Biglari Holdings (BH) is a Berkshire Hathaway like investment vehicle run by a young manager named Sardar Biglari. Actually, BH is what was Steak ‘n Shake (SNS), a hamburger restaurant chain that Biglari’s hedge fund owned. After a bunch of transactions which merged the hedge funds with Steak and Shake and another restaurant chain, Western Sizzlin, SNS was renamed BH (like the intials of Berkshire Hathaway).

Anyway, the details of these transactions are well documented so I won’t repeat them here.

This is certainly an interesting situation as Biglari is going in the direction of Berkshire Hathaway in that he wants to run this business taking the cash generated by the restaurant business and invest it wherever he sees fit. Of course, this rubs some people the wrong way, but I don’t think it’s a bad idea at all.

Controversial

So anyway, Biglari has been talked about on the internet largely due to his similarity to Berkshire Hathaway. Of course, this has caused a lot of the coverage to be negative. His renaming of Steak and Shake to Biglari Holdings was seen as egotistical. His annual reports, website and letter to shareholders have the same sort of look and feel as Berkshire Hathaway’s etc…

Other actions that have been criticized are:

- Did a 1/20 reverse split to get the stock price up into the hundreds (wanted a high price like BRK?)

- Attempted another 1/15 reverse split to get stock price up from $400 to $7000 to artificially create a high stock price, (wanted a higher price just like Berkshire Hathaway?)

- Proposing the issuance of Class B shares with 1/10 the economic value and 1/100th the voting power (just like Berkshire Hathaway’s B-shares). (why go to the trouble of reverse splitting and then issuing low priced B-share?)

- High compensation: $900,000/year salary (versus $150,000 or so for Buffett) plus an incentive bonus plan very hedge-fund-like; 25% of the increase in book value over a 6% hurdle rate (this is capped, however, at $10 million)

- Put a photo of himself in every SNS store (egotistical!?)

- Drives fast cars

I think to many, Biglari comes across as a young, cocky, arrogant kid.

Sure, some of this stuff is a little irksome, but I actually don’t see anything ‘wrong’ with it. Emulating Buffett and Berkshire is actually a good idea, I think. Some feel that he is only emulating the look and feel to deceive investors into thinking he is the next Buffett. Well, that may be so, but I tend to think the Berkshire fans are overreacting a little bit and feel offended that some young kid is copping stuff from their hero.

That’s OK with me. Leucadia’s website looks just like Berkshire Hathaway’s too.

As for the ‘egregious’ compensation, I think it might have been a bit tone-deaf to shoot for a hedge fund-like compensation structure but I don’t see too much a problem with it as long as he performs. There is a hurdle rate of 6%, so the book value has to increase 6% before he gets paid. Plus the bonus is capped at $10 million.

This pay is probably high for a business of this size, but again, if he does well I think it should be fine. But then again, I am OK with the compensation at banks and investment banks which are way more ridiculous so I know my view won’t be shared by most and that’s OK.

There are some other issues out there with respect to past transactions, but I think that’s more about upsetting some people but not anything illegal.

Anyway, so there is a lot to be critical about with BH and there are plenty of negative comments on the internet.

But as I read them, for the most part, I see problems more with people just not liking Biglari and some of his methods. But I don’t see anything really glaring that is a big problem. I actually think he is honestly trying to do well.

So setting aside all of these distractions, let’s see how he is doing in the business.

Steak ‘n Shake

So let’s get down to business.

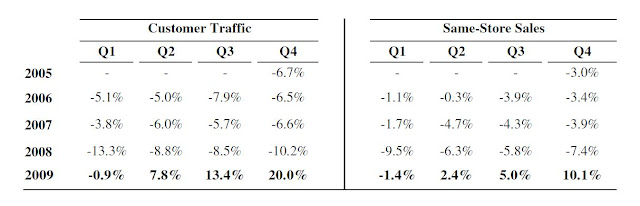

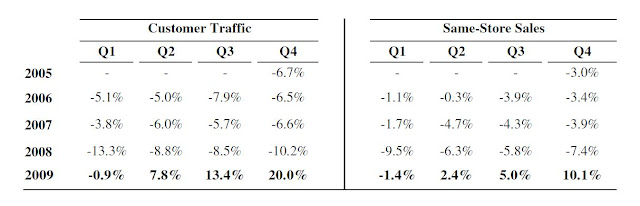

This is the trend in customer traffic in same-store sales at Steak & Shake from the 2009 BH annual report:

So when Biglari took over management of SNS, the fundamentals were horrible. Customer traffic was down consistently as were same store sales. You can’t blame the economy for this horrible performance since the figures seem horrible from late 2005 (2006-2007 were boom years).

The bold figures show how SNS has done since Biglari took over. There is a huge change.

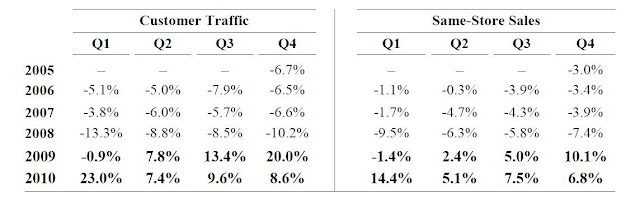

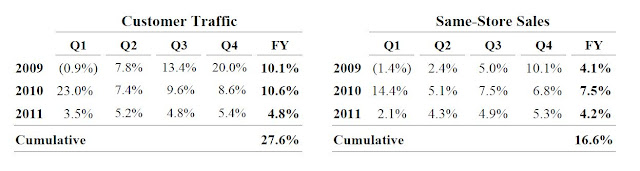

And here is the same from the 2011 BH annual report that includes the figures for 2011:

So there is a very noticable improvement. We know that Biglari has made a big positive change at SNS.

They just opened a new store concept on Broadway in NYC in January, which is called the Steak ‘n Shake Signature, which is more like a fast food joint with counter service only and few tables. The yelp reviews are mixed (as they always seem to be) but I’ve heard recenty from people outside NYC that they do like the Steak and Shake stores.

Yes, the burger market is crowded with everyone from McDonald’s to the new age Five Guys, Shake Shack, In-and-Out and many others.

BH is going to manage the restaurants for their cash flows so will continue to invest as long as they can do so with good returns. Otherwise, they will allocate capital to other areas.

I tend to like these kinds of models (LUK, L, MKL, BRK etc…).

So What is BH Worth?

So that’s the real question. I’m not really that interested in a hamburger joint, but am interested in what Biglari can do with it and where BH will invest capital in the future. Right now, the next largest piece of BH is Cracker Barrel (CKBL), which BH owns 15% of and is trying to activist the stock back to health. Maybe the CKBL drama will be another post for another day.

I do certainly agree with the likes of Biglari that a lot of businesses tend to get stuck in old ways of doing business even if it is no longer the right way to go. So I am not at all opposed or bothered with Biglari’s activism (so far from what I’ve seen).

I think this is another thing that bothers BRK fans; Buffett is a passive investor and doesn’t rock the boat (or at least he doesn’t do that anymore… or he doens’t do it publicly).

Anyway, looking at BH was a bit confusing. First of all, I was disappointed when I searched around for a valuation of BH that most people just took the published financials and used them without any adjustments; people used the GAAP book-value per share, earnings and cash flows and just slapped on the usual multiples and made judgements based on that.

However, BH is a strange animal and the GAAP figures can be very misleading.

For example, BH owns shares in a hedge fund that Biglari runs, but GAAP requires full consolidation of the partnership units even when a large part of it is owned by hedge fund investors and not BH. That’s fine. This is an issue with private equity funds too and investment banks that have to consolidate holdings held in their private equity businesses.

But what makes it confusing for BH is that the hedge fund (The Lion Fund) owns a large stake in BH. So BH owns a part of the Lion Fund, which owns a big stake in BH. This is all consolidated, but since the Lion Fund owns shares in BH, the shares of BH held in the hedge fund are deducted from shareholders’ equity as treasury shares (because by consolidating the hedge fund, they own shares in themselves).

This is all well and fine, but the problem is that the BH shares that the hedge fund owns is still outstanding as outside investors own a majority of the hedge fund.

The correct way to net out this BH holding in BH is to deduct from shareholders equity only the portion that is actually owned by BH, not the entire BH position owned by the hedge fund.

Confusing?

And since the BH shares are deducted from shareholders equity and is accounted for as treasury shares, they don’t appear on the asset side of the balance sheet.

OK. So don’t worry about that too much. I *think* I have it figured out. I may be wrong. But let’s go on.

What’s the Restaurant Business Worth?

In the year-ended September 2011, the restaurant business looked like this:

Revenues: $705 million

Operating earnings: $42 million

Net earnings: $30 million

Depreciation and Amortization: $28 million

Capex: $11 million

Identifiable assets: $414 million

Goodwill: $26.5 million

SNS did a dividend recap; they issued long term debt and paid a cash dividend to the parent company.

As far as I can tell, this debt, $112 million is owed by SNS but the interest expense doesn’t seem to be included in the restaurant business segment breakdown above. Segment operating income typically excludes interest on debt and the difference between operating earnings and net earnings in the above figures suggest that the interest on this debt goes below these lines.

So when valuing the restaurant business, we will just have to deduct the debt from the equity valuation.

What is a restaurant company worth these days?

Here is a quick table for restaurants and valuations:

ttm ttm Operating

P/E EV/EBITDA margin

McDonald’s 19x 11.7x 30.7%

Darden Restaurants 15.2x 8.4x 9.1%

Yum Brands 25.5x 12.5x 15.9%

Brinker International 16.5x 7.7x 8.2%

Bob Evans Farms 17.6x 6.2x 6.7%

Cracker Barrel 14.9x 7.7x 6.9%

Ruby Tuesday 16.9x 6.9x 4.2%

Red Robin Gourmet 18x* 6.8x

*Red Robin has been having problems so 18x is based on what they earned in the past.

So it looks like anywhere between 15-20x is normal for a restaurant business. California Pizza Kitchen was taken private last year and their merger proxy had valuations for restaurants too, and out of their universe, the median p/e ratio was 16.5x p/e and EV/EBITDA ranged from 6-8x depending on the universe.

So let’s say 16.0x p/e and 7x EV/EBITDA is fair for SNS. That does not seem unreasonable at all given that even Red Robin is trading at 18x what they used to earn in good times and 7x last twelve months’ EBITDA.

SNS earned $30 million in net last year, so 16x that is $480 million (I say SNS, but actually I mean the restaurant business; this includes Western Sizzlin, most of the restaurant business is SNS). With $112 million of debt, that leaves an equity value of around $368 million. Using a 7x EV/EBITDA figure, we get $70 million in EBITDA x 7x = $490 million less $112 million in debt gives us a $378 million value; very close to our p/e valuation.

So the first part of the valuation is the restaurnant business:

Restaurant business value: $368 million (use 16x p/e value)

So what else is there? We know that BH owns shares in the hedge fund. But a lot of that is invested in BH, let’s not even include the non-BH assets owned by BH.

Then there are two big pieces left. One is cash. and the other is investments:

Cash at September 2011: $99 million

Investments: $115 million

It’s important to remember that the “investments” don’t include anything owned in the hedge fund, as those are in “Investments held by consolidated affiliated partnerships”.

So the total valuation is the sum of the above three (in simple terms): $368 mn + $99 mn + $115 mn = $582 million

The total value of BH is $582 million.

How many shares do they have outstanding? They have 1.5 million shares outstanding, but deducting as treasury shares the amount BH actually owns through the hedge fund give us 1.43 million shares outstanding.

It’s important to keep in mind that on the balance sheet, the number of shares outstanding shows 1.2 million shares outstanding after deducting 284,000 shares in treasury stock which is wrong. This deducts the entire amount of BH shares owned in the consolidated hedge fund of which BH only owns a portion of.

So the total valuation is $407/share.

Keep in mind this is a simplified analysis. BH owns a part of the hedge fund and there are assets other than BH in them. BH also earns a management fee and incentive fees on the hedge fund. I left all of this out and other smaller items as the above three, I think, look at the big value determinants of BH.

So with BH trading at $411/share, it looks about fairly valued using balance sheet data as of September 2011.

However, let’s take it one more step as BH did announce earnings for the 12/2011 quarter. We can update the above figures and come up with a more up-to-date value for BH.

Updated Value of BH

First of all, as of the end of December 2011, cash and investments have moved up to $234 million.

The restaurant business is interesting, though. In 2011, the operating margin for the restaurant business was around 6%, but in the December 2011 quarter, operating margins went up to 8.5%. This makes sense as they continue to improve operations there.

If we assume, perhaps conservatively, that SNS grows sales 5% in the year to September 2012 (year-over-year sales in the December quarter was around +5%) and they achieve an operating margin for the year of 8.5%, they would get a nice boost in operating income.

This might be conservative as they just launched the new model store, Steak ‘n Shake Signature.

Anyway, so 5% growth from $705 million is $740 million. And an 8.5% margin would give us operating earnings of $62.9 million. Using the same tax rate as last year, net income would be around $45 million.

Going back to the above model of 16x p/e for the restaurant business which is not aggressive at all, I don’t think, that’s a value of $720 million. Deduct the $112 million and you get $608 million equity value for the restaurant business.

So, with the current $234 million cash and investments on the balance sheet, and $608 million equity valuation on what the restaurant business can do this year, that’s a total valuation of $842 million.

With 1.43 million shares outstanding, that’s a value of $590/share, or 40% above current levels.

Is 8.5% operating margin achievable? Biglari has said during 2011 that their earnings are subdued due to investments made for the future implying that the 6% operating margin for last year was not going to be normal.

Judging from how restaurants typically do, 8.5% operating margin does not at all look like a stretch. Also, their new, smaller concept (Signature) and their moving forward on expanding franchising should be good for margins.

(When Chipotle started rolling out their A-model stores, their margins seemed to explode; they were able to make smaller stores for cheaper, but generate simliar amount of traffic as their larger restaurants, which was good for operating margins and returns on capital. Something simliar may happen with Steak and Shake if they can succeed in the Signature rollout. Also, franchise businesses tend to have higher margins and returns on capital for obvious reasons if done right).

Conclusion

So that’s just a quick look at BH and I do find it interesting. If they meet even modest goals I laid out above, this stock can easily move up to $500-600 range.

I have to say that this is a quick first look so I may be missing something. I think the overall look is correct but as I follow this going forward, I may have to make some corrections.

Interestingly, this doesn’t even take into account anything else that might happen there, including what happens with the $100+ plus cash on the balance sheet (I assume the restaurant debt will be paid back over time out of restaurant cash flows, so this current cash is deployable).

Also, further progress in the CBRL drama can give a boost too as it is a large holding in BH. Of course, Biglari failed in his bid to get a board seat, but these things never end just like that. The pressure is on at CBRL and sometimes that’s all it takes to get operational improvements and other changes. We’ll see about that.

I understand that there is a lot of criticism against Biglari and there are things that bother me too. But as long as he isn’t doing something outright wrong, illegal or unethical, I don’t really have a problem. Aggressive tactics is all part of business.

We shall see how this turns out. Of course, like anything else, there is a lot that can go wrong here, so do your own homework!

A major issue that I see here is that when the incentive compensation agreement was approved the stated book value of the company was about $250 million, I think that the economic value exceeded $650 million. The difference was appreciation of assets over decades, a lot of it because of inflation, not real appreciation.

25% of the $400+ million difference is $100+ million. Easy for Biglari to take even though he may have had nothing to do with that appreciation.

Yes, I heard that and it's a fair comment. Biglari's view, I think, is that it was SNS was troubled and that value was not being realized (or appreciated by the market) and his fixing it is realizing that value.

You will always have sort of those legacy advantages that new managers will be able to capitalize on; old, down-and-out retailers with submarket rents (JCP $4/sf rent, for example), so sometimes it's hard to say where the value is actually being created. (Of course, Johnson at JCP is not taking home 25% of book value increase).

I understand both sides of the argument.

For me, I just want to know what the end result is. Just like when some hedge funds charged 50% incentive fee; I don't care what the fee is so much as the net return to the investor (I have never invested in such a hedge fund). If the net return is good, fine. If not, then sometimes no fee schedule is fair.

Biglari is certainly unconventional and what he does seems egregious, but let's see how he does.

I find it interesting, but obviously one can't get the comfort level here as with L, BRK or some others…

What are your current thoughts on BH's valuation? CBRL is doing great, but restaurant operating margins have come down to 3.5% as of the most recent quarter.

Hi,

It is interesting that CBRL has rallied so much and BH hasn't. My initial valuation depended on SNS gaining some traction in terms of profits, margins etc… If that happens, BH can be do really well… We shall see…

Great ARTICLE. I have been following this guy for about 5 years. What are your thoughts on the stock now?? CBRL has really rallied and I like what he did with the monies from the first rights offering. Thanks!

This stock is way undervalued. BH would be wise to repurchase some shares with all that cash from the second offering! THOUGHTS? You said you've been following him for 5 years, next five should be fun to watch.

Hi,

I haven't dug into it deeply recently, but I still think it's an interesting idea. I understand all the criticism about it, but that doesn't bother me too much. I did scratch my head about Maxim, though. Maybe it's one of those low cost bets; high upside (if successful) but low financial risk. But it can easily become a time sink for Biglari too.

But my thoughts haven't changed much from before either for the better or worse…

Thanks! I could see him getting the Maxim brand up and running and then licensing the brand into a "mini" old spice. But, that will be a large task, only time will tell.