First, let’s talk about gold…

By the way, in my last post, I mentioned gold. Something was nagging at me since then, so I completed the thought. I have no idea what gold should be trading at, or whether it should be in your portfolio. I would argue that it shouldn’t be. So here is another thought. There was a time early in my career that I spent a lot of time in commodities, and back then, it was really all about production cost (and open futures positions of commercials vs. speculators etc.). Buffett also said a while ago when he invested in silver that although he had no idea where prices would go, he said that commodities tend not to stay below production cost for too long, so he figured silver can only go up.

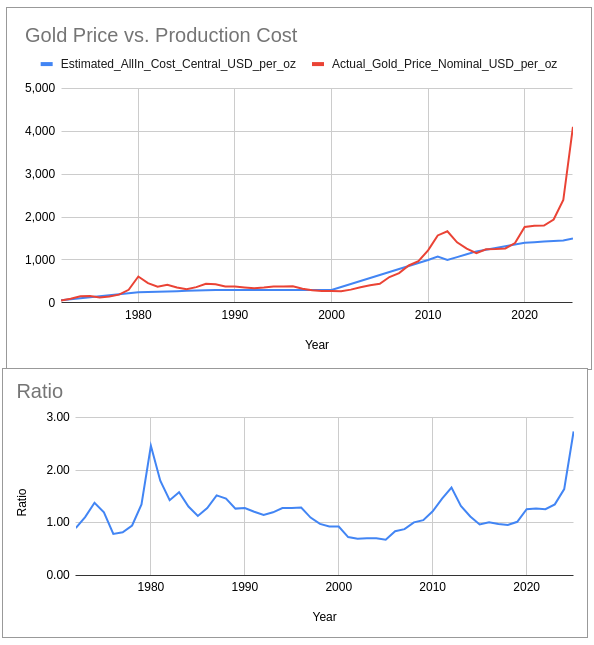

Here is a chart to ponder if you’re interested in, or are ‘invested’ in gold. The first chart just shows the price of gold compared to its all-in cost of production going back to 1972. I am assuming it’s the year-end price of gold. For the most recent price, I put in $4,100. I asked chatGPT to generate these numbers for me, so it can’t be too far off, can it? All those billions spent and it should be able to do something simple like this for me. I know I said this is a chatGPT-free zone, but I meant that the posts are not AI generated. I will use various tools to get information as it’s just faster than me trying to do it myself.

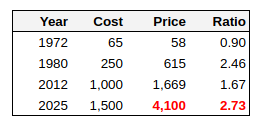

The table is too long to paste here, so here are just some of the important years people may be interested in.

You can see that when gold peaked out in 1980, it peaked out, at least from a yearly price point of view at 2.5x production cost. We know gold actually spiked up to $850/oz or so. But that was a short term spike that didn’t last long. We can see gold peaked out again in 2012 or so at 1.7x cost of production. With gold at $4,100/oz, it is trading at 2.7x production cost, higher than it was in 1980. But if we use the peak price of $850/oz, that was 3.4x the cost of production, so for us to get near that level, gold would have to spike up to $5,100/oz… another $1,000! But last time gold got that high, it went down for the next 20 years, so who wants to get on that boat?!

The title of this post is referring to the stock market, but having written this about gold, I now see that gold is clearly in bubble territory. Is it not? I would think so. I am not trying to turn the tables here against the stock-market-is-a-bubble people. It’s just ironic to say the market is in a bubble so go buy yourself some gold. I’m just looking at some facts.

But you know what? I don’t really care. I don’t buy or short gold. I am sort of surprised that so many people (non-gold bugs, non-permabears) are suggesting gold should be in their portfolios to reduce overall volatility, and that this is one of those times that it might even make sense to own some gold…

Stock market bubble

OK, so let’s talk about the stock market. I keep posting these “bubble watch” sort of things and keep insisting it’s not a bubble. I’ve been saying that pretty much ever since I started this blog, back in 2011. And there have been people insisting we are in a bubble the whole time. In fact, there are people who have been insisting we are in a stock market bubble and we are going to crash since the late 1980s! And they are still saying that.

But OK, let’s assume we get into bubble territory and things get silly. Then, what do we do?! This is a good and valid question, and I think about it all the time. But here’s the thing. Every bubble is different, so the way we react to them would be different in each case. I’ve said similar things in the past, but I would only take drastic action if things got really, really silly. Like Japan in 1989, when the complete stock market was trading at 60-80x P/E! That is not a market to stay long. Japan had quite a long and painful bear market. But this was predictable given the silliness of the valuations levels.

Let’s look at some recent bubbles and see what the smart thing to do would have been. This is not really a deep study but just some casual, random thoughts about them. I will not bother with 1929 as I have no data and no idea what would have worked back then. Plus, hopefully, we won’t make the same mistakes we did back then to make things worse, to cause a depression.

1987 Black Monday: Honestly, for long term investors, this hardly registers as anything. The headlines were the worst you can imagine, and books came out claiming that we are headed for another depression. They were very persuasive, with a lot of data supporting the arguments. But, in hindsight, it’s barely noticeable on long term charts. And, the people who have the best records are people who were long right through it all, and stayed long and kept doing what they do best. The worst performances tended to come from people who did relatively well in 1987. Those who owned puts or were conservatively positioned never really went back to full exposure and lagged since then. That’s just the impression I get. I have no solid data to prove it, though.

1989 Japan Bubble: As I said above, this is one of the only recent bubbles that actually merited serious action, if Japan was your primary market. A stock market trading at 60-80x P/E is just silly. No wonder the market went into a bear market for decades. I don’t have a lot of good data, but even then, I think stocks like Seven-Eleven, Toyota and other export oriented blue chips did well. Small and mid caps did well too. I guess the key was to stay away from sectors that were most affected by the bubble, like banks, brokers, construction, real estate etc. But I do know specialists that focused on small- to mid-caps did really well.

2000 Internet Bubble: As is often mentioned, value investors did fine post bubble collapse, as most value stocks were not overvalued and performed well. The people who did well were the ones that avoided the bubble stocks but stayed invested in solid value stocks. This may be a pattern that may repeat if the current market really bubbles up and collapses. I would keep this image in mind; stay with reasonably valued, solid stocks. Try to stay away from silly stocks, stupid valuations and whatnot.

2008 Financial Crisis: This wasn’t really a bubble in the stock market. Maybe it was a credit market bubble, or housing bubble, but it didn’t really feel like a stock market bubble. But this is one of those bear markets where, I think, the smart thing to do was pretty much nothing. It was painful, but if you held on through the crisis and made it out to the other side, you did fine. So to me, that was just a nasty bear market (as a stock investor).

It seems like in these cases, you were able to just focus on what you own and you should have been fine. When I say “fine”, I don’t mean to suggest there weren’t big drawdowns in the meantime. If you just held through the financial crisis, you did fine, but you were also down 50% at one point. Some would argue, that’s not “fine”. Well, as Buffett always says, if you can’t handle down 50%, you shouldn’t be invested in stocks. I can probably use AI to make a cool video to inject here, but won’t waste my time. I will let you just imagine it: Jack Nicholson barking at you, “You can’t handle the stock market!”.

I would not do anything to avoid being long on a day like Black Monday. As I also keep saying here, more money is lost (and more money is made on Wall Street) by people trying to avoid ‘pain’ in the stock market than probably is lost in simple long investing. Whether it be silly hedges, options strategies, silly derivatives strategies to reduce portfolio volatility, over-diversification, over-trading in and out of various asset classes, being under-invested etc… Wall Street makes much of its money scaring people into doing silly things, buying silly investment products so they can feel safe if there is a correction etc.

My goal in watching this stuff is not to avoid short term bumps and volatility. My main goal would be to make sure I am not stuck in things that won’t go anywhere for years and years, like the Japanese stock market as a whole back in 1989. It would not be OK to be invested in an index fund where the index was trading at 80x P/E. But I would be totally happy being invested in solid companies with decent returns on capital at reasonable valuations, even if they were trading in such an insane market. Sure, the market collapse would take down decent stocks too, but that sort of volatility, I am OK with.

Anyway, this is just a quick followup to my earlier post.

“Plus, hopefully, we won’t make the same mistakes we did back then to make things worse, to cause a depression.”

Like, tariffs? I hope you are right, but I am not as optimistic as you. We are inching towards a centrally planned economy/kleptocracy.

In John Updike’s “Rabbit is Rich,” set in 1979-80, the protagonist has moved into gold, is up 50% and thinks he’s very smart. I wondered what if he’d just held on since then: he’d be up 5x, not bad, although the S&P is up over 50x, much better!

A framing which has stuck with me is that gold is a currency, not a commodity. Value versus the cost curve just doesn’t hold up in the same way as it does with industrial metals which are consumed. Gold demand is fairly inelastic to price.

Excellent. Keep them coming!

Great points again. Agree on every point.

Also, just as an addition, I have a quality company with roe of 15 to 20 at a current pe ratio around 8, with a history of nearly 4 decades with a cagr of over 17%, being among the top10 in terms of performance over that timeframe under 6.000 companies.

Or another one with roes far north of 30 (and even over 45 over the last couple of years) at a pe ratio of 17; and both are non tech, not in a cyclical sector and relatively unrelated to recessions etc.

A world market leader in his niche with a big moat and a roe around 30 at a pe ratio of 28.

„But the S&P500 is way higher“ I here people say. Yes, and that’s why I feel an etf on that being much more risky than my stocks. I don’t care, if my portfolio gets down by 50 percent. There will be great buyback opportunities for „my“ stocks than; and the ones among my portfolio buying other businesses will do that in such a position, where everything is on sale; which will even make them stronger.

Very good, pragmatic post. Thanks for this

i want to get new posts by e-mail

Thanks for sharing! Keep it going!

Amen brother…, I could not agree more.

People often say, ‘You have to be right twice to time the market.’ I say the Buffett times the market while only trying to be right once, noticing when great companies are on sale. And so I 100% agree with you that I don’t care if we are in a bubble. I’ll buy more whenever the bubble pops.

If the money you have in equities is for short term or immediate use, then 50% down is probably going to force a sell. But if you don’t need this money, then just invest in companies that have good return and steady earnings, and forget this bubble prediction. Yeah, you can be down 50% in a recession, but you can also be up 100% in a good year. It is just a total waste of your time to try to time the market.