffett. Will this endure post-Buffett? Maybe, maybe not.

As for tech, I didn’t really mean having younger tech people so BRK can buy more tech stocks. That’s certainly a part of it, maybe BRK could have understood things better. But more important to me is having tech used effectively within the organization. The hands-off part of the current management system makes me fear that maybe one of our subsidiaries is shipping products out of the warehouse and moving it to the nearest train station on a horse and buggy. Now, they may say, hey, we’ve been doing it this way for decades and it works perfectly fine! It costs us a lot more for us to do it this way these days, but we believe strongly in tradition, and we like to preserve our culture by taking care of our people, even the folks running our stables! Changing it would be too disruptive and we don’t want to do that just to make a penny more…

Now, that’s an exaggeration (I hope), but even I come across people spending hours on spreadsheets every day, and I write a simple script for them where a bot completes the work in like 15 seconds. In various areas, I see this sort of thing all the time. Someone completes a form on paper, submits it, an employee grabs it and types the info into a PC, and then files the piece of paper, lol… What about, just writing an app so customers can fill that stuff out on their phone and it gets inserted to our database? No paper, no manual data entry!! Even now, wherever I am helping out, I am looking for this sort of time-wasting. You see all sorts of wasted time like this in bureaucracies everywhere.

Now, when you are hands-off too much, you can have subsidiaries get complacent. Yes, the scrutiny and shareholder value creation pressure on public companies is sometimes too intense and not productive, but we can also have too much non-pressure too… This might have been part of GEICO’s problem; not enough close scrutiny until it was too late and we started losing our edge. Thankfully, that has been rectified to a certain extent. But imagine where else this might apply.

Anyway, all this stuff for me is just discussion points, things to think about and whatnot.

Are you worried that something happens to Greg Abel and there is no deep bench after that?

You are ahead of me. I didn’t even think that far. We haven’t even seen his first annual report. Having said that, I am not really worried at the moment. BRK is not a Porsche flying down the highway at 90 mph where if the driver is incapacitated, you are in big trouble as a passenger. BRK is more like a big ship. If the captain is out, there is plenty of time to figure out what to do. All the equity holdings are fine, they run on their own and no management necessary from day to day. I would assume most subsidiaries are like that too. There should be plenty of talent within the organization, though, many that we never hear about.

When you mentioned someone with influence with DC or regulator ABC soups, I just thought about Berkshire’s energy business and the rails. Impossible to say what having a different voice on the board would do/change, but maybe?

No idea. These are just random thoughts. At an investment bank and hedge fund, there were people like that, people on the ground in DC. I suppose they don’t have to be on the board, though. But corporations often do have people like that on the board. Not that we need to act like other corporations!

Seems to me that the time to begin deploying the cash hoard has arrived: the AI Fear selloff has resulted in some very good companies selling off to prices which afford excellent prospective returns; a few examples of strong, resilient companies with market caps large enough to permit Berkshire investing would include Visa, Microsoft, Intuit-likely Amazon (though I need to update my model for the latest results). Greg and Ted should be busy.

Appreciate your thoughts on BRK.

As a shareholder since ~2006, I’ve recently been trying to sort out my thoughts about the transition and what the future should look like. It feels obvious that a $1 trillion Berkshire, run by Greg Abel must be different from a much smaller version being run by the guy who built it. I agree with your points about cleaning up bad businesses and having tighter operational controls – this seems like a great opportunity to do those things. As an example, see the discussion about exiting the Kraft Heinz position.

The short version of what I’ve been thinking about is the core guiding principles that have made Berkshire what it is (outside of Buffett’s genius) include: financial conservatism, hyper-rationality, opportunism, and the partnership mentality. If those things start to change, regardless of the composition of the Board, it will be time for me to reconsider my holdings. If those things continue, Greg won’t need to replicate Warren’s genius for the business to continue chugging along in a satisfactory way.

Return expectations have to be modest though. BRK isn’t particularly cheap at the moment and growth seems unlikely to be better than high single digits. But, a low risk 7ish percent doesn’t seem terrible give the alternatives.

The core strategic question facing the Board is simple: should Berkshire remain a conglomerate? If Berkshire begins to trade at a persistent conglomerate discount, pressure to restructure will inevitably grow. Which raises a more practical question: who on the Board has the leadership and strategic vision to navigate this transition? Buffett and Munger provided not only capital allocation skill but also intellectual authority that anchored Berkshire’s structure. Post-Buffett, that gravitational centre disappears. Moreover, the Board’s challenge will not simply be preserving Berkshire’s culture. It will be determining whether that culture is best expressed within the existing conglomerate structure or through an evolved form of capital allocation better suited to Berkshire’s scale.