I’ve been thinking a lot about Berkshire Hathaway (BRK) lately. It’s still one of the best investments out there for most people. I don’t think it’s the highest return investment around, but an investment in Berkshire Hathaway at the current price is far better in my mind than owning the S&P 500 index or most actively managed mutual funds.

There is really no need to elaborate on why BRK is a great investment; there are plenty of blogs, books, articles and surely tweets about what a wonderful thing it is.

But I got to thinking a lot about the current low interest rate environment, which lead me to think about insurance companies and then of course how that applies to BRK.

First, a quick look at the ‘mechanics’ of an insurance company.

How Do Insurance Companies Work?

I am no insurance expert, but basically insurance companies collect premiums from customers and then get to keep that premium until some event forces the insurance company to reimburse the customer for damages. This amount of premium that the insurance company holds is called float.

If an insurance company can price their insurance policies correctly, their losses will be covered by their premiums. In other words, their underwriting profits will break even or make money. Most insurance companies, though, don’t make money over time, but lose it in underwriting. But that’s often OK as long as they make more money on their investments; in other words, if the insurance company invests the float profitably, that will often more than pay for the underwriting losses.

Most insurance companies hold most of this float in cash and fixed income investments for obvious reasons. You can’t be speculating with float; this needs to be liquid and ready to be paid out to policy holders when insurable damages occur. Insurance is also highly regulated, so an insurance company can’t just write a lot of policies, collect a bunch of premiums and build up their float and then invest it all in Apple stock, for example.

Anyway, investment companies are often pretty leveraged. This means that their float is often a multiple of their shareholders’ equity.

This is sometimes called investment leverage. The total investments an insurance company owns is going to be a combination of their shareholders equity and their float (or premiums held until it has to be paid out to cover insured damages).

One reason I was looking at this is that most insurance companies seem to be trading at or way below book value per share. I was wondering why.

The answer is quite simply low interest rates. Insurance companies are pretty much like leveraged bond funds.

A typical insurance company can have investment leverage (total investments divided by total shareholders equity) of three to four times.

So let’s say an insurance company has a net worth (shareholders equity) of $100. Oftentimes, these companies will have investments worth $300 or $400. The difference is usually the “float”.

For simplicity, let’s assume that this insurance company breaks even on the insurance business, so their profit is based on the money they make on investments.

In a world where interest rates are at 8% like much of the 1980s, this company can earn a return on equity of 24% – 32%. Earning 8% on $300 worth of investments is a $24 pretax profit, and on $100 in equity, that’s a ROE (return on equity) of 24%.

So it’s easy to see why in this environment, the insurance business should be worth way more than book value. A rule of thumb in investing in financial companies is that you want to earn 10% on your investment. So to earn 10% return on investment, you can pay up to 2.4x book value for this business and still earn 10%.

Now here’s the interesting part that illustrates what’s going on right now. Long term bond yields are now at 2% and the interest rate on cash is 0%. How does the above math work?

Assuming the same $300 worth of investments (investment leverage of 3.0x) and an interest rate of 2%, the investment profit would be $6. A $6 pretax profit on $100 in equity would be 6% pretax ROE. Now that’s not so exciting anymore.

If an equity investor demanded 10% return, we can easily see why this ‘business’ is now worth much less than book value. To earn a 10% return, an equity investor must pay only 0.6x book!

This, in a nutshell, is what is happening in the insurance industry right now and why so many insurance companies are selling well below book value. Not only is the insurance market “soft” (meaning a weak economy and excess capital in the industry is causing low prices for insurance policies) and insurable losses large, investment returns on insurance company investments are plunging.

Normally, I would not be too concerned with low interest rates. Interest rates are not something anyone can predict with any certainty. But since we are drowning in so much debt, and interest rates are a function of supply and demand (for loans), an extended period of low interest rates as seen in Japan is very possible.

In that case, I think it’s very important to understand what the consequences of that might be. Many smart people including Warren Buffett assumes this low interest rate environment is a bond bubble of historic proportions, but I’ve seen the same sort of comments made in Japan for years. For as long as I remember, the JGB (Japanese government bond) has been a favorite short by hedge funds. I’ve heard this Japan JGB bubble talk since at least 1993. And the bubble has never popped, yet.

So What is Float Worth?

So as we see from the above, if you are an insurance company and you are good at underwriting policies, this can be very advantageous. You get to use the float to make money before you have to pay it out to policy holders.

In the world of BRK, since they are so good at underwriting, we consider float to be as good as equity. Why? Because BRK has been able to *make* money in underwriting over time. So the cost of holding this float has been negative over time. That’s like issuing a bond that has a negative interest rate. Also, as long as the insurance company continues as a going concern, it never has to pay back the float (the reality is that the premiums paid out for losses and damages is replaced by new written insurance premiums). Also, this float tends to grow over time at BRK.

So one big factor in valuing BRK over the years has been this factor of float. Some people include float like equity in their intrinsic value calcuations.

But we have to ask, if this low interest rate environment continues for longer than we think, what is this float actually worth?

First of all, we have to clarify one thing. Many BRK fans, I think, assume that this low cost or negative cost float is invested in high return assets like stocks. I used to think so too. But when you look carefully at the BRK insurance segment balance sheet, you will notice that that hasn’t been the case.

Partly for conservatism on Buffett’s part, and also for regulatory reasons, BRK has invested the entire amount of float over the years in bonds and cash.

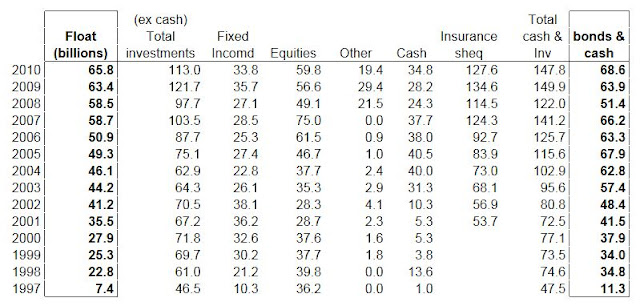

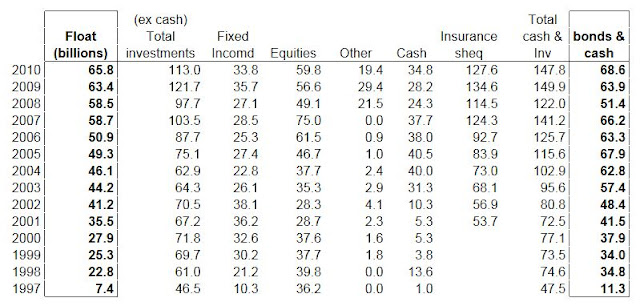

To prove this, I looked at BRK’s float over the past few years and also the amount of bonds and cash it held. (For this, I looked at the “insurance and other” segment in the annual reports. This segment actually includes the “manufacturing, services and retailing” segment, but that doesn’t materially change the point here).

You will notice that BRK, like other insurance companies, collect premiums from customers and then invest that cash. The total investments of an insurance company is roughly the float plus the company’s own shareholders equity.

From the above table, you will see that BRK does in fact invest a large portion of their total investments in equities; much higher than is typical at other insurance companies.

But you will also notice that the amount invested in cash and bonds is rarely below the amount of float. Buffett says bonds are in a bubble of historic proportions and yet owns $34 billion worth of it. Why? Because float needs to be invested in highly liquid assets; basically bonds and cash.

So when people assume that float is invested for high returns in stocks and the like, this has not been true in the past. The entire float amount and often more has been invested in cash and bonds.

In a high interest rate environment, this is fine. If bond yields were 8%, then this float can be worth a lot to an equity holder if the cost of float is zero. That’s a free 8% money; incremental to ROE.

But with cash rates at zero and bond yields at 2%, what is float worth to a shareholder?

Assuming zero cost of float and a blended 1% return on cash and bonds, pretax, that means float is worth to the equity holder the amount of (1% – 0% cost of float) / 10% (equity discount rate) = 10%.

Float is worth approximately 10% of the face amount because this is the discounted value of the profits it will generate for the shareholder over time.

Sometimes in the world of BRK, you hear about this valuation model where you add the float to the shareholders equity of BRK because float is as good as equity. While this is sometimes a good approximation of intrinsic value, it can be wildly off in an extended environment of low interest rates.

Conclusion for Part 1

So we looked at how insurance companies make money and why their valuations (namely price-to-book value ratios) are so low lately. We learned that insurance companies act like levered bond funds, although that grossly oversimplifies reality in many cases.

People often assume that BRK is different because the float is actually invested in equities and other high return assets, but looking at the data show that this is not necessarily the case. BRK’s insurance operations does indeed invest heavily in equities, but there seems to always be the float amount worth of bonds and cash on the balance sheet which limits the ‘bang for the buck’ that the ‘free’ float provides to BRK shareholders in a low interest rate environment.

If the low interest rate environment is more Japan-like, then this can be a relevant factor for BRK and other insurance shareholders.

My experience with watching Japan tells me that we should at least think about this as a possibility and be conservative in our valuation of even BRK.

Over the next few posts, I’ll look at the typical way BRK is valued by BRK-heads. I’ll also pick apart BRK by segment, figure out their expected ROE’s and see if BRK is in fact worth more than book value.