This must have been one of the most anticipated corporate conference calls ever. I have to admit to looking forward to it too. Anyway, we finally see the big number. This is not a summary of the conference call which lasted two hours, but just some thoughts.

Whale Loss

Rumors of losses were as high as $9 billion at one point but settled around $5 billion for the quarter. The announced “whale” loss was $4.4 billion; the actual loss was $5.1 billion but they shifted $460 million (after-tax) of the losses to the first quarter as they found the marks were bad in the first quarter (I think they said that the ‘wrong’ marks were still inside the bid-ask range, but not credible).

The total loss year-to-date is therefore $5.8 billion compared to what we thought was initially a $2 billion loss (that Dimon said could easily get worse over time).

So that is a pretty stunning loss. But what is even more stunning to me is that JPM was able to earn an ROE of 11% and ROTCE (return on tangible common equity) of 15% despite booking this loss. Sure, it includes a bunch of one time offsets to the loss. So let’s take a look at that:

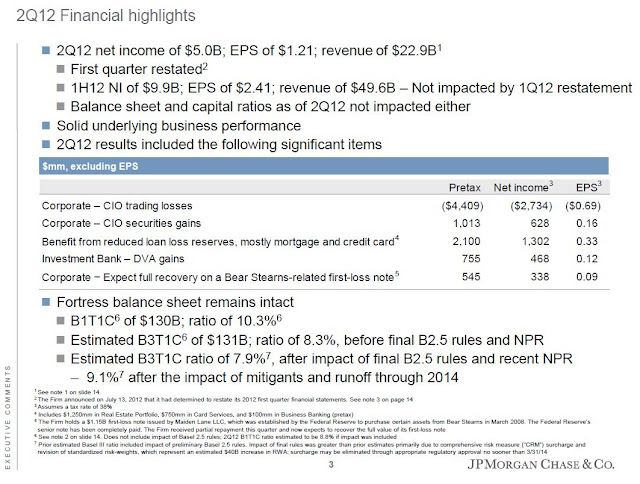

They earned $5 billion net in the second quarter, but let’s take away those one time gains. They realized some gains in their CIO securities portfolio, had reserve releases, DVA gains in the investment bank and a markup in their Bear Stearns note.

So we can subtract all of that from the $5 billion net income in the quarter:

There was a total of $2.7 billion in one-time gains according to the above table (CIO securities gain of $628 mn, reserve release of $1.3 bn, DVA gains of $468 mn and Bear Stearns note gain of $338 mn).

That’s still an annualized 5% ROE and 7% ROTCE; pretty impressive given the big one time loss.

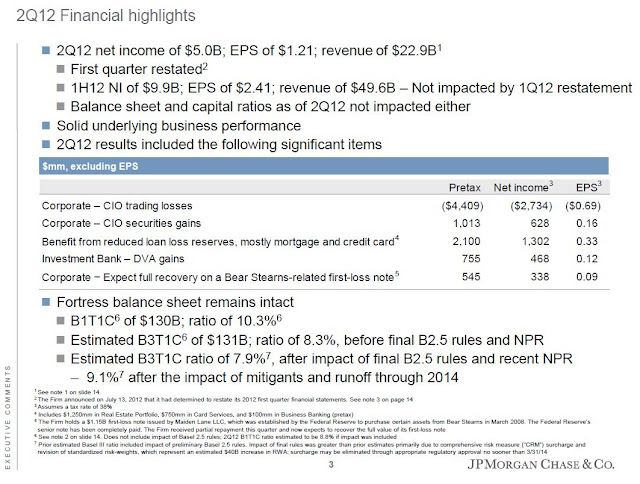

Here is the book value and tangible book value of JPM over the years and through the second quarter of 2012:

Despite the “huge” loss, JPM grew tangible book value per share an annualized 12% since the year-end 2011. BPS grew an annualized 7.8% year-to-date.

It looks like all the business lines did pretty well in the second quarter. Revenues and earnings will fluctuate so let’s just look at the ROE by lines of business:

JPM overall had an ROE of 11% and ROTCE of 15% in the second quarter.

ROE

Investment bank: 19% (15% excluding DVA)

Retail financial services: 34%

Card services and auto: 25%

Commercial banking: 28%

Treasury and security services: 25%

Asset management: 22%

Capital, Dividends and Share Repurchases

Dimon did say that capital and earnings-wise they can start repurchasing shares any time but after discussions with regulators and the Fed, they will only do that after submitting a capital plan to the Fed; they hope they can restart share repurchases early in the fourth quarter of 2012.

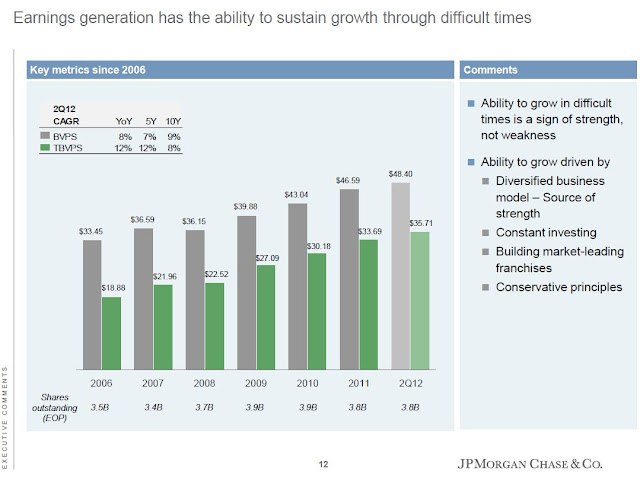

In the above table that shows capital projections, JPM used analyst estimates to project future excess capital. Dimon said that these are analyst estimates of future earnings but noted that JPM hopes to do better than the estimates. He said that he can’t promise it, but he hopes to outdo the estimates. That’s encouraging.

Anyway, according to the above table, if they wanted to get their capital to 9.0% Basel III by the end of 2013, they will have excess capital of $22 billion. This is the amount that they would be able to repurchase shares. At 9.5% by the end of 2013, they would have excess capital of $15 billion (this is cumulative through the end of 2013). The figures for the period through the end of 2014 are $42 billion and $34 billion respectively.

Dimon also said that they do plan on paying out 30% of normalized earnings over time, but that they can do better than that and hope to do so.

$24 billion in Earnings Still Doable?

JPM continues to believe that on an absolute and static basis, earnings should be $24 billion on a normalized basis. This has been a figure they have been using in presentations for a while in demostrating the core earnings power of JPM.

Someone asked during the conference call whether this is still the case after the CIO incident since the CIO did contribute to earnings in the recent past (the question was asked despite the fact that it was stated clearly in the presentation that JPM still believes the $24 billion normalized earnings figure to be good).

Dimon said right away that the $24 billion earnings figure didn’t include assumptions of profits in the synthetic credit portfolio (They disclosed that the synthetic credit portfolio in the earnings presentation (the problem part of the CIO) earned a total of $2 billion during the years 2007 – 2011).

Wouldn’t the winding down of the synthetic credit portfolio reduce the risk in the CIO and therefore future returns? The answer was a simple no. The CIO is a conservatively managed, low return portfolio and that won’t change going forward.

Too Big and Too Complex to Manage?

Someone asked if this incident proves now that JPM is just too big and complex to manage and Dimon simply responded that he doesn’t think so. He mentioned that hundreds of small banks have failed, monolines have failed etc. I don’t know why people keep saying this when the big failures during the crisis were for the most part, non-complex institutions (FNM, FRE, monolines, MER, BSC, LEH, WM, etc…).

He also mentioned the benefits of the diversified business model and the cross-selling advantage.

Perspective

People keep talking about this as a big failure in risk management and a reason JPM is too big to manage. It was a loss big enough for Dimon to be called to congress.

Yes, it was a big loss and yes, it was a massive failure in risk management. It was a big mistake.

But let’s put this in perspective for a second. In the first six months of 2012, JPM earned an ROE of 11% and ROTCE of 15%. The whale loss was $5.8 billion in total. Let’s call that $3.8 billion after tax.

So if this mega-loss didn’t happen, the six month ROE and ROTCE would have been 13% and 18% respectively.

Think about that. So Dimon was called down to congress to face grilling in both the house and senate, people are calling JPM too big and complex to manage and some other person said JPM has “serious managerial issues” (a former prosecutor, governor and ‘trick’).

Let’s get this straight. So a bank manages to earn only an 11% ROE instead of 13%, and this is a major problem?

I can point to a lot of financials that earn nowhere near 11% ROE and their ROE fluctuates much more wildly and nobody utters a single word (what happened to Goldman Sachs’ ROE in recent years and especially last year?!).

JPM made a mistake that caused their ROE for the first six months of the year to go from 13% to 11% and ROTCE from 18% to 15%. Many people would be completely happy with a 15% ROTCE!

Hardly tragic.

LIBOR

Of course, there were questions regarding LIBOR, but Dimon won’t comment on the issue. He did say that not all banks are in the same position.

NIM

There were questions regarding the yield curve and net interest margin. Dimon said that even with the current yield curve, they are making good returns. He also said that the yield curve flattening is entering it’s final stages; that it is coming to the end or final stage. I don’t know what he meant by that; if he thinks that the flattening will reverse and steepen in the future, or if he means that the curve can’t get that much flatter and JPM will keep doing well regardless.

He did say that if the curve keeps flattening, they will adjust and still will make money; they will only do things for good returns. There may be some repricing, adding fees for some services if they can’t make money otherwise etc…

Either way, Dimon didn’t seem all that concerned about it.

Isolated Incident?

Many people are skeptical that this is a one-off event. People see the huge derivatives book and are afraid there might be a big “oops” there too some day. What do I think?

I really do think this is one-off. This is not to say that JPM won’t make other mistakes. I’m sure there will be other problems in the future. It’s a risky business. But what happened at CIO is not really indicative to me how good or bad risk management at JPM is. I think in other business lines, the risk management is very tight.

There have been reports recently about the resentment from the investment bank how lax the risk management was over at CIO compared to what the IB traders had to go through.

This is because I think Dimon had a lot of faith in Ina Drew and cut her a lot of slack. In hindsight that was a mistake because she obviously screwed up. But I do understand that dynamic. There are certain areas where a CEO might cut someone some slack for a certain project and keeping them outside of the general corporate infrastructure.

This is what I thought happened when I first heard the news and everything I’ve heard and read since then confirms this view.

So in that sense, I really do think this is a one-off event.

Going Forward

Dimon said that under stressed conditions, the structured credit portfolio can lose another $1.7 billion. But that’s under a stress test-like scenario, not an expected loss. I think it’s safe to say that the worst of this trade is over.

Stock Still Cheap

The tangible book value per share of JPM was $35.71 at the end of June and the stock even after rallying 6% today is trading at $36/share so I think it’s pretty darn cheap.

JPM has grown tangible book value per share throughout the crisis at 12%/year and in the first six months of the year it grew an annualized 12% including this huge loss that shook the financial world. That’s insane. Imagine what JPM can do in more normal times!

So yes, I do still believe that JPM is a great value at tangible book per share.

I don’t think Buffett has changed his views about JPM despite this incident (he announced earlier this year that he owned shares of JPM in his personal account). Kenneth Langone was interviewed briefly outside of JPM HQ today and he said that if he can only own five stocks, JPM would be one of them. He said this incident shows why Dimon is such a great CEO (how he is handling it), and I do agree with him on that. I do wonder what the other five stocks are, though (other than HD).

Its nice to see the credit trend and mortgage is doing better. Hopefully they come through the libor thing better than its competitors. Given how serious problem JPM's competitor have, JPM's franchise looks really good and you get it at a cheap price. I do like one of the questioners about getting food poisoning in the sausage factory. It looks to me that its really hard to know what the risk is inside the bank so it ended up as a bet on Dimon. Its good to know Buffett trust him.

A question for you if you don't mind. How do you feel about the reserve release in 2Q12 for JPM? Its much larger compared to Wells Fargo given I don't think JPM's loan portfolio is any better or larger.

Good question. That's the first thing that came to mind for me; did they dig in to pump up earnings to fill the hole? I get comfort in knowing that even without the reserve release (and the other one-time gains) JPM would have still earned a decent ROE (as I showed in the post).

Also, the other thing I looked at is the reserve coverage and there didn't seem to be an abnormal drop in that. If they really wanted to, they could have lowered that a lot but I don't think Dimon likes to play those games (and he would say that they can't do that anymore like in the old days when they were able to manage a cookie jar in their reserves).

So I don't see a problem there in that sense.