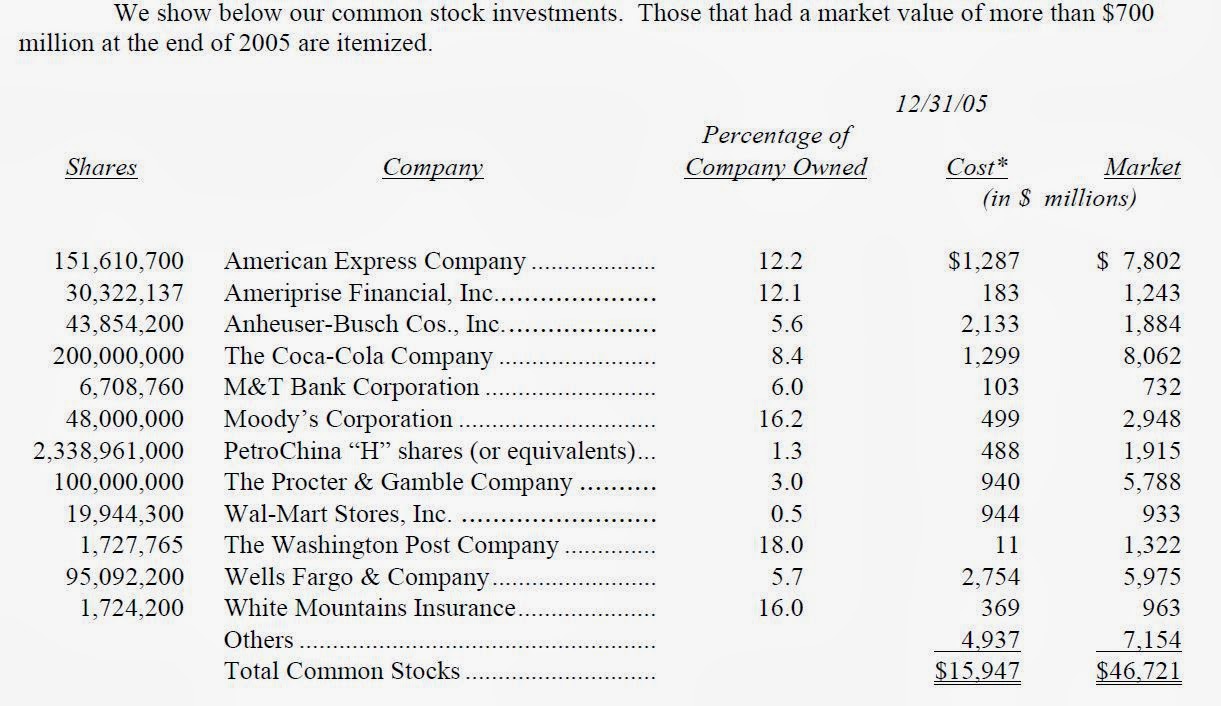

OK, so here we go. Hopefully this will be the last part in this marathon series. BRK LTS 2005 So 2005 turns out to be an interesting year. After years of not doing much in the stock market, Buffett initiates positions in Anheuser-Busch, Walmart, and “substantially” increases his position in Wells Fargo. It’s been a…

Author: kk

Buffett the Market Timer? Part 4: The Berkshire Years 1991-2004

So we continue. Let’s see what he says in 1991: BRK LTS 1991 Our outsized gain in book value in 1991 resulted from a phenomenon not apt to be repeated: a dramatic rise in the price-earnings ratios of Coca-Cola and Gillette. These two stocks accounted for nearly $1.6 billion of our $2.1 billion…

Buffett the Market Timer? Part 3: The Berkshire Years 1981-1990

OK, so this was a little longer than I thought, so I will make Part 3 1981-1990. There’s more stuff here than I thought. Anyway, let’s see what Buffett has to say: BRK LTS 1981 Buffett talks about trying to find whole businesses to buy but sees better opportunities in the stock market: Currently, we…

Buffett the Market Timer? Part 2: The Berkshire Years 1965-1980

I know I’m preaching to the choir here for the most part, and others will disagree completely and say that always being invested in stocks is reckless. But still, I thought it would be interesting to look at how Buffett viewed the market over the years, and what he did about it. We can…

Markel 2013 Annual Report

So Markel’s (MKL) 2013 annual report is out. MKL grew book value per share by +18.2%, the same as Berkshire Hathaway (BRK). BPS is now $477.16 versus the recent price of $591, so it is trading at 1.24x BPS. 18% growth in BPS is pretty good, but they also grew BPS at a +16.5%/year…

Buffett the Market Timer? Part 1: The Partnership Years

OK, so I know this thing about not timing the market leads to a lot of debate. One thing you always hear when talking about this is that Warren Buffett himself is a market-timer. Well, yes, he has made comments on the market over the years; in 1999/2000 warning of a high market cap to…

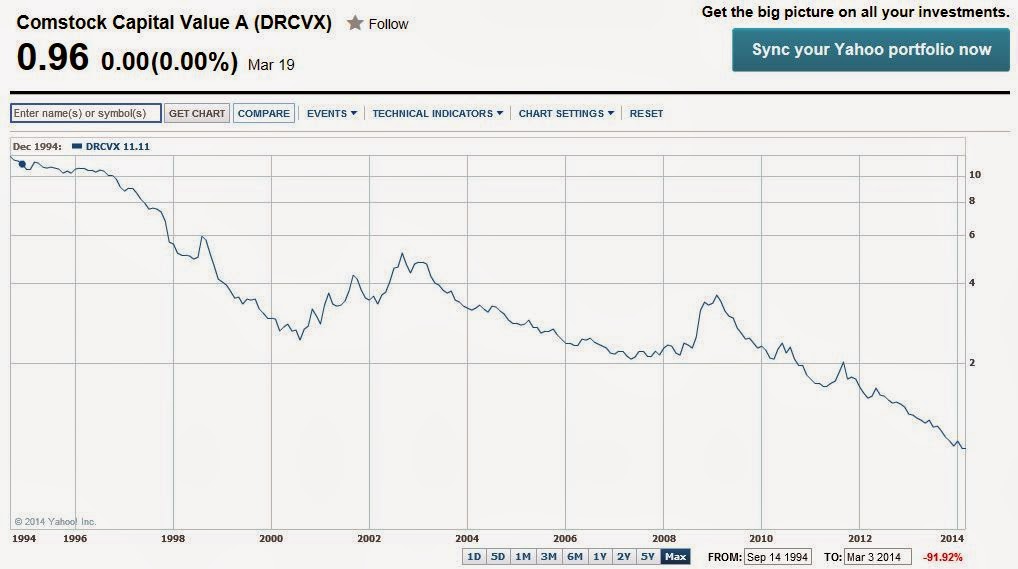

Perils of Trying to Time the Market II

My last post reminded me of the second post I ever made on this blog back in 2011. I didn’t know it was my second post until I just looked back and checked. There are some prominent commentators these days, even an economist that runs a mutual fund based on his econometric analysis. The newsletter…

Greenblatt on CNBC: Market Reasonably Valued

So Joel Greenblatt was just on CNBC and said some interesting things. I don’t intend to post every time someone I respect shows up on TV, but this appearance was especially interesting to me for a couple of reasons. One major reason is, of course, market valuation. I don’t really care about the many folks…

DIRECTV (DTV)

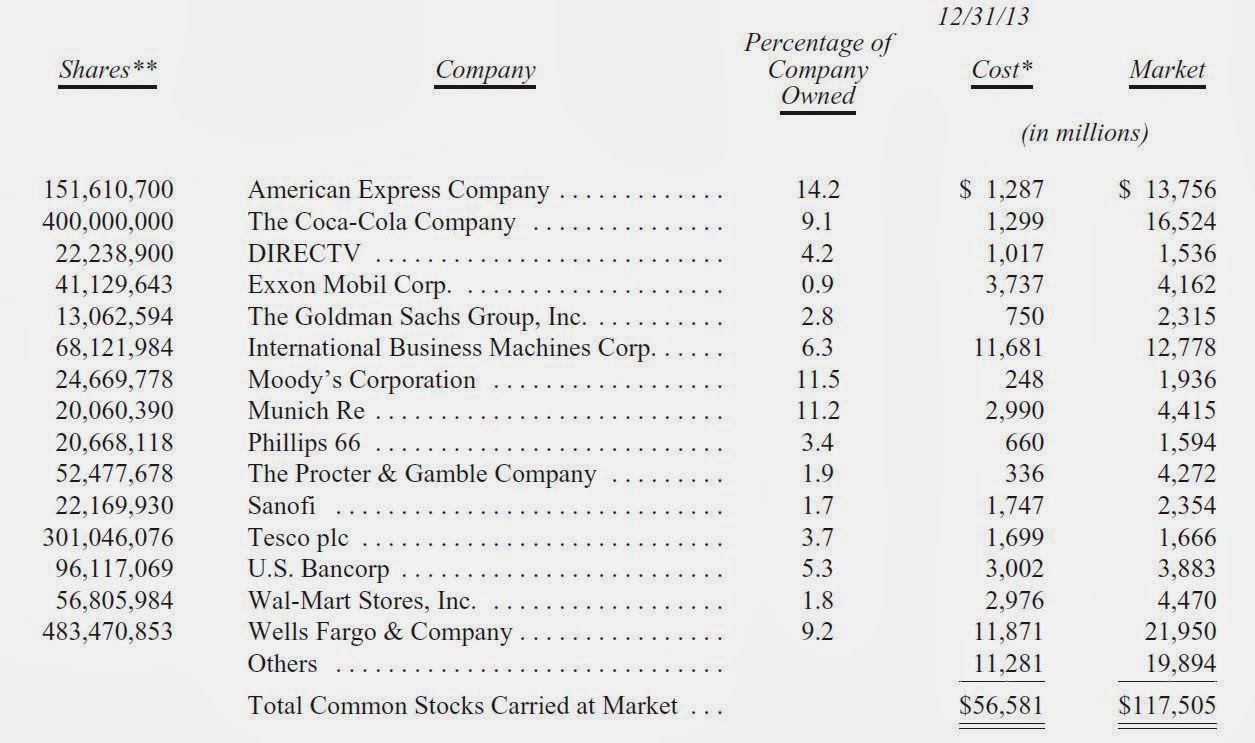

So here is another ripple from the recent flurry of Buffett stuff on this blog (from the letter to shareholders to the 3T’s etc. OK, so two posts does not a flurry make). A lot of people look at Buffett’s holdings for investment ideas, but for most of the recent ten or twenty years, he…

JPM Investor Day 2014

So JPM had their marathon investor day the other day. The slides and presentation is available at the JPM investor relations website. It’s well worth a listen for anyone interested in banking. It might be torture for those who aren’t, though, because it’s long. But long is good. We want more information, right? People keep…