So, it looks like Lou Simpson added a bunch of Charles Schwab (SCHW) to his portfolio, making it the top holding as of the end of June; he increased his position almost 50%.

I am not stalking Simpson in particular, but I just happened to notice this and SCHW is a name that I am sort of familiar with and have been a fan of for a long time. Putting those two together, I figured it’s worth a post. We all know who Lou Simpson is, but in case you don’t, here is a look at his past performance during his time at Berkshire Hathaway with some quotes by Buffett about him: Brookfield Asset Management post

I’m not going to go into too much detail about the business as I think most of us are familiar with SCHW; a discount broker that grew into a more full service financial company.

Quick Comment on Markets

I have no idea what’s going on in the markets, and have no idea what will happen going forward. But I had a conversation with someone very concerned. My answer was that if it’s going to be a major problem if the market keeps going down, you simply own too much stocks. But this is something you have to think about all the time, not when the market is down 1000 points. That is the worst time to think about what to do (unless you want to buy!). Why do people think about this only when the market is down? The market goes down and the first instinct always seems to be, “Should I sell?!”.

If a declining market is a problem for you, don’t own stocks. Or only own enough so that this sort of volatility won’t be a problem.

As for what will happen going forward, I still stick to my view that the market is not that overvalued given the interest rate environment, and we have plenty of cushion even if long term rates rise. They can go to 6% and we’d still be in a zone of reasonableness in terms of valuation.

As for China, yes, the U.S. market is tanking on news out of China, but I still think the world need not go down with China. I don’t worry too much in that respect.

Oh, and by the way, for those interested in stock screens of the Superinvestors’ stockholdings (as defined and tracked by Dataroma) I have updated the screens Friday and last night. I automated the process completely so I just need to type a single line in the command line for the spreadsheets to be updated (I initially had it set up to update an Excel spreadsheet which I cut and paste later to a Google spreadsheet since it was a hassle to directly update a Google sheet from a program; I got over that hump…) so I can update it every time the market has big moves.

See the spreadsheets here:

Superinvestor Stock Rankings

Superinvestor Stock Ranking (Small list)

I do intend to add spreadsheets that show year-to-date winners and losers of those stocks too. Stay tuned for that. (My recent hobby is programming so I did all of this for fun and thought it would make a nice addition to the blog so just put it there…)

Anyway, end of digression and back to SCHW:

Solid Management

I’ve always been impressed with the customer service and the conservative nature of the management there. There are some things that I don’t like, like their dependence on trading frequency; the more people trade, the more money they make. The more margin loans people use, the more money they make etc…

But there seems to be a lot of integrity there. There isn’t much I can say other than that I’ve been following and reading about SCHW for years, and they tend to be very conservative and client focused. I’ve never had a bad experience, and never read anything I didn’t like about them.

One thing, though, is that a lot of this is due to my faith in and respect for Charles Schwab, the founder. He is 77 years old now. Who knows what will happen post-Schwab? The business itself doesn’t depend on his talents on a day-to-day basis so there is a good chance that they can continue to do well as long as they keep their culture.

The only reason I’ve never owned the stock is that it has always been a growth stock. The P/E has always been far above 20x. And there has been growth to support that, except in the past few years. But we’ll get to that in a second.

When an investor you highly respect makes it the top holding in his portfolio, even larger than Berkshire Hathaway, a company he knows better than anyone in the business (as an investor, former employee and Buffett friend), you have to pay attention.

Interest Rate Normalization Bet

So let’s get to the gist of the idea here. In short, this is an interest rate normalization play. This doesn’t sound right because investors like Lou Simpson don’t make macro plays or ‘bets’. But in another sense, value investors make “earnings normalization” bets all the time. When a company is going through hard times, we look at what the business can earn in a more normalized environment. We slap a multiple on it and then buy the stock if it is meaningfully lower than that.

In that sense, this is sort of the same thing so not really a macro play. Macro plays are often time-dependent. People make bets about this or that, and when it doesn’t happen within a year or two, they are in trouble. But in the value investing world, playing for normalization is not as time-dependent. We often don’t know when something will happen, but only need to be confident that it will some day. And if the underlying business can continue to grow and pay dividends in the meantime, that’s great. This is not the same as making a macro bet, like shorting bonds or whatever.

Clip from 2014 Annual Report

SCHW has been talking about this for a few years now, but I never really paid too much attention to it as I was in the camp that the U.S. interest rate environment might follow Japan’s. Well, yes, I do own JPM and they too are a great interest normalization bet, but JPM was trading very cheaply while earning 15% return on tangible equity even with rates very low. SCHW is not really trading cheap in that sense.

But anyway, here is a clip from the 2014 annual report that is the key to this whole idea:

SCHW earned $0.95/share in EPS in 2014. The stock is trading at around $30 for a P/E above 30x. 2015 estimates is $1.05/share (Yahoo finance) so that makes it 29x P/E. Expensive.

But notice the above; due to low interest rates, they waved $751 million in money market fund management fees. Since they are incurring the expenses to manage the funds, getting that back should go right back into pretax profits. Using a 40% tax rate and 1.3 billion shares outstanding, that amounts to $0.35/share in EPS. Adding that to the $0.95 EPS in 2014, that would get us a normalized EPS of $1.30/share bringing the P/E down to around 23x.

Now look at the net interest margin (NIM). NIM was 1.64% in 2014, but as recently as 2008, it was 3.84%. Back then, returns on cash averaged around 2.5%. If NIM went back to 3.84%, that would be a 2.2% increase in NIM. With $140 billion in earning assets on the balance sheet (as of year-end 2014; as of the end of June, there was more than $150 billion), that would add $3.1 billion to revenues. This should also fall straight down to pretax profits. If that is the case, and assuming a 40% tax rate and 1.3 billion shares, it would add $1.42/share to EPS.

Adding $1.42 to $1.30 gets us to a normalized EPS of $2.72/share. At $30/share, SCHW would be trading at a normalized P/E ratio of 11x. Now, that is really, really cheap for SCHW. Using a 3.00% NIM, you get 13.6x P/E.

The question, of course, is if interest rates will normalize. The ‘when’ is not so important here, I don’t think, because the underlying business is growing nicely so if normalization takes place later than people think, it will just have a bigger impact on EPS by then.

I thought about making this post last week, before the market got messy. So maybe interest rate normalization is not at the top of investors’ minds right now. Maybe the scenario is pushed back a little. But if you can wait, and you think rates will eventually normalize to some extent, this is certainly an interesting idea.

And keep in mind, the average yield on cash in 2008 when NIM was 3.84% was around 2.5% so we’re not talking about short rates needing to go back up to 5-6% or anything like that at all.

More Detail on Rate Normalization

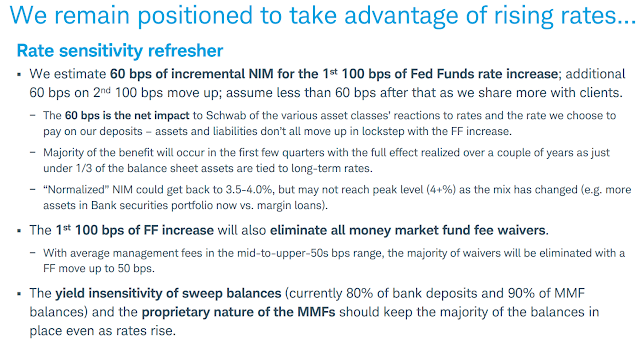

This is a slide from their summer business review presentation. They take a closer look at how interest rates will impact revenues.

SCHW is a Growth Stock

Looking at recent trends, SCHW doesn’t look like a growth stock. It had EPS of $0.92 back in 2007 and only earned $0.95 in 2014. But that is largely due to the above interest rate and fund fee waivers.

If you look over the ten years through 2014, EPS at SCHW actually grew around +14%/year, and going back twenty years to 1994, EPS grew +13.5%/year. And it is still growing. And keep in mind that these growth rates are with an unnaturally depressed endpoint (sub-normal NIM in 2014).

If we use a normalized EPS figure (assume NIM was 3.84% in 2014), then the growth rates would have been +26%/year over ten years and +20%/year over twenty years. That’s kind of insane.

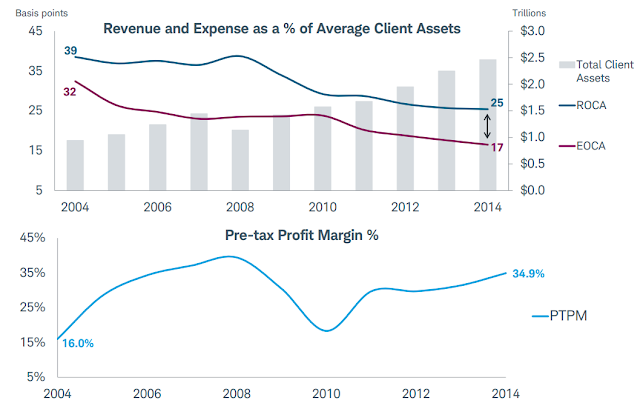

Look at the slide below and you will see that the business is growing since the 2007 peak despite an unchanged EPS.

Client assets are up nicely even compared to the 2007 high.

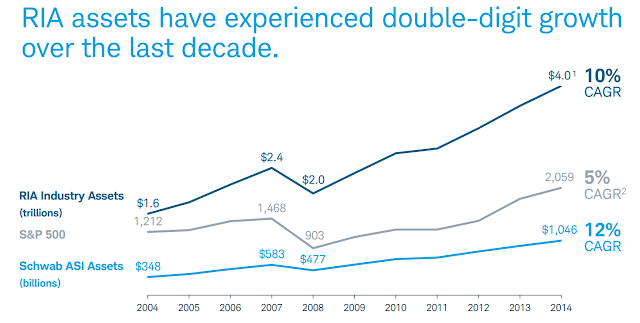

Here is one of the drivers of SCHW’s growth over the past few years. This trend seems to be continuing so there is plenty of runway for growth.

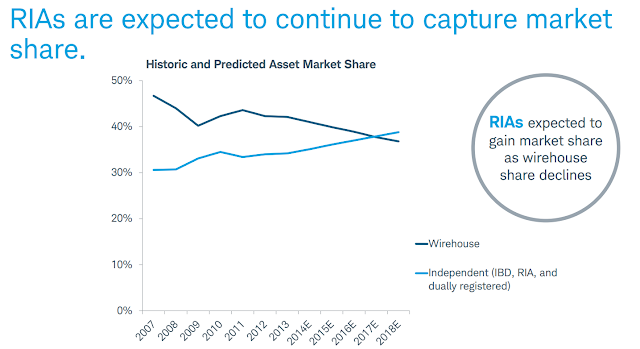

This is a nice chart that shows a trend that I believe will continue:

SCHW sort of feels like the organic food companies while the wirehouses are like the old, traditional food companies.

Conclusion

So, this is kind of an interesting idea. There are a lot of interest rate normalization plays (like, all financials?). But this one is a little different in that it has a lot of growth potential, unlike, say, the larger banks. Plus, I have always liked the company, the management (well, at least the Chairman Charles Schwab) etc. Recent events make interest rate normalization seem less likely to happen soon, but if you believe that it will eventually happen, then this is an interesting idea with a lot of potential. Paying a normalized 11x P/E (or 14x P/E using a 3.00% NIM) for a high growth business with plenty of room to grow seems pretty interesting.

IBKR better

I really like Schwab too, as service and as stock. Looked at it long and hard pre 08. And looked at it but waited around, not really prioritizing research on it post 08, just saw it sitting around 13's, and then next thing I knew, it was 20+ and I said forget it.

The other thing is that the company isn't auto-pilot able as one would think, Charles Schwab had to return to right the ship in early 2000's after stepping down as CEO.

Other than that, really great and surprising post. Not a company I'd assume you'd write about. Maybe you can say something about DHR soon? You had something about it a while back, maybe related to CFX, but any thoughts on DHR's re-org?

Good point about Schwab U-turning back, just like Starbucks and some others. That's always a concern with these owner / founder companies.

As for DHR, yeah, it's really interesting. I suppose it's a good idea to split it as they do seem like very different businesses. I may make a post about it at some point.

I like the schwab stock as a long term investment. I don't think the Chinese stock market will have that adverse of an effect on it. I think it is a good addition to a diversified portfolio.

in the current market there are other companies with a current P/E < 10 without having to estimate movements in interest rates..

IBM for example is down to $145; Buffett bought at $172. Those numbers look good to me..

great post, ive been reading your blog for a while now, always enjoyed. On to my question

could one assume that with higher interest rates, most investors would pull money from MM Funds, and into more lucrative securities, and so then offsetting any gains?

Hi, that's a good point. This sort of linear analysis has all sorts of problems. When JPM did their interest rate impact analysis, they did take into account flows into and out of various types of accounts.

As for MMF, I don't know. My impression was that money was moving out of those into other things as they returned nothing, so if rates go up, money moves back to it from alternatives. But I don't know.

Cash as percentage of customer assets are at very low levels and I thought that was due to zero rates, and it may move back up on non-zero rates. But who knows.

Bingo!

I keep funds in funds in my brokerages cash account, since I earn 0% everywhere. f interest rates go up, I'll move my money out of the brokerage sweep account. I strongly suspect that others will do the same, so the $140B will come way down when rates rise.

-Tom L

Net interest margin is composed of money paid by creditors minus money paid to depositors. Creditors will pay a higher rate and depositors will receive a higher rate. Is the argument of NIM increasing in effect an argument against companies increasing their profits "because they can" since otherwise you'd expect NIM to remain pretty steady regardless of the absolute numbers?

It's normal for financial companies to earn a spread. The zero interest rates make that impossible on the short end of the curve so as those rates go up, companies can earn a spread again. As rates keep rising, deposit rates will go up too so the expectation is that early in the move up, financials will take much of the revenue increase from rising rates (therefore NIM will go up) and share that with depositors as rates keep rising (and then NIM will flatten out).

I was interested in this idea, but the valuation requires a clear opinion on the relationships between FF targets, NGDP, and market yield curves. As kk points out in the comment above, higher short-term rates increases velocity, all things equal. But if FF increases are viewed as monetary tightening, then the reduction in implied inflation tolerance could swamp the velocity increase, as we arguably saw in 2000 and 2006 Japan and in 2011 Europe. I suspect that Charles Schwab is regressing NIM on FF, and implicitly assuming a causal relationship that might not exist.

If only they were trading at big bank valuations.

Yeah, there is an issue with making a linear assumption, but keep in mind that unlike the large banks (or even smaller, regional ones), SCHW is a solid growth company. Revenues and earnings might be depressed due to zero interest rates, so look at client assets as a proxy for underlying business strength. Client assets have grown almost 9%/year over the past 10 years, and even grew a similar amount since the 2007 peak.

That's an impressive growth rate you don't see at the banks.

So even if cash balances are run down due to high rates, if SCHW keeps adding clients as it has been doing (and which I believe will continue to occur as more people migrate to RIA and away from the big brokers), this scenario can still pan out over time on a larger asset base, offsetting the impact of people taking cash out of SCHW.

The key difference between SCHW and the other interest rate normalization plays is that growth factor; it makes the "when" of the normalization less important as they will just keep getting bigger and bigger while they wait.

Given that, the argument that "yeah, but if rates go up, cash balances will drop dramatically", while true in the short run may not be so relevant in the long run… Not to mention that rate normalization process will probably take time… and again, if it takes time, the underlying growth will be offsetting some of that run down of cash balances.

So it's not so simple an argument either way.

Oh, and by the way, someone mentioned IBKR. IBKR is pretty impressive too, but I've always, for some reason, been a little afraid of them. To me, they are more likely to have an FXCM / Knight Trading / REFCO or MF Global problem (not the Corzine blowup but the one(s) before). IBKR seems much smarter than these other firms that blew up, but they are in many, many markets in many, many countries around the world and they seem to be very aggressive. I can't, as an investor, get comfort on IBKR in that sense at all.

This is not to say that IBKR is going to blow up. It's just a relative thing. To me, IBKR seems more likely to have such a problem than, say, SCHW. But you never know. Strange things do happen…

I'm wondering why you consider IBKR as more risky than a SCHW? They do seem agressive in the sense of marketing and gaining share but in my experience they are pretty tight on account risk control. When my account gets low on margin (or whatever term they use) IB sends me a warning of that and lets me know again that my positions could be liquidated if margin becomes inadequate. They don't wait for anyone to post additional collateral, they just start liquidating positions and there is no waiting til end of day, it's all done in real-time.

I'm especially interested in this side issue to your blog since most of my net worth is with IBKR.

IBRK just seems to be involved in many more areas including serving hedge funds via prime brokerage, so there is just a lot more that can go wrong.

If you are a cash stock brokerage customer, I wouldn't worry. If you have a margin account, there is some risk there. Munger kept talking about how assets in margin accounts are not safe. In the Munger sense, IBKR to me is not supersafe.

But my comments was more as an equity investor. In that case, as we have seen in the case of Knight, MF Global, FXCM, the old Refco and many others, in a blowup, the equity investor is the first to lose everything. Cash customer accounts are usually OK as they are just transferred to another brokerage firm. Margin and prime broker accounts are at risk as hedge funds learned in the Lehman fiasco.

As an equity investor, I wouldn't want to own a whole lot of IBKR (I don't own any SCHW or IBKR) for that reason.

But again, I am only speaking relatively. IBKR is in no way close to being in trouble or anything like that at all, and they did come through the financial crisis OK. So unless you have your entire net worth in a margin account at IBKR, I wouldn't worry. If you do have your entire net worth in a margin account there, I would think about having some in a regular cash account and put only what you really need to in the margin account because, as Munger says, if the sh*t really hits the fan, forget about your margin account. It's a potential zero. (the odds are low, though, but not zero).

Excellent post. So I understand NIM and can see how that concept can help banks and insurance companies too. If these companies can earn higher rates on their assets, that is clearly a positive. So there is a large universe of stocks that are available at "depressed earnings" which is positive and can allow for stocks to be more undervalued than they appear. Buffett has said he'd rather pay a higher multiple of "depressed earnings" than to buy at peak earnings. You could probably say this concept applies at Berkshire with its cash and bonds earning such low rates, however my quick calculations is it would increase owner's earnings maybe 5-10% so not as major as 3x at Schwab. So I understand that aspect of it.

My questions is if interest rates rise then how exactly does this affect banks. Clearly on the deposits side the rates they will have to pay will go up. On the assets side, aren't the mortgages mostly fixed and locked in at rates at say 4%. Therefore if rates rise, wouldn't the rates on the deposits side raise rather rapidly, while on the income side for the bank, the mortgages are going to continue earning the same returns, until new mortgages are originated and put on the books. So after say 5-10 years when everything normalizes, I can see NIM for banks returning to historical levels, but in the shorter term after rates rise, wont this be negative for banks?

Hi,

Banks generally have a lot of cash and securities on the b/s, so those will reprice quickly on the short-end. On the funding side, there are a lot of demand deposits etc. On interest bearing accounts, interest rates tend to adjust slower than market rates (just like gasoline stands reducing prices slower than actual crash in wholesale markets).

Mortgages may be fixed but it's not a huge percentage of earnings assets if you look. Plus, we don't know what banks do in terms of ALM (asset/liability management); these can easily be swapped into floating rates by doing conventional fixed/float itnerest rates swaps.

Dimon has said for years that JPM is postured for rising rates and that it is costing them a lot of money every year due to this 'posture'.

Seems like most of the well managed or even not so well managed managers are posturing for rising interest rates. Off top of my head, a lot of insurers (like Markel) are keeping short term fixed income stuff. Right? I wonder what happens when everyone adjusts, or how will they manage if they believe rates will (or will not) continue to rise.

I don't know. If people are on the short end of the curve and waiting for rates to rise, when rates rise they will keep it there, right? If the curve steepens, maybe they go back out on the curve.

In any case, on the short-end, I don't expect much market impact in terms of money moving around, but what do I know…

I'm just not sure what would happen if interest rates stay at their current low or lower for say, ten years. Then an investor is really dependent on the quality of the business and the continuation of growth.

Excellent!

KK, would be interested to see you post about Altice (Drahi) and evaluate whether he's the European John Malone, or someone who is overpaying for assets and cost cutting to reduce his overpayment. On the surface, lots of similarities, but that's level 1 thinking. On level 2 thinking, is Drahi over paying? Or is he really good at operating cable systems and implementing a "frugal" culture?

European telcos/cablecos tend to think ARPUs are higher on the american side. Hence, if they can bring the European cost structure to America, they can overpay and still make a lot of money. Seems a bit too simplistic. Based on what i've read, I think there are more regulatory pressures in Europe that limit the ARPUs (especially in France).

Hi,

That's a really good question. I am not really all that familiar with the industry in Europe so I can't say (I don't even own Liberty Global, for example…). It can be a combination of both, right? Maybe he is the real deal, but also may be overplaying his hand in the U.S. But I don't know. It's probably true that there may be a lot of waste built up over the years at Cablevision due to their being controlled for so long by a single family. He may also be leaning on the fact that there might be strategic value at there as the industry continues to consolidate…

Here is some discussion on the safety of brokerage accounts. The head of SIPC seemed to suggest most customer accounts are safe.

http://blogs.marketwatch.com/greenberg/2008/03/how-to-keep-your-investments-safe/

Thoughts on VRX

Hi, yeah, that merits some post of some kind. It's been really interesting and I've been following it very closely. Actually, I've been following VRX for a while and it is really sort of up my alley in the sense that it is sort of outsider-ish, growing via capital allocation, big holding by ValueAct, Sequoia, Ackman, even Weitz. So this is a stock that I really wanted to own and write about; there was plenty of material with Ackman's huge presentations etc.

But somehow, I got lucky and didn't bite on this one. I can't say exactly what it was, but it just didn't feel right to me and I just generally couldn't figure it out.

And I sort of still can't figure it out. Clearly, Citron was wrong about the channel stuffing. And Ackman made a pretty good presentation and he's right on many points.

On the other hand, as Munger says, this is not American Express. The difference is, other than what Munger said (he said AMEX was conned and was stupid, not immoral), that AMEX's main business had nothing to do with the scandal.

Unfortunately for VRX, this problem has a lot to do with the main business. You can expect basically all insurance companies to lean hard against VRX from now on, making sure that every drug that can be replaced by a generic will be etc…

A lot of the tricks used in the industry (however 'normal' it is) will be closely scrutinized and that's going to be a problem in hitting their goals (not to mention difficulty of closing deals etc…).

So, VRX has always been a potential post for me and it still is. I just haven't gotten around to summarizing my thoughts on it.

At the moment, I am not looking at VRX as an investment…

Dan Loeb is probably short VRX, so HLF all over again; Loeb taking the other side of Ackman. Tactically speaking, it's a great idea as Ackman and Seqouia are very loaded up on the name and there are few triggers to turn the stock around in the near term. Nobody will step in to buy in size with so much obvious supply. Meanwhile, news is more likely to dribble out over time while it is hard to imagine a single headline that clears all the uncertainty in the name.

It reminds me of when Tiger was in trouble a while back. Tiger's long holdings became a target of shorts etc… the same is probably happening now as hedge funds down close to 20% are very vulnerable to mass redemptions…

Thank you for your work on Schwab. Really an enlightening analysis. As an admitted jockey investor, I've followed Lou Simpson and "hop on" when a good opportunity presents.

Kind of a similar situation brewing with Baupost and their position in LNG. A $750+M position that is well under water. Could invest today WELL below what Seth et.al averaged in.

I'd be interested in your thoughts if your inclined to have a look.

Matthew 13

[9] Who hath ears to hear, let him hear.

Revelation 13

[9] If any man have an ear, let him hear.

>>>>>>>>>>>>>>>>>>>>>>>>>>>

NEW TESTAMENT BIBLE STUDY

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

Don't let God fool you, He reaps where He doesn't sow.

!