This is sort of a followup to my last post; it’s just another thought that came to mind as I was typing up a response to someone in the comment section, and I thought I’d expand the thought into a quick post as I think it’s pretty important. (Blog readers take note: This is my…

Author: kk

The Perils of Trying to Time the Market III

I just read an article about a big alternative mutual fund that is facing redemptions due to poor performance last year. And it got me thinking again about a recurring theme on this blog about the perils of trying to time the markets. I know it’s preaching to the choir here, but it is something…

Shake Shack Inc. (SHAK)

Wow, it’s been a long time since my last post. This wasn’t an intentional break but just one of those things where times flies before you realize it. It’s been busy around here for various things (all good / normal things; nothing bad, thankfully). Anyway, I noticed that Shake Shack (SHAK) has filed their…

The Halo Effect

After posting about the Collins book, Good to Great, some people mentioned the book The Halo Effect: . . . and the Eight Other Business Delusions That Deceive Managers by Phil Rosenzweig as a counter to it. So of course, I got it and read it right away. And it’s a really good book. I agree with a…

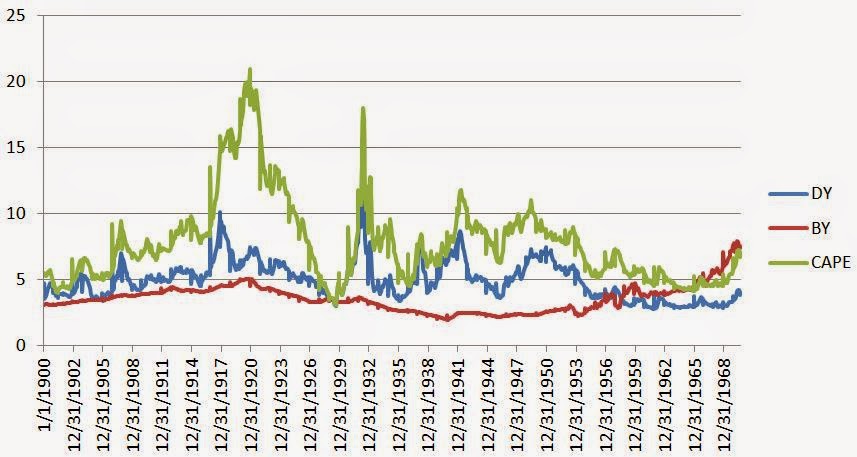

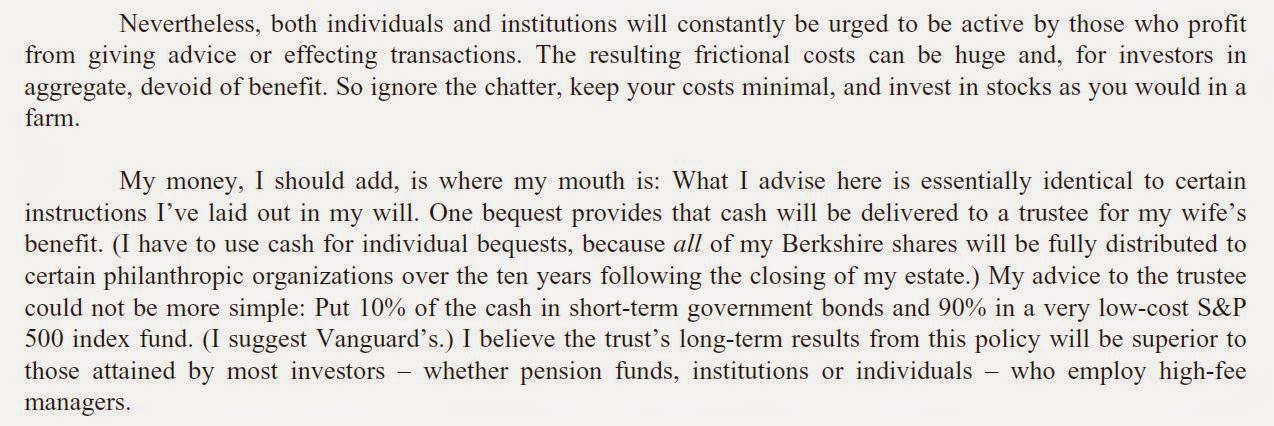

Buffett on Market Valuation

I don’t really spend too much time on market valuation, but I do think about it and post about it every now and then. Of course, debate about market valuation is pretty heated these days due to the super-high looking Shiller p/e ratio, high profit margins etc. I was reading through some old Buffett annual…

Good to Great: The Stockdale Paradox

After watching a video of Carlos Brito pounding the table on the book, Good to Great by Jim Collins, I had to reread it. I read it years ago when it came out and thought it was a great book, but rereading it now, I enjoyed it even more. That’s because I’ve spent more time since…

WL Ross Holding Corp (WLRH)

As I was looking through the new lows list in the newspaper, I stumbled upon WL Ross Holdings Corp (WLRH). Wilbur Ross is a very successful distressed investor so I was surprised to see a listed entity with his name on it. This is a blank check investment company (or Special-Purpose Acquisition Company (SPAC)), and…

Value Stocks In Market Corrections

So with all of this talk of a market correction coming and people wondering what to do in this toppy market, Pzena put out an interesting newsletter back in June. It looks at value stocks and how they performed in market corrections in the past. They define value stocks as the lowest quintile of stocks…

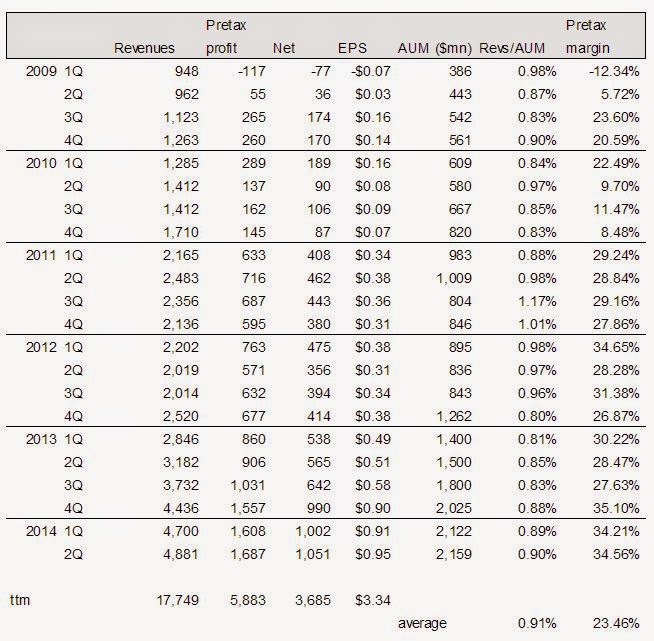

TETAA: Teton Advisors, Inc.

Speaking of nanoo, nanoo, how about a nano-cap? There is some interest in small cap stocks as they tend to outperform over time, but small caps are now looking really expensive. So I was kind of surprised to take a look at this thing and notice that it’s not that expensive. Teton Advisors (TETAA)…

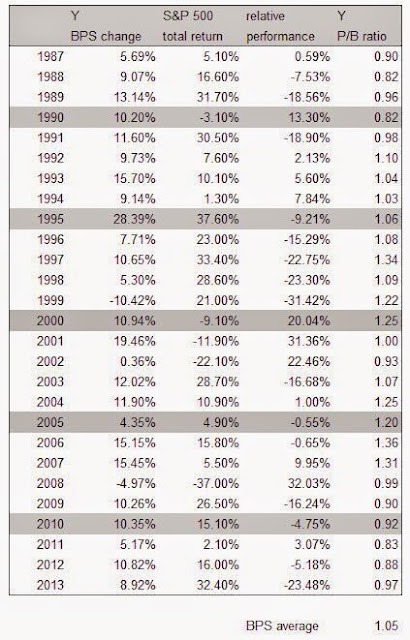

Y So Cheap?

Alleghany (Y) announced earnings earlier this week; BPS is up +9.4% in the first six months to $451.65/share. The stock is trading at $417.70/share so is trading at around 0.92x BPS. The stock market is down 1.5% since then, so maybe less of a discount now. But it does look cheap. Interestingly, book value was…