That’s the hint Warren Buffett offered to CNBC Monday morning when he said he will tell viewers which stock he has been buying this year. None of the CNBC folks were able to guess (I had no idea) what stock it was.

Harold’s short name is Hal, of course, and Hal is the computer in the movie “Space Odyssey”; the letters following each of H-A-L are I-B-M.

This is a surprise on many fronts. For many years, Buffett spoke of not wanting to invest in technology because it’s hard to know what the industry will look like in five, ten, or twenty years. Buffett really does continue to surprise.

He always talked about how he doesn’t like capital intensive businesses but then bought Mid-American, a capital intensive, regulated utility. He also bought Burlington Northern more recently, both capital intensive and cyclical. He has spoken about derivatives as weapons of mass destruction and then wrote $34 billion in notional amount of global stock index put options. He speaks up against investment banks and then buys a large stake in Goldman Sachs (via preferred shares with warrants).

Now, after years of avoiding technology, he makes his largest public equity purchase ever and buys IBM. What is great about Buffett is that he evolves.

Anyway, let’s take a quick look at this.

Big Bet: Focus / Concentration

Buffett bought 64 million shares for $10.7 billion, starting in March of this year. That’s a huge buy. To see how big it is, take a look at these figures.

as of September 2011:

Berkshire Hathaway Shareholder’s Equity: $160 billion

Stock holdings at Market: $67 billion

So he made a purchase that was 6.7% of the total net worth of Berkshire, and 16% of it’s entire stock portfolio. Now, that’s focused investing. How many people put 16% of their stocks into a single idea?

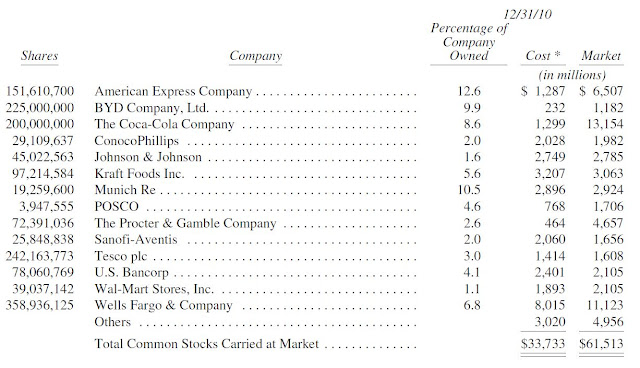

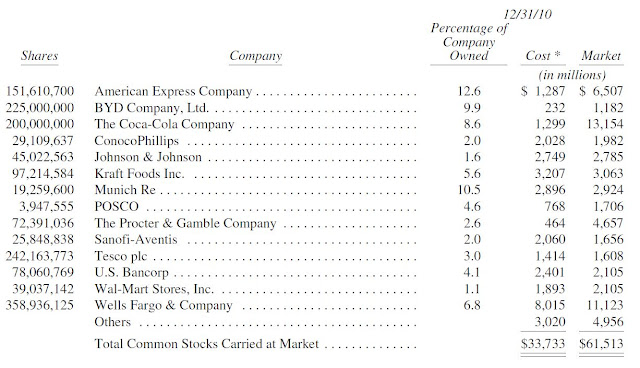

For reference, here is Berkshire’s largest equity holdings as of December 2010:

If you look at the “cost” column here, you will see that this $10.7 billion purchase of IBM stock is the largest purchase ever for Berkshire. After IBM, the next largest purchase is $8 billion in Wells Fargo and after that, nothing even comes close. Kraft Foods comes in at $3.2 billion.

Of course, this table only includes stocks that BRK still owns, and not ones that were sold or were taken over completely (like GEICO, Burlington Northern, Gen Re etc…).

But still, there’s no question this is a big purchase. Only Coca-Cola would be worth more at this point than IBM. Even the companies that he really likes, like Walmart, Procter & Gamble, Johnson and Johnson and others come in at only $2-3 billion. Wow.

Reading Annual Reports

The other striking thing about this is that Buffett was triggered to move on IBM after reading the 2010 annual report in early March. He said he read the report, did some work on it and then started buying in late March.

What is amazing is that he said he has been reading IBM annual reports every year for the past 50 years. He said the same thing when he bought Annheuser-Busch too. So even though Buffett wasn’t interested in technology and thought he’d never buy tech company stocks, he kept reading IBM annual reports every single year anyway. *This* is why he has such a strong understanding of business and good feel of the stock market. This is why he is such a great investor. Can you imagine the information stored in his head from reading tons of annual reports over the decades? Even of stocks you never bought or thought of buying? Incredible.

(Not to belabor the point, but next time you talk to someone who has lost money (or keeps losing money) in the stock market and blames the market, Wall Street or anything else, ask them how many annual reports they have read in the past month, year, lifetime?)

Due Diligence/ BRK Advantage

The other thing that struck me was yet again how BRK being a large conglomerate can be a big advantage. I keep saying that Buffett may not be an economist and his predictions may be no better than anyone else, but with so many businesses reporting to him on a daily basis, he has a real time finger on the ‘pulse’ of the economy so he knows what’s going on. He doesn’t have to wait for government statistics and he doesn’t have to plug them into econometric models or comments/predictions from economists. He knows what is going on every single day.

And here, for kicking the tires on IBM, he researched IBM’s competitive position by asking all his companies about their IT. He realized how sticky IBM really is and entrenched in corporate IT systems (and high cost of switching out), and how businesses will have to rely on IBM more over time as the need to process information increases.

He realized, apparently, that IBM is not your typical tech stocks subject to changing trends. It would be very difficult to displace IBM with their strong position, much stronger than say a software company that writes limited applications and things like that.

Buying at the Highs

As usual, people focus on superficial things like the nominal stock price. But IBM is trading at it’s all time highs, they say. It’s not cheap. These people would rather buy a crappy stock on their lows, like airline stocks in front of bankruptcy. A good stock is a good stock because it’s a great business trading at a decent valuation. It doesn’t matter if the stock is at an all-time high or low.

Of course, we value investors typically like to look for things on the new lows list to see if there are any babies in the bathwater, but Buffett has since been more interested in paying fair prices for great businesses rather than great prices for fair businesses (or something to that effect; I’ll never get these things exactly right).

Some people analogize this to his Coca-Cola (KO) purchase too, which from a value investor standpoint wasn’t a ‘cheap’ price nor was it on the new low list. But it has done tremendously well. I think people do tend to overemphasize this ‘nominal’ price. This, by the way, extends to the overall market too. Some only want to buy stocks during panic periods, like in early 2009 and think it’s not a good time to buy stocks otherwise. However, the KO purchase was not done at a depressed valuation for either KO or the stock market, and yet it is one of Buffett’s biggest winners.

His Burlington Northern purchase also was at a high and the valuation was not even that attractive (I think 20x p/e or some such), and yet this holding (now completely owned by BRK so no market price) has been estimated to be worth 30 or 40% more than the acquisition price already (looking at earnings growth and using multiples of other listed railroad stocks). A huge winner already.

IBM

So what’s so great about IBM? Buffett was impressed with the management even though he couldn’t even pronounce the CEO’s name (he said, “Palmi…”, looked uncertainly at Quick who said “Palmisano”). He has been reading the annuals for years and was impressed with the change that they have undergone recently. He said he was impressed by how they outlined exactly what they were going to do five years ago and achieved it.

He said the 2010 annual report really details why he likes the company so much, and he can’t think of any other management team that has laid out a roadmap with so much detail/specifics on exactly what they are going to do. They did this before five years ago and achieved it so he feels they will continue to be able to meet their plans.

IBM 2010 Annual Report

OK, so what’s the big deal about the 2010 annual report? I took a quick look and here are some notes.

From the letter to shareholders:

Since 2002, IBM has:

- added $14 billion in pretax profit base to IBM

- Increased pretax income 3.4x and EPS 4.7x and free cash flow 2.8x

- had cumulative free cash flow of $96 billion

- Gross margins improved 9.4 points to 46.1%

- Pretax margin improvement to 19.7%

- 90% of profits in 2010 from software, services and financing

In 2010,

- Earned EPS of $11.52, up 15% for eight consecutive years of double digit growth (revenues were up +4%, pretax income +9%)

- Free cash flow was $16.3 billion

- Use of cash in 2010 was $6 billion in acquisitions, $4 billion in net capex, returned $18 billion to stockholders via $15.4 billion in share repurchases and $3.2 billion in dividends.

Over the past decade, IBM has returned $107 billion to shareholders through dividends and share repurchases after $70 billion in capex and $60 billion in R&D. They also earned free cash flow of $109 billion, tripled software profits and increased share of revenues from growth markets to 21% from 11%.

In 2006, IBM introduced the Road Map 2010. In this, one of the goals was for EPS of $10-11/share by 2010 (they achieved $11.52).

For the 2015 Road Map IBM expects $50 billion in share repurchases and $20 billion in dividends to be paid out.

Over the next five years through 2015, IBM will:

- earn at last $20/share in EPS

- generate $100 billion in free cash

- return $70 billion to shareholders

- grow revenues from growth markets to 30% (from 21% in 2010)

Over the past ten years, free cash flow was $109 billion and $107 billion of that was returned to shareholders so we know that IBM is shareholder friendly. Also, net income over those years were $95.6 billion so net income may be a conservative proxy for free cash flow so looking at the p/e ratio won’t lead you too far off course here. (In other words, they really do earn their EPS and they do convert that to distributable/returnable cash, and then they actually do return it to shareholders! This is very unlike other companies that put up positive accounting earnings but generate no cash, or even if they do, spend it unwisely and destroy shareholder value.)

So having said that, what is IBM worth? What does Buffett see? His average purchase price, he said, is $170/share.

That comes to 14.8x last year’s earnings, 12.7x current year and 11.4x next year’s earnings estimates. That’s pretty cheap for a company that plans to grow EPS by 11%/year (to at least $20/share by 2015), and that has grown 10%/year over the past ten years.

(Yahoo finance earnings estimates for IBM were:

12/2011: $13.38

12/2012: $14.85)

Even at the current price of $189/share, it is trading at 14.1x this year and 12.7x next year’s estimate.

Buffett wouldn’t have bought IBM if he thought IBM’s competitive position would decay over the next few years. If this is true, then IBM should manage at least a market multiple as their growth prospects are better than the average company.

Given management’s $20/share EPS target by 2015 (this is a low-end target as they say they will earn at least $20) and putting a 15 P/E multiple on that gives a target price of $300/share for IBM.

Buying it now at $189/share gives a return of 12% or so per year by 2015, not bad at all.

Should We Follow Buffett Into IBM?

In general, you can’t really go wrong copying Buffett’s stock buys. He knows more about businesses and stocks than most others and his decisions will obviously be superior to others.

So for those looking for large, blue chip companies that they can own for a long time, I would recommend IBM and other BRK holdings for sure.

What’s great about recent purchases is that the prices are still pretty close to where Buffett bought it, and the circumstances is going to be the same; fundamentals haven’t changed much over the year.

This may not necessarily be true for Buffett’s other holdings. For example, people followed Buffett into Coca-Cola back in the late 90s calling it a Buffett stock, but they paid 40-50x P/E. This did not turn out well for them (Buffett paid way lower prices back in the late 80s).

Buffett would not pay 40x P/E, even for Coke.

Finding the right stock is only part of the equation. A good price is the other side, and this is trickier to determine for Buffett’s longtime holdings (again, since they may be overvalued at any given point in time).

Buffett put $10 billion+ of fresh BRK capital into IBM at these prices, so that’s a different story than trying to figure out whether the other holdings are good buys now or not.

Having said that, for full-time investors and pros, IBM is not going to be the most attractive investment. BRK can only buy stocks in the largest corporations in the world. This reduces his universe dramatically from what is available to everyone else. There are thousands of companies listed in the U.S. (actually, probably tens of thousands).

Joel Greenblatt, in a speech a while ago, recommended to investors, don’t invest like you’re managing $10 billion. That means to go look for other opportunities where big players can’t look (smaller cap stocks).

Anyway, I haven’t even really dug into the IBM annual report for 2010 (10K etc…) so don’t really have a good feel of the business. I will take a look at it and may post an update if I find interesting things to say about it.

And a By the Way About Microsoft (and Intel)

Some people might have been surprised that Buffett bought IBM and not Microsoft (MSFT) given the cheapness of MSFT versus IBM and his close friendship and presumably good understanding of MSFT’s business and future.

Buffett did say in the CNBC interview that he or anyone at BRK will never buy MSFT because he is just too close to Bill Gates. If he or anyone at BRK (including the two new investment manager hires he told that MSFT was off limits) buys MSFT and then there is a positive development at the company, nobody would believe that Buffett didn’t have inside knowledge of such development. He also did say that it was an attractive stock.

Todd Combs, one of Buffett’s two new investment management hires also bought a bunch of Intel stock (INTC) according to the latest filing. This is also very interesting.

The argument against Microsoft and Intel is quite simply that the Wintel era is over and PC’s are dead. This is why we aren’t supposed to like these companies even if they are cheap. The suggestion is that these are value traps.

Perhaps they are. I actually don’t have a strong view on the future of PC’s. But I am inclined to think that maybe assuming the PC era is over and MSFT and INTC are not interesting investments may go into what Howard Marks calls “first level thinking” and not “second level thinking”. (Speaking of which, it wasn’t too long ago that IBM was supposed to be dead because the PC was going to kill their mainframe business).

Anyway, Buffett’s comment on the attractiveness of MSFT and Comb’s purchase of INTC stock is a counterpoint to the “PC is dead so stay away from MSFT and INTC” argument.