First of all, just some follow-up comments from my recent posts. Judging from the comments that came in about MKL, it makes me wonder if BRK is going to be a white knight (assuming it becomes necessary). Why would BRK expend capital on an underperformer? Does MKL need to be “saved”?

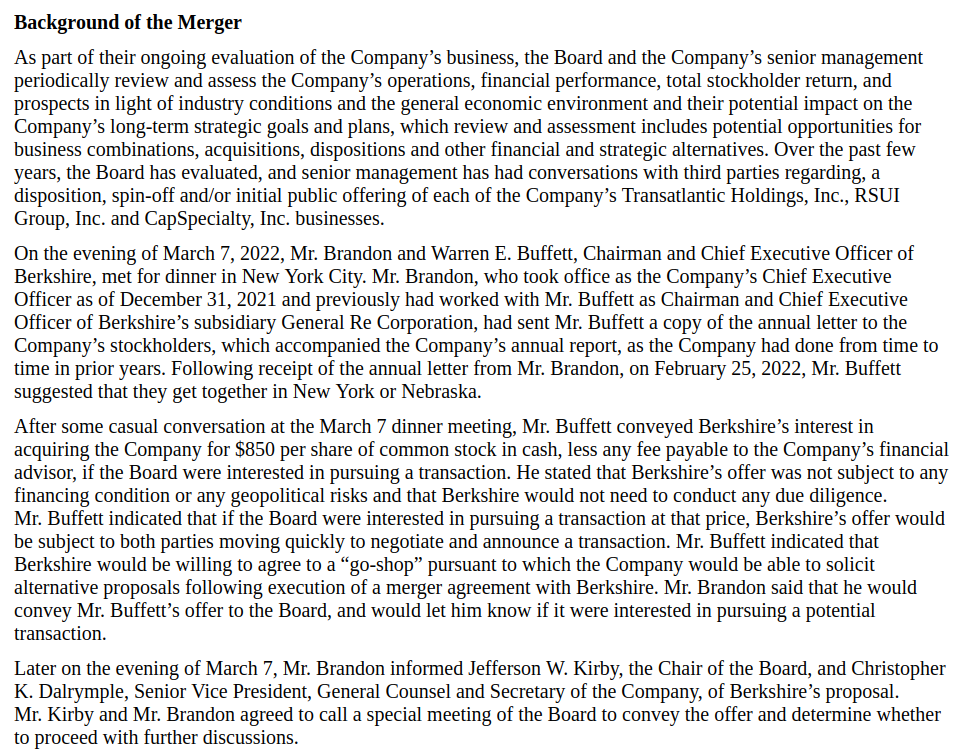

BRK did buy Alleghany in 2022. As a reminder, it was initiated by Buffett. Here is the snip from the merger proxy. By the way, merger proxies are always fun to read so I strongly recommend people spend time reading them, especially in industries they follow. The background of the merger can be interesting, as well as the valuation section, even though one can’t take too seriously work that is meant to justify a valuation to shareholders. But it can still be interesting to look at.

Here is the comparative valuation analysis for Y at the time:

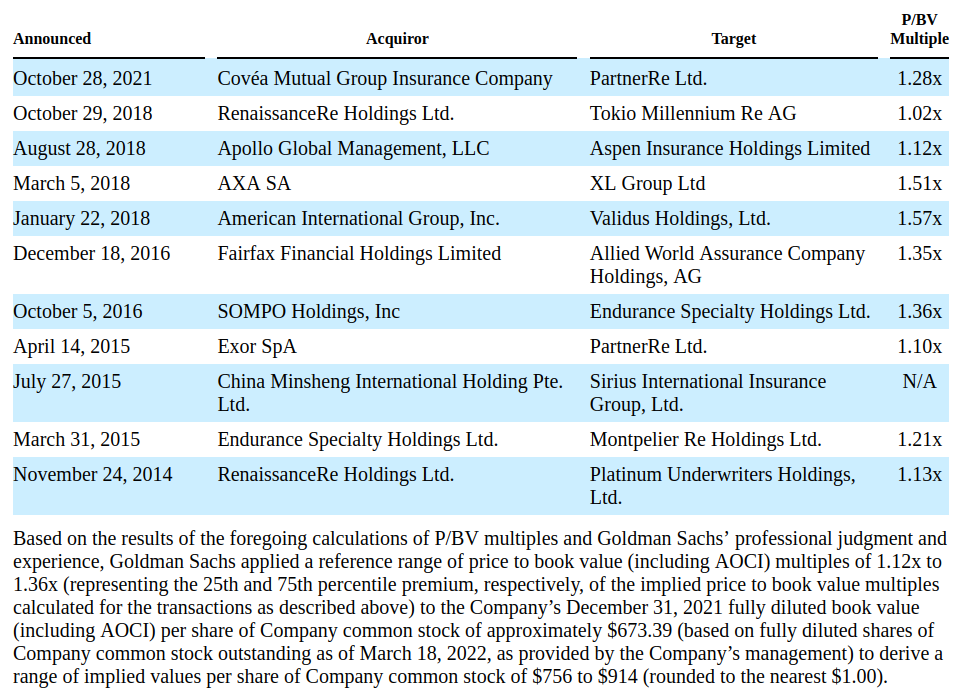

$850 is 1.26x the above-referenced BPS of $673.39. Of course, BRK paid a premium price to the pre-announcement stock price. Here is that part of the analysis:

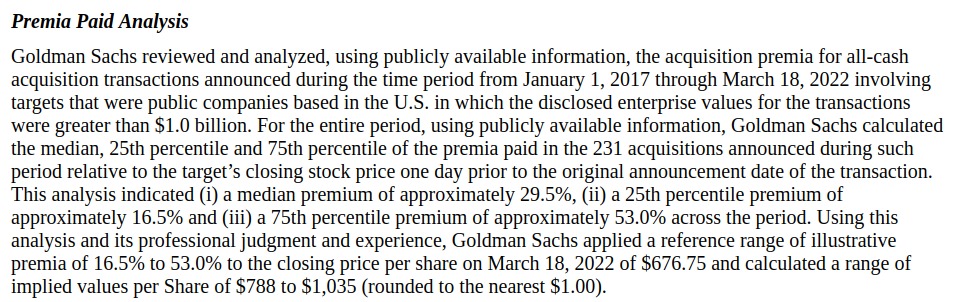

$850/share for Y was a 26% premium. So you can go and do the math for what it might take for BRK to get MKL, if they do. You can argue Y was doing solidly but certainly not outperforming the S&P 500 at the time. Here is the performance chart from their last 10-K:

It’s likely that Buffett really liked what he saw in the insurance business, and that may have been what this deal was about, as that is the most important for him. BRK / Buffett can handle the investments, but I guess what they want are strong businesses. So maybe past performance of the stock due to conservatism is not an issue. Of course, the price was also obviously attractive (or else the deal would not have happened!).

By the way, I asked ChatGPT what MKL would be worth in a takeover. It showed a chart of MKL’s stock price, mentioned the total market cap, and then:

“In the event of a takeover, the acquisition price would typically be based on this market capitalization, though it could be higher or lower depending on various factors such as strategic value, synergies, and negotiations between the acquiring and target companies.”

Pretty lame. Maybe investment banker jobs are safe for now.

By the way, in the MKL discussion, someone mentioned Fairfax. Yes, Fairfax has done really well in the past few years after a ‘disastrous’ run. The biggest mistake was hedging their equity exposure and losing out during a huge rally (tried to time the market!). The deflation trade was a big distraction, but didn’t really cost them all that much economically. I just read through the annual reports over the past three years, and it is amazing what they’ve achieved, growing in the insurance business. India, actually, looks more interesting than anything else. I do own both Fairfax and Fairfax India. Fairfax India looks really interesting but the biggest flaw / problem for BRK-heads like us is that Fairfax will get 20% of any profits (above 5%), so they price their investment management like a hedge fund. Obviously, something like that will make it hard for the stock to trade up to intrinsic value.

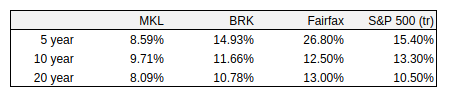

Anyway, here is the updated table including Fairfax. I used the adjusted stock price of FRFHF for simplicity:

Watsa still says he will never invest in technology (what was Blackberry?). This is the sort of dogma that I think can be unhelpful. I can understand not wanting to invest in, say, semiconductors, which is a very capital intensive, cyclical business. But as we keep talking about here, as more and more industries become tech-driven, move online etc., how can you ignore it? Go back 100+ years, and imagine you avoid anything related to the industrial revolution and the technology of the day? But OK, this is all personal preference, and surely, there are people out there doing well with no tech exposure at all.

Mag 7 Capex

We also talked about the $80-100 billion capex that MSFT, GOOG and others are doing. Won’t this make them capital intensive businesses and lower their returns on capital? This is a valid question, and I was curious so I took a look at some numbers. GOOG said they depreciate their servers over 6 years, and I think GOOG or MSFT said that half of their capex is going to longer term assets than servers; land and buildings to build data centers, for example. Pichai or Nadella also pointed out in the recent conference call that these servers/assets are fungible, so they can be used to support any number of businesses.

MSFT and GOOG had EBIT/Net PPE of 80% and 65%, respectively, in their most recent fiscal years. Nice, solid figures. Now, assuming they invest $75 billion and $100 billion respectively in capex, and they have similar depreciation AND their EBIT doesn’t change at all, it remains the same, except for the higher depreciation (so their EBIT will actually be lower), their EBIT/net PPE after this year would be 56% and 42% respectively, so a big move down in return on PPE. 80% -> 56% for MSFT, and 65% -> 42% for GOOG. But, remember, this is assuming flat earnings, or lower earnings including the new depreciation. That’s a pretty harsh assumption for these guys who have been growing steadily for a while. But when you consider the monumental scale of the investment, and the harsh assumption of no new EBIT coming from it and no growth from existing businesses, these figures are not bad at all; these are still pretty high returns. Also, keep in mind, some of us are surprised at the huge capex figures, but they have been increasing a lot over time, so it’s not like anyone is going from $20 billion capex to $100 billion in a year.

I also looked at EBIT/net PPE over time. I’m too lazy to give you a complete table so I just looked at 2014 and 2019 (to avoid the Covid distortion in 2020).

EBIT/net PPE for MSFT was 215% and 119% in 2014 and 2019.

The same for GOOG was 55% and 46% in 2014 and 2019.

You will notice that for GOOG, their EBIT/net PPE was always in this range, and that makes sense as they require an enormous amount of server/data center capacity to run their search engines, Google Workspace, YouTube etc. Whereas the EBIT/net PPE has come down a lot for MSFT and this makes sense too as they used to be a software provider; they didn’t really need much in terms of servers/data centers. They just created a software product, had it manufactured (for cheap) and sold at a nice fat margin with almost zero marginal cost. Once they started Azure, Windows 365 and other cloud businesses, of course, their returns on capital started to come down to where GOOG is, and AMZN. I left out AMZN because all those delivery trucks and distribution centers will make it hard to compare with the rest of the Mag 7.

Anyway, the conclusion from all of this is that, yes, all this capex makes these businesses more and more capital intensive, but for the folks like GOOG, it has always sort of been capital intensive.

Back to BRK

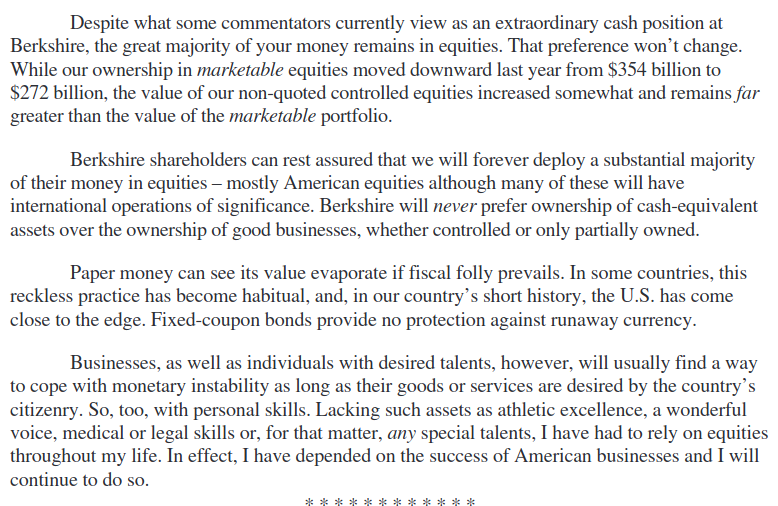

OK, so back to the BRK annual report. It’s interesting that Buffett points out to people that most of BRK’s assets is still in equities. I pointed this out years ago, and will try to illustrate it again. But below, he explains he is still very invested and also talks about how equities is sort of an inflation hedge. I know he’s talked about how inflation is not good for stocks, but over time, and through cycles, it is an inflation hedge. That’s what he says below.

BRK has $650 billion in shareholders’ equity, and $272 billion is invested in stocks. Sure, that looks low, but a lot of BRK net worth is tied up in equity of their wholly-owned/consolidated and equity-method investments. For example, the Railroad, Utilities and Energy segment has equity of $130 billion. That’s as much ‘equity’ as stocks (but just not marked to market every day). That brings up the total equity exposure to $402 billion.

The last time the Manufacturing, Services and Retail had their own balance sheet reported was in 2016, and then, it was $92 billion. It is probably much higher than that now due to acquisitions since then. But let’s just say it’s $92 billion. Add that and we get to $494 billion.

And then there are the equity method holdings like KHC and OXY. Just because they are not included in stock holdings section does not make them any less ‘equity’. Together, they’re on the books at $31 billion, so that takes us up to $525 billion. Yes, market value is lower than that, but since we are comparing this to book value, we will use carrying value. That’s already 80% of BRK’s shareholders equity exposed to equity. Not quite the conservatism you would imagine from the $300+ billion of cash on the books.

There are probably some things I missed, but BRK is exposed to ‘equity’ by more than what you see in the Investments in equity securities. Plus, we don’t typically look at BRK this way, but if you look at net cash, the amount is very low (deduct all current liabilities of $311 billion from cash and cash equivalents), which implies a very normal level of leverage to ‘equity’. Of course, we can argue all day about this or that item in current assets/liabilities, but this is just a quick, mechanical way of looking at it.

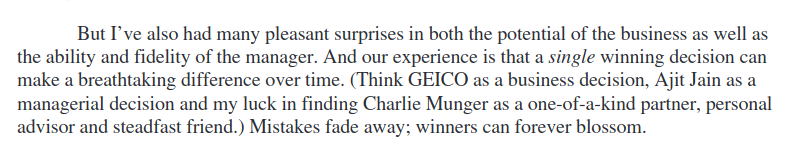

Mistakes Fade Away

By the way, it was interesting to see this comment in the annual report, which sort of reminds me of the story I told in a recent post; my friend who got rich just buying stocks and never selling. He didn’t care about the dogs. I guess in Buffett’s words, those mistakes just fade away. And the few big winners he had made him rich.

Of course, this doesn’t mean one should just go out and buy all sorts of crap, hoping something will become a winner.

This reminds me of another story. I remember talking to a special situations analyst doing a lot of work on merger arb, stubs, index additions/deletions and other things like that. I asked him about index additions/deletions as that used to rock the markets long way back and we had some index positions in our trading book. And he said his studies show that, yes, stocks added to major indices do outperform the index, but so do the ones that were dropped (after the initial post-announce fall). So he said, the strategy is to actually, not only buy the new added stock, but the dropped one too (I forgot if he said to buy the dropped name on the effective date of the deletion). I wonder what a portfolio like that would look like over the past 20 or 50 years… past 100 years… Of course, some of the dropped names would probably end up going bust, but maybe a few of those winners would more than make up for it.

What Does Buffett Expect the Market To Do?

Buffett, of course, has no idea what the market will do, but he is, as usual, bullish America. We all try to read into his actions. I am still looking at the column for Investments in fixed maturity securities, and it went down from $24 billion to $15 billion, so obviously, he still hates bonds, even at close to 5%. He was not even nibbling.

He didn’t sell any AAPL in the most recent period, so is he OK with the valuation? He is happy with 32-35x P/E? Of course, the fact that he is not selling does not mean he would buy here. Selling requires a little bit of a hurdle, right? The hassle to sell, pay taxes etc. Buffett mentioned Moody’s (MCO), which trades at 44x trailing, and 35x ntm earnings, and he still owns it. Of course, this does not mean one should buy these stocks at these valuations, but maybe these valuations aren’t the “What was I thinking?” (KO) prices for Buffett. But I don’t know. Let’s not all start buying these stocks at these levels assuming Buffett approves!

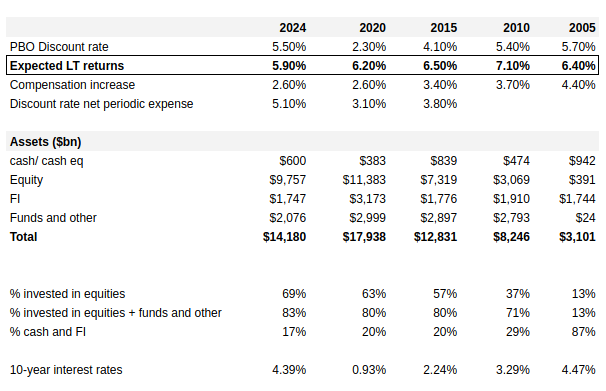

But there is another place to look for what Buffett might be thinking about the markets. I remember he shook his head at the major corporations who had pension disclosures with expected LT returns of 10-12% or maybe it was 8-10%. That got me curious about what BRK has been saying in that section in the recent past. I don’t know much about accounting/disclosure rules, but I can’t seem to find this info going back to the 80s and 90s. So here is a table of it from 2005 on (too lazy to do every year, so I did every five years instead… this stuff shouldn’t change all that much year to year…).

What comes out of the 10-K’s is the top two areas, the discount rate/return assumptions and assets. The % invested in equities and 10-year interest rates, I just put there for reference. You can make of it what you will.

Buffett said long ago that the return on the S&P 500 index is basically the dividend yield plus the nominal economic growth rate. With the dividend yield at 1.1%, and nominal GDP growth over time expected to be around 4-5%, that gets the S&P return to around 5.1-6.1%. With interest rates under 5%, is he expecting a higher return on the equity portfolio?

OK, this is getting a little silly, trying to read too much into things.

Buffett Slowing Down

At the end of the letter, as usual, Buffett talks about the annual meeting, and surprisingly (or not), the Q&A will end at 1:00 pm instead of 4:00 pm. But the net time of taking questions is not 3 hours shorter as the Q&A will start an hour earlier, and the break will be 30 minutes instead of an hour for lunch. So we are going from a 5 hour 45 minutes Q&A session to 4 hours and 30 minutes.

The other thing that might have surprised me more was something recently in the press when Buffett was asked a question, and he said at his age, bridge is not the only thing they have to slow down for him. Meaning, he can’t keep up in a regular-paced bridge game? I don’t know anything about bridge, but that was a little shocking to me. I didn’t really know that his mental capacity, his ability to process information was slowing. Of course, at age 94, all sorts of things happen. This may not be an issue for purposes of investing, but I guess we have to assume he is going through a lot less material than he used to.

Anyway, OK, that’s enough for now. I may have more to say and write about is we start to get more annual reports coming out over the next few weeks.

Just for comparison, I asked Grok 3 deepsearch which I have been playing with: “Based on historic takeover premiums for all cash offers and price to book value premiums paid in insurance M&A transactions in the last 5 years, what premium would Markel command for an all cash, low contingency takeover offer?”

Answer:

Key Points

Research suggests Markel would likely command a premium of about 25% over its book value per share for an all-cash, low contingency takeover offer, based on recent insurance M&A data.

Premiums in similar transactions vary widely, from 19% to 165%, reflecting the complexity of such deals.

The evidence leans toward a mid-range estimate, considering outliers and market trends in the insurance sector over the last five years.

Background

Markel Group Inc., a holding company for insurance and reinsurance businesses, is the target in this hypothetical takeover scenario. The premium is the percentage by which the acquisition price exceeds the target’s book value per share, calculated as (acquisition price – book value per share) / book value per share * 100%. This analysis focuses on all-cash offers with low contingencies in insurance mergers and acquisitions (M&A) from 2020 to 2024, aligning with the user’s query timeframe.

Historical Premiums

Historical data from recent insurance M&A transactions shows a wide range of price-to-book value premiums. For instance:

Aon’s acquisition of XL Group in 2018 (outside the 5-year window but included for context) had a premium of approximately 18.81%.

AIG’s acquisition of Validus Holdings in 2018 (also outside, but relevant) showed a 107.82% premium.

Berkshire Hathaway’s acquisition of Alleghany in 2022 had a 26% premium, as stated in press releases.

Allstate’s acquisition of National General in 2021 had a 164.76% premium, based on financial statements.

These premiums vary due to factors like market conditions, company size, and strategic fit, making a single estimate challenging. Excluding older transactions (pre-2020), the relevant premiums are 26% (Alleghany), 164.76% (National General), and potentially others, but data limitations suggest focusing on these.

Estimation for Markel

Given Markel’s current book value per share is approximately $1,283 (based on 2023 financials with $16.5 billion equity and 12.86 million shares), applying a premium involves estimating a reasonable range. The average premium from the three transactions (18.81%, 26%, 164.76%) is about 69.86%, but the 164.76% is an outlier. Excluding it, the average of 18.81% and 26% is 22.41%, suggesting a 25% premium as a balanced estimate, leading to an acquisition price of around $1,604 per share ($1,283 * 1.25).

Unexpected Detail

While premiums typically range from 20% to 50% in M&A, the 164.76% premium for National General highlights how strategic fit and market dynamics can significantly inflate offers, which is less common but possible in insurance deals.

Survey Note: Detailed Analysis of Premiums in Insurance M&A Transactions

This section provides a comprehensive analysis of the premiums commanded in all-cash, low-contingency takeover offers for insurance companies over the last five years, focusing on estimating the premium Markel Group Inc. might command. The analysis draws on historical M&A data, financial statements, and press releases to ensure a thorough understanding, suitable for stakeholders in the insurance sector.

Methodology and Data Collection

The analysis began by identifying relevant insurance M&A transactions from 2020 to 2024, focusing on all-cash offers with low contingencies. Due to data availability, transactions slightly outside this window (e.g., 2018) were initially considered for context but prioritized those within the timeframe. The premium was calculated as (acquisition price per share – book value per share) / book value per share * 100%, requiring data on acquisition prices from press releases and book values from annual reports.

Key transactions analyzed include:

Aon’s Acquisition of XL Group (2018, for context): Acquisition price $57.60 per share, book value per share approximately $48.48 (from 2017 Form 10-K), premium 18.81%.

AIG’s Acquisition of Validus Holdings (2018, for context): Acquisition price $68 per share, book value per share $32.72 (from 2017 financials), premium 107.82%.

Berkshire Hathaway’s Acquisition of Alleghany (2022): Acquisition price $848.02 per share, book value per share $673.03 (press release states 1.26x book value), premium 26%.

Allstate’s Acquisition of National General (2021): Acquisition price $34.50 per share, book value per share $13.03 (from 2019 annual report, 116 million shares, equity $1.512 billion), premium 164.76%.

These transactions were sourced from press releases and SEC filings, ensuring accuracy in financial metrics.

Analysis of Premium Variability

The premiums varied significantly, from 18.81% to 164.76%, reflecting diverse market conditions and strategic motivations. For instance:

The 26% premium for Alleghany aligns with Berkshire Hathaway’s strategy of acquiring undervalued insurers, leveraging its capital strength.

The 164.76% premium for National General suggests a strategic fit enhancing Allstate’s market share, possibly driven by competitive pressures in personal lines insurance.

The outlier premiums (e.g., 107.82% for Validus, 164.76% for National General) indicate that certain transactions may involve significant synergies or market positioning, which could inflate offers.

To address outliers, the analysis considered excluding the highest premium (164.76%), yielding an average of 22.41% from the remaining two (18.81% and 26%), suggesting a more conservative estimate.

Estimating Markel’s Premium

Markel Group Inc., with a current book value per share of approximately $1,283 (based on 2023 financials, $16.5 billion equity, 12.86 million shares), requires an estimated premium. Given the range, a balanced approach uses the average premium of 69.86% (all four) or 22.41% (excluding the outlier). Considering market norms and the insurance sector’s typical P/B ratios (1.5 to 2.0, implying 50% to 100% premiums), a 25% premium aligns with the median of relevant transactions, leading to an acquisition price of $1,604 per share ($1,283 * 1.25).

Market Context and Limitations

The insurance sector’s M&A activity in 2023 showed deal values rising despite volume drops, per Deloitte’s 2024 Outlook, suggesting continued interest in strategic acquisitions. However, data limitations (e.g., incomplete access to all transactions, reliance on public filings) mean the estimate is indicative, not definitive. The wide premium range (19% to 165%) underscores the need for case-by-case analysis, with Markel’s premium likely influenced by its specialty insurance focus and market position.

Table of Analyzed Transactions

Transaction

Year

Acquisition Price per Share

Book Value per Share

Premium (%)

Aon’s acquisition of XL Group

2018

$57.60

$48.48

18.81%

AIG’s acquisition of Validus

2018

$68.00

$32.72

107.82%

Berkshire Hathaway’s Alleghany

2022

$848.02

$673.03

26.00%

Allstate’s acquisition of NG

2021

$34.50

$13.03

164.76%

Conclusion

Based on historical data, Markel Group Inc. is likely to command a premium of approximately 25% over its book value per share for an all-cash, low-contingency takeover offer, reflecting a balanced estimate from recent transactions. This accounts for the sector’s variability and aligns with market norms, though actual premiums may vary based on strategic fit and market conditions.

Key Citations

Aon completes acquisition of NFP to bring more capability to clients

AIG finalizes Validus Holdings acquisition

Berkshire Hathaway to Acquire Alleghany Corporation for $848.02 Per Share in $11.6 Billion Transaction

Allstate Closes Acquisition of National General Holdings Corp.

2024 Insurance M&A Outlook

Nice! You are better at this AI stuff than me. I do know that a lot of the gruntwork M&A interns/associates/analysts have to do is done much more quickly and efficiently with AI.

I also thought a lot about his comments on playing bridge. FWEIW, as I remember he played at night on his computer. I think it may be more related to having the energy to be intellectually engaged after working all day and maybe talking to Ted, Todd, Ajit and others every night or late in the day…At least that’s what I’m hoping.

I was surprised to see that your comments on Fairfax with respect to India and tech didn’t touch on Digit. That is a massive winner of a “technology” investment for Fairfax, I believe a ~30-50x MOIC sort of winner, now a multi billion dollar exposure, and clearly a tech investment… even if Prem doesn’t define it that way. And Ki seems like a similar sort of winner. Maybe the point is theyve learned from BlackBerry and now only make tech investments squarely in their circle of competence.

Thanks. I read the letter to shareholders every year, but don’t really follow all that closely. Thanks for that info. I should take a closer look at that.

Digit and Ki are great examples of insurance VC investments FFH has made which are already or will be 20x type investments. Digit IPOed last year and Ki seems likely to in the next 12-24 months. They have also owned META and GOOGL in smaller size on their 13F but given the size these weren’t Prem names.

Excellent!

Feels like new golden age of blogging! Enjoying recent crop of posts. Thanks.

It’s very hard to see Berkshire acting as a white knight for Markel given what Gayner (and presumably the Markel family) thinks the company is worth. It’s not clear to me why Markel would be worth a large premium to what Buffett paid for Allegheny relative to book value. An acquisition could make sense as an “acquihire” of Gayner if Berkshire needed a CEO candidate but Abel and Gayner are the same age so Gayner would not likely be heir apparent to Buffett or Abel. I like the MKL culture and Gayner’s approach but the performance just hasn’t been good enough to pay the 1.8-2x book that would probably be needed to seal a deal.

Good point. Price would be an issue for sure.

Always enjoy and get a lot from your thoughts, Brooklyn!

Regarding index deletions, familiar with NIXT offered by Rob Arnott of Research Affiliates? From WSJ:

“That is when investors should pounce, says Rob Arnott, chairman of advisory firm Research Affiliates, with colleague Forrest Henslee. This week they are unveiling a stock index named NIXT that would have earned investors about 74 times their money since 1991 by buying stocks kicked out of indexes.”

See: https://www.wsj.com/finance/stocks/wall-streets-trash-contains-buried-treasure-b22ad00d

Cool. Not familiar with it but not surprised.