Alleghany (Y) announced earnings earlier this week; BPS is up +9.4% in the first six months to $451.65/share. The stock is trading at $417.70/share so is trading at around 0.92x BPS. The stock market is down 1.5% since then, so maybe less of a discount now. But it does look cheap.

Interestingly, book value was up 6.9% but thanks to share repurchases (2%+ of outstanding), BPS went up +9.4%.

I guess in this market that seems expensive, why not repurchase shares at below book value? That makes a lot of sense.

Is 0.9x BPS Really Cheap?

OK, so the question is, should Y trade at or above BPS? I always liked Y; their annual reports, how they think, how they operate etc. But they have always been a little bit on the conservative side for my taste. The annual reports read like gloom and doom reports, and I always wondered if that would get in the way of good performance. Warren Buffett is conservative too, but he’ll back up the truck when he sees something he likes regardless of the outlook.

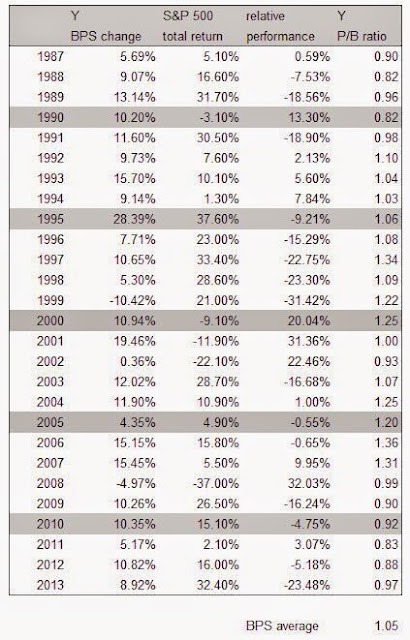

Anyway, here’s a look at Y’s BPS performance over the years and the P/B ratio of the stock:

Y Long Term Performance and P/B Ratio

So it looks like Y has always traded at around BPS since 1987. It traded above book in 1997 and 2000 (bubble times?) and most recently between 2004 and 2007 (peak of the credit bubble). So judging from that, we can’t really expect Y to trade very much above book in a normal environment. The business model sort of evolves and has changed over time so we can’t really say for sure. But a prudent expectation is for Y to trade at around BPS over time. Their big transformational merger with Transatlantic also increases the size of a business that comes with low multiples (many reinsurers, even with much higher ROE than Y trade at or below BPS).

Long Term Relative Performance

Now let’s take a closer look at the long term performance of Y. Getting long term BPS change for Y is sort of a pain because of their 2% stock dividends they used to pay (so you can’t just compare BPS values in different years to each other like you can with BRK or MKL. Someone should ban these stock dividends that make comparisons a pain!)

This is really not that surprising given the extremely conservative nature of the folks at Y. Check this out:

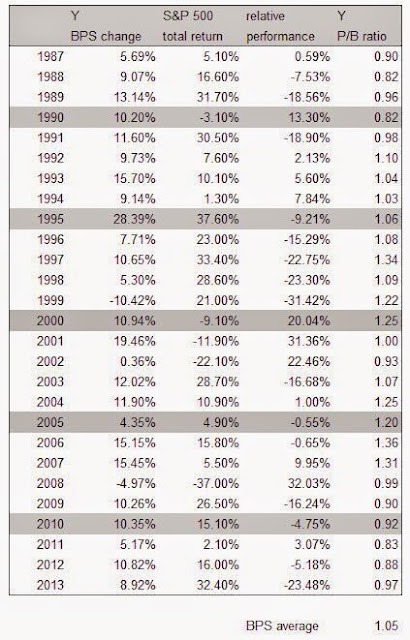

For the 26 years since 1987, Y has actually underperformed the S&P 500 index total return. Y’s BPS grew +9.6%/year versus a total return of +10.7% for the S&P 500 index (and +17.4%/year for BRK; I put BRK’s BPS growth there just for fun).

Y also underperformed in the 20 year time period. The five year time period is sort of irrelevant because that is off of the financial crisis low and is more a function of how far down something went during the crisis.

So that’s really disappointing.

But Wait!

Weston Hicks became CEO in December 2004, so the important performance metric here might be to see how he has done. In the above table, I put the returns for Y, S&P 500 and BRK since the end of 2004. By this measure, despite Y’s (to me) overly conservative and gloomy-doomy world view, Y has outperformed the index by +1.2%.

Other interesting metrics are returns since previous market peaks. This can also be pretty telling. Since the peak (on a year-end basis) in 2000, Y has outperformed the S&P 500 index by +5.5%/year, and since the 2007 peak by +0.4%.

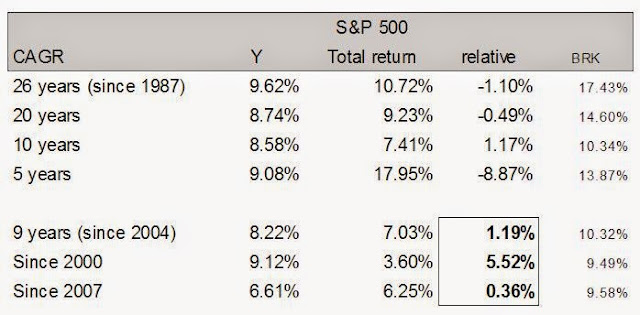

Here’s a nice chart from a June investor presentation:

Y also talks about risk adjusted return in their annual report. It’s not the most important thing for me, but it may be of interest to others who are more worried about the stock market.

If you are going to invest in a stock but are worried about the stock market, you may want to invest in a business that is almost overly conservative and has a world view that is very gloomy. This way, you can rest assured that they won’t overreach for performance and get hit in a bear market (or I should say, get hit too hard in a bear market).

Y has proven itself over time through various insurance cycles (huge events in the past decade+), some bear markets and a 100-year event financial crisis. So in that sense, I would view Y as on the safe side of things.

Of course, with insurance, you can never really know. All surprises tend to be on the downside.

Why Not Other Insurers?

OK, so why bother with Y when we have BRK and MKL? Well, BRK and MKL are really good investments. It’s amazing how well BRK has done even in recent years given it’s size. So I won’t argue there. I won’t say Y is better than BRK/MKL. But I still like it, even though I may not give it a big allocation (again, just due to their seeming over-conservatisim).

There are plenty of other insurance companies with higher ROE’s trading at book or less. So why not look at the others?

Well, I am more interested here in Y as an investment conglomerate than as an insurance company. I look at them more as value investors. I think a lot of us who follow Y, MKL, FRFHF and others think of it the same way. So yes, there are other insurance companies that are very good businesses.

Conclusion

I think Y is a solid investment. It may not trade much above BPS in the near term; their stated goal is to increase BPS 7-10%/year over time, and I think it’s great if they can achieve that and worth BPS if that is the case.

With BRK now trading at 1.4x book and intrinsic value expected to grow at 10% (on the high side, I think), Y is not so bad at 0.9x if it can achieve 7-10%/year growth in EPS. (How many mutual funds can you name that have long term records comparable to Y? And even if you find some that do, fund returns are pretax (you would have had to pay taxes on dividends and capital gains along the way).

Either way, this is an interesting situation to watch as there have been changes since the Transatlantic merger which I tend to view as positive (more disclosure etc.). Check out the financial supplement they put out on their website, for example. Also, their interest income is increasing due to their investments with Ares. I know there is added risk in reaching for yield here with risk spreads as low as they are, but the folks at Y, given their conservative nature, would no doubt keep overall exposure in check.

Ah, I see what you did there in the title! Very nice.

As for Y being cheap, I think it's because their growth in BVPS is fairly low compare to the market. At 7-10% growth, it seems better to buy passive index funds. I remember you saying that a 10% ROE warrants 1 times book. And it seems like Y is below 10% ROE, thus the below book. What do you think?

Hope you're more frequent with the post, always enjoy what you have to say. Cheers!

Hi, yes, that's a common rule of thumb for financial companies (10% ROE = 1x BPS). And yes, passive index funds are good. But in this case, if you can get it for a discount (versus paying a fee (however low) for index funds plus realizing taxes on dividends and cap gains) it's not a bad idea.

But yes, their lower returns are the reason it is cheaper than say, BRK or MKL.

Plus the 10% ROE / 1x book rule of thumb is for financial companies and the reason is the risk often associated with financials (boom/bust nature of business; financial crisis every few years). But when you look back at Y, they tend not to have those booms and busts and make their returns in a remarkably and incredibly boring manner.

Thanks for reading.

The general market has seen multiple expansion over the years, while Y has not. Given the fact that Y's performance has remained the same, Y is cheaper relative to the market than it has been for a long time. Also in absolute term, a 0.9x multiple to book is cheap, given the traditional conservative underwriting and reserving (which implies unaccounted value sitting there). Even buying at 1x book for a 10%ROE business is a good deal, if the business is run in a conservative manner, which is certainly the case with Y.

I bought some a few month ago around 370$ and I will buy more when it falls below 0.9x book, which is a little over 400$ currently. It's not a stock that is going to make you rich, but I think the risk is actually less than investing in the general stock market, so I think a price concious buyer should do well with this stock.

Unrelated to this, but in your strike zone – Do you think 3G and Buffett should bid for the portfolio of brands that P&G is looking to sell? Seems like assets where they could apply their formula to spruce up some aging brands.

Oops, missed this question before… Sorry for the late response. I don't know about 3G/Buffett. The question would be which 'platform' it would fit into. It seems like if they are selling certain brands, it would be easier for someone in a similar business to buy the brands, like Spectrum, Jarden etc… where the brands can fit in. If 3G/Buffett bid for it, what would it be attached to?

I don't know how they would run it without a hq function somewhere…

Thanks! Much appreciated.

Y is fairly valued. I would argue that it's not better than an index fund despite the historically low volatility that Y has seen (assuming management achieves sits target of 7-10% BVPS growth). Management points to the low beta to justify their existence, but I think the comparison is misleading. In an index fund, even if historical volatility is higher than Y's, it's probably much safer over the long run given its highly diversified nature and constant changing composition. By investing in Y, you're investing in an idiosyncratic story, so much more risk despite the low historical volatility. As we all know, beta and historical volatility are not true risk measures for long term investors.

I dislike the fact that management only targets a 7-10% return. Seems lazy to me.

Overall, it's not a great investment, but better than average given the low probability of you losing permanent capital.

That's a fair point, and the S&P is a hard hurdle to beat. I wouldn't argue too much with someone that says the S&P is better because is good.

And yes, vola is not really an indicator of risk to me either.

But what I failed to get across in my post (that came to mind later on) was that Y's performance, actually, is good given their really gloomy world view. It's like they achieved positive returns even when they didn't really want to participate much in the world. Compare that to active fund managers that are, for the most part, fully invested (equity mandate) so they have their pedal to the metal and yet fail to outdo the index.

When you think about it that way, Y has done really well in comparison to that. So underperforming slightly without really trying versus underperforming with full participation seems to me like a no-brainer.

The 7-10% return is realistic to me and is probably a return higher than what you can expect from the S&P over time, so yes, maybe lazy given that it's a single company (and many companies have higher ROE's), but I think it's conservative and realistic.

But I get your point.

Also, I realize that I didn't really point to objective evidence that Y is conservative. So maybe later when I have time, I will make a followup post that shows investment leverage / float leverage / equity as a % of net worth etc… over time to see if Y was in fact more conservatively managed than other similar firms.

And then maybe we can look at those metrics today and see if they are in fact as conservative. Obviously, with the Transatlantic merger and higher float leverage, they may not be as 'conservative' by those metrics as in the past.

Oh yeah, and as for the "idiosyncratic" nature of Y's story, yes, you would have to be comfortable with their approach. Otherwise it's better to stay away and invest in more 'conventional' names or the index.

Thanks for reading and commenting.

Isn't MKL at close to 1.2x BV a much better investment? You still have Tom G. increasing equity % of portfolio.

I won't argue with that. MKL has a much better long term track record and importantly, there is continuity of management there; the same people that is responsible for the great long term record is still there. Y has a new equity manager and new private business manager so they may be wild cards at Y.

But still, I think it is interesting. I don't look at BRK and say that is the best and then stop looking or writing about other ideas, so I won't stop at MKL either.

Thoughts on Post?

There is some discussion in the comments section under the POST posts; the result is disappointing for sure but if these are short term hiccups the POST story should still be intact. I am not too worried about it yet, but I haven't bought more shares either…

Any thoughts on Murray Stahl's long standing TPL investment? Seems interesting. Buying back shares each year.

Wow, that's amazing. I did look at that a while back. I thought it was great they were selling land high and buying back share cheap. And at some point it looked like that arb was played out. But then the land leasing took off and they started getting paid for use of the land as much as they used to get selling it (or something like that).

I'm not sure how to put a value on that…