I was always curious about COWN; it did an interesting merger with Ramius, an alternative asset management company run by some stars from the 1980’s. I have taken a look at it a few times over the years but never really thought much of it. I don’t know what I think of it now, but I thought I’d make a post about it as I am taking a closer look.

First of all, to me, COWN the boutique broker-dealer/investment bank has always been a small company that specialized in health-care and technology; nothing special. I don’t think it has been making any money (or not much) since the 1999/2000 bubble crash. After that, the industry sort of just seemed to shift away from these little guys and to the bigger banks.

The first time I really noticed it as something I should look at more seriously was when it showed up on Leucadia’s (LUK) 13-F back in May 2011. Many of us respect Cumming and Steinberg as great investors so obviously, anything they take a stake in is interesting to me (but of course, I would never blindly buy anything just because someone I like does).

So here is the curious holdings history of COWN at LUK:

COWN #shares owned

price by LUK BPS P/B TBPS P/TBS

3/31/2011 $4.01 1,000,000 $5.95 0.67 $5.42 0.74

6/30/2012 $2.66 2,000,000 $4.45 0.60 $4.23 0.63

3/31/2013 $3.09 3,000,000 $4.40 0.70 $4.03 0.77

9/30/2013 $3.44 0

*shares are rounded to the nearest million. It’s pretty close, though.

Yes, it’s a pretty small position for LUK. The other stock they’ve owned for a long time is INTL FCStone (INTL). We can see that after the LUK/JEF merger, they completely sold out of COWN. This can be because they are a direct competitor to JEF. Or maybe they (Handler, who took over from Cumming/Steinberg) just don’t like COWN. INTL also is being sold down.

INTL

I used to follow INTL until their merger with FCStone. I personally hated that merger because I am not a fan of the commodity futures brokerage business. I didn’t like JEF’s purchase of Bache’s commodities business either. I’ve never worked in that industry, but it has always sort of seemed like a low-margin, low-return business. And then every few years you have these spectacular blowups. Refco had a blowup, MF Global lost a ton on unauthorized, hidden trades (this was in 2008 and not the Corzine blowup of 2011) and there were some others. All it takes is one bad unauthorized trade and *poof*. I hate that. You may argue that this is the case with any financial company. Yes, to some extent. But in futures, it seems much easier to blow up. (But importantly, thanks to central clearing, those blowups rarely lead to systemic problems).

Anyway, that business sort of turned me off to INTL. If I take a close look at it again, maybe I’ll make a post about it.

If someone were to ask why LUK owned COWN, Cumming / Steinberg would have probably said, “Because we like the people and it’s cheap”. I think that’s exactly what they answered when someone asked about INTL at an annual meeting a few years ago.

So, Cumming / Steinberg probably like the people at COWN. It can’t be just because it was cheap; there were plenty of cheap financial stocks back in 2011.

Linkem

But there is another connection. Ramius, the alternative asset manager that merged with COWN had a stake in Linkem before LUK got involved. So there is probably a relationship there. All of these guys (the LUK folks and COWN folks) go way back.

COWN Management

Some of the older people will recognize these names, but the younger folks may not have ever heard of them. Peter Cohen is sort of the original Jamie Dimon (Sandy protege). He was a rising star, young, “boy wonder” back in the 1980’s. Thomas Strauss, of course, will make many Buffett-heads cringe as he was the President and Vice Chairman of Salomon at the time of the scandal.

Peter A. Cohen. Age 67. Mr. Cohen serves as Chairman of the Company’s Board of Directors and Chief Executive Officer of Cowen Group and serves as a member of the Management and Operating Committees of Cowen Group since November 2009. Mr. Cohen is a founding principal of the entity that owned the Ramius business prior to the combination of Ramius and Cowen Holdings, Inc., or Cowen Holdings, in November 2009. From November 1992 to May 1994, Mr. Cohen was Vice Chairman and a director of Republic New York Corporation, as well as a member of its Executive Management Committee. Mr. Cohen was also Chairman of Republic’s subsidiary, Republic New York Securities Corporation. Mr. Cohen was Chairman of the Board and Chief Executive Officer of Shearson Lehman Brothers from 1983 to 1990. Over his career, Mr. Cohen has served on a number of corporate, industry and philanthropic boards, including the New York Stock Exchange, The Federal Reserve International Capital Markets Advisory Committee, The Depository Trust Company, The American Express Company, Olivetti SpA, Telecom Italia SpA, Kroll, Inc. and L-3 Communications. He is presently a Trustee of Mount Sinai Medical Center, Vice Chairman of the Board of Directors of Scientific Games Corporation, a member of the Board of Directors of Chart Acquisition Corp. and a director of Safe Auto Insurance. Mr. Cohen provides the Board with extensive experience as a senior leader of large and diverse financial institutions, and, as Chief Executive Officer, he will be able to provide in-depth knowledge of the Company’s business and affairs, management’s perspective on those matters and an avenue of communication between the Board and senior management.

Thomas W. Strauss. Age 71. Mr. Strauss is Vice Chairman of Cowen Group, Inc. and is the Chairman of Ramius LLC. Mr. Strauss was appointed a director of Cowen Group in December 2011. Mr. Strauss previously served as Chief Executive Officer and President of Ramius Alternative Investments since February 8, 2010 and serves as a member of the Management and Operating Committees of Cowen Group. Mr. Strauss previously served as Chief Executive Officer and President of Ramius Alternative Solutions. Mr. Strauss is a founding principal of Ramius. From 1963 to 1991, Mr. Strauss was with Salomon Brothers Inc. where he was admitted as a General Partner in 1972 and was appointed to the Executive Committee in 1981. In 1986, he became President of Salomon Brothers and a Vice Chairman and member of the Board of Directors of Salomon Inc., the holding company of Salomon Brothers and Phibro Energy, Inc. In 1993, Mr. Strauss became Co-Chairman of Granite Capital International Group. Mr. Strauss is a former member of the Board of Governors of the American Stock Exchange, the Chicago Mercantile Exchange, the Public Securities Association, the Securities Industry Association, the Federal Reserve International Capital Markets Advisory Committee and the U.S. Japan Business-Council. He is a past President of the Association of Primary Dealers in U.S. Government Securities. Mr. Strauss currently serves on the Board of Trustees of the U.S.-Japan Foundation and is a member of the Board of Trustees and Executive Committee of Mount Sinai Medical Center and Mount Sinai-NYU Health System. Mr. Strauss provides the Board with extensive experience in both investment banking and asset management.

I don’t have any particular opinion about these guys as they were pretty much before my time. I only know how they have been portrayed in the media.

Valuation

So why bother looking at this? It is nominally cheap. As of September 2014, BPS was $4.74/share and tangible BPS was $4.33/share. It’s now trading at $4.44/share which is 0.94x BPS and 1.03x TBPS. That’s not that cheap compared to when LUK owned it.

But there is a near-term catalyst that makes this valuation much cheaper. Due to previous losses, they have a large deferred tax asset that is not reflected in book value because of the valuation allowance (as they weren’t profitable enough to be able to say they can use it).

From the 3Q14 10-Q:

Due to recent and current positive operating results and, because the losses from 2011 are rolled off from the three-year rolling analysis, the Company anticipates to be in a three-year cumulative income position later in 2014. As a result of this development and other positive factors as indicated above, it is possible that the Company could release a large part of the Company’s valuation allowance in the fourth quarter of 2014, which would have a material and favorable effect on Net income and Stockholders’ equity. At September 30, 2014, the Company’s valuation allowance was $137.4 million, of which $135.2 million is related to the Company’s US operations.

$135.2 million amounts to around $1.20/share. If this DTA is added to the above BPS and TBPS, we get $5.94/share and $5.53/share respectively. That makes the valuation 0.75x BPS and 0.8x TBPS. COWN starts to look cheap again.

Of course, this assumes that COWN didn’t lose money in the 4Q of 2014. We don’t know that yet. And we don’t know how much of the valuation allowance will actually be released in 4Q2014.

But if the turnaround is for real at COWN, then we can assume that the DTA will eventually be realized.

BPS History

Any time we look at something against book value, we have to see how BPS has changed over time. It’s not cheap if a company can’t or hasn’t grown BPS at a reasonable rate over time (or paid out dividends etc.).

Ramius and COWN merged back in 2009, so let’s look at BPS and TBPS since then. Some of the figures may be off by a penny or two since I rounded when making the BPS/TBPS calculations.

BPS TBPS

Dec 2009 $6.34 $5.75

Dec 2010 $5.95 $5.42

Dec 2011 $4.45 $4.23

Dec 2012 $4.40 $4.03

Dec 2013 $4.41 $3.99

Sep 2014 $4.74 $4.33

So, that’s not so exciting. BPS has been going down since the merger. How can this be when the market has done really well, generally, since the bottom of the crisis?

OK, so COWN was probably in much worse shape and not positioned for the post-crisis world (I don’t think COWN ever even recovered from the other bear market in 2000-2002; it seemed like they were just waiting around for the next bubble to come to bail them out).

But there is hope. COWN is a little complicated because they consolidate some of the funds that Ramius manages. So we have to look at the economic income (which ignores the consolidated funds and other things).

In general, Economic Income (Loss) is a pre-tax measure that (i) eliminates the impact of consolidation for consolidated funds and (ii) excludes certain other acquisition-related and/or reorganization expenses (See Note 2). In addition, Economic Income (Loss) revenues include investment income that represents the income the Company has earned in investing its own capital, including realized and unrealized gains and losses, interest and dividends, net of associated investment related expenses. For US GAAP purposes, these items are included in each of their respective line items. Economic Income (Loss) revenues also include management fees, incentive income and investment income earned through the Company’s investment as a general partner in certain real estate entities and the Company’s investment in the activist business. For US GAAP purposes, all of these items are recorded in other income (loss). In addition, Economic Income (Loss) expenses are reduced by reimbursement from affiliates, which for US GAAP purposes is presented gross as part of revenue.

Here is the economic income of the two businesses (alternative investments (Ramius) and broker-dealer (the old Cowen)) since 2009:

(in $millions)

Alternative Broker-dealer

2009 -25.7 -16.3

2010 31.8 -67.4

2011 10.2 -81.7

2012 18.5 -36.1

2013 10.1 -3.6

2014* 7.9 17.4

*2014 is for the first nine months

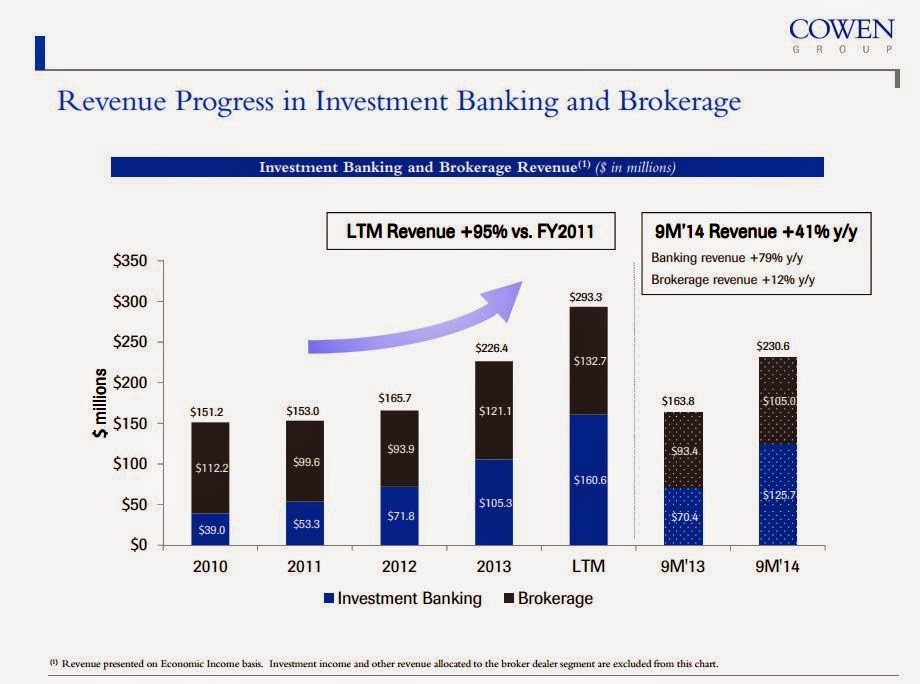

So it looks like they are really turning around the broker-dealer business. If this trend in improvement continues, that can really help the stock. All they need to do is not lose so much money on the broker-dealer side and do well with Ramius.

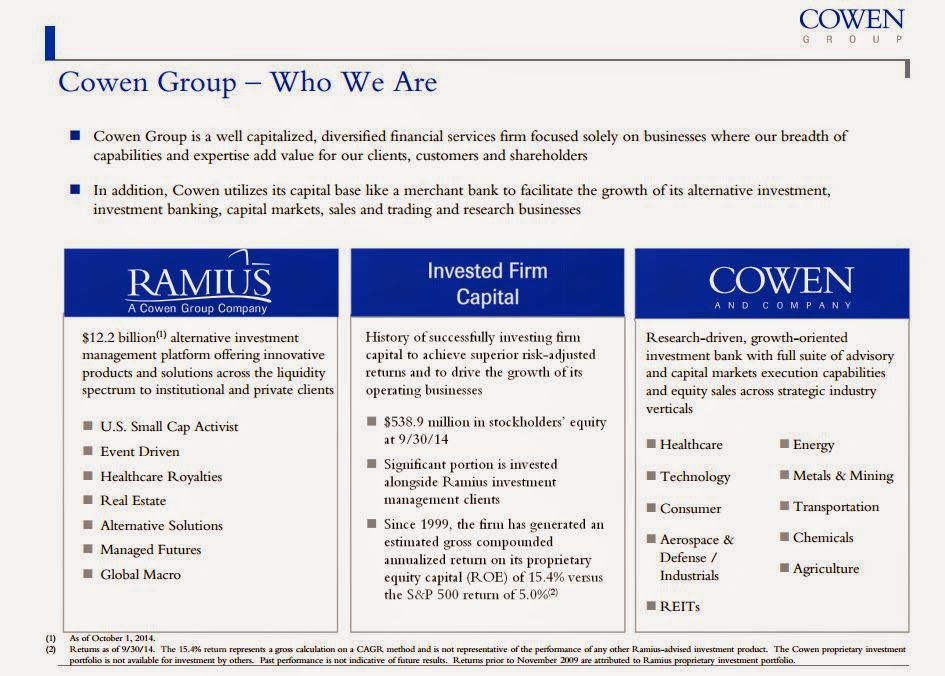

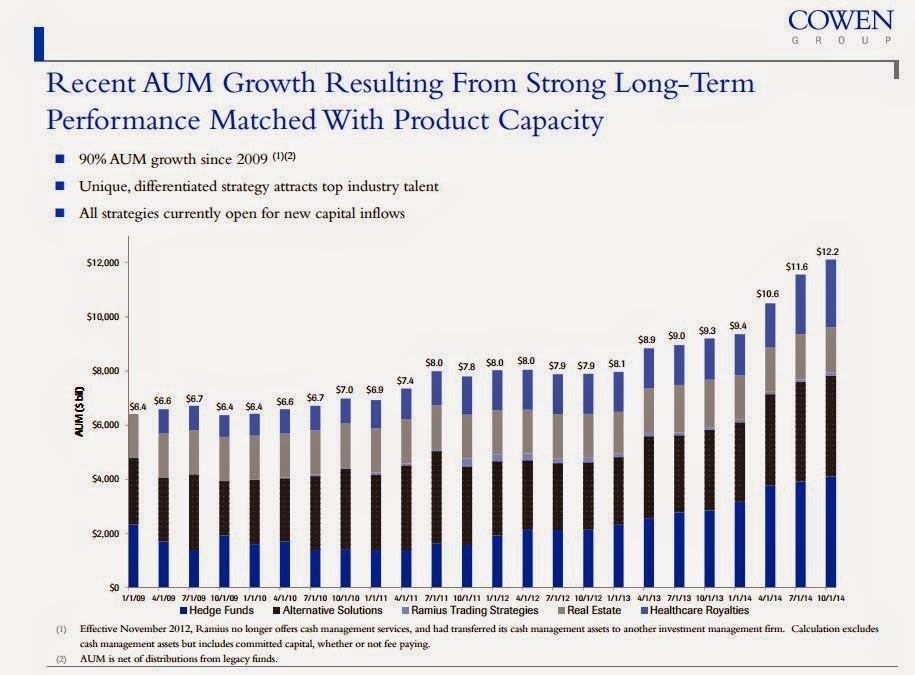

They have a presentation on the website from November 2014, so let’s look at that for a second.

Here are some slides:

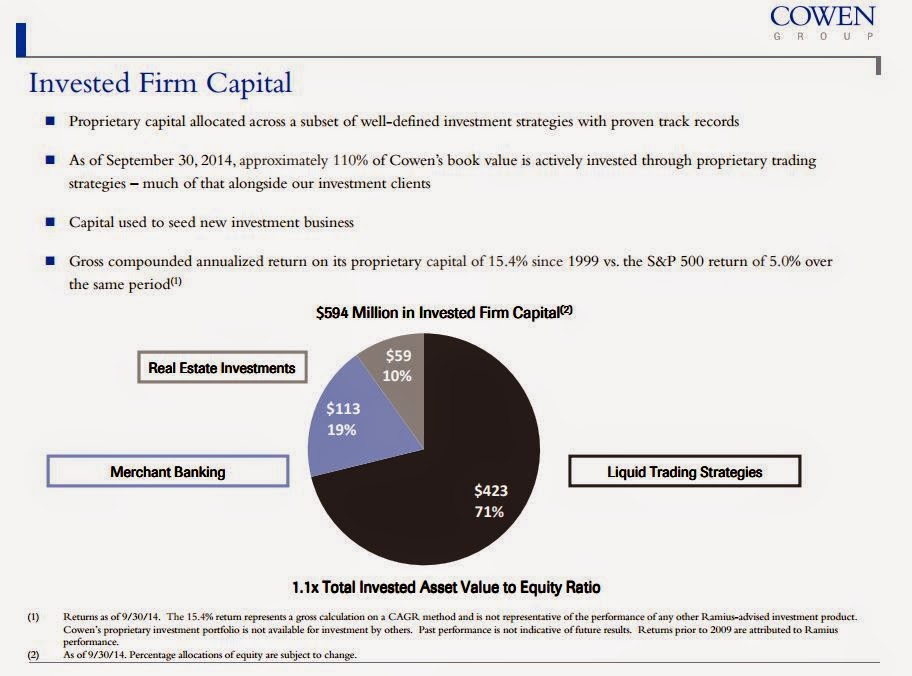

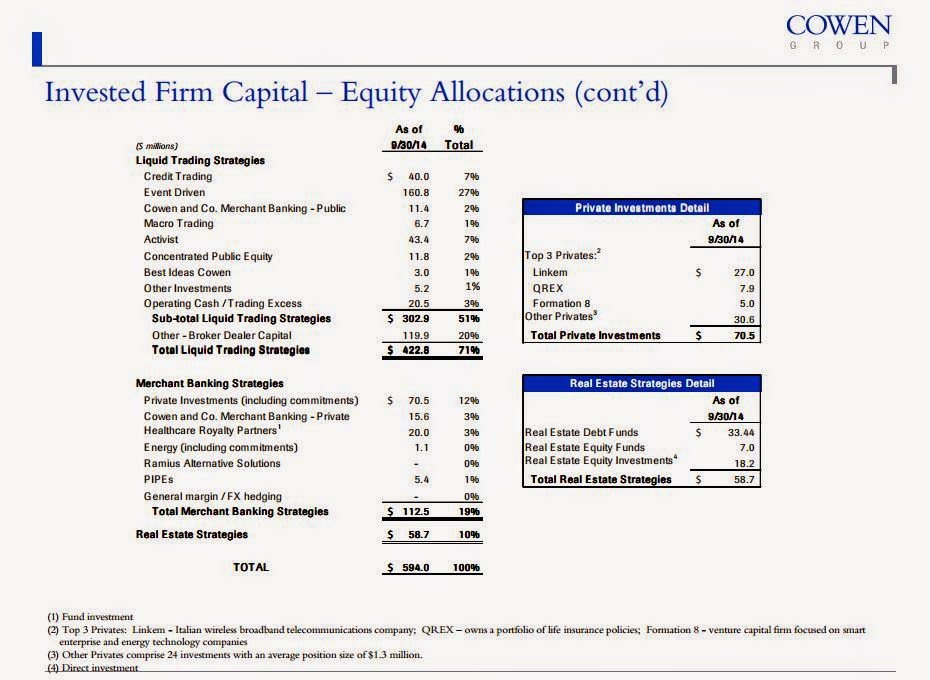

What is interesting here is that not only do they have a broker-dealer business and an alternative asset management business; they invest a lot of their own capital into their alternative strategies. This is different than most other listed alternative asset management companies. Others do invest in their own funds/strategies, but it usually isn’t a large part of their value (OAK, BX etc).

I think it’s obvious that the merger in 2009 was driven by the needs of both sides. Both of them were hit hard during the crisis.

This model sort of reminds me of the old Salomon model. Salomon made a lot of money trading for itself back in the 1980’s, and I think a lot of their ability to take risk came from the steady stream of revenues from their client businesses.

This is why I wondered if Long-Term Capital Management (LTCM) would do as well on its own when they split from Salomon. For example, if you belong to an organization with a stream of $10 million per day coming in, you can take a lot more risk than if you had zero coming in every day. With a $10 million per day revenue stream to support risk taking, you can take VAR up to $10 million and you wouldn’t lose money even on the bad days ($10 million loss offset by $10 million revenue on that day). If you include the revenue stream in the VAR, for example, you really shift the curve to the right and really minimize that nasty tail on the left side.

I think this is a big part of why Salomon was able to take such big risks back then, and this may be one of the reasons LTCM couldn’t survive when they had one of their outlier days/weeks/months; there was nothing there to offset it or smooth it out. And this too, by the way, is why JPM and GS are better off ‘diversified’ than not.

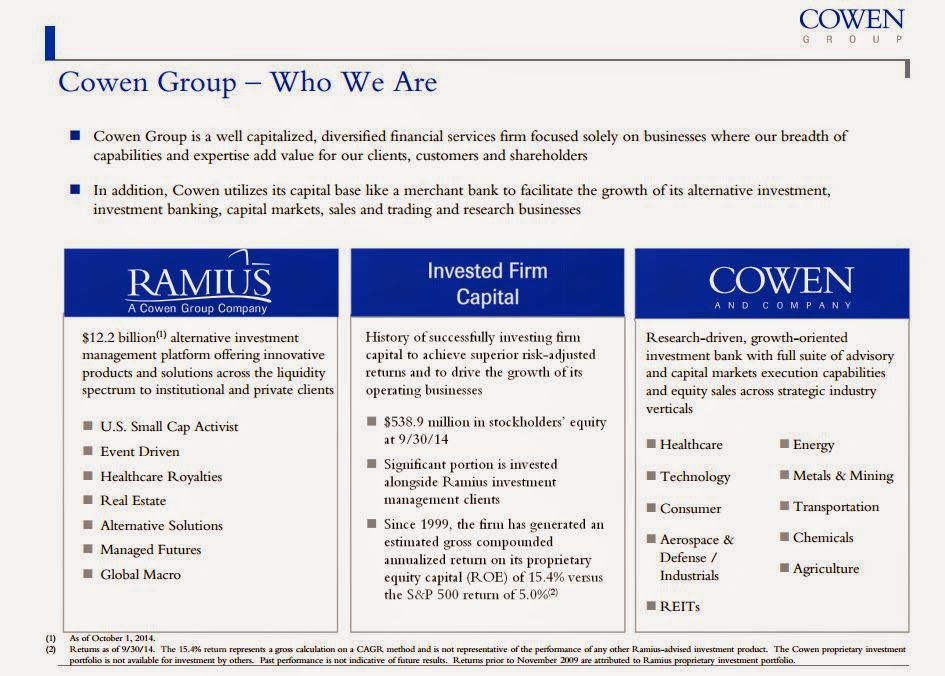

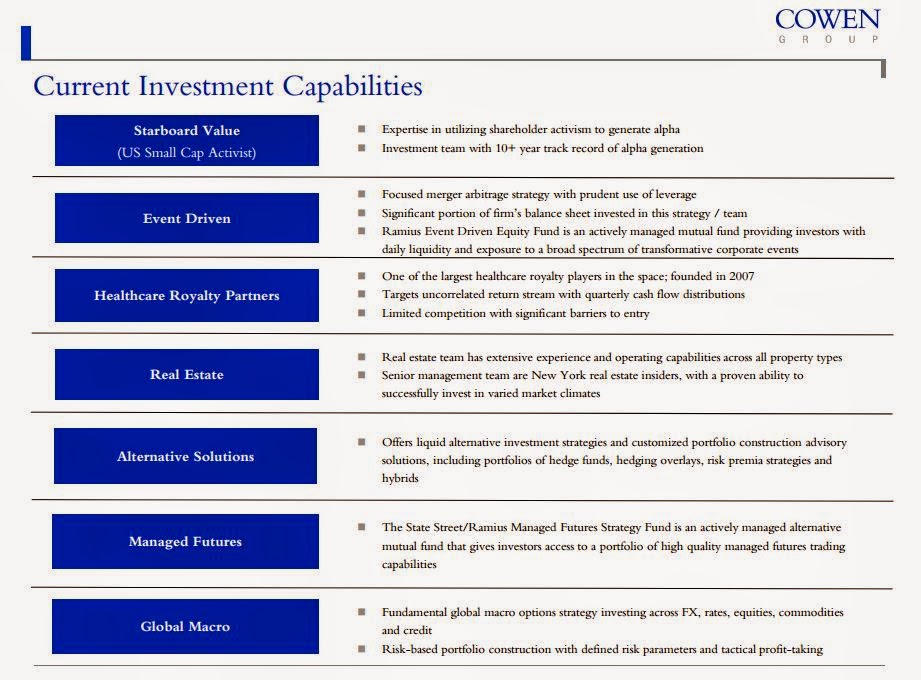

Anyway, moving on. These are the different strategies that Ramius runs. And yes, that Starboard is the “put some damn salt in the water when you boil pasta and don’t give out so much friggin’ bread!” Starboard. They were spun off so COWN only owns a minority stake. This could be a good thing or a bad thing depending on what you think of Starboard (I know there is a wide range of opinions!).

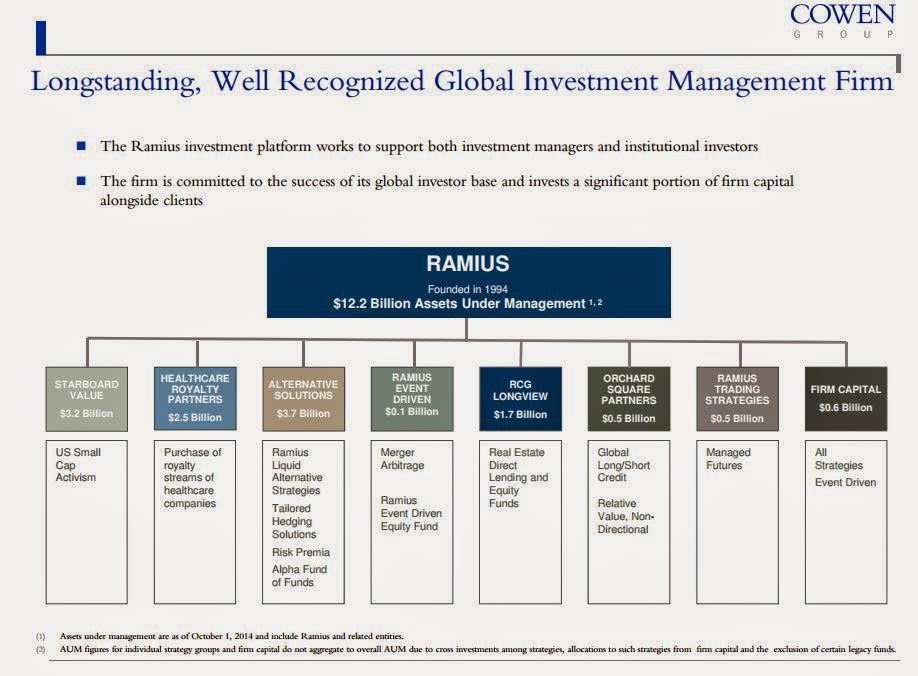

AUM growth has been good since 2009.

I am generally not a big fan of managed futures and global macro. But who cares what I think…

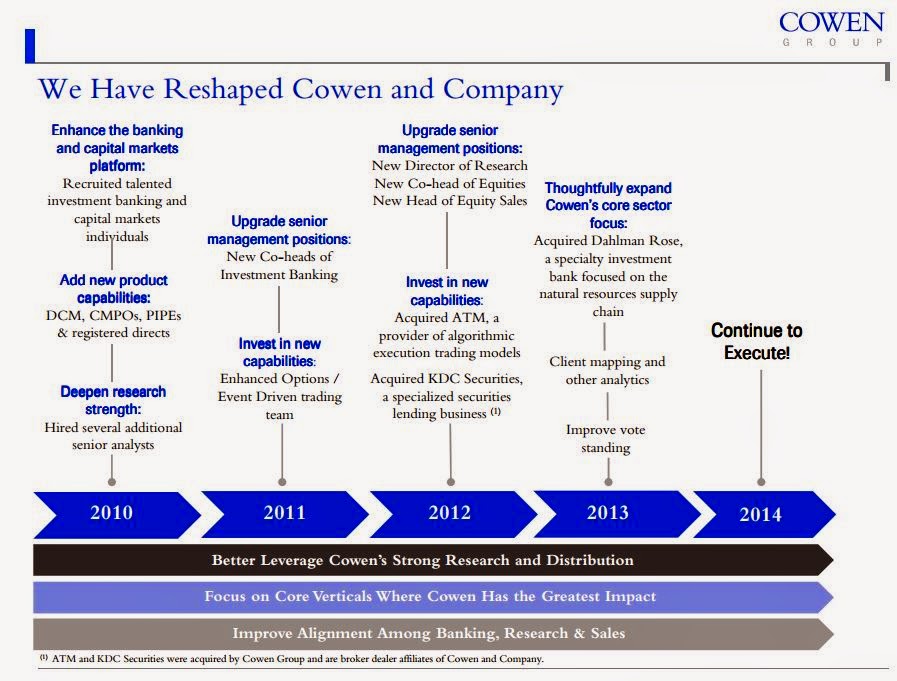

And here is how they are turning around the broker-dealer business:

It is sort of stunning that they have 110% of COWN’s book value invested in their proprietary trading strategies. This could be a good thing for people who want alternative exposure. But it can be scary; what happens in the next bear market? If the next bear market causes the broker-dealer business to go back to losing money, it can get scary.

Here is the breakdown of how the capital is invested (by strategy):

Historical Returns

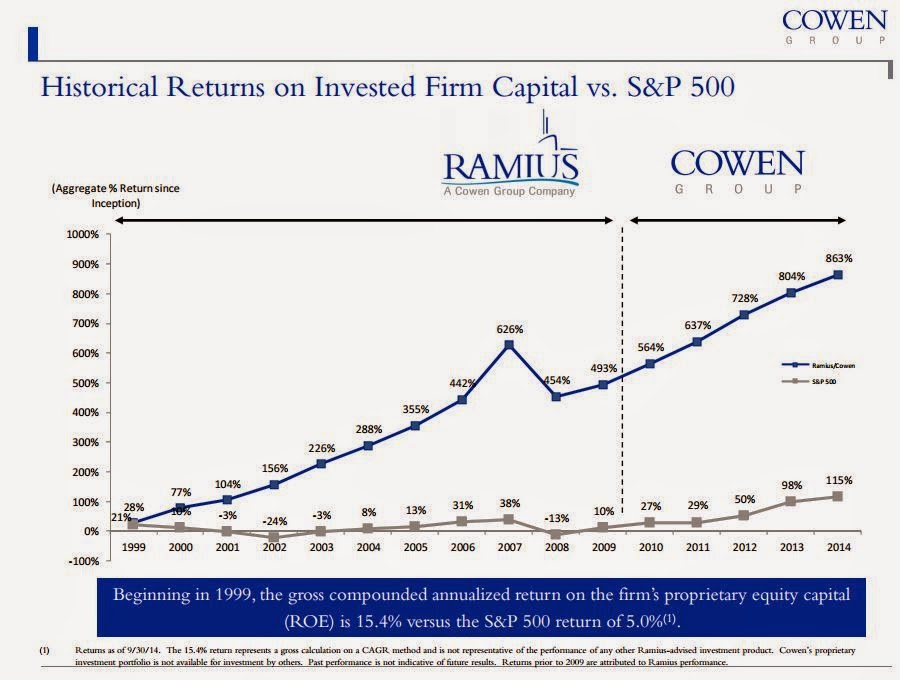

So check out this chart. It shows how COWN’s (and Ramius pre-merger) own invested capital performed since 1999. It seems like they did fine in the 1999-2002 bear market but got killed in the financial crisis.

Since 1999 (or from the end of 1998), their gross return has been 15.4%/year. That’s not bad at all.

But let’s look at it in the different time periods. From 1998 to the top in 2007, the return was +24.6%/year. And then they lost -23.7% in 2008. That’s not bad at all, but if this sort of loss happens in a broker-dealer and the b/d business also loses money, things can get pretty ugly pretty quickly.

Since the low in 2008, they earned +10%/year. So there is something going on that is making it harder for alternative strategies to make money. Or they prudently scaled back their risk due to being part of a broker-dealer. We don’t know how the mix has changed over time so we can’t really say. It’s not the stock market, though, because that has done really well since 2008.

Mutual Funds

Ramius runs some mutual funds too with some of these alternative strategies. There is a website with some interesting information:

They run four alternative investment mutual funds:

Ramius Hedged Alpha Fund (RDRIX/RDRAX)

State Street/Ramius Managed Futures Strategy Fund (RTSRX/RTSIX)

Ramius Strategic Volatility Fund (RVOAX/RVOIX)

Ramius Event Driven Equity Fund (REDIX/REDAX)

You can see for yourself at the website, but the performance is not so great. The Strategic Volatility Fund can’t be considered anything other than a total disaster. True, most of these funds are still new so it will take time to see if they perform well.

The Ramius Event Driven Fund is run by Andrew Cohen, Peter Cohen’s son. The blurb on that fund actually looks interesting but I have no idea if Andrew Cohen has actual experience managing money and if he has a proven track record.

I wouldn’t recommend any of the above funds, mostly because I am unfamiliar with the managers and I don’t think some of the strategies make any sense.

Conclusion

I actually don’t know much about Ramius and COWN. It is an interesting play for sure if you like this sort of thing (proprietary trading / alternative investments). But I don’t know enough about them and their funds for me to be comfortable. For alternative asset management, I would prefer the other big names (BX, OAK etc.) and for broker-dealers, I would much prefer GS and LUK. But that’s mostly because of the familiarity I have with those organizations; I have been following them for years.

To date, I have heard very little about Ramius (other than Starboard which has been in the public eye a bit lately) and I never thought much of the old Cowen. I don’t mean it was a bad company, I just mean that I had no interest in small, boutique investment banks in general; the world seemed to have moved away from that model.

I also have no view, particularly, on the management of COWN (Cohen, Strauss) even though I used to read and hear a lot about them early on in my career.

One big concern for me is how COWN would do in a bear market. If you get a combination of losses in proprietary / alternative strategies and the broker-dealer business, it might not be a situation I would want to sit through.

Also, Cohen/Strauss and the other old Ramius owners initially owned a bunch of COWN, but it looks like they sold that down in the past few years. It seems clear that the merger was basically an exit strategy for the Ramius owners.

This is from the 2010 proxy:

|

Executive Officers and Directors

|

Amount and Nature of Beneficial Ownership |

Percent of Class |

|||||

|---|---|---|---|---|---|---|---|

|

Peter A. Cohen(1)(2)

|

37,252,171 | 49.9 | % | ||||

|

Stephen Kotler

|

— | * | |||||

|

Jules B. Kroll

|

70,000 | * | |||||

|

David M. Malcolm(3)

|

668,522 | * | |||||

|

Jerome S. Markowitz(4)

|

25,000 | * | |||||

|

Jack H. Nusbaum

|

30,000 | * | |||||

|

L. Thomas Richards, M.D.

|

12,734 | * | |||||

|

Edoardo Spezzotti(5)

|

— | * | |||||

|

John E. Toffolon, Jr.(6)

|

64,717 | * | |||||

|

Charles W.B. Wardell, III

|

11,734 | * | |||||

|

Joseph R. Wright

|

50,000 | * | |||||

|

Morgan B. Stark(1)(7)

|

37,252,171 | 49.9 | % | ||||

|

Thomas W. Strauss(1)(8)

|

37,252,171 | 49.9 | % | ||||

|

Stephen A. Lasota(9)

|

20,000 | * | |||||

|

Christopher A. White(10)

|

271,169 | * | |||||

|

All directors and named executive officers as a group (15 persons)

|

38,476,047 | 51.5 | % | ||||

…and this is the 2014 proxy:

| Amount and Nature of Beneficial Ownership |

Percent of Class |

||||||

|---|---|---|---|---|---|---|---|

|

Executive Officers and Directors:

|

|||||||

|

Peter A. Cohen

|

3,039,220 | 2.6 | % | ||||

|

Katherine Elizabeth Dietze

|

48,030 | (1) | * | ||||

|

Steven Kotler

|

10,000 | (2) | * | ||||

|

Jerome S. Markowitz

|

306,180 | (3) | * | ||||

|

Jack H. Nusbaum

|

141,568 | (4) | * | ||||

|

Joseph R. Wright

|

103,217 | (5) | * | ||||

|

Jeffrey M. Solomon

|

712,408 | * | |||||

|

Thomas W. Strauss

|

2,998,832 | 2.6 | % | ||||

|

John Holmes

|

197,540 | * | |||||

|

Stephen A. Lasota

|

221,156 | * | |||||

|

Owen S. Littman

|

224,180 | * | |||||

|

All directors and named executive officers as a group (11 persons)

|

8,002,331 | 6.9 | % | ||||

It’s true that these guys aren’t so young anymore, so I can see selling down. Also, it might be safer to just own the Ramius funds instead of owning stock in COWN. If things hit the fan, you may take big marks against you but funds generally don’t go bust. But this can’t be said of broker-dealers. (One of the ironies here is that Ramius had some assets stuck in the London prime brokerage of Lehman when they went under).

This combination of broker-dealer + alternative asset manager + capital invested in alternative strategies can be very interesting when things are going well, but if things go back to where they were (when the b/d was losing money), and we get a bear market, things might get ugly.

Also, from a valuation viewpoint, ideally, if the broker-dealer business does OK, and the proprietary investments work out like it has historically, then you get the alternative asset management business for free. A sum of the parts analysis might add a value using some sort of percentage of fee-earning AUM, but I have never really liked that approach since the fee structures differ between firms.

It’s hard to put a value on the asset management business if the earnings are not separated out. For example, other alternative managers are typically valued based on fee-related earnings and incentive fees. In the case of COWN, I don’t know what the fee-related earnings is; if you deduct expenses from management fees, it is negative, but some costs might be offsets to incentive income and bonuses from proprietary trading (strategies done in-house but not for any fund).

So, in any case, you can add some value based on AUM, but I haven’t done it here. (Also, if you deduct investment income from economic income of the alternative investments segment, it’s negative every year. This suggests that the asset management business is not adding value (or there are costs included that are not related to the asset management business)).

If it was clear that fee-related earnings are consistently positive, then that also would add to the stability of COWN; a stable, positive fee-related earnings would help stabilize potential volatility on the balance sheet.

But to date, this hasn’t been the case.

In any case, this is an interesting investment. If someone has more familiarity with the people and funds here (as Cumming/Steinberg presumably did), it’s an interesting idea. But for me, I don’t have the comfort level but I’ll keep an eye on it.

I think COWN's wish to be bailed out by another bubble is in progress. I do not think the broker dealer would do well in a bear market for stocks.

Strauss isn't really involved at all, his position has been taken by Michael Singer at Ramius, I think. Cowen is a bad bet, imo. Basically banks only make money on two things, M&A advisory and IPOs and other forms of raising capital (and asset management, but that's a separate business). The basic problem is that Cowen is really bad at M&A and leading IPOs. More often than not, Cowen does zero M&A revenue. On IPOs and debt offerings, quarter before last Cowen did zero debt deals. Basically, Cowen is not hustling, that's all there is to it.

The trading is a capital sink. The posted returns are gross, which means (I think) before expenses. Net returns are probably pretty close to zero in the last few years. Any decent trader has better opportunities than risk arbitrage at Cowen.

Compare Cowen and FBR. FBR lives or dies off IPOs and 144s and M&A, and they have no choice. No deals means nobody gets paid. Of course, that means that FBR has a much better ROE in the bank than Cowen does. And Cowen will never get close to FBR in terms of performance because there is no need. The asset managment business will pay the bills indefinitely. There are probably diseconomies of scope between asset management, trading and banking.

Thanks for the input. What you say doesn't surprise me at all. Actually, upon further thought I can't understand why the alternative investment segment isn't profitable excluding investment income. As a pure asset manager, they should be in the black on incentive fees and then the gains on investments should just be icing on the cake. So something is wrong there. Maybe some of their funds are as bad as the mutual funds… who knows (I didn't figure the mutual funds mediocrity to be necessarily indicative of their other funds as the mutual funds are very small).

Oh yeah, and I realize that if you exclude investment income from the Alternative Investment segment economic income, expense might be overstated as there may be bonuses tied to that; so assuming you paid out 20% of profits as bonuses (40-60% of incentive fees are paid out as bonuses at alternative asset managers, but hopefully they don't pay out more than 20% on gains on proprietary capital), you can add back 20% of investment income to the economic income and that would still be negative over the years.

You say that these banks are better diversified than not. OK, what is the ROE in the broker dealer, if you back out asset management and M&A? Even at firms like GS, it has to be in the single digits. It's just not a good business anymore. The entire industry is massively overcapitalized. A better model is Evercore, that's built around the high-margin businesses. I doubt that Cowen will manage a 10% return over an entire cycle, even with the asset management business. Cohen is trying to recreate Lehman or Salomon, and that model is dead.

If you look at JPM, the ROE by line of business is broken out.

Evercore is a good model, yes, because they only focus on advisory which doesn't necessitate any capital. But as you can see historically, M&A is very cyclical; historic volume charts look like the Brooklyn Bridge.

As for Cowen, this may just be a case of an awful broker-dealer stuck to an awful asset manager. As I said, in this 'space' (hate that word!), I would go for LUK/JEF.

Is the model broken/outdated? I don't know about that. I'm not convinced it is yet. There are cyclical factors at work here, like these historically low interest rates that really reduce returns in many lines of businesses, and the low volatility in the markets (until 4Q14). Of course increased capital requirements and tighter regulations don't help, but I think they will evolve over time and make good money over time.

Having said that, there are a lot of small boutiques like COWN that may never come back to make good money. In a sense, the world has really shifted especially for those guys; electronic trading, alternative sources of information, more comprehensive coverage of their areas by the bigger banks etc… Oh, and indexation and the ETF boom doesn't help either, and institutional cash moving into alternatives, so "alpha" seekers look for other ways to beat the market than finding stocks that will outperform (which is what COWN is supposed to help do). etc…

The bigger banks are better able to deal with that shift.

The interesting thing about financials these days is to try to parse out these factors. I don't have the answers, of course, but my hunch is that it's not just regulation and capital, but some other cyclical factors I mention.

Anyway, it's an interesting topic for sure.

It's the sixth year of a bull market, if Cowen's broker dealer is losing $10M a quarter (my estimate before last quarter) it can't be cyclical, plus the biotech boutique is right in the sweet spot of the cycle, and that's 150% of the bank. Cohen had the chance to buy stock back at $2.25 and he didn't take it. Clearly management doesn't care about ROE. In fact Cohen said a few quarters ago that the target ROE was 10%, that the days of 15% were over.

But maybe the situation is not that grim. The bull case is stated here by Cohen:

"I think that we, among ourselves, have always said, you couldn't reproduce what we have here, what we inherited and rebuilt and built on for, I don't know, pick a number, $250 million, $300 million, $400 million, the investment you would have to make. And I guess I've just been around so long that my perspective is that we will get rewarded for that eventually. I look at Evercore, which has got a great franchise and ISI, which is a great franchise, and this deal, and I go, well, there it is, I mean they're going to spend $200 million to $400 million to try and put in place what we already have. And I think it's great. I wish them tons of luck. And I think it's good for us and for the industry, and there will be fewer and fewer people who garner a bigger and bigger share of wallet. The commission business isn't going away. The equities business isn't going away. And kind of like I lived in the 70s, if you have a long-term view, and you're right, which I believe we are, we're going to get very well rewarded for it."

The conference calls are worth reading.

Good point. If COWN is in the sweet spot and they're still losing money, that's bad. But in their defense, they have been rebuilding the business in the past few years so it's not like they were ready for this upcycle. But still, maybe they should be doing better.

I did say there are cyclical factors, but maybe it shouldn't apply as much to COWN. My thinking about cyclical factors may apply more to JPM, GS and other big banks. Those guys have more traditional FICC business (that depends on higher interest rates, higher and more consistent market volatility) and global exposure (needs robust economic activity around the world which is not happening in Europe, emerging markets etc…). COWN doesn't have that as stuff as much.

Anyway, the stuff Cohen talks about, the research based b/d model has been a tough business for years. The European universal banks have been trying for years to build out those businesses and it's really expensive with wildly cyclical revenues.

One concern with people from the past generation, like Cohen, may be that they are trying to rebuild the model they succeeded with in the 80's, and times have changed. (You or someone else said that already in a comment somewhere).

Anyway, I've read the recent calls but haven't gone back a lot.

In any case, COWN may be interesting for people collecting cheap stocks but it's not one of my pound-the-table-this-is-great-management kind of stocks at all.

More important for me than the model is management. Do I trust them and do I want to give them my money? Would I want to work for them? Would I want my kid to work for them? I can't check those checkboxes for COWN with what I know so far…

Now is probably the time to buy COWN but more of a bounce back to some discount to TBV vs a buy and hold investment. Linkem actually looks really interesting. LUK put a bunch of stuff on it in slides in their annual investor slide deck. Who knows when/how they exist the investment but could be worth multiples of what it is held on the books as….

Cowen is looking good now. They've poured a ton of money into the bank (probably not worth it but w/e it's in the past) and the deal for Convergex was beautiful, they got about $200M of brokerage revs plus $20M of capital! They got paid to take Convergex and now Cowen is the most brokerage-heavy of the small banks. Plus there are some assets there that are interesting like Wish dot com and Linkem and Nikola, but they lost about $10M in Miami real estate (Surfside) which shows the danger with holding real estate in a bank. So Cowen is still really weak in the high margin advisory stuff and maybe they could buy JMP (also strong in biotech) or even Greenhill, which has a crushing $350M bond maturing in a few years. So I like Cowen at this price and there have been a lot of 13Gs recently, including Fidelity with over 10%. Cohen got fired for a big mergerarb loss on the Swiss Franc move and then Solomon took over and has been 10x better than Cohen.