This is not a blog that tracks the buys and sells of hedge funds or anything like that, but I just stumbled on this so I thought I’d post it. (Of course, a hedge fund manager liking gold is hardly breaking news, but…)

We all know Stanley Druckenmiller; he needs no introduction (if you do, just google him and there is plenty of short articles about who he is). He ran the Quantum Fund (Soros’ Fund) and then his own hedge fund Duquesne Capital (which he actually started before joining Soros and continued to run during his time there) but closed down Duquesne in August 2010.

I noticed that websites that track hedge funds dropped his investment activities as Duquesne Capital no longer files 13F’s. Well, that makes sense as it no longer exists.

But I did notice by chance that Druckenmiller started filing a 13F again but this time as “Duquesne Family Office LLC”. So this is his own money.

I find this interesting for a couple of reasons. Of course, Druckenmiller is one of the all-time great traders/investors, so it’s always interesting to see what he is up to. But what is really interesting now is that he is doing a lot of the work for the family office himself. His colleagues at Duquesne Capital left to start their own hedge fund (which Druckenmiller invested $1 billion in according to one article).

So the 13F stocks show what Druckenmiller himself really likes. It’s not his other portfolio managers’ picks. These are *his* picks.

You will notice that it’s a much smaller list than what they used to file as Duquesne Capital. That makes sense.

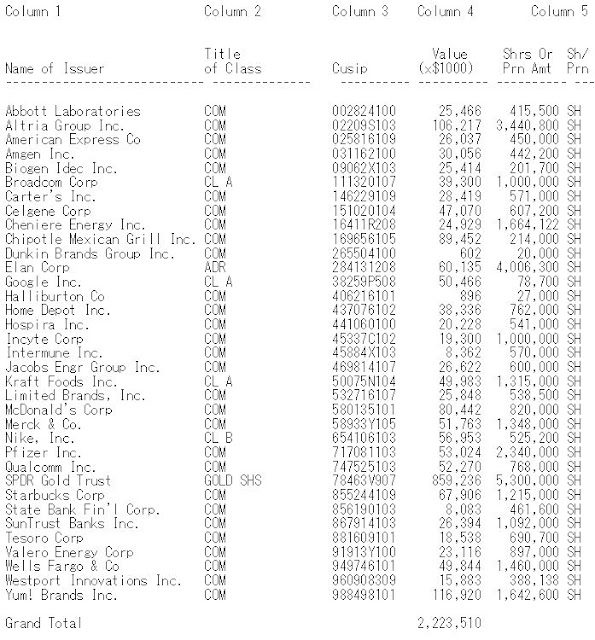

Anyway, here is the 13F that was filed in May for the portfolio as of March-end 2012 (Look up Duquesne Family Office at sec.gov). See table below.

It is a small portfolio in terms of number of stocks and there are many familiar names in there. It sort of feels right to me as I feel like I can get a sense for why these stocks would be interesting; Wells Fargo is a great bank, YUM Brands is a great way to get exposure to China without having to deal with Chinese companies/fraud etc…, Chipotle is just recreating the fast food business, American Express is a transaction driven high return on capital business (paid on number of transactions, not loans outstanding etc.) etc…

SPDRs!

But then here’s the whopper: 5.3 million shares of GLD, the SPDR Gold Trust. As of March-end 2012, that position was worth $859 million. The total U.S. equity portfolio on the 13F is $2.2 billion, so that’s a whopping 40% of the portfolio invested in gold. Einhorn has 10% of his assets invested in gold. 40% is pretty big.

[Correction (added later): The GLD position is in the form of call options and the $859 million is just the notional amount; I didn’t notice that the first time I looked at the filing. ]

As of September 2011, Forbes had Druckenmiller’s net worth at $2.5 billion or so. So this $2.2 billion portfolio constitutes most of his wealth. Given that, this 40% exposure to gold is pretty big.

This is not like some billionaire that files a 13-F, but the U.S. equity portfolio is only 10 or 20% of his net worth or anything like that. It looks like this is a substantial portion of Druckenmiller’s wealth is represented here. Of course, we don’t know the real exposure as Druckenmiller probably has futures and options positions that won’t show up here. We have no idea what his S&P 500 index futures and gold futures positions are. Also, I am leaning on Forbes’ estimate of his net worth too and I have no idea how close those are, never having been a billionaire with net worth estimated by them.

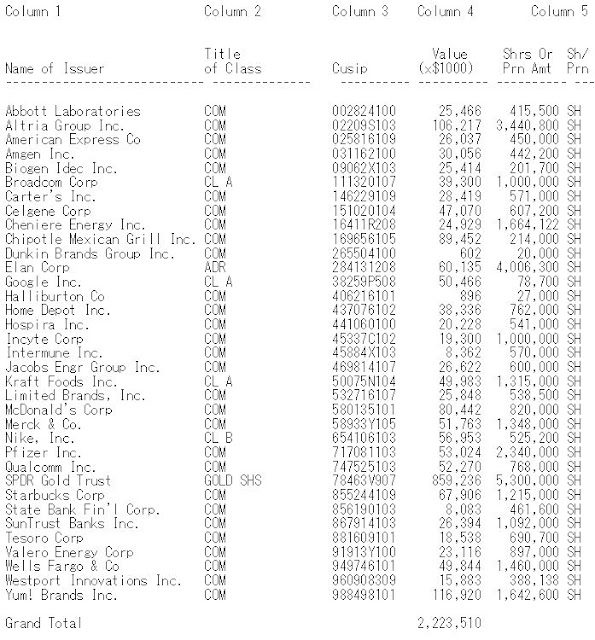

And here’s the other puzzle. The first filing the family office made was in February of this year and there is no GLD position there. Here it is:

13-F for Duquesne Family Office LLC filed on Feb 9, 2012 for Quarter ended Dec 31, 2011

[ Correction: Since the GLD position is just the notional amount of the call option, the above is irrelevant; there was no addition in the dollar value of the portfolio. ]

Based on how bad they did with Soros's net worth my guess is that Druck's was higher than Forbes had it. 32% a year for like 30 years will do that. Also some of the team at the new fund left to start their own so he may have taken out a bunch of it.

Love your blog,

MacroDave

Thanks for the comment. And thanks for that info; that would explain a billion increase in the 13F positions (and the sudden GLD investment).

very interesting post, however, the gld position is in options with an underlying value of $859 million…….

Good catch, I missed that. I will add a corrective note in the post. Thanks.

George Soros likes Ancestry.com as do I. Email me at daneskola@gmail.com if you want to see my work.

this great family office information. It will surely make them to advise others t read this post.

the useful family office information you shared. Informative with great work.

Its nice and awesome information about family office.I really like to know about this.I want to keep myself update with it.Please let me know how can I do this?

family-office