2011 Annual Report

As usual, the Leucadia National annual report is a great read. This is one of those annual reports that is never a waste of time. They made an exception in this year’s annual report to talk about the sorry state of this country’s politics.

It says,

“Usually we begin our Letter to Shareholders with a recap of last year’s earnings, but this year all business including Leucadia’s plays second fiddle to the sad state of our body politic or more simply put the mess in Washington.”

The first paragraph ends,

“All of the above is not sustainable and when interest rates get back to normal we’ll be the headline, not Greece. Without fixing our fiscal infrastructure high inflation seems inevitable. One of us loves GLD the other farmland.”

So that’s a very different tone than usual and very different from some other annual reports (Buffett and Dimon being more optimistic). Alleghany Corp’s Letter to Shareholders too have been quite bearish over the past few years.

The folks at LUK are very smart people so I wouldn’t want to bet against them, but I still wonder if it’s a contrary indicator when people who are not normally into gold or farmland really like gold and farmland because of what’s in the headlines (farmland prices are up a lot in the U.S. in certain areas, partly driven, apparently, by financial buyers).

National Beef Packing

LUK bought 79% of National Beef Packing in late 2011 for $867.9 million. I was wondering why they would buy a beef packer as I get the impression that this is a spread business where management has no control of either side of the business (input price and output price). I remember reading beef and chicken processing annual reports and every year it seemed to be, earnings were down due to high corn prices, earnings were down due to lower chicken prices etc… Every year the earnings would be up or down due to factors that management had no control over.

LUK explains well why they like National Beef Packing. Of course they think NBP has great management and that is probably the most imporant thing (along with efficient operations). But the levers for growth here is the increasing percentage of sales coming from value-added products (replacing the butcher in supermarkets etc… by processing more at the NBP level) and the rising food consumption pattern around the world (increased protein as GDP per capita increases).

I also had the impression in the past few years that LUK regretted not owning a large business that threw off a lot of cash flow. They do own a lot of wholly owned businesses but they don’t really seem like cash machines. Much of their earnings and cash flow seemed to be from investments etc… I think in tough times, they wished they had a cash generator that would help pay the bills and build up ammunition for further deployment (like Berkshire Hathaway).

More on this later, but this is also good for the deferred tax assets.

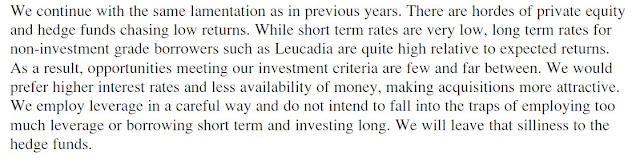

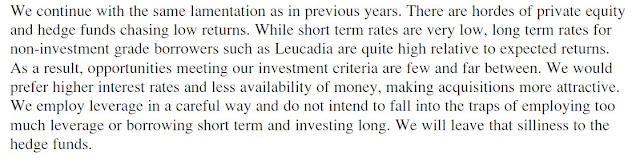

Few Opportunities

Leucadia sees very few investment opportunities in this day of low interest rates and multitudes of hedge funds:

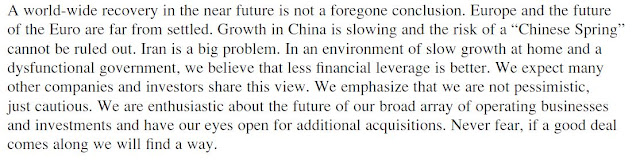

Not Pessimistic but Cautious

Like Buffett, their bearish or cautious view won’t stop them from doing a good deal if they see one. They are not shorting S&P 500 futures (like Larry Tisch did with Loews a while back), buying puts, gold or anything like that in LUK. (Alleghany folks are pretty pessimistic if you read their reports but they too have continued to grow the business and increase book value without resorting to piling into gold or index put options. There is a lesson in there somewhere…)

Surprise?

The other surprise is that Ian Cumming won’t be renewing his employment contract when it ends in July 2015. I think I have read in the past that both Cumming and Steinberg intended to renew their contracts in 2015. Cumming will be 75 in 2015 so it’s understandable, but still surprising given that I thought they would renew (I think most shareholders thought that too).

Succession

It looks like they are also working on their succession plan more publicly and explicitly than Berkshire Hathaway (not that I have a problem with Berkshire’s succession plan. I don’t have a problem with it at all and I don’t know why people are so upset that he hasn’t named a successor. Most companies haven’t named one either even though many will probably retire long before Buffett).

LUK Not BRK

By the way, just as an aside, I should mention that LUK is not a mini-BRK. It sort of looks like it because it’s a value investing congolmerate run by two old guys with opposing political views. The big difference is that BRK likes to buy great businesses with moats, great management and all of that, whereas LUK is almost the opposite. Here’s a snip from one of their annual reports:

Buffett doesn’t like “troubled” businesses.

Also, BRK is one of the highest credited rated entities and LUK is not even investment grade. There are folks who have 80% or more of their net worth in BRK, but LUK is not that kind of investment. With BRK, first of all, you have a large portion of the value in a portfolio of blue chip common stocks and then a large portfolio of diverse operating businesses. You can easily argue that holding BRK is safer than owning the S&P 500 index. I would not say the same for LUK.

Updated Book Value Per Share (BPS)

As of the end of March, 2012, book value per share of LUK was $26.28/share ($6.4 billion shareholders’ equity and 244.6 million shares outstanding). In order to update this, I just look at their large equity holdings and adjust the book value by the price change in their stock holdings since the last balance sheet date.

Doing this, I get a BPS of $25.28/share as of now (May 10, 2012). So it seems with LUK trading at $23.91, it is trading slightly below BPS.

BPS Adjustments

There are a lot of adjustments that need to be made in valuing LUK. I don’t even attempt to value the wholly owned businesses as in the past much of the value just seems to come from their large stock holdings. Why bother fine-tuning what you think Sangart is worth when what happens to JEF would have a much larger impact on the value of LUK? Of course I may be wrong. I’m just saying what I do and don’t do.

In any case, there are two big pieces that must be adjusted to reflect reality.

The two big pieces are:

- Fortescue Metals notes

- Deferred tax assets

In the case of the Fortescue Metals notes, they are on the balance sheet at a much lower level than what it is probably worth. Deferred tax assets, on the other hand, are on the books for much higher than what it is worth (since the deferred tax assets are booked as an asset without present valuing it. $1.4 billion today is not the same as something that might be worth $1.4 billion in total over the next 20 years).

So we would have to adjust the BPS level UP for the Fortescue notes and then DOWN for the present value factor of the deferred tax assets.

Fortescue Notes

These are the notes that LUK got from Fortescue when they invested. The notional amount is $100 million, but the coupon is based on 4% of revenues generated at two of Fortecue’s mines. It turns out that his amount is huge due to the rise in iron ore prices.

As of March-end 2012, LUK had these notes booked on the balance sheet at a total value of $232 million (LUK booked this note as two separate items: a zero coupon bond and a prepaid mining interest).

I have in the past used various assumptions to try to figure out the value of the prepaid mining interest and get all sorts of figures. So I decided to just look at how FMG values it and their guess is as good as mine (or much better).

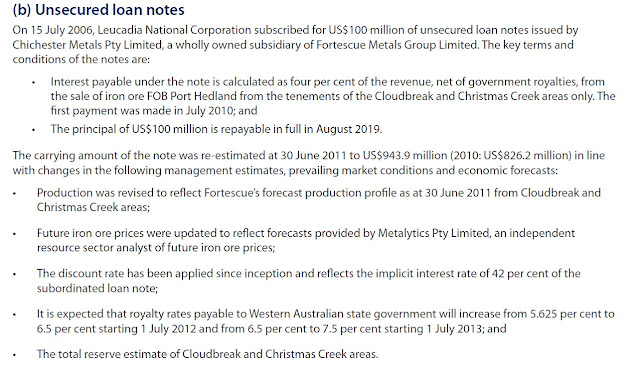

Here is how FMG has the notes valued on their books:

This is from their notes to the June 2011 annual report:

They use all sorts of assumptions, which I can’t imagine would be worse than mine (no pun intended), to get a fair value of the notes. They probably have a better look at iron ore prices, production schedule, expected royalties etc…

And this is from their interim report for the period ending December 2011 for a more up-to-date figure:

The LUK notes are the “Unsecured loan notes”, both current and non-current.

According to FMG, these notes held by LUK is worth $991.4 million. That’s $759 million more than it is carried on LUK’s books. With 245 million shares outstanding, that’s worth $3.10/share not reflected on the books of LUK. You can knock off 10% for withholding tax that LUK will have to pay from the value of these notes (as reported on FMG’s books). That would take it to $2.70/share.

This figure will vary wildly with changes in iron ore prices (and forward curve) and the other factors.

There is also one hidden bomb here as FMG has claimed that they can issue more of these notes to dilute LUK’s 4% share of revenues. This is being fought out in court in Australia, as stated in LUK’s 10k and Letter to Shareholders. The outcome of this is obviously a big unknown.

Deferred Tax Asset

The other elephant that must be dealt with is the deferred tax asset. Unless you are valuing LUK as an immediate liquidation story, I don’t think it makes sense to not give the DTA some value.

However, to give a full, undiscounted value as SFAS 109 requires is not realistic either. There is $1.4 billion of DTA on LUK’s balance sheet as of the end of March 2012. With $6 billion in shareholders’ equity, it’s highly unlikely that LUK will be able to generate $4 billion this year.

So let’s hope they can earn this out over the next decade. They only need to earn $400 million/year pretax over the next decade. With more than $6 billion in shareholders equity, one would hope that they can earn at least this much from an ROE point of view.

Also, National Beef Packing has averaged $190 million or so in operating earnings over the past five years so that would certainly help a lot in digesting this DTA.

Just using a simple valuation, let’s assume the $1.4 billion is digested over the next ten years. That’s $140 million/year in taxes saved (need to earn $400 million/year pretax in taxable income). Using a discount rate of 10%, that would present value the $1.4 billion at $860 million. That’s a $540 million haircut and that comes to $2.20/share.

If you assume that they can absorb this in five years, the discount would be only $1.40/share.

You can do whatever you want. You can use seven years or twenty years. You can use a different discount rate. But either way, unless LUK is going to bag an elephant and flip it this year for a $4 billion profit, you have to give the DTA a haircut.

On the other hand, even if LUK had to take a valuation allowance (as required by GAAP) and write this off completely every now and then, I would not worry that the DTA is worthless (unless of course there is some sort of transaction that kills the DTA).

It’s a Wash

So the hidden asset of the FMG notes is offset by the time value adjustment of the DTA. Net, net, that means the published BPS, at least in my mind, is a pretty good indication of fair value of LUK at this point.

Of course, both of these things (FMG notes value and DTA value) can vary dramatically. This is more true of the FMG notes. I don’t worry about GAAP changes in the DTA at all and I don’t worry that they won’t be able to earn enough to use it up (because if you don’t believe they can, you wouldn’t own the stock).

Conclusion

So, after all of that, I still like LUK. It’s run by some of the smartest people in the business. I wouldn’t worry too much about trying to value the various businesses as much of the value is created in deals. For example, look at what they did with FMG and ACF.

As recently as 2001, LUK only had shareholders’ equity of $1.1 billion or so and it’s now $6.4 billion as of the end of March. That’s a lot of value creation (well, there was stock issued for a merger).

This value creation wouldn’t have been predicted by picking apart and valuing the various pieces of LUK at the end of 2001. You have to believe that LUK will find and make great deals going forward.

If I have time, maybe later on, I may (but don’t hold your breath) look at the various pieces of this value creation. Where exactly did the $5.5 billion over the past ten years come from? Of course, part of that is the DTA. And then the homerun in FMG etc…

As usual, don’t buy this stock just because some guy on the internet said it’s good. There is a lot of risk here and it’s certainly not a Berkshire Hathaway in terms of margin of safety, diversity and safety of business, strength of culture etc… It is much more private equity firm-like than BRK is.

Also, I often tend to like reading the annual reports of LUK than actually owning the stock (I do own some now) so just because I like it doesn’t make it the best investment around.

fyi the annual shareholder meeting is May 15