I attended this event today and here are some notes. As usual, this is not intended to be a comprehensive summary at all so I won’t get into every detail. Also, there may be mistakes. Reading through the many Berkshire Hathaway annual meeting notes, we know that many people can hear the same thing and interpret it differently so keep that in mind.

There was a slide presentation in the beginning (so I’m just jotting down some key points, and sometimes copying down the whole slide):

Who We Are

Some of the bullet points are:

- “dual-engine” reinsurance and investment strategy is fundamentally different (make money on both insurance and investment sides of the business)

- Seek to earn economic profit on every reinsurance contract and every investment in all market conditions

- Compensation structure focuses on economics of business (paid based on underwriting profits, not premium growth etc…)

- Measure progress by growth in fully diluted adjusted book value per share over the long term

Our Approach

- Employs “symmetric” and complementary reinsurance and investment strategies

- Client-centric underwriting approach to develop long term relationships

- Portfolio is heavily weighted towards frequency business (95% frequency in 2011)

- Selective in severity transactions when priced right

- Seek to partner with specialists

Symmetric Approach

There are similarities in how both the insurance side and investment sides are run. They both focus on capital preservation / downside risk on deal-by-deal basis, concentrate on best investments (or deals), focus on economics, bottom-up approach, portfolio is sum total of good opportunities and they both have small team of “highly skilled generalists”.

The above seeks to “deliver superior long-term growth in book value”.

Growth in Book Value per Share Over the Long Term

Book value per share has grown 11.7%/year since 2004.

How Do We Compare?

GLRE has both much lower net earned premium / surplus and invested assets / surplus than others, but has managed to compound book value at 11.7%/year.

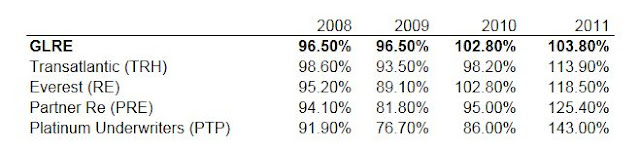

Combined Ratio Comparison

Hedges (Bart Hedges, the CEO of GLRE) said that the competitors exclude corporate overhead from their combined ratio calculations, but GLRE includes it. If GLRE excluded corporate overhead, the combined ratios of GLRE would be 2% lower.

He said that their low leverage business made them underperform in the good years but spared them in the bad year of 2011 (with the Japan earthquake/tsunami, New Zealand earthquake etc.)

Motor Liability Commercial

Hedges talked about their mistake in Motor Liability Commercial, but that the contracts are rolling off and as the losses works it’s way through, there will be less of an impact going forward.

Areas of Focus

Hedges talked about some opportunities in areas they are focusing on:

- Florida homeowners

- Employer Stop Loss (health)

- Small Account Workers Comp, General Liability and Commercial Auto

- Property Catastrophe Retro

Takeaways

So summing up,

- Measures results based on growth in fully diluted adjusted BPS

- Frequency oriented strategy has preserved capital in volatile times

- Client-centric underwriting model has gained market recognition

- Underwriting portfolio is concentrated in highest conviction ideas

- Well positioned for growth when market conditions improve

Market Conditions

Persistent low interest rate environment reduces investment income putting more pressure on underwriting earnings and increases interest for high yielding catastrophe bonds, side cars etc. (which is not good for insurance pricing).

Economic uncertainties reduces demand for insurance and inflationary environment has leveraged impact on excess layers and long duration liabilities

Aging U.S. population and increasing obesity trends leads to higher utilization (health care) and higher costs per visit and slower return to work (workers comp?).

With some comments on opportunities going forward, Hedges passes the podium to David Einhorn:

Investment Approach

- Value Long/short investments with macro hedges

- Focus on capital preservation

- Average gross long exposure of 90% long and 53% short since formation of GLRE

- Annualized return of 9.6%/year since formation of GLRE

Investment returns of 9.6%/year compares to 5.3% for the S&P 500 index, 6.6% for the Russell 200 and 7.5% for the Barclays Aggregate Bond Index.

He showed a table showing attractive Sharpe Ratio and low correlations to the market (0.58 correlation to S&P 500 index and 0.14 to bond index) and some other metrics (used by hedge funds).

Current Investment Environment

- U.S. economy and corporate earnings continue to grow

- Quantitative easing on hold for now; commodity prices trending lower

- Wide disparity of equity valuations (Einhorn notes that there are a lot of cheap stocks and expensive stocks so that is an opportunity)

- European problems remain unsolved

- Slowdown in China

- Possible Japan sentiment change (Einhorn thinks Japan has passed the point of no return (in terms of too much government debt)

Current Investment Portfolio

- Currently 96% long and 57% short (now more net long as they added to longs during recent downturn)

- Largest holdings Apple, Arkema, GM (he said is a cheap stock), gold and Seagate. He also mentioned MSFT, Dell, gold stocks and puts on the Japanese yen

- Longs included cash-rich large cap tech stocks

- Shorts include misunderstood cyclicals and overpriced deteriorating businesses

- overlaying macro hedges due to risky fiscal and monetary policies

Then CFO Tim Courtis talked about the business in general.

Calculation of Float

He noted that many companies calculate float differently, but that GLRE uses a simple measure. He adds up total investments (including cash, restricted cash, due to prime brokers and many items not in the actual “total investments”) and subtracts adjusted shareholders’ equity and he calls that “float”.

Appearance of Debt

He also talked about the fact that data vendors like Yahoo Finance show debt on GLRE’s balance sheet and he gets asked about it often. He pointed out that GLRE has never issued debt as part of the capital structure.

The ‘debt’ that shows up is actually cash collateral put up to support a letter of credit. Since the financial crisis, regulations have made it harder to offer letters of credit; they need cash collateral. So GLRE puts up cash out of a margin account to support the letter of credit. So net-net, it’s not actually debt outstanding; margin borrowing is offset by cash that sits in a custody account to support the LOC.

How Reinsurance Companies Make Money

Courtis did a quick tutorial on how reinsurance companies make money. I think most readers understand this, but it was well-presented so here goes:

ROE = Underwriting Return + Investment Return

ROE = (P/E) * (100% – CR) + (IA/E) * (IR)

where: P = Earned premium

E = Equity

CR = Combined Ratio

IA = Invested Assets

IR = Invested Return

Courtis talked about the two types of leverage: Underwriting leverage and investment leverage (float).

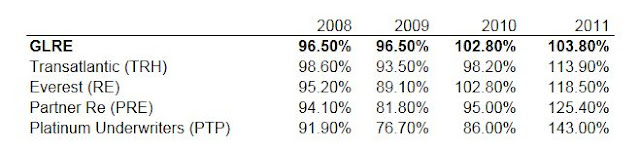

Return on Equity Breakdown

This is the breakdown of the change in fully diluted adjusted book value per share:

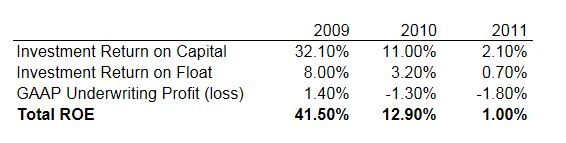

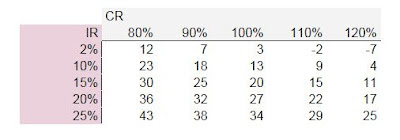

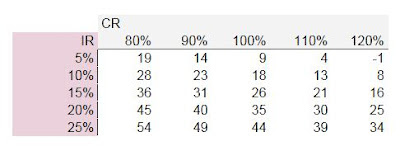

To illustrate the power of the dual engine model, Courtis showed two tables (which I hastily reproduced here):

The numbers in the top row are the combined ratios and the column to the left show investment returns.

So assuming the same ratios as the year 2011, earned premiums at 47% of capital and invested assets at 134% of capital, the ROE would be the following depending on various combined ratio and investment returns:

Earned premiums = 47% of capital

Invested assets = 134% of capital

So with a combined ratio of 100% and a 15% investment return, GLRE would increase book value by 20%. If they had a 120% combined ratio but earned 15% on their investments, they would still increase book by 11%.

Courtis was careful to say this is not a forecast or estimate, but just illustrative, he put up a table that showed what happens if earned premiums were 50% of capital and invested assets increased to 175% of capital. In that case, the ROE, or change in book values under various investment returns and combined ratios would be:

Earned premiums = 50% of capital

Invested assets = 175% of capital

So with a 100% combined ratio and a 15% return on the investment portfolio, GLRE would grow book 26%. In a great year if combined ratio was 90% and the investments returned 20%, they can grow book 40%.

This is the power of a dual engine strategy.

He (or someone) mentioned that the capital is not fully deployed. When market conditions improve, then GLRE can do pretty well.

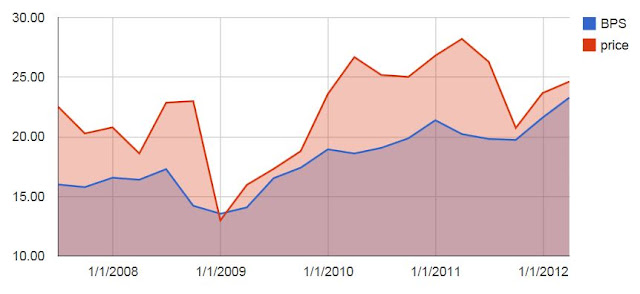

This is a chart of the fully diluted adjusted book value per share of GLRE compared to the stock price. GLRE has rarely traded below book (at least on a quarterly basis) and usually trades at a good premium (this is my comment, not GLRE’s).

The average based on quarterly prices and data is around 1.23x, so it does seem cheap right now on this basis (again, my comment, not GLRE’s). Courtis said that they will leave it up to the market how to value GLRE.

So with that done, the Q&A started:

Q&A

Is the interest rate for margin debt (to support LOC) fixed or float?

Float. No need to fix it. Matches the LOC. As to a follow up question about whether GLRE should be locking in low rates by issuing debt or borrowing, Einhorn pointed out that there is leverage already built into the GLRE model so there is no need to borrow.

Commercial Trucking Losses; was it market-wide or GLRE specific?

They thought with better trucks and systems, lower traffic due to slower economy etc. that frequency should go down but it didn’t; it went up. This was market-wide and not GLRE specific and they can’t find a reason it happened. The policies are rolling off so shouldn’t have impact in the future.

Thailand Floods?

Someone asked that Japanese insurance companies are upping their loss estimates on the Thailand flood; is GLRE seeing any of that? GLRE said they have some exposure there but aren’t seeing anything reaching their limits.

Not Being U.S. Corporation Factor in Trucking Losses?

Someone asked whether being a non-U.S. entity was a factor in causing the losses in the Commerical Trucking business. Would it have been different if they were a U.S. corporation and had their own guys on the ground looking at this stuff? Being a Cayman entity, they are restricted in what they can do within the U.S. Hedges pointed out that they do have outside auditors looking at this stuff; they go through audits both on the underwriting side and the claims side, so they do see what’s going on. They do a lot of that.

Would Competitors Put Pressure on Prices in GL’s Areas of Focus?

Hedges talked about the market in general and said that it is dynamic. The portfolio would move around over time and “could change quite a bit”. They will go where the opportunities are so what that is today may not be the same as some time in the future.

Isn’t Severity Pricing More Inefficient?

Someone pointed to the “Buffett model” of insurance, that severity pricing is more inefficient; shouldn’t GLRE be looking at that? Hedges points out that there is a lack of information and modelling in the severity business that leads to “unknown unknowns”. Models were wrong during the hurricanes. The tails are very hard to model.

Also, Hedges pointed out the difficulty in marrying the severity business with the asset side investment strategy. It’s difficult to walk that line between the two sides and maintain their credit ratings.

He did mention that they will write severity business if the pricing makes sense, pointing out that they had a lot of it in 2006 when pricing was firmer after the hurricanes wiped out a lot of capital.

Question to Einhorn: Sovereign Crisis, how and when will it unfold?

Einhorn said it’s impossible to know when and how these things unfold. Monetary policy is holding things together for now but that is not sustainable. As for how he is preparing for it, GLRE owns gold, FX options (Japanese yen puts) and credit and interest rate derivatives. He can’t say when and how; all he can do is prepare.

GLRE and Hedge Fund Conflict?

Someone asked how Einhorn deals with potential conflict between the two entities. Einhorn said that both portfolios are mirrors so they are managed the same, but they can’t be exactly the same as securities can’t move between the two entities. So they will never be exactly the same but it’s a rounding error problem.

Other issues that might cause a difference is something like the withholding tax. Sometimes it may not make sense to own something in the Cayman entity for tax reasons. There may be some difference due to legacy positions; hedge funds may own old positions held since before GLRE was formed.

Also, GLRE has limit on margin. Sometimes in certain situations, the hedge fund might be more leveraged and that may cause a difference in returns. But that won’t be often.

But in general and over time, these differences should not be significant.

Question about 1.5-3 years short duration of insurance book

I think someone asked whether it would be better for GLRE to have a longer duration book in insurance. Einhorn said that he doesn’t think longer duration is good or better. Long tail business has risk like inflation and being locked into a bad policy for a longer time. Shorter tail businesses can be repriced more often so has less risk.

Hedges pointed out that shorter tail insurance and primary layers have less inflation risk.

Housing?

Someone asked Einhorn about the housing market. He said that housing is improving and it’s broad-based. In terms of construction, he said we are “well passed the bottom”.

Equity Net Exposure based on Market View?

Someone asked about corporate profit margins (high and unsustainable?) and whether Einhorn takes that into account in determining net long/short exposure.

Einhorn responded that he does make comments about the markets every now and then, but that it’s immaterial in terms of structuring the equity portfolio. The portfolio is structured on a bottoms up basis; it’s a function of how many long ideas and short ideas they have. After they build up their portfolio, they look at the net position and then sees if it makes sense given what’s going on in the world.

What’s the biggest challenge in growing premiums?

Someone asked if it was pricing, not being able to look at enough deals or what? Hedges said that it is general market conditions (soft market). The market was good when they started underwriting in 2006 after a lot of capital left (due to hurricanes). Severity was good and GLRE had more back then.

How to think about macro bets in terms of net long/short exposure

Einhorn pointed out that macro bets are not included in the net long/short book; those are only equity positions. Macro bets are additive to the overall portfolio. As for what is in the macro bets, he points out that there is quite a lot of detail disclosed in the 10k and 10q’s. You can see sensitivities to certain exposures (how much will be gained/loss on yen movement etc…).

And that’s it.

The presentation slides are available here:

http://sec.gov/Archives/edgar/data/1385613/000138561312000029/investormeetingdeckmay21.htm

The item that makes me careful with GLRE is that the investment portion is such a big factor. If you can generate investment returns of 10%/year and maybe even 20% a year on occasion, then you can underwrite at almost any combined ratio and turn an economic profit. I don't see this in their mentality yet, however I would not be surprised to see them write at 110 overall because of the economic profitability that it could create.

That said, I have a lot of respect for Einhorn, because his investment analysis is far better than I typically see, like his work on Allied. This must just not be for me, however I would be lying if I didn't say that I get tempted at discounts to book value 🙂

I don't understand, do you want GLRE to write at 110 CR or are you afraid that they will end up doing that? They have been very clear that they want to only write business that is profitable. The insurance employees are only paid on their underwriting results, not the investment results. So if they wrote at 110 CR, they will not get paid and will probably end up getting fired. The dual engine concept is to make money on both ends of the deal. Typical insurers might use investment income to offset bad underwriting, but GLRE plans *not* to do that.

Of course, the "dual-engine" strategy means both engines can go into reverse too. That's obviously a risk.

I think I was initially against it because I didn't read it all closely 🙂

I was afraid of underwriting risk getting out of hand, because if they did the calculations that underwriting @ a 120 was okay, then it would just spell disaster to me. (It's easy to let underwriting slip…) However, they aren't doing that, and they're a frequency focused company at current pricing, which I really like, because it will reduce the odds of a really bad year due to cat losses.

Thanks for putting all of this good information together – I need to take a closer look at GLRE myself.

I really like the cusion they have on total returns assuming their underwriting is conservative. 120% Combined Ratio and only 2% IR gives you -7% off equity….nice…

This insurance – using the free float – setup seems pretty sweet. Especially, when combined with the ability to borrow against your prime brokerage portfolio.

Question is, how do you get into a position to execute. And what exactly is good pricing? I guess I don't know enough about insurance. Life and auto seems to have a pretty simple actuarial, data collection, solution. But reinsurnace, catastrophe, property etc…not sure where they get their loss estimates to calculate a good price.

Maybe I'll sit for the actuary exam after all.

I wonder if anyone sells CDS, which is a type of insurance, and uses the float for capital market activities. Oh wait, AIG…

Maybe its best to stick to insuring physical things like people, cars, and Beyonce's legs.

Hi, yes it's an attractive model that Berkshire Hathaway has been using forever. Markel is another one that uses float to invest; a sort of dual-engine model too.

As for hedge funds, there have been other structures like this. I think Max Re was one of those started by Moore Capital. It was the same deal, but the asset management was more like a multi-strategy fund of funds-type structure. That ended being good on the insurance/underwriting side and not so good on the asset management side; subpar returns.

They moved to conventionalize the portfolio and then I think it was merged into someone else so Moore is no more (at least in the insurance space).

Greenlight now is 95% frequency so they are short-tail businesses. I don't think AIG/CDS is a comp to this situation.

Also, one good thing here is that Greenlight started in a strong market but the market has been soft for most of it's existence. That's actually a good thing. What you don't want is for someone to start in a strong market and write too much business being overly aggressive and then trying to keep up the premium/float even as prices come down, building up more risk at lower prices and eventually getting clobbered. Here, the prices are so bad that they are very cautious in building their book.

Or at least that's one way to look at it.

One thing to think about regarding GLRE is how much Einhorn has personally committed to the business. At cost he has around $50 million invested via B shares (if I'm remembering correctly). That gives me a lot of comfort as an investor in GLRE when comparing it to other attempts by hedge fund managers searching for permanent capital via a reinsurance arm. I feel very comfortable investing alongside Einhorn. Just as a reference point, since 2004 GLRE has compounded BVPS at 11.8% per year through 1Q2012 while MKL has compounded BVPS at 11.6% during the same period. This growth was accomplished during one of the most volatile financial markets and costliest insurance (in terms of losses) markets in recent history.

I am not sure how the calc on slide 32 is a float, or the full float. If we look at Q10 03/2012 from SEC, which slide 32 takes its figures from, and add up/subtract 'reinsurance' figures only as below:

+Due to prime brokers

+Loss and loss adj reserves

+Unearned premium reserves

+Reinsurance balances payable

-Reinsurance balance receivables

-loss and loss adjustment recoverable

-DAC

-Unearned Premium ceded

will result in a US$557m float which is exactly double the US$282 mentioned on slide 32. Doesn't US$282 look understated (and we didn't even throw in other assets/other liabilities)?

Hi, thanks for the comment. I think you can ignore the "due to prime brokers". This is an accounting thing specific to hedge funds related to letters of credit and collateral needed to support that.

I forget the specifics at the moment but there was some regulatory change that necessitated this round-about accounting.

If I have time I may post something in more detail, but think of this accounting item as something that is put on the books as a separate item whereas in practical terms it can be offset with cash/securities on the other side of the b/s sheet. (This due to prime brokers is a margin loan of cash from the prime broker that is put up for collateral for a line of credit; this is offset by the cash so net-net, this is not a liability).

thanks for reading.

Thanks kk!

IF we ignore "due to prime brokers" and add in "Funds withheld" on reinsurance I didn't include earlier, figure works out just fine at $275m (compared to their $282m).