Just a quick note that this blog is still alive and well. It’s earnings/conference call season so I will be spending most of my day for the next week or two reading earnings announcements and listening to conference calls. I won’t be making comments on quarterly earnings as I only look at stocks from a…

Author: kk

CRESY: Emerging Market, Farmland, Real Estate

This is a stock that Leucadia owned for a brief time. I think they paid around $15/share for it and even participated in a global offering of the stock at $17 (per U.S. ADR) back in 2008. Asked at the annual meeting whether they were worried about the populist policies of the Argentina government, Leucadia…

Stocks No Good? (Superinvestors)

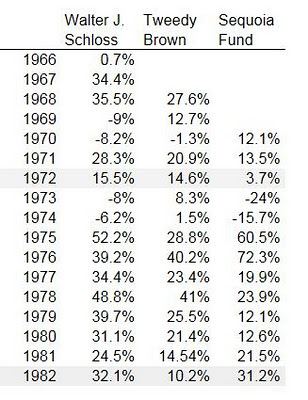

Continuing on the “stocks are no good” theme, it is interesting to look at what the Superinvestors did during the long flat market period between 1965 and 1982. I think the Dow hit 1,000 back then and didn’t go above it for good until late 1982. The talk now is that the U.S. may go…

Ungold!

Gold has done really well the last decade or so and more and more people are talking about the inevitability of gold as a wealth saving asset (protection against inflation, monetary pump-priming etc…). However, a lot of what we hear today sounds a lot like Howard Marks’ first-level thinking (see here what that means). Central…

Renault-Nissan: The Stub Trade from Hell?

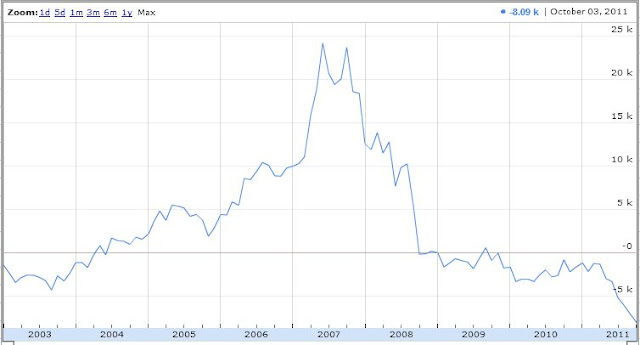

Here is a stub trade that doesn’t seem to get talked about much. I remembered that Renault owns a big chunk of Nissan and that it is very valuable. The talk a while back was that if you backed out Renault’s ownership of Nissan and Volvo, you can get the Renault auto business for free. Well,…

Alleghany Corp (Y)

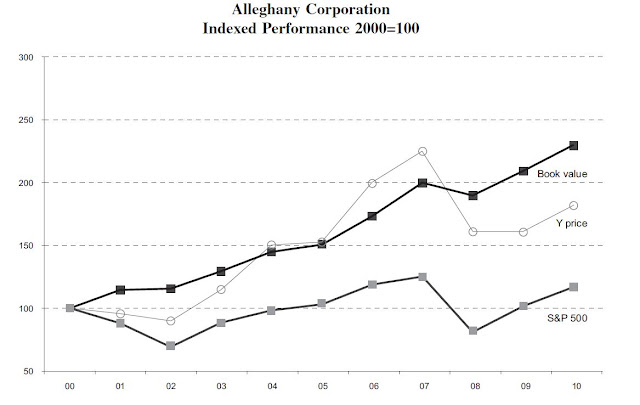

To continue the boring pattern of featuring companies with great track records being offered by Mr. Market at a discount, here is Alleghany Corp (Y), an insurance company/conglomerate. This currently looks like an insurance company but acts more like a conglomerate. This is one of those companies where the annual reports are very well written…

Goodbye Steve Jobs

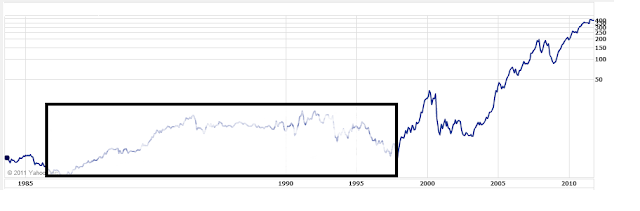

Apple Stock Price Since 1984 Apple’s stock was IPO’ed on December 12, 1980 at $22/share. On a split-adjusted basis, that’s $2.75/share. Apple closed yesterday at around $378/share for an annualized return of +17.8%/year. Pretty incredible given the long period that Apple went nowhere and did nothing (after they fired Jobs until he came back). The…

Are Stocks Expensive Now?

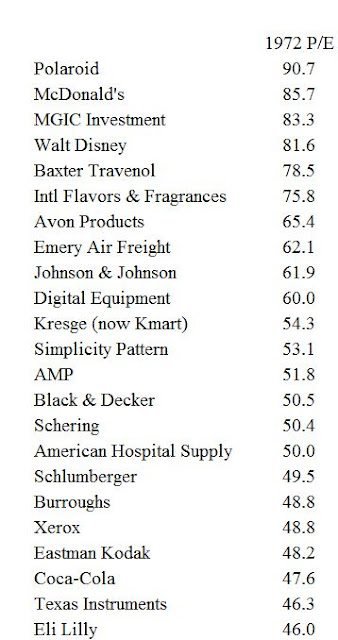

I couldn’t find a list of the nifty fifty stocks of the early 70’s and their p/e ratios to illustrate the difference between then and now, but I did find some lists with p/e ratios of some popular stocks back in 1972. I found this on the internet and just cut and pasted it (sorry…

VIX: The Fear Index

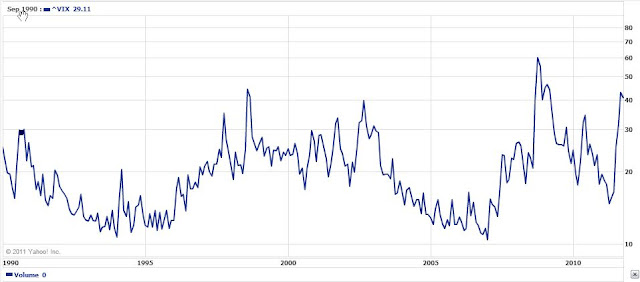

We all know that we have to be greedy when others are fearful and fearful when others are greedy. Well, here’s an interesting chart: The VIX index: 1990 – Now I don’t intend to make market calls, bottoms and things like that. That’s really not my thing at all. But I will mention things when…

Loews Corp

I might as well write about this old, classic sum-of-the-parts investment too. It’s well known in the value investing community, so nothing new here either except a fresh update. For those who this is new to, it’s a conglomerate that is run by the Tisch family. Of course, I think many people know Larry Tisch,…